Millennial Travel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436575 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Millennial Travel Market Size

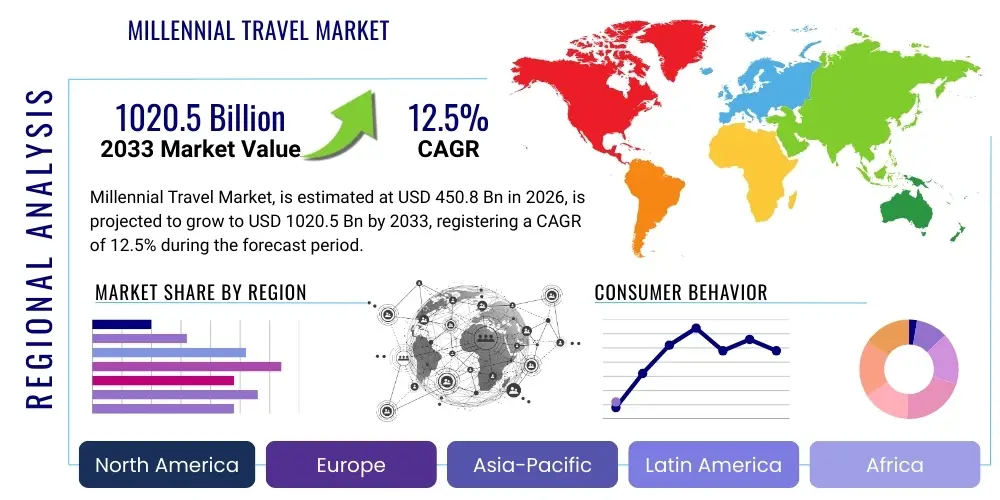

The Millennial Travel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 450.8 Billion in 2026 and is projected to reach USD 1020.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the demographic's prioritization of experiential spending, coupled with increased disposable income, and a strong propensity for digital booking and personalized itineraries.

Millennial Travel Market introduction

The Millennial Travel Market encompasses all leisure and business travel activities undertaken by individuals born roughly between 1981 and 1996. This demographic, often referred to as Generation Y, is characterized by its digital fluency, preference for authentic and sustainable experiences, and heavy reliance on peer reviews and social media for travel planning and inspiration. Major applications include adventure travel, ecotourism, cultural immersion trips, and short-term remote work arrangements (bleisure travel). The primary benefit of targeting this segment is their high lifetime customer value and influence on subsequent generations (Gen Z). Key driving factors include the global proliferation of low-cost carriers, the rise of sharing economy platforms (Airbnb, Uber), flexible work policies encouraging longer stays, and robust technological integration allowing for hyper-personalized travel services. The market structure is highly fragmented, featuring significant competition between established hospitality chains and disruptive digital startups focusing on unique, technology-enabled offerings tailored to the independent and value-conscious millennial traveler.

Millennial Travel Market Executive Summary

The Millennial Travel Market is undergoing a rapid transformation, moving away from traditional package tours toward personalized, experience-centric journeys often booked dynamically across multiple digital channels. Business trends emphasize the strategic acquisition of niche travel tech platforms and the establishment of robust loyalty programs focused on experiential rewards rather than monetary discounts. The market segmentation reveals a strong preference for experiential tourism (e.g., culinary, wellness, adventure) over conventional sight-seeing, demanding tailored products from providers. Regionally, Asia Pacific is anticipated to exhibit the fastest growth, propelled by the massive outbound travel volume from populous nations like China and India, alongside increasing affluence within the cohort. Conversely, North American and European markets are characterized by high digital adoption rates and a mature infrastructure supporting sustainable and wellness-focused travel. Overall, the competitive landscape is shifting towards platforms offering comprehensive trip curation and seamless integration of local, authentic experiences, utilizing data analytics to predict and satisfy highly specific traveler demands efficiently.

AI Impact Analysis on Millennial Travel Market

Users frequently inquire about AI's role in personalizing travel, optimizing booking processes, and ensuring safety during autonomous travel. The core themes revolve around the expectation of hyper-relevant recommendations, frictionless customer service (24/7 chatbots and virtual assistants), and predictive pricing models. Consumers are particularly concerned with how AI aggregates and uses personal data to curate travel packages, balancing convenience against privacy. The key expectations center on AI providing proactive itinerary adjustments based on real-time events (weather, delays) and enabling genuinely local, non-touristy experiences by analyzing unstructured data from social media and lesser-known local resources. Concerns often touch upon the potential reduction of human interaction in customer service and the risk of algorithmic bias leading to standardized or less diverse travel recommendations, underscoring the demand for AI tools that enhance, rather than replace, human expertise in complex trip planning.

- AI-driven personalization engines optimizing itinerary design based on social data and past behavior.

- Implementation of advanced Natural Language Processing (NLP) in chatbots for instantaneous, multilingual customer support and booking modifications.

- Predictive analytics utilized for dynamic pricing strategies, yield management, and forecasting demand for specific destinations or activities.

- Integration of Virtual Reality (VR) and Augmented Reality (AR) experiences for pre-trip visualization and on-site guidance, powered by AI mapping algorithms.

- Enhanced operational efficiency through AI-powered fraud detection and optimized logistics management across airlines and accommodations.

- Development of autonomous and semi-autonomous travel services, including self-driving airport shuttles and optimized baggage handling systems.

DRO & Impact Forces Of Millennial Travel Market

The Millennial Travel Market is primarily driven by the demographic's strong affinity for experiential luxury, the increasing ease and accessibility provided by digital booking platforms, and robust growth in disposable income among older millennials reaching peak earning years. Restraints on market growth include economic instability and currency fluctuations impacting discretionary spending, concerns regarding global climate change leading to "flight-shame" movements in developed markets, and geopolitical uncertainties that disrupt popular travel routes. Significant opportunities exist in the expansion of niche travel segments, such as voluntourism, digital nomad packages, and health and wellness retreats tailored for stress reduction. Furthermore, leveraging big data analytics to create highly customized, subscription-based travel services presents a major avenue for future revenue generation. The primary impact forces shaping the market are the rapid pace of technological innovation, particularly mobile integration and AI-driven services, and evolving socio-cultural trends that prioritize authenticity and sustainability, forcing established providers to adapt their operational models and environmental commitments rapidly.

Segmentation Analysis

Segmentation within the Millennial Travel Market provides critical insight into the diversity of consumer needs and spending habits, allowing suppliers to tailor offerings effectively. The market is broadly categorized by Type of Trip, Booking Channel, and Purpose of Travel. Type of Trip encompasses elements ranging from backpacking and budget travel to luxury, personalized tours, reflecting the wide economic spectrum of the cohort. Booking Channel segmentation highlights the dominance of Online Travel Agencies (OTAs) and direct supplier websites, often accessed via mobile applications. Analyzing Purpose of Travel distinguishes between leisure, business (including bleisure), adventure, and specialized niches such as cultural or eco-tourism. This granular analysis confirms that millennials prioritize flexible cancellation policies, instant confirmation, and transparency in pricing across all segmented categories, necessitating mobile-first strategies for successful market penetration and revenue optimization.

- Type of Trip:

- Budget/Backpacking

- Mid-Range Personalized Travel

- Luxury Experiential Travel

- Group Tours and Organized Expeditions

- Purpose of Travel:

- Leisure and Recreation

- Business and Bleisure Travel

- Adventure and Sports Tourism

- Cultural and Heritage Tourism

- Health and Wellness Retreats

- Booking Channel:

- Online Travel Agencies (OTAs)

- Direct Supplier Websites/Apps (Airlines, Hotels)

- Traditional Travel Agents

- Aggregators and Meta-Search Engines

Value Chain Analysis For Millennial Travel Market

The Millennial Travel Market value chain is characterized by a significant shift in power from traditional intermediaries to technology platforms and direct service providers. Upstream analysis focuses on core infrastructure providers, including global distribution systems (GDS), airline operators, and large hotel chains, whose services form the fundamental components of any trip. The efficiency and pricing of these upstream entities are heavily scrutinized by millennials, who frequently use comparison tools to optimize costs. Furthermore, the content creators—influencers, review aggregators, and curated blog sites—act as crucial upstream inspiration and validation points, heavily influencing early planning decisions and destination selection among this demographic, differentiating this chain from previous generations.

Midstream activities primarily involve aggregation, curation, and transaction processing. This segment is dominated by Online Travel Agencies (OTAs) like Expedia and Booking Holdings, along with niche booking platforms specializing in specific types of experiences (e.g., Airbnb Experiences, GetYourGuide). These platforms focus on integrating diverse inventory—from accommodation to activities and transportation—into seamless, mobile-optimized packages. The direct channel remains vital, as many millennials prefer booking directly with hotels and airlines to leverage loyalty programs and ensure superior customer service, bypassing OTAs for high-value transactions. Technology enablement, particularly robust API integration and instant confirmation capabilities, is the critical competitive differentiator at this stage of the value chain.

Downstream analysis centers on the delivery and consumption of the actual travel experience. This includes local ground transportation, personalized guiding services, F&B establishments, and on-site hospitality. Distribution channels are highly fragmented: direct distribution (supplier websites, branded apps) capitalizes on loyalty and direct relationships, while indirect channels (OTAs, metasearch) provide breadth and convenience. The post-purchase phase, encompassing real-time customer support, feedback mechanisms, and review solicitation (often crucial for the next traveler), completes the value chain, emphasizing continuous digital engagement. Success in the millennial market depends heavily on seamless communication between upstream content sources, midstream booking platforms, and downstream experience delivery, ensuring an integrated, high-quality journey from inspiration to homecoming.

Millennial Travel Market Potential Customers

The primary end-users and buyers in the Millennial Travel Market are highly diversified, but share common characteristics: digital savvy, a strong preference for experiences over possessions, and a significant concern for social and environmental impact. The core demographic ranges from younger millennials (early 30s) who prioritize budget flexibility, hostel stays, and adventure sports, often characterized by extended, self-planned trips, to older millennials (late 30s to early 40s) who possess higher disposable income, are often traveling with families (family travel segment), and seek personalized luxury, wellness retreats, or high-value cultural immersion tours. Identifying these sub-segments is crucial for targeted marketing efforts.

Beyond leisure travelers, business professionals who incorporate personal time into work trips ("bleisure travelers") represent a rapidly expanding customer segment. These individuals often extend mandatory business trips by several days to explore the destination, leading to increased demand for accommodation that caters equally well to productivity (fast WiFi, dedicated workspaces) and leisure (central location, local amenities). Furthermore, the burgeoning segment of digital nomads—individuals utilizing remote work capabilities to travel indefinitely—demands specialized products, including co-living spaces, reliable global connectivity packages, and insurance designed for long-term, non-static residency.

Ultimately, potential customers for the Millennial Travel Market are defined not just by age, but by their psychological profile—they are highly independent decision-makers who value authenticity and seek to curate unique, shareable narratives. They are heavy users of user-generated content (UGC) and are significantly influenced by peer reviews and social validation. Service providers must, therefore, position themselves as facilitators of authentic local experiences, utilizing technology to streamline logistics while ensuring the human element of discovery and connection remains central to the travel offering. Effective targeting requires deep understanding of platform preferences, moving beyond traditional advertising to focus on content marketing and community engagement across platforms like Instagram, TikTok, and specialized travel forums.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 Billion |

| Market Forecast in 2033 | USD 1020.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Booking Holdings, Expedia Group, Airbnb Inc., Tripadvisor LLC, TUI Group, Intrepid Travel, G Adventures, Marriott International, Hilton Worldwide, Delta Air Lines, Southwest Airlines Co., Travel + Leisure Co., Klook Travel Technology, MakeMyTrip Limited, Selina, Contiki Tours International, Secret Escapes, GetYourGuide, Musement, Viator (Tripadvisor). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Millennial Travel Market Key Technology Landscape

The technological landscape of the Millennial Travel Market is defined by the necessity for instant access, ubiquitous mobile functionality, and highly personalized service delivery. The primary technology driving evolution is the use of robust mobile applications, which function not merely as booking portals but as complete, in-trip operational hubs for itinerary management, check-ins, local recommendations, and communication. This reliance on mobile technology necessitates significant investment in responsive design, seamless integration of payment gateways (including digital wallets), and geo-location services that can provide context-aware recommendations for activities and dining, enhancing spontaneity while maintaining structure.

Furthermore, the integration of advanced data analytics and Artificial Intelligence (AI) is critical for maintaining a competitive edge. AI is extensively deployed in predictive modeling for dynamic pricing, ensuring that millennials, who are highly price-sensitive but prioritize value, receive optimal deals. Machine learning algorithms analyze vast datasets encompassing search history, social media engagement, and past booking patterns to generate hyper-personalized travel suggestions, moving beyond simple demographic segmentation. Blockchain technology, although nascent, is also emerging as a potential solution for secure identity management, transparent loyalty programs, and streamlining cross-border payments, addressing millennial demands for security and efficiency in financial transactions.

The experiential focus of millennial travel is heavily supported by immersive technologies. Virtual Reality (VR) is increasingly used by destinations and operators for pre-trip marketing, allowing travelers to virtually explore accommodations and activities before booking, mitigating risk and increasing confidence in high-value purchases. Augmented Reality (AR) applications provide interactive, on-site navigation and historical information overlays, transforming walking tours and museum visits into engaging, digitally enhanced experiences. These technologies collectively reduce friction throughout the travel process, from inspirational searching to post-trip feedback, solidifying the market's dependence on cutting-edge digital infrastructure for customer retention and service differentiation.

Regional Highlights

North America maintains a dominant position in terms of market value, characterized by early adoption of technology and a high concentration of affluent older millennials. This region sees heavy utilization of digital platforms for booking, strong demand for wellness and adventure travel within domestic boundaries (e.g., National Parks, unique city breaks), and a mature infrastructure supporting 'bleisure' travel. The emphasis here is on convenience, speed, and leveraging loyalty programs across major hotel and airline groups, with sustainability concerns increasingly influencing purchasing decisions, particularly among younger cohorts in metropolitan areas. Providers in North America must focus on seamless, high-speed digital interactions and clearly communicated corporate social responsibility initiatives to capture this high-spending demographic.

Europe represents a highly diversified market, segmented by pronounced cultural differences and varied consumer priorities, but unified by excellent connectivity through low-cost carriers (LCCs) and robust rail networks. Western European millennials exhibit a strong inclination toward short-haul, frequent city breaks, placing high value on sustainable travel options and authentic cultural experiences, often prioritizing local operators over global chains. Eastern Europe, while growing rapidly, offers a more budget-conscious segment, prioritizing value and unique, off-the-beaten-path destinations. Regulatory environments related to data privacy (GDPR) significantly impact how travel providers market and personalize services in this region, demanding high transparency in data usage and digital communication strategies.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by expanding middle classes in China, India, and Southeast Asia. This region is characterized by immense outbound travel growth and high mobile penetration rates, often bypassing desktop internet usage entirely. APAC millennials often travel in multi-generational groups or in large peer groups, driving demand for packaged tours that integrate highly sought-after, novel experiences. Furthermore, inbound tourism within APAC is thriving, leveraging the region's diverse cultural and natural landscapes. Digital platforms must cater specifically to regional preferences, incorporating local social media (e.g., WeChat in China) and local payment methods to effectively penetrate these massive, technologically adept consumer bases.

Latin America presents a dynamic market focused on unique ecological and adventure tourism, driven by domestic and regional travel spurred by improving economic conditions in key countries like Brazil and Mexico. The millennial cohort here seeks value-driven, often flexible travel options, preferring experiences that highlight the region's biodiversity and indigenous cultures. Challenges include fluctuating currencies and infrastructure disparities, which necessitate travel providers offering robust logistical support and insurance. Mobile usage for booking and research is extremely high, and trust is built through strong word-of-mouth recommendations and local influencer partnerships, making social proof vital for market entry and expansion.

The Middle East and Africa (MEA) region exhibits dual characteristics: the Middle Eastern market, driven by high disposable income, focuses on luxury travel, global city breaks, and large-scale entertainment events, often combining family and business travel. African millennial travelers, particularly in South Africa and Nigeria, show growing interest in domestic, intra-regional, and adventure tourism, characterized by strong digital literacy but sometimes limited access to sophisticated financial infrastructure for online bookings. Investment in seamless digital booking systems and culturally sensitive marketing is paramount. Furthermore, outbound travel from the Gulf Cooperation Council (GCC) countries remains a highly lucrative segment, demanding premium, personalized services and exclusive access to global luxury destinations and experiences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Millennial Travel Market.- Booking Holdings

- Expedia Group

- Airbnb Inc.

- Tripadvisor LLC

- TUI Group

- Intrepid Travel

- G Adventures

- Marriott International

- Hilton Worldwide

- Delta Air Lines

- Southwest Airlines Co.

- Travel + Leisure Co.

- Klook Travel Technology

- MakeMyTrip Limited

- Selina

- Contiki Tours International

- Secret Escapes

- GetYourGuide

- Musement

- Viator (Tripadvisor)

Frequently Asked Questions

Analyze common user questions about the Millennial Travel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary motivations driving millennial travel decisions?

Millennials are primarily motivated by the pursuit of authentic, shareable experiences, personal growth, and cultural immersion rather than traditional sight-seeing or luxury. Their decisions are heavily influenced by social media proof, peer recommendations, and the desire to find unique, non-touristy activities that align with their personal values, such as sustainability.

How significant is technology integration in the millennial travel booking process?

Technology is absolutely essential, with 85% of millennials relying on mobile devices for trip research, booking, and in-destination activities. They demand seamless mobile applications, instant confirmation capabilities, high-speed WiFi connectivity, and personalized service derived from AI-driven data analysis across the entire customer journey.

Which travel segments are experiencing the fastest growth within the millennial demographic?

The fastest-growing segments include adventure tourism, wellness retreats, specialized cultural tours, and 'bleisure' travel (combining business and leisure). Voluntourism and eco-conscious travel are also seeing accelerated adoption, reflecting the demographic's increasing awareness and prioritization of social and environmental impact.

What impact do sustainability concerns have on millennial travel choices?

Sustainability concerns significantly influence millennial choices, leading to a preference for providers demonstrating clear environmental responsibility, often choosing train or bus travel over short flights, and prioritizing local, ethical accommodation. Transparency regarding carbon offsetting and local community support is a major differentiator in supplier selection.

What is the competitive positioning of OTAs versus direct booking channels for millennials?

OTAs are favored for research, price comparison, and diverse activity booking due to their convenience and breadth of inventory. However, direct booking channels (supplier websites) are frequently preferred for high-value transactions, enabling travelers to secure better loyalty points, specialized deals, and direct access to customer service often unavailable through third-party platforms.

How do global economic trends affect the Millennial Travel Market?

Global economic stability directly influences millennial discretionary spending. While older, more affluent millennials may seek resilience in luxury experiences during downturns, younger segments are highly sensitive to price fluctuations, leading to increased demand for budget carriers, hostel accommodation, and longer trips focused on lower-cost regions, optimizing for value per experience.

What role does social media play in destination selection for this market?

Social media platforms like Instagram and TikTok serve as primary inspiration sources and validation tools. Destinations and experiences that are highly 'Instagrammable' often gain significant traction. Furthermore, user-generated content (UGC) and detailed reviews from peers on platforms like Tripadvisor and travel blogs are trusted sources, substantially outweighing traditional advertising efforts.

What are the key differences between older and younger millennial travel habits?

Older millennials (35-42) typically exhibit higher spending, often incorporating family needs, seeking comfort, and prioritizing wellness or high-end personalized luxury. Younger millennials (27-34) are more likely to prioritize budget flexibility, extend travel duration, choose unconventional destinations, and rely on shared accommodation and group tours to minimize costs while maximizing experience.

How are accommodations adapting to millennial traveler needs?

Accommodations are shifting towards hybrid models, offering communal spaces for working and socializing, emphasizing high-quality, free WiFi, integrating smart room technology, and providing curated local experiences. Traditional hotels are adopting lifestyle branding, while specialized hostel and co-living concepts like Selina cater directly to the needs of digital nomads and experience-seekers.

What is 'Bleisure' travel and why is it important to the millennial segment?

Bleisure travel refers to combining elements of business and leisure travel by extending a work trip with personal days. It is crucial for millennials because they seek to maximize productivity while integrating experiences, demanding hotels and logistics providers that facilitate a smooth transition between professional tasks and local exploration seamlessly.

Which geographical region shows the highest growth potential for millennial travelers?

The Asia Pacific (APAC) region demonstrates the highest growth potential, driven by the rapidly increasing disposable incomes of millennials in economies like China, India, and Southeast Asia. The rise of outbound travel from these nations, combined with high mobile adoption, makes APAC the focal point for future market expansion.

What are the main risks associated with rapid digitalization in this market?

The main risks include increased cybersecurity threats impacting personal and financial data, the challenge of maintaining competitive relevance against rapidly innovating tech startups, and the difficulty of balancing hyper-personalization with consumer privacy concerns. Over-reliance on automation may also lead to a perceived loss of human warmth in customer service.

How do millennials utilize Virtual Reality (VR) in their travel planning process?

Millennials utilize VR primarily for "try before you buy" experiences, allowing them to virtually tour hotel rooms, explore cruise ship amenities, or navigate specific destinations. This technology reduces booking anxiety, enhances confidence in itinerary choices, and functions as an effective, immersive marketing tool for high-value bookings.

What is the typical trip duration preferred by millennial travelers?

Trip duration varies significantly, but millennials generally favor frequent, shorter trips (3-5 days) for city breaks or wellness retreats, alongside longer, more immersive trips (10-21 days) for backpacking, adventure tourism, or international exploration, especially among younger cohorts and digital nomads seeking cultural depth.

How do loyalty programs need to adapt to appeal specifically to millennials?

Traditional points-based loyalty programs are less appealing. Millennials prefer loyalty programs that offer experiential rewards, such as free local tours, exclusive access to curated events, or upgrades that enhance authenticity and personalization, prioritizing flexibility and meaningful experiences over purely monetary value.

What is the impact of low-cost carriers (LCCs) on market dynamics?

LCCs have fundamentally democratized travel for millennials, enabling more frequent and shorter trips across greater distances by significantly reducing the barrier to entry related to transportation costs. This has shifted the focus of spending from transportation to in-destination activities and experiences.

Why is authenticity a key demand for millennial travelers?

Authenticity is critical because millennials seek genuine connection and unique narratives that reflect local culture, rather than standardized tourist experiences. They actively avoid highly commercialized destinations and tours, opting instead for local food vendors, boutique accommodations, and interactions that provide personal insights, which are highly valued for social sharing.

What role do travel bloggers and influencers play in market segmentation?

Influencers act as crucial conduits for inspiration and trust. Millennials often segment their travel choices based on the recommendations of trusted niche influencers (e.g., adventure travelers, vegan food bloggers) who provide detailed, seemingly unbiased accounts, effectively creating segmented demand for specific destinations and unique product offerings.

How important is the concept of 'wellness' in millennial travel?

Wellness is highly important, extending beyond traditional spa treatments to encompass mental health, digital detox retreats, fitness-focused itineraries, and healthy, locally sourced food. Millennials view travel as a form of self-care and stress reduction, driving demand for specialized retreats and integrated wellness options within standard hotel offerings.

What challenges do legacy travel agencies face in retaining millennial customers?

Legacy agencies struggle due to perceived lack of digital agility, reliance on packaged tours, and difficulty in matching the instant, personalized, and diverse inventory options offered by OTAs. To compete, they must pivot to offering highly specialized, concierge-level services for complex, bespoke itineraries that technology cannot easily replicate.

What is the primary mode of communication preferred by millennials during a trip?

Millennials overwhelmingly prefer asynchronous, instant communication channels, such as WhatsApp, in-app messaging, or chatbot interfaces for customer support and quick modifications. They expect immediate, 24/7 service capability, minimizing the need for traditional voice calls for non-urgent issues.

How is the cruise industry adapting to attract the millennial segment?

The cruise industry is adapting by introducing shorter, experience-rich itineraries, focusing on smaller ships that access unique ports, and integrating higher-end dining and entertainment options. They are also heavily investing in technology, high-speed WiFi, and environmentally friendly operations to address millennial values and digital needs.

What is the outlook for collaborative consumption platforms like Airbnb in this market?

Collaborative consumption platforms like Airbnb are expected to maintain strong growth, capitalizing on millennial preferences for local immersion, cost-effectiveness, and unique accommodation styles. The expansion into 'Experiences' further solidifies their position by satisfying the core demand for authenticity and novel local activities.

What are the key considerations for marketing travel products to millennials?

Marketing must be mobile-first, visually driven, and focus on storytelling that emphasizes the experience rather than the product features. Transparency in pricing and clear commitment to sustainability and ethical practices are non-negotiable considerations for gaining trust and driving conversion.

How is the demand for solo travel evolving among millennials?

Solo travel is rapidly increasing, particularly among female millennials, driven by a desire for self-discovery and freedom in itinerary planning. Providers are responding by offering safer solo-friendly accommodations, community-focused tours, and integrated networking features to connect independent travelers upon arrival.

What impact does the "digital nomad" trend have on long-term travel products?

The digital nomad trend creates a specialized demand for products centered on affordability, extended-stay housing with dedicated workspaces, reliable global connectivity, and specialized insurance/visa services. This segment is driving the growth of co-living and purpose-built long-term remote work destinations worldwide.

How does geopolitical uncertainty affect destination choice for millennial travelers?

Geopolitical uncertainty causes millennials to rapidly shift destination choices, often preferring regions perceived as stable and safe, relying heavily on real-time governmental travel advisories and user sentiment data. This necessitates highly flexible booking and cancellation policies from travel providers to accommodate sudden changes in traveler confidence.

What role do payment technologies play in market growth?

Mobile payment technologies, digital wallets, and cross-border payment simplification are critical accelerators. Millennials expect fast, secure, and diverse payment options, including local methods in foreign destinations, reducing friction and enabling impulsive booking behavior common among this demographic.

How important are personalized recommendations in the discovery phase?

Personalized recommendations are extremely important, as millennials suffer from "choice overload" due to the vast digital information available. AI and machine learning are employed to filter options, presenting highly relevant, curated suggestions based on historical data, significantly shortening the decision cycle and improving conversion rates.

What are the primary factors contributing to the market's high projected CAGR?

The high CAGR is driven by the fact that the millennial generation is entering its peak earning years, increasing their capacity for discretionary spending on travel. This demographic tailwind, combined with continuous technological innovation simplifying global travel, underpins the robust forecast expansion through 2033.

How do millennials prioritize value when selecting a travel package?

Millennials prioritize "value for experience" over simply the lowest price. They are willing to pay a premium for unique, authentic, and high-quality experiences, fast logistics, and guaranteed sustainability, but they are highly intolerant of hidden fees or lack of transparency in the booking and consumption process.

What is the future outlook for traditional travel agents in servicing this market?

Traditional agents must transition into specialized travel advisors, focusing on complex, multi-component international trips, small group luxury excursions, or unique niche markets (e.g., highly specialized adventure travel). Their value lies in human expertise, crisis management, and access to exclusive inventory not available online.

How does data security influence millennial booking confidence?

High-profile data breaches significantly erode booking confidence. Millennials expect travel platforms to utilize robust encryption, clear data privacy policies, and multi-factor authentication, viewing security as a non-negotiable component of a trustworthy digital service provider.

What are the emerging trends in food and culinary tourism for millennials?

Culinary tourism for millennials emphasizes authenticity, often prioritizing street food experiences, farm-to-table dining, and cooking classes focusing on local traditions. They seek deep immersion into regional gastronomy, driven by a desire to understand the culture through its food, rather than standard fine dining experiences.

What impact do macroeconomic factors like inflation have on millennial travel?

Inflation forces millennials to adjust their itineraries, often leading to a shift from international to domestic travel, shorter trip durations, or increased use of sharing economy platforms to manage accommodation costs, demonstrating their ability to adapt rapidly while maintaining their desire for frequent travel experiences.

How are airlines attracting younger millennial travelers?

Airlines are attracting younger millennials through personalized dynamic pricing, enhanced in-flight connectivity, improved basic economy options, and strategic use of social media engagement. They focus on loyalty programs that offer flexible redemption options and experiential perks beyond just flight upgrades.

What is the role of voice search technology in planning millennial trips?

Voice search technology is increasingly used for initial research, simple queries ("best hotels near Central Park"), and hands-free logistics management during the trip, especially via smart speakers and mobile assistants, driving demand for content optimized for conversational search queries.

How do local government policies influence the appeal of a destination to millennials?

Government policies related to safety, visa ease, and sustainable infrastructure (e.g., accessible public transport, pedestrian zones) significantly enhance a destination's appeal. Conversely, policies perceived as hostile to tourists or restrictive of local culture can deter millennial visitation, which values freedom and authentic local interaction.

What is the demand for specialized travel insurance products in this market?

There is high demand for specialized travel insurance that covers activity risks (e.g., adventure sports), provides comprehensive health coverage for longer stays, and offers robust protection against geopolitical or pandemic-related disruptions, reflecting the demographic's engagement in riskier, longer, and more dynamic travel types.

How is the market leveraging user-generated content (UGC) for marketing?

The market relies heavily on UGC, using traveler photos, videos, and reviews across booking platforms and social channels to build credibility and authenticity. UGC is more trusted than brand advertising, making community engagement and prompt response to reviews a fundamental marketing strategy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager