Military Deployable Infrastructure Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435221 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Military Deployable Infrastructure Market Size

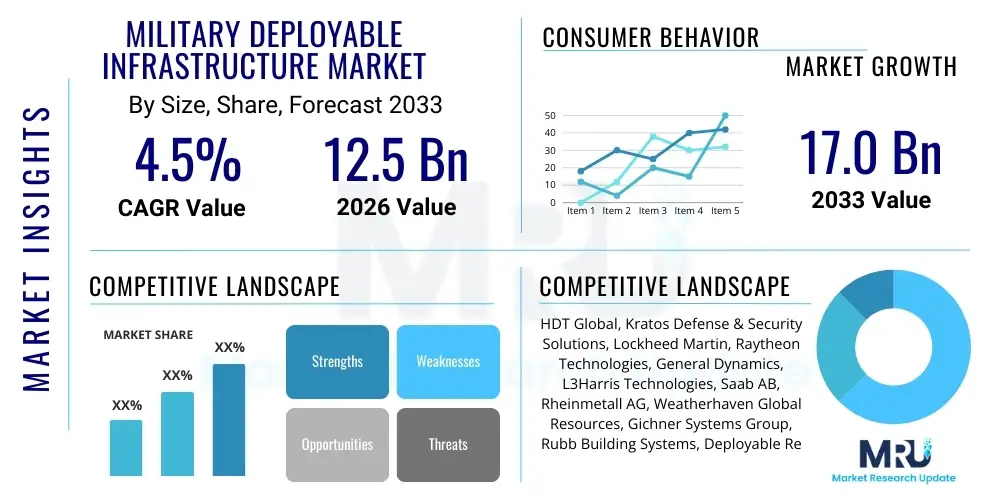

The Military Deployable Infrastructure Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 17.0 Billion by the end of the forecast period in 2033.

Military Deployable Infrastructure Market introduction

The Military Deployable Infrastructure Market encompasses temporary, modular, and rapidly erectable physical facilities essential for supporting military operations, training exercises, and humanitarian aid missions globally. This infrastructure is designed for quick mobilization, installation, deconstruction, and transportability, addressing the critical requirement for establishing operational bases, command centers, medical facilities, and housing in remote or contested environments. Key product descriptions include high-tech rigid wall shelters, flexible fabric structures, integrated power generation systems, water purification units, and advanced communication platforms, all engineered to withstand extreme environmental conditions and operational stress.

Major applications for military deployable infrastructure span a wide array of mission profiles, including forward operating bases (FOBs), tactical command and control (C2) centers, field hospitals (Role 2/3 medical facilities), accommodation camps for personnel, aircraft hangars, and secure data processing hubs (C4ISR). The fundamental benefits driving market expansion include enhanced operational flexibility, reduced logistical footprint, accelerated response times, and improved force protection capabilities. The transition from large, fixed installations to agile, distributed operations necessitates robust, yet rapidly deployable solutions that maintain operational effectiveness without compromising personnel safety or mission continuity.

The primary driving factors propelling the growth of this market involve escalating geopolitical instability, leading to increased defense spending on modernized expeditionary capabilities, and the global trend toward modularity and interoperability among allied forces. Furthermore, continuous technological advancements, particularly in lightweight composite materials, energy harvesting technologies, and intelligent environmental control systems, are optimizing deployment speed and reducing reliance on traditional, heavy supply chains. The demand for resilient, self-sustaining infrastructure capable of supporting sophisticated electronic warfare and cyber defense systems further underpins sustained market expansion over the forecast horizon.

Military Deployable Infrastructure Market Executive Summary

The Military Deployable Infrastructure market is exhibiting robust growth, driven primarily by evolving geopolitical landscapes requiring swift, agile military responses and significant modernization efforts across major defense organizations, particularly NATO and allied nations. Current business trends indicate a strong shift towards integrated, turnkey solutions, where vendors provide complete packages encompassing shelters, power, climate control, and connectivity, rather than disparate components. This trend is fueled by the military’s demand for seamless interoperability and reduced vendor complexity during rapid deployments. Furthermore, sustainability and energy efficiency are emerging as critical design requirements, pushing manufacturers to innovate in areas such as hybrid power generation and advanced insulation materials to minimize operational costs and logistical burdens associated with fuel transport.

Regionally, North America maintains its dominance due to substantial defense budgets and a proactive focus on high-mobility expeditionary warfare doctrine. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by territorial disputes, modernization programs in countries like India, China, and Australia, and increased maritime security requirements necessitating deployable naval and coastal support infrastructure. Europe’s market growth is supported by increased NATO commitment, rearmament efforts following recent geopolitical events, and investment in specialized infrastructure supporting joint training exercises and rapid reaction forces. The Middle East and Africa (MEA) continue to be significant markets, driven by regional conflicts and ongoing internal security operations requiring temporary, robust base establishment solutions.

Segment trends reveal that the shelters and housing segment, particularly rigid-wall and semi-rigid structures, holds the largest market share due to the fundamental requirement for protective operational and living spaces. Concurrently, the Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) application segment is experiencing accelerating demand. This growth is directly linked to the increasing complexity of modern warfare, which requires deployable infrastructure capable of housing sensitive electronic equipment, maintaining secure network connectivity, and supporting high-bandwidth data transmission in austere environments. The component segment is witnessing substantial technological improvements, especially in modular power generation and water management systems, moving towards highly resilient, self-sufficient infrastructure packages.

AI Impact Analysis on Military Deployable Infrastructure Market

Common user questions regarding AI’s impact on military deployable infrastructure center on optimizing the logistical supply chain, predictive maintenance of deployed assets, and autonomous management of microgrids within forward operating bases. Users are concerned about how AI can accelerate setup and teardown times, manage power distribution efficiency autonomously in fluctuating demand scenarios, and provide real-time structural health monitoring to ensure personnel safety in harsh conditions. Key themes summarized include leveraging AI for dynamic resource allocation, enhancing the resiliency of deployed infrastructure through predictive failure analytics, and automating routine operational tasks like climate control and energy generation scheduling, thereby reducing reliance on human oversight in hazardous environments and freeing up military personnel for core operational duties.

- AI-Powered Logistics and Optimization: Utilizing machine learning algorithms to calculate optimal infrastructure placement, predict supply requirements (e.g., fuel, water filters), and optimize transport routing, significantly reducing deployment timelines and costs.

- Predictive Maintenance and Structural Integrity: Implementing AI models to analyze sensor data from deployed shelters, HVAC systems, and power generators, predicting component failures before they occur and scheduling proactive maintenance, thereby maximizing operational uptime and asset lifespan.

- Autonomous Base Management Systems: AI systems automating complex base operations, including dynamic load balancing for modular power grids, optimizing waste management cycles, and regulating environmental control systems based on occupancy and external conditions.

- Enhanced Force Protection and Sensor Integration: Integrating AI to process data from perimeter security sensors (e.g., thermal, acoustic) housed within deployable infrastructure, enabling rapid threat detection, classification, and response coordination, augmenting passive defenses.

- Rapid Configuration and Adaptability: AI tools assisting in the modular design and configuration process, allowing military planners to rapidly prototype and adapt base layouts based on mission-specific requirements and geographic constraints, ensuring maximal operational efficiency.

DRO & Impact Forces Of Military Deployable Infrastructure Market

The market for military deployable infrastructure is shaped by a confluence of accelerating demand drivers and persistent logistical restraints, while technological advancements create substantial market opportunities. The primary impact forces include heightened global security threats, which necessitates rapid establishment of forward bases (Driver), tempered by high initial investment costs and complex compliance standards (Restraint). The opportunity lies significantly in developing lighter, more energy-efficient, and easily interconnected modular systems. The resultant impact force drives continuous innovation in materials science and system integration, compelling defense organizations to adopt advanced expeditionary capabilities.

Key drivers include the shift towards highly mobile, distributed military operations, emphasizing agility over large, fixed bases, and a critical need for secure, reliable C4ISR facilities capable of functioning effectively at the tactical edge. Increased investment in military modernization by emerging economies also stimulates demand for standardized, interoperable deployable solutions. These drivers are further amplified by global climate change, increasing the frequency of large-scale disaster relief and humanitarian operations, where military logistical capabilities are vital and require swift establishment of operational support centers using deployable infrastructure.

Restraints impeding market growth primarily revolve around the stringent procurement processes and long qualification cycles typical of defense contracting, coupled with the high upfront capital expenditure required for sophisticated, ruggedized equipment designed for extreme environments. Opportunities are vast, focusing on the integration of renewable energy sources (solar, wind) into deployable power systems, development of advanced robotics for automated deployment and recovery, and the adoption of IoT sensors for real-time asset tracking and predictive maintenance across the deployed network. These opportunities favor companies offering truly integrated, smart infrastructure solutions that promise reduced lifecycle costs and enhanced operational efficiency.

Segmentation Analysis

The Military Deployable Infrastructure Market is comprehensively segmented based on its platform of operation, the application or end-use scenario, and the specific components that constitute the infrastructure package. Analyzing these segments provides a detailed understanding of demand dynamics, investment priorities, and technological focus areas within the defense industry. The segmentation highlights the diverse needs ranging from ground operations support, which requires robust, protected shelters, to air and naval operations demanding specialized temporary hangars and mobile docking facilities. This granular view allows vendors to tailor their product offerings to highly specific military requirements across various echelons of operations, from tactical field deployment to strategic logistical hubs.

The dominance of certain segments, such as the ground platform and the C4ISR application, reflects current military doctrine prioritizing information superiority and expeditionary maneuver warfare. Growth rates are often higher in niche segments like water and waste management systems, driven by the increasing emphasis on self-sustainability and minimizing the logistical footprint of deployed forces. Furthermore, the segmentation by component, specifically the distinction between soft-wall (tents) and rigid-wall shelters (containers), outlines the trade-offs military planners make between speed/lightness and protection/durability. The demand for integrated solutions capable of modular scaling is a cross-cutting trend affecting all segments, pushing manufacturers towards standardization and interoperability.

- By Platform:

- Ground

- Naval

- Airborne (e.g., UAV support infrastructure)

- By Application:

- Command & Control (C2) Centers

- C4ISR Facilities

- Military Housing and Accommodation

- Medical Facilities (Field Hospitals)

- Maintenance and Logistics (Workshops, Storage)

- Hangars and Aircraft Support

- By Component:

- Shelters and Tents (Soft-Wall and Rigid-Wall)

- Power and Energy Systems (Generators, Renewable Energy Kits)

- HVAC and Environmental Control Units (ECU)

- Water and Waste Management Systems (WWS)

- Perimeter Security and Force Protection

- Interiors and Accessories (Furniture, Flooring)

Value Chain Analysis For Military Deployable Infrastructure Market

The value chain for military deployable infrastructure is characterized by specialized manufacturing and a highly regulated distribution process, emphasizing quality assurance, system integration, and security compliance. Upstream analysis involves the procurement of highly specialized raw materials, including advanced lightweight composites, high-strength fabrics, specialized insulation panels, and ruggedized electronic components. Suppliers in this phase must adhere to strict military specifications (Mil-Specs) regarding durability, fire resistance, and electromagnetic shielding. Research and Development (R&D) forms a critical part of the upstream activities, focusing on minimizing weight and volume while maximizing the thermal efficiency and structural integrity of the final product, often in collaboration with defense technology agencies.

Midstream activities are dominated by specialized manufacturers and system integrators who take the raw components and assemble them into deployable solutions. This stage involves complex engineering, including integration of proprietary locking mechanisms, folding systems, and standardized interconnections ensuring seamless coupling of modules (e.g., linking a power module to a C2 shelter). Quality control and rigorous testing under simulated operational environments (vibration, extreme temperatures, sand, dust) are essential before products enter the downstream phase. System integration companies, often prime defense contractors, play a vital role in ensuring that all components (shelters, power, communications) function as a unified, interoperable system tailored to specific military unit requirements.

The downstream distribution channel in the military market is predominantly direct, involving competitive tenders and long-term framework contracts established between the original equipment manufacturers (OEMs) or prime integrators and governmental defense procurement agencies (e.g., Department of Defense, MoDs). Indirect distribution, through authorized defense intermediaries or third-party logistics (3PL) providers specialized in military hardware, is less common but used for smaller, routine purchases or servicing contracts in specific regions. Post-sales service, including maintenance, repair, and overhaul (MRO), is a crucial component of the downstream value chain, often secured through multi-year support contracts, ensuring the long-term readiness and operational lifespan of the deployed infrastructure assets.

Military Deployable Infrastructure Market Potential Customers

The primary end-users and buyers of military deployable infrastructure are national defense organizations globally, encompassing the Army, Navy, Air Force, and specialized operations commands. These institutions are the foundational customers, procuring large-scale systems for both sustained operational deployment and extensive training exercises. The core purchasing driver for these entities is the necessity to project military power quickly and establish temporary, secure, and self-sufficient operational footholds in diverse geographic locations, ranging from arid deserts to arctic environments. Procurement cycles are heavily centralized and driven by defense policy, budget allocation, and modernization mandates, making long-term relationships with qualified vendors essential.

Beyond traditional military forces, significant potential customers include international peacekeeping missions managed by organizations like the United Nations (UN), and multi-national defense alliances such as NATO. These organizations require standardized, highly mobile infrastructure kits that facilitate joint operations and rapid establishment of logistics and command centers in conflict zones or stabilizing regions. The emphasis for these customers is on interoperability, ease of assembly by non-specialist personnel, and compliance with international standards for health, safety, and environmental impact during deployment and withdrawal.

A growing segment of potential customers includes governmental and non-governmental organizations involved in humanitarian aid, disaster relief (HADR), and civil defense operations. While often leveraging military logistics, these entities purchase or lease deployable infrastructure tailored for civilian support—such as temporary refugee centers, mobile medical clinics, and emergency communication hubs. Although their specifications may differ slightly from front-line combat requirements, they prioritize robustness, rapid mobilization, and scalability. Furthermore, internal security forces and border control agencies increasingly utilize smaller-scale deployable infrastructure for temporary surveillance posts and tactical base operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 17.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HDT Global, Kratos Defense & Security Solutions, Lockheed Martin, Raytheon Technologies, General Dynamics, L3Harris Technologies, Saab AB, Rheinmetall AG, Weatherhaven Global Resources, Gichner Systems Group, Rubb Building Systems, Deployable Resources, LLC, Utilis SAS, Alaska Structures, Inc., Marshall Aerospace and Defence Group, Vanguard Modular Building Systems, AAR Corp., General Shelter, DRASH (A division of DHS Systems), Foster-Miller (a QinetiQ North America company). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Deployable Infrastructure Market Key Technology Landscape

The technology landscape for military deployable infrastructure is rapidly evolving, moving away from simple metal containers and canvas tents towards integrated, intelligent, and energy-efficient modular systems. A core technological focus is on advanced materials science, specifically the utilization of carbon fiber, advanced polymers, and specialized composite materials. These materials significantly reduce the weight and bulk of shelters and components, crucial for air transportability and rapid deployment using minimal logistics assets. Furthermore, innovation in passive thermal management, using phase-change materials and high-efficiency insulation, is minimizing the energy burden associated with heating and cooling, which is often the largest consumer of fuel in deployed environments.

Another crucial technological pillar is the shift towards self-sustaining and smart infrastructure. This includes the development of compact, high-efficiency hybrid power systems that integrate conventional diesel generators with modular solar panels, wind turbines, and advanced battery storage solutions. These microgrids are managed by intelligent power management systems (often incorporating AI/IoT) that dynamically optimize power generation and distribution based on real-time load requirements, ensuring maximum fuel efficiency and operational redundancy. Water and waste management technologies are also central, with advanced mobile reverse osmosis (RO) units and incinerators ensuring the operational footprint is minimized and compliance with environmental regulations is maintained.

Connectivity and digital integration represent the third major area of technological advancement. Deployable C4ISR infrastructure now incorporates ruggedized networking hardware, satellite communication systems (SATCOM), and specialized server racks designed to maintain critical data integrity and secure communication links in highly demanding electromagnetic and physical environments. The trend is toward ‘plug-and-play’ modularity, where infrastructure elements are pre-wired and tested, drastically reducing on-site setup time and minimizing reliance on specialized technical staff. The entire infrastructure setup is increasingly viewed not just as a physical structure, but as a resilient, interconnected platform for digital operations.

Regional Highlights

- North America (Dominant Market): Dominated by the United States’ significant defense budget allocations towards expeditionary and rapid global response capabilities. The region is a hub for innovation, heavily investing in C4ISR deployable systems, advanced power generation, and light armored shelters. Demand is driven by military modernization programs and a strategic shift towards dynamic force employment models requiring high mobility and resilience.

- Europe (Accelerated Growth): Experiencing substantial growth fueled by increased defense spending among NATO members, particularly in Eastern and Central Europe, focused on enhancing military mobility and preparedness. Investment is concentrated on procuring interoperable infrastructure that supports joint training exercises, rapid reaction forces, and the establishment of forward command posts along borders. Key drivers include framework contracts for standardized equipment across alliances.

- Asia Pacific (Highest Growth Rate): Driven by escalating regional geopolitical tensions, large-scale military modernization efforts in countries like China, India, and Australia, and high demand for maritime and island-based operational support. This region emphasizes robust solutions capable of withstanding extreme humidity and monsoon conditions, with significant opportunities in deployable radar and surveillance infrastructure.

- Middle East and Africa (Strategic Market): Characterized by sustained demand for rapid establishment of secure, long-term operating bases due to ongoing regional conflicts and counter-insurgency operations. Procurement focuses on rugged, highly protected shelters, specialized desert-cooling HVAC systems, and independent water supply solutions, emphasizing force protection and operational self-sufficiency in austere environments.

- Latin America (Steady Demand): Market growth is steady, focusing primarily on infrastructure for border security, internal stability operations, and increasing military participation in national disaster relief efforts. Procurement usually targets cost-effective, easily maintained, and multi-purpose modular camps and field hospitals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Deployable Infrastructure Market.- HDT Global

- Kratos Defense & Security Solutions

- Lockheed Martin

- Raytheon Technologies

- General Dynamics

- L3Harris Technologies

- Saab AB

- Rheinmetall AG

- Weatherhaven Global Resources

- Gichner Systems Group

- Rubb Building Systems

- Deployable Resources, LLC

- Utilis SAS

- Alaska Structures, Inc.

- Marshall Aerospace and Defence Group

- Vanguard Modular Building Systems

- AAR Corp.

- General Shelter

- DRASH (A division of DHS Systems)

- Foster-Miller (a QinetiQ North America company)

Frequently Asked Questions

Analyze common user questions about the Military Deployable Infrastructure market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key technological advancements driving innovation in deployable infrastructure?

The key technological drivers include the integration of lightweight composite materials (reducing transport costs), the adoption of hybrid and renewable energy microgrids for self-sufficiency, and the implementation of IoT and AI for autonomous base management and predictive maintenance of critical systems.

Which component segment holds the largest share in the Military Deployable Infrastructure market?

The shelters and tents segment, particularly encompassing rigid-wall shelters (containerized solutions) and high-performance soft-wall structures, currently holds the largest market share due to the fundamental and non-negotiable requirement for protective and operational workspace in any deployment scenario.

How does the shift toward C4ISR applications affect infrastructure design?

The demand for secure C4ISR requires deployable infrastructure to feature enhanced shielding against electromagnetic interference (EMI), robust climate control systems to protect sensitive electronics, and modular layouts designed for rapid setup and integration with high-bandwidth communication networks.

What is the primary factor restraining market growth for advanced deployable systems?

The primary restraint is the high initial capital investment required for procurement, coupled with the extended, highly regulated, and complex procurement and qualification cycles mandated by national defense departments, which often slow the adoption of new, cutting-edge technologies.

Which regional market is projected to exhibit the fastest growth rate through 2033?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial military modernization efforts, rising geopolitical tensions necessitating enhanced expeditionary capabilities, and increased investment in regional security architecture by key national defense forces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager