Milk and Butter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433956 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Milk and Butter Market Size

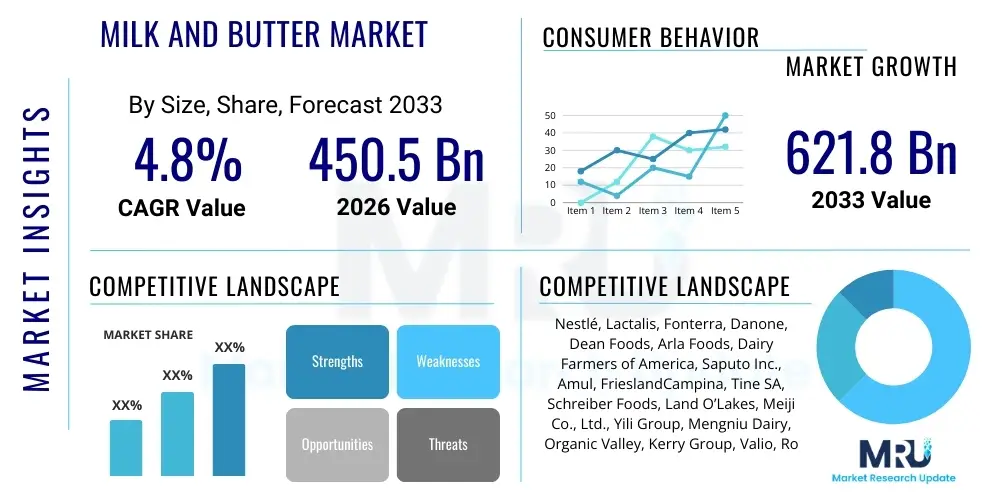

The Milk and Butter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 621.8 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by rising global population, increasing disposable income in emerging economies leading to higher consumption of dairy products, and continuous innovation in product offerings, including lactose-free, fortified, and organic variants of both milk and butter. The market structure remains competitive, characterized by established international conglomerates and strong regional cooperatives vying for market share through strategic acquisitions and product diversification focused on health and sustainability attributes.

The valuation reflects robust demand resilience, even amidst fluctuating raw milk prices and stringent environmental regulations concerning dairy farming. Developed regions, particularly North America and Europe, exhibit stable, mature consumption patterns, focusing heavily on premiumization and value-added products like specialized cheeses and high-fat artisanal butters. Conversely, the Asia Pacific region is expected to be the primary engine of growth, driven by rapid urbanization, Westernization of diets, and significant investments in modernizing the cold chain infrastructure necessary for widespread dairy distribution. The shift towards packaged and processed dairy products, replacing traditional loose milk sales, further contributes significantly to the formal market size increase.

Milk and Butter Market introduction

The Milk and Butter Market encompasses the production, processing, distribution, and consumption of liquid milk and various derived dairy products, with a specific focus on butter manufacturing. This sector is a foundational component of the global food industry, providing essential nutrients and catering to diverse culinary needs across the globe. Liquid milk, available in whole, reduced-fat, skim, and specialty formulations (e.g., organic, A2, fortified), serves as a staple beverage, while butter—a dairy product made by churning fresh or fermented cream—is indispensable in baking, cooking, and as a spread. The market's stability is underpinned by its critical role in nutrition and its deep integration into global dietary habits, spanning everyday consumer goods to highly specialized industrial food inputs.

Major applications for milk include direct consumption, the production of secondary dairy products such as yogurt, cheese, ice cream, and the utilization of milk powders in confectionaries, infant formula, and nutritional supplements. Butter’s applications are equally diverse, extending from household use to large-scale operations in the food service sector, encompassing pastries, sauces, and ready-to-eat meals, driven by its desirable texture, flavor profile, and functional properties. Key benefits driving market demand include the inherent nutritional value—providing calcium, protein, vitamins D and B12—and the versatility of these products in food preparation, which supports both traditional and innovative dietary trends. The perception of dairy as a wholesome and essential food group maintains its central position in consumer baskets globally.

Driving factors propelling market expansion include sustained population growth, particularly in emerging economies, alongside significant improvements in dairy processing technologies that extend shelf life and ensure food safety across long supply chains. Furthermore, proactive marketing emphasizing the health benefits of dairy, coupled with the introduction of lactose-free and plant-based alternatives that broaden the consumer base, contributes significantly. Regulatory standardization and the increasing requirement for certified and traceable dairy products are also professionalizing the market, encouraging larger, more efficient players and fostering consumer trust, which collectively contributes to the market's consistent upward trajectory across all segments.

Milk and Butter Market Executive Summary

The Milk and Butter Market is characterized by robust business trends focusing on sustainability, premiumization, and digital transformation, driving efficiency in production and enhancing consumer transparency. Key business trends include the consolidation of farming operations into larger, industrialized units to achieve economies of scale, heavy investment in climate-smart agriculture practices to mitigate environmental impacts (such as methane emissions), and the rapid adoption of processing technologies like ultra-high temperature (UHT) treatment to facilitate long-distance distribution. Furthermore, companies are increasingly leveraging mergers and acquisitions to expand geographic reach and diversify product portfolios, especially towards high-margin, functional dairy products and novel delivery formats, while navigating evolving consumer preferences regarding animal welfare and ethical sourcing.

Regionally, the market exhibits divergent growth trajectories; Asia Pacific leads in volume growth due to increasing urbanization and rising per capita dairy consumption, supported by governmental initiatives promoting milk consumption in countries like India and China. North America and Europe, while mature, emphasize innovation in specialized dairy (e.g., grass-fed butter, single-source milk) and strong demand for value-added dairy derivatives used in the sports nutrition and aging population segments. Latin America and MEA are experiencing growth fueled by expanding middle classes and improving cold chain logistics, making packaged milk and butter more accessible to mass populations, though political and economic instability remains a risk factor affecting localized market dynamics and consumer spending power.

Segmentation trends highlight a pronounced shift towards diversification, moving beyond conventional products. The liquid milk segment sees significant traction in A2 milk and lactose-free offerings, addressing intolerance concerns and perceived digestive benefits. In the butter category, demand for unsalted and organic butter is rising, catering to health-conscious consumers and professional chefs seeking higher quality ingredients. Distribution channels are undergoing a transformation, with online retail (e-commerce) showing the fastest growth rate, especially for premium and long shelf-life products, complementing the enduring dominance of large supermarkets and hypermarkets which continue to serve as the primary retail touchpoints for staple dairy goods.

AI Impact Analysis on Milk and Butter Market

Common user questions regarding AI's impact on the Milk and Butter Market often center on how AI can optimize farm-to-shelf operations, improve animal welfare, and enhance predictive capabilities concerning market demand and supply chain risks. Users inquire about AI applications in precision dairy farming, specifically targeting areas such as automated disease detection, yield forecasting, and maximizing feed efficiency. Concerns frequently revolve around the initial high capital expenditure required for implementation, the need for skilled labor to manage AI systems, and the ethical implications of data privacy collected from livestock and farming practices. The overall expectation is that AI will be a transformative force, enabling dairy producers to achieve greater sustainability, reduce waste, and ensure the consistent quality of milk and butter products distributed globally.

- AI-powered predictive maintenance minimizes equipment downtime in processing plants, increasing overall yield efficiency.

- Precision dairy farming utilizes machine learning algorithms for real-time monitoring of cow health, nutrition, and reproductive cycles, optimizing milk output.

- Demand forecasting models driven by AI improve inventory management, significantly reducing spoilage and waste across the cold chain for perishable milk products.

- Automated quality control systems, utilizing computer vision and AI analysis, detect contaminants or deviations in milk composition faster than traditional testing methods.

- Supply chain optimization through AI algorithms determines the most efficient routes and storage conditions, crucial for maintaining butter and liquid milk quality during transit.

- Consumer sentiment analysis using AI helps dairy companies rapidly adapt marketing strategies and product formulations to address emerging dietary trends (e.g., grass-fed, ethical sourcing).

DRO & Impact Forces Of Milk and Butter Market

The Milk and Butter Market dynamics are shaped by a complex interplay of Drivers, Restraints, Opportunities, and external Impact Forces. Key drivers include rising global disposable incomes and the increasing awareness of the nutritional benefits associated with dairy consumption, specifically the high-quality protein and essential micronutrients found in milk and butter. Opportunities are abundant in the development of functional dairy products, such as those fortified with vitamins or probiotics, and the expansion into new geographic territories characterized by under-penetrated dairy markets. Conversely, the market faces significant restraints, notably the volatility of raw milk prices influenced by climatic conditions and feed costs, and growing consumer shifts towards non-dairy alternatives due to environmental or ethical concerns, creating competitive pressure across all product lines.

Impact forces exert substantial influence on market performance and stability. Government regulations pertaining to food safety, milk composition standards, and environmental protection (e.g., managing water usage and manure) dictate operational costs and market access. Geopolitical instability and trade disputes frequently affect global dairy commodity flows, impacting export-oriented producers and influencing localized pricing structures. Furthermore, technological innovation, especially in extending the shelf life of liquid milk (like UHT) and developing advanced packaging solutions, acts as a pivotal force enabling market expansion into previously inaccessible regions, transforming cold chain requirements and distribution models across the global dairy ecosystem.

The market must also contend with the macro impact force of climate change, which directly threatens feed availability and affects cattle productivity, necessitating significant investments in climate-resilient farming practices. Simultaneously, the persistent consumer demand for transparency regarding product origin and sustainability practices compels industry players to adopt robust traceability systems and achieve certifications, which, while beneficial for consumer trust, introduce complexity and additional compliance costs, impacting the final cost structure of both milk and butter products across retail and industrial segments.

Segmentation Analysis

The Milk and Butter Market segmentation provides a granular view of demand patterns, production methods, and distribution channels, enabling strategic market positioning. The market is primarily segmented based on Source (Cow Milk, Buffalo Milk, Goat Milk, others), Product Type (Liquid Milk, Milk Powder, Flavored Milk; Salted Butter, Unsalted Butter, Ghee), Fat Content, Distribution Channel (Online Retail, Hypermarkets, Convenience Stores), and End-User (Household, Food Service, Industrial). Analyzing these segments reveals that while cow milk dominates globally due to its established infrastructure and volume output, specialty milk sources, particularly goat and A2 cow milk, are capturing niche, high-value segments due to perceived health benefits and ease of digestion among certain consumer groups.

Within the Product Type segmentation, Liquid Milk remains the largest segment by volume, but the fastest growth is observed in value-added derivatives like Milk Powder, driven by demand from the infant nutrition sector and its utility in industrial food manufacturing due to its extended shelf life. The butter market is undergoing a transition where premium, artisanal, and organic unsalted butter commands higher prices in developed markets, while traditional products like Ghee (clarified butter) maintain strong cultural importance and steady demand in Asia, underlining the regional diversity in product preference and preparation habits.

- By Source: Cow Milk, Buffalo Milk, Goat Milk, Sheep Milk, Others (Camel, Yak).

- By Product Type (Milk): Liquid Milk (Whole Milk, Skimmed Milk, Semi-Skimmed Milk, Lactose-Free Milk, A2 Milk), Condensed Milk, Milk Powder (Skimmed Milk Powder, Whole Milk Powder), Flavored Milk.

- By Product Type (Butter): Salted Butter, Unsalted Butter, Clarified Butter (Ghee), Cultured Butter, Spreads.

- By Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Direct Sales.

- By End-Use Application: Household/Retail Consumption, Food Service Industry (Restaurants, Cafes), Food Manufacturing Industry (Confectionery, Bakery, Sauces).

Value Chain Analysis For Milk and Butter Market

The Milk and Butter value chain is complex and capital-intensive, starting with upstream activities involving dairy farming and raw milk collection. Upstream analysis focuses on livestock management, feed production, and immediate chilling facilities at the farm gate. Efficiency at this stage is crucial, as raw milk quality and cost directly influence the profitability of the entire chain. Investments in genetics, veterinary care, and precision agriculture technologies are vital to ensure high milk yields and adherence to stringent quality parameters before transportation to the processing centers, establishing the foundational input quality for all subsequent dairy derivatives.

The midstream involves extensive processing, manufacturing, and packaging, transforming raw milk into pasteurized liquid milk, powdered milk, and churning cream into various butter forms (salted, unsalted, ghee). This stage requires sophisticated machinery, significant energy consumption, and adherence to global food safety standards (HACCP, ISO 22000). Downstream analysis focuses on logistics, distribution, and retail, where maintaining the cold chain is paramount for the integrity of highly perishable products. The distribution channel network includes direct sales to industrial customers, large volume sales through hypermarkets, and increasingly, direct-to-consumer models facilitated by e-commerce platforms.

Distribution channels exhibit a dual structure: direct channels facilitate the supply of large volumes of processed ingredients (e.g., milk powder, industrial butter blocks) directly to food manufacturers and large institutional buyers, ensuring transactional efficiency. Indirect channels involve wholesalers, distributors, and various retail formats—including supermarkets, convenience stores, and specialized dairy shops—which are necessary to reach the vast and fragmented consumer base. The rise of online retail acts as a hybrid channel, offering convenience and potentially bypassing traditional intermediaries for specialty or premium dairy goods, optimizing market reach while demanding reliable last-mile refrigerated logistics to preserve product quality.

Milk and Butter Market Potential Customers

The primary end-users and buyers of Milk and Butter products span across three major categories: household consumers, the food service sector, and the industrial manufacturing segment, each exhibiting distinct purchasing behaviors and needs. Household consumers represent the largest volume buyer, purchasing liquid milk as a staple beverage and butter for domestic cooking and spreading, driven by factors like price, brand loyalty, perceived nutritional value (e.g., low fat, high protein), and convenience of packaging. The increasing number of nuclear families and rising health consciousness dictate preferences towards specialized products such as organic milk and fortified options.

The food service sector, encompassing restaurants, hotels, cafes, bakeries, and institutional kitchens (schools, hospitals), is a vital segment focused on bulk procurement and consistent quality. These buyers prioritize industrial-grade butter for baking and cooking functionality (texture and melting point), along with high volumes of liquid milk for beverages like coffee and tea. Their demand is highly sensitive to price fluctuations and requires reliable, timely delivery from distributors, necessitating robust B2B logistical support tailored to the high turnover and specific quality requirements of professional culinary environments.

The industrial manufacturing segment serves as a crucial purchaser of milk derivatives, particularly milk powders (WMP/SMP) and anhydrous milk fat (AMF) used as ingredients in secondary processing. This includes manufacturers of infant formula, confectionery (chocolates, candies), ready-to-eat meals, and specialized nutritional supplements. Their purchasing decisions are driven by ingredient functionality, technical specifications (e.g., protein content, solubility), and cost-effectiveness for large-scale integration into complex formulations, requiring long-term supply contracts and strict quality certifications from their dairy suppliers to ensure compliance with end-product standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 621.8 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé, Lactalis, Fonterra, Danone, Dean Foods, Arla Foods, Dairy Farmers of America, Saputo Inc., Amul, FrieslandCampina, Tine SA, Schreiber Foods, Land O’Lakes, Meiji Co., Ltd., Yili Group, Mengniu Dairy, Organic Valley, Kerry Group, Valio, Royal A-ware. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Milk and Butter Market Key Technology Landscape

The Milk and Butter market relies heavily on advanced processing and preservation technologies to ensure product safety, quality, and extended shelf life, especially given the global nature of trade and the perishable nature of raw milk. A critical technology is Ultra-High Temperature (UHT) processing, which sterilizes milk by heating it to extremely high temperatures for a few seconds, allowing for storage for several months without refrigeration until opened. This has fundamentally revolutionized distribution, particularly in regions with limited cold chain infrastructure. Furthermore, advanced membrane filtration technologies, such as microfiltration and ultrafiltration, are employed to fractionate milk components, enabling the creation of high-protein concentrates and specialized ingredients used in functional foods and nutritional supplements, driving premiumization.

In butter production, continuous churning machines have significantly replaced traditional batch processes, enhancing efficiency, ensuring uniform moisture content, and maximizing yield recovery from cream. Specialized packaging technologies are also paramount; this includes aseptic packaging for UHT milk and inert gas flushing for butter packaging to prevent oxidation and rancidity, maintaining flavor integrity over longer periods. Furthermore, traceability technologies, utilizing blockchain and RFID tags, are increasingly adopted across the supply chain, allowing consumers and regulators to track the product from the farm to the retail shelf, satisfying the rising demand for supply chain transparency and ethical sourcing verification.

On the agricultural side, the integration of smart farming technologies is transforming raw material sourcing. This includes automated milking systems, sensor technology for real-time monitoring of herd health and environmental conditions (known as precision dairy farming), and sophisticated feed management software that optimizes nutritional input for maximum milk yield and desired component profile (e.g., fat and protein percentages). These technologies not only enhance productivity and reduce operational costs but also contribute significantly to mitigating the industry's environmental footprint by optimizing resource utilization, establishing a foundation for sustainable long-term market growth and product reliability.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Milk and Butter market, with each geography presenting unique drivers, consumption habits, and regulatory environments. Asia Pacific (APAC) currently stands out as the fastest-growing region, characterized by a massive population base, rapidly rising middle-class disposable incomes, and increasing urbanization, which facilitates the shift from loose milk consumption to packaged, branded dairy products. Key countries like India and China are major consumption hubs, with India being the world’s largest milk producer and China driving demand for high-value imports like infant formula and specialized butter, necessitating significant infrastructure investment in processing and cold chain logistics.

North America and Europe represent mature, high-value markets defined by sophisticated consumer demands and stringent quality standards. In these regions, growth is less about volume expansion and more about premiumization, innovation, and diversification. Europe, led by countries like Germany, France, and Ireland, benefits from established dairy traditions and strong cooperative structures, focusing heavily on organic, grass-fed, and artisanal dairy products (e.g., high-fat European-style butter and specific geographical indication products). North America, driven by the U.S. and Canada, exhibits strong demand for lactose-free milk, fortified milk products, and specialty dairy ingredients used in the expansive food service and industrial sectors.

Latin America and the Middle East & Africa (MEA) offer substantial long-term growth potential. Latin America benefits from large-scale producers like Brazil and Argentina, aiming to optimize processing efficiency and expand their export capabilities, while consumption is steadily increasing domestically due to improved economic stability. The MEA region is heavily reliant on imports, but local production is increasing, particularly in Saudi Arabia and the UAE, driven by government support for food security initiatives. Consumption trends here favor long-shelf-life products like UHT milk and ghee due to climatic conditions and dispersed populations, emphasizing the importance of resilient supply chains tailored to challenging logistical environments across this diverse geographical bloc.

- Asia Pacific (APAC): Dominates market volume and growth rate. Driven by urbanization, large consumer base (India, China), rising per capita dairy consumption, and strong government support for dairy development. Focus on UHT milk, powdered milk, and traditional clarified butter (Ghee).

- Europe: High-value market focused on premiumization and sustainability. Strong demand for organic, A2 milk, and specialized artisanal butters. Characterized by strict regulatory standards and mature consumer preferences for ethical sourcing and animal welfare.

- North America: Market leader in innovation and product diversification. High consumption of lactose-free products, fortified milk, and specialized industrial dairy ingredients. Technological adoption in precision farming is highly advanced.

- Latin America: Emerging market with increasing industrialization of dairy production. Growth is tied to improved economic conditions and expanding middle class. Key producers include Brazil, Mexico, and Argentina, focusing on export capability and modernized processing.

- Middle East & Africa (MEA): Growth driven by food security initiatives and population expansion. High reliance on imports, making long shelf-life products critical. Local production is increasing but faces significant challenges related to water scarcity and feed costs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Milk and Butter Market.- Nestlé

- Lactalis

- Fonterra Co-operative Group

- Danone S.A.

- Dairy Farmers of America (DFA)

- Arla Foods amba

- Saputo Inc.

- Gujarat Co-operative Milk Marketing Federation Ltd. (Amul)

- FrieslandCampina N.V.

- Dean Foods (Now part of Dairy Farmers of America)

- Tine SA

- Schreiber Foods

- Land O’Lakes, Inc.

- Meiji Co., Ltd.

- Inner Mongolia Yili Industrial Group Co., Ltd.

- China Mengniu Dairy Company Limited

- Organic Valley

- Kerry Group plc

- Valio Ltd.

- Royal A-ware

Frequently Asked Questions

Analyze common user questions about the Milk and Butter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate in the Asia Pacific Milk and Butter Market?

The primary factor driving high growth in APAC is the combination of rapid urbanization and increasing disposable income, leading to a substantial consumer shift from traditional, informal dairy sources to packaged, branded, and value-added milk and butter products that require advanced distribution and processing chains.

How are environmental concerns impacting the production of milk and butter globally?

Environmental concerns are driving mandatory industry transitions towards sustainable practices, focusing on reducing methane emissions, optimizing water usage, and improving manure management. This necessitates significant capital investment in precision dairy farming and green energy solutions, potentially increasing operational costs but improving brand sustainability credentials.

What major technological advancements are sustaining the long-distance trade of liquid milk?

Ultra-High Temperature (UHT) processing coupled with advanced aseptic packaging technology is the major advancement enabling liquid milk to achieve extended shelf stability without refrigeration (until opened), thereby facilitating long-distance trade and market penetration into regions with underdeveloped cold chain infrastructure.

Which segment of the butter market is experiencing the highest value growth?

The organic, grass-fed, and specialized artisanal unsalted butter segments are experiencing the highest value growth, particularly in mature markets like North America and Europe, driven by consumer demand for premium ingredients, enhanced flavor profiles, and products perceived as having superior nutritional benefits compared to conventional butter.

What role does Artificial Intelligence (AI) play in modern dairy farming operations?

AI plays a crucial role in modern dairy farming by implementing precision monitoring through sensors to track animal health, optimize feed consumption, predict milk yield variations, and detect diseases early. This improves herd efficiency, reduces waste, and ensures the consistent quality of the raw milk input for processing.

The detailed analysis of the Milk and Butter market reveals a sector in dynamic evolution, balancing traditional staples with cutting-edge technological innovations. The market's resilience is predicated on continuous adaptation to consumer health trends, rigorous adherence to sustainability goals, and the successful navigation of complex global supply chain logistics. Future growth will be highly dependent on regional economic performance, the ability of producers to adopt advanced data analytics and AI for operational efficiency, and effective strategies to counter the competitive pressure from rapidly evolving non-dairy alternatives. The shift towards transparency, ethical sourcing, and value-added products ensures the long-term vitality and premiumization potential of both the milk and butter categories globally, reaffirming their status as critical components of the worldwide food system structure.

Further strategic insights indicate that consolidation among smaller and medium-sized regional dairy processors is expected to accelerate, driven by the need for increased scale to manage fluctuating commodity prices and meet growing global demand for export-quality products. Large multinational dairy corporations are prioritizing vertical integration, securing stable access to high-quality raw milk sources and investing heavily in advanced research and development facilities focused on improving dairy protein functionality and exploring novel applications of milk fat globally. This proactive approach to R&D is essential for maintaining a competitive edge against the rapid innovation cycles witnessed within the plant-based beverage and alternative fat sectors, necessitating continuous product portfolio refinement to retain consumer relevance and market share across diverse demographic groups.

The regulatory landscape also presents both challenges and opportunities. Stricter standards regarding animal welfare, pesticide use, and antibiotic stewardship in major import regions require exporters to demonstrate full compliance and traceability, often facilitated by blockchain technology implementation. While compliance increases operational burdens, it also establishes a barrier to entry for non-compliant producers, benefiting large, established companies that possess the financial capacity to meet these global benchmarks. Furthermore, trade agreements and geopolitical considerations will continue to influence market access, emphasizing the necessity for diverse sourcing and distribution footprints to mitigate risks associated with sudden trade policy shifts affecting major dairy commodity flows worldwide.

In conclusion, the Milk and Butter Market remains robust, underpinned by essential consumer demand and driven forward by innovation in processing, logistics, and sustainable farming practices. The projected CAGR of 4.8% through 2033 underscores a healthy growth trajectory, largely fueled by emerging markets, while mature markets focus on high-margin specialization. Success in this environment requires a dual focus: optimizing upstream efficiency through technology like AI and precision agriculture, and satisfying downstream demand through continuous product differentiation, transparency, and a commitment to environmental stewardship throughout the entire value chain.

The evolution of consumer purchasing channels, particularly the shift towards e-commerce, demands agile distribution strategies capable of maintaining product integrity during last-mile delivery. Companies excelling in digital engagement and direct-to-consumer models for premium, long shelf-life dairy items are positioned to capture significant incremental market share. Furthermore, the industrial application segment, relying heavily on stable pricing and consistent supply of milk powders and butter oil, provides a foundational stabilizing element to the market. Addressing global challenges such as climate change impact on feed and water resources remains a pivotal strategic objective for sustaining the long-term viability and profitability of the Milk and Butter Market.

Regional variations in butter consumption provide distinct market opportunities. In Western markets, there is a clear distinction between cooking butter (often salted and mass-produced) and specialty, high-fat cultured butters favored for artisanal baking and premium spreading. Conversely, in South Asia and parts of the Middle East, the traditional dominance of Ghee (clarified butter) persists due to its cultural significance, high smoking point suitable for frying, and extended shelf stability in warmer climates. Market players must tailor their product formulations, packaging sizes, and marketing narratives to align precisely with these deeply ingrained regional culinary preferences and usage patterns to ensure effective penetration and sustained consumer loyalty in diverse global settings.

Moreover, the competition from non-dairy fats and plant-based milks necessitates continuous investment in differentiating dairy products based on their intrinsic nutritional superiority and functional characteristics, which are difficult to replicate fully in non-dairy alternatives. Focused marketing campaigns emphasizing the natural origin, protein quality, and essential micronutrient profile of dairy are critical for retaining the core consumer base and attracting new health-conscious demographics. The long-term sustainability of the sector is inextricably linked to technological advances that address production inefficiencies and environmental footprints while simultaneously ensuring product diversification meets the increasingly fragmented and sophisticated demands of the modern global consumer.

The market faces structural challenges related to the consolidation of retail power, which often exerts downward pressure on farmgate prices for milk. Dairy producers and processors must counter this pressure by enhancing operational efficiency, reducing waste across the supply chain, and seeking vertical integration opportunities to control costs from raw material to final packaged goods. Strategic partnerships with key retail chains and leveraging data analytics to optimize pricing and promotion strategies are crucial for maintaining profitability margins in a fiercely competitive environment where consumers are highly sensitive to price changes for staple goods like milk and butter.

Furthermore, regulatory changes specific to international trade, such as potential tariffs or non-tariff barriers related to sanitary and phytosanitary measures, require global dairy players to maintain flexible production capabilities and contingency plans. Ensuring that products meet the highest standard of food safety and quality across numerous jurisdictions is non-negotiable for large-scale exporters. The dairy industry’s reliance on global trade mandates that companies actively monitor and influence policy developments that affect cross-border movement of both finished products and necessary inputs like specialized feed supplements, thus intertwining geopolitical stability with market performance.

The continued proliferation of flavored and functional milk beverages represents a significant area of volume growth, especially among younger demographics seeking convenient, nutrient-dense on-the-go options. These products, often enriched with protein, fiber, or specialized vitamins, command premium pricing compared to plain liquid milk and offer higher margins to processors. Innovation in flavor profiles, combined with attractive, sustainable packaging, is key to capturing this segment. Similarly, the use of specialized butter in premium food manufacturing—such as high-end confectionery and gourmet snacks—provides another avenue for value creation, moving butter beyond its traditional role as a simple spread or cooking medium and positioning it as a key ingredient differentiator.

Finally, the growing awareness surrounding A2 milk and other niche dairy products reflects a consumer inclination toward personalized nutrition and perceived health benefits. While A2 milk processing requires segregated supply chains and specialized testing, its increasing acceptance, particularly in developed Asian markets and Australia, suggests a willingness among consumers to pay a premium for dairy products tailored to perceived sensitivities. This trend mandates that farmers and processors invest in genetic testing and herd segregation technologies to capitalize on this expanding segment, ensuring market offerings remain relevant to evolving individual dietary needs and preferences.

Addressing the inherent perishability of milk requires continual innovation in preservation and cold chain logistics. Modern refrigerated transport and storage technologies, coupled with improved packaging materials that offer superior barrier protection against oxygen and light, are vital for minimizing spoilage. Efficient logistics management, often supported by sophisticated temperature monitoring systems and cloud-based tracking, ensures that highly perishable goods like liquid milk and fresh butter maintain their quality throughout their journey from the farm to the consumer’s refrigerator, crucial for maintaining consumer trust and reducing economic losses associated with food waste across the entire dairy ecosystem.

The industrial sector's demand for high-quality milk proteins (casein, whey) and specialized milk fats continues to grow, fueled by the expansion of the sports nutrition, clinical nutrition, and ready-meal industries. These ingredients are valued for their functional properties, such as emulsification, texture modification, and high biological value. Companies that specialize in fractionation and isolation technologies to extract these specific components efficiently are commanding significant market power and higher profit margins, indicating a strategic shift towards high-tech ingredient manufacturing alongside traditional liquid milk and butter production.

Emerging economies are increasingly investing in modernizing their dairy infrastructure, often through international partnerships and technology transfer. This involves constructing modern large-scale processing plants, implementing advanced pasteurization and UHT capabilities, and developing robust cold chain networks. These investments not only boost domestic production and self-sufficiency but also open up possibilities for regional export, transforming local dairy producers into international competitors and significantly altering the global balance of supply and demand for both bulk and packaged milk and butter products.

Furthermore, the competitive dynamic between branded products and private label offerings remains a constant feature of the retail landscape. While global brands leverage high marketing expenditure and established consumer trust to maintain premium pricing, private label dairy products, offered by major supermarkets and hypermarkets, appeal strongly to price-sensitive consumers, often mirroring the quality of branded goods at a lower cost. Companies must strategically manage their portfolio, deciding whether to focus solely on high-margin branded products or engage in private label manufacturing to maximize plant utilization and achieve comprehensive market penetration across all consumer income strata.

The future trajectory of the Milk and Butter Market is highly sensitive to external global economic shocks, including inflation and recessions, which directly impact consumer spending on food items. Dairy products, while staples, can face down-trading pressures where consumers might switch from premium brands to cheaper alternatives or reduce overall consumption if economic conditions deteriorate significantly. Therefore, maintaining operational flexibility and cost control is essential for sustaining profitability across economic cycles, necessitating continuous efficiency improvements across all manufacturing and distribution segments globally.

Finally, labor market dynamics, including the availability of skilled dairy farmers, processors, and cold chain technicians, pose a persistent challenge, especially in developed markets facing aging populations. Automation and the integration of AI and robotic systems are becoming necessary not only for efficiency but also for mitigating labor shortages. Investing in training and talent retention programs for the skilled workforce that manages complex, technology-driven operations is paramount for ensuring the long-term operational stability and growth potential of the advanced dairy industry.

The strategic differentiation of butter products based on feed source (e.g., grass-fed vs. conventional) is a major market trend, reflecting consumer willingness to pay a premium for perceived quality and welfare improvements. Grass-fed butter, often noted for its distinct yellow hue and higher concentrations of Omega-3 fatty acids and Vitamin K2, is rapidly gaining traction. This segment demands rigorous verification and certification processes to substantiate claims, driving transparency in farming practices and adding complexity to the supply chain management for manufacturers aiming to cater to this specific, high-value consumer niche.

Sustainability certifications, such as those related to carbon footprint reduction and waste management, are becoming powerful competitive tools. Major retailers and institutional buyers are increasingly incorporating sustainability metrics into their procurement decisions. Dairy companies are responding by setting ambitious net-zero targets and investing in renewable energy sources for processing plants. This focus on verifiable sustainability not only aligns with consumer values but also opens doors to partnerships with environmentally conscious supply chain partners and accessing capital specifically earmarked for green investments.

The health and wellness trend continues to fuel innovation in low-fat and high-protein milk segments. Beyond traditional skim milk, new processing methods allow for the creation of protein-enriched milk beverages without excessive thickening or compromise on flavor. These fortified products directly compete with specialty protein shakes and nutritional supplements, positioning milk as a natural, highly bioavailable source of functional nutrition, attracting athletes, fitness enthusiasts, and the aging population seeking to maintain muscle mass.

Furthermore, the segmentation of the market based on geographical origin and specific breeds of cattle is adding layers of complexity and value. Products marketed under specific regional appellations (Protected Designation of Origin) command high premiums based on their unique processing methods, flavor profiles, and strict adherence to historical standards. This specialized marketing approach emphasizes the cultural heritage of dairy products, particularly butter, attracting gourmet consumers and providing diversification opportunities away from pure commodity pricing pressures.

The continuous need for efficiency in the industrial use of milk powder and butter oil drives innovation in powder characteristics, such as improved solubility and reduced dusting, crucial for seamless integration into high-speed food manufacturing lines. Dairy ingredients manufacturers invest significantly in optimizing spray-drying and crystallization processes to meet the exacting technical specifications demanded by global food and beverage giants, ensuring that dairy remains a functional, cost-effective, and indispensable component in a wide array of processed foods and nutritional formulations worldwide.

Finally, intellectual property protection around novel processing techniques, specific ingredient formulations (like unique butter blends or milk fractions), and advanced packaging designs is critical for maintaining long-term competitive advantages. Companies that successfully patent and commercialize proprietary technologies gain temporary monopolies in high-value niches, allowing them to capture substantial returns on their research investments and influence the technological trajectory of the entire Milk and Butter Market globally.

The comprehensive review confirms the Milk and Butter Market's trajectory toward value growth, driven by technological integration and consumer preference shifts, necessitating robust operational strategies across the entire farm-to-table value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager