Midstream Oil and Gas Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436204 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Midstream Oil and Gas Market Size

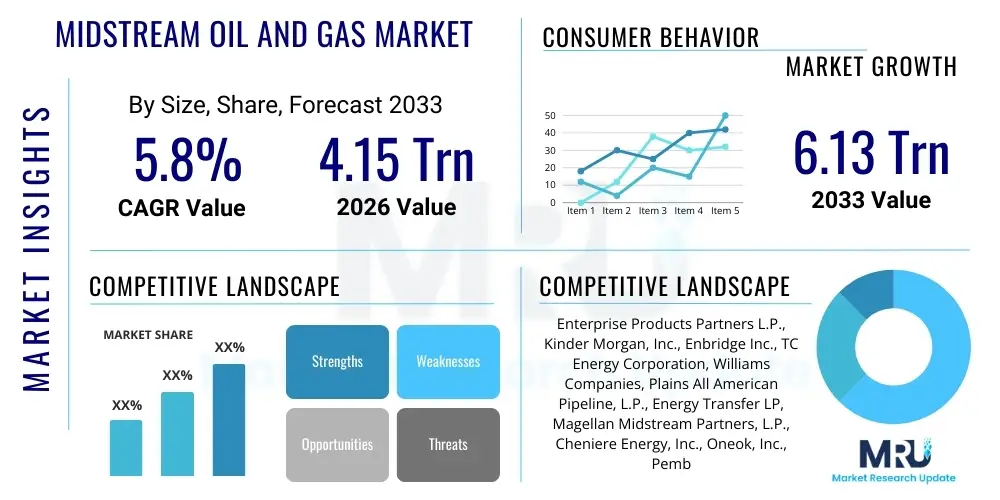

The Midstream Oil and Gas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.15 trillion in 2026 and is projected to reach USD 6.13 trillion by the end of the forecast period in 2033.

Midstream Oil and Gas Market introduction

The Midstream Oil and Gas Market encompasses the crucial processes and infrastructure necessary to move hydrocarbon resources—primarily crude oil, natural gas, and natural gas liquids (NGLs)—from extraction points (upstream) to processing and distribution centers (downstream). This sector involves extensive networks of pipelines, sophisticated transportation systems (rail, truck, tanker), storage facilities (tank farms, underground caverns), and initial processing plants designed to clean and prepare the raw materials for refining or end-use consumption. Given the geographical separation between major production basins and consumption centers, the midstream segment acts as the indispensable link stabilizing the global energy supply chain.

Product descriptions within the midstream sector are varied, focusing not on the final refined product but on the services and assets facilitating transport and storage. Key infrastructure elements include large-diameter mainline pipelines for long-haul transport, gathering pipelines connecting wellheads to processing centers, and liquefaction/regasification terminals crucial for the burgeoning Liquefied Natural Gas (LNG) trade. Major applications involve ensuring uninterrupted supply continuity, balancing regional demand fluctuations through strategic storage, and preparing hydrocarbons to meet purity standards required by refineries and petrochemical plants.

The market's growth is heavily driven by increasing global energy demand, especially from rapidly industrializing economies in Asia Pacific, coupled with prolific upstream production, particularly in North America (shale plays). Benefits derived from a robust midstream infrastructure include enhanced energy security, reduced commodity transportation costs, and optimized utilization of hydrocarbon resources by minimizing flaring and maximizing the value of associated gas. Regulatory environments promoting cleaner energy transition, ironically, necessitate advanced midstream solutions for transporting lower-carbon fuels, such as blending hydrogen or managing Carbon Capture and Storage (CCS) infrastructure, further propelling investment and technological development in this complex sector.

Midstream Oil and Gas Market Executive Summary

The Midstream Oil and Gas Market is undergoing significant transformations driven by global energy transition efforts, shifts in geopolitical dynamics, and rapid technological advancements focused on operational efficiency and emission reduction. Business trends indicate a strong focus on consolidation among major pipeline operators to achieve economies of scale and diversify geographical exposure, particularly integrating liquefied natural gas (LNG) infrastructure into traditional pipeline networks to capitalize on burgeoning global gas demand. Investment is heavily directed toward modernization projects, replacing aging infrastructure to enhance safety and throughput capacity, alongside digital transformation initiatives leveraging IoT and cloud computing for predictive maintenance and optimized logistics planning, thereby creating substantial barriers to entry for smaller players.

Regionally, North America remains the primary engine of growth, underpinned by resilient shale production in the Permian Basin and Appalachian region, necessitating continuous expansion of gathering and long-haul transmission pipelines, including substantial investment in NGL processing facilities. Asia Pacific, particularly China and India, represents the fastest-growing consumption hub, driving massive capital expenditure in import infrastructure, including Floating Storage and Regasification Units (FSRUs) and domestic pipeline networks to distribute imported LNG. Europe, while prioritizing decarbonization, maintains strategic investments in gas storage and interconnection pipelines to bolster energy security following geopolitical supply shocks, balancing clean energy mandates with immediate reliability requirements.

Segment trends highlight the dominance of the transportation segment, particularly high-pressure transmission pipelines, due to their sheer capital intensity and lengthy operational lifespan. However, the storage segment is rapidly gaining prominence, driven by the need for strategic reserves and the inherent volatility introduced by renewable energy sources, which require traditional fuels to act as baseload stabilizers. Furthermore, technological shifts are making the processing segment more complex, requiring facilities to handle a more diverse and often 'wetter' mix of natural gas, demanding advanced fractionation and impurity removal capabilities, thus spurring specialized equipment markets like cryogenics and molecular sieve systems.

AI Impact Analysis on Midstream Oil and Gas Market

Common user questions regarding AI's impact on the midstream sector frequently revolve around how artificial intelligence can significantly mitigate operational risks, optimize complex logistical routing, and drive down massive maintenance costs associated with extensive pipeline networks and large storage facilities. Users express keen interest in AI’s ability to predict equipment failure (Predictive Maintenance), manage supply-demand fluctuations in real-time for optimized asset utilization, and enhance regulatory compliance through autonomous monitoring and leak detection systems. The core themes center on achieving higher levels of safety and efficiency, transitioning from reactive to proactive operational models, and ensuring data security as more field assets become interconnected via smart sensors.

AI technologies, including machine learning and deep learning algorithms, are fundamentally changing how pipeline integrity management is performed. Historically, inspection relied on periodic physical checks and pigging operations; now, AI analyzes sensor data, satellite imagery, and historical failure records to identify anomalies indicative of corrosion, stress cracking, or third-party interference before they escalate into catastrophic failures. This capability not only saves billions in preventative repairs but dramatically enhances the safety profile of pipeline operations, making the infrastructure more resilient and environmentally sound by minimizing potential spills.

Furthermore, AI plays a pivotal role in optimizing throughput and minimizing energy expenditure in pumping and compression stations, which are major operational costs in the midstream sector. By analyzing variables like fluid dynamics, pressure differentials, and external environmental factors (temperature, elevation), AI algorithms can dynamically adjust compressor speeds and flow rates to maximize efficiency and minimize the overall carbon footprint per barrel or cubic foot transported. The integration of AI also extends to commercial decision-making, utilizing advanced analytics to forecast commodity pricing trends and optimize storage utilization and transport scheduling, providing a significant competitive advantage to early adopters.

- AI enables highly accurate Predictive Maintenance (PdM) for compressors, pumps, and valves, reducing unplanned downtime by up to 30%.

- Implementation of advanced machine vision and acoustic monitoring for immediate, autonomous leak detection and security breach alerts.

- Optimization of pipeline throughput and energy consumption using dynamic flow rate adjustment models based on real-time data analysis.

- Enhanced inventory management in storage facilities by predicting optimal filling and withdrawal schedules based on market demand forecasting.

- Streamlining regulatory compliance through automated data collection, reporting, and anomaly detection in operational logs.

DRO & Impact Forces Of Midstream Oil and Gas Market

The Midstream Oil and Gas Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively dictate investment cycles, geographical focus, and technological adoption. The primary drivers stem from sustained global energy demand, especially for natural gas as a transition fuel, requiring extensive capital investment in associated infrastructure, alongside regulatory environments that mandate higher safety and environmental performance, pushing companies toward modernization. Restraints largely center on the intense capital expenditure required for greenfield projects, prolonged and complex permitting processes driven by environmental opposition, and the overarching uncertainty created by accelerating global decarbonization pledges that threaten the long-term viability of fossil fuel assets.

Opportunities for growth are abundant, particularly in leveraging digital technologies like the Industrial Internet of Things (IIoT), AI, and Big Data analytics to drastically improve operational efficiency and risk management, transforming how assets are monitored and maintained. Furthermore, the midstream sector has a unique opportunity to pivot toward handling future energy carriers, such as hydrogen, carbon dioxide (for CCS), and sustainable biofuels, utilizing and repurposing existing pipeline infrastructure where feasible. These opportunities encourage diversification and help mitigate the long-term risk associated with hydrocarbon assets, positioning midstream companies as core facilitators of the broader energy transition ecosystem.

Impact forces illustrate the high sensitivity of the midstream sector to macroeconomic factors and geopolitical stability. Energy transition mandates represent a long-term transformative force, forcing operators to assess asset lifespan and potential stranding risk. Simultaneously, short-term forces such as commodity price volatility directly affect upstream production levels, subsequently impacting the volume of material requiring midstream transport and processing. Political and regulatory stability, particularly concerning cross-border pipeline permits and land use rights, remains a decisive impact force determining the feasibility and cost effectiveness of major infrastructure projects globally, making robust stakeholder engagement essential for market success.

Segmentation Analysis

The Midstream Oil and Gas Market segmentation provides a detailed structural breakdown of the sector, analyzing market dynamics across different asset classes, operational functions, and geographical footprints. Segmentation is critical for understanding capital allocation patterns, identifying high-growth sub-sectors, and assessing competitive positioning. The market is typically segmented by Type (Oil, Gas, NGLs), Infrastructure (Pipelines, Storage, Transportation, Processing), and Geography, with each segment exhibiting distinct capital requirements, regulatory hurdles, and growth trajectories. The complexity of the midstream value chain necessitates granular analysis to differentiate between high-capacity, long-haul transmission systems and smaller, more flexible gathering and processing systems.

- By Type:

- Crude Oil

- Natural Gas

- Natural Gas Liquids (NGLs)

- By Infrastructure/Asset:

- Pipelines (Gathering, Transmission, Distribution)

- Storage (Above-ground tanks, Underground caverns, LNG storage)

- Transportation (Rail, Truck, Tankers/Shipping)

- Processing and Treatment (Gas Processing Plants, Fractionation Facilities)

- By Service Type:

- Transportation Services

- Storage and Terminalling

- Gathering and Processing Services

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Midstream Oil and Gas Market

The midstream segment serves as the central conduit connecting the upstream exploration and production (E&P) activities with the downstream refining, distribution, and end-user markets, thus providing essential logistical and quality enhancement services. The value chain starts immediately after the wellhead, where crude oil, raw natural gas, and associated liquids are gathered. Upstream analysis focuses on the reliability and volume of supply, as midstream investments are fundamentally dependent on sustainable production volumes; low upstream activity translates directly to low midstream utilization and returns. The midstream’s primary value addition lies in aggregation, processing (removing impurities like water, sulfur, and CO2), fractionation (separating NGLs), and efficient, safe, long-distance transport.

Downstream analysis in the value chain involves ensuring that transported hydrocarbons meet specific quality specifications for refineries or power generation facilities. For instance, natural gas must meet pipeline quality standards, while crude oil is segregated by API gravity and sulfur content before reaching refineries. The midstream sector creates value by minimizing grade degradation and optimizing the movement to maximize downstream processing yields. This interplay requires close coordination; midstream companies often operate under long-term, fee-based contracts, insulating them partially from commodity price volatility but tying their revenue stream directly to volume demand from the downstream market.

Distribution channels in the midstream market are segmented into direct and indirect methods. Direct distribution primarily utilizes massive transmission pipelines for continuous, high-volume flow to major consuming hubs or export terminals (e.g., crude oil directly from Cushing, OK, to refineries). Indirect distribution involves intermittent, flexible transport mechanisms such as rail, truck, or marine tankers, often used for smaller volumes, remote locations, or specialized products like LNG, which requires dedicated liquefaction and regasification infrastructure. The decision between direct pipeline transport (high fixed cost, low variable cost) and indirect methods (lower fixed cost, higher variable cost) is a major determinant of logistical efficiency and overall profitability across the entire hydrocarbon supply chain.

Midstream Oil and Gas Market Potential Customers

Potential customers for midstream services are highly diverse, spanning the entire energy ecosystem from the point of extraction to the point of final commercial processing. The core clientele includes Independent Exploration and Production (E&P) Companies, which rely entirely on midstream operators to move their product from the wellhead to market hubs. These E&P companies are the primary 'shippers' utilizing gathering systems and long-haul pipelines, often signing long-term capacity reservation agreements that underpin the financial viability of new midstream infrastructure projects. The stability of these long-term contracts is a cornerstone of the midstream business model, guaranteeing steady, fee-based revenue streams irrespective of short-term commodity price movements.

Another major customer segment consists of Major Integrated Oil and Gas Companies (IOCs and NOCs). While many of these integrated giants own significant internal midstream assets, they frequently use third-party services for transport in specific geographic areas or for highly specialized processing needs (e.g., complex NGL fractionation). These large players demand high reliability, advanced safety protocols, and often seek equity partnerships in major infrastructure projects to secure guaranteed capacity for their substantial and diversified global production volumes, ensuring predictable access to key markets like export terminals.

Furthermore, the customer base extends to entities involved in post-processing activities, including Petrochemical Manufacturers, Electric Utilities, and Commodity Traders. Petrochemical plants are major consumers of NGLs (like ethane and propane) supplied directly via dedicated midstream pipelines, requiring stringent purity specifications. Electric utilities, particularly those relying on natural gas for power generation, depend heavily on reliable gas transmission and storage services. Finally, commodity traders utilize storage and terminalling services to capitalize on contango and backwardation market conditions, requiring flexible storage capacity to manage inventory and execute physical delivery arbitrage strategies across regional market hubs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.15 Trillion |

| Market Forecast in 2033 | USD 6.13 Trillion |

| Growth Rate | 5.8% CAGR ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Enterprise Products Partners L.P., Kinder Morgan, Inc., Enbridge Inc., TC Energy Corporation, Williams Companies, Plains All American Pipeline, L.P., Energy Transfer LP, Magellan Midstream Partners, L.P., Cheniere Energy, Inc., Oneok, Inc., Pembina Pipeline Corporation, Gibson Energy Inc., Gazprom, Transneft, Sempra Infrastructure, ADNOC, Saudi Aramco, Equinor, BP plc, Shell plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Midstream Oil and Gas Market Key Technology Landscape

The technological landscape of the midstream market is increasingly focused on digitization, material science, and enhanced environmental controls, moving beyond traditional mechanical systems. A foundational technology involves the widespread deployment of advanced sensor arrays and the Industrial Internet of Things (IIoT), which transform passive infrastructure assets like pipelines and storage tanks into continuously monitored, smart systems. These sensors collect massive amounts of data—on pressure, temperature, flow rate, vibration, and corrosion levels—which are then transmitted via secure networks to central analytical platforms. This IIoT backbone is essential for enabling subsequent innovations like predictive maintenance and real-time operational optimization, reducing human error and manual inspection frequency significantly.

Key integrity management technologies include advanced In-Line Inspection (ILI) tools, commonly referred to as "Smart Pigs." These specialized devices use sophisticated methodologies such as Magnetic Flux Leakage (MFL), Ultrasonic Testing (UT), and advanced laser mapping to scan the interior of pipelines for microscopic defects, corrosion, and welding imperfections. The data gathered by these ILI tools, combined with geospatial data, is fed into sophisticated pipeline integrity management software platforms. These platforms utilize AI and machine learning algorithms to prioritize repair schedules based on risk probability, rather than arbitrary time intervals, thereby maximizing the safety performance and maximizing the utilization window of the assets.

Furthermore, environmental technologies and materials science are driving significant changes. The development of high-strength, lightweight pipeline materials, often incorporating advanced coatings and composite linings, enhances durability and resistance to harsh operating environments, extending asset life and reducing maintenance costs. Crucially, in response to climate change concerns, technologies focusing on methane emission reduction, such as advanced flare mitigation systems, continuous emission monitoring via drones and satellites, and high-efficiency compression units (often electrically powered rather than gas-powered), are becoming standard capital expenditure requirements. Finally, the development of specialized cryogenic technology is vital for the expanding LNG sector, requiring robust, scalable, and highly efficient liquefaction and regasification processes.

Regional Highlights

- North America: This region dominates the global midstream market, primarily driven by massive, sustained unconventional (shale) production, especially in the US (Permian, Marcellus, Bakken). The market is characterized by robust, competitive pipeline infrastructure, significant NGL fractionation capacity, and a massive build-out of LNG export terminals along the Gulf Coast, positioning the US as a major global gas supplier. Canadian projects, particularly those facilitating oil sands transport and coastal LNG exports, also contribute substantially.

- Europe: The European midstream sector is defined by its focus on energy security and diversification away from Russian pipeline gas. Key developments include increased investment in LNG import capacity, particularly FSRUs and terrestrial terminals in countries like Germany and Poland, alongside the expansion of intra-European interconnection pipelines and strategic underground gas storage facilities to buffer against geopolitical supply volatility. Decarbonization efforts are also spurring initial studies and pilots for repurposing gas pipelines for hydrogen transport.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapidly increasing energy demand from industrialization and urbanization in China, India, and Southeast Asia. The region is the primary destination for global LNG trade, necessitating massive capital investment in import receiving terminals, especially FSRUs, and the subsequent domestic pipeline distribution networks required to deliver gas to power plants and industrial consumers inland. India and China are heavily investing in expanding their national gas grid length to accelerate the penetration of gas in their energy mix.

- Middle East and Africa (MEA): This region is a major global exporter of crude oil and natural gas, fueling significant investment in export infrastructure, including massive crude pipelines, oil terminals, and large-scale LNG liquefaction plants (especially in Qatar and the US). Within the Middle East, large national oil companies (NOCs) control the midstream assets, focusing on maximizing export efficiency and integrating offshore production via complex subsea gathering systems. Africa sees growth driven by new offshore gas discoveries (e.g., Mozambique, Mauritania), requiring corresponding investment in export-focused midstream solutions.

- Latin America: The market is influenced by major offshore discoveries in Brazil (Pre-salt) and increasing unconventional production in Argentina (Vaca Muerta). Midstream development here focuses on both domestic processing and the necessary export routes, often requiring complex cross-country pipelines to facilitate regional trade and access to deep-water shipping lanes for global export, though regulatory and political risks remain significant factors affecting investment decisions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Midstream Oil and Gas Market.- Enterprise Products Partners L.P.

- Kinder Morgan, Inc.

- Enbridge Inc.

- TC Energy Corporation

- Williams Companies

- Plains All American Pipeline, L.P.

- Energy Transfer LP

- Magellan Midstream Partners, L.P.

- Cheniere Energy, Inc.

- Oneok, Inc.

- Pembina Pipeline Corporation

- Gibson Energy Inc.

- Gazprom

- Transneft

- Sempra Infrastructure

- ADNOC

- Saudi Aramco

- Equinor

- BP plc

- Shell plc

Frequently Asked Questions

Analyze common user questions about the Midstream Oil and Gas market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary revenue model for midstream oil and gas companies?

The primary revenue model is fee-based, relying on long-term contracts where shippers pay tariffs for reserving capacity and utilizing transportation, storage, and processing services, rather than basing revenue directly on the fluctuating price of the underlying commodity. This structure provides stable, predictable cash flows, distinguishing midstream assets from riskier upstream production assets.

How is the midstream sector addressing environmental concerns and emissions?

The sector is heavily investing in technologies to minimize methane leakage, primarily through advanced continuous monitoring systems, using drones and satellites, and replacing older pneumatic controllers. Additionally, there is a push to electrify compressor stations and explore the repurposing of existing pipelines for low-carbon fuels like hydrogen and carbon dioxide (CCS infrastructure).

What are Natural Gas Liquids (NGLs) and why are they important to the midstream market?

NGLs are hydrocarbons separated from raw natural gas, including ethane, propane, butane, and natural gasoline. They are critical to the midstream market because they require specialized processing (fractionation) and dedicated pipeline transportation, yielding high-value feedstocks for the petrochemical industry, making NGL infrastructure a high-growth, high-margin subsegment.

Which geographical region is currently experiencing the most significant midstream infrastructure growth?

North America, particularly the United States, continues to see the most substantial infrastructure growth, driven by prolific shale gas and oil production (e.g., Permian Basin), necessitating continuous expansion of gathering systems, long-haul transmission pipelines, and vast LNG export capabilities, making it the central hub for global midstream investment.

What role does digitalization play in enhancing pipeline integrity management?

Digitalization leverages the Industrial Internet of Things (IIoT) sensors, advanced data analytics, and Artificial Intelligence (AI) to shift integrity management from reactive or time-based maintenance to predictive maintenance. This allows operators to accurately forecast potential equipment failures, prioritize targeted repairs based on risk, and enhance regulatory compliance through real-time, autonomous monitoring of pipeline health.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager