Microscopic Illumination Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435119 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Microscopic Illumination Equipment Market Size

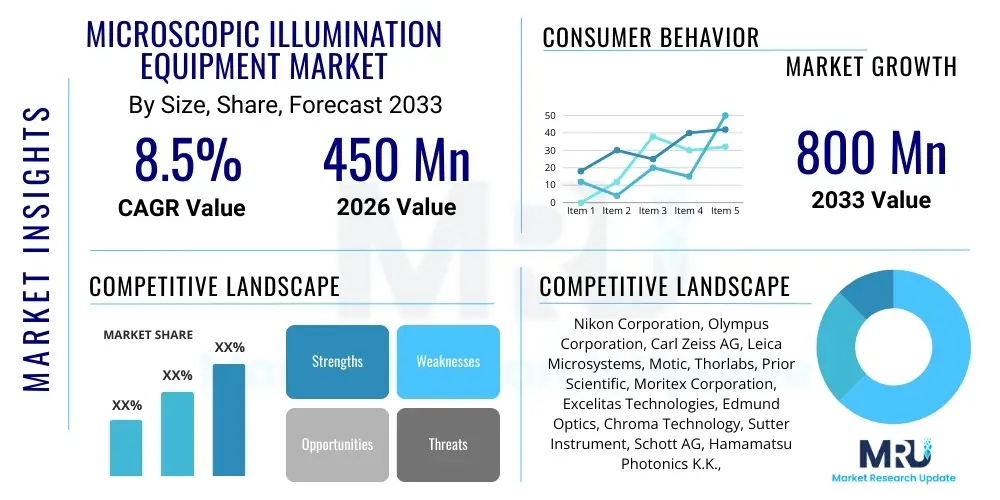

The Microscopic Illumination Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Microscopic Illumination Equipment Market introduction

The Microscopic Illumination Equipment Market encompasses a wide range of devices essential for providing precise and controllable light sources to facilitate high-resolution imaging in microscopy. These instruments are fundamental components across various microscopic platforms, including compound microscopes, stereo microscopes, confocal systems, and specialized fluorescence imaging setups. The primary function of this equipment is to optimize contrast, resolution, and visibility of samples, which is critical for accurate observation, analysis, and documentation in scientific research, medical diagnostics, and industrial quality control. Continuous technological advancements, particularly the shift towards Light Emitting Diode (LED) and advanced laser sources, are defining the contemporary landscape of this market, offering enhanced efficiency, longevity, and spectral flexibility compared to traditional halogen or mercury lamps.

The product portfolio within this market includes diverse illumination techniques such as brightfield, darkfield, phase contrast, differential interference contrast (DIC), and fluorescence illumination. Each technique requires specific equipment tailored to the optical setup and the nature of the sample being examined. Fluorescence illumination, driven by the increasing complexity of biological assays and live-cell imaging, utilizes high-intensity, wavelength-specific light sources (often LED or laser) coupled with complex filter sets to excite fluorophores and capture emitted light. This specialization underscores the market's reliance on precision engineering and integration with advanced digital imaging systems, necessitating constant innovation in light management and optical pathway design.

Major applications for microscopic illumination equipment span critical sectors globally. In life sciences, they are indispensable for cell culture observation, pathology, histology, and advanced molecular biology studies. Within materials science, they facilitate the inspection of semiconductor wafers, polymers, and metallurgical samples, ensuring quality and structural integrity. Furthermore, their role in clinical diagnostics, particularly in hematology and microbiology, is pivotal for the routine identification of pathogens and cellular anomalies. The inherent benefits, such as improved image clarity, reduced heat generation (especially with LED systems), lower operational costs, and rapid shuttering capabilities, are key driving factors accelerating market adoption across academia, pharmaceuticals, and manufacturing industries worldwide.

Microscopic Illumination Equipment Market Executive Summary

The Microscopic Illumination Equipment Market is currently experiencing robust expansion, primarily fueled by the accelerating investment in life sciences research, the global drive towards personalized medicine, and the increasing demand for high-throughput screening technologies. Key business trends indicate a strong industry focus on transitioning from conventional illumination sources, such as halogen and mercury lamps, to advanced solid-state lighting solutions, particularly high-power LED systems and laser diode modules. This shift is motivated by the superior efficiency, longevity, spectral purity, and digital integration capabilities offered by solid-state technologies. Furthermore, competitive strategies are centered on developing modular and adaptable illumination platforms that can be seamlessly integrated with existing microscopic infrastructure and automated workflow systems, thus catering to the diverse needs of both research laboratories and industrial inspection environments.

Regionally, North America maintains its dominance due to the presence of leading pharmaceutical and biotechnology companies, extensive government and private funding for fundamental research, and the early adoption of cutting-edge imaging technologies, particularly in specialized fields like neurobiology and cancer research. However, the Asia Pacific region is projected to exhibit the highest growth rate (CAGR) throughout the forecast period. This rapid growth is attributed to massive investments in academic infrastructure, the expansion of the clinical diagnostic sector in emerging economies like China and India, and the rising establishment of outsourced pharmaceutical research and manufacturing facilities (CROs and CDMOs) that require sophisticated quality control and analytical tools, including advanced microscopy setups.

In terms of segment trends, the LED Illumination segment is the primary growth driver, expected to capture the largest market share owing to its technical superiority in power, reliability, and wavelength specificity crucial for fluorescence imaging. The Life Sciences application segment continues to be the largest consumer, driven by increasing complexity in cellular and molecular studies that necessitate advanced techniques like TIRF (Total Internal Reflection Fluorescence) and confocal microscopy, which rely on highly specialized illumination sources. Additionally, the industrial inspection segment is showing significant upward trajectory, particularly within the semiconductor and microelectronics industries, where ultra-precise illumination is required for defect detection at nanoscale levels, reinforcing the importance of high-brightness fiber optic and ring light solutions.

AI Impact Analysis on Microscopic Illumination Equipment Market

User queries regarding the intersection of Artificial Intelligence (AI) and Microscopic Illumination Equipment frequently focus on themes related to automation, optimization, and enhanced analytical precision. Common concerns include how AI can be leveraged to dynamically adjust illumination parameters (like intensity, aperture, and spectral profile) in real-time based on sample characteristics, thereby maximizing image quality autonomously. Users also inquire about the role of machine learning in reducing setup time, managing complex light sequencing for high-content screening, and correlating illumination inputs with resulting image features to predict optimal settings for various staining protocols or sample types. Expectations center on AI driving the next generation of smart microscopes capable of self-calibration and condition monitoring, moving beyond manual or static predefined illumination settings toward intelligent, adaptive lighting environments that improve reproducibility and efficiency, especially in high-volume laboratory settings.

The application of AI algorithms, particularly deep learning, directly impacts the illumination equipment market by creating demand for digital, controllable, and highly precise light sources. AI-driven image processing pipelines require consistent and optimized illumination input; variability introduces noise that complicates algorithmic analysis. Therefore, AI implementation necessitates illumination equipment with superior stability, minimal flicker, extremely fast switching speeds (for synchronized imaging), and deep digital integration capabilities (e.g., Ethernet or USB-C interfaces) allowing external software to modulate parameters instantly. This requirement accelerates the obsolescence of manual or analog illumination systems and champions sophisticated LED and laser engines that offer granular control over intensity and wavelength mixing.

Furthermore, AI facilitates predictive maintenance and condition monitoring of the illumination sources themselves. By analyzing operational data such as usage hours, temperature profiles, and performance degradation rates (e.g., LED output drift), AI systems can alert users or maintenance staff to potential failures before they impact experimental results. This enhanced reliability is crucial for long-duration time-lapse experiments and high-throughput screening applications where light consistency is paramount. Consequently, manufacturers are embedding sensors and local processing capabilities within illumination modules to gather the necessary data feed for AI optimization, transforming these components from passive light providers into intelligent, digitally networked devices within the microscopy ecosystem.

- AI algorithms automate real-time spectral and intensity adjustments based on sample feedback, optimizing contrast and exposure.

- Machine learning models are used for predictive maintenance, estimating the lifespan and performance degradation of light sources, reducing downtime.

- AI integration drives demand for fully digital, high-speed LED and laser illumination systems with precise wavelength control.

- Deep learning enhances high-content screening throughput by synchronizing complex light sequences with rapid acquisition cycles.

- Smart illumination units enable automated image consistency across multiple experimental replicates and instruments.

DRO & Impact Forces Of Microscopic Illumination Equipment Market

The Microscopic Illumination Equipment Market is shaped by a confluence of driving forces, restraining factors, and promising opportunities. The principal driver is the continuous and significant investment in life sciences R&D globally, particularly in areas like genomics, proteomics, and cell-based therapeutics, which necessitates increasingly sensitive and versatile microscopic tools. The rapid adoption of fluorescence microscopy techniques, which require powerful and stable illumination sources with defined spectral characteristics, further pushes market expansion. Additionally, the industrial sector's stringent quality control requirements, especially in semiconductor manufacturing and materials analysis, demand highly uniform and high-intensity illumination for automated inspection systems. These drivers collectively amplify the demand for high-performance, digitally controlled lighting solutions.

Conversely, the market faces several restraining factors. High initial investment costs associated with advanced illumination systems, particularly high-power laser sources and sophisticated fluorescence illuminators, can limit adoption, especially in smaller research facilities or developing economies. Furthermore, the complexity of integrating advanced digital illumination systems with legacy microscope platforms presents compatibility challenges and steep learning curves for end-users. Regulatory hurdles and standardization issues concerning the safety and spectral output consistency of ultra-high-intensity light sources also impose constraints on rapid product development and deployment. The rapid obsolescence of illumination technology, driven by the pace of innovation (e.g., constant upgrades in LED power and spectral range), requires frequent capital expenditure for replacement, which can strain institutional budgets.

Opportunities for growth are significant, particularly in the development of specialized and miniaturized illumination components. The rise of portable and handheld microscopy systems creates demand for compact, low-power, and highly efficient illumination modules. The growing field of multiplexed imaging and super-resolution microscopy presents opportunities for manufacturers to develop highly specialized light engines capable of multi-wavelength simultaneous output and precise spatial light modulation. Moreover, the integration of illumination controls with cloud-based data platforms and automated robotics systems offers avenues for developing fully autonomous, high-throughput imaging solutions, optimizing laboratory workflows and reducing human error, particularly in drug discovery and high-content analysis environments.

Segmentation Analysis

The Microscopic Illumination Equipment Market is segmented based on critical technical and application parameters, providing a detailed view of market dynamics and adoption trends across different user groups. The primary segmentation criteria involve product type, differentiating between traditional and advanced lighting technologies, and application, highlighting the diverse end-user scientific and industrial fields requiring specialized illumination techniques. Understanding these segments is crucial for strategic market positioning, as the requirements for spectral bandwidth, intensity control, and operational lifetime vary dramatically between, for instance, clinical brightfield observation and cutting-edge super-resolution fluorescence imaging. The predominant trend across all segments is the shift toward solid-state lighting, emphasizing digital control and energy efficiency.

Further segment granularity is achieved through analyzing End-User categories, which reveal spending patterns and technology adoption rates. Research and Academic Institutions remain foundational consumers, driven by fundamental research needs and grant funding cycles, often prioritizing versatility and the ability to integrate specialized aftermarket components. Conversely, Pharmaceutical and Biotechnology Companies prioritize high-throughput capabilities, reliability, and validation protocols, heavily investing in standardized, automated illumination solutions suitable for drug screening. Geographical segmentation provides insight into regional market maturity, regulatory environment, and expenditure on life sciences infrastructure, demonstrating a distinct technological gap between established markets like North America and rapidly evolving markets in the Asia Pacific region.

- By Product Type:

- LED Illumination Systems

- Halogen Illumination Systems

- Mercury and Metal Halide Illumination Systems (HBO/XBO)

- Fiber Optic Illumination

- Laser Illumination Modules

- By Application:

- Life Sciences Research (Cell Biology, Neurobiology, Genomics)

- Materials Science and Industrial Inspection

- Clinical Diagnostics and Pathology

- Semiconductor and Microelectronics Inspection

- By End-User:

- Research and Academic Institutions

- Pharmaceutical and Biotechnology Companies

- Hospitals and Clinical Laboratories

- Industrial and Manufacturing Facilities

Value Chain Analysis For Microscopic Illumination Equipment Market

The value chain for Microscopic Illumination Equipment begins with upstream activities focused on the sourcing and manufacturing of core optical components. This stage involves specialized material suppliers providing high-purity glass, custom optics (lenses, prisms, mirrors, dichroic filters), and advanced electronic components such as high-power LEDs, laser diodes, and sophisticated thermal management systems. Key upstream players include specialized component manufacturers like Hamamatsu Photonics for light sources and Schott AG for fiber optics. The quality and spectral precision of these raw materials critically determine the performance, longevity, and cost structure of the final illumination system. Significant R&D investment is centered here, driving miniaturization and efficiency improvements, ensuring components meet the stringent requirements of high-numerical aperture optics and multi-modal imaging.

Midstream activities involve the assembly, integration, and final manufacturing of the complete illumination modules. Major microscope manufacturers (e.g., Zeiss, Olympus, Nikon) often integrate proprietary illumination systems into their microscope bodies, while specialized third-party manufacturers (e.g., Excelitas, Thorlabs) focus solely on producing high-performance illumination accessories and retrofit kits. This stage includes complex processes such as designing precise mechanical mounts, integrating advanced heat sinks to maintain spectral stability, and incorporating firmware and software for digital control and communication protocols. Quality control and calibration are paramount in this phase, ensuring the alignment accuracy, intensity uniformity, and spectral fidelity required for quantitative microscopy applications, which is a major value addition before distribution.

The downstream segment focuses on distribution channels and end-user engagement. Direct distribution is common for high-value, integrated microscope systems sold by leading OEMs (Original Equipment Manufacturers) to major research institutions and large pharmaceutical firms, often accompanied by extensive technical support and service contracts. Indirect channels involve specialized distributors and local representatives who cater to smaller laboratories, academic departments, or provide aftermarket parts and upgrades. These distributors are crucial for localized technical expertise and fast service turnaround, particularly in geographically diverse markets. Customer feedback from the downstream market heavily influences upstream R&D, especially regarding ease of use, longevity, and compatibility with emerging imaging techniques like deep tissue imaging or high-speed live-cell microscopy, completing the cyclical flow of value creation.

Microscopic Illumination Equipment Market Potential Customers

The primary consumers of microscopic illumination equipment are diverse and span the entire life science, clinical, and industrial ecosystems. Research and academic institutions represent a foundational customer base, driving volume demand due to their consistent need for equipment across numerous departments—including biology, chemistry, physics, and engineering—for both fundamental scientific inquiry and educational purposes. These institutions frequently purchase versatile, modular illumination systems that support a wide array of techniques, from basic brightfield teaching labs to highly specialized fluorescence setups funded by specific research grants. Their purchasing decisions are often influenced by grant availability, the need for cutting-edge technology to maintain competitive research standing, and long-term durability and serviceability of the equipment.

A second major segment consists of pharmaceutical and biotechnology companies. These customers demand the highest reliability, throughput, and consistency, focusing heavily on automated, standardized illumination modules for critical processes such as high-content screening (HCS), compound validation, and quality control (QC) of manufactured therapeutics. For these organizations, illumination equipment is integral to regulatory compliance and maintaining workflow efficiency, leading to higher spending on advanced laser light engines and robust LED systems with full digital integration. The shift towards biologics and advanced cell therapies further necessitates sophisticated live-cell imaging capabilities, driving demand for temperature-stable and low-phototoxicity illumination solutions.

Finally, hospitals, clinical diagnostic laboratories, and industrial facilities constitute significant potential customer groups. Clinical labs utilize robust and straightforward illumination for routine diagnostics, such as blood smear analysis and pathology sample examination, valuing reliability and low maintenance costs over extreme spectral flexibility. Industrial customers, particularly those in semiconductor, materials, and electronics manufacturing, require high-intensity, defect-free illumination for critical inspection processes. This segment often purchases specialized ring lights, coaxial illumination, and high-brightness fiber optic bundles to ensure precise surface analysis and contamination detection, highlighting a preference for highly specialized, purpose-built lighting solutions integrated directly into automated inspection machinery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nikon Corporation, Olympus Corporation, Carl Zeiss AG, Leica Microsystems, Motic, Thorlabs, Prior Scientific, Moritex Corporation, Excelitas Technologies, Edmund Optics, Chroma Technology, Sutter Instrument, Schott AG, Hamamatsu Photonics K.K., Newport Corporation, PCO-Tech, Keyence Corporation, Carl Zeiss Meditec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microscopic Illumination Equipment Market Key Technology Landscape

The technological landscape of microscopic illumination equipment is dominated by the transition to solid-state lighting, primarily LED (Light Emitting Diode) technology, which has fundamentally reshaped microscopy workflows. Modern LED illumination systems offer numerous advantages over traditional mercury or halogen lamps, including extended operational lifespan, reduced heat generation (critical for live-cell imaging), minimal environmental impact, and exceptional spectral stability. Crucially, the ability of LEDs to be precisely controlled—allowing rapid on/off switching (microsecond speed) and digital intensity modulation—makes them ideal for advanced applications such as high-speed imaging, fluorescence lifetime imaging (FLIM), and automated high-throughput screening where synchronization is essential. Furthermore, the development of spectrally tunable LED arrays allows users to select specific excitation wavelengths without the need for complex filter wheels, streamlining multi-color fluorescence experiments and enhancing experimental flexibility, driving significant technological obsolescence in legacy systems.

Laser illumination technology represents the high-end spectrum of the market, essential for specialized techniques like confocal microscopy, super-resolution microscopy (e.g., STED, STORM, PALM), and optogenetics. These applications demand light sources with extremely high coherence, monochromaticity, and peak power density, capabilities that only lasers can reliably provide. The trend here involves developing multi-line laser engines that combine several distinct laser wavelengths (e.g., 405 nm, 488 nm, 561 nm, 640 nm) into a single, compact unit, managed by highly sophisticated acoustic-optic tunable filters (AOTFs) or digital micromirror devices (DMDs) for extremely fast and spatially controlled beam delivery. The challenge remains in managing the high cost and thermal requirements of these powerful laser combinations, necessitating specialized cooling and control mechanisms that add complexity and expense to the illumination system, positioning them primarily for core research facilities and specialized industry applications.

Another pivotal technological advancement is the integration of digital light processing (DLP) or digital micromirror devices (DMDs) into illumination pathways. These devices allow for the precise spatial patterning of light, enabling advanced illumination techniques such as structured illumination microscopy (SIM) and specialized photomanipulation methods (e.g., photoactivation or photobleaching) within live cells. DMDs consist of millions of individually controllable microscopic mirrors, allowing researchers to project complex illumination patterns onto the sample plane with high temporal and spatial resolution. This technology is vital for maximizing image resolution beyond the traditional diffraction limit and for conducting precise, localized biological experiments, signaling a significant evolution from traditional uniform field illumination to highly localized and dynamic light delivery systems, cementing the link between illumination hardware and computational image processing algorithms.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share in the Microscopic Illumination Equipment Market. This dominance is underpinned by substantial governmental and private sector funding directed towards biomedical and academic research, coupled with the dense concentration of major market players and early technology adopters (pharmaceutical giants, leading universities). The region exhibits high demand for advanced, high-precision laser and high-power LED systems required for cutting-edge techniques like super-resolution imaging and high-throughput drug screening. Stringent regulatory standards also drive demand for validated, reliable illumination solutions, positioning the market here as mature, high-value, and focused on specialized, integrated systems.

- Europe: Europe represents a strong and technologically sophisticated market, driven by significant R&D initiatives supported by the European Union and national science foundations, particularly in Germany, the UK, and France. The market shows a strong inclination towards sustainable and energy-efficient solutions, accelerating the adoption of LED over older mercury lamp systems. There is a robust presence of key microscopy manufacturers, fostering strong collaboration between hardware providers and life science researchers. Growth is concentrated in fluorescence and materials science applications, emphasizing quality, precision, and adherence to strict environmental and safety regulations for light source disposal and usage.

- Asia Pacific (APAC): The APAC region is projected to experience the fastest growth rate during the forecast period. This accelerated expansion is primarily fueled by rapid infrastructure development in countries like China, India, South Korea, and Japan, coupled with increased government investment in local R&D capabilities and educational institutions. The market is characterized by growing demand from both established clinical diagnostics sectors and burgeoning pharmaceutical outsourcing facilities. While cost sensitivity remains a factor, there is increasing adoption of advanced fluorescence illumination systems, driven by the desire to implement global standards in scientific research and manufacturing quality control, making it a pivotal area for future investment.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold smaller market shares but offer emerging opportunities, particularly in expanding clinical diagnostic infrastructure and basic university research. Adoption rates are often slower due to budget constraints and reliance on imported equipment, leading to higher popularity of cost-effective and low-maintenance solutions, such as basic LED and robust halogen systems. However, increasing healthcare awareness and investment in localized pharmaceutical manufacturing (MEA) and raw materials analysis (LATAM) suggest a gradual shift towards higher-performance, reliable illumination equipment in metropolitan and industrial centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microscopic Illumination Equipment Market.- Nikon Corporation

- Olympus Corporation

- Carl Zeiss AG

- Leica Microsystems

- Motic

- Thorlabs

- Prior Scientific

- Moritex Corporation

- Excelitas Technologies Corp.

- Edmund Optics

- Chroma Technology Corp.

- Sutter Instrument

- Schott AG

- Hamamatsu Photonics K.K.

- Newport Corporation (MKS Instruments)

- PCO-Tech

- Keyence Corporation

- Carl Zeiss Meditec AG

- Lumen Dynamics (Excelitas Technologies)

- AmScope

Frequently Asked Questions

Analyze common user questions about the Microscopic Illumination Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Microscopic Illumination Equipment Market?

The primary driver is the accelerating global investment in life science research and development (R&D), specifically the increasing adoption of advanced fluorescence microscopy techniques, which necessitate high-precision, stable, and spectrally specific illumination sources like LEDs and lasers.

How is LED technology impacting the market compared to traditional illumination sources?

LED technology is replacing traditional halogen and mercury lamps due to its superior benefits, including significantly longer lifespan, reduced energy consumption, minimal heat generation (critical for live-cell imaging), and the capability for fast, precise digital control required for high-speed and automated imaging workflows.

Which application segment accounts for the largest share of microscopic illumination equipment usage?

The Life Sciences Research application segment holds the largest market share, driven by the continuous need for advanced imaging tools in cell biology, molecular biology, genomics, and drug discovery processes, necessitating specialized and powerful illumination for complex fluorescence assays.

What is the role of Artificial Intelligence (AI) in modern microscopic illumination systems?

AI is increasingly used for autonomous illumination control, allowing the system to dynamically optimize light intensity, spectrum, and spatial patterning in real-time based on sample characteristics, thereby maximizing image contrast, consistency, and analytical throughput, particularly in automated screening.

Which geographical region is expected to show the fastest growth rate for this market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by substantial government investment in research infrastructure, rapid expansion of the biotechnology and pharmaceutical sectors, and increased demand for high-quality clinical diagnostics in major emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager