Military Optronics Surveillance and Sighting Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435896 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Military Optronics Surveillance and Sighting Systems Market Size

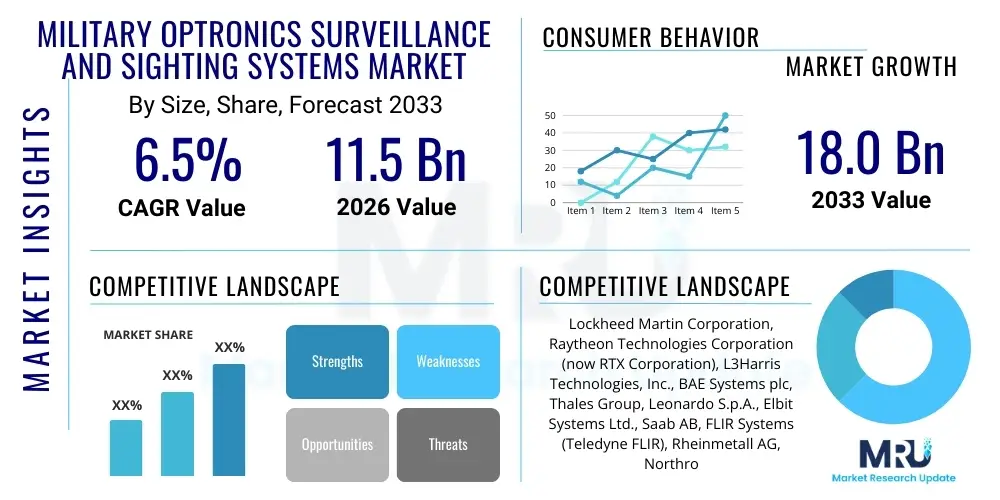

The Military Optronics Surveillance and Sighting Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 18.0 Billion by the end of the forecast period in 2033.

Military Optronics Surveillance and Sighting Systems Market introduction

The Military Optronics Surveillance and Sighting Systems Market encompasses advanced electro-optical and infrared (EO/IR) technologies deployed across various defense platforms to enhance situational awareness, targeting precision, and reconnaissance capabilities. These systems integrate sophisticated sensors, lasers, display units, and image processing modules, crucial for converting light or heat signatures into usable data for military personnel. Key products include thermal imaging cameras, laser rangefinders, targeting pods, night vision goggles, and stabilized surveillance turrets, all designed to operate effectively across diverse operational environments, day or night, and under adverse weather conditions. The core function of these systems is to provide detection, identification, recognition, and ranging capabilities over extended distances, ensuring operational superiority.

Major applications of military optronics span ground vehicles, infantry operations, naval vessels, and an increasingly critical role in airborne and unmanned platforms. In ground warfare, optronics are integral to fire control systems for armored vehicles, providing essential sighting capabilities for main guns and remotely operated weapon stations (RWS). For airborne assets, such as fighter jets and reconnaissance aircraft, these systems manifest as sophisticated targeting pods and panoramic surveillance systems, enabling precision strikes and long-range intelligence gathering. The primary benefit derived from deploying these technologies is the significant enhancement of lethality, survivability, and mission effectiveness, allowing forces to engage threats proactively while minimizing exposure.

Driving factors propelling the market expansion are deeply rooted in global geopolitical instability and the resulting necessity for comprehensive defense modernization programs across established and emerging military powers. The shift towards asymmetric warfare and counter-insurgency operations demands lighter, more agile, and highly precise targeting solutions, which optronics systems inherently provide. Furthermore, the persistent push for digital battlefield integration, where real-time data sharing and networked operations are paramount, necessitates high-definition, multi-spectral optronics that can seamlessly interface with command and control (C2) infrastructure. Investment in next-generation imaging technologies, such as Short-Wave Infrared (SWIR) and hyper-spectral imaging, further underscores the sustained demand profile.

Military Optronics Surveillance and Sighting Systems Market Executive Summary

The Military Optronics Surveillance and Sighting Systems market is characterized by robust technological innovation, driven predominantly by the demand for multi-spectral sensor fusion and enhanced long-range detection capabilities. Business trends highlight strategic mergers and acquisitions among major defense contractors to consolidate expertise in sensor technology and AI integration, aiming to offer fully integrated platform solutions rather than singular components. Miniaturization remains a critical trend, enabling the deployment of high-performance optronics on smaller, tactical platforms like small Unmanned Aerial Systems (UAS) and individual soldier systems. The focus is shifting towards software-defined optronics, allowing rapid system upgrades and customization through firmware updates, thereby increasing platform longevity and adaptability in dynamic threat environments. Furthermore, companies are prioritizing ruggedization and reliability to meet stringent military standards for deployment in extreme temperatures and harsh operational settings.

Regionally, North America maintains its position as the dominant market shareholder, primarily due to the substantial defense budgets of the United States, which continually allocate significant funding for advanced research, development, and procurement of sophisticated targeting and surveillance systems. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by escalating maritime and territorial disputes, leading countries like China, India, and Japan to heavily invest in naval and ground force modernization, with a specific emphasis on indigenization of electro-optical technologies. Europe represents a mature but stable market, driven by multinational defense cooperation initiatives and the imperative to replace legacy Cold War-era equipment with modern, networked optronic suites compliant with NATO interoperability standards. The Middle East remains a high-value procurement region, relying on imports of advanced systems for border security and internal stability operations.

Segment trends clearly indicate that the Unmanned Systems segment, encompassing UAS, Unmanned Ground Vehicles (UGVs), and Unmanned Maritime Vessels (UMVs), is experiencing exponential growth, recognizing the essential role of optronics in enabling autonomous navigation, target acquisition, and payload delivery in these platforms. Within the component segment, the demand for advanced sensor technologies, particularly uncooled thermal detectors and high-resolution CMOS/CCD sensors, is outpacing traditional components, emphasizing lower Size, Weight, and Power (SWaP) consumption requirements. Furthermore, the sighting systems category, including helmet-mounted displays (HMDs) and fused weapon sights, is undergoing significant evolution to improve soldier lethality and cognitive load management, integrating augmented reality overlays with real-world sensor data.

AI Impact Analysis on Military Optronics Surveillance and Sighting Systems Market

Common user inquiries regarding AI’s influence on military optronics revolve around the concepts of autonomous target recognition, the reliability of AI-driven image processing under complex battlefield clutter, and the ethical implications of delegating decision-making processes to algorithms in kinetic engagements. Users are highly interested in how AI can manage the massive streams of data generated by multi-spectral sensors, asking specifically how machine learning algorithms accelerate the detection, classification, and tracking of subtle threats—an essential requirement for reducing the cognitive overload on human operators. Key themes include the expectation that AI integration will shift military optronics from simple observation tools to integrated, predictive intelligence platforms, enabling systems to dynamically adjust sensor parameters, prioritize targets, and generate actionable intelligence significantly faster than traditional methods, thereby dramatically shortening the sensor-to-shooter loop.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the capabilities and operational paradigms of military optronics systems, moving them toward predictive and autonomous functions. AI algorithms are particularly valuable in processing complex, high-volume sensor data, allowing systems to autonomously perform crucial tasks such as automatic target recognition (ATR), anomaly detection, and rapid fusion of thermal, visual, and radar data. This shift minimizes the human error associated with monotonous surveillance tasks and drastically improves the speed and accuracy of target identification, especially in environments cluttered by decoys or urban structures. Furthermore, AI contributes to predictive maintenance by analyzing system performance metrics in real-time, anticipating potential component failures, and thereby maximizing operational readiness and minimizing unexpected system downtime during critical missions.

AI also plays a pivotal role in optimizing image quality and stabilizing sensors in dynamic environments, a crucial feature for airborne or fast-moving ground platforms. Deep learning models can effectively filter out atmospheric interference, motion blur, and sensor noise, delivering clearer, more reliable intelligence data to the operator. This optimization extends the effective range and reliability of surveillance and sighting systems. The ongoing development of robust, edge-processing AI hardware ensures that these complex algorithms can operate directly within the embedded systems of the optronics unit (on-the-edge processing), reducing latency and dependency on central command infrastructure, which is vital for operations in denied or contested environments where communication bandwidth is limited or non-existent.

- AI enables Autonomous Target Recognition (ATR) and classification, significantly reducing operator cognitive load.

- Machine Learning algorithms enhance sensor data fusion from multi-spectral inputs (EO/IR, SWIR), creating superior situational awareness.

- Predictive maintenance schedules are established by AI, analyzing system performance and minimizing operational downtime.

- Edge computing capabilities facilitate real-time AI processing within the optronics unit, optimizing response times.

- AI-driven image stabilization and enhancement algorithms improve clarity and reliability in adverse weather or high-vibration conditions.

- Generative AI models are being utilized in simulation and training environments to create realistic, complex threat scenarios for system testing.

DRO & Impact Forces Of Military Optronics Surveillance and Sighting Systems Market

The Military Optronics Surveillance and Sighting Systems market is principally driven by escalating global defense spending, particularly focused on modernization initiatives aimed at countering emerging peer-level and asymmetric threats. Restraints include stringent international export controls, such as the International Traffic in Arms Regulations (ITAR), which significantly complicate cross-border technology transfer and collaboration, alongside the exceptionally high costs associated with research, development, and stringent military certification processes for new optronic technologies. Key opportunities reside in the rapid integration of advanced optronics into the burgeoning Unmanned Systems domain and the development of software-defined apertures that allow for highly flexible, multi-mission capabilities. The overall impact forces indicate a market characterized by high regulatory barriers and significant technological complexity, yet consistently sustained by indispensable strategic military requirements and large, long-term procurement cycles.

Drivers: The most prominent driver is the ongoing proliferation of sophisticated electronic warfare (EW) and integrated air defense systems globally, which necessitate the use of passive surveillance technologies like optronics, as opposed to radar, to maintain stealth and operational surprise. Furthermore, the persistent requirement for enhanced border security, counter-terrorism operations, and intelligence, surveillance, and reconnaissance (ISR) missions drives the continuous procurement of high-definition, long-range imaging systems. The increasing emphasis on networked warfare also accelerates demand, requiring optronics that can generate precise geo-referenced data seamlessly integrated into the soldier systems and vehicle combat networks. Modernization efforts in older NATO and allied nation inventories, replacing legacy image intensifiers with advanced thermal and fused systems, further solidify the demand pipeline.

Restraints: Significant barriers to market growth include the substantial cost and complexity of manufacturing high-performance infrared detectors, particularly Focal Plane Arrays (FPAs), which require specialized production facilities and highly controlled environments. Furthermore, the lengthy procurement timelines inherent in defense budgeting cycles often delay the adoption of cutting-edge commercial technology, leading to potential obsolescence before wide-scale deployment. The strict dual-use regulatory framework, intended to prevent sensitive military technology from reaching adversarial nations, restricts commercial scale-up and limits market access for many advanced components. Additionally, reliance on imported critical components, such as specialized rare earth materials, presents supply chain vulnerabilities that can restrain mass production.

Opportunities: The advent of low-SWaP (Size, Weight, and Power) technologies, driven by advances in micro-bolometer and miniaturized laser technologies, opens substantial market opportunities, particularly for dismounted soldier applications and small tactical UAVs where every gram matters. The development of multi-spectral and hyper-spectral imaging represents a substantial opportunity, offering capabilities beyond simple thermal or visible light detection, allowing for material identification and improved camouflage penetration. The growing global trend towards upgrading aging military aircraft and naval platforms with modern surveillance suites provides sustained retrofit opportunities. Moreover, the integration of advanced data processing algorithms, including AI/ML for automated threat detection, positions optronics systems as integral nodes in the future digital battlefield architecture, unlocking potential for high-margin software services.

Segmentation Analysis

The Military Optronics Surveillance and Sighting Systems Market is comprehensively segmented based on critical characteristics including Platform, Component, Technology, and System Type, reflecting the diverse application landscape within the defense sector. The Platform segmentation distinguishes between systems tailored for integration into Ground, Airborne, Naval, and Unmanned platforms, where each domain requires specialized ruggedization, range, and stabilization features. The Component segment breaks down the market by the core elements, such as sensors, lasers, and display units, highlighting areas of technological investment. Technology segmentation focuses on the underlying physics used for imaging, ranging from traditional Image Intensification to modern Thermal Imaging and sophisticated Laser-based systems. This granular segmentation aids stakeholders in understanding specific market niches and prioritizing R&D efforts based on platform and component criticality.

- By Platform

- Ground Systems (e.g., Fire Control Systems, Vehicle Sights, Surveillance Systems)

- Airborne Systems (e.g., Targeting Pods, Reconnaissance Systems, Helicopter Turrets)

- Naval Systems (e.g., Search and Track Systems, Navigation Systems)

- Unmanned Systems (UAVs, UGVs, USVs/UUVs Optronics Payloads)

- By Component

- Sensors (e.g., IR Detectors, CMOS/CCD Sensors, Multi-spectral sensors)

- Lasers (e.g., Laser Range Finders, Laser Target Designators, Laser Pointers)

- Displays and Processors (e.g., Helmet-Mounted Displays, Embedded Processors)

- Stabilization Systems

- By Technology

- Thermal Imaging (Cooled and Uncooled)

- Image Intensification (I2)

- Laser Technology

- Fusion Technology

- By System Type

- Surveillance and Reconnaissance Systems

- Sighting and Targeting Systems

Value Chain Analysis For Military Optronics Surveillance and Sighting Systems Market

The value chain for military optronics surveillance and sighting systems is complex and highly specialized, beginning with the upstream analysis dominated by niche suppliers of critical raw materials and highly technical components. Upstream activities involve the fabrication of high-purity semiconductor materials, the complex engineering required for Focal Plane Array (FPA) manufacturing, and the production of specialized, high-transmission optical lenses and prisms, often subject to stringent quality control and high entry barriers. Key suppliers in this phase often hold proprietary intellectual property, dictating component cost and availability. These specialized suppliers provide the core technology inputs (sensors and optics) which represent the highest value-add stage due to the precision and performance requirements unique to military applications.

Midstream activities involve the integration and assembly of these components into deployable systems. This stage is dominated by large, established defense primes and specialized systems integrators who combine sensors, lasers, display hardware, advanced processors, and proprietary software algorithms to build the final surveillance turrets, targeting pods, or weapon sights. System integration requires significant expertise in ruggedization, stabilization, and software interface development to ensure seamless compatibility with specific military platforms (e.g., aircraft, armored vehicles). Rigorous testing, qualification, and military certification processes, which can take several years, are critical intermediate steps before a product can enter the downstream market.

The downstream analysis focuses on the distribution channels and the end-user procurement landscape. Distribution is heavily skewed towards direct sales to government defense ministries or national armed forces, facilitated by long-term strategic contracts, often managed directly by the prime integrator. Indirect channels are typically limited to aftermarket services, maintenance, repair, and overhaul (MRO), and sometimes the sales of less sensitive peripheral equipment through authorized defense distributors. The nature of high-value defense procurement means that trust, historical performance, and political relationships are as crucial as technological superiority in securing sales contracts, characterizing a highly regulated and government-centric distribution environment.

Military Optronics Surveillance and Sighting Systems Market Potential Customers

The primary consumers and end-users of Military Optronics Surveillance and Sighting Systems are national defense organizations, encompassing various branches of the armed forces that require enhanced tactical observation and precision engagement capabilities. The largest segment of buyers includes government defense ministries responsible for modernizing infantry units, ground vehicle fleets (tanks, IFVs, reconnaissance vehicles), and combat aircraft inventories. These customers prioritize high reliability, interoperability with existing communication networks, and technological superiority to maintain a strategic advantage. Procurement is often driven by multi-year defense budgets and focused on replacing aging analog equipment with digitally integrated optronic suites capable of multi-domain operations.

Secondary, yet rapidly growing, customer groups include specialized paramilitary and law enforcement agencies responsible for border patrol, coastal surveillance, and specialized counter-terrorism operations. These organizations often require tactical, hand-held, or vehicle-mounted thermal and night vision systems that offer quick deployment and ease of use, prioritizing portability and rapid intelligence gathering over the heavy-duty specifications needed for front-line combat. Furthermore, original equipment manufacturers (OEMs) of military platforms, such as aerospace and ground vehicle manufacturers, represent crucial indirect customers, as they integrate these optronic systems into their weapon platforms before delivering the finished product to the end-user military client, thus driving demand for bulk component and system sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin Corporation, Raytheon Technologies Corporation (now RTX Corporation), L3Harris Technologies, Inc., BAE Systems plc, Thales Group, Leonardo S.p.A., Elbit Systems Ltd., Saab AB, FLIR Systems (Teledyne FLIR), Rheinmetall AG, Northrop Grumman Corporation, Kontron AG (formerly EIZO Rugged Solutions), Rafael Advanced Defense Systems Ltd., Bharat Electronics Limited (BEL), Aselsan A.S., Jena-Optronik GmbH, HENSOLDT AG, Safran S.A., UTC Aerospace Systems (Collins Aerospace), General Dynamics Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Optronics Surveillance and Sighting Systems Market Key Technology Landscape

The technology landscape of military optronics is currently defined by convergence and advancements in sensor physics, moving beyond traditional visible light and simple thermal capabilities towards integrated multi-spectral systems. A significant technological shift involves the transition from traditional cooled infrared (IR) detectors, which require cryocoolers and are power-intensive, to high-resolution, uncooled thermal imaging sensors based on Vanadium Oxide (VOx) microbolometers. While cooled systems still offer superior range and sensitivity, especially in long-wave infrared (LWIR), uncooled systems are rapidly closing the performance gap while offering substantial advantages in SWaP (Size, Weight, and Power), making them ideal for dismounted soldiers and small UAVs. This technological evolution democratizes high-performance thermal imaging across a broader range of military applications, reducing reliance on complex maintenance procedures.

Another crucial technological development is the pervasive adoption of sensor fusion, where data from multiple modalities—such as Visible light, Short-Wave Infrared (SWIR), Medium-Wave Infrared (MWIR), and laser rangefinders—are combined in real-time to generate a single, highly detailed, and contextualized image for the operator. Fusion technology significantly enhances target discrimination in challenging conditions, such as haze, fog, or heavy camouflage, where single-spectrum systems might fail. Furthermore, the incorporation of advanced quantum dot technology and meta-materials is paving the way for hyper-spectral and polarized imaging, which allows military personnel to extract information about the composition and structural characteristics of objects, moving surveillance from simple detection to detailed material analysis.

In the domain of sighting and targeting, the emphasis is placed on highly stable, high-repetition-rate laser technologies for accurate rangefinding and target designation, often utilizing eye-safe wavelengths to minimize risk to friendly forces. Concurrent advancements in digital signal processing (DSP) and ruggedized computing hardware are essential for managing the sheer volume of data produced by these advanced sensors and executing complex AI-driven algorithms at the tactical edge. Helmet-mounted display (HMD) technology is evolving to integrate fused imagery directly onto the soldier’s view, incorporating augmented reality (AR) overlays for navigational data and target cues, significantly boosting the overall situational awareness and reducing the cognitive burden of data interpretation during combat operations.

The convergence of optronics with RF systems is also emerging as a key strategic technology. By co-locating optical sensors with small, tactical radar or electronic support measures (ESM) systems, defense platforms can achieve highly robust, multi-layered surveillance capabilities that maintain effectiveness even when one modality is compromised, such as in heavy electronic jamming environments. This necessitates advanced system architecture capable of managing and synchronizing dissimilar data types. Ultimately, the long-term technological trajectory points toward highly adaptive, modular optronic systems where sensor heads and processing units can be easily swapped or upgraded based on mission requirements, ensuring long-term operational relevance.

Advancements in micro-optics and micro-electro-mechanical systems (MEMS) are critical for the continued miniaturization trend across all platform segments. MEMS technology is increasingly utilized in optical image stabilization components, offering superior shock resistance and precision in smaller form factors compared to traditional mechanical gimbals. This is particularly relevant for the expanding market of disposable or expendable optronic payloads used on loitering munitions and small reconnaissance drones. Simultaneously, improvements in battery technology and power management circuits are essential to support the increased computational demand required by AI integration without compromising the runtime of battery-dependent systems like soldier-worn night vision goggles and hand-held targeting devices. The drive towards lower power consumption is a continuous engineering challenge directly impacting product viability and adoption rates across various branches of the armed forces.

Moreover, the development of sophisticated optical coatings and specialized lensing materials designed to maximize transmission across multiple spectral bands (Visible, NIR, SWIR, MWIR, LWIR) while simultaneously minimizing internal reflections and glare is a critical technological area. These coatings not only enhance image fidelity but also protect sensitive sensor elements from environmental degradation and potential laser threats. Standardization in digital interfaces and protocols, such as integration with the Modular Open Systems Approach (MOSA), is gaining traction. MOSA compliance ensures that optronics components from different vendors can be easily integrated and upgraded, significantly reducing vendor lock-in and streamlining procurement processes for defense ministries focused on maximizing life-cycle affordability and system adaptability.

Finally, the security of the optronic systems themselves is becoming a core technological requirement. As systems become more networked and software-dependent, there is an increased risk of cyber-physical attacks targeting the embedded processors or communication links. Therefore, the implementation of hardware-based security features, secure boot processes, and robust encryption protocols is paramount to ensure the integrity of the collected intelligence data and the reliability of the system’s targeting calculations. Companies are investing heavily in cyber-resilient architectures, recognizing that an advanced sensor system is only valuable if the data it produces is trustworthy and protected from malicious manipulation throughout its operational lifecycle.

Regional Highlights

The global Military Optronics Surveillance and Sighting Systems market exhibits pronounced regional variations in procurement strategies, technological adoption rates, and market maturity, primarily driven by geopolitical imperatives and defense spending capacity.

- North America (USA and Canada): This region dominates the market, characterized by the highest defense budgets globally and a continuous commitment to fielding technologically superior equipment. The United States drives innovation, with massive investments focused on AI integration, networked warfare capabilities, and next-generation, low-SWaP optronics for the Future Vertical Lift (FVL) program and ground vehicle modernization. The market here is highly competitive, sustained by long-term contracts awarded to Tier 1 defense primes.

- Europe: A mature market focused on interoperability (NATO standards) and platform modernization. Key countries like the UK, France, and Germany are heavily investing in indigenous optronics capabilities, particularly for naval and airborne reconnaissance systems. The emphasis is on multi-national programs and the replacement of aging thermal imaging equipment, with a strong push towards fusion technology and secure communication links for collaborative defense operations.

- Asia Pacific (APAC): The fastest-growing region, fueled by rising geopolitical tensions, particularly in the South China Sea and along major border disputes. Countries such as China, India, and South Korea are aggressively modernizing their militaries, leading to substantial procurement of advanced targeting pods, thermal weapon sights, and UAV surveillance payloads. India, in particular, is boosting domestic manufacturing capacity (Make in India initiative) to reduce reliance on foreign suppliers.

- Middle East and Africa (MEA): A significant importer of advanced optronics, driven by internal security needs, border surveillance requirements, and counter-insurgency operations. The region focuses on high-performance surveillance systems, particularly long-range thermal imagers and ground-based tactical surveillance radars integrated with EO/IR. Procurement is heavily influenced by defense relationships with North American and European suppliers.

- Latin America: This region holds a smaller share, with demand focused primarily on coastal surveillance, border monitoring, and internal security applications. Procurement is typically budget-sensitive, leading to a demand for cost-effective, ruggedized optronic solutions rather than the most cutting-edge, high-cost systems, often procured through foreign military sales programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Optronics Surveillance and Sighting Systems Market.- Lockheed Martin Corporation

- Raytheon Technologies Corporation (now RTX Corporation)

- L3Harris Technologies, Inc.

- BAE Systems plc

- Thales Group

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Saab AB

- FLIR Systems (Teledyne FLIR)

- Rheinmetall AG

- Northrop Grumman Corporation

- Kontron AG (formerly EIZO Rugged Solutions)

- Rafael Advanced Defense Systems Ltd.

- Bharat Electronics Limited (BEL)

- Aselsan A.S.

- Jena-Optronik GmbH

- HENSOLDT AG

- Safran S.A.

- UTC Aerospace Systems (Collins Aerospace)

- General Dynamics Corporation

Frequently Asked Questions

Analyze common user questions about the Military Optronics Surveillance and Sighting Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Military Optronics Market?

The primary factor driving market growth is the global acceleration of defense modernization programs, coupled with increasing investments in high-definition surveillance and precision targeting capabilities to counter modern asymmetric warfare threats and enhance overall situational awareness across all operational domains.

How is AI specifically impacting military surveillance systems?

AI is fundamentally transforming surveillance systems by enabling Autonomous Target Recognition (ATR), real-time sensor data fusion, and predictive intelligence generation. This reduces the cognitive burden on human operators and dramatically improves the speed and accuracy of threat detection and classification.

Which segment is projected to show the highest growth rate during the forecast period?

The Unmanned Systems segment, encompassing optronic payloads for UAVs, UGVs, and USVs, is projected to exhibit the highest growth rate, driven by military doctrines increasingly relying on unmanned platforms for reconnaissance, targeting, and persistent monitoring missions globally.

What are the main technological trends defining next-generation military optronics?

Key technological trends include the integration of multi-spectral sensor fusion (combining visible, SWIR, and thermal data), the widespread adoption of low-SWaP uncooled thermal imaging, and the utilization of edge computing for processing complex algorithms directly within the sensor unit, maximizing real-time performance.

Why is North America the leading market for Military Optronics?

North America leads the market due to the enormous R&D expenditure and robust defense procurement budgets of the United States, which continuously fund the development and deployment of highly sophisticated, digitally integrated optronics systems for ground, naval, and airborne platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager