Mineral Flotation Collectors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439321 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Mineral Flotation Collectors Market Size

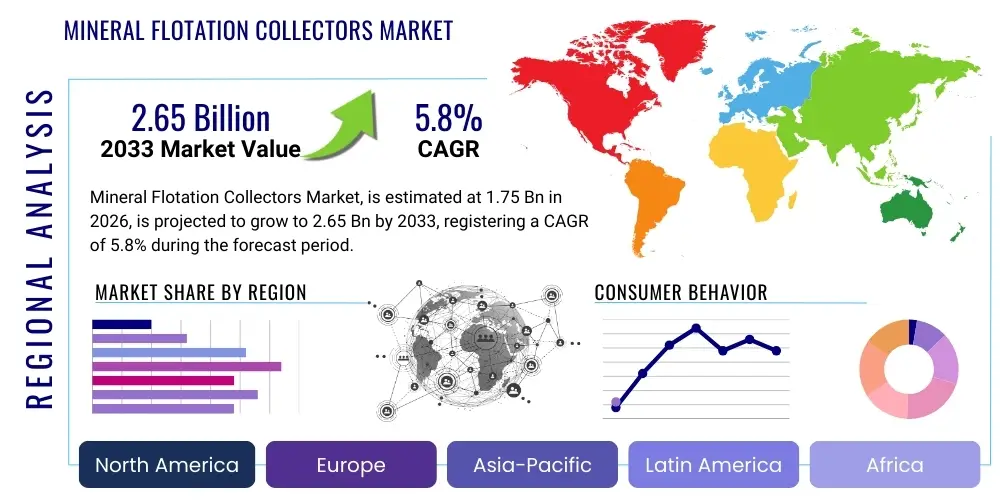

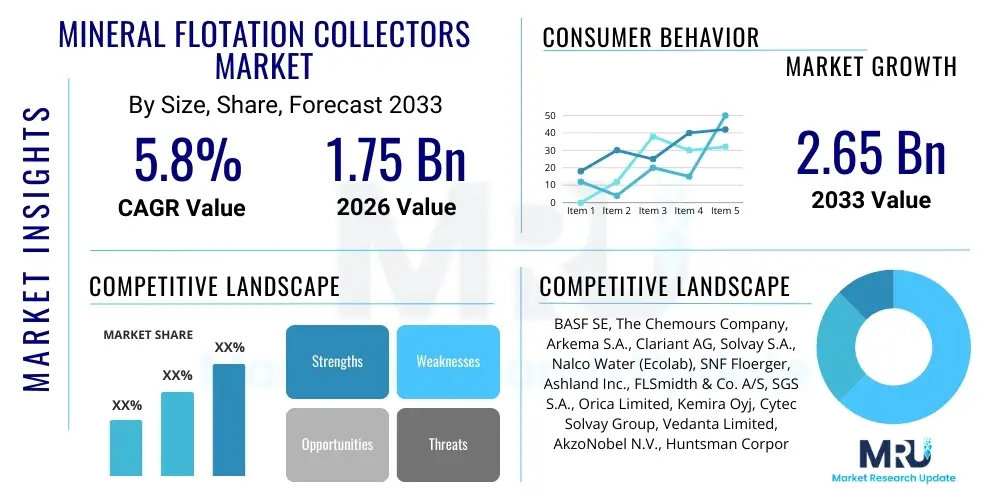

The Mineral Flotation Collectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.75 billion in 2026 and is projected to reach USD 2.65 billion by the end of the forecast period in 2033.

Mineral Flotation Collectors Market introduction

The Mineral Flotation Collectors market is a critical segment within the broader mining and mineral processing industry, providing essential chemical reagents that enable the separation of valuable minerals from gangue material. These collectors are surface-active chemicals designed to selectively attach to specific mineral surfaces, rendering them hydrophobic and allowing them to adhere to air bubbles during the froth flotation process. This differential attachment facilitates the recovery of target minerals such as copper, gold, lead, zinc, and phosphates, which would otherwise be uneconomical or impossible to extract using conventional methods. The efficiency and selectivity of these collectors directly impact the overall productivity and profitability of mining operations, making them indispensable components in modern mineral beneficiation.

The product portfolio within this market is diverse, encompassing various chemical classes including xanthates, dithiophosphates, fatty acids, amines, and mercaptans, each tailored for optimal performance with specific ore types and processing conditions. Xanthates, for instance, are widely used for sulfide minerals, while fatty acids often find application in the flotation of non-sulfide minerals like phosphates and industrial minerals. Major applications span across base metal mining, precious metal recovery, industrial mineral processing, and coal beneficiation. The increasing complexity of ore bodies, characterized by lower grades and finer disseminated minerals, further amplifies the demand for highly efficient and selective flotation collectors, driving continuous innovation in reagent chemistry and application methodologies. The ability of these collectors to enhance recovery rates and improve concentrate grades is paramount for sustainable mineral production.

The primary benefits derived from the effective use of mineral flotation collectors include significantly improved mineral recovery, enhanced concentrate quality, and reduced processing costs through optimized resource utilization. These benefits are crucial for maintaining competitive advantages in a volatile commodities market. Driving factors for market growth include the escalating global demand for metals and minerals, particularly from developing economies undergoing rapid industrialization and urbanization. Furthermore, technological advancements in flotation processes, the increasing focus on extracting valuable minerals from complex and low-grade ores, and the growing emphasis on sustainable mining practices that require efficient resource utilization are all contributing to the expansion of this market. Environmental regulations, while presenting challenges, also spur innovation towards greener, more biodegradable collector chemistries, further shaping market dynamics.

Mineral Flotation Collectors Market Executive Summary

The Mineral Flotation Collectors Market is currently experiencing robust growth, driven by a confluence of factors including sustained global demand for key industrial metals and precious minerals, alongside significant technological advancements in mineral processing. Business trends indicate a strong push towards specialized reagents capable of handling complex ore bodies, which are becoming more prevalent as high-grade reserves deplete. There is also a notable shift towards environmentally friendly and sustainable collector chemistries, responding to increasingly stringent global regulatory frameworks and corporate sustainability initiatives. Companies are investing heavily in research and development to create novel collectors that offer improved selectivity, reduced dosage rates, and lower environmental footprints, thereby enhancing operational efficiency and compliance for their mining clients. The market is characterized by intense competition among chemical manufacturers, fostering continuous innovation and strategic partnerships.

Regional trends reveal Asia Pacific as the leading and fastest-growing market, primarily due to the expansive mining activities in countries like China, Australia, and India, coupled with rapid industrial growth and urbanization driving demand for metals. North America and Europe, while mature markets, continue to demonstrate demand for advanced and specialized collectors, particularly those addressing environmental concerns and optimizing existing operations for efficiency gains. Latin America, rich in copper and gold deposits, presents significant opportunities, with increasing investments in large-scale mining projects boosting the consumption of flotation reagents. Africa also holds substantial mineral reserves and is emerging as a critical growth region, attracting foreign investment in mining infrastructure and processing capabilities. Geopolitical stability and commodity price fluctuations significantly influence regional market dynamics and investment patterns, dictating the pace of new project developments and expansions.

Segmentation trends highlight the increasing dominance of xanthates and dithiophosphates due to their efficacy in sulfide mineral flotation, which remains a cornerstone of the mining industry. However, the demand for non-sulfide collectors, including fatty acids and amines, is also expanding, driven by the growing extraction of industrial minerals and phosphate rock. Application-wise, copper and gold mining continue to be the largest consumers, but significant growth is observed in lead, zinc, and platinum group metals (PGMs) processing, where specialized collectors are essential for optimal recovery. The trend towards higher selectivity and dosage efficiency is influencing product development across all segments, pushing manufacturers to innovate beyond traditional collector types. Furthermore, the rise of custom-blended reagents, tailored to specific ore characteristics, represents a growing niche, reflecting the industry's move towards highly optimized and data-driven mineral processing strategies. This customization offers significant potential for enhancing recovery rates and reducing overall operational costs for mining companies.

AI Impact Analysis on Mineral Flotation Collectors Market

Common user questions regarding AI's impact on the Mineral Flotation Collectors Market frequently revolve around how artificial intelligence can enhance the efficiency and sustainability of flotation processes, optimize reagent dosage, and predict performance in real-time. Users are keen to understand the extent to which AI can lead to more precise control over chemical consumption, reduce operational costs, and mitigate environmental risks associated with reagent usage. There is also significant interest in AI's role in processing complex ore data to recommend optimal collector formulations and operational parameters, ultimately aiming for improved mineral recovery rates and cleaner concentrates. The key themes that emerge are optimization, predictive analytics, automation, and sustainable resource management, all underpinned by the potential for AI to unlock new levels of efficiency and intelligence in mineral processing.

- AI-driven optimization of collector dosage, leading to reduced reagent consumption and cost savings.

- Predictive analytics for real-time monitoring and adjustment of flotation parameters, improving recovery rates.

- Enhanced data analysis from sensors to identify optimal collector chemistries for specific ore types.

- Automation of reagent delivery systems, ensuring precise and consistent application.

- Development of smart flotation circuits that adapt to varying ore characteristics using machine learning algorithms.

- Improved environmental footprint through minimized waste and optimized chemical usage.

- Faster troubleshooting and process anomaly detection, reducing downtime.

- Creation of digital twins for flotation cells, enabling simulation and scenario planning for reagent strategies.

- Personalized collector recommendations based on historical performance data and ore mineralogy.

- Augmented human decision-making for plant operators regarding collector selection and operational adjustments.

DRO & Impact Forces Of Mineral Flotation Collectors Market

The Mineral Flotation Collectors Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, all contributing to its overall impact forces. Key drivers include the ever-increasing global demand for various metals and minerals, propelled by rapid industrialization, urbanization, and technological advancements, particularly in emerging economies. The depletion of high-grade ore deposits necessitates more efficient and selective processing techniques, directly increasing the reliance on sophisticated flotation collectors to extract valuable minerals from lower-grade and more complex ores. Furthermore, advancements in mineral processing technologies and the development of novel, highly selective collector chemistries also act as significant drivers, improving the economic viability of extracting challenging mineral resources. The continuous need for improved recovery rates and higher concentrate quality across mining operations globally underpins the consistent demand for these specialized reagents. These factors collectively push the market forward, fostering innovation and expansion.

Despite these strong drivers, the market faces several notable restraints. Volatility in raw material prices, which are essential for manufacturing flotation collectors, can lead to increased production costs and impact market stability. Stringent environmental regulations concerning the use and discharge of chemical reagents pose significant challenges, pushing manufacturers to invest heavily in developing greener, more biodegradable, and less toxic collector formulations, which can sometimes be more expensive to produce. Furthermore, the high capital expenditure required for new mining projects and the inherent cyclical nature of the mining industry, influenced by global economic conditions and commodity price fluctuations, can lead to project delays or cancellations, thereby impacting the demand for collectors. Logistical challenges in transporting chemical reagents to remote mining sites, coupled with potential supply chain disruptions, also present operational hurdles that restrain market growth to some extent.

Opportunities within the Mineral Flotation Collectors Market are substantial and varied, presenting avenues for significant future growth and innovation. The discovery of new mineral deposits, particularly those with complex mineralogy that requires advanced flotation techniques, creates new markets for specialized collectors. The increasing focus on resource efficiency and sustainable mining practices worldwide is driving demand for eco-friendly and high-performance collectors that minimize environmental impact while maximizing recovery. The advent of advanced analytics, artificial intelligence, and machine learning in mineral processing offers opportunities for optimizing collector usage, improving process control, and developing more intelligent reagent schemes. Furthermore, the growing trend of reprocessing mine tailings and low-grade stockpiles to recover residual valuable minerals presents a considerable opportunity for specialized collectors designed for these specific applications. Strategic collaborations between chemical suppliers, technology providers, and mining companies to develop customized solutions for challenging ore bodies are also fostering innovation and market expansion. These opportunities are poised to shape the future landscape of the mineral flotation collectors industry, promoting both technological and environmental advancements.

Segmentation Analysis

The Mineral Flotation Collectors Market is meticulously segmented across various dimensions to provide a comprehensive understanding of its intricate dynamics and diverse applications. This segmentation allows for targeted market analysis, highlighting specific growth areas, competitive landscapes, and evolving customer needs. The market is primarily categorized by type of collector, which refers to the chemical class of the reagent; by application, detailing the specific minerals or metals being processed; and by end-user industry, identifying the primary consumers of these collectors. Each segment possesses unique characteristics, growth drivers, and challenges, making a detailed analysis crucial for strategic planning and investment decisions within the mineral processing sector. Understanding these segments is key to deciphering the nuanced market behaviors and predicting future trajectories.

- By Type

- Xanthates

- Dithiophosphates

- Fatty Acids and Their Derivatives

- Amines

- Thionocarbamates

- Mercaptobenzothiazoles (MBT)

- Phosphine Collectors

- Others (e.g., Hydroxamates, Sulfosuccinamates)

- By Application

- Sulfide Minerals

- Copper Flotation

- Lead-Zinc Flotation

- Molybdenum Flotation

- Nickel Flotation

- Precious Metals Flotation (e.g., Gold, Silver, Platinum Group Metals)

- Non-Sulfide Minerals

- Phosphate Flotation

- Iron Ore Flotation

- Industrial Minerals Flotation (e.g., Fluorspar, Feldspar, Silica)

- Potash Flotation

- Coal Flotation

- Sulfide Minerals

- By End-User Industry

- Mining Companies

- Mineral Processing Plants

- Metallurgical Industries

- Construction (aggregate processing)

- By Form

- Liquid

- Solid (Powder, Pellets)

- By Function

- Primary Collectors

- Auxiliary Collectors

- Frothers (though often a separate category, sometimes considered alongside)

Value Chain Analysis For Mineral Flotation Collectors Market

The value chain for the Mineral Flotation Collectors Market begins with the upstream analysis, which focuses on the sourcing and production of raw materials essential for manufacturing these complex chemical reagents. This includes various petrochemical derivatives, sulfur, phosphorus, and other specialty chemicals. Key players in this stage are major chemical producers and petrochemical companies that supply these basic building blocks. The availability, quality, and price stability of these raw materials significantly influence the production costs and competitiveness of collector manufacturers. Strong relationships with reliable suppliers, coupled with effective supply chain management, are crucial for ensuring a consistent flow of materials and mitigating risks associated with commodity price volatility. Innovations in raw material synthesis or sourcing that enhance sustainability or reduce costs can provide a significant competitive advantage in this initial phase of the value chain.

Moving downstream, the value chain progresses through the manufacturing of the collectors themselves, followed by their distribution and eventual application at mineral processing sites. Collector manufacturers engage in complex chemical synthesis processes, often involving specialized intellectual property and proprietary formulations to produce a diverse range of reagents tailored for specific minerals and operational conditions. This stage is characterized by significant R&D investment aimed at developing more efficient, selective, and environmentally friendly products. Once manufactured, these collectors are distributed through a combination of direct sales, specialized chemical distributors, and global logistics networks to reach mining companies and mineral processing plants worldwide. The effectiveness of the distribution channel, including inventory management, warehousing, and transportation, is critical for ensuring timely delivery and reducing operational lead times for end-users, especially given the global nature of mining operations.

The distribution channel for mineral flotation collectors typically involves both direct and indirect sales approaches. Direct sales are often utilized for large-volume customers or for highly specialized products where technical support and customized solutions are paramount. This allows manufacturers to build direct relationships with key mining operations, offering tailored advice and fostering long-term partnerships. Indirect sales, on the other hand, leverage a network of distributors and agents who possess extensive regional reach, market knowledge, and logistical capabilities. These intermediaries play a crucial role in serving smaller mining operations, consolidating orders, and managing local inventory, thereby expanding the market penetration of collector manufacturers. The choice between direct and indirect channels often depends on factors such as market maturity, geographical dispersion of customers, product complexity, and the level of technical support required. An optimal distribution strategy often involves a hybrid approach, combining the benefits of both direct engagement and broad market coverage through partnerships, ensuring efficient delivery and customer satisfaction across diverse operational landscapes.

Mineral Flotation Collectors Market Potential Customers

The primary potential customers and end-users of mineral flotation collectors are predominantly entities engaged in the mining and mineral processing industries across the globe. These include large-scale multinational mining corporations, mid-sized regional mining companies, and independent mineral processing plants that specialize in upgrading raw ores. Companies involved in the extraction and beneficiation of base metals such as copper, lead, zinc, and nickel represent a significant customer base, as froth flotation is the most widely adopted method for processing these sulfide ores. Similarly, producers of precious metals like gold and silver, especially when found in complex sulfide matrices, are crucial consumers of specialized collectors designed for enhanced recovery and selectivity in these high-value applications. The continuous need for these companies to maximize metal recovery from increasingly complex and lower-grade ore bodies drives their ongoing demand for advanced flotation reagents.

Beyond traditional base and precious metal mining, the market for mineral flotation collectors extends to operators involved in the extraction and processing of various industrial minerals and non-sulfide ores. This segment includes companies producing phosphate rock for fertilizers, iron ore for steel manufacturing, and a range of industrial minerals such as fluorspar, feldspar, silica, and potash, which are vital for sectors like construction, ceramics, glass, and chemicals. These diverse applications often require specific types of collectors, such as fatty acids or amines, tailored to the surface chemistry of these non-sulfide minerals. The expansion of infrastructure projects, agricultural demands, and manufacturing activities globally directly correlates with the demand for these industrial minerals, thereby broadening the customer base for flotation collector suppliers. The unique challenges associated with floating different industrial minerals necessitate a wide array of specialized chemical solutions, driving innovation in this customer segment.

Furthermore, coal beneficiation plants represent another significant end-user segment for mineral flotation collectors. These plants utilize flotation processes to remove impurities from coal, improving its quality and calorific value, which is crucial for power generation and industrial applications. As environmental regulations become more stringent regarding emissions, the demand for cleaner coal through efficient beneficiation processes continues to drive the consumption of flotation reagents in this sector. Beyond direct mining and processing, other indirect customers include engineering, procurement, and construction (EPC) firms involved in designing and building new mineral processing facilities, as they often specify and procure flotation reagents as part of their project scope. Research institutions and academic bodies also act as customers, utilizing these collectors for experimental studies and developing new processing techniques. The broad array of applications and the critical role collectors play in modern resource extraction ensure a robust and diverse customer base across the global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.75 Billion |

| Market Forecast in 2033 | USD 2.65 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, The Chemours Company, Arkema S.A., Clariant AG, Solvay S.A., Nalco Water (Ecolab), SNF Floerger, Ashland Inc., FLSmidth & Co. A/S, SGS S.A., Orica Limited, Kemira Oyj, Cytec Solvay Group, Vedanta Limited, AkzoNobel N.V., Huntsman Corporation, Dow Chemical Company, Qingdao Ruchang Mining Industry Co. Ltd., Coogee Chemicals, Shanghai Huayi Group Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mineral Flotation Collectors Market Key Technology Landscape

The Mineral Flotation Collectors Market is characterized by a dynamic and evolving technology landscape, driven by the continuous need for enhanced efficiency, selectivity, and environmental sustainability in mineral processing. Central to this landscape are advancements in organic chemistry, enabling the synthesis of novel collector molecules with highly tailored functional groups designed to interact specifically with target mineral surfaces. This precision chemistry minimizes unintended adsorption on gangue minerals, leading to higher recovery rates and improved concentrate grades, which is critical as ore bodies become more complex and lower in grade. Techniques such as molecular modeling and quantum chemical calculations are increasingly employed to predict the interaction mechanisms between collectors and minerals, guiding the rational design of new reagents before expensive laboratory synthesis, thereby accelerating product development cycles and optimizing performance characteristics. The focus on developing collectors that perform effectively in challenging conditions, such as high ionic strength brines or fine particle slurries, further defines this technological frontier, ensuring broader applicability across diverse mining environments.

Beyond the molecular design of collectors, the technological landscape also encompasses innovations in reagent delivery and process control systems within flotation plants. The integration of advanced sensor technologies, real-time analytics, and automated dosage systems is transforming how collectors are applied. For instance, online analyzers capable of monitoring pulp chemistry, froth characteristics, and mineralogical composition allow for dynamic adjustment of collector feed rates, optimizing their usage and reducing over-dosage or under-dosage. This smart reagent management not only improves metallurgical performance but also leads to significant cost savings and a reduction in chemical consumption, aligning with sustainability goals. The development of specialized instruments for measuring contact angles, zeta potential, and surface energy helps in understanding the fundamental interactions at the mineral-solution interface, providing critical feedback for both collector development and process optimization. These integrated technologies move the industry towards more intelligent and autonomous flotation operations, reducing reliance on manual adjustments.

Furthermore, the drive towards eco-friendly and sustainable mining practices is a major technological impetus in the market, leading to the development of "green" flotation collectors. This involves designing reagents that are biodegradable, non-toxic, and have a minimal environmental footprint throughout their lifecycle. Research is heavily focused on replacing traditional petroleum-derived raw materials with bio-based alternatives, such as those derived from agricultural products or renewable resources. Examples include novel plant-based collectors or those synthesized using greener chemical processes that minimize hazardous byproducts. The development of collectors that operate effectively at neutral pH, reducing the need for costly and environmentally impactful pH modifiers, is another significant area of innovation. These advancements are crucial for meeting increasingly stringent environmental regulations and addressing public concerns about chemical usage in mining. The integration of biotechnology, such as using microorganisms or enzymes to modify mineral surfaces, also represents a nascent but promising technological frontier that could synergize with traditional collector chemistries to achieve superior separation efficiencies. The convergence of chemistry, engineering, and environmental science continues to shape the cutting-edge of flotation collector technology.

Regional Highlights

- Asia Pacific (APAC): This region dominates the Mineral Flotation Collectors Market, primarily driven by extensive mining activities in countries like China, Australia, India, and Indonesia. Rapid industrialization and urbanization fuel a high demand for metals and minerals, leading to continuous expansion of mining and mineral processing capacities. The presence of large reserves of copper, gold, iron ore, and other minerals, coupled with ongoing infrastructure development, makes APAC a critical growth hub.

- North America: A mature market characterized by advanced mining technologies and stringent environmental regulations. Demand here focuses on high-performance, environmentally friendly collectors that optimize recovery from existing complex ore bodies. Countries like the United States and Canada are significant producers of base metals, precious metals, and industrial minerals, driving consistent demand for specialized reagents.

- Europe: While having fewer large-scale new mining projects compared to APAC, Europe maintains a strong demand for advanced and sustainable flotation collectors, particularly in countries with established mining industries like Russia, Poland, and Sweden. The region's emphasis on circular economy principles and environmental protection stimulates innovation in green chemistries and efficient processing technologies.

- Latin America: This region is a powerhouse for copper, gold, and silver mining, with countries like Chile, Peru, Brazil, and Mexico holding vast mineral reserves. Significant investments in new mining projects and expansions drive a robust demand for a wide range of flotation collectors. The market is characterized by a need for high-performance collectors suitable for large-scale operations and diverse ore types.

- Middle East and Africa (MEA): Emerging as a crucial growth region, MEA possesses substantial untapped mineral wealth, including gold, phosphates, copper, and diamonds. Increased foreign investment in mining infrastructure and processing plants, particularly in countries like South Africa, Saudi Arabia, and Morocco, is fueling the demand for mineral flotation collectors. The region offers significant potential for future market expansion as new projects come online.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mineral Flotation Collectors Market.- BASF SE

- The Chemours Company

- Arkema S.A.

- Clariant AG

- Solvay S.A.

- Nalco Water (Ecolab)

- SNF Floerger

- Ashland Inc.

- FLSmidth & Co. A/S

- SGS S.A.

- Orica Limited

- Kemira Oyj

- Cytec Solvay Group

- Vedanta Limited

- AkzoNobel N.V.

- Huntsman Corporation

- Dow Chemical Company

- Qingdao Ruchang Mining Industry Co. Ltd.

- Coogee Chemicals

- Shanghai Huayi Group Co., Ltd.

Frequently Asked Questions

What are mineral flotation collectors and how do they work?

Mineral flotation collectors are chemical reagents used in the froth flotation process to selectively separate valuable minerals from gangue (waste rock). They work by attaching to the surface of specific minerals, making them hydrophobic (water-repelling). These hydrophobic mineral particles then adhere to air bubbles introduced into the flotation cell, rise to the surface as a froth, and are collected, while the hydrophilic gangue remains in the slurry. This selective attachment is crucial for efficient mineral recovery.

What are the primary types of mineral flotation collectors?

The primary types of mineral flotation collectors include xanthates, dithiophosphates, fatty acids and their derivatives, amines, thionocarbamates, and mercaptobenzothiazoles (MBT). Each type is designed to work optimally with specific mineral classes; for example, xanthates are widely used for sulfide minerals like copper and lead-zinc ores, while fatty acids are effective for non-sulfide minerals such as phosphates and iron ore.

Which factors are driving the growth of the Mineral Flotation Collectors Market?

The market growth is primarily driven by the increasing global demand for metals and minerals, particularly from developing economies. Other key drivers include the depletion of high-grade ore deposits, necessitating more efficient processing of lower-grade ores, and continuous technological advancements in flotation processes that demand specialized, high-performance collectors. The focus on improved recovery rates and concentrate quality also contributes significantly.

How do environmental regulations impact the Mineral Flotation Collectors Market?

Environmental regulations significantly impact the market by increasing pressure on manufacturers to develop and offer "green" flotation collectors that are biodegradable, less toxic, and have a minimal environmental footprint. This drives innovation towards sustainable chemistries and cleaner production processes, though it can also lead to higher production costs for compliant reagents.

What role does artificial intelligence play in the future of mineral flotation collectors?

Artificial intelligence is poised to revolutionize the market by enabling advanced optimization of collector dosage, real-time process control, and predictive analytics for mineral separation. AI can help identify optimal collector formulations for specific ore types, automate reagent delivery, and enhance overall operational efficiency and sustainability, leading to reduced costs and improved recovery rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager