Microwave Signal Generator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438839 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Microwave Signal Generator Market Size

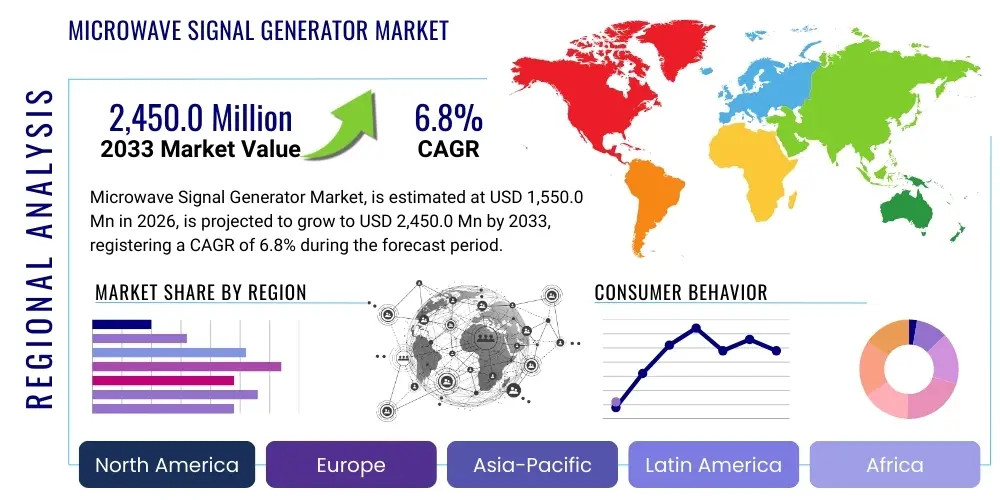

The Microwave Signal Generator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033.

Microwave Signal Generator Market introduction

The Microwave Signal Generator Market encompasses essential electronic testing equipment designed to produce high-fidelity radio frequency (RF) and microwave signals, typically spanning frequencies from 1 GHz up to the emerging sub-Terahertz bands. These sophisticated instruments are the backbone of modern electronic system development, enabling engineers to characterize components, subsystems, and complete systems under controlled and highly precise signal environments. Key product differentiators involve spectral purity, characterized by extremely low phase noise, frequency stability, and the ability to generate complex, wideband vector-modulated signals necessary for contemporary digital communication protocols. The market’s evolution is intricately tied to advancements in semiconductor technology, particularly the shift toward high-speed Digital-to-Analog Converters (DACs) and proprietary frequency synthesis architectures that enhance signal integrity and instantaneous bandwidth.

Microwave signal generators are critically utilized across a range of high-technology applications. In the telecommunications sector, they are indispensable for testing 5G New Radio (NR) base stations and user equipment, requiring instruments that can generate signals with multi-gigahertz modulation bandwidths and precise error vector magnitude (EVM) performance to ensure maximum data throughput and network reliability. For the aerospace and defense industry, the primary function is simulation; generators must replicate complex, frequency-hopping, and pulsed radar signals, as well as electronic countermeasure (ECM) techniques, providing realistic threat scenarios necessary for the rigorous testing of electronic warfare (EW) receivers and defense systems. Furthermore, the burgeoning automotive industry uses these devices for validating the performance of 77 GHz and 79 GHz radar sensors crucial for Advanced Driver-Assistance Systems (ADAS) and autonomous vehicle development.

The primary driving force behind the sustained market growth is the global technological mandate for higher data rates and increased system complexity. The continuous demand for spectrum efficiency necessitates moving into higher frequency bands (millimeter-wave and sub-Terahertz), which inherently increases the technical challenges for signal generation, demanding instruments with superior frequency accuracy and stability. Moreover, the shift in military doctrine towards cognitive and wideband electronic warfare systems requires test equipment that can not only generate static signals but can also dynamically adapt signal characteristics in real-time, mirroring the sophistication of modern adversarial systems. This requirement for adaptive testing capabilities pushes manufacturers toward integrating advanced computational resources and sophisticated software algorithms directly into the generator hardware.

Benefits derived from investing in advanced microwave signal generators include drastically reduced time-to-market for new electronic products due to automated and faster test routines, enhanced confidence in system performance through highly accurate characterization, and adherence to stringent industry standards set by bodies like 3GPP and FCC. The market sees a strong movement toward modular solutions, such as PXI and AXIe platforms, offering users scalable, multi-channel capabilities essential for testing phased array antennas and massive MIMO systems. This modular approach provides flexibility, cost efficiency, and improved synchronization capabilities compared to traditional monolithic benchtop units, appealing significantly to high-volume manufacturing test environments and advanced research facilities.

Microwave Signal Generator Market Executive Summary

The Microwave Signal Generator Market is characterized by intense technological competition and strategic corporate maneuvers, predominantly focused on capturing the high-growth segments of 5G/6G testing and specialized defense applications. Business trends highlight a pronounced shift from purely hardware-centric sales to integrated solutions incorporating proprietary software defined instrumentation (SDI) capabilities. Leading manufacturers are emphasizing the development of instruments with wider instantaneous bandwidths, often surpassing 2 GHz, to address the needs of advanced radar and ultra-wideband communication systems. Strategic partnerships between test equipment vendors and telecommunication chip manufacturers are becoming common practice, aimed at accelerating the development of pre-compliance and conformance test solutions for rapidly evolving standards, thus securing early market penetration.

Regional trends reveal a bifurcation in market dynamics: North America retains its premium position due to massive military spending and established R&D infrastructure, while the Asia Pacific region aggressively leads in volume growth, fueled by government-backed 5G deployment strategies and the concentration of consumer electronics manufacturing. This geographical disparity drives product specialization; North America focuses on low-volume, high-specification military-grade instruments, whereas APAC demands higher volumes of cost-optimized, high-throughput vector signal generators for production line testing. European markets, meanwhile, show a steady trajectory, driven significantly by the standardization of vehicular technology and the resulting need for specialized 77 GHz radar testing equipment, ensuring regulatory compliance across the continent.

Segment trends underscore the vector signal generator category as the primary engine for future revenue growth, largely overshadowing analog signal generators, which are now relegated mostly to niche low-noise applications. The shift towards higher frequencies is undeniable, making the Above 30 GHz segment critical, especially with mmWave bands becoming standard in commercial deployments. Furthermore, the modular form factor segment, including PXI and AXIe, is increasingly favored in automated test equipment (ATE) deployments across manufacturing sectors, displacing traditional benchtop units in high-volume testing scenarios due to superior integration density and synchronization performance. Manufacturers are keenly focusing on offering software enhancements, such as simplified user interfaces and sophisticated signal analysis libraries, to manage the inherent complexity of high-frequency measurements and enhance user experience.

AI Impact Analysis on Microwave Signal Generator Market

Common user questions regarding AI’s impact frequently center on how machine learning can enhance the efficiency and accuracy of complex signal testing, particularly in scenarios involving dynamic channel emulation or massive measurement datasets. Users are keen to understand if AI can democratize access to high-end testing, reducing the necessity for deeply specialized RF knowledge by automating calibration, optimization, and measurement validation. Key themes emerging from these inquiries include the potential for AI to implement cognitive testing—where the test system adapts its parameters based on real-time feedback from the device under test (DUT)—and concerns about the computational resources required to embed these intelligent algorithms directly within the test instrumentation itself, impacting latency and cost. Expectations are high that AI will streamline the entire workflow, moving beyond simple automation to achieve predictive system diagnostics and optimized signal generation synthesis.

Artificial Intelligence, particularly Machine Learning (ML), is fundamentally transforming the usage models of microwave signal generators by embedding intelligence directly into the measurement process. ML algorithms are utilized for sophisticated auto-calibration routines, significantly reducing the downtime and human error associated with manually calibrating wideband, high-frequency instruments. For complex tasks like measuring Error Vector Magnitude (EVM) in massive MIMO systems, AI optimizes the signal crest factor reduction (CFR) and digital pre-distortion (DPD) parameters far faster than traditional iterative methods, leading to quicker throughput in both R&D and manufacturing test environments. This integration allows test systems to learn the behavioral nuances of the Device Under Test (DUT) and adapt the generated signal parameters to stress-test specific non-linearities, providing deeper diagnostic insights previously unattainable.

In electronic warfare (EW) simulation, AI plays a game-changing role by enabling the signal generator to operate as a cognitive threat simulator. Traditional EW test systems rely on pre-programmed threat libraries; however, modern EW requires signals that can adapt instantly to countermeasures. AI utilizes techniques like reinforcement learning to observe the DUT's jamming response and dynamically adjust the signal characteristics (frequency, power, modulation) in real-time. This dynamic capability ensures the generated signal accurately mimics a highly agile, modern threat, crucial for validating the cognitive capabilities of next-generation defense receivers. Furthermore, AI-powered predictive maintenance algorithms analyze instrument usage data and performance metrics to anticipate potential hardware failures, thereby maximizing uptime and reliability in critical test installations.

- AI algorithms automate and optimize complex calibration sequences, reducing setup time and maximizing instrument uptime.

- Machine learning is deployed for real-time optimization of signal quality parameters, such as Crest Factor Reduction (CFR) and Digital Pre-Distortion (DPD), enhancing test speed for 5G/6G waveforms.

- Cognitive Signal Generation utilizes reinforcement learning to create adaptive, dynamic threat signals crucial for advanced electronic warfare testing.

- Predictive analytics powered by AI monitors instrument health and forecasts maintenance needs, ensuring operational continuity in high-reliability applications.

- Intelligent software streamlines the analysis of massive datasets generated during wideband testing, identifying subtle performance degradation trends automatically.

- AI assists in channel modeling and emulation, generating complex environmental signals with higher fidelity and less computational overhead for simulating real-world wireless conditions.

DRO & Impact Forces Of Microwave Signal Generator Market

The Microwave Signal Generator Market's trajectory is primarily influenced by the synergistic relationship between technological push factors and market adoption pull factors. The most dominant driver remains the continuous pursuit of advanced wireless technologies, notably the ongoing transition into 5G Standalone (SA) and Non-Standalone (NSA) architectures and the exploratory stages of 6G, which inherently demand signal generation capabilities extending into the sub-Terahertz spectrum. Conversely, market expansion is significantly restrained by the prohibitive cost of developing and acquiring ultra-high-performance components, such as low-noise, wide-bandwidth DACs and complex frequency multipliers, which translates directly into high capital expenditure (CAPEX) for end-users. Opportunities are abundant in the modularization of test equipment and the increasing necessity for sophisticated simulation tools in non-traditional markets like autonomous driving and medical imaging, creating specialized, high-margin niche areas for key players.

Drivers: The requirement for massive connectivity and ultra-low latency, central tenets of 5G, necessitate sophisticated testing tools that can accurately characterize signal integrity and intermodulation distortion across multi-band, high-power environments. Defense modernization programs globally, particularly the investment in next-generation fighter aircraft, missile defense, and unmanned aerial vehicles (UAVs), rely heavily on advanced signal generators to test onboard radar, guidance systems, and communication links against simulated hostile electromagnetic environments. The convergence of these commercial and military requirements ensures sustained demand for instruments offering higher frequency, wider bandwidth, and superior noise performance. Furthermore, the increasing integration of microwave links in backhaul networks and satellite communications for global connectivity also contributes substantially to the demand curve for highly stable signal sources.

Restraints: Beyond the financial barrier of entry, technological restraints related to maintaining signal fidelity at extremely high frequencies pose significant limitations. Issues such as phase noise accumulation and amplitude flatness degradation become exponentially challenging above 40 GHz, requiring expensive technical solutions that inflate the final product cost. The complexity of operating and programming advanced vector signal generators, especially those integrated into automated test environments (ATE), requires highly skilled and often scarce engineering talent, posing an operational restraint for smaller organizations. Moreover, geopolitical risks and intellectual property disputes over proprietary ASIC designs and software algorithms introduce supply chain uncertainties, potentially delaying the delivery of critical components and specialized high-end systems necessary for premium product lines.

Opportunities: The transition towards software-defined instrumentation provides a significant growth opportunity, allowing vendors to sell recurring software upgrades and maintenance contracts rather than relying solely on hardware sales cycles, improving long-term revenue stability. The rise of quantum computing research presents a specialized, though smaller, market segment requiring ultra-stable, highly phase-locked microwave sources for qubit manipulation, demanding extremely stringent phase noise specifications. Another substantial opportunity lies in providing tailored, standardized testing solutions for the rapidly growing automotive sensor market, allowing vendors to leverage economies of scale in this high-volume industrial application. Exploiting the capabilities of integrated arbitrary waveform generation (AWG) to offer enhanced signal simulation fidelity further opens doors in high-stakes simulation markets, ensuring that generators move beyond simple testing into sophisticated modeling platforms.

- Drivers (D):

- Accelerated global commercialization of 5G infrastructure and dedicated R&D towards 6G standards requiring sub-THz testing capabilities.

- Escalating global defense spending focused on modernizing electronic warfare, AESA radar, and secure satellite communication systems.

- Regulatory mandates in the automotive sector driving the standardization and mass production of high-frequency ADAS radar sensors.

- Demand for superior spectral purity and stable frequency synchronization in complex, multi-channel testing setups (massive MIMO).

- Restraints (R):

- Exorbitant R&D and manufacturing costs for instruments achieving low noise performance at millimeter-wave frequencies.

- Short product life cycles and rapid obsolescence driven by new communication standards and technology leaps.

- Limited availability of highly specialized technical expertise required for advanced operation and integration.

- International trade restrictions and export control challenges on high-performance defense-grade test equipment.

- Opportunities (O):

- Market expansion through the adoption of flexible, cost-efficient modular instrumentation platforms (PXI/AXIe).

- Significant potential in offering specialized, high-stability signal sources for emerging quantum computing applications.

- Integration of advanced software features and cloud connectivity for remote monitoring and automated data analysis.

- Targeting niche industrial applications requiring high-precision microwave energy control, such as specialized material processing.

- Impact Forces:

- Technology Innovation Intensity: Extremely High, focusing on DAC resolution and phase noise reduction.

- Threat of New Entrants: Low, due to high R&D cost and complexity barrier to entry.

- Supplier Power: Moderate to High, as key components (e.g., proprietary ASICs, low-noise oscillators) are sourced from limited specialized vendors.

- Substitutability: Very Low, as fundamental generation equipment is irreplaceable, though software-defined radios offer limited substitutes for specific low-end tasks.

Segmentation Analysis

The detailed segmentation of the Microwave Signal Generator Market provides crucial insights into differential demand patterns and technology adoption rates across various end-user industries. Analyzing the market by technology type, the Vector Signal Generator (VSG) segment dominates revenue generation due to its indispensable role in testing digital communication systems that rely on complex modulation formats. VSGs, equipped with Arbitrary Waveform Generation (AWG) capabilities, allow for the creation of intricate, non-standard signals required for emerging technologies and military simulation, securing their market prominence. Conversely, Analog Signal Generators maintain a critical, albeit smaller, share in applications where absolute spectral purity and ultra-low noise are non-negotiable, such as testing high-performance mixers and low-noise amplifiers (LNAs) in satellite ground stations.

The segmentation by Frequency Range clearly illustrates the market's migration towards higher spectrum utilization. While the 10 GHz to 30 GHz segment remains substantial, catering to traditional radar and standardized wireless protocols, the Above 30 GHz segment, encompassing the critical millimeter-wave (mmWave) bands (e.g., 28 GHz, 39 GHz, 77 GHz), is experiencing the fastest acceleration in growth. This shift reflects the commercial reality of 5G deployments and the increasing sophistication of defense radars operating in Ka and V bands. Furthermore, the segmentation by Form Factor emphasizes a growing industry preference for Modular Instruments (PXI, AXIe). These modular solutions offer unparalleled system scalability, superior channel-to-channel phase coherence, and higher integration density, making them ideal for massive MIMO and large-scale ATE installations in manufacturing, contrasting with the traditional flexibility and stand-alone performance of Benchtop Units preferred in R&D labs.

- By Type/Technology:

- Analog Signal Generators (Optimized for CW, low phase noise)

- Vector Signal Generators (Essential for complex digital modulation like QAM, OFDM)

- Integrated AWG Solutions (Focus on complex, custom waveform creation)

- By Frequency Range:

- Below 10 GHz (Legacy communication, basic testing)

- 10 GHz to 30 GHz (Mid-range radar, Ku band satellite, early 5G research)

- Above 30 GHz (Millimeter-wave applications, 5G NR, automotive radar, advanced defense systems)

- By Application:

- Telecommunication Testing (Base station validation, handset testing, component characterization)

- Aerospace and Defense (Radar calibration, Electronic Warfare (EW) simulation, satellite payload testing)

- Automotive Radar Testing (77 GHz/79 GHz sensor calibration and validation for ADAS)

- General Purpose T&M and R&D (Education, academic research, industrial component testing)

- By Form Factor:

- Benchtop/Rackmount Units (Stand-alone, high-performance R&D)

- Modular Instruments (PXI, AXIe – High channel density, automated manufacturing ATE)

Value Chain Analysis For Microwave Signal Generator Market

The initial stage of the Microwave Signal Generator value chain involves the procurement of highly advanced electronic components and proprietary modules. This upstream segment is capital-intensive and requires specialized technological know-how, as the core performance metrics of the final generator—phase noise, frequency range, and bandwidth—are determined here. Key components include ultra-low phase noise Oven Controlled Crystal Oscillators (OCXOs) or atomic frequency references, high-speed, high-resolution Digital-to-Analog Converters (DACs) often running at tens of giga-samples per second, and specialized monolithic microwave integrated circuits (MMICs) for amplification and frequency multiplication at millimeter-wave frequencies. The ability of major vendors to vertically integrate the design and fabrication of critical ASICs provides a strong competitive advantage, ensuring control over intellectual property and supply reliability, especially for military-grade equipment where component provenance is strictly regulated.

The manufacturing and assembly phase constitutes the midstream segment, focusing on integrating complex hardware and software architectures. This involves meticulous assembly in highly controlled environments to prevent physical degradation that could impact signal purity. Crucially, the midstream phase adds significant value through proprietary frequency synthesis techniques (e.g., fractional-N PLL designs) and advanced digital signal processing (DSP) embedded in FPGAs. These DSP capabilities enable real-time baseband processing, digital pre-distortion, and sophisticated waveform generation necessary for modern vector modulation. Rigorous, traceable calibration using primary metrology standards is mandatory to ensure the instrument meets published specifications, requiring large investments in specialized calibration facilities and adherence to ISO/IEC 17025 standards, solidifying the professional reputation and reliability of the end product.

Downstream activities center on market distribution, installation, training, and long-term service provision. High-end microwave signal generators are typically sold through direct sales channels to major defense contractors and Tier 1 telecom companies, facilitating deep technical consultation and customized solutions. Indirect channels, involving authorized distributors and integrators, serve the broader market, including academic and smaller commercial R&D labs. A critical aspect of the downstream value is the provision of post-sales service, including periodic re-calibration, hardware upgrades (e.g., frequency extensions), and subscription-based software updates for new communication standards (e.g., 5G FR2 conformance test libraries). The profitability in the market often shifts towards these high-margin service contracts, which ensure customer retention and extend the operational lifespan of the high-value instrumentation assets.

Microwave Signal Generator Market Potential Customers

The vast ecosystem of the telecommunications industry represents the single largest and fastest-growing customer base for microwave signal generators. This includes major telecom equipment manufacturers (TEMs) like Ericsson and Huawei, mobile network operators (MNOs) such as Verizon and China Mobile, and the entire chain of component suppliers dealing with RF filters, power amplifiers, and transceivers. These customers primarily procure Vector Signal Generators (VSGs) capable of high-throughput testing for compliance and performance validation of 5G New Radio (NR) systems, particularly requiring measurement capabilities in the C-band and millimeter-wave (mmWave) spectrum. Their procurement cycles are driven by global standards updates (3GPP releases) and the need for scalable, high-speed automated test environments (ATE) to handle massive volumes of components and base station systems during production.

The Aerospace and Defense sector is the second most crucial segment, characterized by high-specification requirements and non-price sensitivity, focusing heavily on mission criticality. Customers include defense primes (e.g., Lockheed Martin, Northrop Grumman), government research labs (e.g., specialized military labs), and organizations involved in missile guidance and surveillance technology. They seek instruments offering superior frequency agility, low phase noise, and highly complex arbitrary waveform generation capabilities to simulate realistic electronic warfare scenarios, including sophisticated jamming and decoys. Procurement is often long-term, tied to specific government contracts and military platform upgrades, emphasizing reliability, security features, and adherence to ruggedization standards for field deployment and specialized laboratory use.

A rapidly expanding customer segment is the Automotive industry, particularly those involved in developing Advanced Driver-Assistance Systems (ADAS). Automotive OEMs and Tier 1 suppliers require cost-efficient, yet highly accurate, 77 GHz and 79 GHz signal generators for characterizing and calibrating radar sensors used for collision avoidance and autonomous navigation. Unlike defense, this segment prioritizes automated, reproducible testing tailored for high-volume manufacturing environments, favoring modular instruments that integrate easily into assembly lines. Other emerging, albeit smaller, customers include academic and university research centers focusing on next-generation physics experiments (e.g., material science, quantum research), which demand extreme frequency stability and phase coherence, often utilizing analog signal generators with specialized synchronization features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,550.0 Million |

| Market Forecast in 2033 | USD 2,450.0 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, Teledyne Technologies, BAE Systems, National Instruments (NI), Stanford Research Systems, Berkeley Nucleonics Corporation, Tabor Electronics, Shanghai UniSS, Holzworth Instrumentation, Vaunix, Cobham Advanced Electronic Solutions, Tektronix (Fortive), Chroma ATE Inc., Giga-tronics (Micronetics), Aeroflex (Viavi Solutions), RIGOL Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microwave Signal Generator Market Key Technology Landscape

The contemporary technological landscape of microwave signal generation is dominated by advancements in frequency synthesis and high-speed digital-to-analog conversion. Modern generators utilize sophisticated architectures, often combining Direct Digital Synthesis (DDS) for fine frequency resolution and fast switching speed with Phase-Locked Loops (PLLs) based on fractional-N synthesizers for achieving high-frequency outputs with minimal phase noise. The critical challenge lies in pushing the boundary of the phase noise floor, which is essential for ensuring accurate testing of sensitive receiver systems, particularly in radar and satellite communications. Manufacturers are heavily investing in proprietary oscillator technologies (like Yttrium Iron Garnet, YIG, or specialized OCXOs) and advanced filtering to minimize spurious emissions and harmonic content across the wide operating spectrum, differentiating high-end models from general-purpose equipment.

Vector Signal Generation relies critically on the performance of integrated Arbitrary Waveform Generation (AWG) capabilities, driven by ultra-high-speed DACs (often 50 GSa/s or higher) coupled with robust Digital Signal Processing (DSP) implemented via custom FPGAs. This integration allows for the creation of complex, wideband IQ (In-phase/Quadrature) modulated signals required by 5G NR and proprietary military waveforms. Key technological innovation focuses on developing effective Digital Pre-Distortion (DPD) algorithms and crest factor reduction (CFR) techniques that are embedded within the generator to ensure high linearity and low Error Vector Magnitude (EVM) even at high power levels and wide modulation bandwidths. The ability to manage these complex digital processes in real-time is a crucial competitive factor, enabling faster test times and higher quality results for increasingly complex communications standards.

Furthermore, technology development is concentrated on optimizing the physical and operational aspects of the instruments. Thermal management systems are becoming increasingly critical; as high-speed components generate more heat, sophisticated internal cooling and temperature compensation circuits are required to maintain frequency stability and amplitude accuracy over temperature variations, which is vital for long-duration test runs. Synchronization technology is also paramount; for multi-channel testing of phased array antennas, the generators must employ precise synchronization mechanisms, often referencing external, highly stable clocks (e.g., 10 MHz references or specialized distribution networks) to achieve nanosecond-level phase coherence between channels. The continued adoption of Software-Defined Radio (SDR) principles within the hardware architecture allows for flexible licensing of features (bandwidth, modulation types) and remote upgradeability, ensuring the long-term viability and return on investment for end-users.

Regional Highlights

North America maintains its leadership position in the Microwave Signal Generator Market, driven by robust governmental investment in sophisticated defense technology and the significant presence of globally leading telecommunication equipment manufacturers and aerospace contractors. The U.S. Department of Defense (DoD) procurement cycles for new AESA radar systems and sophisticated electronic warfare suites necessitate continuous demand for high-performance, low-phase noise, and wideband vector signal generators, often customized for specific military applications and subject to stringent security requirements. Furthermore, North American telecom giants were early adopters and investors in 5G mmWave technology, fueling the need for complex, multi-channel testing solutions utilizing modular platforms, thereby maintaining a premium pricing structure and high market penetration for advanced instruments across the region.

The Asia Pacific (APAC) region is characterized by explosive growth and rapid infrastructure buildout, making it the most dynamic market globally for microwave signal generators. China, in particular, drives significant volume demand through massive state-backed investment in 5G and 6G development, indigenous military modernization, and a dominant position in high-volume electronics manufacturing. Countries like South Korea, Japan, and Taiwan also contribute substantially, focusing on high-tech component development and advanced wireless research. This region's demand profile emphasizes instruments offering high throughput and automation capabilities suitable for factory floor testing, leading to increased adoption of modular PXI solutions. The competitive landscape in APAC is intensifying, with local vendors rapidly improving their technical capabilities to challenge established global leaders on cost and integration flexibility, particularly in the mid-range performance segments.

Europe’s market stability is underpinned by strong regional focus on standardization and high-tech automotive development. Germany, France, and the UK are key markets, driven by defense modernization programs (e.g., radar system upgrades) and leading R&D efforts in autonomous driving technology, requiring standardized 77 GHz radar testing equipment. Europe also benefits from a mature industrial test and measurement ecosystem, with demand extending beyond traditional telecom and defense into specialized scientific research, including particle accelerators and advanced medical systems. The Middle East and Africa (MEA) and Latin America represent nascent markets where growth is highly dependent on national investment cycles in telecom upgrades (transitioning from 4G to 5G) and localized defense procurement, focusing initially on general-purpose, high-reliability benchtop generators before transitioning to more complex vector solutions.

- North America: Dominant market share, focused on high-specification, custom solutions for defense (EW, AESA radar) and pioneering 5G/6G research; high ASP driven by premium technology.

- Asia Pacific (APAC): Highest CAGR, driven by extensive 5G network rollout, large-scale electronics manufacturing (driving modular ATE adoption), and military modernization in key nations.

- Europe: Stable growth, strong demand from automotive radar testing (ADAS) and sophisticated industrial communications; market is mature with stringent regulatory compliance requirements.

- Latin America: Moderate, fluctuating growth tied to telecom privatization and infrastructure modernization efforts; slower adoption rate for high-frequency mmWave technology compared to other regions.

- Middle East and Africa (MEA): Emerging market, primarily driven by investments in defense communications, oil & gas industry specialized sensing, and smart city connectivity initiatives in the GCC states.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microwave Signal Generator Market.- Keysight Technologies Inc.

- Rohde & Schwarz GmbH & Co. KG

- Anritsu Corporation

- Teledyne Technologies Incorporated

- National Instruments (NI)

- Stanford Research Systems

- Tabor Electronics Ltd.

- Holzworth Instrumentation

- Vaunix Technology Corporation

- Cobham Advanced Electronic Solutions (CAES)

- Tektronix (Fortive Corporation)

- Giga-tronics (Micronetics)

- Aeroflex (Acquired by Viavi Solutions)

- Berkeley Nucleonics Corporation (BNC)

- Shanghai UniSS Technology Co., Ltd.

- RIGOL Technologies, Inc.

- Chroma ATE Inc.

- B&K Precision Corporation

- Analog Devices Inc. (Component Level Influence)

- Wireless Telecom Group (Noisecom, Boonton)

Frequently Asked Questions

Analyze common user questions about the Microwave Signal Generator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Vector Signal Generators (VSGs)?

The main driver for Vector Signal Generators is the global proliferation of modern wireless communication standards, particularly 5G and ongoing 6G research, which necessitate high-fidelity testing of complex digital modulation schemes (like OFDM and QAM) across wide instantaneous bandwidths, especially in the millimeter-wave frequency range (above 30 GHz).

How is the aerospace and defense sector influencing microwave signal generator technology?

The aerospace and defense sector demands generators capable of ultra-low phase noise, high spectral purity, and exceptional pulse modulation capabilities to accurately simulate sophisticated radar systems and adaptive electronic warfare threat scenarios. This requirement pushes manufacturers toward higher frequency agility and advanced arbitrary waveform generation features.

What role does modular instrumentation, such as PXI, play in the market?

Modular instrumentation like PXI is growing rapidly because it offers scalable, cost-effective, and dense test solutions. PXI generators are critical for testing multi-channel systems, such as massive MIMO arrays and phased array antennas, where phase coherence and precise timing synchronization across numerous channels are mandatory requirements, allowing for flexible system expansion.

Which geographical region is anticipated to demonstrate the fastest market growth?

The Asia Pacific (APAC) region, spearheaded by China, South Korea, and India, is anticipated to show the fastest market growth due to massive government-backed investment in 5G infrastructure deployment, expanding indigenous defense electronics programs, and a dominant position in the global high-volume electronics manufacturing supply chain.

What is the difference between an Analog Signal Generator and a Vector Signal Generator?

An Analog Signal Generator (ASG) produces a continuous wave (CW) signal, sometimes modulated with analog methods (AM, FM, PM), optimized for spectral purity and low phase noise. A Vector Signal Generator (VSG) generates complex, digitally modulated signals (IQ modulation) necessary for testing advanced data transmission protocols utilized in modern wireless communication systems.

Why is low phase noise a critical specification in microwave signal generators?

Low phase noise is crucial because it indicates the frequency stability and spectral purity of the generated signal. In receiver testing (e.g., radar, satellite links), high phase noise can mask the performance of the Device Under Test (DUT), elevate the noise floor, and degrade measurement sensitivity, making high spectral purity essential for accurate component characterization.

How does the automotive industry specifically use high-frequency signal generators?

The automotive industry utilizes signal generators, typically operating around 77 GHz, to simulate various radar signatures and distances. This is essential for testing the accuracy, range resolution, and reliability of radar sensors used in ADAS functions like adaptive cruise control, ensuring the safety and performance of autonomous vehicle technology.

What are the primary technical challenges in generating signals above 40 GHz?

Technical challenges at extremely high frequencies include maintaining amplitude flatness, suppressing harmonic content and spurious signals, and managing phase noise degradation. These challenges require specialized components like high-linearity frequency multipliers and highly accurate thermal compensation to ensure stable and precise signal output.

What financial factors restrain market growth for high-end signal generators?

The primary financial restraints are the extremely high capital expenditure (CAPEX) required for purchasing instruments with wide bandwidth and ultra-low noise specifications, coupled with high recurring costs associated with periodic, highly specialized calibration services and the rapid obsolescence of digital components.

How does Software Defined Instrumentation (SDI) affect the market?

SDI affects the market by decoupling hardware capabilities from specific application requirements. It allows manufacturers to offer base hardware with functionality unlocked via software licensing, enabling flexible, rapid upgrades for new standards (like 6G waveforms) and providing opportunities for recurring revenue through software maintenance contracts, reducing the total cost of ownership for end-users.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager