Middle Office Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434571 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Middle Office Outsourcing Market Size

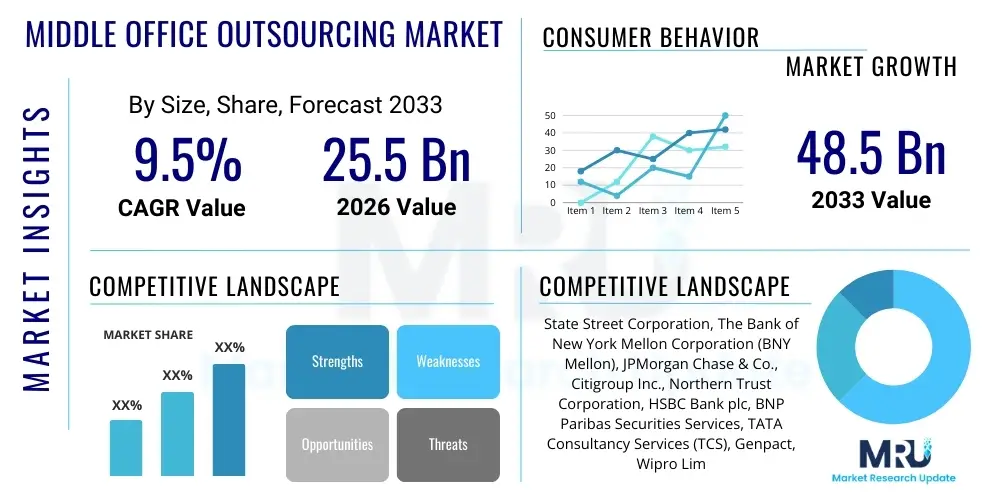

The Middle Office Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $25.5 Billion in 2026 and is projected to reach $48.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing complexity of global financial markets, stringent regulatory requirements, and the necessity for financial institutions (FIs) to optimize operational efficiency and focus capital on core competencies like alpha generation and client relationship management. The shift towards specialized third-party providers capable of handling intricate data management and post-trade activities is a central theme defining this growth trajectory.

Middle Office Outsourcing Market introduction

Middle Office Outsourcing involves the delegation of critical, non-core operational functions—spanning investment operations, risk management, performance measurement, and regulatory reporting—to specialized external service providers. The primary product encompasses a suite of services designed to enhance efficiency between front-office decision-making (trading and portfolio management) and back-office settlement and accounting. Major applications of these services are predominantly found within institutional asset management, hedge funds, pension funds, insurance companies, and sovereign wealth funds, all seeking enhanced operational scalability and reduced capital expenditure on internal infrastructure. Key benefits include superior data integrity, access to best-in-class technology without large upfront investments, enhanced compliance with evolving regulatory mandates, and optimized cost structures, enabling FIs to refocus internal resources on value-added tasks. Driving factors include the continuous rise in data volumes, global fragmentation of asset classes, increasing sophistication of investment strategies (such as derivatives and alternative investments), and the pervasive pressure to reduce operational risk while improving speed to market.

Middle Office Outsourcing Market Executive Summary

The Middle Office Outsourcing market is witnessing a profound transformation characterized by significant business, regional, and segment trends. From a business perspective, the dominant trend is the move toward holistic, end-to-end outsourcing solutions, often bundled with sophisticated data warehousing and analytics capabilities, rather than piecemeal function delegation. Service providers are investing heavily in proprietary technology stacks that integrate advanced reporting, real-time risk calculations, and compliance monitoring, positioning them as essential technology partners rather than mere operational conduits. This strategic shift is being accelerated by the demand for transparency and operational resilience following global market volatility.

Regionally, North America and Europe remain the largest markets due to established financial ecosystems, high regulatory burdens, and early adoption rates among large institutional investors. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, driven by rapidly expanding wealth management sectors, increasing cross-border investment flows, and the need for scalable operations in emerging markets like China and India. Firms in APAC are leveraging outsourcing to leapfrog older technologies and meet international reporting standards rapidly.

Segment trends highlight the exceptional growth within the risk management and performance analytics segments. As investment strategies become more complex—involving multi-asset class portfolios and illiquid alternatives—the requirement for real-time, accurate risk measurement (including liquidity risk, counterparty risk, and market risk) has intensified. Furthermore, the increasing investor demand for detailed performance attribution and benchmark analysis is fueling the growth of outsourced performance reporting services, necessitating providers to deploy cloud-based, scalable solutions capable of handling massive data throughput and complex calculation methodologies across diverse regulatory jurisdictions.

AI Impact Analysis on Middle Office Outsourcing Market

User queries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on Middle Office Outsourcing primarily revolve around efficiency gains, job displacement, data security implications, and the future role of human analysts. Common concerns center on whether AI will automate complex functions like regulatory mapping and exception handling, thereby rendering traditional outsourcing models obsolete, and whether third-party vendors are adequately investing in secure, proprietary AI models. Users are keenly interested in how AI can enhance data scrubbing and reconciliation processes, dramatically reducing settlement failures and operational errors, and providing predictive insights into potential risks.

AI’s influence is shifting the value proposition of Middle Office Outsourcing from pure labor arbitrage to advanced technological partnership. AI algorithms are fundamentally redefining how complex, repetitive, and data-intensive tasks are managed, particularly in areas such as trade matching, settlement processing, and dynamic regulatory change monitoring. By implementing intelligent automation and Natural Language Processing (NLP) tools, providers can offer unprecedented speed and accuracy in processing high volumes of transactions and documentation, moving beyond simple automation to cognitive automation that handles structured and unstructured data seamlessly. This enhanced capability allows financial institutions to react instantly to market events and regulatory shifts, significantly lowering the overall operational risk profile.

The adoption of AI is not eliminating the need for outsourcing but rather elevating the requirement for highly skilled oversight and domain expertise within the service provider ecosystem. Outsourcing contracts are increasingly judged on the technological sophistication and AI maturity of the vendor. Providers are leveraging ML models for enhanced risk scenario analysis, optimizing liquidity buffers, and offering predictive compliance reporting that anticipates future regulatory breaches before they occur. This integration ensures that the middle office becomes a proactive, strategic function rather than a reactive cost center, fundamentally strengthening the competitive differentiation of leading outsourcing firms.

- AI-driven automation accelerates trade processing and reconciliation, minimizing exception handling time.

- Machine Learning models enhance risk reporting by providing predictive analysis of potential breaches and market exposures.

- Natural Language Processing (NLP) streamlines regulatory compliance by rapidly analyzing new legislation and mapping changes to internal operating procedures.

- Intelligent process automation (IPA) reduces operational costs by automating data quality checks and routine reporting functions.

- AI facilitates sophisticated performance attribution analysis by handling multi-dimensional data sets and complex benchmarks efficiently.

DRO & Impact Forces Of Middle Office Outsourcing Market

The dynamics of the Middle Office Outsourcing market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces influencing strategic decision-making. Key drivers include the overwhelming pressure on financial institutions to reduce costs, the increasing complexity and volume of regulatory mandates (such as EMIR, SFTR, and evolving ESG reporting requirements), and the institutional desire to shift fixed infrastructure costs to variable operational expenses. Restraints primarily involve concerns over data security and cyber risk, vendor concentration risk, and the inherent challenges associated with migrating complex, interconnected systems and data archives. The potential for outsourcing providers to lack specialized knowledge in niche asset classes, such as private equity or highly structured products, also acts as a limiting factor for some institutions. Conversely, major opportunities arise from the proliferation of cloud-native outsourcing platforms, the expansion into specialized services like climate risk modeling, and the growing demand from mid-tier and regional banks seeking scalable, enterprise-grade solutions they cannot afford to build internally. These forces together propel market growth while demanding continuous innovation in security protocols and technological integration.

Segmentation Analysis

The Middle Office Outsourcing market is fundamentally segmented across functional services, asset classes supported, and end-user types, reflecting the specialized needs of different financial entities. Functional segmentation highlights the critical operational tasks outsourced, ranging from comprehensive trade processing and settlement support to highly analytical tasks such as performance measurement, compliance management, and collateral management. Segmentation by asset class is crucial, differentiating services specialized for traditional assets (equities, fixed income) versus complex alternatives (private debt, infrastructure, real estate, and hedge funds), which demand unique data handling and valuation methodologies. The diversity of end-users, spanning large institutional asset managers to smaller, independent wealth advisors and regional banks, dictates the scale and customization level required from service providers, ensuring that market offerings are highly tailored to operational sophistication and regulatory mandates of the client base.

- By Component:

- Solutions (Software and Technology Platforms)

- Services (Consulting, Implementation, Maintenance, and Management Services)

- By Service Type:

- Investment Operations Outsourcing (Trade Management, Corporate Actions Processing)

- Risk Management and Analytics Outsourcing

- Performance Measurement and Attribution

- Regulatory and Compliance Reporting

- Collateral Management

- By Asset Class:

- Traditional Assets (Equities, Fixed Income)

- Alternative Assets (Hedge Funds, Private Equity, Real Estate)

- Multi-Asset Class Solutions

- By End-User:

- Asset Managers and Institutional Investors

- Hedge Funds and Private Equity Firms

- Insurance Companies and Pension Funds

- Banks and Brokerage Firms

Value Chain Analysis For Middle Office Outsourcing Market

The value chain for Middle Office Outsourcing begins with the upstream activities of core technology development and proprietary platform creation, where vendors invest heavily in cloud infrastructure, AI/ML tools, and data integration technologies. Upstream suppliers are typically specialized financial technology (FinTech) firms providing core engines for accounting, risk modeling, and data aggregation, alongside infrastructure providers offering robust, scalable cloud environments. The efficiency and security of these upstream technology inputs directly determine the quality and scalability of the outsourced services offered downstream.

The central stage of the value chain involves the service delivery and operational execution by the outsourcing provider. This encompasses client onboarding, process standardization, continuous reconciliation, and the generation of tailored regulatory and performance reports. Distribution channels are predominantly direct, characterized by long-term strategic contracts established through intensive due diligence processes focusing on operational resilience (e.g., business continuity planning) and technological fit. Indirect distribution is less common but occurs through strategic partnerships, where large consulting firms recommend preferred outsourcing vendors or where technology integrators embed specific middle office functions into broader enterprise solutions.

Downstream analysis focuses on the end-users—the financial institutions that consume the services. Success in the downstream segment is measured by the provider’s ability to offer bespoke, integrated solutions that seamlessly interface with the client’s front-office trading systems and back-office accounting ledgers. Critical factors include transparent pricing models, robust service level agreements (SLAs) regarding accuracy and timeliness, and ongoing innovation to meet shifting regulatory landscapes. The high switching costs associated with changing outsourcing providers create significant barriers to entry, emphasizing the importance of initial strong vendor selection and comprehensive, relationship-based service management throughout the contract lifecycle.

Middle Office Outsourcing Market Potential Customers

The primary consumers of Middle Office Outsourcing services are institutional financial entities requiring high levels of operational scalability, data integrity, and regulatory specialization. Asset Managers and Institutional Investors constitute the largest segment of potential customers. These firms manage vast and diverse portfolios, necessitating sophisticated tools for performance attribution, complex fee calculations, and stringent regulatory reporting (e.g., AIFMD, UCITS). Outsourcing allows them to focus internal resources entirely on portfolio strategy and alpha generation, viewing the middle office as a mission-critical utility rather than an internally managed operational burden.

Another significant customer cohort includes Hedge Funds and Private Equity firms, particularly those expanding globally or dealing with highly illiquid and complex alternative investments. These firms demand specialized middle office services capable of handling unique valuation methodologies, complex collateral management, and real-time risk calculations in high-frequency trading environments. For smaller and emerging hedge funds, outsourcing provides instant access to institutional-grade infrastructure and compliance expertise that would otherwise be cost-prohibitive to develop internally. The pressure for greater transparency from Limited Partners (LPs) further drives these alternative investment firms towards robust, external operational partners.

Finally, Banks, Brokerage Firms, and Insurance Companies represent vital customer bases. Banks often outsource middle office functions related to custody support, treasury operations, and reference data management to streamline compliance processes and manage increased capital reserve requirements effectively. Insurance companies, facing complex liability structures and long-dated investment horizons, utilize these services for comprehensive asset-liability matching analysis and regulatory solvency reporting (e.g., Solvency II in Europe), seeking efficiency and specialized risk modeling capabilities inherent in advanced outsourcing platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion |

| Market Forecast in 2033 | $48.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | State Street Corporation, The Bank of New York Mellon Corporation (BNY Mellon), JPMorgan Chase & Co., Citigroup Inc., Northern Trust Corporation, HSBC Bank plc, BNP Paribas Securities Services, TATA Consultancy Services (TCS), Genpact, Wipro Limited, Cognizant, DXC Technology, Capgemini, SEI Investments Company, FIS Global, Broadridge Financial Solutions, Brown Brothers Harriman (BBH), MUFG Investor Services, Société Générale, Apex Group Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Middle Office Outsourcing Market Key Technology Landscape

The technological infrastructure supporting Middle Office Outsourcing is rapidly evolving, moving away from legacy, siloed systems towards integrated, cloud-native platforms. A foundational element of this landscape is the adoption of Software-as-a-Service (SaaS) models, which enable providers to offer scalable, continuously updated services without requiring significant on-premises installation from clients. These platforms are designed for interoperability, utilizing Application Programming Interfaces (APIs) to seamlessly connect with clients’ front-office trading systems and external market data providers. Key technologies include advanced data warehousing solutions that ensure data aggregation across disparate sources and robust reporting engines capable of generating complex, multi-jurisdictional compliance documents in real time.

Furthermore, Distributed Ledger Technology (DLT) and blockchain are emerging as pivotal technologies, particularly in areas like collateral management and trade settlement. While still nascent in widespread adoption, DLT promises to reduce counterparty risk and friction in post-trade processes by creating immutable records and automating reconciliation, potentially transforming the settlement lifecycle. Crucially, the deployment of Robotic Process Automation (RPA) and intelligent workflow management tools is standardizing processes, enhancing efficiency, and dramatically lowering the cost floor for routine middle office tasks such as data entry and exception routing. This technological push is elevating service providers from simply managing processes to providing genuine technological partnership.

The convergence of advanced analytics, AI, and ML is perhaps the most transformative technological shift. Vendors are deploying predictive analytics tools to model market risk exposure based on large datasets, moving beyond retrospective reporting to proactive decision support. Cybersecurity remains a non-negotiable technological focus, with providers utilizing advanced encryption techniques, behavioral analysis tools, and multi-factor authentication systems to protect sensitive client data against increasingly sophisticated cyber threats. The overall technology landscape is characterized by platform consolidation and a strategic emphasis on resilient, secure, and highly automated operational ecosystems built on cloud infrastructure to ensure global scalability and regulatory readiness.

Regional Highlights

- North America: Dominates the market, fueled by the presence of the world’s largest asset management firms and hedge funds, alongside stringent regulatory environments (SEC, CFTC rules). The region exhibits high technological maturity and a pervasive “buy versus build” philosophy among institutions, driving consistent demand for sophisticated, tech-enabled outsourcing solutions, particularly in risk analytics and performance measurement.

- Europe: Represents a mature market characterized by complex cross-border regulation (MiFID II, AIFMD, Solvency II). European firms prioritize regulatory compliance reporting and data governance, often seeking providers with deep expertise in managing jurisdictional diversity. The UK, Luxembourg, and Ireland are key hubs, focusing on servicing cross-border investment funds and insurance firms requiring multi-asset administration.

- Asia Pacific (APAC): Expected to register the highest CAGR due to rapid asset growth, particularly in China and Southeast Asia, and increasing institutionalization of pension and wealth management sectors. APAC firms often use outsourcing to quickly implement international operational best practices and meet emerging regulatory standards, favoring scalable, often cloud-based, solutions.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets for middle office outsourcing, driven by increasing foreign investment flows and the need to professionalize local financial services sectors. Demand is focused on core investment operations and fundamental risk reporting capabilities, often requiring specialized expertise in local market infrastructure and capital controls.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Middle Office Outsourcing Market.- State Street Corporation

- The Bank of New York Mellon Corporation (BNY Mellon)

- JPMorgan Chase & Co.

- Citigroup Inc.

- Northern Trust Corporation

- HSBC Bank plc

- BNP Paribas Securities Services

- TATA Consultancy Services (TCS)

- Genpact

- Wipro Limited

- Cognizant

- DXC Technology

- Capgemini

- SEI Investments Company

- FIS Global

- Broadridge Financial Solutions

- Brown Brothers Harriman (BBH)

- MUFG Investor Services

- Société Générale

- Apex Group Ltd.

Frequently Asked Questions

Analyze common user questions about the Middle Office Outsourcing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for adopting Middle Office Outsourcing services?

The primary drivers include the necessity for financial institutions (FIs) to achieve operational cost efficiencies, the increasingly intricate global regulatory landscape mandating specialized reporting, and the strategic imperative to shift focus and capital resources toward core value-generating activities like investment strategy and client relations. Outsourcing provides FIs with access to cutting-edge technology and skilled operational expertise without incurring heavy fixed investment costs or managing complex, internal technological obsolescence cycles.

How does the integration of AI change the typical outsourcing relationship?

AI transforms the relationship by elevating the service provider from a transactional processor to a sophisticated technological partner. AI and Machine Learning enable automated data reconciliation, predictive risk modeling, and advanced performance attribution, ensuring real-time operational resilience and compliance. This shift requires vendors to invest in proprietary AI platforms, making technological capability and data security critical determinants in vendor selection, moving beyond simple labor arbitrage.

What are the main risks associated with Middle Office Outsourcing?

Key risks revolve around data security and cyber threats, given that providers handle highly sensitive investment and client data. Other significant risks include vendor concentration risk (reliance on a single provider for multiple critical functions), high switching costs if a vendor relationship fails, and the potential for a lack of specialized expertise when dealing with niche or highly complex alternative asset classes requiring unique valuation and reporting standards.

Which asset classes demonstrate the highest demand for specialized outsourcing services?

While traditional assets (equities and fixed income) still dominate volume, the highest demand for specialized, high-margin outsourcing services comes from the Alternative Assets sector, including private equity, hedge funds, real estate, and infrastructure. These asset classes require unique, specialized middle office support for complex valuation techniques, managing capital calls and distributions, detailed regulatory reporting (e.g., Form PF), and sophisticated risk management tailored to illiquidity and non-standard data structures.

What is the regional growth outlook for Middle Office Outsourcing?

The global market exhibits strong growth, with North America and Europe maintaining the largest market share due to mature financial infrastructure and high regulatory compliance needs. However, the Asia Pacific (APAC) region is forecasted to experience the fastest growth rate (CAGR). This acceleration is driven by institutionalization, rapid growth in fund domiciliation centers, and the strategic need for APAC firms to quickly adopt world-class operational standards and technology platforms through outsourcing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager