Military Image Intensifier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435107 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Military Image Intensifier Market Size

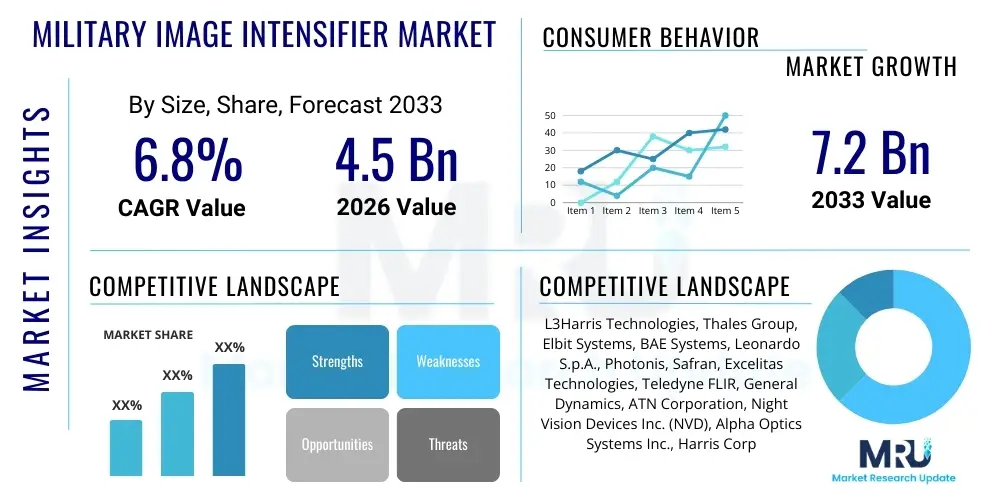

The Military Image Intensifier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Military Image Intensifier Market introduction

The Military Image Intensifier (II) Market encompasses advanced optoelectronic devices designed to amplify ambient light, primarily in low-light or nocturnal conditions, enabling military and defense personnel to conduct operations effectively without external illumination. These devices capture faint photons from sources such as starlight or moonlight and convert them into electrons, which are then multiplied and projected onto a phosphor screen, creating a visible, intensified image. The core product categories include night vision goggles (NVGs), weapon sights, and surveillance systems utilized across various military platforms. Technological advancements, particularly the transition from Generation 2 to Generation 3 and the introduction of advanced Generation 4 and fused technology, are defining the operational effectiveness and market trajectory.

Image intensifiers are critical components in modern asymmetrical warfare and counter-insurgency operations, providing a decisive tactical advantage. Their major applications span across ground forces, airborne platforms, and naval operations, ensuring situational awareness, precise targeting capabilities, and enhanced soldier mobility during periods of darkness or degraded visibility. The integration of digital image processing, reduced size and weight, and improved spectral response are key product descriptions driving adoption. The market’s growth is fundamentally driven by the continuous global emphasis on soldier modernization programs and increasing procurement of advanced night-fighting capabilities by major defense powers.

Military Image Intensifier Market Executive Summary

The global Military Image Intensifier Market is characterized by robust investment driven by escalating geopolitical tensions and the modernization imperative across defense forces worldwide. Business trends indicate a strong shift towards lightweight, high-performance Generation 3 and fused systems, offering superior Figure of Merit (FOM) and improved operational longevity. Leading market players are strategically focusing on vertically integrated supply chains and developing proprietary photocathode technologies, particularly Gallium Arsenide (GaAs), to maintain competitive advantages. Mergers, acquisitions, and long-term supply contracts with governmental agencies remain crucial business strategies defining the competitive landscape, emphasizing the high barriers to entry due to regulatory and technical complexity.

Regionally, North America maintains its dominance due to substantial defense spending by the United States Department of Defense (DoD) and a concentration of leading technology developers. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by accelerated military modernization programs in nations like China, India, and South Korea, coupled with territorial disputes necessitating enhanced border surveillance. Europe also represents a mature market, with concerted efforts under NATO frameworks to standardize and upgrade existing night vision equipment, favoring common Gen 3+ technologies and digital integration capabilities.

Segment trends reveal that the Generation 3 segment currently holds the largest market share owing to its proven reliability and performance standards, particularly the white phosphor variants preferred for enhanced contrast and reduced eye strain. Concurrently, the Fused Systems segment, which combines Image Intensification (I2) with thermal imaging (IR), is witnessing the fastest expansion. This technological convergence addresses the limitations of I2 in obscured environments (smoke, fog) and the inherent resolution challenges of purely thermal systems, thereby offering unparalleled situational awareness across diverse operational scenarios. Platform segmentation highlights ground forces as the primary end-users, though demand from unmanned aerial vehicles (UAVs) and surveillance aircraft is rapidly gaining momentum.

AI Impact Analysis on Military Image Intensifier Market

User queries regarding the impact of Artificial Intelligence (AI) on the Military Image Intensifier Market frequently revolve around how AI enhances data processing capabilities, improves target recognition accuracy, and facilitates the fusion of sensor data. Key concerns center on the operational tempo (speed of decision-making), the potential for reducing cognitive load on soldiers, and the shift from raw image amplification to intelligent image interpretation. Users are specifically keen on understanding how AI algorithms, particularly deep learning and computer vision techniques, can process the output from high-FOM image intensifier tubes to automatically detect, classify, and track threats, thereby augmenting human sight with automated intelligence layers. Expectations are high regarding AI’s role in optimizing power consumption, predicting device failure, and enabling real-time metadata tagging for post-mission analysis and enhanced training protocols.

The integration of AI transforms the image intensifier from a passive viewing tool into an active intelligence-gathering system. AI algorithms embedded within or linked to the image intensification system facilitate automatic clutter reduction, dynamic noise filtering, and optimal gain control adjustment, which significantly improves image clarity and detection range under varying environmental conditions. Furthermore, AI enables intelligent sensor fusion, seamlessly merging the high resolution of the I2 channel with the thermal detection capabilities, ensuring threats are perceived and categorized faster than traditional human analysis allows. This technological shift is imperative for achieving decision superiority on the modern battlefield, making the transition from purely analog to digitally enhanced II systems inevitable for future military procurement cycles.

- AI enhances Automatic Target Recognition (ATR) by processing intensified video feeds in real-time.

- Deep learning optimizes image quality, dynamically reducing noise and compensating for blooming effects in high-light environments.

- AI facilitates intelligent sensor fusion, ensuring seamless integration between image intensifiers and thermal/digital sensors.

- Predictive maintenance algorithms use AI to monitor tube degradation, maximizing operational readiness and device lifespan.

- Edge computing allows localized AI processing within the device, minimizing latency for mission-critical applications.

DRO & Impact Forces Of Military Image Intensifier Market

The Military Image Intensifier Market is driven by extensive soldier modernization programs, the pervasive need for superior situational awareness in low-light combat scenarios, and ongoing technological evolution moving towards higher resolution, reduced weight, and integrated thermal capabilities. However, market growth faces restraints due to stringent export control regulations (such as ITAR), high component costs (especially for advanced photocathode materials like GaAs), and the reliance on specific rare-earth elements. Significant opportunities arise from the increasing demand for Fused Night Vision Systems (FNVS) and the adoption of image intensifiers in unmanned systems (UAS/UAVs). These market dynamics are heavily influenced by the competitive intensity among a few highly specialized manufacturers and the significant bargaining power of major defense procuring entities, coupled with evolving geopolitical instability driving urgent procurement cycles.

The primary driving factor remains the intrinsic value image intensifiers provide in ensuring tactical parity or superiority during night operations, which historically account for a disproportionate number of critical military engagements. Modern militaries are recognizing the limits of legacy systems (Gen 2 and older) and are rapidly upgrading to Gen 3 and Gen 4 equivalents which offer vastly improved Figure of Merit (FOM), crucial for extended ranges and complex urban environments. The integration requirements for heads-up display symbology and augmented reality overlays necessitate high-quality, stable image feeds provided by the latest intensifier technologies, pushing adoption rates upwards across all major defense budgets globally.

Conversely, the development and manufacturing of high-performance image intensifier tubes, particularly those utilizing Gen 3 technology, require specialized vacuum tube technology and proprietary processing techniques, which creates significant dependence on a handful of suppliers, acting as a major supply chain restraint. Moreover, the technological complexity translates directly into high unit costs, sometimes challenging the budgetary allocation of smaller defense forces. The pervasive presence of export controls dictates which markets can access the highest performance systems, segmenting the global market significantly based on technological tiers and limiting the potential addressable market for the most advanced technologies, thereby acting as a critical non-tariff restraint.

Segmentation Analysis

The Military Image Intensifier Market is meticulously segmented based on Technology Generation, Application, and Platform, reflecting the varied operational requirements and performance specifications demanded by global defense organizations. The segmentation by technology is the most defining factor, differentiating devices based on their photocathode material, gain, halo reduction capabilities, and overall Figure of Merit (FOM). Application segmentation reveals the primary deployment methods, ranging from individual soldier systems (goggles, weapon sights) to crew-served weapon systems and long-range surveillance apparatus. Platform segmentation addresses the environment of deployment, whether ground-based infantry operations, airborne reconnaissance, or naval surveillance and security. This layered segmentation allows manufacturers to tailor performance characteristics and cost structures to specific military procurement needs, ensuring optimal balance between capability and budget.

- By Technology Generation:

- Generation 2 (Gen 2)

- Generation 3 (Gen 3)

- Generation 4 (Gen 4/Unfilmed)

- Fused Systems (I2 & Thermal)

- By Application:

- Night Vision Goggles (NVGs)

- Weapon Sights

- Surveillance Systems

- Drivers Viewers

- By Platform:

- Ground Forces

- Airborne Platforms (Aircraft, Helicopters, UAVs)

- Naval Vessels

Value Chain Analysis For Military Image Intensifier Market

The value chain for the Military Image Intensifier Market is characterized by highly specialized stages, beginning with upstream material sourcing and culminating in sophisticated system integration and post-sales support. Upstream activities are dominated by the production of highly specific components, notably the photocathode materials (like Gallium Arsenide, GaAs) and the Microchannel Plates (MCPs). This segment is highly consolidated and proprietary, involving stringent quality control and complex vacuum processing. The midstream involves the assembly of the image intensifier tube itself—a delicate, high-precision manufacturing process that determines the final performance metrics like FOM and longevity. The concentration of technological expertise at the tube manufacturing level dictates pricing and supply dynamics throughout the entire value chain.

Downstream activities involve the integration of these tubes into complete systems—such as NVGs, weapon sights, or vehicular platforms—by Original Equipment Manufacturers (OEMs). This stage includes the design of housing, optics, power management systems, and increasingly, digital interfaces for data processing and fusion. Distribution channels are predominantly direct, involving long-term contracts and direct procurement agreements between the defense OEMs or prime contractors and governmental defense agencies. Due to the sensitive nature of the technology, indirect channels are minimal and usually involve authorized, highly vetted defense distributors operating within specific geopolitical regions under strict regulatory compliance, ensuring secure and controlled delivery of classified components.

The distribution methodology is fundamentally different from commercial markets; direct sales dominate because of rigorous testing, certification, and customization requirements imposed by military end-users. Direct channels ensure technical expertise is available immediately for deployment support and minimize the risk of technology diversion. Furthermore, direct engagement allows manufacturers to provide tailored logistical support, critical repair, and refurbishment services, which form a significant part of the long-term revenue stream. The indirect channel, when utilized, often serves ancillary markets or handles lower-tier technologies subject to fewer export restrictions, or acts as a local liaison for maintenance and service contracts within specific foreign military sales (FMS) contexts.

Military Image Intensifier Market Potential Customers

The primary customers and end-users of Military Image Intensifiers are the Ministries of Defense and associated security and paramilitary organizations worldwide. These entities include national armies, special operations forces, border patrol agencies, and federal law enforcement units requiring enhanced visibility under low-light conditions. Within the military structure, individual soldiers, reconnaissance teams, vehicle crews (tank commanders, drivers), and surveillance operators constitute the largest consuming segments, driven by soldier lethality and survivability programs. Procurement decisions are highly centralized, governed by large-scale, multi-year budgetary cycles, placing emphasis on long-term reliability, interoperability, and system standardization across allied forces.

Secondary potential customers include major defense prime contractors who integrate image intensifiers into larger defense systems (e.g., weapon platforms, integrated soldier systems, or high-altitude surveillance payloads). These prime contractors serve as intermediaries, procuring tubes and core components from specialized manufacturers and integrating them with proprietary optics, software, and housing to deliver a complete solution to the governmental buyer. Moreover, NATO member countries and regional defense alliances often represent a concentrated procurement block, seeking common equipment standards and economies of scale through multinational acquisition efforts, thereby prioritizing suppliers capable of meeting stringent NATO standardization agreements (STANAGs).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L3Harris Technologies, Thales Group, Elbit Systems, BAE Systems, Leonardo S.p.A., Photonis, Safran, Excelitas Technologies, Teledyne FLIR, General Dynamics, ATN Corporation, Night Vision Devices Inc. (NVD), Alpha Optics Systems Inc., Harris Corporation, Adams Industries, Inc., Newcon Optik, Armasight, Inc., AGM Global Vision, Inc., American Technologies Network, Corp., Nivisys LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Image Intensifier Market Key Technology Landscape

The technology landscape of the Military Image Intensifier Market is defined by continuous innovation aimed at increasing the Figure of Merit (FOM), enhancing spectral response, and decreasing the Size, Weight, and Power consumption (SWaP). The most prevalent technology is Generation 3 (Gen 3), characterized by the use of a Gallium Arsenide (GaAs) photocathode, offering superior sensitivity across the visible and near-infrared spectrum. Recent advancements have focused heavily on white phosphor technology (P45), which, while structurally similar to traditional green phosphor (P43) Gen 3 tubes, provides a monochromatic white image that is clinically proven to reduce user fatigue and improve visual acuity and contrast, leading to widespread adoption in elite forces.

Beyond traditional Gen 3, the landscape is evolving toward Fused Night Vision Systems (FNVS). These systems represent a significant technological leap by combining the strengths of image intensification (high resolution, detailed scene viewing) with thermal imaging (detection of heat signatures independent of light levels). FNVS devices utilize advanced algorithms to overlay the I2 and thermal imagery in real-time, providing the user with a comprehensive visual output that overcomes the limitations of either technology individually, particularly in adverse weather or smoke-filled environments. This fusion capability requires high-speed digital processing and precise optical alignment, pushing manufacturers towards miniaturization and integration with helmet-mounted displays.

Another crucial technological development involves Gen 4 or Filmless technology, also known as gated or auto-gated tubes. Gen 4 tubes remove the ion barrier film traditionally placed on the Microchannel Plate (MCP) in Gen 3 devices. This removal results in a significantly higher signal-to-noise ratio and improved photo response, though it requires sophisticated gating electronics to protect the tube from bright light exposure. While Gen 4 theoretically offers the highest performance, Gen 3 remains the industry standard globally, with continued enhancements focused on achieving the highest possible FOM through tighter manufacturing tolerances and improved photocathode durability.

Regional Highlights

Regional dynamics within the Military Image Intensifier Market are heavily influenced by defense budgets, indigenous manufacturing capabilities, and geopolitical security requirements. North America, specifically the United States, commands the largest market share due to its massive defense procurement expenditure and its role as the global technological leader in Gen 3 and fused night vision systems. The U.S. military consistently invests in cutting-edge, high-FOM systems, driving technological innovation and maintaining a stable demand for domestically produced image intensifiers. This region also acts as a primary source for major global export controlled technology, defining the performance benchmarks for international allies.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This rapid expansion is primarily attributed to rising military spending in countries like India, China, and Japan, driven by territorial disputes and modernization initiatives to counter perceived regional threats. Many APAC nations, historically reliant on older Generation 2 technology, are now making large-scale transition procurements to advanced Gen 3 and Fused systems, often sourcing from both Western and indigenous suppliers, creating a highly competitive and expanding market segment focused on localized assembly and transfer of technology agreements.

Europe represents a mature market characterized by standardization efforts under the European Defence Agency (EDA) and NATO. Key procuring nations such as the UK, France, and Germany are systematically upgrading their night vision capabilities, focusing on interoperability and next-generation helmet-mounted systems. While some European companies maintain strong indigenous manufacturing capabilities (e.g., in France and the Netherlands), there is often significant collaboration and sourcing of core components (like specialized photocathodes) from North American suppliers. The Middle East and Africa (MEA) region remains an important consumer market, driven by persistent internal conflicts and the need for advanced border security and counter-terrorism night capabilities, often relying on high-end Gen 3 systems acquired through Foreign Military Sales (FMS) programs.

- North America: Dominates the market share due to substantial U.S. Department of Defense investment and technological leadership in Gen 3 and fused systems.

- Asia Pacific (APAC): Exhibits the highest CAGR, propelled by rapid military modernization in China, India, and escalating regional security requirements.

- Europe: Characterized by structured upgrades within NATO frameworks, focusing on interoperability and advanced white phosphor Gen 3+ technologies.

- Middle East & Africa (MEA): High demand driven by internal security challenges and reliance on imported high-performance night vision technology for counter-insurgency operations.

- Latin America: Stable but smaller market, focused on border security applications and often procuring Gen 2+ or older Gen 3 systems due to budget constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Image Intensifier Market.- L3Harris Technologies

- Thales Group

- Elbit Systems

- BAE Systems

- Leonardo S.p.A.

- Photonis

- Safran

- Excelitas Technologies

- Teledyne FLIR

- General Dynamics

- ATN Corporation

- Night Vision Devices Inc. (NVD)

- Alpha Optics Systems Inc.

- Harris Corporation

- Adams Industries, Inc.

- Newcon Optik

- Armasight, Inc.

- AGM Global Vision, Inc.

- American Technologies Network, Corp.

- Nivisys LLC

Frequently Asked Questions

Analyze common user questions about the Military Image Intensifier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key technological difference between Generation 3 and Fused Image Intensifiers?

Generation 3 (Gen 3) Image Intensifiers rely solely on amplifying ambient light via a Gallium Arsenide (GaAs) photocathode. Fused systems combine Gen 3 image intensification technology with a separate thermal imaging sensor, using internal processing to overlay the two images, providing superior situational awareness by ensuring detection of heat signatures even when the I2 channel is obscured by smoke or complete darkness.

Why is the Figure of Merit (FOM) a critical specification for military procurement?

The Figure of Merit (FOM) is a comprehensive metric calculated by multiplying the system's resolution (line pairs per millimeter) by its signal-to-noise ratio (SNR). A higher FOM indicates a tube capable of producing a clearer, brighter image with less noise, particularly under extremely low-light conditions, directly correlating to better target acquisition range and enhanced soldier performance in combat scenarios.

Which geographical region leads the global Military Image Intensifier Market?

North America, driven primarily by the extensive defense spending and continuous technological advancements mandated by the U.S. Department of Defense (DoD), maintains the largest market share. However, the Asia Pacific (APAC) region is projected to experience the highest growth rate due to accelerating military modernization programs and rising geopolitical tensions requiring enhanced night capabilities.

How do export controls impact the availability of high-end image intensifier tubes?

Export controls, particularly the U.S. International Traffic in Arms Regulations (ITAR), severely restrict the distribution of the most advanced Gen 3 and Gen 4/Filmless tubes. This creates tiered availability, limiting access to the highest performing technology to close allies, thereby segmenting the global market and driving non-U.S. manufacturers to develop comparable indigenous technologies.

What role does Artificial Intelligence (AI) play in next-generation image intensification systems?

AI is being integrated to process and enhance the intensified image data in real-time. Key functions include Automatic Target Recognition (ATR), dynamic noise reduction, intelligent gain control, and seamless fusion of I2 with thermal data, which reduces the cognitive load on the operator and dramatically speeds up the decision-making cycle in complex operational environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager