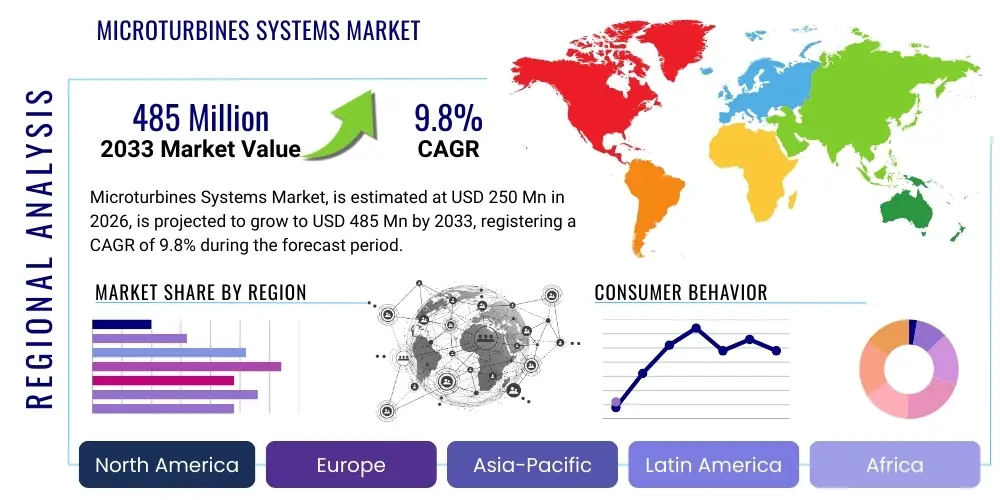

Microturbines Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436751 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Microturbines Systems Market Size

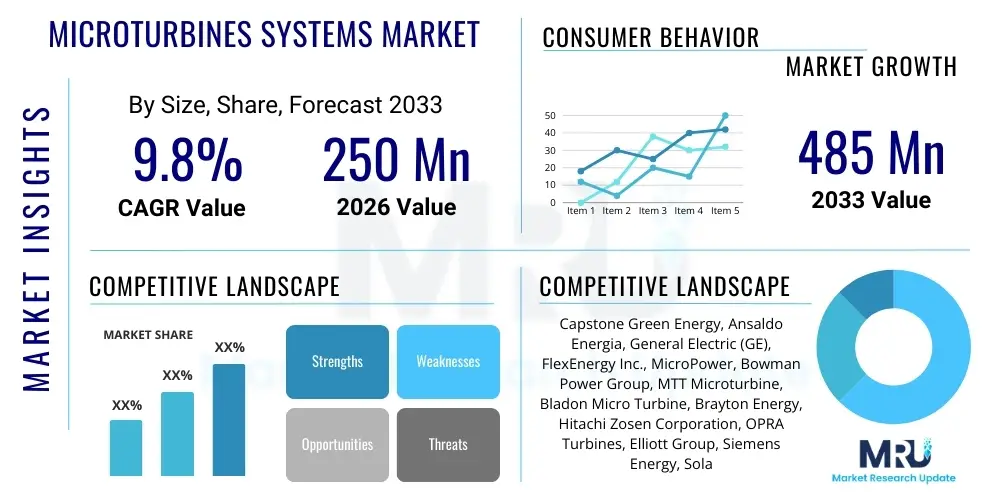

The Microturbines Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 250 Million in 2026 and is projected to reach USD 485 Million by the end of the forecast period in 2033.

Microturbines Systems Market introduction

The Microturbines Systems Market encompasses the development, manufacturing, and deployment of compact combustion turbine generator systems, typically ranging in size from 30 kW to 1000 kW. These systems are designed primarily for distributed generation applications, offering high efficiency, low emissions, and reliable power supply, especially suitable for Combined Heat and Power (CHP) systems. Microturbines utilize a single shaft and incorporate advanced recuperators to capture waste heat, significantly boosting their electrical efficiency compared to traditional combustion engines in smaller scales. Their operational flexibility allows them to run on various fuels, including natural gas, biogas, diesel, and alternative fuels, making them a versatile solution for energy resiliency and decarbonization efforts across multiple sectors.

Major applications driving the adoption of microturbines include commercial buildings seeking resilient power (such as hospitals, data centers, and universities), industrial facilities requiring process heat and electricity simultaneously (CHP/Cogen), and remote areas where grid connectivity is impractical or expensive, favoring standalone power generation. The inherent benefits of microturbines—such as minimal moving parts leading to lower maintenance costs, compact footprint, quiet operation, and superior emission profiles (particularly NOx and CO) compared to reciprocating engines—position them as an essential component in the modern decentralized energy infrastructure. Furthermore, their ability to integrate seamlessly with renewable energy sources and grid balancing mechanisms enhances their attractiveness in smart grid architectures.

The primary driving factors propelling the market include stringent environmental regulations promoting cleaner energy technologies, the increasing global demand for decentralized power generation due to grid vulnerability and congestion, and rising fuel efficiency standards mandating the use of technologies like CHP. Government incentives and subsidies, especially in developed economies, supporting the installation of high-efficiency distributed energy resources (DERs) further accelerate market growth. The ongoing expansion of oil and gas exploration and production activities in remote locations, requiring reliable, continuous power supply, also significantly contributes to the demand for robust microturbine systems.

Microturbines Systems Market Executive Summary

The Microturbines Systems Market is experiencing robust expansion driven by global energy transition efforts toward decentralized and cleaner power generation. Key business trends include an intensified focus on optimizing microturbine efficiency through advanced material science and digital controls, and a significant shift toward models capable of utilizing hydrogen and biogas, positioning them favorably in the circular economy context. Strategically, market leaders are forging partnerships with utility providers and energy service companies (ESCOs) to offer integrated, packaged CHP solutions, reducing complexity for end-users. The competitive landscape is characterized by innovation in modular design, allowing for scalability and rapid deployment, catering particularly to the rapidly growing data center and remote industrial sectors.

Regionally, North America maintains its dominance, primarily due to supportive regulatory frameworks for CHP, high energy costs, and the widespread adoption of microturbines in the oil and gas extraction industries and critical infrastructure like hospitals. Asia Pacific (APAC) is projected to exhibit the fastest growth, fueled by rapid industrialization, increasing urbanization, and governmental initiatives in countries like India and China to enhance grid stability and reduce reliance on centralized coal-fired power plants. Europe demonstrates steady growth, highly influenced by ambitious decarbonization mandates and generous incentive schemes promoting high-efficiency heating and cooling solutions, favoring biogas-fueled systems in the region.

In terms of segmentation, the 100kW - 250kW power rating segment is projected to hold the largest market share, offering an optimal balance of cost-effectiveness, compact size, and power output suitable for medium-sized commercial and light industrial applications. Concurrently, the Combined Heat and Power (CHP) application segment remains the foundational growth driver, as the economic viability and environmental benefits derived from simultaneous electricity and useful thermal energy generation are unparalleled in distributed energy systems. The Industrial End-Use segment, encompassing manufacturing and petrochemical plants, is set for substantial growth, driven by the need for on-site, resilient power that can insulate operations from increasing grid instability and price volatility.

AI Impact Analysis on Microturbines Systems Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) into the Microturbines Systems Market heavily revolve around predictive maintenance, optimization of fuel consumption, and integration into smart energy grids. Users are keenly interested in how AI algorithms can monitor real-time operational parameters, anticipate component failure before critical incidents occur, and dynamically adjust fuel-air ratios to maximize efficiency under varying load conditions. Concerns also focus on the cybersecurity risks associated with connecting these physical assets (microturbines) to networked AI systems and the necessary investment in digital infrastructure required to harness these capabilities. Overall, the expectation is that AI will transform microturbines from static power generators into smart, self-optimizing energy assets crucial for future energy management systems.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze vibration, temperature, and performance data, forecasting required maintenance cycles, thereby minimizing unplanned downtime and reducing operational costs by up to 30%.

- Optimized Energy Management (OEMS): AI systems manage the dispatch of microturbines within a microgrid, coordinating seamlessly with solar, battery storage, and utility tariffs to ensure the lowest operational cost and highest energy resilience.

- Enhanced Fuel Flexibility and Efficiency: AI models continuously adjust combustion parameters in real-time based on the specific composition of diverse fuels (e.g., varying biogas quality), maximizing the conversion efficiency and minimizing harmful emissions.

- Remote Diagnostics and Troubleshooting: AI enables rapid identification of faults and root cause analysis through remote monitoring, reducing the need for on-site technician visits and speeding up system restoration.

- Improved Grid Interaction: AI facilitates the integration of microturbines as Virtual Power Plant (VPP) assets, allowing them to provide ancillary services like frequency regulation and demand response to the main electrical grid.

DRO & Impact Forces Of Microturbines Systems Market

The Microturbines Systems Market is fundamentally shaped by the confluence of strict environmental regulations, the imperative for energy resilience, and the economic benefits derived from high-efficiency power generation. Drivers include the global push for cleaner energy and decentralized generation, supported by government incentives for CHP installations, which are increasingly seen as critical infrastructure. Restraints primarily involve the relatively high initial capital expenditure compared to traditional reciprocating engines and the lingering skepticism regarding long-term maintenance costs in certain developing regions. Opportunities lie in the rapidly expanding application sectors such as data centers, renewable energy integration (using microturbines as backup or balancing power), and the transition to fuels like hydrogen and biogas. These forces collectively dictate market trajectory, favoring suppliers who can provide integrated, high-efficiency, and digitally enabled modular systems.

The primary driving factor remains the superior efficiency achieved through Combined Heat and Power (CHP) systems, often reaching thermal efficiencies exceeding 80%. This substantial energy savings potential, coupled with the enhanced energy security provided by on-site power generation, makes microturbines highly attractive for commercial and industrial users vulnerable to grid outages or fluctuating energy prices. Furthermore, the low-emission profile of microturbines, especially concerning nitrogen oxides (NOx) and carbon monoxide (CO), aligns perfectly with tightening global air quality standards, particularly in densely populated urban centers. The geopolitical need to diversify energy sources and minimize dependence on large, centralized power plants also significantly bolsters the demand for robust, distributed solutions.

Conversely, the high upfront cost remains a substantial barrier to widespread adoption, particularly for small and medium-sized enterprises (SMEs) that may struggle to secure the necessary financing compared to the lower initial investment required for older, established technologies. Another significant restraint is the operational complexity and required technical expertise for sophisticated system maintenance, which can deter potential buyers in regions with limited skilled labor. Opportunities, however, abound in the development of modular and plug-and-play microturbine units that simplify installation and integration, lowering overall deployment time and cost. The burgeoning green hydrogen economy presents a long-term opportunity, as microturbines are inherently adaptable to burn hydrogen, promising zero-carbon power generation and future-proofing current installations against aggressive climate mandates.

Segmentation Analysis

The Microturbines Systems Market is comprehensively segmented based on power rating, application, and end-use industry, reflecting the diverse requirements of the distributed energy landscape. Analyzing these segments provides critical insights into purchasing behaviors, technological preferences, and regional adoption trends. The power rating segmentation (e.g., 30kW-100kW, 100kW-250kW) helps suppliers tailor products to specific facility sizes, with mid-range units being most popular for institutional and large commercial applications. Application analysis differentiates between the highly lucrative Combined Heat and Power (CHP) market, which capitalizes on total energy efficiency, and Standalone Power Generation, crucial for remote sites and grid resilience. The End-Use segment highlights the dominance of the Industrial sector, driven by continuous operational needs, and the accelerating demand from critical infrastructure and data center operators seeking unparalleled uptime.

- By Power Rating:

- 30kW - 100kW

- 100kW - 250kW

- Above 250kW (up to 1000 kW)

- By Application:

- Combined Heat and Power (CHP) / Cogeneration

- Standalone Power Generation

- By End-Use Industry:

- Commercial (e.g., Hospitals, Hotels, Universities)

- Industrial (e.g., Manufacturing, Food & Beverage, Petrochemicals)

- Residential (Limited Scope, mainly micro-CHP)

- Oil & Gas (e.g., Upstream and Midstream Operations)

- Data Centers and Critical Infrastructure

Value Chain Analysis For Microturbines Systems Market

The value chain for the Microturbines Systems Market begins with upstream suppliers providing highly specialized components, including the high-temperature alloys for the recuperator and turbine wheel, advanced electronic controls, and specialized compressors. The performance and efficiency of the final product are heavily reliant on the quality and precision of these core components, where technological advancements often focus on heat resistance and durability. Manufacturing and assembly form the core stage, dominated by key global players who focus on integrating these complex components into compact, efficient, and standardized systems, often adhering to strict quality control and safety standards necessary for compliance in regulated energy markets. This manufacturing phase also includes rigorous testing and quality assurance to ensure long operational life and low emissions.

The distribution channel represents a critical link, often relying on specialized engineering procurement and construction (EPC) firms, certified distributors, and energy service companies (ESCOs) for direct and indirect sales. Direct sales are common for large-scale industrial projects or integrated energy solutions sold directly to utilities or major corporations. Indirect channels, through regional distributors and channel partners, are crucial for reaching smaller commercial customers and managing localized installation and post-sales service requirements. These partners provide regional expertise in permitting, installation, commissioning, and critically, long-term operational maintenance and technical support, which is often contracted out to maintain system uptime.

Downstream analysis focuses on installation, commissioning, and long-term maintenance services, which represent a significant portion of the total lifetime cost and value. The service market—including remote monitoring, predictive maintenance, and part replacement—is crucial for maintaining high capacity factors and customer satisfaction. The eventual end-users, ranging from oil and gas operations needing remote power to urban commercial centers requiring resilient CHP, ultimately dictate the demand patterns. Successful positioning in the value chain requires manufacturers to establish robust service networks and digital capabilities (e.g., IoT connectivity) to provide continuous operational support and minimize total cost of ownership (TCO) for the end customer.

Microturbines Systems Market Potential Customers

The primary end-users and buyers of microturbine systems are entities requiring high reliability, energy efficiency, and a reduced carbon footprint, often characterized by continuous operational needs. Key potential customers include operators of mission-critical infrastructure, such as data centers and hospitals, where power interruption is unacceptable and the capability for quick black start is essential. The industrial sector, particularly those involved in continuous processing like chemical manufacturing, food and beverage production, and paper mills, are major buyers due to their high thermal energy demand, making CHP systems economically compelling. Furthermore, telecommunication companies and upstream oil and gas producers operating in remote or off-grid locations rely heavily on microturbines for robust, continuous, and compact power generation solutions that can utilize associated gas or other readily available fuels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 485 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Capstone Green Energy, Ansaldo Energia, General Electric (GE), FlexEnergy Inc., MicroPower, Bowman Power Group, MTT Microturbine, Bladon Micro Turbine, Brayton Energy, Hitachi Zosen Corporation, OPRA Turbines, Elliott Group, Siemens Energy, Solar Turbines, Turbec S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microturbines Systems Market Key Technology Landscape

The technological landscape of the Microturbines Systems Market is defined by continuous innovation focused on enhancing efficiency, reducing emissions, and improving fuel flexibility. A core area of technological development is the recuperator design, which utilizes heat exchange technology to preheat compressed air before combustion, dramatically improving overall cycle efficiency. Ongoing research focuses on using advanced materials, such as ceramic composites and specialized high-temperature alloys, to increase the operating temperature of the turbine wheel and enhance the durability and thermal effectiveness of the recuperator, pushing electrical efficiencies closer to 40% in smaller units. Furthermore, the integration of magnetic bearing technology is gaining traction, eliminating the need for oil lubrication systems, which simplifies maintenance, reduces the system footprint, and allows for even quieter, high-speed operation, particularly beneficial in noise-sensitive urban environments.

Another crucial technological frontier is the advancement in combustion technology to accommodate diverse fuel inputs, particularly renewable and transitional fuels. Manufacturers are investing heavily in dry low-emission (DLE) combustion systems that ensure efficient, clean burning of high-calorific fuels like natural gas while also adapting the systems to handle low-calorific fuels such as waste gas, landfill gas, and biogas, which exhibit significant compositional variability. The ability to seamlessly switch between fuels (dual-fuel capability) provides essential operational flexibility to end-users. This adaptability is key to market penetration in sectors generating waste heat or gases, such as wastewater treatment plants and agricultural operations, enabling them to convert waste into valuable energy, supporting circular economy initiatives.

Finally, the evolution of digital control systems and integration capabilities is transforming microturbines into smart energy assets. Modern microturbines incorporate sophisticated microprocessor-based controllers that enable precise monitoring, remote diagnostics, and seamless integration into larger microgrid energy management systems (EMS). These systems utilize IoT sensors and cloud connectivity to allow operators to optimize performance remotely, implement predictive maintenance schedules, and participate in grid ancillary services. The focus on modularity and containerization also represents a technological shift, standardizing units for faster deployment and integration, making microturbines more appealing for decentralized, scalable power solutions. The continuing development of power electronics is equally important, ensuring high-quality power output and reliable synchronization with various grid conditions.

Regional Highlights

- North America: Dominates the global microturbines market, driven by significant investment in oil and gas infrastructure, robust regulatory support for CHP initiatives (especially in the US Northeast and California), and the high demand for resilient power generation from critical facilities like data centers and military bases. The region benefits from established natural gas pipeline networks and strong governmental focus on enhancing grid independence through distributed energy resources (DERs).

- Europe: Characterized by strong governmental commitment to energy efficiency and decarbonization targets. Demand is heavily concentrated in high-efficiency CHP systems, utilizing generous incentives and feed-in tariffs. The European market leads in the adoption of biogas and syngas fueled microturbines, particularly in Germany, the UK, and Italy, aligned with aggressive renewable energy mandates and waste-to-energy strategies.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by rapid industrialization, massive urbanization, and increasing energy demand that outstrips traditional grid capacity. Countries like China and India are investing in microturbines to improve energy access in remote areas and address severe air quality concerns by adopting cleaner distributed generation technologies. Economic growth necessitates reliable backup power, further boosting market penetration.

- Latin America: Exhibits steady growth, driven by investments in the oil and gas sector (e.g., Mexico and Brazil) requiring robust, reliable off-grid power for exploration and extraction sites. Grid instability and high transmission losses in various parts of the region make decentralized microturbine solutions economically attractive for commercial and small industrial applications seeking energy independence.

- Middle East and Africa (MEA): Growth is concentrated in the Middle East due to massive infrastructure projects and the high energy needs associated with desalination plants and petrochemical industries. Microturbines are valued for their robustness in extreme temperatures and their ability to run on locally abundant fuels, including associated petroleum gas, reducing flaring and waste.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microturbines Systems Market.- Capstone Green Energy

- Ansaldo Energia

- General Electric (GE)

- FlexEnergy Inc.

- MicroPower

- Bowman Power Group

- MTT Microturbine

- Bladon Micro Turbine

- Brayton Energy

- Hitachi Zosen Corporation

- OPRA Turbines

- Elliott Group

- Siemens Energy

- Solar Turbines

- Turbec S.p.A.

- Caterpillar Inc. (through its distributed power solutions)

- Kawasaki Heavy Industries

- Mitsubishi Power, Ltd.

- MAN Energy Solutions

- Ingersoll Rand (through key acquisitions)

Frequently Asked Questions

Analyze common user questions about the Microturbines Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of microturbines over reciprocating engines for distributed power generation?

Microturbines offer distinct advantages over reciprocating engines, including significantly lower maintenance requirements due to fewer moving parts and the absence of oil lubrication (especially with magnetic bearings). They provide superior exhaust quality (lower NOx and CO emissions) and greater fuel flexibility, capable of seamlessly running on natural gas, biogas, or hydrogen, making them highly suitable for environmentally sensitive applications.

How significant is the role of Combined Heat and Power (CHP) in driving microturbine market growth?

CHP is the predominant application driving the microturbine market, enabling total system efficiencies often exceeding 80%. This dual output—electricity and useful thermal energy (hot water or steam)—provides immense cost savings and reduces energy wastage, making CHP systems economically viable and preferred for industrial sites, hospitals, and large commercial facilities globally seeking energy independence.

What is the typical lifespan and maintenance schedule for a microturbine system?

Microturbines are designed for robust, continuous operation with a typical operational lifespan exceeding 80,000 hours, often lasting 15 to 20 years or more with proper care. Maintenance is generally low compared to other distributed generators, typically involving major servicing (e.g., replacement of the turbine core or bearings) occurring every 4,000 to 8,000 equivalent operating hours, facilitated increasingly by predictive maintenance enabled by IoT and AI.

Which geographical region exhibits the highest growth potential for microturbine system adoption?

Asia Pacific (APAC), particularly China and India, represents the highest growth potential for microturbine adoption. This is primarily driven by massive infrastructure expansion, escalating industrial power demands, and urgent government mandates to improve grid reliability and reduce local pollution through the deployment of efficient, decentralized energy solutions.

Can microturbines effectively integrate with renewable energy sources and battery storage in microgrids?

Yes, microturbines are highly effective for microgrid integration. They provide essential base-load power and rapid ramp-up capability, compensating for the intermittency of renewables (like solar and wind). When coupled with battery storage, they ensure optimal energy dispatch, stability, and black-start capability, offering resilient, hybrid power solutions crucial for future smart energy systems and decentralized power security.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager