Military Thermal Weapon Sights Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440400 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Military Thermal Weapon Sights Market Size

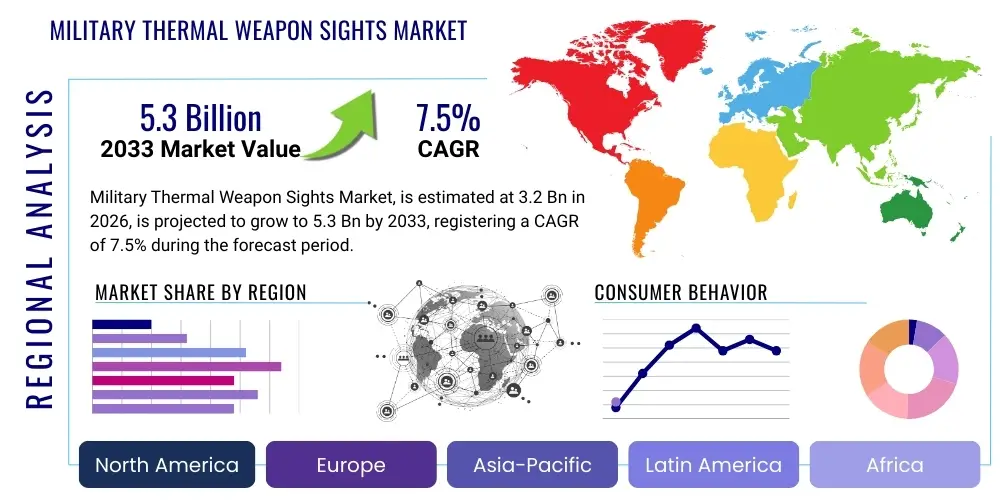

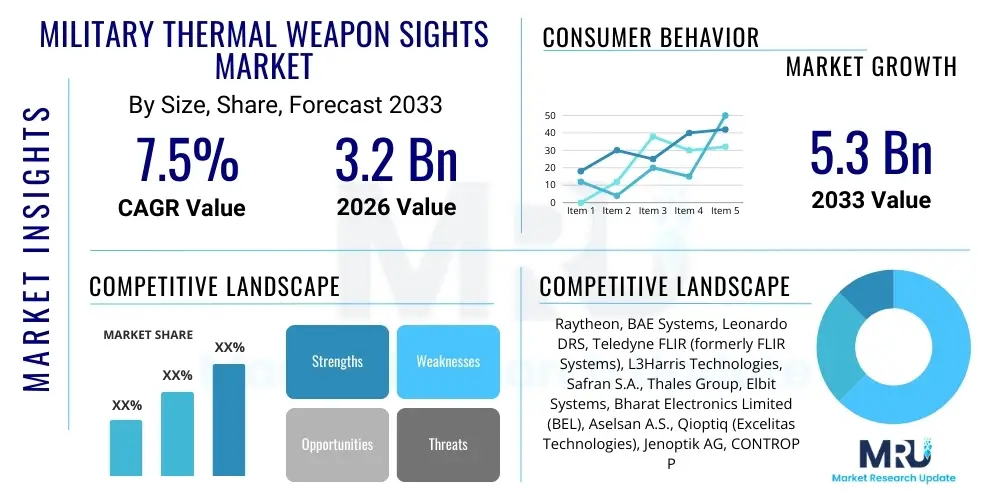

The Military Thermal Weapon Sights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.3 Billion by the end of the forecast period in 2033.

Military Thermal Weapon Sights Market introduction

The Military Thermal Weapon Sights Market encompasses the design, development, manufacturing, and deployment of advanced electro-optical devices that leverage infrared technology to detect heat signatures, enabling soldiers to operate effectively in low-light conditions, darkness, smoke, fog, and camouflage. These sophisticated systems provide a distinct tactical advantage by enhancing situational awareness, target acquisition, and engagement capabilities across diverse operational environments. Primarily, these sights are mounted on various small arms, crew-served weapons, and even some vehicle-mounted platforms, serving as critical tools for modern warfare and surveillance.

The core product in this market is a thermal imager integrated into a weapon sight, capable of converting infrared radiation emitted by objects into a visual image, thereby allowing for detection of targets irrespective of ambient light. Major applications span across infantry operations, special forces missions, border security, counter-terrorism, and reconnaissance activities, offering unparalleled visibility where traditional night vision devices might be hindered. Benefits include improved accuracy, enhanced target discrimination against cluttered backgrounds, and the ability to detect heat sources concealed by foliage or adverse weather, significantly augmenting a soldier's lethality and survivability.

Driving factors for market expansion include the continuous modernization efforts by global defense forces, increasing geopolitical instabilities necessitating advanced surveillance and targeting capabilities, and significant investments in research and development to integrate cutting-edge technologies like artificial intelligence and sensor fusion. The demand for superior battlefield performance and the imperative to maintain technological superiority against adversaries further propel market growth, as militaries seek to equip their personnel with the most effective tools for contemporary and future conflicts.

Military Thermal Weapon Sights Market Executive Summary

The Military Thermal Weapon Sights Market is experiencing robust growth, driven by escalating defense expenditures globally and the persistent need for technological superiority in modern warfare. Current business trends indicate a strong emphasis on miniaturization, enhanced resolution, extended battery life, and the integration of these sights with broader battlefield management systems. Manufacturers are focusing on developing multi-spectral imaging capabilities that combine thermal with other sensor data, offering a more comprehensive situational picture to the operator. This trend is also fostering strategic partnerships and collaborations between traditional defense contractors and specialized electro-optics firms, aiming to accelerate innovation and market penetration.

Regionally, North America and Europe continue to dominate the market, largely due to established defense industries, substantial R&D investments, and ongoing procurement programs for advanced military hardware. However, the Asia Pacific region is rapidly emerging as a significant growth hub, propelled by increasing defense budgets, rising geopolitical tensions, and ambitious military modernization initiatives in countries like China, India, and South Korea. Latin America and the Middle East and Africa regions are also showing steady growth, driven by internal security concerns, counter-insurgency operations, and the replacement of aging equipment.

Segmentation trends highlight a growing preference for uncooled thermal weapon sights due to their lower cost, reduced power consumption, and absence of cryogenic coolers, making them ideal for a wider range of infantry applications. Concurrently, advancements in cooled thermal technology continue to push the boundaries of range and resolution, maintaining their crucial role in high-end surveillance and long-range targeting systems. The market is also witnessing increased demand for sights with embedded ballistic calculators, laser rangefinders, and wireless connectivity, transforming them from standalone devices into integral components of a networked soldier system, thereby enhancing operational effectiveness and data sharing capabilities on the battlefield.

AI Impact Analysis on Military Thermal Weapon Sights Market

User questions regarding AI's impact on Military Thermal Weapon Sights frequently revolve around its potential to revolutionize target detection, enhance soldier effectiveness, and address ethical considerations. Common inquiries explore how AI can improve target recognition accuracy, reduce cognitive load on operators, and enable more rapid decision-making in complex environments. There are also significant concerns about the implications of AI-driven autonomous targeting, the reliability of AI in diverse combat scenarios, and the cybersecurity risks associated with integrating sophisticated AI algorithms into military hardware. Users anticipate AI will significantly boost operational capabilities but also seek assurances regarding responsible development and deployment, alongside a clear understanding of its limitations and human oversight requirements.

- AI algorithms significantly enhance automated target detection and classification, reducing human error and reaction time.

- Integration of AI facilitates sensor fusion, combining thermal data with visible light, radar, and LiDAR for comprehensive situational awareness.

- Predictive analytics powered by AI can forecast potential threats and target movements, offering preemptive tactical advantages.

- AI enables adaptive image processing, optimizing thermal imagery in real-time for varying environmental conditions and obscurants.

- Augmented reality (AR) overlays, driven by AI, can provide real-time tactical information, ballistic solutions, and target identification directly in the soldier's field of view.

- AI-driven systems can learn from battlefield data, continually improving their performance in identifying combatants, non-combatants, and specific threat types.

- Potential for AI to reduce cognitive burden on soldiers by autonomously tracking multiple targets and highlighting critical information.

- Facilitates intelligent power management, optimizing battery life by adapting processing intensity based on operational requirements.

- Enables advanced ballistic compensation, using AI to factor in environmental variables for highly accurate shot placement.

- Supports advanced threat identification by differentiating between various heat signatures, including distinguishing between vehicles and personnel, or even specific types of equipment.

- AI can contribute to proactive maintenance schedules by monitoring sensor performance and predicting component failures.

- Integration with networked soldier systems allows for AI-assisted sharing of target data and situational updates across units.

DRO & Impact Forces Of Military Thermal Weapon Sights Market

The Military Thermal Weapon Sights market is significantly shaped by a confluence of driving forces, restraining factors, and emerging opportunities, all interacting to exert powerful impacts on its trajectory. Key drivers include the pervasive global increase in defense spending, driven by heightened geopolitical tensions and regional conflicts, necessitating military forces to upgrade their capabilities with advanced night vision and all-weather operational tools. The continuous push for modernization of existing military equipment, coupled with the strategic imperative to achieve battlefield superiority, further propels demand. Technological advancements in thermal imaging, such as improved detector sensitivity, higher resolution, and reduced size, weight, and power (SWaP) consumption, also act as strong market accelerators, making these devices more effective and accessible.

Conversely, several restraints impede the market's full potential. The high acquisition cost associated with advanced thermal weapon sights, particularly for cooled systems, presents a significant barrier for some nations with more constrained defense budgets. Strict export controls and regulatory frameworks imposed by leading technology-producing countries limit global proliferation, often requiring complex compliance procedures and governmental approvals. Furthermore, ethical concerns surrounding the use of advanced targeting technologies, especially those with AI integration, and the potential for unintended civilian casualties, contribute to public and political scrutiny, affecting procurement decisions and R&D directions. The long procurement cycles inherent in defense contracting also introduce delays and uncertainties for manufacturers.

However, substantial opportunities lie in the ongoing miniaturization and integration of thermal sights into multi-sensor platforms, creating more versatile and compact solutions for soldiers. The proliferation of sensor fusion technologies, combining thermal with visible light, laser, and other spectral bands, promises enhanced target discrimination and situational awareness, opening new avenues for product development. Moreover, the increasing adoption of AI and Internet of Things (IoT) principles within military systems offers avenues for smarter, networked sights capable of predictive analysis and real-time data sharing. Emerging markets in Asia Pacific, Latin America, and the Middle East, with their growing defense budgets and increasing focus on internal and border security, represent untapped potential for market expansion, provided manufacturers can navigate regional complexities and supply chain demands. These drivers, restraints, and opportunities collectively create a dynamic competitive landscape, influencing investment decisions, technological priorities, and market access strategies for key players.

Segmentation Analysis

The Military Thermal Weapon Sights market is broadly segmented based on technology, platform, application, and end-user, reflecting the diverse operational requirements and technological capabilities within the defense sector. This segmentation helps to understand the specific market dynamics influencing each category and allows for targeted product development and market penetration strategies. Each segment addresses distinct needs, from the fundamental operational environment to the specific military branch utilizing the equipment, providing a granular view of the market landscape and enabling stakeholders to identify precise growth areas and competitive advantages.

- By Technology

- Cooled Thermal Weapon Sights

- Uncooled Thermal Weapon Sights

- By Platform

- Handheld Sights

- Weapon Mounted Sights

- Vehicle Mounted Sights

- Airborne Sights

- By Application

- Targeting

- Surveillance & Reconnaissance

- Search & Rescue

- Border Security

- By End-User

- Army

- Navy

- Air Force

- Special Forces

- Homeland Security

Value Chain Analysis For Military Thermal Weapon Sights Market

The value chain for the Military Thermal Weapon Sights market is complex and highly specialized, beginning with sophisticated upstream component suppliers and extending through intricate manufacturing, integration, and distribution networks. Upstream activities involve the research, development, and production of critical components such as infrared detectors (microbolometers for uncooled, and various semiconductor-based detectors for cooled systems), high-performance optical lenses, image processing units, microdisplays, and power management systems. These components often require advanced materials and precision engineering, making this stage highly capital-intensive and reliant on specialized expertise from a limited number of global suppliers.

Midstream in the value chain, original equipment manufacturers (OEMs) and defense contractors are responsible for the assembly, integration, and rigorous testing of these components into a complete thermal weapon sight system. This stage involves complex optical design, electronic integration, ruggedization for military environments, and adherence to stringent military specifications and standards. Value-added activities here include software development for image enhancement, ballistic calculations, and connectivity features. Manufacturers often work closely with military end-users during the development phase to ensure products meet specific operational requirements, leading to customized solutions and extended development cycles.

Downstream activities focus on the distribution and sale of these finished products. The primary distribution channel for military thermal weapon sights is direct sales to government defense ministries, national armies, navies, air forces, and special operations commands, often facilitated through large defense prime contractors acting as system integrators. Indirect channels might involve sales through authorized defense distributors or agents who manage procurement processes and provide localized support. Post-sales services, including maintenance, repair, overhaul, and training, are critical components of the value chain, ensuring the longevity and effectiveness of these high-value assets throughout their operational lifespan and generating significant revenue streams for manufacturers. The entire chain is heavily influenced by geopolitical factors, national defense policies, and international arms trade regulations.

Military Thermal Weapon Sights Market Potential Customers

The primary potential customers for Military Thermal Weapon Sights are national defense organizations and their various specialized units across the globe. These include the Army, which requires thermal sights for infantry small arms, crew-served weapons, and mounted applications on combat vehicles, crucial for operations in diverse terrains and conditions where visibility is limited. The need for enhanced situational awareness during night operations, reconnaissance, and direct engagement drives procurement decisions for land forces, with a focus on ruggedness, reliability, and ease of use in harsh combat environments. Special Operations Forces (SOF) represent a particularly high-demand segment, often requiring the most advanced, compact, and high-performance thermal imaging solutions for clandestine missions and specialized tactical operations.

Beyond land forces, the Navy and Air Force also constitute significant end-users, albeit with different specific requirements. Naval forces utilize thermal sights for maritime security, coastal surveillance, and force protection, particularly on patrol boats and larger vessels to detect small crafts or individuals in low visibility. Air Force applications, while less direct for weapon sights, may involve specialized ground units, security forces, or integration with airborne platforms for certain surveillance or targeting roles. Border security agencies and national homeland security departments also increasingly procure thermal weapon sights for perimeter defense, counter-insurgency, and law enforcement operations, especially in regions prone to illicit cross-border activities or domestic threats. Their requirements often mirror those of military ground forces, emphasizing robust performance and rapid deployment.

Procurement processes for these end-users are typically governed by national defense budgets, long-term strategic defense plans, and often competitive bidding processes managed by government procurement agencies. The decisions are heavily influenced by geopolitical dynamics, perceived threat levels, and the ongoing modernization cycles of military equipment. Emerging markets, driven by rising defense spending and a focus on upgrading legacy systems, also represent a growing customer base. Factors such as interoperability with existing equipment, system reliability, post-sales support, and training programs are critical considerations for potential buyers, in addition to the core technical specifications of the thermal sights themselves.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Raytheon, BAE Systems, Leonardo DRS, Teledyne FLIR (formerly FLIR Systems), L3Harris Technologies, Safran S.A., Thales Group, Elbit Systems, Bharat Electronics Limited (BEL), Aselsan A.S., Qioptiq (Excelitas Technologies), Jenoptik AG, CONTROP Precision Technologies Ltd., Opgal Optronic Industries Ltd., Rheinmetall AG, Northrop Grumman, HENSOLDT AG, SCD – SemiConductor Devices, Excelitas Technologies, Leupold & Stevens |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Thermal Weapon Sights Market Key Technology Landscape

The technological landscape of the Military Thermal Weapon Sights market is characterized by rapid advancements aimed at enhancing performance, reducing size, weight, and power (SWaP), and improving integration capabilities. A significant area of focus is on detector technology, with ongoing improvements in the sensitivity, resolution, and pixel pitch of both cooled and uncooled infrared detectors. For uncooled systems, advancements in microbolometer technology have led to smaller, more power-efficient sensors with higher thermal sensitivity (NETD - Noise Equivalent Temperature Difference), enabling clearer images and longer detection ranges for handheld and infantry weapon sights. Cooled detectors, typically used for longer-range and higher-performance applications, benefit from improved cryogenic coolers and quantum well infrared photodetectors (QWIPs), pushing the boundaries of detection and identification capabilities.

Another critical area of innovation is image processing and algorithms. Manufacturers are leveraging powerful digital signal processors (DSPs) and custom-designed ASICs (Application-Specific Integrated Circuits) to implement advanced image enhancement algorithms that reduce noise, improve contrast, and provide clearer imagery in challenging conditions like heavy smoke or fog. These algorithms are crucial for feature recognition, target identification, and reducing operator fatigue. The integration of sensor fusion technologies is also paramount, combining thermal imaging with visible light, image intensification, laser rangefinders, and GPS data to create a comprehensive, multi-spectral view of the battlespace. This fused data provides superior situational awareness and target discrimination, overcoming the limitations of single-sensor systems and offering a more robust operational picture.

Furthermore, the market is witnessing significant developments in optics, power management, and human-machine interface (HMI). Advanced optical materials and design techniques are yielding lighter, more compact lenses with wider fields of view and improved light transmission. Battery technology is evolving to provide longer operational durations with smaller, lighter power packs, which is critical for dismounted soldiers. Ergonomic design, intuitive controls, and integration with helmet-mounted displays or augmented reality systems are enhancing the user experience and combat effectiveness. Connectivity solutions, including secure wireless protocols, enable seamless data sharing with networked soldier systems and battlefield management platforms, transforming thermal sights from standalone tools into integral components of a cohesive digital combat ecosystem, thereby multiplying their tactical utility and operational impact.

Regional Highlights

- North America: This region holds a dominant share of the Military Thermal Weapon Sights market, primarily driven by the United States' robust defense budget, continuous military modernization programs, and significant investments in advanced defense technologies. Key players and R&D centers are concentrated here, leading innovation in detector technology, sensor fusion, and AI integration.

- Europe: A strong market driven by ongoing military modernization efforts, rising defense spending among NATO members, and the need to counter evolving security threats. Countries like the UK, France, Germany, and Italy are significant consumers, focusing on sophisticated, interoperable thermal imaging systems for their armed forces.

- Asia Pacific (APAC): Emerging as the fastest-growing market due to escalating defense budgets in countries like China, India, Japan, and South Korea. Geopolitical tensions, border disputes, and the focus on enhancing night-fighting capabilities are key drivers. The region is also becoming a hub for local manufacturing and technology development.

- Latin America: This market is characterized by steady growth, primarily driven by internal security challenges, border control requirements, and counter-narcotics operations. Countries such as Brazil, Mexico, and Colombia are investing in thermal weapon sights to equip their military and law enforcement agencies for effective surveillance and engagement in diverse environments.

- Middle East and Africa (MEA): Marked by significant defense spending fueled by regional conflicts, internal security threats, and counter-terrorism operations. Countries like Saudi Arabia, UAE, and Israel are major purchasers of advanced thermal imaging technology to maintain regional military superiority and enhance operational capabilities against insurgent forces.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Thermal Weapon Sights Market.- Raytheon Company

- BAE Systems Plc

- Leonardo DRS Inc.

- Teledyne FLIR (formerly FLIR Systems Inc.)

- L3Harris Technologies Inc.

- Safran S.A.

- Thales Group

- Elbit Systems Ltd.

- Bharat Electronics Limited (BEL)

- Aselsan A.S.

- Qioptiq (Excelitas Technologies)

- Jenoptik AG

- CONTROP Precision Technologies Ltd.

- Opgal Optronic Industries Ltd.

- Rheinmetall AG

- Northrop Grumman Corporation

- HENSOLDT AG

- SCD – SemiConductor Devices

- Excelitas Technologies Corp.

- Leupold & Stevens, Inc.

Frequently Asked Questions

What are the primary benefits of military thermal weapon sights?

Military thermal weapon sights offer significant advantages by enabling detection of heat signatures in complete darkness, smoke, fog, and camouflage. They enhance target acquisition, improve situational awareness, and provide a critical tactical edge in adverse conditions, leading to increased soldier effectiveness and safety.

How does AI impact the performance of military thermal sights?

AI significantly enhances thermal sights by enabling automated target detection and classification, improving image processing for clearer visuals, facilitating sensor fusion with other data, and offering predictive analytics. This reduces cognitive load on operators and increases the accuracy and speed of decision-making.

What is the difference between cooled and uncooled thermal weapon sights?

Cooled thermal sights use cryogenic coolers to reduce sensor temperature, offering higher sensitivity, longer detection ranges, and superior image quality, typically at a higher cost. Uncooled sights operate at ambient temperatures, are more compact, consume less power, and are more affordable, making them suitable for widespread infantry use, albeit with shorter ranges.

Which regions are leading the growth in the Military Thermal Weapon Sights market?

North America and Europe currently dominate the market due to high defense spending and advanced technological infrastructure. However, the Asia Pacific region is experiencing the fastest growth, driven by increasing defense budgets, military modernization efforts, and regional geopolitical tensions.

What are the key technological advancements expected in military thermal weapon sights?

Future advancements include further miniaturization and SWaP reduction, enhanced sensor fusion with multi-spectral imaging, deeper integration of AI for advanced analytics and autonomous capabilities, improved power management for extended battery life, and seamless connectivity with networked soldier systems for real-time data sharing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager