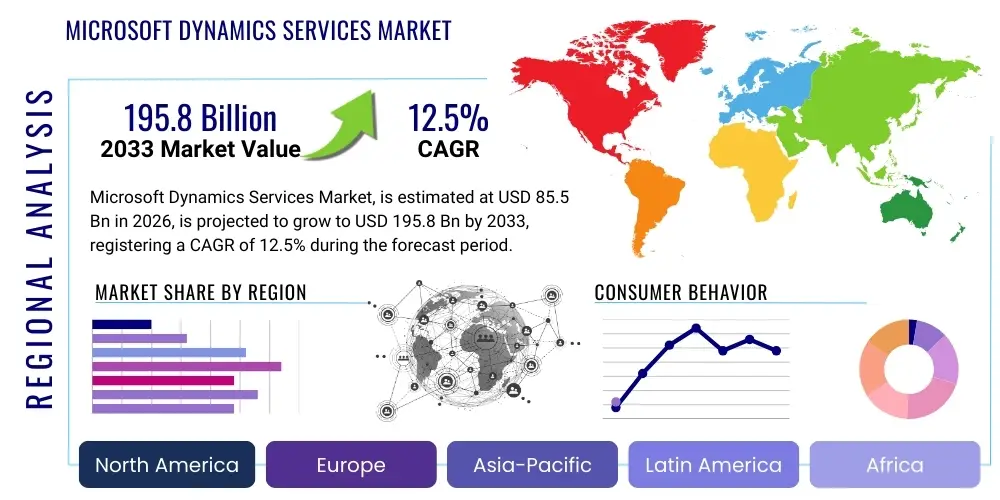

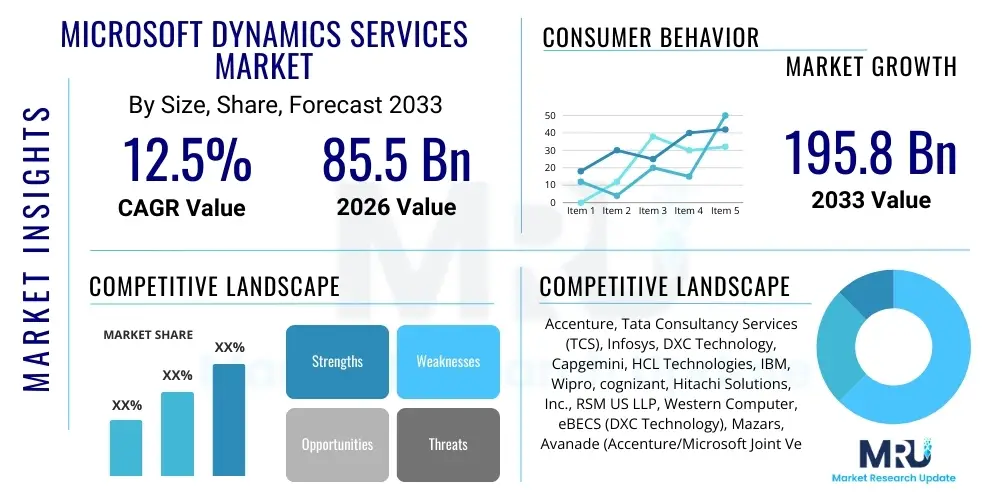

Microsoft Dynamics Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435050 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Microsoft Dynamics Services Market Size

The Microsoft Dynamics Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $85.5 Billion in 2026 and is projected to reach $195.8 Billion by the end of the forecast period in 2033. This substantial expansion is driven by the accelerating global shift towards cloud-based enterprise resource planning (ERP) and customer relationship management (CRM) solutions, specifically the Microsoft Dynamics 365 suite, which offers unparalleled integration with the broader Microsoft ecosystem, including Azure and the Power Platform. Organizations globally are prioritizing digital transformation initiatives that necessitate robust implementation, integration, customization, and managed services support for these complex, mission-critical systems.

Microsoft Dynamics Services Market introduction

The Microsoft Dynamics Services Market encompasses the entire spectrum of professional services related to the deployment, customization, maintenance, training, and strategic consulting for Microsoft Dynamics products, predominantly Dynamics 365 (D365) which includes Finance, Supply Chain Management, Sales, Customer Service, Field Service, and Human Resources. These services are vital for enabling businesses to leverage D365’s capabilities effectively, ensuring seamless integration with existing IT infrastructure and aligning the platform’s features with specific operational requirements and industry compliance standards. The demand for specialized expertise is escalating as D365 becomes increasingly modular and AI-integrated, requiring intricate configuration work that goes beyond standard out-of-the-box functionality.

Dynamics 365 serves as a unified cloud platform combining ERP and CRM functionalities, offering comprehensive solutions for modernized business operations. Major applications include enhancing sales performance through robust CRM tools, optimizing complex supply chains using SCM modules, streamlining financial management, and improving customer engagement. The primary benefits derived from these services include accelerated digital transformation, improved operational efficiency, enhanced data visibility leading to better strategic decision-making, and reduction in total cost of ownership (TCO) through optimized cloud migration strategies and ongoing managed services. Expert services ensure that businesses maximize their investment return and maintain system relevance amidst continuous feature updates by Microsoft.

Key driving factors fueling the market growth include the mandatory end-of-life support for older on-premise Dynamics versions (such as Dynamics AX and GP), pushing migration to D365 Cloud; the explosive growth of the Power Platform (Power BI, Power Apps, Power Automate) which necessitates deep integration services; and the critical need for global enterprises to standardize processes across diverse geographic regions. Furthermore, the increasing complexity of regulatory environments, especially concerning data privacy and financial reporting (e.g., GDPR, CCPA, IFRS), mandates continuous service engagement to ensure compliance and system integrity. The shift toward subscription-based models for software consumption has also fostered long-term, high-value managed service contracts for ongoing support and optimization.

Microsoft Dynamics Services Market Executive Summary

The global Microsoft Dynamics Services Market is characterized by robust business trends centered on cloud migration, vertical specialization, and the imperative of hyper-automation. System integrators (SIs) and consulting partners are increasingly moving away from large, one-time implementation projects towards continuous value delivery models, focusing on maximizing the utilization of D365 features like Copilot and industry-specific cloud solutions. There is a notable consolidation trend among service providers aiming to acquire niche expertise in specialized D365 modules (e.g., Field Service optimization) or geographic regions. Business investment is heavily skewed towards modernizing core ERP processes (Finance and Operations) and enhancing customer engagement capabilities (Customer Engagement/CRM), ensuring data fluidity across the entire organizational stack.

Regionally, North America maintains its dominance due to high cloud spending, early adoption of cutting-edge D365 technologies, and the presence of a large installed base of legacy Dynamics users requiring urgent cloud migration services. Europe follows, with growth particularly strong in regulated sectors like financial services and manufacturing, driven by stringent compliance requirements and the need for sophisticated supply chain resilience post-pandemic. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapid digitization efforts in developing economies, increased foreign direct investment, and a growing acceptance of public cloud deployments for critical business applications. Service providers are establishing significant delivery centers in India, the Philippines, and Australia to meet this escalating regional demand, often focusing on scalable, template-based deployment models for mid-market clients.

Segment trends highlight the significant dominance of the managed services segment, reflecting the complexity of D365 updates and the preference for outsourced maintenance and continuous optimization rather than relying solely on internal IT teams. By application, the ERP segment (Dynamics 365 Finance and Supply Chain Management) secures the largest market share, serving as the foundational operational backbone for large enterprises. However, the CRM segment (Sales and Customer Service) is witnessing accelerated growth, driven by the immediate return on investment provided by enhanced customer journey mapping and personalized engagement strategies. Furthermore, the mid-sized enterprise segment is showing robust adoption rates, seeking scalable, less customized versions of D365, which is pushing service providers to develop standardized, quick-start implementation packages that lower the barrier to entry.

AI Impact Analysis on Microsoft Dynamics Services Market

The impact of Artificial Intelligence (AI), particularly through Microsoft’s introduction of Copilot across the Dynamics 365 suite and the broader Power Platform, is fundamentally reshaping the services landscape. Users are primarily concerned with how AI will streamline traditionally complex and time-consuming implementation tasks, questions revolving around the true Return on Investment (ROI) from incorporating generative AI into customer service and sales processes, and the ethical and data governance challenges associated with deploying large language models (LLMs) within sensitive ERP data environments. Key themes indicate that while users recognize AI's potential to automate mundane tasks (like data entry, report generation, and basic customer inquiries), they require expert guidance on customizing AI models for industry-specific terminology, ensuring data quality needed to train these models, and managing the inevitable organizational change required to adapt to AI-driven workflows. The demand for services related to "AI readiness assessments," data strategy consulting, and prompt engineering within D365 is rapidly outpacing traditional implementation needs.

- AI enhances system customization and deployment speed by automating repetitive coding and configuration tasks, reducing reliance on extensive manual effort.

- Copilot capabilities within D365 Finance accelerate financial forecasting, anomaly detection, and automated variance analysis, driving demand for specialized service consultants focused on financial AI integration.

- Service providers are shifting focus from basic data migration to sophisticated data governance and strategy consulting required to ensure AI models are trained on clean, unbiased, and compliant data sets.

- Predictive analytics powered by AI optimizes supply chain management by forecasting demand fluctuations and identifying potential logistical bottlenecks before they materialize, necessitating advanced integration services.

- AI-driven automation in Customer Service and Sales modules (e.g., automated summaries of customer interactions, suggested responses) increases the urgency for user training and organizational change management services.

- The rise of AI tools elevates the need for cybersecurity services focused on protecting AI models from adversarial attacks and ensuring the secure storage and processing of AI-generated insights within Azure environments.

- AI enables advanced personalization in marketing and commerce, demanding specialized consulting to align marketing strategies with D365 Customer Insights and AI-driven segmentation capabilities.

- The development of industry-specific AI models requires vertical expertise from service providers, moving beyond generic AI implementation to bespoke solution deployment within sectors like healthcare and manufacturing.

- AI facilitates proactive system monitoring and predictive maintenance for D365 instances, transforming managed services into highly automated, preventative support operations, thereby reducing downtime.

- Skill transformation services are critical, focusing on upskilling client teams in prompt engineering, AI monitoring, and responsible AI usage within their daily Dynamics workflows.

DRO & Impact Forces Of Microsoft Dynamics Services Market

The dynamics of the Microsoft Dynamics Services Market are significantly influenced by a confluence of accelerating drivers and persistent restraints, offset by transformative opportunities. The primary driver is the pervasive global mandate for digital transformation, compelling organizations to adopt integrated cloud solutions like D365 to maintain competitive advantage. This is coupled with Microsoft's continuous investment and expansion of the D365 product line, including seamless integration with the Azure cloud platform and robust low-code/no-code capabilities offered by the Power Platform, making D365 a highly attractive, future-proof solution. However, market growth faces restraints, chiefly the high initial implementation costs and the substantial complexity involved in migrating large, highly customized legacy systems to the D365 cloud architecture, often leading to project delays and budget overruns. The critical shortage of highly specialized D365 consultants, particularly those proficient in complex SCM or F&O implementations combined with specific vertical knowledge, also acts as a bottleneck.

Opportunities abound, specifically driven by the necessity for vertical specialization. Service providers who develop deep expertise in high-growth sectors such as financial services, life sciences, and public sector are positioned for accelerated market penetration, offering pre-configured, industry-specific D365 accelerators that reduce deployment time and risk. Furthermore, the integration of Generative AI and IoT capabilities presents immense potential for high-value consulting services focused on data strategy and advanced automation within D365 workflows, moving services beyond simple configuration towards strategic business optimization. The expanding mid-market segment, seeking simplified, cloud-first implementations, offers a vast, untapped opportunity for scalable, standardized service offerings, often delivered via nearshore or offshore models to optimize cost structures. The transition from reactive support to proactive managed services, leveraging AI for predictive maintenance and continuous improvement, also represents a significant avenue for recurring revenue growth.

The cumulative impact forces strongly favor market expansion. The continuous product innovation cycle by Microsoft ensures that D365 remains at the forefront of enterprise technology, maintaining high demand for skilled service providers who can implement and manage these new features immediately upon release. While implementation risks and skill shortages pose immediate challenges (Restraints), the long-term strategic advantage offered by D365's integrated cloud ecosystem and the massive efficiency gains achievable through AI integration (Drivers and Opportunities) far outweigh these barriers. These forces dictate that service providers must evolve rapidly, shifting their workforce focus from technical skills alone to a blend of technical proficiency, vertical business process knowledge, and advanced data/AI consulting, solidifying the market's trajectory towards high growth and sophisticated, ongoing client engagement models.

Segmentation Analysis

The Microsoft Dynamics Services Market is highly diversified, segmented across various dimensions including type (implementation, upgrade/migration, managed services), application (ERP, CRM, specialized applications), deployment model (cloud, on-premise, hybrid), organization size (SMEs, large enterprises), and industry vertical. This segmentation allows service providers to tailor their offerings precisely, addressing the unique complexities and budgetary constraints of different client types. The services market is characterized by a fundamental shift toward cloud-based managed services, reflecting the preference among enterprises to outsource the complexity of platform maintenance and continuous updates inherent in the D365 environment. Large enterprises typically dominate the demand for complex, customized ERP (Finance & Operations) implementation services, while SMEs increasingly seek rapid, standardized cloud deployment of CRM and standardized accounting modules. The specialized applications segment, covering niche areas like Retail, Project Operations, and Field Service, is demonstrating exceptionally high growth rates due to the focused automation and efficiency gains these modules deliver to specific operational teams.

- By Service Type:

- Implementation and Consulting

- Upgrade and Migration Services (especially legacy AX/GP to D365 Cloud)

- Managed Services and Support

- Optimization and Customization Services

- Training and Change Management

- Data Integration and Strategy Consulting (including AI/ML enablement)

- By Application:

- Enterprise Resource Planning (ERP): Dynamics 365 Finance and Supply Chain Management (F&O)

- Customer Relationship Management (CRM): Dynamics 365 Sales, Customer Service, and Marketing

- Specialized Applications: Dynamics 365 Project Operations, Field Service, Human Resources (HR)

- Power Platform Integration Services (Power Apps, Power BI, Power Automate)

- By Deployment Model:

- Cloud (Public, Private, Hybrid)

- On-Premise (Legacy Support and Select Regulatory Environments)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises (Globally integrated and highly customized deployments)

- By Industry Vertical:

- Manufacturing and Automotive

- Retail and E-commerce

- Financial Services and Insurance (BFSI)

- IT and Telecommunications

- Healthcare and Life Sciences

- Public Sector and Government

- Professional Services

Value Chain Analysis For Microsoft Dynamics Services Market

The value chain for the Microsoft Dynamics Services Market is intricate, starting with Microsoft (the upstream provider) and extending through a network of specialized partners to the final end-user. Microsoft's role is critical as the intellectual property owner, defining the platform architecture, releasing continuous updates, and providing the underlying Azure infrastructure. The core value generation then shifts to the Tier 1 and Tier 2 service providers (System Integrators/SIs and Managed Service Providers/MSPs) who act as the primary distribution channel for implementation expertise. These partners invest heavily in talent, certifications, and developing proprietary accelerators or Intellectual Property (IP) tailored to specific industry needs, thereby significantly enhancing the platform's value proposition beyond its standard features. Upstream analysis focuses on the certification programs, technological roadmap announcements by Microsoft, and the licensing models that dictate the competitive environment for service delivery.

The distribution channel is predominantly indirect, relying heavily on the Microsoft Partner Network (MPN). Direct engagement by Microsoft is rare, usually reserved for strategic accounts or highly complex, specialized federal projects. Indirect channels include global SIs (like Accenture, Infosys, IBM), specialized regional consulting firms, and Value-Added Resellers (VARs). The shift to cloud subscription models (Dynamics 365) has fundamentally altered the payment structure in the value chain, transitioning from large, upfront license fees to recurring revenue streams for both Microsoft and its partners, particularly benefiting the Managed Services providers downstream. This ecosystem relies on strong co-selling agreements and shared revenue models, ensuring that partners are continuously motivated to drive adoption and consumption of D365 modules and the adjacent Power Platform tools.

Downstream analysis centers on the end-user adoption and post-implementation optimization phases. The value captured by the customer is determined by the quality of the implementation, the seamlessness of data migration, and the effectiveness of the change management strategies employed by the service provider. The increasing complexity of D365 features, particularly the AI components and rapid release cycles, guarantees long-term engagement through managed services contracts. This downstream demand requires partners to specialize not just in implementation, but in data strategy, organizational training, and continuous technical governance. The most successful partners are those who can integrate D365 with other enterprise systems (e.g., SAP, Salesforce) and provide ongoing strategic consulting that aligns D365 utilization directly with key business performance indicators (KPIs), thus maximizing the long-term realized business value for the potential customer.

Microsoft Dynamics Services Market Potential Customers

The potential customer base for Microsoft Dynamics Services is extensive and diverse, primarily categorized by organization size and industry vertical, reflecting the global need for modern, integrated ERP and CRM solutions. End-users/buyers of these services span from large, multinational corporations requiring complex, global deployments of Dynamics 365 Finance and Supply Chain Management (F&O) to small and mid-sized enterprises (SMEs) looking for standardized, low-cost implementations of D365 Business Central or specialized CRM modules like D365 Sales. Large enterprises constitute the most valuable customer segment, demanding highly customized solutions, multi-region deployments, and ongoing high-value consulting focused on digital transformation roadmapping, complex regulatory compliance, and extensive integration with legacy systems. These customers often engage Tier 1 global system integrators for comprehensive, multi-year contracts.

SMEs represent a rapidly expanding segment, increasingly adopting cloud-first strategies. For this segment, services revolve around rapid deployment, template-based configurations, and affordable managed services. Potential customers in the mid-market are specifically attracted to Dynamics 365 Business Central for its scalability and lower total cost of ownership compared to full F&O implementations. Service providers targeting SMEs often utilize standardized industry accelerators (e.g., manufacturing lite, standard distribution) to ensure quick time-to-value. Furthermore, vertical-specific businesses—such as heavily regulated financial institutions, healthcare providers dealing with patient data compliance (HIPAA, GDPR), and discrete manufacturing firms requiring precise inventory and production scheduling—are prime customers, as D365 services provide the necessary specialized customization and compliance frameworks crucial for these sectors.

In essence, any organization undergoing significant operational modernization, seeking to consolidate disparate business applications, or mandated to migrate away from legacy on-premise solutions is a potential buyer. The adoption is particularly strong in sectors where real-time data visibility, sophisticated supply chain orchestration, and exceptional customer experience are competitive necessities. Buyers include CFOs and finance teams (seeking F&O implementations), Chief Revenue Officers and sales teams (seeking D365 Sales implementations), Chief Operating Officers (seeking SCM and Field Service optimization), and Chief Information Officers (seeking robust Azure integration and managed security services). The ongoing product innovation by Microsoft ensures a continuous need for services relating to upgrades, new feature adoption (like Copilot), and complex integration with the expanding Power Platform ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $85.5 Billion |

| Market Forecast in 2033 | $195.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, Tata Consultancy Services (TCS), Infosys, DXC Technology, Capgemini, HCL Technologies, IBM, Wipro, cognizant, Hitachi Solutions, Inc., RSM US LLP, Western Computer, eBECS (DXC Technology), Mazars, Avanade (Accenture/Microsoft Joint Venture), PwC, KPMG, Deloitte, NTT DATA, Ciber Global. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microsoft Dynamics Services Market Key Technology Landscape

The technology landscape underpinning the Microsoft Dynamics Services Market is entirely dominated by the Microsoft Cloud stack, necessitating deep expertise in interconnected proprietary technologies. Central to this landscape is Microsoft Azure, which provides the foundational scalability, security, and global infrastructure for Dynamics 365 and all related services. Service providers must possess comprehensive knowledge of Azure's architectural components, including data lakes, Synapse Analytics for data warehousing, and Azure DevOps for continuous integration and deployment (CI/CD) pipelines essential for modern D365 development and maintenance. Furthermore, the technology focus has heavily shifted towards the low-code/no-code environment of the Power Platform, requiring consultants skilled in creating bespoke applications (Power Apps), automating workflows (Power Automate), and generating actionable business intelligence (Power BI) that extend and enhance D365 functionality without traditional, complex coding methods.

Specialized services are increasingly focused on the integration of Artificial Intelligence and Machine Learning (AI/ML) directly within the Dynamics environment, primarily via Microsoft Copilot and Azure AI services. This includes services related to setting up predictive maintenance models, optimizing inventory forecasting algorithms in SCM, and implementing advanced chatbot capabilities in Customer Service. Data management services are critical, encompassing data quality initiatives, mastering data migrations (especially from legacy ERP systems to D365’s Common Data Model/Dataverse), and ensuring strict adherence to global data privacy regulations (e.g., managing data residency requirements through Azure). The move towards industry clouds, such as the Dynamics 365 Cloud for Retail or Financial Services, dictates that service technology competence must be packaged with vertical business process knowledge, moving beyond generic technical skills to integrated industry solution design.

Moreover, the continuous update cadence of Dynamics 365, often involving mandatory bi-annual updates, requires service providers to employ sophisticated technology tools and methodologies for continuous system monitoring, regression testing, and automated deployment management. This involves utilizing specialized Microsoft tools, third-party testing automation suites, and robust DevOps practices to minimize disruption during feature releases and ensure ongoing compliance. The underlying technology focus also includes advanced cybersecurity practices for D365 environments, addressing identity management via Azure Active Directory (now Entra ID), managing role-based access controls, and implementing advanced threat protection mechanisms tailored specifically for mission-critical enterprise data housed within the Dynamics applications. This holistic approach ensures resilience, compliance, and optimal performance for the customer's entire D365 instance.

Regional Highlights

The regional distribution of the Microsoft Dynamics Services Market exhibits distinct growth patterns and maturity levels, heavily influencing service delivery strategies and partner focus. North America (NA) represents the largest market share, characterized by high IT spending, a mature cloud adoption curve, and a substantial legacy installed base of older Dynamics products (AX, GP, NAV) which drives continuous, large-scale migration and upgrade services. NA businesses, particularly large enterprises in financial services and high-tech manufacturing, prioritize high-value consulting services focused on digital transformation and sophisticated AI integration, demanding Tier 1 global system integrators and highly specialized consulting partners.

Europe stands as the second-largest market, with growth driven significantly by stringent regulatory requirements, particularly GDPR and IFRS, necessitating compliance-focused D365 implementations and financial configuration services. The demand is strong across Western Europe, where manufacturing and retail sectors seek supply chain resilience and multi-country operational standardization. However, the market structure often involves a mix of large global SIs and specialized, language-specific local partners, particularly in Germany and France, catering to unique regulatory and linguistic requirements. Eastern Europe is emerging rapidly, driven by industrial modernization efforts and the lower cost structure of local implementation firms.

Asia Pacific (APAC) is projected to record the highest CAGR during the forecast period. This rapid expansion is fueled by accelerated cloud adoption, government-led digitization initiatives across countries like India, China, and Southeast Asia, and massive infrastructure investments. APAC customers often seek greenfield D365 implementations focused on scalability and mobility, driven by the need to manage complex, dispersed supply chains and burgeoning consumer markets. This region is vital for the growth of offshore delivery centers, which provide cost-effective implementation and managed services to global clients, further solidifying its role in the global Dynamics ecosystem. The MEA and Latin America regions are experiencing moderate growth, primarily focused on oil & gas, public sector modernization, and localized financial services implementations, often relying on hybrid deployment models due to evolving data infrastructure capabilities and regulatory landscapes.

- North America (NA): Dominant market share; High maturity in cloud ERP adoption; Primary focus on large-scale F&O implementations, specialized industry clouds, and aggressive AI integration (Copilot); High demand for premium strategic consulting and legacy migration services.

- Europe: Second-largest market; Growth heavily influenced by compliance (GDPR, IFRS); Strong demand in manufacturing, retail, and public sector for multi-country, standardized implementations; Reliance on a blend of global SIs and strong local partners.

- Asia Pacific (APAC): Fastest-growing region; Driven by rapid digitization, infrastructure investment, and expansion of multinational operations; High demand for scalable Business Central and core CRM implementations; Emergence as a key hub for offshore/nearshore delivery centers.

- Latin America (LATAM): Developing market; Growth centered on manufacturing modernization and financial services; Significant requirement for services ensuring adherence to complex local tax and regulatory reporting standards; Hybrid cloud deployment preference is common.

- Middle East and Africa (MEA): Emerging growth market; Investment concentrated in energy, government, and retail sectors; Focus on digital transformation initiatives like Saudi Vision 2030; High demand for services related to data sovereignty and security within the Azure environment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microsoft Dynamics Services Market.- Accenture

- Tata Consultancy Services (TCS)

- Infosys

- DXC Technology

- Capgemini

- HCL Technologies

- IBM

- Wipro

- Cognizant

- Hitachi Solutions, Inc.

- RSM US LLP

- Western Computer

- eBECS (DXC Technology)

- Mazars

- Avanade (Accenture/Microsoft Joint Venture)

- PwC

- KPMG

- Deloitte

- NTT DATA

- Ciber Global

- Dynamics Consultants

- Columbus A/S

- Barrett Business Services, Inc.

- AlfaPeople

- Tectura

- Nisum Technologies

- Orion Group

- Quisitive

- To-Increase

- Queue Associates

- Solution Dynamics, Inc.

- Binary Stream Software

- ProServ International

- SA Global

- Velosio

- CloudFronts

- 360 Visibility

- Sierra-Cedar

- Synergy Business Consulting

- IntelliSense

- Merkle (Dentsu)

Frequently Asked Questions

Analyze common user questions about the Microsoft Dynamics Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Microsoft Dynamics Services Market?

The primary driver is the accelerating global mandate for cloud migration, particularly the sunsetting of legacy on-premise Dynamics versions (AX, GP) and the continuous, feature-rich integration of Dynamics 365 with the Microsoft Azure cloud and the Power Platform ecosystem, necessitating specialized implementation and continuous managed services.

How is AI impacting the delivery of Dynamics 365 services?

AI is fundamentally transforming service delivery by introducing highly automated tools like Copilot, which require specialized consulting in prompt engineering, data governance, and strategic AI integration. This shifts services from basic configuration to high-value data and automation strategy consulting, speeding up deployment and enhancing predictive capabilities.

Which segment holds the largest market share in terms of service type?

The Managed Services and Support segment holds the largest and fastest-growing share by service type. This dominance is driven by the complexity of D365’s continuous updates, the desire of enterprises to outsource ongoing maintenance, and the need for 24/7 proactive system optimization and security management.

What is the typical timeframe and cost for a Dynamics 365 implementation for a large enterprise?

Implementation time and cost vary significantly based on customization, integration complexity, and industry. For a large enterprise requiring comprehensive Dynamics 365 Finance and Supply Chain Management (F&O), projects typically range from 12 to 24 months and can involve substantial seven-figure investments, requiring meticulous project management and phased deployment services.

What are the key technological differentiators service providers must master?

Service providers must master deep expertise in Azure infrastructure and security, the entire Power Platform (Power Apps, Power BI, Power Automate) for extending D365 functionality, and advanced AI services for incorporating predictive and generative capabilities. Mastery of CI/CD and DevOps practices for agile updates is also mandatory.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager