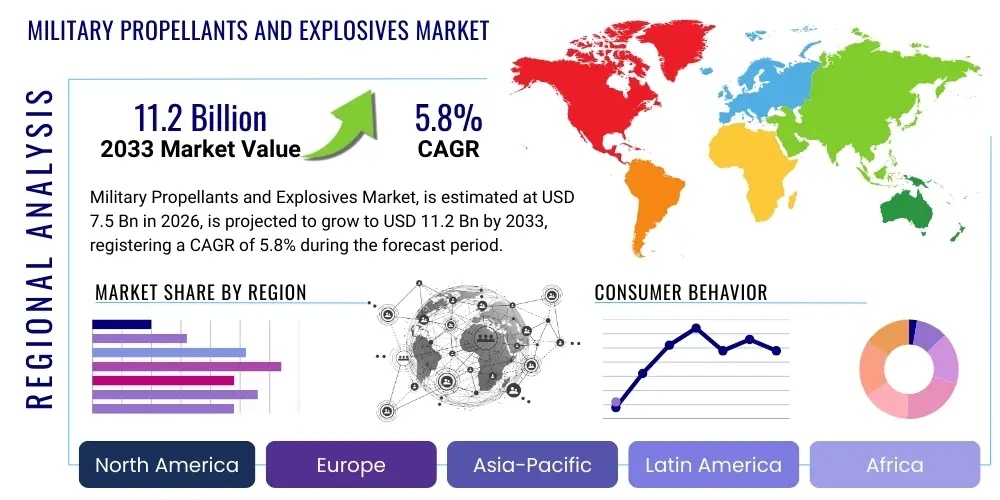

Military Propellants and Explosives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435023 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Military Propellants and Explosives Market Size

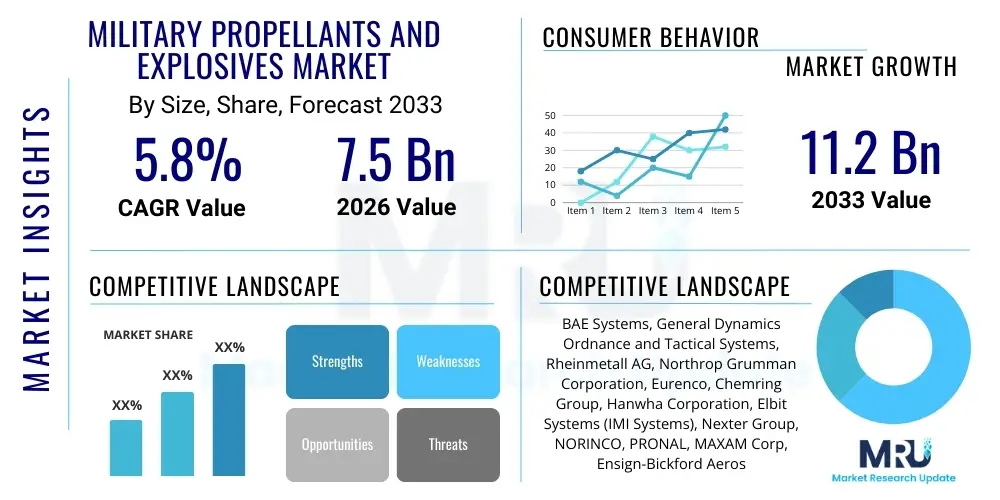

The Military Propellants and Explosives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Military Propellants and Explosives Market introduction

The Military Propellants and Explosives Market encompasses the research, development, manufacturing, and supply of energetic materials crucial for military applications worldwide. These materials form the core kinetic energy source for ammunition, missiles, rockets, artillery shells, and various specialized weapon systems. The market is characterized by stringent quality controls, high barriers to entry, and significant government oversight due to the sensitive nature of the products and their direct impact on national security capabilities. Propellants, such as those based on nitrocellulose or solid composite fuels, are designed to produce controlled combustion and generate high pressure needed to launch projectiles or power rocket motors. Explosives, conversely, are engineered for rapid detonation, producing massive shockwaves and fragmentation required for warheads and demolition tasks. The integrity and performance stability of these energetic materials are paramount, particularly under extreme operational conditions.

Product categories within this domain range from traditional black powder and TNT to modern, high-performance compounds like HMX (High Melting Explosive) and RDX (Research Department Explosive), and advanced, polymer-bonded explosives (PBXs). Major applications span across large-caliber artillery systems, small arms ammunition used by infantry, strategic missile systems, and underwater ordnance such as torpedoes. The constant demand for modernization by armed forces globally, coupled with escalating geopolitical tensions and regional conflicts, serves as the fundamental underpinning for market expansion. Furthermore, the imperative to develop materials that offer improved safety and reduced collateral damage, often termed Insensitive Munitions (IM), drives research investment into novel chemical compositions and manufacturing techniques.

The primary benefits derived from advancements in this market include increased range, enhanced terminal effects, greater reliability, and, crucially, superior safety during handling and storage. Driving factors include large-scale defense modernization programs, particularly in Asia Pacific and the Middle East, necessitated by technological parity goals and external threats. Additionally, the replacement cycle for aging ordnance inventories in Western nations, combined with the shift toward precision-guided munitions requiring specialized, high-density energetic fillers, sustains robust market activity and innovation.

Military Propellants and Explosives Market Executive Summary

The Military Propellants and Explosives Market is experiencing a robust period of expansion, driven primarily by elevated global defense spending and sustained geopolitical volatility. Business trends highlight a strong industry focus on mergers and acquisitions among established defense contractors to consolidate technological expertise and supply chain resilience, particularly concerning key raw materials like specialized polymers and chemical precursors. The demand curve is shifting toward advanced energetic materials that comply with Insensitive Munitions (IM) protocols, pushing manufacturers to invest heavily in research for low-vulnerability explosives (LOVA propellants and PBXs). Furthermore, manufacturers are exploring modular charge systems for artillery, offering increased flexibility and reduced logistics complexity for field operations. Overall market growth is balanced between modernization requirements in developed nations and foundational inventory buildup in emerging economies.

Regionally, North America maintains its dominance due to the extensive procurement activities of the U.S. Department of Defense and the presence of major global defense primes. However, the Asia Pacific region, led by China, India, and South Korea, is anticipated to record the highest CAGR, fueled by significant domestic production initiatives and escalating maritime and territorial disputes, necessitating rapid build-up of missile and artillery stockpiles. Europe’s market growth is primarily revitalized by the conflict in Ukraine, prompting NATO member states to replenish depleted inventories and increase readiness levels, leading to long-term contracts for ammunition and energetic components.

In terms of segment trends, the Explosives segment, especially high-density RDX and HMX variants used in missile warheads and advanced artillery, holds the largest market share due to the proliferation of precision-guided munitions (PGMs). However, the Propellants segment, particularly solid rocket propellants utilized in tactical and strategic missile systems, is forecast to exhibit slightly faster growth. Segmentation by chemistry is also crucial, with advancements in melt-cast explosives and novel nitramines driving performance improvements, while the application segment remains dominated by conventional ammunition, which represents the constant, high-volume requirement of all global armed forces.

AI Impact Analysis on Military Propellants and Explosives Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can interface with the deeply traditional and chemical-intensive domain of propellants and explosives, seeking to understand if AI can revolutionize material design, safety protocols, and supply chain management. Key concerns revolve around the integration of predictive analytics for material lifespan estimation, enhancing the safety of explosive handling by reducing human error, and accelerating the discovery of novel high-performance, low-vulnerability energetic compounds. Users expect AI to optimize complex chemical formulations that are currently developed through costly and time-consuming physical testing, leading to faster deployment of next-generation weapons systems. The underlying theme is the expectation that AI will transition energetic material development from empirical trial-and-error to data-driven, accelerated synthesis.

The practical application of AI in this highly specialized sector centers on material science informatics. AI algorithms can process vast datasets related to chemical properties, crystal structures, stability metrics, and manufacturing parameters (such as curing times and mixing ratios) far more efficiently than traditional modeling methods. This capability allows researchers to predict the performance characteristics (e.g., detonation velocity, brisance) and long-term storage stability of theoretical compositions before resource-intensive lab synthesis begins. For instance, ML models can identify optimal plasticizer combinations for PBXs to maximize insensitivity without compromising energy output, significantly reducing the development cycle for new Insensitive Munitions (IM) compliant explosives.

Furthermore, AI-driven process optimization is transforming the manufacturing floor. Machine vision and predictive maintenance, powered by AI, monitor critical processes such as solvent removal, powder mixing, and pressing density within propellant casting facilities. These systems can detect minor inconsistencies or deviations from safety thresholds in real-time, preempting potential hazards and ensuring strict quality control, which is vital given the inherent dangers of working with energetic materials. The integration of digital twins for high-hazard production environments, simulated and managed by AI, also enables safer testing of process modifications and throughput maximization without physical risk.

- AI-Accelerated Material Discovery: Utilization of machine learning for rapid screening and prediction of novel energetic compound properties (e.g., density, thermal stability, sensitivity).

- Manufacturing Process Optimization: Deployment of predictive maintenance and AI-driven quality control systems to enhance consistency and safety in casting and pressing operations.

- Lifetime Prediction and Inventory Management: AI algorithms estimate the degradation rate and shelf life of stored propellants and explosives, optimizing inventory rotation and reducing risk of disposal.

- Safety Protocol Enhancement: AI-powered surveillance and monitoring systems detect anomalous behavior or unsafe conditions in high-hazard areas, preventing accidents.

- Supply Chain Resilience: ML models analyze global precursor chemical availability and geopolitical risks to ensure robust sourcing and security of supply for vital components.

- Simulation and Modeling: Creation of AI-driven digital twins to simulate detonation dynamics and propellant burn rates under various environmental conditions, reducing the need for costly physical trials.

DRO & Impact Forces Of Military Propellants and Explosives Market

The market dynamics for military propellants and explosives are fundamentally shaped by a confluence of governmental defense strategies, technological advancements, and stringent regulatory frameworks. The primary market drivers include the pervasive global need for defense modernization, driven by the replacement of aging Soviet-era ordnance and the deployment of advanced weapon systems that require higher-energy density materials. Escalating geopolitical tensions across regions like Eastern Europe, the South China Sea, and the Middle East necessitate continuous armament replenishment and strategic stockpiling by nations, directly stimulating demand for both standard ammunition and sophisticated missile propellants. Furthermore, the global proliferation of drones and unmanned aerial systems (UAS) is creating a parallel demand for specialized counter-UAS warheads and low-signature propellants for rapid-response interceptor missiles.

However, the market faces significant restraints. The most prominent constraint is the increasingly stringent environmental, health, and safety (EHS) regulations governing the manufacturing, transportation, and disposal of energetic materials. There is a concerted global effort, particularly in Western Europe and North America, to phase out highly polluting or toxic components, such as heavy metal stabilizers or certain legacy solvents, which drives up R&D costs and complicates production scaling. Additionally, the industry is highly capital-intensive, requiring specialized, explosion-proof manufacturing facilities, leading to very high barriers to entry for new competitors. The reliance on a limited number of global suppliers for critical chemical precursors, often volatile in price and availability, also poses a significant supply chain vulnerability.

Opportunities for growth are predominantly centered on technological innovation, specifically the development and implementation of Insensitive Munitions (IM) technology. This includes designing new formulations (e.g., LOVA propellants, new PBXs) and incorporating structural design features that prevent unintended detonation during accidental exposure to heat, shock, or sympathetic detonation. Another major opportunity lies in the modularization of charge systems for artillery, offering militaries logistical flexibility and simplified operations. The long-term shift towards solid-fuel rocket technology for space and hypersonic applications provides an adjacent growth path, as many of the foundational materials and manufacturing processes are shared with military solid propellants. Impact forces are strong, primarily dictated by national defense budgets (a macro-economic force) and specific military requirements (a technological force), making the market highly inelastic to general economic cycles but extremely sensitive to political instability and technological breakthroughs.

- Drivers:

- Increased global defense spending driven by regional conflicts and geopolitical instability.

- Extensive modernization programs replacing legacy ordnance with advanced munitions.

- Growing demand for precision-guided munitions (PGMs) and high-density energetic materials.

- Stockpile replenishment necessitated by active conflicts and strategic readiness goals.

- Restraints:

- Stringent governmental regulations regarding EHS (Environmental, Health, and Safety).

- High capital expenditure required for specialized, secure manufacturing infrastructure.

- Volatility in the supply and price of critical chemical precursors (e.g., cellulose, nitramines).

- Public pressure and ethical concerns related to the use and disposal of explosive ordnance.

- Opportunities:

- Development and commercialization of next-generation Insensitive Munitions (IM) and LOVA technology.

- Focus on modular charge systems and scalable, flexible propellant manufacturing techniques.

- Integration of advanced digital manufacturing and AI to optimize chemical synthesis.

- Exploration of green chemistry alternatives to reduce the environmental footprint of energetic materials.

- Impact Forces:

- Political Stability and Budget Cycles: Direct correlation between defense budgets and procurement volumes.

- Technological Advancements: Shift towards high-performance, safer materials (e.g., shift from TNT to RDX/HMX).

- Regulatory Compliance: Mandates (like IM standards) force material substitution and production overhaul.

Segmentation Analysis

The Military Propellants and Explosives Market is comprehensively segmented based on the type of material, its chemical composition, and the specific application in weapon systems. This segmentation provides clarity on technological specialization and demand patterns within the defense industry. The primary segmentation by material type distinguishes between propellants—designed for controlled thrust generation over a period—and explosives—designed for near-instantaneous energy release. Propellants include single, double, and triple-base configurations, as well as complex composite rocket motors. Explosives cover traditional blasting materials, demolition charges, and high-performance melt-cast and polymer-bonded formulations used in missile warheads.

Further analysis is conducted by application, where demand varies significantly based on military structure and operational needs. The Ammunition segment, encompassing small, medium, and large caliber rounds, represents the highest volume consumption, driven by training, readiness, and active conflict requirements. The Missiles & Rockets segment, however, drives demand for the highest performance and most technologically advanced propellants (solid fuel rockets) and explosives (advanced PBX warhead fillers). The third key segmentation focuses on the chemistry involved, which dictates the energy density, stability, and handling characteristics of the final product. Key chemistries include traditional nitrocellulose-based propellants and high-energy nitramines such like RDX and HMX, crucial for modern, compact warhead designs.

Understanding these segmentations is vital for manufacturers and strategic planners. For instance, countries focusing on conventional ground warfare will heavily prioritize the Ammunition segment, driving demand for lower-cost, high-volume propellants and TNT equivalents. Conversely, nations investing heavily in air superiority and strategic deterrents will prioritize the Missiles & Rockets segment, stimulating intense research and development in composite propellants and insensitive nitramine explosives. The market's future growth is heavily weighted toward high-performance segments capable of integration into smart munitions and long-range precision weapons.

- By Type:

- Propellants (Single-Base, Double-Base, Triple-Base, Composite Propellants, Liquid Propellants)

- Explosives (High Explosives, Low Explosives, Bulk Explosives, Insensitive Munitions Explosives)

- Pyrotechnics and Initiators (Flares, Smoke Generators, Detonators, Fuzes)

- By Application:

- Ammunition (Small Caliber, Medium Caliber, Large Caliber Artillery, Tank Ammunition)

- Missiles & Rockets (Tactical Missiles, Strategic Missiles, Anti-Tank Guided Missiles, Rocket Artillery)

- Naval Ordnance (Torpedoes, Depth Charges, Mines)

- Demolition and Specialized Charges

- By Chemistry:

- Nitrocellulose and Nitrates

- RDX (Cyclotrimethylenetrinitramine)

- HMX (Cyclotetramethylenetetranitramine)

- TNT (Trinitrotoluene) and Related Compounds

- PBX (Polymer Bonded Explosives)

- Composite Energetic Materials

Value Chain Analysis For Military Propellants and Explosives Market

The value chain for military propellants and explosives is complex, highly regulated, and involves multiple specialized stages, starting from the synthesis of raw chemical precursors through to the integration of the final energetic charge into a complete weapon system. The upstream segment is critical and involves the production of bulk chemical intermediates such as nitric acid, sulfuric acid, cellulose, ammonia, and specialized raw materials like nitramines and plasticizers. This stage is often vulnerable to global supply chain disruptions and price volatility, making vertical integration or long-term supply contracts essential for major manufacturers. Strict quality control at the precursor level is mandatory, as material purity directly impacts the final product’s stability and performance. Key upstream players often include specialized chemical companies and large petrochemical corporations.

The midstream segment is where the core manufacturing and conversion processes occur, including nitration, compounding, mixing, casting, pressing, and curing. This stage requires highly secured, specialized, and often government-owned or heavily regulated facilities due to the inherent dangers of handling energetic materials. Major defense contractors specializing in ordnance and tactical systems dominate this phase, converting raw chemicals into finished propellants (e.g., solid rocket motors, gun propellants) and explosive fillers (e.g., melt-cast explosives, PBX charges). Certification and qualification by military end-users are paramount, forming a significant barrier to entry, as the development and qualification cycle for a new energetic material can take many years.

The downstream segment involves the integration of the energetic materials into complete weapon systems, followed by distribution and end-user deployment. Defense primes assemble the final munitions, integrating the propellant charge, explosive warhead filler, fuse, and casing. Distribution channels are predominantly direct, involving long-term, classified contracts between the manufacturer and government defense agencies or national defense ministries. Indirect distribution is minimal and typically restricted to sales between allied nations under strict export controls (FMS – Foreign Military Sales). The entire downstream process includes rigorous storage, handling, transportation protocols, and, finally, stockpile management and eventual demilitarization/disposal. Direct channels ensure maximum security and traceability, essential for high-risk military assets.

Military Propellants and Explosives Market Potential Customers

The potential customers for the Military Propellants and Explosives Market are highly concentrated and consist almost exclusively of governmental entities and their authorized procurement agencies. The primary end-users are the Ministries of Defense (MoD) and armed forces (Army, Navy, Air Force) of sovereign nations, who require these materials for operational readiness, training, and strategic deterrence. These buyers are characterized by their large volume requirements, stringent quality specifications, and long-term contractual demands. Procurement often operates under complex tender processes and national security exemptions, focusing less on competitive pricing and more on certified reliability, compliance with international treaties (e.g., IM standards), and secure domestic supply assurance.

A secondary, yet rapidly growing, customer base includes intergovernmental defense organizations, most notably the North Atlantic Treaty Organization (NATO) Support and Procurement Agency (NSPA). These organizations facilitate joint procurement programs, standardization efforts, and bulk purchases on behalf of member states, particularly relevant for common ammunition types and standardized artillery charges. This centralization aims to achieve economies of scale and ensure interoperability across allied forces. Similarly, United Nations peacekeeping operations occasionally require specialized low-fragmentation or non-lethal pyrotechnics, though their conventional propellant/explosive requirements are sourced indirectly through contributing national forces.

Furthermore, state-owned defense industrial complexes, especially prevalent in nations like Russia, China, and India, act as major internal customers. While they often produce materials domestically, they still purchase specialized precursors, advanced manufacturing technology, and occasionally, high-end energetic compounds under license or directly from international suppliers to fill technological gaps or meet peak demand. The buying decision is always strategic, heavily influenced by geopolitical alignment, national industrial capacity goals, and immediate threat assessments, positioning these products as mission-critical, essential national assets rather than standard commodities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BAE Systems, General Dynamics Ordnance and Tactical Systems, Rheinmetall AG, Northrop Grumman Corporation, Eurenco, Chemring Group, Hanwha Corporation, Elbit Systems (IMI Systems), Nexter Group, NORINCO, PRONAL, MAXAM Corp, Ensign-Bickford Aerospace & Defense, Saab AB, Mesko S.A., L3Harris Technologies, Poongsan Corporation, DUPONT, Nammo AS, Tencate Advanced Armour. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Propellants and Explosives Market Key Technology Landscape

The technological landscape of military propellants and explosives is characterized by continuous evolution aimed at enhancing energy output, improving safety, and reducing the logistical footprint. The most significant advancement in recent decades has been the pervasive adoption of Insensitive Munitions (IM) technology. This encompasses both the chemical formulation (using less sensitive, yet high-performance energetic ingredients like advanced PBXs and specific nitramines) and the physical design of the ordnance, such as incorporating specialized casings and venting mechanisms to manage thermal and shock inputs without catastrophic explosion. LOVA (Low-Vulnerability Ammunition) propellants represent a critical technological subset, designed to burn rather than detonate when subjected to hostile fire, greatly increasing safety for personnel and stored ordnance.

Another major technological focus is on increasing the energy density of propellants for solid rocket motors. This involves complex composite formulations often utilizing novel binders, high-purity HMX or AP (Ammonium Perchlorate) components, and advanced manufacturing techniques like robotic casting and non-destructive testing. The aim is to achieve longer ranges and higher velocities for tactical and strategic missiles without increasing the overall volume or weight of the propulsion unit. Furthermore, the development of modular charge systems for large-caliber artillery allows military forces to adapt the range and trajectory of shells quickly in the field, moving away from complex, bulky bagged charge systems toward standardized, stackable modules, which relies heavily on high-precision, low-variation propellant production.

Digitalization is increasingly influencing manufacturing technology, moving beyond simple automation. Advanced technologies now include continuous flow chemistry (CFC) for synthesizing precursors more safely and efficiently, and the integration of advanced process controls and simulation software (digital twins) for manufacturing facilities. These tools allow for precise control over crystallization rates, particle size distribution, and curing processes, all critical factors determining the performance and stability of the final energetic material. The combination of IM compliance, enhanced energy density, and smart manufacturing techniques defines the competitive edge in the modern military propellants and explosives sector.

Regional Highlights

Geographically, the Military Propellants and Explosives Market exhibits distinct characteristics across major regions, driven by disparate defense spending levels, geopolitical climates, and technological investment priorities.

- North America: Dominates the market, primarily fueled by the massive defense budget of the United States. The region is a leader in high-end technological development, focusing heavily on Insensitive Munitions (IM) standards, solid rocket motor propulsion for strategic assets, and R&D into exotic energetic materials. Procurement is steady, involving long-term contracts for both replenishment and new weapon system integration.

- Europe: Experiencing revitalized growth, particularly since 2022, as NATO members increase defense spending to meet the 2% GDP target. The focus is on rapidly replenishing depleted artillery and missile stocks (especially 155mm ammunition) and investing in next-generation missile defense and short-range tactical weapon systems. Key regional players like Rheinmetall and Eurenco are seeing significant order backlogs.

- Asia Pacific (APAC): Projected to be the fastest-growing region, driven by the massive military modernization programs in China, India, and South Korea, coupled with intensifying territorial disputes (e.g., South China Sea, Taiwan Strait). Demand is strong across all segments, from small arms to strategic missile propulsion systems. Domestic production capacity expansion is a central theme in key national defense strategies.

- Middle East & Africa (MEA): Growth is driven by internal conflicts, regional rivalries (e.g., Saudi Arabia, UAE, Iran), and reliance on imports for advanced ordnance. While procurement is significant, it is highly dependent on Foreign Military Sales (FMS) from North America and Europe, focusing on maintaining existing missile and air defense inventories.

- Latin America: Represents a smaller, more fragmented market characterized by low defense budgets and limited high-tech procurement. Demand is focused mainly on conventional small arms ammunition and maintenance of older weapon systems. Local production capabilities are often limited.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Propellants and Explosives Market.- BAE Systems

- General Dynamics Ordnance and Tactical Systems

- Rheinmetall AG

- Northrop Grumman Corporation

- Eurenco

- Chemring Group

- Hanwha Corporation

- Elbit Systems (IMI Systems)

- Nexter Group

- China North Industries Group Corporation (NORINCO)

- PRONAL

- MAXAM Corp

- Ensign-Bickford Aerospace & Defense

- Saab AB

- Mesko S.A.

- L3Harris Technologies

- Poongsan Corporation

- DUPONT

- Nammo AS

- Tencate Advanced Armour

Frequently Asked Questions

Analyze common user questions about the Military Propellants and Explosives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Insensitive Munitions (IM) technology and why is it important?

Insensitive Munitions (IM) technology refers to the design and chemical formulation of propellants and explosives to prevent unintended detonation when subjected to external stimuli like heat, shock, or bullet impact. It is crucial because IM significantly enhances the safety of military personnel, reduces collateral damage, and improves the survivability of ordnance during transportation and storage, making it a mandatory requirement for modern weapon procurement globally.

How does geopolitical instability influence the market demand for energetic materials?

Geopolitical instability is the primary demand driver, leading sovereign nations to increase defense budgets for modernization, rapid strategic stockpiling, and replenishment of expended inventories during active conflicts. Increased tensions directly translate into higher procurement volumes for ammunition, missile propellants, and warhead fillers, ensuring steady market growth.

Which segment holds the largest volume share in the Military Propellants and Explosives Market?

The Ammunition segment holds the largest volume share. This segment encompasses small, medium, and large caliber rounds required for extensive military training, base defense, and ground combat operations. Although the Missiles & Rockets segment requires the highest energy-density materials, ammunition represents the essential, high-volume baseline demand for all global armed forces.

What are the main regulatory constraints affecting the manufacturing of propellants and explosives?

The main constraints are stringent Environmental, Health, and Safety (EHS) regulations. These rules govern the handling, production, storage, and disposal of toxic or hazardous materials. Furthermore, international conventions and national safety mandates, especially regarding the shift away from highly toxic ingredients and towards IM-compliant formulations, restrict operational flexibility and increase compliance costs.

How are RDX and HMX different from traditional military explosives?

RDX (Cyclotrimethylenetrinitramine) and HMX (Cyclotetramethylenetetranitramine) are nitramines, offering significantly higher energy density and stability compared to traditional military explosives like TNT. HMX, in particular, is the core ingredient in most high-performance, polymer-bonded explosives (PBXs) used in modern missile warheads, providing superior destructive power while enhancing insensitivity when properly formulated.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager