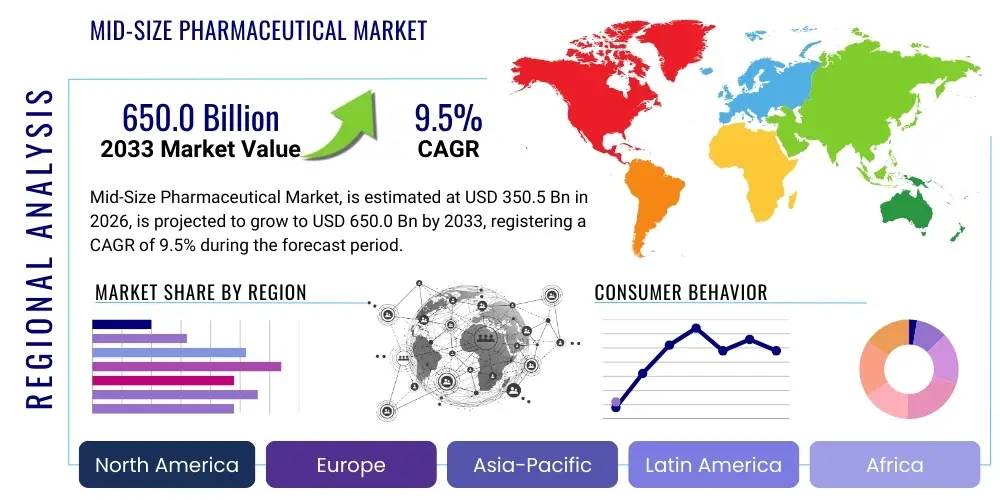

Mid-Size Pharmaceutical Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431473 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Mid-Size Pharmaceutical Market Size

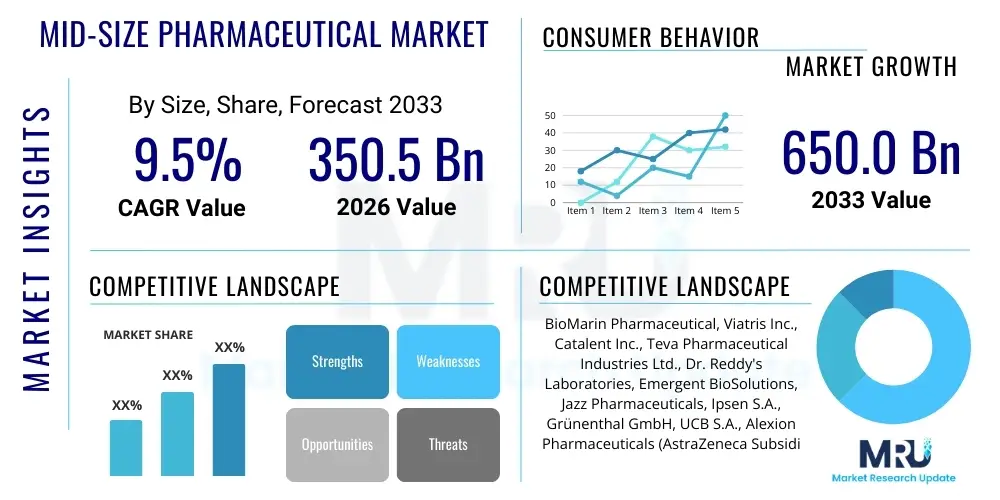

The Mid-Size Pharmaceutical Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $350.5 Billion USD in 2026 and is projected to reach $650.0 Billion USD by the end of the forecast period in 2033.

Mid-Size Pharmaceutical Market introduction

The Mid-Size Pharmaceutical Market encompasses companies generating annual revenues typically ranging from $500 million to $5 billion USD. These entities occupy a strategic position, often bridging the gap between large, diversified multinational corporations (MNCs) and small, emerging biotechs. Products developed by mid-size firms frequently include specialty drugs, complex generics, biosimilars, and novel therapeutics targeting rare diseases or underserved patient populations. Unlike their large counterparts, mid-size firms typically focus their research and development (R&D) efforts on specific therapeutic areas, allowing for greater agility and faster decision-making processes, which are crucial in highly competitive segments like oncology, immunology, and central nervous system disorders. Their operational model often incorporates extensive outsourcing of manufacturing and clinical trials, relying heavily on Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) to optimize capital expenditure and speed to market.

Major applications of mid-size pharmaceutical products span chronic disease management, infectious disease treatment, and personalized medicine applications. The inherent benefit of these companies lies in their ability to quickly pivot R&D strategies based on clinical outcomes and market demands, leading to a higher potential for disruptive innovation compared to the sometimes bureaucratic structures of Big Pharma. This operational flexibility allows them to rapidly acquire promising assets from academic institutions or early-stage biotechs, effectively fueling their product pipelines. Furthermore, mid-size companies are increasingly playing a critical role in addressing global health challenges by focusing on regional specific diseases or developing drugs that are often overlooked due to lower global profit margins, demonstrating a commitment to niche market penetration.

The primary driving factors sustaining the growth of this market include the increasing prevalence of chronic diseases globally, significant advancements in drug discovery technologies (such as genomics and proteomics), and favorable regulatory pathways designed to accelerate the approval of specialty and orphan drugs. Patent expirations of blockbuster drugs held by large pharmaceutical companies present a massive opportunity, enabling mid-size firms to quickly launch biosimilars or complex generic alternatives, capturing substantial market share. Moreover, sustained global demand for specialized treatments, coupled with improved healthcare access in emerging economies, provides a robust foundation for continued revenue expansion, compelling mid-size players to scale up their commercialization and distribution networks.

Mid-Size Pharmaceutical Market Executive Summary

The Mid-Size Pharmaceutical Market is defined by intense competitive dynamics, shifting towards highly specialized therapeutic areas driven by technological innovation and strategic mergers and acquisitions (M&A). Business trends indicate a strong focus on pipeline diversification through targeted acquisitions of clinical-stage assets, allowing these companies to bypass lengthy, high-risk early-stage R&D. Financially, mid-size firms are demonstrating improved capital efficiency, leveraging external funding and strategic partnerships to manage escalating R&D costs. A significant operational trend involves the digitalization of commercial and medical affairs functions, utilizing advanced analytics to enhance marketing effectiveness and improve patient outcomes, thereby optimizing their return on investment (ROI) in commercialization efforts. Furthermore, sustainable manufacturing practices and a renewed emphasis on supply chain resiliency are becoming foundational requirements, particularly in response to geopolitical volatility and recent global health crises.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by expanding middle-class populations, increased government investment in healthcare infrastructure, and favorable regulatory environments for clinical trials and manufacturing. North America and Europe remain the largest revenue contributors, characterized by high spending on specialty medicines and established intellectual property protection frameworks, although pricing pressures continue to challenge profitability. Mid-size companies are strategically establishing localized R&D centers and manufacturing hubs in key emerging markets to benefit from lower operational costs and direct access to rapidly growing patient populations, aligning their geographic footprint with anticipated future growth centers. Latin America and the Middle East & Africa (MEA) are also emerging as crucial territories, primarily for out-licensing and distribution partnerships aimed at maximizing the global reach of existing products.

Segmentation trends reveal a pronounced shift toward complex biologics and niche therapeutic segments, particularly gene and cell therapies, where mid-size companies can often achieve market leadership before large competitors mobilize. The product segment is experiencing accelerated growth in biosimilars, driven by regulatory support (e.g., FDA interchangeability designation) and healthcare system pressures to reduce costs. Furthermore, the distribution segment is evolving, with greater utilization of specialized pharmacy networks and direct-to-patient models to handle cold chain logistics and complex patient onboarding required for specialized medications. This trend emphasizes the criticality of supply chain sophistication and patient support services as essential competitive differentiators within the mid-size space.

AI Impact Analysis on Mid-Size Pharmaceutical Market

Common user questions regarding AI's influence in the Mid-Size Pharmaceutical Market typically revolve around whether smaller organizations can afford and effectively integrate these advanced technologies, how AI accelerates the painfully long drug discovery process, and what immediate, tangible benefits AI offers beyond large-scale clinical trials. Users are often concerned about the regulatory acceptance of AI-derived data and the necessary internal skill sets required for successful deployment. The analysis reveals that the primary themes are efficiency gains in R&D, specifically target identification and hit-to-lead optimization, cost reduction in preclinical stages, and improved clinical trial design through predictive analytics. Mid-size firms are adopting modular AI solutions that are less capital-intensive than enterprise-wide systems, enabling them to focus resources on specific high-value activities, thus improving their ability to compete with larger players.

AI adoption allows mid-size companies to significantly reduce the time and expense associated with identifying viable drug candidates, a crucial competitive advantage given their often-limited R&D budgets. By utilizing machine learning algorithms to analyze vast datasets—including genomics, proteomics, and historical clinical data—these firms can rapidly predict compound efficacy, toxicity, and potential side effects with greater accuracy than traditional methods. This capability de-risks early-stage projects, allowing companies to allocate resources more efficiently to the most promising assets. Furthermore, AI tools are instrumental in repurposing existing drugs for new indications, providing a fast track to market expansion.

In the clinical development phase, AI is transforming trial management by optimizing site selection, predicting patient enrollment rates, and monitoring participant adherence remotely. For a mid-size company running specialized, often global, trials, predictive modeling ensures faster enrollment, reduces operational costs, and improves the integrity of the data collected. Beyond R&D, AI algorithms are being integrated into pharmacovigilance systems to rapidly detect and analyze adverse events from real-world evidence (RWE), bolstering patient safety and regulatory compliance. This integration ensures that mid-size firms maintain stringent quality and safety standards while maximizing operational agility across the entire product lifecycle.

- AI accelerates drug target identification and validation, improving R&D throughput.

- Machine learning optimizes lead compound selection and de-risking preclinical development.

- Predictive analytics enhance clinical trial design, improving patient recruitment and retention rates.

- AI-driven pharmacovigilance systems ensure rapid detection and reporting of adverse drug reactions.

- Automation of data analysis streamlines regulatory submissions and compliance processes.

- Personalized medicine strategies are enabled through AI analysis of patient genomic profiles.

DRO & Impact Forces Of Mid-Size Pharmaceutical Market

The Mid-Size Pharmaceutical Market is shaped by a confluence of powerful drivers, challenging restraints, and strategic opportunities, collectively constituting the major impact forces. Key drivers include the global aging population, which necessitates continuous development of chronic and age-related disease treatments, coupled with favorable government policies like fast-track designation and orphan drug status incentives, significantly speeding up the commercialization pathway for novel drugs. Conversely, major restraints involve intense pricing pressure from payers and healthcare systems worldwide, escalating regulatory hurdles requiring complex, high-cost clinical documentation across multiple jurisdictions, and the inherent difficulty in securing specialized scientific talent necessary for advanced biological and gene therapy R&D. The major opportunities stem from the rise of precision medicine, the growing market for biosimilars due to major patent cliffs, and the increasing reliance on outsourcing (CMOs/CROs), which allows mid-size firms to remain asset-light and operationally flexible.

Impact forces are centered around globalization and technological disruption. Globalization mandates robust, resilient supply chains capable of navigating complex international regulatory landscapes and geopolitical risks, directly affecting drug availability and cost. Technological forces, particularly the integration of advanced data analytics, genomics, and digital health tools, are forcing mid-size companies to rapidly modernize their R&D platforms or face obsolescence. Furthermore, the financial stability of the sector is constantly impacted by venture capital availability and public market investor sentiment towards biotech, influencing the feasibility of high-risk, high-reward development programs. The requirement for sustainable and ethical operations, including environmental and social governance (ESG) factors, is also emerging as a significant force, increasingly influencing investor and consumer preferences, especially in developed markets.

A critical impact force specific to the mid-size segment is the 'acquire or be acquired' dynamic. These companies are often attractive acquisition targets for Big Pharma seeking to replenish pipelines, but they must strategically maintain their independence long enough to realize the full value of their proprietary assets. Regulatory harmonization efforts, such as those undertaken by the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), serve as a positive force, potentially simplifying the process for global drug approvals. However, the continuous evolution of intellectual property laws, particularly concerning complex biologics and platform technologies, presents an ongoing legal challenge, demanding specialized expertise to maintain market exclusivity and defend against infringement claims.

Segmentation Analysis

The Mid-Size Pharmaceutical Market is meticulously segmented based on product type, therapeutic area, distribution channel, and mechanism of action to provide granular market insights. Product type segmentation distinguishes between branded specialty drugs, biosimilars, complex generics, and over-the-counter (OTC) products, reflecting the diverse portfolio strategies employed by mid-size entities. Therapeutic segmentation is crucial, as mid-size firms often specialize in high-growth, high-margin areas such as oncology, rare diseases (orphan drugs), and immunology, driving significant revenue concentrations in these focused niches. Distribution channels are analyzed to understand the complexities of logistics for specialized drugs, differentiating between hospital pharmacies, retail pharmacies, and specialized mail-order or limited distribution networks essential for patient access to high-cost treatments.

- By Product Type:

- Branded Specialty Pharmaceuticals

- Complex Generics and Biosimilars

- Over-the-Counter (OTC) Drugs

- Active Pharmaceutical Ingredients (APIs)

- By Therapeutic Area:

- Oncology

- Immunology and Autoimmune Diseases

- Central Nervous System (CNS) Disorders

- Rare and Orphan Diseases

- Infectious Diseases

- Cardiovascular Diseases

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Specialty & Mail-Order Pharmacies

- By Application:

- Human Use

- Veterinary Use

Value Chain Analysis For Mid-Size Pharmaceutical Market

The value chain for mid-size pharmaceutical companies is characterized by a high degree of specialization and strategic outsourcing, aiming for operational efficiency over vertical integration. Upstream analysis involves sourcing critical raw materials, primarily Active Pharmaceutical Ingredients (APIs) and excipients, which are often procured globally from specialized contract manufacturers in regions like India and China, demanding rigorous quality control and supply chain traceability. Unlike Big Pharma, mid-size firms often co-develop or in-license novel compounds from academic institutions or early-stage biotechs, effectively shifting the initial high-risk R&D burden. This lean approach to R&D allows them to focus internal capabilities on late-stage clinical development, regulatory filings, and subsequent commercialization.

Downstream analysis highlights manufacturing and distribution as key value-adding activities, frequently executed through external partners. Manufacturing is predominantly handled by Contract Development and Manufacturing Organizations (CDMOs) who provide specialized capacity for complex formulations (e.g., injectables, sustained-release tablets, and sterile biologics), minimizing the need for massive fixed capital investment by the mid-size firm. The distribution channel analysis is critical, distinguishing between direct and indirect sales models. Direct distribution, often used for highly specialized or orphan drugs, involves the company managing the logistics to specialized clinics or hospitals. Indirect distribution utilizes wholesalers, distributors, and third-party logistics (3PL) providers to reach mass-market pharmacies and healthcare providers, requiring careful margin management and inventory control.

The strategic deployment of distribution channels is tailored to the specific drug portfolio. For high-value specialty drugs that require stringent temperature control (cold chain) and intensive patient support services, mid-size firms rely heavily on limited distribution networks (LDNs) and specialty pharmacies. This direct engagement ensures optimal patient adherence and maximizes reimbursement efficiency. The entire value chain is increasingly reliant on digitalization, using advanced Enterprise Resource Planning (ERP) and supply chain management software to maintain visibility, traceability, and compliance across globally dispersed operations, ensuring that the necessary product reaches the patient efficiently, adhering to Good Distribution Practices (GDP).

Mid-Size Pharmaceutical Market Potential Customers

The potential customer base for the Mid-Size Pharmaceutical Market is diverse and multi-layered, extending beyond the end-user patients to include crucial institutional buyers, payers, and influencing bodies. Hospitals and specialized medical centers represent a primary customer segment, particularly for parenteral and high-cost specialty drugs used in acute care or complex treatments such as chemotherapy and complex surgeries. These institutions purchase directly or through Group Purchasing Organizations (GPOs), demanding reliability in supply, demonstrable clinical efficacy, and favorable pharmacoeconomic profiles that justify the therapy cost within their budget constraints. Specialized clinics, such as infusion centers and oncology practices, are increasingly vital customers, especially for products requiring specific administration protocols or patient monitoring, often served through limited distribution channels.

Furthermore, Managed Care Organizations (MCOs), Pharmacy Benefit Managers (PBMs), and government health systems (e.g., CMS in the US, NHS in the UK) are significant buyers, acting as gatekeepers that determine drug access and reimbursement levels. Mid-size companies must strategically engage these payers by demonstrating the superior value and cost-effectiveness of their therapies through robust real-world evidence (RWE) studies and comparative effectiveness research. Securing favorable formulary placement is paramount, as inclusion dictates whether the product is accessible and affordable to large populations of insured patients. The success in this market segment hinges on rigorous health economics and outcomes research (HEOR) capabilities.

The ultimate end-users, the patients, influence demand through advocacy groups and adherence programs. However, institutional buyers and healthcare providers are the direct purchasers and prescribers. Physicians, specialists (oncologists, neurologists, immunologists), and pharmacists act as key decision-makers who utilize pharmaceutical products. Mid-size firms invest heavily in medical science liaison (MSL) teams to educate these prescribers on the clinical data and appropriate use of their novel therapies. Understanding the specific needs of these diverse buyers—from cost containment required by payers to clinical data validation sought by prescribers—is essential for effective market penetration and sustaining long-term commercial success.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350.5 Billion USD |

| Market Forecast in 2033 | $650.0 Billion USD |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BioMarin Pharmaceutical, Viatris Inc., Catalent Inc., Teva Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories, Emergent BioSolutions, Jazz Pharmaceuticals, Ipsen S.A., Grünenthal GmbH, UCB S.A., Alexion Pharmaceuticals (AstraZeneca Subsidiary focusing on rare diseases), Sun Pharmaceutical Industries Ltd., Alnylam Pharmaceuticals, Sage Therapeutics, Horizon Therapeutics (Amgen Subsidiary focusing on rare diseases), PTC Therapeutics, Alkermes plc, Hikma Pharmaceuticals PLC, Supernus Pharmaceuticals, Amarin Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mid-Size Pharmaceutical Market Key Technology Landscape

The technological landscape for mid-size pharmaceutical companies is characterized by selective adoption of high-impact technologies focused on enhancing R&D productivity and commercial agility. Key among these is advanced data analytics and bioinformatics platforms, which are crucial for integrating complex biological data from genomic sequencing, clinical trial outcomes, and electronic health records (EHRs). These analytical tools allow mid-size firms, often specializing in targeted therapies, to identify novel drug targets more effectively and stratify patient populations for trials, thereby increasing the probability of technical and regulatory success (PTRS). Furthermore, the reliance on cloud computing infrastructure enables flexible scaling of computational resources for complex modeling and simulation studies, avoiding the massive capital expenditure associated with maintaining proprietary on-premise data centers, aligning perfectly with the asset-light strategy of this market segment.

In manufacturing and supply chain management, process automation and continuous manufacturing techniques are gaining traction. While capital constraints might limit full adoption, mid-size companies are implementing modular automation solutions to improve batch consistency, reduce lead times, and enhance quality control, especially important for sterile and highly potent drug products. The incorporation of IoT sensors and real-time monitoring throughout the cold chain distribution network is another critical technological focus, ensuring the integrity of temperature-sensitive biologics from the manufacturing site to the point of care. Digital twins, which are virtual representations of physical processes or products, are also being explored to optimize manufacturing yields and predict potential equipment failures before they occur.

Digital therapeutics (DTx) and patient engagement technologies represent a burgeoning area of technological focus for commercialization. Mid-size firms are integrating companion apps, remote monitoring devices, and AI-powered patient support platforms alongside their drug products. These technologies not only improve patient adherence and track real-world outcomes but also provide valuable proprietary data back to the company, demonstrating added value to payers and enhancing product differentiation. The rapid evolution of blockchain technology is also being investigated for securing clinical trial data integrity and improving supply chain transparency, addressing mounting concerns over counterfeiting and ensuring compliance with stringent data governance regulations (e.g., GDPR, HIPAA).

Regional Highlights

- North America (NA): NA represents the largest market share, driven primarily by the United States due to high healthcare expenditure, established R&D infrastructure, and a robust environment for specialty and orphan drug commercialization. The presence of sophisticated biotech funding mechanisms and favorable regulatory frameworks (FDA) for fast-track pathways continues to attract mid-size pharmaceutical investment. However, intense scrutiny on drug pricing and the influence of PBMs pose significant market challenges.

- Europe: This region is characterized by fragmented but high-value markets, with Germany, France, and the UK leading in revenue generation. Mid-size companies benefit from strong academic research collaborations and centralized regulatory processes (EMA), though market access negotiations are complex due to national health technology assessment (HTA) bodies. Focus is on biosimilar uptake and advanced biological therapies, supported by high regulatory standards.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth rate, fueled by improving healthcare access, increasing insurance coverage, and rising prevalence of lifestyle diseases across densely populated countries like China, India, and Japan. Mid-size firms utilize APAC as a manufacturing hub (API sourcing) and a critical location for expanding clinical trials due to large, treatment-naive patient pools and lower operational costs. Regulatory reform in China and Japan to accelerate drug approvals is further boosting market attractiveness.

- Latin America (LATAM): Growth is moderate but steady, driven by urbanization and rising private sector healthcare investments in major economies such as Brazil and Mexico. Mid-size companies often enter LATAM through strategic licensing agreements or partnerships to navigate complex local registration procedures and fluctuating economic stability, focusing primarily on essential medicines and high-demand specialty treatments.

- Middle East and Africa (MEA): MEA offers strategic opportunities in specific, high-spending nations like Saudi Arabia and the UAE, which are actively investing in local manufacturing capacity and specialized healthcare services (e.g., specialized oncology centers). The rest of the region faces hurdles related to political instability, fragmented distribution, and low per-capita healthcare spending, making market entry challenging but rewarding for essential drug providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mid-Size Pharmaceutical Market.- BioMarin Pharmaceutical

- Viatris Inc.

- Catalent Inc.

- Teva Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories

- Emergent BioSolutions

- Jazz Pharmaceuticals

- Ipsen S.A.

- Grünenthal GmbH

- UCB S.A.

- Alexion Pharmaceuticals (AstraZeneca Subsidiary focusing on rare diseases)

- Sun Pharmaceutical Industries Ltd.

- Alnylam Pharmaceuticals

- Sage Therapeutics

- Horizon Therapeutics (Amgen Subsidiary focusing on rare diseases)

- PTC Therapeutics

- Alkermes plc

- Hikma Pharmaceuticals PLC

- Supernus Pharmaceuticals

- Amarin Corporation

- Gilead Sciences, Inc. (Focusing on non-core segments)

- Bausch Health Companies Inc.

- Novo Nordisk A/S (Segmentally mid-size operations focus)

- Kyowa Kirin Co., Ltd.

- Recordati S.p.A.

Frequently Asked Questions

Analyze common user questions about the Mid-Size Pharmaceutical market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes a mid-size pharmaceutical company from Big Pharma?

Mid-size firms typically have annual revenues between $500 million and $5 billion USD, maintain greater operational agility, and focus R&D on specialized therapeutic niches (e.g., orphan drugs) rather than broad, diversified portfolios managed by larger multinational corporations (MNCs).

How is the Mid-Size Pharmaceutical Market responding to patent cliffs?

Mid-size companies capitalize on patent cliffs by accelerating the development and commercialization of complex generics and biosimilars, leveraging their efficient production capabilities and focused regulatory expertise to enter the market quickly and capture high-volume revenue streams.

What are the primary investment areas for R&D in this market segment?

The primary R&D investment areas are specialty drugs, particularly within oncology, immunology, and gene therapies. Mid-size firms prioritize platforms utilizing external partnerships (in-licensing and CROs) to mitigate internal risk and focus on late-stage clinical trials.

Which regions are driving the highest growth for mid-size pharmaceutical companies?

The Asia Pacific (APAC) region is forecasted to drive the highest market growth, attributed to increasing healthcare spending, growing prevalence of chronic diseases, and strategic outsourcing opportunities that enable market expansion and lower manufacturing costs for specialized pharmaceuticals.

What role does outsourcing play in the operations of mid-size pharmaceutical companies?

Outsourcing is critical; mid-size firms rely heavily on Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) for manufacturing, clinical trials, and specialized logistics. This strategy helps them maintain an asset-light operational structure, reduce fixed costs, and accelerate time-to-market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager