Milled Log Homes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435159 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Milled Log Homes Market Size

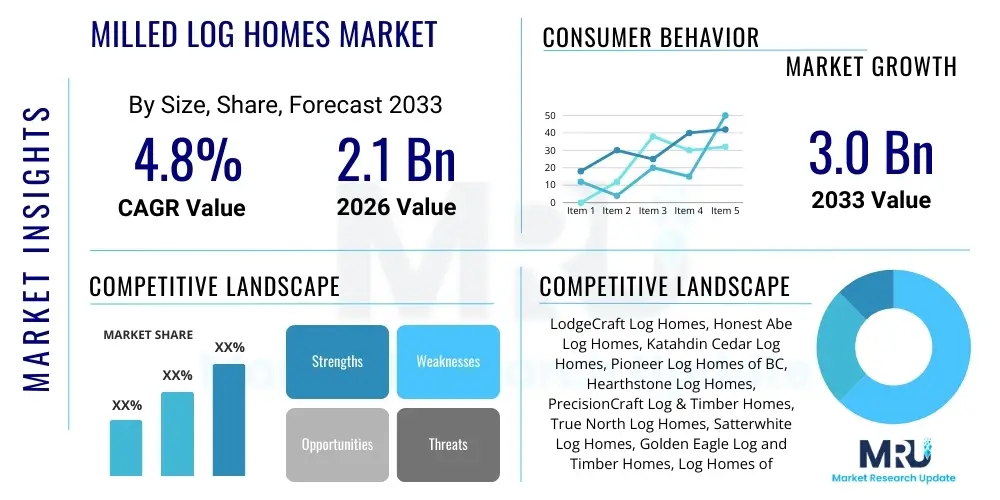

The Milled Log Homes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.0 Billion by the end of the forecast period in 2033.

Milled Log Homes Market introduction

The Milled Log Homes Market encompasses the design, production, and construction of residential and commercial structures utilizing logs that have been processed, typically through large-scale machinery, to achieve uniform dimensions, consistent profiles, and smooth surfaces. Unlike handcrafted log homes where logs retain their natural taper and curvature, milled log homes utilize machine-cut logs, often standardized into shapes such as D-logs, round logs, or square logs, which facilitates faster assembly and ensures tighter, more predictable construction tolerances. This standardization is crucial for meeting modern building codes and maximizing energy efficiency, positioning milled log homes as a structurally reliable and aesthetically appealing option within the wider custom housing and recreational real estate sectors.

The demand for milled log homes is fundamentally driven by a confluence of factors including the increasing consumer preference for sustainable, natural building materials, the desire for rustic or traditional aesthetics combined with modern amenities, and the efficiency of the construction process afforded by pre-milled kits. Major applications span primary residences, vacation homes, retirement properties, and commercial structures like resorts or lodges. The inherent energy efficiency, often superior to traditional stick-built housing when properly sealed and insulated, further bolsters their market appeal. Geographically, areas characterized by abundant timber resources and strong outdoor recreational tourism tend to exhibit the highest market penetration and growth rates.

Key benefits associated with milled log homes include their remarkable durability, inherent thermal mass properties that aid in regulating interior temperatures, and their relatively quick erection time once the foundation is prepared, due to the precise manufacturing of the interlocking components. Furthermore, the modern milling process minimizes waste and allows for better utilization of timber resources, aligning with contemporary environmental stewardship goals. Driving factors include favorable interest rate environments stimulating housing demand, increasing disposable income in developed economies allowing for custom home construction, and technological advancements in log preservation and sealing techniques that mitigate historical concerns related to settling and moisture infiltration.

Milled Log Homes Market Executive Summary

The Milled Log Homes Market is characterized by stable growth, fueled by strong demand in the residential leisure sector and advancements in automated log processing. Current business trends indicate a critical shift towards increased customization capabilities within the standardized milled framework. Manufacturers are leveraging Computer-Aided Manufacturing (CAM) to offer highly personalized floor plans and log profiles while retaining the cost and speed advantages of milling. Furthermore, there is a growing trend among key market players to achieve certification for sustainable forest management, appealing directly to the environmentally conscious affluent buyer base. Operational efficiency, particularly in supply chain logistics concerning timber sourcing and kit delivery, remains a primary competitive differentiator for firms seeking to expand market share in geographically dispersed regions.

Regional trends highlight North America as the dominant market, driven by a deeply ingrained cultural affinity for log construction, extensive timber resources, and a robust second-home market. However, Asia Pacific, particularly countries experiencing rapid urbanization coupled with a rising demand for high-end resort accommodations, is emerging as the fastest-growing region. European growth is steady, concentrated in Scandinavia and the Alpine countries, where strict energy efficiency standards necessitate innovation in log wall insulation systems and air sealing technologies. Regulatory landscapes surrounding fire codes and structural requirements continue to influence construction methods across all major geographical areas, pushing manufacturers toward certified, engineered log systems.

Segmentation trends reveal that the Residential segment, specifically vacation and retirement homes, maintains the largest market share due to the perceived quality of life and aesthetic advantages offered by log structures. In terms of Log Profile, the D-Log segment is experiencing high growth due to its internal flat surface, which simplifies interior finishing, plumbing, and electrical installations compared to fully rounded logs. Furthermore, the market for Hybrid Log Homes, which combine milled logs with traditional frame construction materials like drywall and stone, is expanding rapidly, appealing to consumers who desire the rustic exterior look but prefer conventional interiors or require multi-story designs not easily achieved with full log construction.

AI Impact Analysis on Milled Log Homes Market

Users frequently inquire about how Artificial Intelligence can streamline the design-to-construction pipeline, improve material efficiency, and enhance the longevity of milled log structures. Key concerns revolve around the integration of AI-driven optimization tools for complex cuts and minimizing timber waste during the milling process, as well as the potential for AI to automate quality control checks on log profiles and moisture content. The market anticipates that AI will primarily be used in predictive modeling for material sourcing and demand forecasting, crucial given the variable nature of timber supply and fluctuating commodity prices. Expectations also include AI-enhanced customer relationship management (CRM) systems capable of personalizing design iterations based on extensive databases of successful past projects and regional aesthetic preferences, thereby accelerating the sales cycle for custom log home kits.

The integration of AI extends significantly into the realm of design optimization and structural analysis. Generative Design algorithms, powered by machine learning, can rapidly iterate thousands of potential log home configurations based on parameters such as site topography, local climate, budget constraints, and structural load requirements. This allows architects and builders to identify the most efficient and structurally sound design solutions faster than traditional methods permit. Furthermore, AI-driven software is becoming instrumental in calculating precise log shrinkage and settling over time, enabling the pre-design of corrective measures or specialized fasteners, which dramatically reduces the long-term maintenance burden for homeowners and improves structural integrity.

AI's role in the manufacturing process is transforming the efficiency of the milling plant. Predictive maintenance systems analyze operational data from milling machinery (spindle speed, vibration, temperature) to forecast equipment failures before they occur, minimizing costly downtime. Computer vision systems, trained on high-resolution imagery, perform instantaneous quality checks on every log, identifying minor defects, knots, or deviations in profile that human inspectors might miss. This high level of quality assurance is essential for guaranteeing the tight tolerances required for modern, energy-efficient log stacking systems, solidifying the perception of milled log homes as a precision-engineered product rather than a purely manual construction effort.

- AI-Powered Generative Design: Rapid iteration of complex, optimized floor plans based on site-specific criteria and structural integrity analysis.

- Predictive Maintenance: Minimizing downtime in manufacturing facilities by forecasting failure of high-precision milling equipment.

- Automated Quality Control: Utilizing computer vision to instantly inspect log profiles, dimensions, and moisture content for adherence to strict engineering standards.

- Supply Chain Optimization: Machine learning algorithms forecasting timber availability and pricing fluctuations to optimize raw material procurement strategies.

- Settlement Modeling: Advanced simulation of long-term log settling and shrinkage to pre-engineer specialized fasteners and joinery, improving structural performance.

DRO & Impact Forces Of Milled Log Homes Market

The Milled Log Homes Market is significantly propelled by the increasing consumer desire for unique, rustic, and environmentally friendly housing options (Drivers), countered by volatility in lumber prices and stringent, often complex, regional building codes (Restraints). Opportunities emerge primarily through technological advancements in log preservation, the expansion of the market into high-density commercial resort developments, and the hybridization of log construction with conventional materials to meet urban construction specifications. These forces collectively shape the market's trajectory, determining investment priorities and influencing product development strategies among key manufacturers, who must constantly balance aesthetic appeal with cost efficiency and regulatory compliance. The ultimate impact force stems from the cyclical nature of the housing market, wherein demand for custom and second homes is highly sensitive to macroeconomic indicators such as interest rates and overall consumer wealth.

Key drivers include the demonstrable energy efficiency benefits of thermal mass in log walls, which is increasingly important as global energy costs rise. Furthermore, the standardization inherent in the milling process provides reliable, predictable construction timelines, appealing to both professional builders and owner-builders seeking efficiency. Restraints primarily involve the high initial capital investment required compared to standard frame homes, perceived long-term maintenance requirements (despite modern sealing techniques), and transportation costs associated with moving large, heavy log kits over long distances, particularly in remote building sites. The availability of skilled log home assemblers also presents a bottleneck in certain rapidly growing regions.

Opportunities for market expansion are concentrated in the development of engineered log systems that feature internal insulation channels, enhancing thermal performance beyond traditional solid logs, thus meeting stringent Passive House or Net-Zero standards. There is also a substantial opportunity in emerging markets where eco-tourism and high-end residential communities are being developed, positioning milled log homes as premium, aspirational living spaces. Lastly, targeted marketing focusing on the health benefits of natural wood construction (e.g., air quality and psychological well-being) offers a strong differentiation strategy. The immediate impact forces currently shaping the market are the global logistics constraints affecting material flow and the persistent labor shortage in the construction industry, which increases the value proposition of pre-fabricated, easy-to-assemble milled kits.

Segmentation Analysis

The Milled Log Homes Market is segmented based on several critical dimensions, including Log Profile, Application Type, and Construction Method, each reflecting distinct consumer preferences and construction requirements. Understanding these segments is vital for manufacturers to tailor their production capabilities and marketing efforts effectively. The segmentation reveals that the residential segment, specifically targeting luxury and leisure properties, is the largest consumer base, preferring profiles that balance structural stability with easy interior finishing. This comprehensive analysis allows for targeted resource allocation, ensuring that products are aligned with prevailing trends in aesthetic demand and regulatory compliance across different geographic markets.

The segmentation by Construction Method is becoming increasingly significant, differentiating between full log construction, which uses solid milled logs for the entire wall structure, and hybrid construction, which integrates log walls with conventional wall framing. Hybridization offers greater flexibility in design, especially for multi-story buildings and complex architectural features, making it a growing segment appealing to a broader range of architects and builders who seek to blend rustic aesthetics with modern architectural complexity. The Log Profile segmentation is important as it dictates both the exterior appearance and the interior feasibility; D-logs and square logs dominate in North America due to ease of interior finishing, while fully rounded logs maintain strong traditional appeal in Europe and specialized resort markets.

- Log Profile

- D-Logs

- Round Logs

- Square Logs

- Swedish Cope Logs

- Application Type

- Residential (Primary, Vacation, Retirement Homes)

- Commercial (Resorts, Lodges, Retreat Centers)

- Construction Method

- Full Milled Log Construction

- Hybrid Log Construction

- Material Type

- Pine

- Cedar

- Spruce

- Fir

Value Chain Analysis For Milled Log Homes Market

The value chain for the Milled Log Homes Market begins with upstream activities centered on sustainable forestry and responsible timber harvesting, where the quality and species of the wood (e.g., kiln-dried Western Red Cedar or Eastern White Pine) are determined. This stage is critical as it dictates the raw material cost, durability, and aesthetic characteristics of the final product. Key upstream players include specialized logging operations and large timberland owners who supply raw logs directly to the milling facilities. Efficiency in this stage relies heavily on obtaining logs that meet precise diameter and straightness specifications suitable for automated milling, ensuring minimal waste and maximizing yield per unit of harvested timber.

The core manufacturing stage involves the primary and secondary milling operations, where raw logs are debarked, dried (often kiln-dried for stability), and precisely shaped using Computer Numerically Controlled (CNC) machinery to create uniform logs with interlocking joinery (e.g., corner notches, dovetails). This manufacturing step adds significant value through precision engineering, quality control, and the creation of standardized log kits. Following milling, logs are treated with preservatives and sealants, packaged, and prepared for transportation. Manufacturers often manage the design and engineering services in-house, creating detailed blueprints and construction manuals that accompany the packaged kit.

Downstream activities focus on logistics, distribution, and construction. Distribution channels are typically dual: direct sales from the manufacturer to the end-user (common for custom homes) or sales through a network of independent authorized dealers or builders (indirect). Dealers often provide localized sales support, construction consultation, and coordination services. The final stage involves site preparation, foundation work, and the highly specialized process of assembling the log package, usually overseen by experienced log home builders who understand the nuances of log stacking, sealing, and managing settlement allowances. Success in the downstream market is highly dependent on establishing a trusted network of skilled labor and efficient, reliable transportation logistics.

Milled Log Homes Market Potential Customers

The primary target demographic for the Milled Log Homes Market consists of affluent consumers aged 50 and above who are seeking specialized housing solutions, often for retirement or second homes located in scenic, rural, or recreational areas. These buyers prioritize quality, natural aesthetics, and structural durability. They possess the disposable income necessary to afford the custom nature and higher initial cost associated with engineered log construction kits. Furthermore, this demographic is increasingly focused on the environmental footprint of their dwellings, making manufacturers that emphasize sustainable sourcing and energy efficiency particularly attractive.

A rapidly growing segment of potential customers includes professional developers and commercial entities specializing in the hospitality and resort sector. These buyers utilize milled log kits for building large-scale lodges, rental cabins, and retreat centers, valuing the material’s ability to evoke a rustic, high-quality, and immersive experience for guests. For these commercial applications, the speed and predictability of the pre-milled kit assembly are paramount, allowing for rapid deployment and quicker return on investment compared to traditional commercial construction methods. They prioritize fire resistance treatments and low-maintenance exterior finishes for long-term operational efficiency.

A third, emerging customer segment includes younger, environmentally conscious consumers in the 35–45 age range who are seeking primary residences that align with a minimalist or sustainable lifestyle. While often budget-conscious, this group is drawn to smaller, highly energy-efficient hybrid log homes that blend timber aesthetics with modern, compact design principles. They frequently engage in owner-built or semi-custom projects, leveraging the detailed assembly instructions and standardized nature of milled kits. Key purchase motivators for this group include the inherent thermal performance and the reduced chemical content compared to conventional building materials, positioning the log home as a healthy living environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LodgeCraft Log Homes, Honest Abe Log Homes, Katahdin Cedar Log Homes, Pioneer Log Homes of BC, Hearthstone Log Homes, PrecisionCraft Log & Timber Homes, True North Log Homes, Satterwhite Log Homes, Golden Eagle Log and Timber Homes, Log Homes of America, Jim Barna Log & Timber Homes, Rocky Mountain Log Homes, Montana Log Homes, Gastineau Log Homes, Coventry Log Homes, Timber Kings, Kuhns Bros Log Homes, Blue Ridge Log Cabins, Beaver Log Homes, Wisconsin Log Homes |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Milled Log Homes Market Key Technology Landscape

The technological landscape of the Milled Log Homes Market is increasingly dominated by precision manufacturing techniques adapted from other high-tolerance industries. The most significant advancement is the widespread adoption of Computer Numerically Controlled (CNC) machinery and robotic milling centers. These systems utilize 3D architectural models (BIM – Building Information Modeling) to execute complex cuts, notches, and bores with sub-millimeter accuracy. This precision minimizes the gaps between logs, which historically required extensive chinking, thus significantly enhancing the structural integrity and air tightness of the final structure, a critical factor for energy performance ratings. CNC milling is essential for producing standardized, pre-cut kits ready for rapid assembly on-site, dramatically reducing construction time and required labor skills.

Beyond the milling process, advancements in moisture management and log preservation technologies are crucial for increasing the longevity and stability of milled log structures. Kiln-drying processes, now highly optimized and computer-controlled, ensure that logs achieve a stable moisture content (typically below 19%) before milling, which drastically reduces subsequent shrinkage and settling issues after construction. Furthermore, the development of borate-based treatments provides highly effective, non-toxic resistance against insect infestation and fungal decay. Coupled with high-performance synthetic sealants and gasket systems designed to withstand significant temperature cycling and UV exposure, these technologies address the historical maintenance concerns associated with log housing, positioning the modern milled log home as a truly long-lasting investment.

The integration of digital design tools, specifically BIM software tailored for log construction, is streamlining the entire project lifecycle. BIM allows for comprehensive virtual walkthroughs, clash detection (ensuring plumbing and electrical systems fit precisely within the log structure), and accurate material take-offs. This level of digital pre-construction planning is vital for custom projects, reducing costly errors on site and facilitating clear communication between the architect, manufacturer, and builder. Additionally, certain manufacturers are exploring advanced modularization techniques, where large sections of log wall are pre-assembled in the factory environment before transport, further accelerating site construction and ensuring optimal quality control in a climate-controlled setting, leveraging logistical optimization software to manage the transportation of these larger modules efficiently.

Regional Highlights

North America, comprising the United States and Canada, represents the largest and most mature market for Milled Log Homes. This dominance is attributable to vast, sustainably managed timber resources, a strong cultural heritage of log building, and significant consumer wealth driving the second-home and vacation property market, particularly in states like Montana, Colorado, and regions surrounding the Great Lakes. The US market benefits from well-established manufacturing expertise and sophisticated distribution networks, often supported by independent dealer organizations specializing in log home assembly. The focus here is increasingly on large, luxury residences utilizing western species like cedar and fir, with high consumer expectations regarding structural warranties and energy certification.

Europe maintains a substantial market, driven primarily by Scandinavian countries (Norway, Sweden, Finland) and the Alpine regions, where log construction traditions are deeply embedded. The European market, however, is heavily influenced by stringent energy performance directives, requiring manufacturers to innovate with highly insulated log systems, often incorporating rigid foam or mineral wool within a structural log shell (hybrid systems). The demand leans towards highly engineered, smaller-footprint homes that maximize energy efficiency while adhering to aesthetic traditions. Eastern European countries are showing rapid growth as consumer wealth increases and eco-tourism drives investment in high-quality commercial accommodations.

The Asia Pacific (APAC) region is poised for the fastest growth, though starting from a lower base. Market expansion is concentrated in key areas experiencing rapid growth in eco-tourism, luxury resort development, and high-end retirement communities, notably Japan, Australia, and New Zealand. Japan, in particular, values wood construction for its natural aesthetic and earthquake resistance (when properly engineered). Australian and New Zealand markets reflect a strong demand for vacation homes that utilize native timber species. Growth in this region is constrained by import duties and logistical challenges but presents massive potential as regional disposable income rises and urbanization pushes demand for natural, escapist living environments.

- North America: Dominant market share; driven by the luxury residential sector, abundant lumber supply, and strong cultural affinity for log structures. Key focus on customization and large-scale homes.

- Europe: Stable growth; characterized by strict energy efficiency regulations favoring highly engineered, insulated, and hybrid log systems. Strong presence in Scandinavian and Alpine regions.

- Asia Pacific (APAC): Highest projected growth rate; fueled by rapid expansion in eco-tourism, resort development, and luxury second homes in Australia, New Zealand, and Japan.

- Latin America: Emerging market potential; niche applications in high-end remote resorts and private estates, dependent on regional economic stability and sustainable local timber availability.

- Middle East and Africa (MEA): Limited adoption, primarily concentrated in high-end luxury safari lodges and climate-controlled expatriate communities, requiring specialized climate adaptation technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Milled Log Homes Market.- LodgeCraft Log Homes

- Honest Abe Log Homes

- Katahdin Cedar Log Homes

- Pioneer Log Homes of BC

- Hearthstone Log Homes

- PrecisionCraft Log & Timber Homes

- True North Log Homes

- Satterwhite Log Homes

- Golden Eagle Log and Timber Homes

- Log Homes of America

- Jim Barna Log & Timber Homes

- Rocky Mountain Log Homes

- Montana Log Homes

- Gastineau Log Homes

- Coventry Log Homes

- Timber Kings

- Kuhns Bros Log Homes

- Blue Ridge Log Cabins

- Beaver Log Homes

- Wisconsin Log Homes

Frequently Asked Questions

Analyze common user questions about the Milled Log Homes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between milled log homes and handcrafted log homes?

Milled log homes use standardized, machine-cut logs with uniform dimensions and precise interlocking profiles, allowing for faster assembly and predictable structural settling. Handcrafted log homes utilize logs with their natural taper and shape, requiring highly specialized manual fitting, resulting in unique aesthetics but potentially longer construction timelines and higher labor costs.

Are modern milled log homes energy efficient?

Yes, modern milled log homes achieve high energy efficiency primarily through precision milling, which minimizes air gaps, and the thermal mass effect of the solid wood walls, which helps regulate internal temperatures. Many manufacturers offer kiln-dried logs and hybrid systems that incorporate advanced insulation to meet or exceed current international energy codes, making them highly efficient.

What are the typical long-term maintenance requirements for milled log homes?

Long-term maintenance involves periodic application of high-quality exterior stains and sealants (typically every 3 to 7 years, depending on climate and exposure) to protect against UV damage and moisture. Due to modern kiln-drying and CNC precision, significant chinking or extensive structural adjustments related to settling are largely minimized compared to older log structures.

Which log profile is most commonly requested in the Milled Log Homes Market?

The D-Log profile is one of the most popular globally. It features a rounded exterior, providing the traditional log aesthetic, while having a flat interior surface. This flat interior greatly simplifies the installation of electrical wiring, plumbing, and standard interior finishes like drywall or paneling, offering a practical balance between rustic charm and conventional modern construction feasibility.

How do volatile lumber prices impact the Milled Log Homes industry?

Volatility in lumber prices is a primary constraint, directly impacting the raw material cost, which constitutes a significant portion of the total log home kit price. Manufacturers mitigate this risk through strategic forward purchasing agreements and integrating AI-driven supply chain forecasts, though significant price spikes can lead to higher consumer pricing or temporary delays in contract fulfillment, influencing short-term market stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager