Military Aircraft Weighing Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434847 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Military Aircraft Weighing Platform Market Size

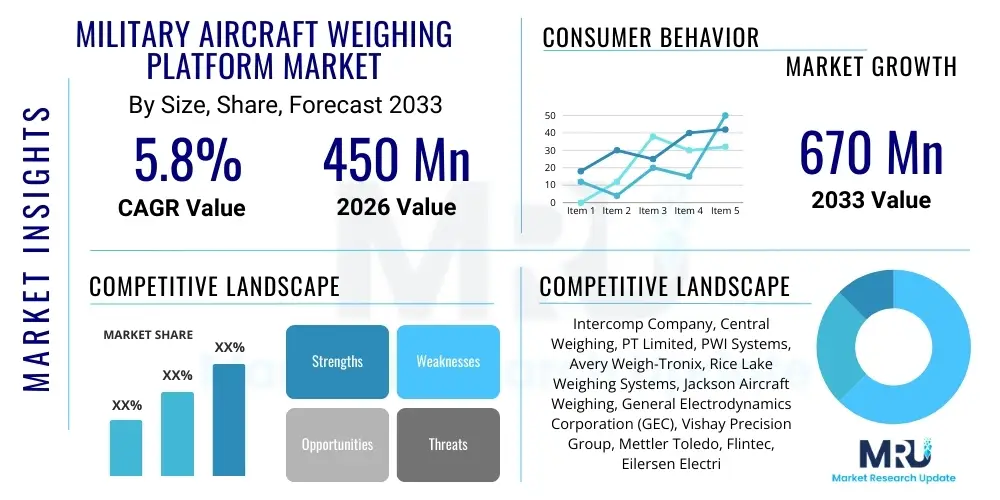

The Military Aircraft Weighing Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033.

Military Aircraft Weighing Platform Market introduction

The Military Aircraft Weighing Platform Market encompasses specialized, high-precision weighing systems designed to accurately measure the gross weight and center of gravity (CG) of military aviation assets, ranging from unmanned aerial vehicles (UAVs) to heavy strategic transport aircraft. These platforms are essential tools within the defense and aerospace maintenance ecosystem, providing critical data necessary for ensuring flight safety, optimizing fuel efficiency, and verifying compliance with stringent military and regulatory weight and balance limitations. The systems often utilize advanced load cell technologies, including strain gauge and hydraulic types, deployed either as portable pads placed under the landing gear or as fixed, in-ground installations integrated into hangar floors.

The primary applications of these sophisticated weighing systems reside within Maintenance, Repair, and Overhaul (MRO) operations, routine pre-flight inspections, and mandatory weight and balance certification processes. Maintaining accurate weight records is paramount for military logistics and operational readiness, as deviations in CG can significantly impact aircraft maneuverability, structural integrity, and mission payload capacity. Benefits derived from utilizing these platforms include enhanced operational safety through precise load management, reduced maintenance costs by early detection of uneven loading issues, and improved overall operational tempo due to fast and reliable weighing procedures. Key products in this domain feature robust, all-weather designs capable of operating in demanding field environments, often incorporating wireless data transmission capabilities for seamless integration with modern maintenance management software.

Driving factors propelling market expansion include the continuous modernization efforts across global air forces, leading to the deployment of complex, heavy aircraft requiring frequent weight monitoring. Furthermore, increasing regulatory scrutiny over aircraft structural loading, coupled with the rising operational tempo of aerial assets in conflict zones and humanitarian missions, necessitates reliable and deployable weighing solutions. The shift towards highly precise wireless and digital weighing systems that offer rapid deployment and minimal error margins is also fueling demand, particularly among NATO members and nations expanding their strategic airlift capabilities.

Military Aircraft Weighing Platform Market Executive Summary

The Military Aircraft Weighing Platform Market is characterized by steady growth, primarily driven by increasing global defense spending focused on fleet readiness and MRO efficiency. Current business trends indicate a strong preference for portable, wireless systems that reduce setup time and enhance flexibility, critical factors for forward operating bases and remote maintenance environments. Technological advancement is leaning heavily toward digital systems incorporating sophisticated sensor calibration and automated data logging, minimizing human error and providing verifiable audit trails crucial for military compliance standards. Manufacturers are investing in developing platforms that can handle the extreme weights of next-generation aircraft while maintaining high levels of accuracy in harsh conditions.

Regional trends highlight North America, particularly the United States, as the dominant market due to massive investment in defense aviation and stringent requirements for aircraft airworthiness certification. The Asia Pacific region is demonstrating the fastest growth trajectory, fueled by China, India, and other emerging military powers significantly expanding their air force inventories and subsequently requiring essential ground support equipment. Europe maintains a mature market, driven by the replacement cycle of older, less accurate systems and the collaborative defense initiatives under organizations like NATO, which mandate standardized equipment and maintenance protocols across allied nations.

Segment trends underscore the dominance of portable/mobile systems, favored for their versatility and ease of deployment, especially in tactical scenarios. Within the technology segment, wireless load cells are rapidly outpacing traditional cabled systems, offering superior efficiency and reduced risk of cable damage. The Maintenance, Repair, and Overhaul (MRO) application segment remains the largest revenue contributor, as weighing is a fundamental procedure in heavy checks and modifications. Future growth is anticipated in the Application segment related to pre-flight checks and real-time operational diagnostics, driven by the demand for maximizing payload optimization.

AI Impact Analysis on Military Aircraft Weighing Platform Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can move beyond simple weight measurement to predictive maintenance and strategic operational planning within the context of military weighing platforms. Common concerns revolve around integrating weighing data (raw weight and CG measurements) with other maintenance datasets (flight hours, structural stress, fuel consumption) to create holistic models. Users seek to understand if AI can predict structural failure or stress-related maintenance needs based on historical weight fluctuations, potentially optimizing MRO schedules and reducing unscheduled downtime. Furthermore, there is interest in using AI for automated calibration and anomaly detection within the weighing platforms themselves, ensuring system integrity and accuracy under variable environmental conditions.

The integration of AI is transforming military aircraft weighing from a static measurement task into a dynamic, predictive process. By applying machine learning algorithms to continuous weight and balance data collected over the operational lifespan of an aircraft, maintainers can identify subtle, long-term trends indicative of material degradation, excessive wear, or unauthorized modifications. This predictive capability allows military logistics planners to schedule maintenance proactively, precisely when and where it is needed, rather than relying solely on fixed intervals. AI also plays a crucial role in validating data quality; complex algorithms can rapidly analyze thousands of data points to flag inconsistencies caused by environmental factors (like temperature drift) or operational errors, thus maintaining the high fidelity required for military aviation safety records.

Moreover, AI is being deployed to optimize the weighing process itself. Smart calibration routines leverage historical data and environmental inputs to automatically adjust sensor readings, ensuring peak accuracy without constant manual intervention. For strategic operations, AI models can use real-time weight and balance data, combined with mission parameters (e.g., fuel load, intended payload distribution), to provide immediate, optimized loading instructions for pilots and loadmasters. This is particularly vital for transport missions where quick turnaround times and precise CG management are critical for safety and operational success, transforming the platform into a data-generating node within the broader digital maintenance ecosystem.

- AI enhances predictive maintenance by correlating weight drift with structural stress indicators.

- Machine learning algorithms enable automated, highly precise sensor calibration and verification.

- Integration with MRO systems allows for holistic, data-driven planning of heavy maintenance checks.

- AI supports real-time, optimized load planning and center of gravity calculations for tactical operations.

- Generative AI models can simulate load distribution scenarios under various environmental pressures for training purposes.

- Automated anomaly detection ensures the integrity and reliability of the weighing data output.

DRO & Impact Forces Of Military Aircraft Weighing Platform Market

The market dynamics for Military Aircraft Weighing Platforms are shaped by a complex interplay of defense modernization mandates (Drivers), budgetary limitations and system complexity (Restraints), advancements in sensor technology (Opportunities), and the stringent regulatory environment (Impact Forces). The core driver remains the non-negotiable requirement for aviation safety and compliance; aircraft cannot be safely operated or certified without verified weight and balance data. This mandatory compliance ensures a consistent replacement cycle and upgrade demand for existing systems. However, high initial procurement costs, especially for highly precise, customized fixed installations, present a significant restraint, particularly for smaller air forces or those operating under tight budget constraints. The opportunity landscape is dominated by the emergence of smart, IoT-enabled, wireless systems offering higher data fidelity and easier field deployment. These market forces collectively dictate the procurement cycles and technological adoption rates globally.

Drivers: Key drivers include the global trend of military aircraft fleet expansion and modernization, necessitating new weighing equipment tailored to specialized, larger aircraft (e.g., F-35, C-17, heavy drones). Furthermore, the increasing complexity of modern airframes, often utilizing non-uniform materials and specialized coatings, requires weighing equipment with higher sensitivity and accuracy to detect even minor weight shifts. The rising emphasis on preventative maintenance and the shift towards digital MRO frameworks also boost the demand for weighing platforms capable of seamless data integration. The logistical demands of frequent deployments to remote or austere environments require rugged, portable, and reliable weighing technology that can withstand extreme temperature and moisture variations, driving procurement decisions.

Restraints: Significant restraints include the substantial capital expenditure required for acquiring and maintaining certified weighing platforms, specialized training needed for operational personnel, and the challenges associated with achieving and maintaining necessary NIST or international calibration certifications. Furthermore, the long product lifecycles of military weighing systems, often lasting 15 to 20 years, restrict frequent replacement purchases, slowing market growth compared to consumer technology sectors. Technical challenges related to electromagnetic interference (EMI) in highly electronic military environments, which can affect sensor accuracy, also pose a technical hurdle that manufacturers must constantly address, often adding complexity and cost.

Opportunities: Major opportunities lie in developing next-generation wireless load cells with extended battery life, improved environmental shielding, and proprietary software that offers integrated predictive analytics and diagnostics. The burgeoning market for unmanned aerial vehicles (UAVs) and drones, which also require precise weight and CG checks for optimal flight performance, presents a new segment for specialized, lower-capacity weighing platforms. Additionally, offering comprehensive, long-term service and calibration contracts to military organizations provides sustained revenue streams, mitigating the impact of slow replacement cycles. Geographically, untapped potential exists in rapidly developing defense markets in Southeast Asia and parts of Africa undergoing fleet modernization.

Impact Forces: The most significant impact force is regulatory compliance, specifically military and civil aviation regulations (e.g., FAA/EASA weight and balance rules applied to military logistics). Failure to comply with these rules renders an aircraft unserviceable, making weighing equipment a mission-critical asset. Standardization efforts among military alliances (like NATO) often dictate specific compatibility and accuracy standards, influencing procurement specifications across multiple nations simultaneously. Geopolitical tensions and shifting defense priorities directly impact defense budgets, which subsequently govern the scale and timing of military hardware purchases, including support equipment like weighing platforms.

Segmentation Analysis

The Military Aircraft Weighing Platform Market is comprehensively segmented based on Type, Technology, Aircraft Type, and Application, reflecting the diverse needs of global defense forces. The segmentation by Type, specifically distinguishing between portable and fixed systems, determines the operational flexibility and investment scale. Portable systems dominate due to their tactical utility and ease of deployment, while fixed systems are reserved for heavy maintenance hubs. The Technology segmentation highlights the shift toward advanced digital and wireless sensors, crucial for precision and data integrity. Aircraft Type segmentation confirms that the largest market value is associated with weighing heavy transport and multi-role fighter jets, which undergo the most rigorous MRO cycles. Application analysis clearly indicates MRO activities as the primary revenue generator, though pre-flight checks are emerging as a vital, high-frequency activity segment.

Analyzing these segments provides strategic insights into investment priorities. For instance, manufacturers focusing on the wireless technology segment and targeting fixed-wing transport aircraft applications are positioned to capture the highest growth potential, particularly in nations focused on strategic airlift capability. Conversely, vendors specializing in fixed, hydraulic systems may focus on providing robust solutions for large, long-term maintenance bases where supreme accuracy over decades is prioritized over portability. The evolving landscape of military aviation, including the proliferation of advanced rotary-wing and vertical takeoff and landing (VTOL) platforms, mandates continuous refinement of platform designs to accommodate diverse landing gear configurations and unique CG requirements.

- Type:

- Portable/Mobile Weighing Systems (High demand for field operations)

- Fixed/In-Ground Weighing Systems (Used in permanent MRO hangars)

- Technology:

- Strain Gauge Load Cells

- Hydraulic Load Cells

- Wireless Weighing Systems (Growing rapidly)

- Digital/Electronic Weighing Systems

- Aircraft Type:

- Fixed-Wing Aircraft (Fighter Jets, Bombers, Transport Aircraft)

- Rotary-Wing Aircraft (Helicopters)

- Unmanned Aerial Vehicles (UAVs) and Drones

- Application:

- Maintenance, Repair, and Overhaul (MRO)

- Pre-flight Checks and Readiness Assessment

- Weight & Balance Certification

- Research & Development (R&D) and Modification Testing

Value Chain Analysis For Military Aircraft Weighing Platform Market

The value chain for the Military Aircraft Weighing Platform market begins with the Upstream segment, dominated by highly specialized sensor and material suppliers. This segment involves the production of critical components such as high-accuracy load cells (often based on specialized metal alloys and advanced strain gauge technology), temperature compensation circuits, and durable materials required for platforms to withstand military operational environments. Key players in the upstream market are niche sensor manufacturers and precision engineering firms that supply standardized yet highly customized components to the platform assemblers. Quality control and material certification at this stage are paramount, as they directly determine the accuracy and reliability of the final product under extreme load and temperature variations.

The Midstream phase involves the core manufacturing and assembly processes. This is where specialized military equipment providers design, calibrate, and integrate the load cells, structural components, and electronic interfaces into the final weighing platforms. Strict adherence to military specifications (MIL-SPEC) and calibration standards (e.g., traceable to NIST) is non-negotiable. Downstream activities involve distribution, installation, and extensive after-sales support. Due to the specialized nature of the equipment, distribution often utilizes Direct channels, where the manufacturer or authorized distributor interacts directly with national defense ministries, air forces, or military MRO facilities. Indirect channels, involving defense contractors or system integrators, are also used when the weighing platform is procured as part of a larger infrastructure or MRO project package.

The importance of the service segment (calibration, maintenance, and software updates) cannot be overstated. Given the criticality of the data, long-term service contracts are highly lucrative and necessary, often generating significant recurring revenue for manufacturers. Direct relationships facilitate rapid responsiveness for on-site calibration and troubleshooting, which is essential for maintaining aircraft operational readiness. The stringent requirements for periodic re-calibration, often mandated every 12 to 24 months, lock customers into long-term support relationships, making customer service a defining factor in competitive differentiation within this specialized market.

Military Aircraft Weighing Platform Market Potential Customers

The primary customers for Military Aircraft Weighing Platforms are highly regulated and specialized entities within the global defense ecosystem. These include the Air Forces and Naval Aviation Wings of sovereign nations, which are the direct operators and end-users responsible for the safety and operational readiness of their aircraft fleets. Procurement decisions are generally centralized within defense ministries or relevant military commands, prioritizing certified equipment that meets specific tactical requirements for deployment and durability. A substantial volume of sales is also directed towards specialized Military MRO (Maintenance, Repair, and Overhaul) facilities, whether they are government-owned or outsourced to major defense contractors such as Lockheed Martin, Boeing Defense, or BAE Systems, where routine heavy checks require verified weight and balance data.

Furthermore, major defense prime contractors developing new aircraft platforms represent significant potential customers, requiring these systems during the Research and Development (R&D) and initial certification phases of new aircraft programs. Aircraft modification centers and conversion specialists also rely heavily on precise weighing equipment to recertify aircraft after major upgrades, structural changes, or avionics integration. The demand profile of these customers is defined by an absolute need for verifiable accuracy, robust construction capable of handling high loads (up to 200,000 lbs or more per wheel pad), and software interoperability with existing military logistics and maintenance management systems (MMS). The purchasing cycle is typically long, involving detailed technical evaluations and competitive tenders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intercomp Company, Central Weighing, PT Limited, PWI Systems, Avery Weigh-Tronix, Rice Lake Weighing Systems, Jackson Aircraft Weighing, General Electrodynamics Corporation (GEC), Vishay Precision Group, Mettler Toledo, Flintec, Eilersen Electric A/S, Measurement Specialties, HBM, RADWAG, Teknomek Industrial Systems, VPG Force Sensors, Kistler Group, Thames Side Sensors, HANGHAI YOZAN INDUSTRIAL. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Aircraft Weighing Platform Market Key Technology Landscape

The technological landscape of military aircraft weighing platforms is defined by continuous innovation focused on precision, durability, and connectivity. The foundational technology remains the load cell, with advancements primarily occurring in sensor materials and digital signal processing. Traditional hydraulic load cells are still utilized for extremely high-capacity, fixed installations due to their inherent robustness, but they are increasingly challenged by electronic strain gauge load cells. Modern strain gauge systems integrate proprietary micro-electronics that compensate for temperature variations and lateral forces, significantly improving accuracy and long-term stability in unpredictable field conditions. The push for higher resolution and reduced error margins (typically required to be less than 0.1% of applied load) drives substantial R&D investment in this area.

The most transformative technology in recent years is the proliferation of wireless weighing systems. These systems utilize secure, encrypted communication protocols (such as proprietary radio frequencies or Wi-Fi Mesh networks) to transmit weight data from the individual platform pads to a central indicator or computer without the need for cumbersome and potentially fragile cables. Wireless connectivity drastically cuts down setup and teardown time, minimizes trip hazards in busy hangar environments, and is essential for rapid deployment scenarios. Furthermore, these systems often incorporate advanced diagnostics, allowing operators to monitor battery life, communication strength, and sensor health remotely, ensuring system readiness before use. The adoption of military-grade battery technology is also crucial to ensure platforms can operate autonomously for extended periods in remote locations.

Future technological advancements are centered on integrating weighing data directly into the Industrial Internet of Things (IIoT) ecosystem of military MRO. This involves developing platform software capable of seamless, bi-directional communication with enterprise resource planning (ERP) systems and logistics software, enabling automated record-keeping and instantaneous comparison against mandated weight limits. Furthermore, researchers are exploring the use of advanced materials, such as carbon fiber composites, in platform construction to reduce the system's overall weight while maintaining structural integrity, making the large-capacity portable systems easier to transport and deploy by fewer personnel. The convergence of secure wireless transmission, enhanced digital processing, and robust, lightweight construction defines the competitive advantage in this sophisticated technological domain.

Regional Highlights

Regional analysis reveals distinct market maturity and growth dynamics driven by geopolitical factors and defense spending priorities.

- North America: Dominates the global market, led by the United States Department of Defense (DoD). High defense budgets, the necessity for meticulous weight and balance control for complex fleets (including high-value assets like the B-2, F-22, and C-17), and stringent FAA/military airworthiness standards mandate the use of the most advanced and highly calibrated weighing platforms. The presence of major defense prime contractors and key technology innovators solidifies the region's leadership in both consumption and technological development.

- Europe: Represents a mature and stable market, driven primarily by NATO member countries. Demand is characterized by a need for standardized equipment compliant with alliance protocols, focusing on replacing aging hydraulic systems with modern, integrated digital and wireless platforms. Key markets include the UK, Germany, and France, driven by domestic fighter programs and strategic transport requirements.

- Asia Pacific (APAC): The fastest-growing region globally. Exponential defense modernization efforts in countries like China, India, and South Korea, coupled with significant increases in military aviation procurement, are fueling demand. These nations are investing heavily in establishing advanced MRO capabilities and require new, high-accuracy weighing solutions to support their rapidly expanding fixed-wing transport and naval aviation fleets.

- Middle East and Africa (MEA): Growth is localized and influenced by oil revenues and geopolitical instability, leading to significant, albeit intermittent, defense procurement cycles. Major Gulf nations (UAE, Saudi Arabia) are key consumers, acquiring sophisticated Western aircraft and requiring associated certified support equipment for localized MRO. The market often favors proven, durable systems suitable for high-temperature desert environments.

- Latin America: Constitutes a smaller market share, characterized by gradual modernization programs. Demand is concentrated among the larger economies (Brazil, Mexico) focusing on standardizing equipment and improving logistical efficiency for existing transport and rotary-wing fleets. Budgetary constraints often favor cost-effective, portable solutions over complex fixed installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Aircraft Weighing Platform Market.- Intercomp Company

- Central Weighing

- PT Limited

- PWI Systems

- Avery Weigh-Tronix

- Rice Lake Weighing Systems

- Jackson Aircraft Weighing

- General Electrodynamics Corporation (GEC)

- Vishay Precision Group (VPG)

- Mettler Toledo

- Flintec

- Eilersen Electric A/S

- HBM (Hottinger Baldwin Messtechnik GmbH)

- RADWAG Balances and Scales

- Teknomek Industrial Systems

- Measurement Specialties (TE Connectivity)

- Kistler Group

- Thames Side Sensors Ltd.

- SENSOR TECHNOLOGY LTD.

- HANGHAI YOZAN INDUSTRIAL CO., LTD.

Frequently Asked Questions

Analyze common user questions about the Military Aircraft Weighing Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for military aircraft weighing platforms?

The primary driver is the non-negotiable regulatory requirement for accurate weight and center of gravity (CG) measurement, essential for ensuring flight safety, airworthiness certification, and optimal mission performance according to military aviation standards.

What are the key technological differences between portable and fixed weighing systems?

Portable systems offer flexibility and rapid deployment using wireless load cells and modular pads, ideal for field MRO. Fixed systems are highly accurate, built into hangar floors, and often use robust hydraulic or high-capacity strain gauge technology for heavy, long-term maintenance checks.

How does the adoption of wireless technology impact military operations?

Wireless technology significantly reduces aircraft downtime by minimizing setup complexity, eliminating cable failure risks, and enhancing safety in busy operational environments, facilitating faster and more reliable weighing procedures in tactical and MRO settings.

Which military aircraft application segment generates the highest market revenue?

The Maintenance, Repair, and Overhaul (MRO) application segment is the largest revenue generator, as weighing is a critical and mandatory procedure during heavy maintenance checks, structural repairs, and modifications throughout the operational life of an aircraft.

How does AI contribute to the future of military aircraft weighing?

AI integrates weighing data with MRO data to enable predictive maintenance, anticipating structural issues based on weight shifts. It also optimizes real-time load distribution and enhances system accuracy through automated calibration routines and anomaly detection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager