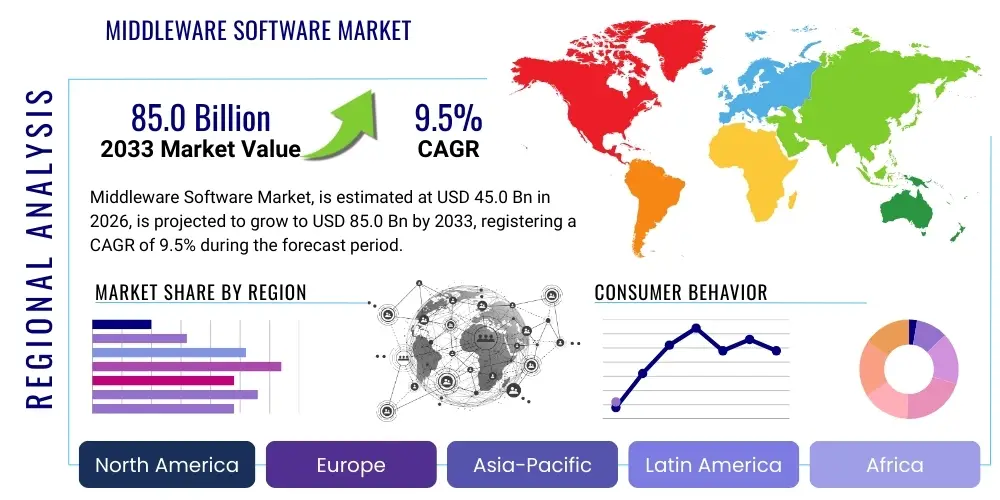

Middleware Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436831 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Middleware Software Market Size

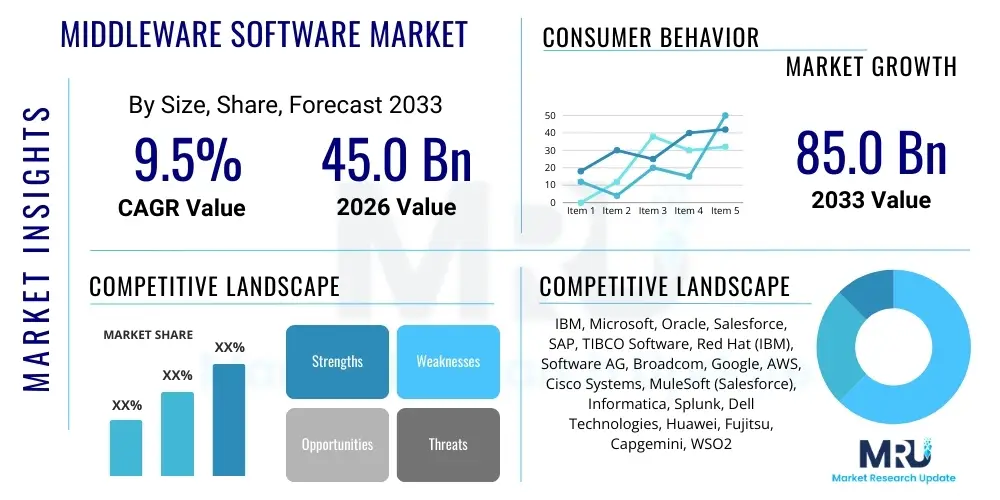

The Middleware Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 45.0 Billion in 2026 and is projected to reach USD 85.0 Billion by the end of the forecast period in 2033.

Middleware Software Market introduction

Middleware software serves as the crucial bridge enabling communication, data management, and application integration across distributed networks and disparate systems. This layer of software operates between the operating system and applications, facilitating complex transactional processes, managing security protocols, and ensuring reliable connectivity in heterogeneous IT environments. The primary product scope encompasses various types such as Enterprise Application Integration (EAI), Business Process Management (BPM) middleware, Data Integration middleware, and Message Oriented Middleware (MOM). These solutions are foundational for modernizing legacy systems and supporting cloud-native architectures, making them indispensable components of enterprise IT infrastructure.

Major applications of middleware span numerous industries, including financial services where it manages real-time transactions and regulatory compliance, healthcare systems requiring secure data exchange and interoperability, and the retail sector utilizing it for omnichannel customer experience management and supply chain optimization. The inherent benefits of employing robust middleware include enhanced operational efficiency, reduced integration complexity, improved scalability, and accelerated time-to-market for new digital services. By abstracting the intricacies of underlying protocols, middleware allows organizations to focus on core business logic rather than connectivity challenges, thus boosting overall productivity.

Key driving factors accelerating market expansion include the exponential growth in demand for seamless connectivity across hybrid and multi-cloud environments, the pervasive trend of digital transformation initiatives across global enterprises, and the necessity to manage vast volumes of data generated by IoT devices. Furthermore, the rise of microservices architecture and API economy mandates sophisticated integration capabilities that traditional point-to-point connections cannot handle efficiently. Consequently, the adoption of modern middleware, particularly Integration Platform as a Service (iPaaS), is surging, fueling market growth significantly throughout the forecast period.

Middleware Software Market Executive Summary

The Middleware Software Market is experiencing profound shifts driven by the transition to cloud computing and the imperative for real-time data processing. Business trends indicate a strong move away from monolithic, on-premise integration suites towards agile, subscription-based iPaaS models that offer enhanced flexibility, scalability, and reduced infrastructure overhead. Enterprises are heavily investing in API management platforms and service mesh technologies, which are integral components of modern middleware ecosystems, to support microservices deployment and secure external data exchange. This paradigm shift underscores the growing importance of integration capabilities that can handle complex, asynchronous communication patterns efficiently.

Regional trends demonstrate North America leading the market, primarily due to high technological maturity, the presence of major industry vendors, and robust early adoption of hybrid cloud architectures and advanced integration patterns like event-driven middleware. The Asia Pacific (APAC) region, however, is anticipated to register the highest Compound Annual Growth Rate (CAGR), fueled by aggressive digitalization efforts across emerging economies, rapid expansion of the manufacturing and telecommunications sectors, and substantial government investments in smart city projects that require sophisticated data interoperability solutions. Europe maintains a steady growth trajectory, driven by mandates for data governance, financial services modernization (e.g., PSD2), and the need for standardized cross-border data flows.

Segmentation trends highlight the Integration Platform as a Service (iPaaS) segment as the fastest-growing category, reflecting the market preference for managed, cloud-native integration solutions over traditional installed software. Furthermore, the BFSI (Banking, Financial Services, and Insurance) sector remains the dominant end-user segment, relying heavily on transaction processing monitors and messaging middleware for mission-critical operations. Within the deployment landscape, hybrid environments are the most prevalent, necessitating middleware solutions capable of effectively bridging on-premise legacy systems with new cloud applications, thereby driving innovation in specialized areas like Robotic Process Automation (RPA) integration and serverless computing functions.

AI Impact Analysis on Middleware Software Market

User inquiries regarding AI's influence on middleware predominantly revolve around how Artificial Intelligence can automate integration processes, enhance data quality assurance, and predict system failures within complex IT infrastructures. Key themes frequently analyzed include the integration of AI/ML models into existing business processes (requiring AI-enabled middleware), the potential for AIOps (AI for IT Operations) to streamline middleware management and monitoring, and the security implications of autonomous decision-making within integrated environments. Concerns often focus on the complexity of deploying AI pipelines and the need for middleware to handle specialized data formats and computational loads specific to machine learning workloads, while expectations center on significantly reduced manual effort in mapping, transformation, and error resolution.

The strategic deployment of AI technologies within middleware is transforming how enterprise integration is designed, managed, and executed. AI is increasingly used to optimize data routing, dynamically adjust resource allocation for messaging queues, and provide proactive anomaly detection in transaction monitoring systems, thereby significantly enhancing system resilience and performance. Middleware vendors are incorporating machine learning algorithms into their platforms to automate schema mapping, suggest optimal integration flows, and ensure data lineage tracking, moving beyond traditional rule-based integration into a more adaptive and self-optimizing ecosystem. This automation reduces development time and minimizes human error in complex integration projects.

Furthermore, AI-driven insights are critical for next-generation middleware focused on event-driven architecture. By analyzing event streams in real-time, AI can trigger business process adjustments or automated responses through the middleware layer, such as instantaneously updating inventory across sales channels based on predictive analytics. This enhanced capability is vital for industries requiring hyper-personalization and immediate responsiveness, effectively repositioning middleware from a simple data transporter to an intelligent decision-support facilitator. This fusion ensures that integration capabilities remain central to the intelligent enterprise framework.

- AI drives the automation of complex data mapping and transformation processes.

- Integration of AIOps capabilities enhances predictive maintenance and monitoring of middleware infrastructure.

- Middleware platforms facilitate the deployment and scaling of AI/ML models across enterprise applications.

- Real-time event processing is optimized through AI algorithms for improved routing and load balancing.

- Enhanced security protocols leverage machine learning for detecting unauthorized access patterns in data transit.

- AI helps in dynamic optimization of resource allocation for message queues and transaction servers.

- Automated suggestion systems for building new integration flows reduce development cycle time.

DRO & Impact Forces Of Middleware Software Market

The Middleware Software Market is highly influenced by the compelling need for digital transformation (Driver) which is countered by complex integration challenges inherent in hybrid IT landscapes (Restraint), while the emergence of highly specialized iPaaS solutions presents a significant avenue for expansion (Opportunity). These factors interact dynamically, where the increasing adoption of cloud services necessitates robust integration (Driver), yet concerns regarding data governance and vendor lock-in create market friction (Restraint). The overall impact is a market accelerating its shift towards cloud-native, API-centric integration models, demanding solutions that are both flexible and highly secure.

The primary impact forces driving market growth include the relentless acceleration of cloud migration strategies, compelling organizations to adopt iPaaS and cloud-based integration tools to connect SaaS applications and cloud services seamlessly. The pervasive adoption of microservices architecture requires modern middleware that can handle service discovery, communication, and traffic management efficiently, often utilizing service mesh technology. Conversely, a major restraining force is the technical debt associated with migrating or replacing established, mission-critical legacy middleware systems, which involves significant cost, risk, and organizational inertia, particularly in regulated sectors like banking and government.

Opportunities for exponential growth are concentrated in areas such as IoT integration and vertical-specific middleware solutions. As the volume and velocity of IoT data increase, specialized IoT middleware is required for device management, data filtering, and secure ingestion into enterprise systems. Furthermore, the expansion of Robotic Process Automation (RPA) mandates sophisticated middleware to facilitate integration between RPA bots and enterprise applications, ensuring end-to-end process automation. The impact forces collectively push the market toward hyper-integration capabilities that are automated, intelligent, and scalable across globally distributed operations.

Segmentation Analysis

The Middleware Software Market is segmented based on the type of software, the deployment model utilized, the organization size, and the specific industry vertical served. This structured segmentation provides a clear view of market dynamics, revealing preferences for modern, cloud-centric solutions over traditional monolithic systems, particularly among small and medium enterprises (SMEs) seeking agility and cost efficiency. The dominance of hybrid deployment reflects the current enterprise reality of managing both legacy IT infrastructure and rapidly expanding cloud footprints, requiring flexible interoperability solutions.

- By Type:

- Application Platform Middleware

- Integration and Process Management Middleware (e.g., EAI, BPM)

- Data Integration Middleware

- Message-Oriented Middleware (MOM)

- Transaction Processing Monitors (TPM)

- Cloud Middleware (iPaaS)

- Security Middleware

- By Deployment Model:

- On-Premise

- Cloud (Public, Private, Hybrid)

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- IT and Telecommunications

- Retail and E-commerce

- Manufacturing

- Government and Defense

- Others (Energy & Utilities, Transportation)

Value Chain Analysis For Middleware Software Market

The Middleware Software value chain commences with upstream analysis, involving core software development, intellectual property creation, and foundational infrastructure provision. This stage is dominated by major technology providers who invest heavily in R&D to develop sophisticated integration algorithms, proprietary communication protocols, and cloud-native architectures. Key upstream activities include coding the core integration engine, developing APIs, and ensuring compatibility with various operating systems and database technologies. Access to high-quality technical talent and strategic partnerships with cloud infrastructure providers (like AWS, Azure, Google Cloud) are crucial for competitive advantage at this stage.

The distribution channel primarily consists of direct sales models for large enterprise contracts, often coupled with professional services for custom implementation and consulting. However, indirect channels, including value-added resellers (VARs), system integrators (SIs), and managed service providers (MSPs), play a critical role, especially in delivering bundled solutions and servicing the SME segment. The shift towards Subscription-as-a-Service (SaaS) and iPaaS models has significantly streamlined distribution, allowing vendors to leverage cloud marketplaces for rapid deployment and automated subscription management, reducing reliance on traditional physical distribution networks.

The downstream analysis focuses on the final deployment, integration, and consumption of middleware solutions by end-users. This stage involves configuration, testing, monitoring, and ongoing maintenance. Potential customers utilize these solutions to connect disparate enterprise resource planning (ERP) systems, customer relationship management (CRM) software, and custom applications. The value extracted downstream is measured by improvements in business process automation, real-time data flow, and overall system interoperability, validating the necessity of robust post-sales support and continuous software updates to address evolving cybersecurity threats and functional requirements.

Middleware Software Market Potential Customers

Potential customers for middleware software encompass virtually all enterprises undergoing or planning digital transformation, regardless of size, though the maturity of their IT infrastructure significantly influences the type of middleware adopted. Large enterprises, particularly those in regulated sectors like BFSI and Telecommunications, represent a foundational customer base due to their high volume of legacy systems and the continuous need for complex, secure, high-throughput transactional processing. These organizations typically require sophisticated solutions like Transaction Processing Monitors (TPMs) and EAI suites to maintain operational continuity while integrating new cloud applications.

The rapidly expanding segment of potential customers includes Small and Medium Enterprises (SMEs) and mid-market companies that are prioritizing agility and rapid connectivity to SaaS applications such as Salesforce, ServiceNow, and specialized industry software. These buyers often favor cloud-based Integration Platform as a Service (iPaaS) solutions due to their lower total cost of ownership (TCO), faster deployment cycles, and reduced need for specialized internal IT integration expertise. For SMEs, iPaaS acts as an essential gateway to modern cloud ecosystems without the prohibitive infrastructure investment required by traditional middleware.

Furthermore, government agencies and healthcare providers constitute critical potential customer segments, driven by modernization mandates and the urgent requirement for standardized data interoperability and secure information exchange (e.g., electronic health records, public services data). These sectors demand middleware with stringent security features, compliance auditing capabilities, and proven reliability for managing sensitive data, ensuring that the chosen solutions meet rigorous regulatory standards like HIPAA, GDPR, and FedRAMP compliance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.0 Billion |

| Market Forecast in 2033 | USD 85.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Microsoft, Oracle, Salesforce, SAP, TIBCO Software, Red Hat (IBM), Software AG, Broadcom, Google, AWS, Cisco Systems, MuleSoft (Salesforce), Informatica, Splunk, Dell Technologies, Huawei, Fujitsu, Capgemini, WSO2 |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Middleware Software Market Key Technology Landscape

The technological landscape of the Middleware Software Market is rapidly evolving, driven by the shift towards decoupled, distributed systems. Modern middleware architecture is heavily influenced by the adoption of containerization technologies like Docker and Kubernetes, which necessitate middleware that is lightweight, portable, and natively supports microservices deployments. This has propelled the use of Service Mesh technologies (such as Istio or Linkerd), which operate as an infrastructure layer to manage communication between services, handling functions like traffic control, security, and monitoring, thereby minimizing the need for these concerns to be addressed within the application code itself.

Another dominant technological trend is the rise of API Gateway management platforms. These platforms serve as the single entry point for all external and internal APIs, providing critical services such as authentication, rate limiting, and analytics. Effective API management is now central to the middleware stack, enabling organizations to securely expose data and capabilities to partners and third-party developers, which is fundamental to participating in the digital economy. Furthermore, Event-Driven Architecture (EDA), facilitated by technologies like Apache Kafka and messaging queues, is becoming standard practice, allowing for real-time responsiveness and asynchronous communication necessary for modern transactional systems and IoT data processing.

Integration Platform as a Service (iPaaS) represents the technological convergence of cloud capabilities with traditional middleware functions, offering self-service integration tools that leverage low-code/no-code interfaces. This simplifies complex integration tasks for citizen integrators and significantly accelerates digital projects. Furthermore, the integration of Artificial Intelligence and Machine Learning (AI/ML) into middleware—AIOps—is enabling advanced features like automated root cause analysis, predictive scaling, and intelligent data transformation, thereby positioning the middleware layer as an increasingly self-managing and intelligent component of the enterprise IT ecosystem.

Regional Highlights

North America maintains its dominant position in the global Middleware Software Market, primarily driven by early and extensive adoption of cloud computing, high levels of investment in digital infrastructure modernization, and the presence of numerous technology pioneers and solution providers in the United States. Enterprises in this region are actively replacing legacy integration bus solutions with modern iPaaS and API management platforms to facilitate complex hybrid IT environments and support rapid DevOps lifecycles. The strong demand across the BFSI, IT, and healthcare sectors for highly secure, high-performance transaction middleware further solidifies the region's market leadership.

The Asia Pacific (APAC) region is poised for the highest growth rate during the forecast period, fueled by aggressive governmental initiatives focused on digitalization, substantial growth in the manufacturing and telecommunications industries, and rapid adoption of mobile and e-commerce platforms. Countries such as China, India, and Japan are experiencing a surge in demand for integration solutions necessary to connect fragmented IT landscapes and support massive cross-border data flows. The need for scalable and agile middleware to support new technologies like 5G network expansion and smart factory implementation is a key catalyst for market acceleration in APAC.

Europe represents a mature yet dynamic market, characterized by stringent data governance requirements, notably GDPR, which mandates reliable and traceable data integration and security provided by advanced middleware solutions. The European market growth is largely propelled by the financial services sector's mandates for Open Banking (e.g., PSD2), necessitating robust API gateway and integration capabilities. Western European countries are focusing on adopting hybrid cloud strategies, driving demand for middleware that ensures interoperability and compliance across various cloud and on-premise environments, with a particular focus on data residency and sovereignty requirements.

- North America: Leading market share due to early adoption of cloud and advanced API management, high maturity in financial and tech sectors, and significant investment in IT infrastructure modernization.

- Asia Pacific (APAC): Fastest growing region, driven by governmental digitalization projects, rapid e-commerce expansion, and industrial automation initiatives in developing economies.

- Europe: Steady growth driven by regulatory compliance mandates (GDPR, PSD2) and modernization efforts in the banking and public sectors, emphasizing secure hybrid cloud integration.

- Latin America (LATAM): Emerging market characterized by increasing foreign investment and adoption of basic integration tools, particularly in retail and telecommunications, focusing on operational efficiency.

- Middle East and Africa (MEA): Growth attributed to large-scale smart city projects, oil and gas sector IT modernization, and increasing cloud service consumption, necessitating secure data integration middleware.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Middleware Software Market.- IBM

- Microsoft

- Oracle

- Salesforce

- SAP

- TIBCO Software

- Red Hat (IBM)

- Software AG

- Broadcom

- AWS

- Cisco Systems

- MuleSoft (Salesforce)

- Informatica

- Splunk

- Dell Technologies

- Huawei

- Fujitsu

- Capgemini

- WSO2

Frequently Asked Questions

Analyze common user questions about the Middleware Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of modern middleware in a cloud-native environment?

The primary function of modern middleware is to provide seamless, secure connectivity and communication services between distributed applications, microservices, and data sources across hybrid and multi-cloud environments. It enables real-time data flow, API management, service discovery, and resilient transaction processing critical for modern, scalable architectures.

How is Integration Platform as a Service (iPaaS) impacting the Middleware Software Market?

iPaaS is fundamentally transforming the market by shifting integration capabilities from on-premise, complex infrastructure to agile, cloud-based subscription models. This lowers the barrier to entry for SMEs, accelerates integration development through low-code tools, and supports easier connectivity with SaaS applications, driving rapid market adoption.

Which industry vertical is the largest consumer of middleware solutions?

The Banking, Financial Services, and Insurance (BFSI) sector remains the largest consumer, primarily due to its mission-critical need for high-speed, secure Transaction Processing Monitors (TPMs) and Message-Oriented Middleware (MOM) to handle vast volumes of real-time financial transactions, regulatory compliance, and core system modernization.

What role does Artificial Intelligence (AI) play in next-generation middleware?

AI is integrated into middleware to automate operational tasks (AIOps), optimize data routing, suggest and automate data mapping, and perform predictive anomaly detection in message queuing systems. This enhances the intelligence, efficiency, and self-managing capabilities of the overall integration architecture.

What are the key technological restraints limiting the growth of the Middleware Software Market?

The key restraints include the significant cost and technical complexity associated with migrating legacy, on-premise middleware systems to modern cloud platforms, alongside persistent concerns regarding data governance, security vulnerabilities in complex hybrid environments, and the challenge of managing vendor lock-in.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager