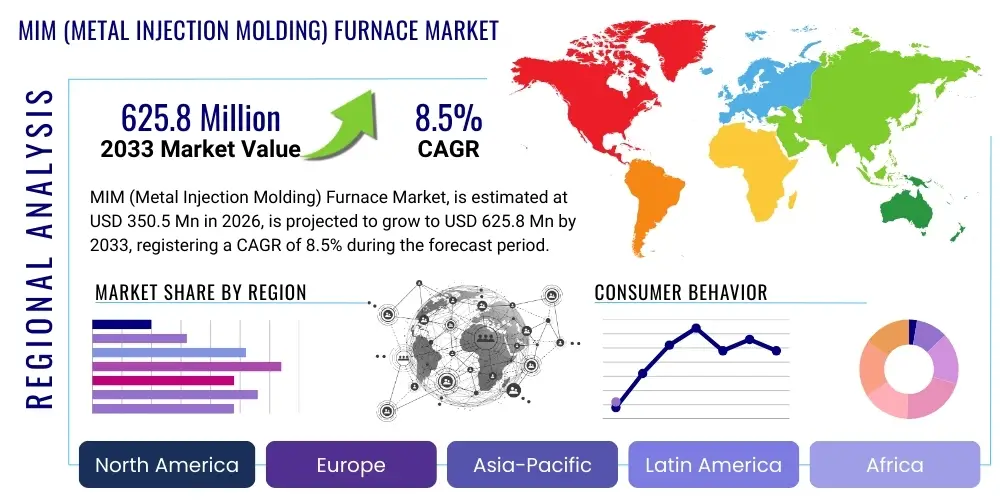

MIM (Metal Injection Molding) Furnace Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435917 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

MIM (Metal Injection Molding) Furnace Market Size

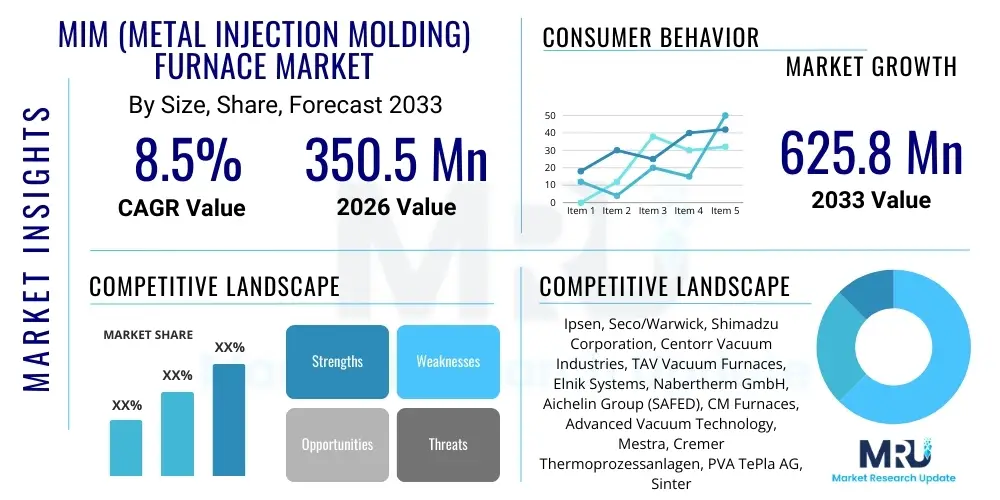

The MIM (Metal Injection Molding) Furnace Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 625.8 Million by the end of the forecast period in 2033.

MIM (Metal Injection Molding) Furnace Market introduction

The MIM Furnace Market revolves around specialized thermal processing equipment critical for the final stages of the Metal Injection Molding process. These furnaces are engineered to handle the demanding requirements of debinding and high-temperature sintering, converting fragile, molded "green" parts into dense, functional metal components. The performance metrics of these furnaces—including temperature uniformity, atmosphere control (e.g., hydrogen, inert gases, high vacuum), and cycle time precision—directly influence the mechanical properties, dimensional accuracy, and final quality of the complex parts produced by MIM, which is essential for sectors requiring high volume and complexity, such as medical devices and automotive systems.

The core function of the MIM furnace involves two primary steps: thermal debinding, where the polymer binder is carefully removed without distorting the part structure, and subsequent high-temperature sintering, where the metal powder particles consolidate through diffusion to achieve near-full density. These systems utilize advanced heating elements, insulation materials, and gas management technologies to ensure process repeatability and efficiency. Key applications driving demand include the production of intricate geometries for consumer electronics (like smartphone hinge components), lightweight structural parts for aerospace, and high-precision instruments for orthopedic and dental fields. The ongoing trend toward miniaturization and high-performance material utilization significantly elevates the strategic importance of reliable and technologically advanced MIM furnace solutions.

Major driving factors fueling market expansion include the increasing adoption of MIM technology as a cost-effective alternative to traditional machining for producing small, complex metal parts in large volumes. Furthermore, the ability of modern MIM furnaces to process specialized materials like stainless steels, nickel alloys, and titanium with exceptional efficiency and minimal waste positions them centrally in advanced manufacturing strategies globally. The benefits offered—superior surface finish, high material utilization, and geometric complexity achievement—make MIM furnaces indispensable tools for modern high-tech industries striving for component innovation and manufacturing scalability.

MIM (Metal Injection Molding) Furnace Market Executive Summary

The MIM Furnace market is experiencing robust growth driven primarily by technological advancements in high-temperature materials processing and escalating demand from the automotive and medical sectors for highly complex, small metal components. Business trends indicate a strong move towards continuous sintering furnaces over traditional batch systems, favoring higher throughput, improved energy efficiency, and reduced operational costs, particularly in high-volume production centers across Asia Pacific. Regional trends highlight APAC, led by China and India, as the epicenter of manufacturing investment, showcasing the highest adoption rates due to significant expansion in consumer electronics and electric vehicle component manufacturing, while North America and Europe maintain steady growth focused on high-specification, critical applications in medical implants and aerospace structures, necessitating ultra-high vacuum and specialized atmosphere controls.

Segment trends reveal that the Vacuum Sintering segment dominates revenue share, attributed to its necessity in processing reactive and refractory metals like titanium and tungsten alloys, vital for medical and aerospace applications where stringent quality and density standards are non-negotiable. Concurrently, the application segment of Consumer Electronics is projected to register the fastest CAGR, propelled by the relentless demand for miniaturized components, requiring advanced furnace capabilities for processing micro-MIM parts with extreme precision. Furthermore, there is a distinct trend toward integrating automation and digital twin technologies into new furnace installations to optimize cycle times, enhance predictive maintenance, and ensure complete process traceability, addressing critical industry requirements for compliance and quality assurance in sectors like orthopedic surgery and precision fluid handling.

The competitive landscape is characterized by innovation in energy recovery systems and the development of multi-atmosphere furnaces capable of handling both debinding and sintering in a single unit, streamlining production lines and reducing overall processing time. Companies are focusing on providing turnkey solutions that include integrated gas purification and closed-loop control systems to meet increasingly strict environmental regulations and material purity requirements. The underlying strategic imperative across the market is delivering furnaces that offer superior thermal uniformity and rapid cooling capabilities, enabling manufacturers to efficiently process next-generation materials designed for extreme performance environments, solidifying the market's trajectory towards highly automated and digitally integrated manufacturing processes.

AI Impact Analysis on MIM (Metal Injection Molding) Furnace Market

User inquiries regarding AI in the MIM Furnace market frequently center on maximizing throughput, achieving zero-defect rates, and optimizing energy consumption during complex sintering cycles. Key themes revolve around leveraging machine learning for predictive modeling of material shrinkage and distortion, automating fault detection in vacuum systems, and dynamically adjusting temperature ramps based on real-time sensor data to counteract thermal irregularities. Users are keenly interested in how AI can move the process from reliance on standardized recipes to data-driven, adaptive process control, ensuring consistent quality even when feedstock materials exhibit slight variance. There is a strong expectation that AI will be the foundational technology enabling true 'smart' furnaces capable of self-diagnosing maintenance needs and optimizing utility usage for sustainability goals.

The primary concern analyzed from user engagement is the complexity and cost associated with integrating sophisticated AI infrastructure into legacy furnace systems. Manufacturers are seeking validation on the return on investment (ROI) of AI adoption, particularly concerning enhanced quality control (reducing expensive scrap rates) and maximizing equipment uptime through accurate predictive maintenance scheduling. Furthermore, the need for standardized data acquisition protocols and interoperability between different equipment vendors’ systems is a recurring topic. The potential for AI to dramatically shorten the R&D cycle for new alloys by simulating sintering behavior without physical trials is also a high-priority area of interest, reflecting a fundamental shift in how material science and thermal processing are approached within the industry.

AI's influence is thus projected to transition MIM furnace operation from an art reliant on experienced operators to a highly scientific, data-centric process. This includes using deep learning models trained on millions of historical processing parameters to anticipate and correct process deviations before they affect the final part quality. This shift not only improves manufacturing efficiency but also elevates the compliance standards achievable within regulated industries such as aerospace and medical device production, where rigorous process validation and documentation are mandatory requirements. The deployment of robust sensor networks combined with edge computing for immediate data analysis is essential for realizing these AI-driven benefits.

- AI optimizes sintering cycles by predicting part shrinkage and geometric distortion, reducing trial-and-error costs.

- Predictive maintenance algorithms minimize unplanned downtime by monitoring heating element degradation and vacuum pump performance.

- Machine learning enhances quality control by analyzing thermal profiles in real-time to identify anomalies indicative of porosity or incomplete densification.

- AI-driven energy management systems dynamically adjust power consumption based on load and desired cycle time, optimizing operational efficiency.

- Natural Language Processing (NLP) aids in analyzing voluminous process logs and operator notes for systematic process improvement and knowledge capture.

DRO & Impact Forces Of MIM (Metal Injection Molding) Furnace Market

The MIM Furnace Market is strongly influenced by a confluence of accelerating drivers and persistent restraining factors, creating dynamic impact forces that shape investment decisions and technological focus. The primary drivers include the global trend toward miniaturization of components across consumer electronics and medical sectors, necessitating the precision offered only by MIM technology and, consequently, high-specification sintering furnaces. Furthermore, the increasing adoption of complex, high-performance materials (such as tungsten heavy alloys and certain intermetallics) in aerospace and defense applications demands advanced furnace capabilities like ultra-high vacuum and specialized hydrogen atmospheres, pushing manufacturers to continuously upgrade their equipment. These drivers are fundamentally linked to global industrial mandates for increased efficiency, reduced weight, and improved component longevity.

However, the market growth is constrained by significant barriers, chiefly the substantial initial capital expenditure required for acquiring and installing state-of-the-art MIM furnace systems. This high upfront cost, coupled with the complexity associated with operating and maintaining these specialized thermal processing units, particularly those involving reactive gases like hydrogen, limits rapid adoption by smaller enterprises. The necessity for highly skilled personnel for process control, maintenance, and complex troubleshooting also acts as a restraint. Furthermore, stringent safety regulations concerning high-temperature equipment and explosive atmosphere handling (hydrogen) impose complex compliance costs and operational limitations on manufacturers, necessitating specialized engineering solutions and continuous training protocols.

Opportunities for market expansion are abundant, particularly in integrating MIM furnaces with additive manufacturing (AM) post-processing, specifically in binder jetting applications, where specialized sintering cycles are required for large-volume parts. The rising focus on green manufacturing and energy efficiency offers a lucrative opportunity for developing furnaces equipped with advanced heat recovery systems and rapid cooling mechanisms, appealing to environmentally conscious industries. Impact forces manifest through competitive intensity, where key players continuously innovate on furnace automation and integration features, and through material science breakthroughs that necessitate entirely new furnace designs capable of handling experimental powder chemistries and high-temperature requirements exceeding 1600°C, ensuring the market remains highly competitive and technology-driven.

Segmentation Analysis

The MIM (Metal Injection Molding) Furnace Market is comprehensively segmented based on Furnace Type, Process Atmosphere, Operating Temperature, and End-User Application, providing crucial insights into market dynamics and growth trajectories across various industrial verticals. The segmentation by Furnace Type, distinguishing between Batch, Continuous, and Combination (debinding/sintering) units, reflects the trade-offs manufacturers make between flexibility and throughput. Batch furnaces offer process versatility and are preferred for smaller runs or R&D, while continuous systems are the backbone of high-volume manufacturing, dominating segments like automotive and consumer electronics due to their inherent efficiency and lower cost-per-part over extended cycles. Understanding these segmentation nuances is vital for equipment providers to align their product portfolios with specific customer operational demands.

Segmentation by Process Atmosphere is particularly critical, as it directly relates to the type of material being processed and the required metallurgical quality. Segments include High Vacuum, Hydrogen, Inert Gas (Argon/Nitrogen), and Multi-Atmosphere configurations. High Vacuum furnaces are essential for refractory metals and alloys like titanium and ceramics where oxygen contamination must be minimized to parts per million (ppm) levels, primarily serving the medical and aerospace sectors. Conversely, Hydrogen and Inert Gas atmospheres are common for stainless steel and ferrous alloys, offering superior quality control during the sintering phase. The shift towards Multi-Atmosphere systems, capable of seamlessly transitioning between different gases and vacuum levels within a single cycle, highlights a key technological advancement catering to diverse manufacturing requirements.

The End-User Application segmentation underscores the key demand drivers for MIM furnaces, encompassing major sectors such as Automotive, Medical & Healthcare, Aerospace & Defense, Consumer Electronics, and Industrial Goods. The Medical sector demands the highest quality standards, prioritizing reliable vacuum and precise temperature control for implants and surgical instruments. Meanwhile, the Automotive segment, particularly driven by the transition to Electric Vehicles (EVs), focuses on volume, cost-efficiency, and processing lightweight, complex components like gears and fluid handling parts. This granular analysis of application needs assists stakeholders in strategically prioritizing market penetration efforts and product development tailored to the unique regulatory and operational requirements of each industry.

- By Furnace Type:

- Batch Furnaces

- Continuous Furnaces

- Combination Furnaces (Debind/Sinter)

- By Process Atmosphere:

- High Vacuum Furnaces

- Hydrogen Atmosphere Furnaces

- Inert Gas (Argon/Nitrogen) Furnaces

- Multi-Atmosphere Furnaces

- By Operating Temperature:

- Up to 1400°C

- 1400°C to 1600°C

- Above 1600°C (Ultra-High Temp)

- By End-User Application:

- Automotive (Engine components, EV parts)

- Medical & Healthcare (Implants, Surgical Tools)

- Consumer Electronics (Micro-components, Casings)

- Aerospace & Defense (Structural parts, Nozzles)

- Industrial Machinery & Tools

Value Chain Analysis For MIM (Metal Injection Molding) Furnace Market

The value chain for the MIM Furnace Market begins with upstream activities dominated by specialized component suppliers. This includes manufacturers of high-purity graphite components (heating elements, insulation), advanced refractory materials, and sophisticated control systems (PLC, temperature sensors, vacuum gauges). The efficiency and reliability of the final furnace product are heavily contingent upon the quality and durability of these upstream components. Key strategic relationships are often formed between major furnace builders and component providers to secure supply consistency and integrate proprietary technology, such as specialized hot zone designs and energy-efficient insulation packages, which are critical differentiators in this capital equipment sector.

Midstream activities involve the core competencies of the furnace manufacturers themselves, encompassing R&D, engineering design, assembly, and rigorous testing. This stage adds significant value through intellectual property related to thermal uniformity, atmosphere control systems, and automation software. Distribution channels are typically highly specialized and primarily direct, characterized by substantial technical consultation and customized solutions. Due to the high investment cost and technical complexity of the equipment, sales cycles are long, requiring intensive pre-sales engineering support. Direct channels ensure the manufacturer maintains control over installation, commissioning, and immediate after-sales service, which is a major factor in customer satisfaction and repeat business.

Downstream analysis focuses on the end-users—MIM parts manufacturers (captive operations or specialized job shops)—who purchase, operate, and maintain these furnaces to produce final metal components. Indirect distribution channels, such as regional representatives or integrators, sometimes facilitate access to smaller or geographically remote markets, although technical support often reverts back to the original equipment manufacturer (OEM). The final stage involves extensive post-sales support, including maintenance contracts, spare parts supply, and process optimization consulting. The ability to provide prompt, expert service and ensure maximum uptime is a critical success factor for furnace manufacturers, as equipment failure can lead to severe production losses for MIM operators.

MIM (Metal Injection Molding) Furnace Market Potential Customers

Potential customers for MIM (Metal Injection Molding) furnaces are primarily high-volume, precision metal component manufacturers who utilize the MIM process to produce small, complex parts that are challenging or cost-prohibitive to manufacture using conventional techniques like CNC machining or investment casting. The largest segments of end-users are specialized MIM job shops that serve diverse industries, providing a broad range of materials and part sizes, requiring highly flexible multi-purpose batch furnaces. These job shops invest heavily in advanced furnace technology to maintain a competitive edge based on process repeatability, quick turnaround times, and the ability to handle exotic materials demanded by their varied clientele.

Another significant customer segment includes captive manufacturing operations within large Original Equipment Manufacturers (OEMs), particularly those in the automotive and consumer electronics industries. For instance, automotive OEMs producing complex transmission components, sensor housings, or electric vehicle battery connectors, often prefer high-throughput continuous furnaces to manage their immense production volumes efficiently and maintain tight control over their supply chain and proprietary component designs. Similarly, large medical device companies require dedicated, validated furnaces (often vacuum or hydrogen-based) for the production of critical surgical tools, orthopedic implants, and dental components, where zero-defect manufacturing is paramount, making reliable, high-precision thermal processing equipment indispensable.

Emerging potential customers are also found within the burgeoning Additive Manufacturing (AM) sector, specifically companies employing Binder Jetting technology. These AM firms require large-format, high-temperature sintering furnaces capable of handling green parts made from various powders, often with specialized atmospheric requirements. Research institutions and material development laboratories also represent a specialized niche market, demanding flexible, small-scale batch furnaces for R&D on new powder metallurgy techniques and advanced material formulations, further diversifying the customer base beyond traditional mass production facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 625.8 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ipsen, Seco/Warwick, Shimadzu Corporation, Centorr Vacuum Industries, TAV Vacuum Furnaces, Elnik Systems, Nabertherm GmbH, Aichelin Group (SAFED), CM Furnaces, Advanced Vacuum Technology, Mestra, Cremer Thermoprozessanlagen, PVA TePla AG, SinterMet, Systronix Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MIM (Metal Injection Molding) Furnace Market Key Technology Landscape

The MIM Furnace market's technology landscape is characterized by continuous innovation focused on improving efficiency, process control, and material handling capabilities. A critical technological thrust involves advanced hot zone design, utilizing materials like high-density graphite felt or specialized molybdenum alloys to ensure superior thermal uniformity and rapid thermal cycling, directly impacting production throughput and part quality. Furthermore, the development of sophisticated, multi-zone heating systems allows for precise temperature profiling during the critical debinding and pre-sintering phases, minimizing distortion and binder residue. Modern furnaces are increasingly incorporating highly sensitive oxygen and humidity sensors combined with mass flow controllers to maintain ultra-pure and tightly controlled atmospheres, which is essential for processing highly reactive metal powders like titanium and specialty stainless steels.

Another major technological advancement is the integration of closed-loop process control and Industrial Internet of Things (IIoT) architectures. This allows for real-time monitoring of critical parameters such as vacuum levels, gas consumption, cooling rates, and energy usage, enabling operators to adjust process variables dynamically. Advanced software platforms now include data logging and traceability features compliant with strict industry standards, particularly important for medical and aerospace customers requiring detailed records of every thermal cycle. The shift toward integrated debinding and sintering (IDS) furnaces, which combine these traditionally separate steps into a single, continuous process chamber, represents a significant leap in efficiency, reducing handling damage and overall processing time, though requiring highly specialized furnace engineering to manage the volatile binder removal process effectively.

Furthermore, energy efficiency remains a core area of focus, driving the adoption of high-efficiency vacuum pumps (such as dry pumps), superior insulation packages designed to minimize heat loss, and advanced heat exchangers for rapid and controlled cooling using inert gas recirculation. The increasing complexity of materials necessitates furnaces capable of achieving and maintaining ultra-high temperatures (above 1600°C) with exceptional stability, leading to innovations in material handling within the hot zone, such as robust ceramic or molybdenum hearth systems. This commitment to technological superiority ensures that MIM furnaces can effectively process the next generation of complex, high-performance materials demanded by evolving high-tech industries.

Regional Highlights

The MIM Furnace Market exhibits distinct growth patterns and technological preferences across major global regions, influenced significantly by local manufacturing capacity, regulatory environments, and dominant end-user industries. The Asia Pacific (APAC) region stands out as the global leader in terms of market size and growth trajectory, largely driven by its enormous capacity in consumer electronics manufacturing, particularly in China, Taiwan, and South Korea. The rapid urbanization and industrial expansion across India and Southeast Asia are also contributing substantially, focusing primarily on high-volume production utilizing continuous sintering furnaces. Investment here is focused on scalable, cost-effective solutions and the processing of ferrous and stainless steels for mobile device components and automotive parts. The regional dynamic is further boosted by strong government support for advanced manufacturing initiatives and favorable conditions for rapid capital deployment.

North America and Europe represent mature markets characterized by a strong emphasis on high-specification, low-volume, high-value applications. In North America, demand is heavily concentrated in the Aerospace & Defense and Medical & Healthcare sectors, necessitating the use of advanced High Vacuum and specialized atmosphere furnaces capable of handling titanium, cobalt-chrome, and nickel-based superalloys. European market growth, particularly in Germany and Switzerland, is driven by the precision engineering and automotive sectors, with a notable focus on integrating sophisticated automation and Industry 4.0 concepts into furnace operations to enhance quality traceability and energy efficiency. These regions prioritize furnace reliability, long-term technical support, and compliance with stringent environmental and safety standards, particularly regarding hydrogen usage.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but are exhibiting promising growth potential. LATAM, led by Brazil and Mexico, shows steady adoption primarily within the regional automotive supply chain and industrial goods sectors, relying predominantly on batch furnace technology for versatile production needs. MEA's market expansion is linked to localized efforts to diversify industrial base away from natural resources, with investments in precision metal forming in the UAE and South Africa. While adoption rates are lower due to fragmented industrial infrastructure, the long-term outlook suggests increasing demand, especially as regional manufacturing capabilities mature and require specialized thermal processing for high-quality domestic production, often sourced through international vendors providing comprehensive installation and training services.

- Asia Pacific (APAC): Dominates the market due to massive consumer electronics and automotive (including EV) manufacturing base; high demand for continuous, high-throughput systems; focus on ferrous and stainless steel processing. Key countries: China, Japan, South Korea.

- North America: Strong demand driven by Aerospace & Defense and Medical industries; high preference for vacuum sintering and highly automated, validated batch systems for critical applications; focus on refractory and exotic alloys. Key country: United States.

- Europe: Focus on precision engineering, high-end automotive, and Industry 4.0 integration; emphasis on energy efficiency, environmental compliance, and integrated processing; substantial market share in Germany and Switzerland.

- Latin America (LATAM): Emerging market concentrated in automotive parts and general industrial goods; growing use of batch furnaces for flexibility; key growth markets in Brazil and Mexico.

- Middle East & Africa (MEA): Nascent market primarily focused on industrial diversification projects; slow but steady adoption supported by international partnerships and localized defense requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MIM (Metal Injection Molding) Furnace Market.- Ipsen

- Seco/Warwick

- Shimadzu Corporation

- Centorr Vacuum Industries

- TAV Vacuum Furnaces

- Elnik Systems

- Nabertherm GmbH

- Aichelin Group (SAFED)

- CM Furnaces

- Advanced Vacuum Technology

- Mestra

- Cremer Thermoprozessanlagen

- PVA TePla AG

- SinterMet

- Systronix Co., Ltd.

- C. I. Hayes, Inc.

- ALD Vacuum Technologies

- Gasbarre Products, Inc.

- Lindberg/MPH

Frequently Asked Questions

Analyze common user questions about the MIM (Metal Injection Molding) Furnace market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between batch and continuous MIM furnaces?

Batch furnaces offer flexibility for lower volumes, variable materials, and R&D, requiring manual loading/unloading per cycle. Continuous furnaces provide higher throughput and better energy efficiency for large, consistent production volumes, moving parts automatically through different thermal zones.

Which atmospheric control technology is crucial for processing titanium components?

High Vacuum atmosphere technology is crucial for titanium MIM components. Sintering titanium requires vacuum levels typically below 10^-5 mbar to prevent the highly reactive metal from absorbing interstitial elements like oxygen and nitrogen, which would severely compromise mechanical properties.

How does the MIM furnace market segment relate to the growth of electric vehicles (EVs)?

The EV sector significantly drives demand for continuous MIM furnaces to produce complex, lightweight components such as sensors, internal gears, battery connector pins, and thermal management parts, necessitating high-volume and high-precision processing of ferrous and non-ferrous alloys.

What role does AI play in optimizing the MIM sintering process?

AI is used for predictive process control, utilizing real-time sensor data to dynamically adjust heating rates and gas flows. This minimizes part distortion, predicts and prevents defects, and optimizes energy consumption, transitioning the process toward adaptive, data-driven manufacturing excellence.

What are the key safety considerations when operating hydrogen atmosphere MIM furnaces?

Operating hydrogen atmosphere furnaces requires stringent adherence to safety protocols, including specialized gas leak detection systems, active exhaust ventilation, controlled atmosphere purging procedures using inert gas, and robust safety interlocking mechanisms to prevent the formation of explosive mixtures within the furnace chamber.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- MIM (Metal Injection Molding) Furnace Market Size Report By Type (Batch Furnaces, Continuous Furnaces), By Application (Automobile, Mechanical, Consumer Electronics, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- MIM (Metal Injection Molding) Furnace Market Statistics 2025 Analysis By Application (Automobile, Mechanical, Consumer Electronics), By Type (Batch Furnaces, Continuous Furnaces), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Mim (Metal Injection Molding) Furnace Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Batch Furnaces, Continuous Furnaces), By Application (Automobile, Mechanical, Consumer Electronics, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager