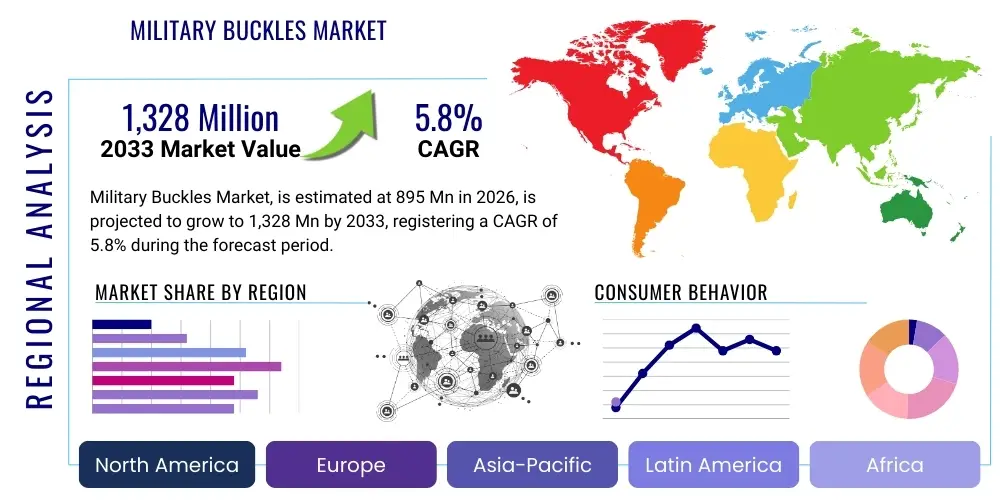

Military Buckles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439811 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Military Buckles Market Size

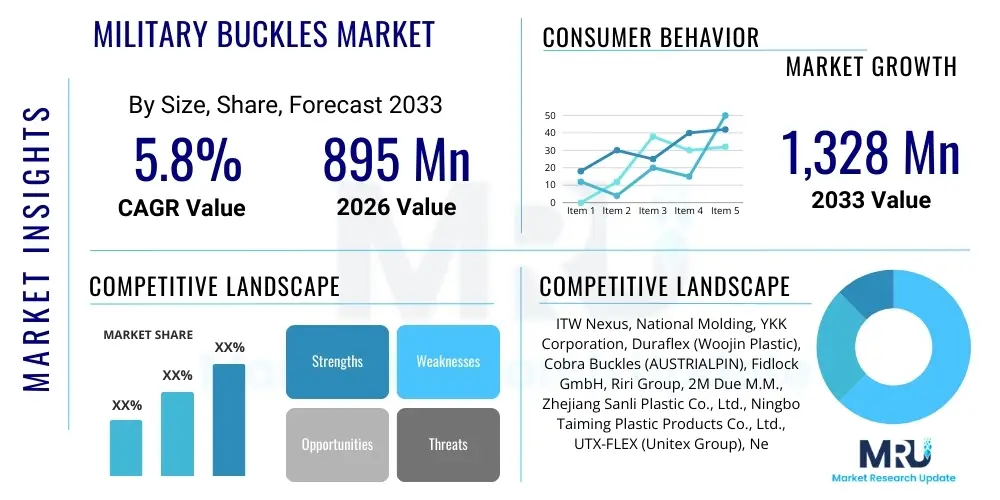

The Military Buckles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 895 million in 2026 and is projected to reach USD 1,328 million by the end of the forecast period in 2033. This robust growth is primarily driven by escalating global defense expenditures, continuous advancements in military equipment technology, and the persistent demand for high-performance, durable, and reliable fastening solutions for tactical gear, uniforms, and various military applications. The increasing complexity of modern warfare and the need for adaptable and secure soldier systems further fuel this market expansion, emphasizing innovation in material science and design to meet stringent operational requirements across diverse environments.

Military Buckles Market introduction

The Military Buckles Market encompasses the global industry dedicated to the design, manufacturing, and distribution of specialized fastening devices tailored for military and defense applications. These buckles are critical components in a wide array of equipment, including tactical vests, backpacks, load-bearing systems, parachutes, helmets, uniforms, and various strapping mechanisms. Their primary function is to provide secure, quick-release, and highly durable connections under extreme conditions, ensuring the safety and operational efficiency of military personnel and equipment. The product range is diverse, featuring materials such as high-strength polymers, aerospace-grade aluminum, stainless steel, and various composite materials, each selected for specific performance characteristics like weight reduction, corrosion resistance, infrared signature management, and unparalleled tensile strength.

Major applications of military buckles span across virtually all branches of armed forces, including infantry, special operations units, naval forces, and air force personnel. They are integral to personal protective equipment (PPE), combat apparel, field logistics, and even vehicle or aircraft interior safety systems. The benefits derived from advanced military buckles are manifold: enhanced soldier safety through reliable load distribution and retention, improved operational readiness via rapid adjustability and quick-release mechanisms, increased durability to withstand harsh environmental factors like extreme temperatures, sand, salt, and moisture, and reduced equipment weight contributing to soldier mobility and endurance. These buckles are not merely fasteners; they are engineered solutions designed to meet rigorous military specifications and international standards, often exceeding those found in civilian applications, thereby contributing significantly to mission success and personnel protection.

The market is predominantly driven by several key factors. Foremost among these is the global trend of increasing defense budgets and modernization initiatives undertaken by various nations to upgrade their military capabilities. This includes significant investments in advanced tactical gear and soldier systems that demand superior fastening components. Technological advancements in material science, leading to the development of lighter, stronger, and more resilient composites and alloys, continually push the boundaries of product performance. Furthermore, the evolving nature of combat, requiring personnel to operate in diverse and challenging environments, necessitates buckles that offer exceptional reliability, ease of use, and adaptability. The emphasis on ergonomics and user comfort in modern military equipment design also plays a crucial role, as well as the increasing demand for stealth-compatible materials that minimize visibility under night vision or thermal imaging.

Military Buckles Market Executive Summary

The Military Buckles Market is experiencing dynamic shifts, characterized by robust business trends driven by global defense modernization programs and a heightened focus on soldier survivability and operational efficiency. Innovators within the market are consistently introducing new materials, such as advanced polymer composites and lightweight metal alloys, designed to offer superior strength-to-weight ratios, enhanced stealth properties, and increased resistance to environmental stressors like extreme temperatures and corrosive elements. There is a discernible trend towards integrated fastening solutions that combine mechanical reliability with smart functionalities, although AI integration remains nascent. The competitive landscape is marked by a blend of established industry giants and specialized manufacturers, all vying to meet stringent military specifications and supply chain demands. Business models are evolving to include more collaborative research and development efforts with defense contractors to ensure tailor-made solutions for specific tactical requirements, alongside increasing emphasis on long-term supply agreements and customization capabilities. Furthermore, sustainability and lifecycle management are emerging as considerations, with manufacturers exploring more durable and repairable designs to minimize waste and ensure cost-effectiveness over the operational life of military assets.

Regionally, North America continues to dominate the market due to substantial defense spending by the United States and Canada, coupled with a robust domestic defense industrial base that fosters innovation and advanced manufacturing. Europe also represents a significant market, with countries like the UK, France, and Germany investing heavily in modernizing their armed forces and procuring high-quality tactical gear. The Asia-Pacific region is projected to exhibit the highest growth rate, fueled by escalating geopolitical tensions, significant military build-ups by nations such as China, India, and South Korea, and increasing indigenous manufacturing capabilities. Latin America, the Middle East, and Africa are also witnessing gradual market expansion driven by regional conflicts, counter-terrorism efforts, and the acquisition of more sophisticated military equipment. Each region presents unique procurement processes and regulatory frameworks, influencing market entry strategies and product adaptation, with a growing trend towards localized production and supply chain resilience to reduce dependencies on foreign imports and enhance national security interests.

Segmentation trends reveal a strong demand for quick-release buckles across all end-user categories due to their critical role in emergency situations, allowing personnel to rapidly shed gear. The material segment is witnessing a shift towards advanced polymer composites, balancing weight reduction with high strength and durability, though metal alloys remain crucial for applications requiring extreme load bearing. Application-wise, tactical gear and load-bearing equipment represent the largest segments, reflecting the direct interaction of soldiers with these components. End-user segments, particularly special forces and infantry, prioritize buckles that offer optimal performance, stealth features, and ergonomic design for prolonged field operations. Customization within these segments is a key differentiating factor, with armed forces often requiring buckles that integrate seamlessly with proprietary gear systems. The emphasis on multi-functional buckles, offering features like integrated sensors or specialized locking mechanisms, is also a burgeoning trend, reflecting the increasing technological sophistication expected in military equipment.

AI Impact Analysis on Military Buckles Market

User questions related to AI's impact on the Military Buckles Market frequently revolve around how artificial intelligence could enhance material selection, optimize manufacturing processes, improve quality control, and even integrate smart functionalities into buckles themselves. Common concerns include the practicality and cost-effectiveness of AI adoption in a relatively traditional manufacturing sector, the potential for AI to introduce new vulnerabilities, and the specific ways AI-driven analytics could contribute to the performance and reliability of military-grade fasteners. Users are eager to understand if AI can predict buckle failure, streamline inventory, or even assist in designing lighter, stronger, and more resilient components. There's also an underlying curiosity about whether "smart buckles" with embedded sensors and AI capabilities could provide real-time data on soldier strain, equipment integrity, or even biometric information, thus transforming traditional fastening devices into critical data-gathering tools within a networked battlefield ecosystem.

- AI-powered predictive analytics for material selection, identifying optimal composites or alloys for specific operational environments to maximize durability and reduce weight.

- Integration of AI in generative design processes to create novel buckle geometries that are stronger, lighter, and more ergonomically efficient, while minimizing material waste.

- Enhanced quality control and inspection through AI-driven vision systems, detecting microscopic flaws or inconsistencies in manufacturing that human inspectors might miss, ensuring zero-defect products.

- Optimization of manufacturing workflows using AI to manage production lines, predict equipment maintenance needs, and reduce lead times, thus increasing efficiency and throughput.

- Supply chain optimization and inventory management with AI algorithms forecasting demand, managing raw material procurement, and streamlining logistics for military contractors.

- Development of "smart buckles" with embedded sensors and AI edge computing capabilities for real-time monitoring of load stress, wear and tear, or even environmental conditions, transmitting critical data for equipment readiness.

- AI-assisted simulation and testing environments to virtually assess buckle performance under extreme conditions, reducing the need for costly physical prototypes and accelerating R&D cycles.

- Improved counterfeit detection by using AI to analyze product characteristics and supply chain data, verifying authenticity and ensuring only military-grade components are deployed.

DRO & Impact Forces Of Military Buckles Market

The Military Buckles Market is shaped by a complex interplay of drivers, restraints, opportunities, and various impact forces that influence its growth trajectory and competitive dynamics. Key drivers include the consistent increase in global defense spending, particularly for modernizing soldier systems and tactical gear, which directly translates into higher demand for advanced fastening solutions. The continuous pursuit of lighter, stronger, and more functional materials, driven by military operational requirements, also propels innovation in buckle design and manufacturing. Geopolitical instabilities and the persistent need for national security further stimulate demand for reliable and high-performance military equipment components. Conversely, stringent regulatory standards and certification processes, while ensuring product quality, act as significant restraints by increasing development costs and market entry barriers. The cyclical nature of defense procurement budgets and the inherent sensitivity to economic downturns also introduce volatility, impacting market stability. Furthermore, the specialized nature of the market means production volumes are typically lower than commercial equivalents, which can lead to higher unit costs and limited economies of scale, posing a challenge for manufacturers.

Opportunities within this market are abundant, especially in emerging economies that are rapidly expanding and modernizing their defense capabilities, offering new avenues for market penetration. The trend towards modular and customizable tactical gear presents a significant opportunity for manufacturers to develop specialized buckle systems that can be easily integrated and adapted to diverse mission profiles. Advancements in material science, such as the development of novel composites, smart materials, and advanced manufacturing techniques like additive manufacturing, open doors for creating revolutionary products with superior performance characteristics, including enhanced stealth features or integrated functionalities. Moreover, the increasing focus on soldier comfort and ergonomics in prolonged field operations offers a chance to innovate buckle designs that reduce pressure points and improve overall wearability. The ongoing push for interoperability among allied forces also creates demand for standardized yet high-performance components that can be universally adopted.

The market is also subject to various impact forces. The bargaining power of buyers, primarily large defense contractors and government agencies, is substantial due to their consolidated procurement power, long-term contracts, and strict specification requirements, often dictating prices and terms. Simultaneously, the bargaining power of suppliers of raw materials, particularly for specialized alloys and advanced polymers, can also be high, especially for proprietary or scarce materials, which impacts manufacturing costs. The threat of new entrants is relatively low due to the high capital investment required for R&D, manufacturing processes, and navigating stringent military qualification standards. However, niche specialized manufacturers with innovative technologies can still carve out market segments. The threat of substitute products is also low, as traditional fastening methods (e.g., zippers, simple Velcro) often do not meet the extreme durability, load-bearing, or quick-release requirements of military applications, though continuous innovation in other fastening technologies always warrants monitoring. Finally, competitive rivalry among existing players is intense, driven by the desire for lucrative long-term government contracts and the need to differentiate through product innovation, performance, and adherence to evolving military standards. Companies compete on factors such as product quality, reliability, cost-effectiveness, customization capabilities, and the ability to meet complex logistical demands of global defense supply chains.

Segmentation Analysis

The Military Buckles Market is meticulously segmented to reflect the diverse operational needs and technological specifications demanded by various defense applications. This segmentation allows for a granular understanding of market dynamics, identifying specific growth drivers, competitive landscapes, and emerging trends within each category. The primary segmentation criteria include the type of buckle, the materials used in their construction, the specific applications they serve, and the end-user military branches. Each segment plays a crucial role in the overall market structure, addressing distinct requirements for strength, weight, stealth, and functionality in combat and support scenarios. Understanding these segments is paramount for manufacturers to tailor product development, marketing strategies, and distribution channels effectively, ensuring that specialized solutions meet the precise demands of a highly discerning customer base.

- By Type:

- Quick Release Buckles: Designed for rapid detachment in emergency situations, offering immediate safety and operational advantage.

- Standard Buckles: Traditional fastening mechanisms providing secure, robust connections for general-purpose applications.

- Specialized Buckles: Custom-engineered buckles for unique applications, potentially incorporating features like specific locking mechanisms, multi-axis rotation, or integrated sensors.

- By Material:

- Metal Alloys: Including aluminum (e.g., 7075-T6), stainless steel, and titanium, chosen for their high strength, durability, and corrosion resistance.

- Polymer Composites: Advanced plastics (e.g., Acetal, Nylon 6/6, glass-filled polymers) offering a balance of lightweight, strength, and reduced IR signature.

- Hybrid Materials: Combinations of metal and polymer to leverage the benefits of both, such as metal frames with polymer release mechanisms.

- By Application:

- Tactical Gear: Vests, plate carriers, holsters, pouches, and utility belts requiring robust and reliable fastening.

- Uniforms and Apparel: Belts, straps, and closures for combat fatigues and specialized military clothing.

- Backpacks and Rucksacks: Ensuring secure closure and load distribution for military packs of various sizes.

- Strapping Systems: For securing equipment, vehicles, or cargo in transport and field operations.

- Parachutes and Aerial Delivery Systems: Critical for safety and deployment mechanisms.

- Other Applications: Medical kits, weapon slings, specialized equipment harnesses.

- By End-User:

- Army: General infantry, armored divisions, logistics, and special operations forces.

- Navy: Marine corps, naval special warfare, and shipboard applications.

- Air Force: Aircrew survival gear, ground support personnel, and specialized equipment.

- Special Forces: Elite units requiring highly specialized, stealth-compatible, and ultra-reliable fastening solutions for demanding missions.

- Other Defense Organizations: Coast guard, border patrol, and other governmental security agencies.

Value Chain Analysis For Military Buckles Market

The value chain for the Military Buckles Market is characterized by a series of integrated stages, commencing with raw material sourcing and culminating in the deployment of finished military equipment. Upstream activities involve the acquisition of specialized materials crucial for manufacturing high-performance buckles, such as aerospace-grade aluminum alloys, high-strength stainless steel, titanium, and advanced engineering polymers like Acetal (POM), Nylon 6/6, and various glass-filled composites. These raw materials are typically sourced from a specialized base of chemical and metallurgical suppliers who adhere to stringent quality and performance standards. Research and development also represent a significant upstream activity, where manufacturers invest heavily in material science, design engineering, and prototyping to meet evolving military specifications for strength, durability, weight reduction, and stealth. The reliability and consistency of these upstream suppliers are paramount, as the quality of the final product is directly dependent on the integrity of its foundational components, often requiring long-term partnerships and rigorous qualification processes.

Midstream activities primarily encompass the manufacturing and assembly processes. This stage involves precision machining, injection molding, stamping, casting, and finishing operations to transform raw materials into finished buckle components. Quality control and testing are integral at this stage, with buckles undergoing rigorous stress tests, environmental simulations (e.g., extreme temperatures, salt spray, sand), and functional checks to ensure compliance with military specifications (MIL-SPEC) and international standards (e.g., ISO, ASTM). Many manufacturers also engage in advanced surface treatments like anodizing, cerakoting, or specialized coatings for corrosion resistance, reduced infrared signature, or enhanced durability. Assembly involves integrating various components, such as springs, pins, and locking mechanisms, into the final buckle unit. This stage often requires specialized tooling, skilled labor, and adherence to strict production protocols to maintain consistency and traceability for every batch of products.

Downstream activities involve the distribution channel and the ultimate end-users. The distribution channel for military buckles is predominantly B2B, characterized by direct sales to prime defense contractors (e.g., Lockheed Martin, Raytheon, BAE Systems, General Dynamics) who integrate these buckles into larger systems like tactical vests, backpacks, and weapon slings. Indirect channels may involve specialized distributors who cater to smaller defense procurement agencies, military surplus stores (for older models or non-critical applications), or government purchasing portals. Manufacturers often work closely with these contractors to ensure seamless integration and to offer customized solutions for specific equipment platforms. The end-users are the various branches of the military (Army, Navy, Air Force, Marine Corps, Special Forces) and other governmental security agencies. Direct sales allow for tighter control over product specifications and client relationships, while indirect channels can provide broader market reach. The effectiveness of the distribution channel hinges on strong logistics, compliance with international trade regulations, and the ability to maintain a secure and reliable supply chain that can meet urgent military demands. Post-sales support, including technical assistance and potential warranty services, also forms a critical part of the downstream value chain, reinforcing long-term relationships and product trust within a highly demanding sector.

Military Buckles Market Potential Customers

The primary potential customers for the Military Buckles Market are governmental defense departments and their affiliated military branches across the globe. This encompasses the armies, navies, air forces, and specialized units like marine corps and special operations forces of various nations. These entities are the ultimate end-users and primary buyers, acquiring buckles for integration into a vast array of personal equipment, combat platforms, and logistical systems. Their procurement decisions are driven by operational mandates, budget allocations, and the constant need to equip their personnel with the most reliable, durable, and effective gear available. The rigorous demands of combat and field operations necessitate buckles that can withstand extreme environmental conditions, offer critical quick-release functionality, and reliably support heavy loads, making military organizations highly discerning buyers with stringent specifications.

Beyond the direct military branches, a significant customer segment comprises prime defense contractors and original equipment manufacturers (OEMs) who design, develop, and supply complete military systems and tactical gear. Companies like Crye Precision, Eagle Industries, Safariland, and larger defense conglomerates fall into this category. These contractors serve as intermediaries, integrating buckles into complex products such as body armor systems, advanced rucksacks, tactical vests, and specialized vehicle interiors. They are critical decision-makers in the value chain, as their product designs often dictate the types, specifications, and quantities of buckles required. Manufacturers of military buckles therefore often focus their sales and marketing efforts on establishing strong partnerships with these key contractors, ensuring their products are specified in the design phase of new military equipment programs, allowing for larger, more consistent orders and long-term contracts.

Furthermore, an emerging segment of potential customers includes specialized law enforcement agencies, counter-terrorism units, and private security contractors who operate in environments demanding military-grade equipment. While their scale of procurement may be smaller than national militaries, their requirements for durability, functionality, and reliability are equally stringent. These organizations often seek similar performance characteristics to military forces for their tactical gear, equipment harnesses, and personal protective equipment. Additionally, research and development institutions focused on soldier systems and future combat technologies also act as potential customers, acquiring buckles for prototyping and testing innovative designs. The market for military buckles is thus characterized by a highly specialized customer base that prioritizes performance, compliance with exacting standards, and proven reliability over cost, creating a niche yet highly valuable market segment for manufacturers capable of meeting these elevated expectations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 895 Million |

| Market Forecast in 2033 | USD 1,328 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ITW Nexus, National Molding, YKK Corporation, Duraflex (Woojin Plastic), Cobra Buckles (AUSTRIALPIN), Fidlock GmbH, Riri Group, 2M Due M.M., Zhejiang Sanli Plastic Co., Ltd., Ningbo Taiming Plastic Products Co., Ltd., UTX-FLEX (Unitex Group), Nexus Clips & Buckles, Paskal Zippers, Alpha Systems, TacWare, KAMM Components, Trimming Co., Ltd., Zhejiang Sanli Plastic Co. Ltd., Ningbo Hongtai Plastic & Hardware Co. Ltd., Nanjing Yunzheng New Material Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Buckles Market Key Technology Landscape

The Military Buckles Market is heavily reliant on cutting-edge material science and precision engineering to meet the exacting demands of defense applications. Key technologies employed include advanced polymer injection molding techniques, which allow for the creation of lightweight yet exceptionally strong composite buckles with precise dimensional accuracy and complex geometries. These polymers often incorporate glass fibers or carbon nanofibers to enhance tensile strength and stiffness, while also being formulated for reduced infrared (IR) signatures to aid in stealth operations. Furthermore, specialized metalworking technologies such such as CNC machining, forging, and casting are critical for producing high-strength aluminum alloys (e.g., 7075-T6 grade), titanium, and stainless steel buckles that can withstand extreme load-bearing requirements, impact forces, and corrosive environments. The development of new alloys with superior strength-to-weight ratios and enhanced fatigue resistance is a continuous area of technological focus.

Surface treatment technologies also play a pivotal role in optimizing buckle performance and durability. Anodizing, a common process for aluminum, enhances corrosion resistance and hardness, while also allowing for various color finishes to match camouflage requirements. Specialized coatings, such as Cerakote or other advanced polymer-ceramic composites, provide additional abrasion resistance, chemical resistance, and further minimize IR reflectivity. Furthermore, the integration of advanced locking mechanisms, including proprietary quick-release systems that can be operated swiftly with one hand or gloved hands, represents a significant technological advancement. These mechanisms are often engineered with redundant safety features to prevent accidental release while ensuring reliable operation under duress. The design process itself increasingly leverages CAD/CAM software for precision modeling and Finite Element Analysis (FEA) for virtual stress testing, significantly reducing development cycles and improving product robustness before physical prototyping.

Emerging technologies are continuously shaping the future of military buckles. Additive manufacturing (3D printing) is gaining traction, particularly for rapid prototyping and the production of complex, customized buckle designs with optimized internal structures for weight reduction and strength. This technology also allows for on-demand production of specialized components, potentially shortening supply chains. The concept of "smart buckles" is also on the horizon, involving the integration of micro-sensors and embedded electronics that could monitor load, temperature, wear, or even biometric data, providing critical real-time information to soldiers or command centers. While still in nascent stages, these intelligent fastening solutions could revolutionize soldier systems by offering unprecedented levels of situational awareness and equipment health monitoring. Overall, the technology landscape is dynamic, driven by a relentless pursuit of performance, reliability, and innovation to equip modern military forces with the best possible fastening solutions.

Regional Highlights

- North America: This region stands as the dominant market for military buckles, primarily driven by the colossal defense budget of the United States. The presence of major defense contractors and a strong emphasis on modernizing soldier systems fuels consistent demand for advanced, high-performance fastening solutions. Canada also contributes to regional growth through its defense expenditures and participation in international peacekeeping operations, necessitating robust military gear. Innovation in material science and manufacturing technologies, alongside stringent MIL-SPEC standards, are key regional characteristics.

- Europe: The European market demonstrates significant demand, spurred by ongoing military modernization programs across key nations like the UK, France, Germany, and Italy. Geopolitical uncertainties and the need for enhanced collective defense within NATO contribute to sustained procurement of high-quality tactical equipment. The region is home to several specialized buckle manufacturers renowned for precision engineering and adherence to strict European defense standards.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC's market expansion is propelled by rising defense spending in countries such as China, India, Japan, and South Korea, driven by geopolitical tensions, territorial disputes, and national security concerns. Increasing indigenous manufacturing capabilities and a growing focus on self-reliance in defense production are major trends. The demand is high for buckles that can withstand diverse and often challenging environmental conditions prevalent in the region.

- Latin America: This region exhibits a steady but more moderate growth trajectory. Military buckle demand is influenced by efforts to combat drug trafficking, internal security challenges, and limited defense modernization initiatives across various countries. Procurement often focuses on durable, cost-effective solutions for general-purpose military and law enforcement applications, with some interest in specialized equipment for special forces.

- Middle East and Africa (MEA): The MEA market is characterized by significant demand driven by ongoing regional conflicts, counter-terrorism operations, and substantial investments in defense capabilities, particularly by oil-rich nations in the Middle East. There is a strong emphasis on acquiring advanced military equipment from international suppliers, with a growing interest in rugged, high-performance buckles that can withstand arid and challenging operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Buckles Market.- ITW Nexus

- National Molding

- YKK Corporation

- Duraflex (Woojin Plastic)

- Cobra Buckles (AUSTRIALPIN)

- Fidlock GmbH

- Riri Group

- 2M Due M.M.

- Zhejiang Sanli Plastic Co., Ltd.

- Ningbo Taiming Plastic Products Co., Ltd.

- UTX-FLEX (Unitex Group)

- Nexus Clips & Buckles

- Paskal Zippers

- Alpha Systems

- TacWare

- KAMM Components

- Trimming Co., Ltd.

- Zhejiang Sanli Plastic Co. Ltd.

- Ningbo Hongtai Plastic & Hardware Co. Ltd.

- Nanjing Yunzheng New Material Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Military Buckles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are commonly used for military buckles?

Military buckles are primarily made from high-strength materials such as aerospace-grade aluminum alloys (e.g., 7075-T6), stainless steel, titanium, and advanced polymer composites like Acetal (POM) or Nylon 6/6, often reinforced with glass fibers for enhanced durability and reduced weight. Material selection depends on specific application requirements for strength, corrosion resistance, weight, and stealth properties.

What distinguishes military buckles from civilian buckles?

Military buckles are engineered to meet stringent military specifications (MIL-SPEC) for extreme durability, load-bearing capacity, resistance to harsh environmental conditions (temperature extremes, sand, salt, moisture), and often feature quick-release mechanisms for emergency situations. They prioritize performance and reliability over cost or aesthetic, unlike most civilian counterparts.

How do quick-release buckles enhance soldier safety?

Quick-release buckles allow military personnel to rapidly shed heavy or cumbersome gear, such as tactical vests or backpacks, in emergencies. This is crucial for quickly escaping submerged vehicles, evading capture, or responding to immediate threats where equipment might hinder movement or pose a drowning risk.

What role do stealth properties play in modern military buckle design?

Stealth properties, such as reduced infrared (IR) signatures and non-reflective coatings, are increasingly vital in modern military buckle design. These features help minimize a soldier's visibility under night vision or thermal imaging, crucial for clandestine operations and preventing detection by adversaries equipped with advanced surveillance technology.

Which regions are leading the growth in the Military Buckles Market?

North America currently dominates the Military Buckles Market due to substantial defense spending by the United States. However, the Asia Pacific region, driven by escalating defense modernization and geopolitical tensions in countries like China and India, is projected to exhibit the highest growth rate during the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager