Milbemycin Oxime API Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433739 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Milbemycin Oxime API Market Size

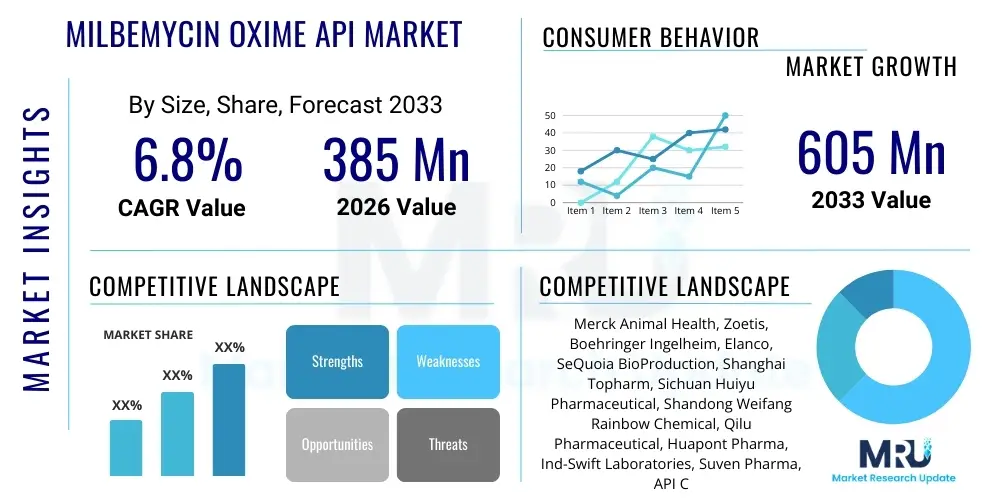

The Milbemycin Oxime API Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 385 million in 2026 and is projected to reach USD 605 million by the end of the forecast period in 2033.

Milbemycin Oxime API Market introduction

Milbemycin Oxime is a crucial active pharmaceutical ingredient (API) widely utilized in the veterinary sector for the prevention and treatment of various parasitic infections, particularly heartworm, hookworm, roundworm, and ear mites in companion animals such as dogs and cats. Chemically derived from the fermentation products of Streptomyces hygroscopicus var. aureolacrimosus, this macrocyclic lactone compound functions by disrupting the neurological system of parasites, leading to paralysis and subsequent death. Its high efficacy, broad-spectrum antiparasitic activity, and established safety profile have cemented its status as a cornerstone API in pet healthcare formulations globally.

The primary applications for Milbemycin Oxime API include the formulation of chewable tablets, topical solutions, and combination therapies, often paired with other parasiticides like praziquantel or afoxolaner to provide comprehensive protection against both external and internal parasites. The market driving factors for this API are intrinsically linked to the increasing rate of pet adoption worldwide, the rising consumer expenditure on preventative veterinary care, and heightened awareness among pet owners regarding zoonotic diseases transmitted by parasites. Furthermore, the persistent threat of heartworm disease in endemic regions mandates continuous prophylactic treatment, thereby ensuring stable and increasing demand for Milbemycin Oxime formulations.

A significant benefit of Milbemycin Oxime lies in its efficacy against multiple parasitic stages and its favorable pharmacokinetic properties, allowing for monthly or extended-interval dosing regimens, which improves owner compliance. The robust demand is further amplified by technological advancements in API synthesis, focusing on achieving higher purity and yield while adhering to stringent global pharmacopeial standards (USP, EP). Challenges related to drug resistance in certain parasite populations necessitate ongoing research and development in formulation science, but Milbemycin Oxime remains a reliable first-line treatment option, underpinning its sustained market growth trajectory.

Milbemycin Oxime API Market Executive Summary

The Milbemycin Oxime API market exhibits robust growth driven by favorable business trends centered on the expansion of the global companion animal pharmaceutical industry and continuous innovation in combination antiparasitic products. Key business trends involve strategic collaborations between specialized API manufacturers and large animal health companies to secure supply chain resilience and meet escalating global demand. Furthermore, the increasing focus on generic API manufacturing in emerging economies, catalyzed by patent expirations, is driving competitive pricing and accessibility across various regional markets, fundamentally changing the competitive landscape for established suppliers. Investment in advanced purification techniques, particularly chromatography, is a major trend to meet the high-purity requirements mandated for injectable and long-acting formulations.

Regional trends indicate North America and Europe retaining dominance due to high pet ownership rates, substantial disposable income allocated to pet healthcare, and well-established veterinary infrastructure that promotes regular preventative medication use. However, the Asia Pacific region is demonstrating the highest growth potential, fueled by rapid urbanization, rising middle-class income, and a significant shift toward formalized pet ownership and scheduled veterinary care, particularly in China and India. Regulatory harmonization efforts globally, such as those facilitated by VICH (International Cooperation on Harmonisation of Technical Requirements for Registration of Veterinary Medicinal Products), are streamlining the registration process for new Milbemycin Oxime-based products, accelerating market entry across multiple geographies.

Segmentation trends highlight the increasing preference for high-purity API grades suitable for complex drug delivery systems, such as extended-release matrices. In terms of application, the companion animal segment (dogs and cats) remains the dominant consumer, although minor applications in large livestock (off-label use or specific regional protocols) contribute marginally. The combination drug segment, integrating Milbemycin Oxime with ingredients like spinosad or afoxolaner for comprehensive flea, tick, and heartworm prevention, is outperforming monotherapy formulations, reflecting consumer demand for convenience and broader efficacy in a single product. These trends collectively underscore a stable but dynamically evolving market focused on quality assurance, expanded geographical reach, and formulation versatility.

AI Impact Analysis on Milbemycin Oxime API Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the complex chemical synthesis pathways of Milbemycin Oxime, particularly focusing on yield improvement, impurity reduction, and cost optimization. Common concerns revolve around whether AI models can accelerate the discovery of novel derivatives with improved efficacy against resistant parasitic strains or streamline clinical trials for new veterinary drugs utilizing this API. Expectations center on AI's ability to enhance regulatory compliance through predictive modeling of manufacturing variations and to optimize supply chain logistics, ensuring a stable and traceable global supply of high-purity Milbemycin Oxime API necessary for continuous preventative animal healthcare programs.

- AI-driven optimization of fermentation parameters and synthesis routes to maximize Milbemycin Oxime yield and purity.

- Machine Learning models utilized for predictive quality control, anticipating potential synthesis bottlenecks or contamination issues.

- Accelerated virtual screening for potential synergistic drug combinations involving Milbemycin Oxime to combat drug resistance.

- Enhanced supply chain management through predictive analytics, optimizing inventory levels and mitigating geopolitical supply risks.

- AI in pharmacovigilance, analyzing real-world data to monitor the safety and efficacy of Milbemycin Oxime-based veterinary drugs post-market release.

DRO & Impact Forces Of Milbemycin Oxime API Market

The Milbemycin Oxime API market is subject to significant Drivers, Restraints, and Opportunities (DRO) which collectively dictate the Impact Forces shaping its future trajectory. The primary driver is the pervasive threat of parasitic diseases, particularly heartworm, which necessitates consistent and long-term prophylactic treatment, ensuring sustained demand. This is powerfully complemented by the escalating humanization of pets, leading to increased veterinary spending on premium and preventative healthcare globally. However, the market faces restraints, chiefly the complexity and high cost associated with the API's multi-step chemical synthesis, leading to high dependence on specialized manufacturers. Furthermore, the ongoing development and market entry of competitive parasiticides, including isoxazolines (e.g., fluralaner, afoxolaner), pose a competitive challenge, requiring Milbemycin Oxime manufacturers to emphasize combination product development and cost efficiencies.

Opportunities for growth are vast, particularly in exploring novel drug delivery systems that improve bioavailability and compliance, such as long-acting injectable formulations or transdermal patches utilizing the Milbemycin Oxime API. Expansion into untapped emerging markets, particularly Southeast Asia and Latin America, represents a significant growth avenue where preventative veterinary medicine is becoming increasingly normalized. The Impact Forces analysis indicates that the 'Intensity of Rivalry' is moderate but increasing, driven by capacity expansion among Asian API suppliers. The 'Threat of Substitutes' remains high due to the success of newer chemical classes, making sustained investment in efficacy trials and combination products critical for market incumbents. Simultaneously, the 'Bargaining Power of Buyers' (large animal pharmaceutical companies) is substantial, pressuring API suppliers on price and demanding ultra-high purity specifications.

Addressing the restraints requires API manufacturers to invest heavily in process chemistry optimization, potentially adopting continuous manufacturing techniques to lower unit costs and minimize waste, thereby enhancing sustainability and competitiveness. Capitalizing on opportunities involves fostering stronger vertical integration or exclusive supply agreements with key veterinary pharmaceutical giants to secure long-term demand. The cumulative effect of these forces suggests a stable market underpinned by essential medical need, yet characterized by intense competition on price, quality, and regulatory compliance. Suppliers who can consistently deliver high-quality, cost-effective Milbemycin Oxime API, while navigating the intellectual property landscape for combination formulations, are positioned for enduring success in the veterinary pharmaceutical supply chain.

Segmentation Analysis

The Milbemycin Oxime API market is comprehensively segmented based on its application, formulation type, grade of purity, and geographical distribution, providing granular insights into demand patterns. Segmentation by application clearly distinguishes between companion animals (dogs and cats), which constitute the largest and most rapidly expanding segment, and minor uses in livestock. Formulation-based segmentation highlights the dominant share held by oral formulations (chewable tablets), followed by topical applications and specialized injectable products requiring the highest purity grades of the API. Understanding these segments is vital for API manufacturers to align their production capabilities and quality management systems with specific end-user product requirements and regulatory scrutiny.

The grade of purity segmentation is critical, reflecting the regulatory landscape and the intended route of administration. Standard grades are typically used for basic oral tablets, whereas high-purity and ultra-pure grades are mandatory for combination products and novel delivery systems, demanding sophisticated analytical testing and purification processes. Geographically, the market is dissected into established high-value regions (North America and Europe) characterized by maturity and high consumption, and high-growth potential regions (Asia Pacific and Latin America) where market penetration and pet adoption rates are rapidly accelerating. This multifaceted segmentation helps stakeholders define targeted business strategies, allocate R&D resources effectively, and optimize their supply chains to meet diverse global quality and volume demands.

- By Application:

- Companion Animals (Dogs, Cats)

- Livestock and Others (Minor Use)

- By Formulation Type:

- Oral Tablets/Chewables

- Topical Solutions (Spot-on)

- Injectable/Other Novel Delivery Systems

- By Purity Grade:

- Standard Grade API

- High-Purity Grade API (for advanced formulations)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Milbemycin Oxime API Market

The Milbemycin Oxime API value chain begins with complex upstream analysis, involving the sourcing and optimization of microbial fermentation processes using Streptomyces strains, followed by multi-step isolation and chemical modification (oximation) necessary to produce the active molecule. This upstream phase is highly capital-intensive and requires specialized bioprocessing expertise and containment facilities to ensure sterile conditions and controlled yields. Key upstream challenges include maintaining strain viability, optimizing nutrient media, and managing complex waste streams. Only a limited number of specialized global firms possess the technological capability and regulatory approvals to master this initial, high-barrier entry point, defining the oligopolistic nature of the early value chain segment.

The midstream phase focuses on purification, crystallization, and drying processes to achieve the required API purity, often utilizing advanced chromatographic techniques to remove structural analogs and impurities. This purified Milbemycin Oxime API is then supplied to downstream pharmaceutical companies (Veterinary CMOs and Branded Animal Health companies). Downstream activities involve formulation (e.g., blending with excipients to create chewables or solvents for topical applications), packaging, and large-scale distribution. Direct channels often involve large, established API suppliers selling directly to major pharmaceutical clients under long-term supply contracts, ensuring supply reliability and customized quality specifications. Indirect channels may utilize specialized pharmaceutical distributors or trading houses, particularly for smaller clients or entry into highly regulated local markets where specialized importation expertise is necessary.

The final stage involves the distribution of the finished veterinary medicinal products through various channels, including veterinary clinics, specialized pet pharmacies, and increasingly, direct-to-consumer e-commerce platforms facilitated by prescription authentication. The regulatory stringent nature of the veterinary drug market means that traceability and quality documentation are critical at every stage, linking raw material sourcing back to the final distribution point. Efficiency in the distribution channel, minimizing storage costs and maintaining inventory security, is essential for maintaining competitive pricing in the final veterinary product market.

Milbemycin Oxime API Market Potential Customers

The primary customers and end-users of Milbemycin Oxime API are large multinational animal health pharmaceutical corporations that specialize in preventative veterinary medicine. These companies, such as Zoetis, Boehringer Ingelheim, Elanco, and Merck Animal Health, require consistent, high-volume supplies of GMP-certified API to manufacture their flagship heartworm and broad-spectrum antiparasitic products. Their purchasing decisions are heavily influenced by the supplier's regulatory track record (FDA, EMA compliance), the API's consistency, and the ability to scale production rapidly in response to seasonal or epidemic demand spikes. These large buyers often establish long-term, strategic supply relationships, sometimes mandating dual-sourcing strategies to mitigate risk.

Secondary customer segments include generic veterinary drug manufacturers, especially those focused on market segments where the original patents have expired or are nearing expiration. These companies prioritize cost-effectiveness and rapid regulatory filing, seeking API suppliers who can provide Drug Master Files (DMFs) or equivalent technical documentation that meets stringent local regulatory requirements for abbreviated new animal drug applications. Furthermore, specialized compounding pharmacies and smaller regional pharmaceutical companies also constitute a niche customer base, requiring smaller batches of the API, often catered to by pharmaceutical trading houses or specialized distributors, emphasizing flexibility and customized technical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 385 Million |

| Market Forecast in 2033 | USD 605 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck Animal Health, Zoetis, Boehringer Ingelheim, Elanco, SeQuoia BioProduction, Shanghai Topharm, Sichuan Huiyu Pharmaceutical, Shandong Weifang Rainbow Chemical, Qilu Pharmaceutical, Huapont Pharma, Ind-Swift Laboratories, Suven Pharma, API Corporation, Eurofarma Laboratórios, Dr. Reddy's Laboratories, Cipla, Zydus Animal Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Milbemycin Oxime API Market Key Technology Landscape

The technological landscape surrounding the Milbemycin Oxime API market is dominated by advancements in large-scale fermentation and chemical synthesis optimization, driven primarily by the need for higher yield, improved purity, and cost reduction. Core technology relies on controlled microbial fermentation using engineered strains of Streptomyces to produce the precursor milbemycins. Recent technological breakthroughs focus on utilizing advanced bioreactors and continuous fermentation processes to enhance productivity and reduce batch-to-batch variability. Furthermore, genetic engineering techniques are being employed to optimize the biosynthetic pathways of the microbial hosts, aiming to specifically increase the output of desired milbemycin components suitable for subsequent oxime conversion, thereby streamlining the overall production cycle and reducing reliance on extensive physical separation processes.

Post-fermentation technology centers on highly efficient and selective purification methods. Since Milbemycin Oxime is structurally similar to several related compounds (analogs), achieving the stringent purity levels required by regulatory bodies is challenging. Key technologies here include High-Performance Liquid Chromatography (HPLC) and specialized countercurrent chromatography methods used for large-scale isolation and purification. These techniques are crucial for producing the 'High-Purity Grade API' demanded for modern drug delivery systems, especially those where even trace impurities could affect stability or safety. Manufacturers are continuously investing in automation and process analytical technologies (PAT) to monitor critical quality attributes in real-time, ensuring consistent quality control and reducing the time needed for final product release testing.

Beyond synthesis and purification, formulation technology also heavily influences the API demand. Novel drug delivery platforms, such as liposomal encapsulation or polymeric matrix systems, require highly stable and specific crystalline forms of the API. This has spurred research into crystal engineering and polymorph screening to identify and control the most stable and bioavailable solid forms of Milbemycin Oxime, optimizing its physical characteristics for incorporation into diverse dosage forms, including specialized long-acting injectables that promise extended protection against parasites with fewer dosing events. The integration of continuous manufacturing principles is also a nascent but important technology trend aimed at mitigating risks associated with large batch processing and improving overall environmental sustainability.

Regional Highlights

- North America (United States, Canada): This region dominates the Milbemycin Oxime API market, driven by the highest per capita pet ownership globally and strong veterinary spending. The market is characterized by mandatory heartworm preventative protocols, resulting in consistent, high-volume demand. The U.S. remains the core consumer, with key regulatory bodies (FDA-CVM) setting stringent quality and efficacy standards. High market maturity means growth is primarily focused on premium, combination products and brand loyalty.

- Europe (Germany, UK, France): Europe constitutes a robust market characterized by high regulatory standards (EMA) and sophisticated animal healthcare infrastructure. While pet populations are stable, the increasing complexity of parasitic challenges (due to climate change) drives demand for broad-spectrum prevention. Germany and France lead in overall consumption, focusing on high-quality, EU-GMP-compliant APIs for distribution across the continent.

- Asia Pacific (China, India, Japan, Australia): APAC is the fastest-growing region. This expansion is fueled by rising disposable incomes, rapid urbanization leading to increased pet keeping, and the gradual shift from traditional livestock markets to commercialized companion animal healthcare. China and India are emerging as critical production hubs for generic API manufacturing, influencing global pricing, while Australia and Japan remain high-value consumer markets with strict importation rules.

- Latin America (Brazil, Mexico): LATAM presents significant growth potential, underpinned by large domestic pet populations and increasing awareness of zoonotic disease prevention. Economic volatility remains a challenge, but the demand for cost-effective, efficacious treatments drives market penetration. Brazil, with its large veterinary sector, is the anchor market, serving as a regional manufacturing and distribution hub.

- Middle East & Africa (South Africa, GCC Nations): This region represents the smallest current market share, yet exhibits focused growth potential in specific segments. South Africa has a well-developed veterinary sector driving API consumption. In the GCC nations, increased affluence supports higher spending on imported, specialized companion animal healthcare products, favoring branded formulations utilizing high-quality imported Milbemycin Oxime API.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Milbemycin Oxime API Market.- Merck Animal Health (Manufacturer of key finished products)

- Zoetis

- Boehringer Ingelheim

- Elanco

- SeQuoia BioProduction (Specialized API Supplier)

- Shanghai Topharm Chemical Co., Ltd.

- Sichuan Huiyu Pharmaceutical Co., Ltd.

- Shandong Weifang Rainbow Chemical Co., Ltd.

- Qilu Pharmaceutical Co., Ltd.

- Huapont Pharmaceutical Co., Ltd.

- Ind-Swift Laboratories Ltd.

- Suven Life Sciences (formerly Suven Pharma)

- API Corporation (Japan-based API producer)

- Eurofarma Laboratórios S.A.

- Dr. Reddy's Laboratories Ltd.

- Cipla Ltd. (Veterinary Division)

- Zydus Animal Health and Neutraceuticals

- Hebei Veyong Animal Pharmaceutical Co., Ltd.

- Chongqing Huapont Pharmaceutical Co., Ltd.

- Bayer AG (Legacy portfolio now part of Elanco/B.I.)

Frequently Asked Questions

Analyze common user questions about the Milbemycin Oxime API market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Milbemycin Oxime API in veterinary medicine?

Milbemycin Oxime is primarily used as a macrocyclic lactone antiparasitic agent in veterinary formulations, highly effective for the prevention of heartworm disease and the treatment of various parasitic infections, including hookworms, roundworms, and whipworms, predominantly in companion animals like dogs and cats.

How does the Milbemycin Oxime synthesis process impact API market supply?

The synthesis is complex, involving large-scale microbial fermentation followed by multi-step chemical modification, which necessitates specialized equipment and high capital investment. This complexity limits the number of qualified suppliers, leading to a moderately concentrated market where supply stability and purity control are major competitive factors.

Which geographical region holds the largest market share for Milbemycin Oxime API?

North America currently holds the largest market share, driven by high rates of pet ownership, substantial spending on preventative veterinary care, and established clinical protocols that mandate continuous heartworm prophylaxis throughout the year, ensuring high demand volume.

What are the key purity requirements for Milbemycin Oxime API?

Regulatory standards (GMP, USP/EP) require extremely high purity, typically above 98%, with rigorous controls over related substances and residual solvents. Ultra-high purity grades are often demanded for complex, novel delivery systems, such as long-acting injectables, to ensure product stability and patient safety.

Are generic versions of Milbemycin Oxime products driving market growth?

Yes, the expiry of original patents has facilitated the entry of generic veterinary drug manufacturers, particularly those sourced from cost-competitive regions like Asia Pacific. This generic competition is crucial for increasing the accessibility and affordability of preventative treatments globally, thereby expanding the overall market volume.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager