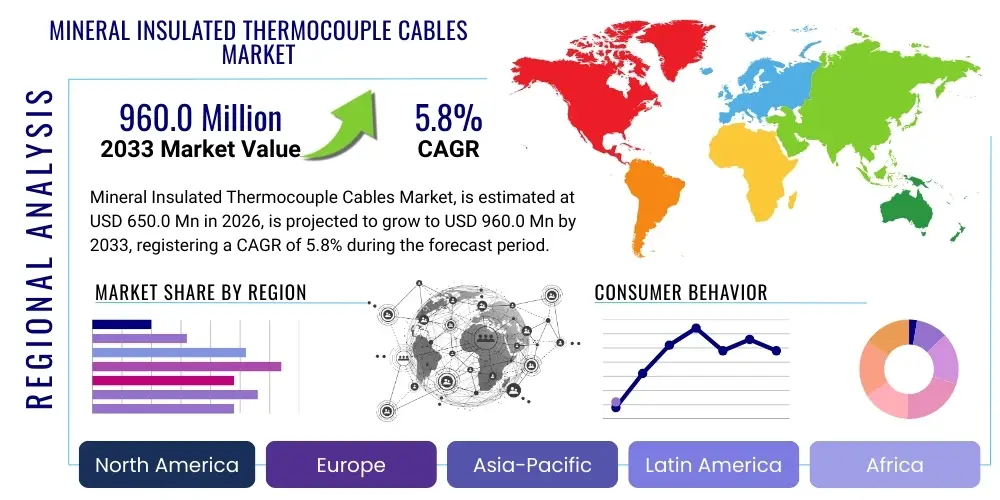

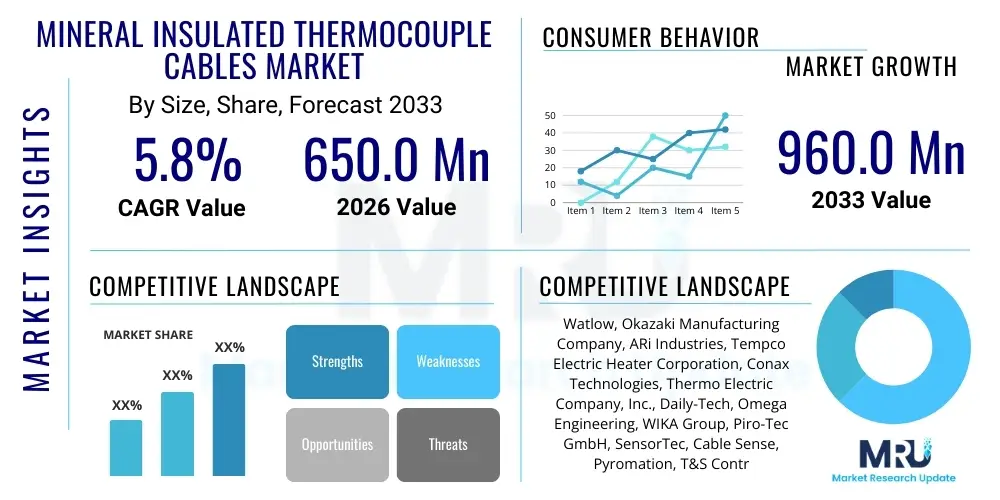

Mineral Insulated Thermocouple Cables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438409 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Mineral Insulated Thermocouple Cables Market Size

The Mineral Insulated Thermocouple Cables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 650.0 Million in 2026 and is projected to reach USD 960.0 Million by the end of the forecast period in 2033. This consistent expansion is primarily driven by the increasing automation and modernization across heavy industries, which necessitate reliable and highly accurate temperature sensing solutions in extreme environments. Mineral Insulated (MI) cables offer superior performance, stability, and longevity compared to conventional alternatives, positioning them as essential components in critical industrial monitoring systems.

Mineral Insulated Thermocouple Cables Market introduction

The Mineral Insulated Thermocouple Cables Market comprises highly specialized temperature sensing wires designed for use in harsh industrial conditions characterized by high temperatures, corrosive environments, and high pressure. These cables consist of two dissimilar conductors (the thermocouple wires) encased in a metal sheath, typically stainless steel or Inconel, and insulated with densely packed magnesium oxide (MgO) powder. This robust construction provides excellent mechanical strength, protection against oxidation, and superior electrical insulation, ensuring accurate and stable temperature measurement over extended periods. The resulting assembly is flexible, allowing for installation in complex geometries, yet durable enough to withstand challenging operational parameters.

The primary applications of MI thermocouple cables span vital industrial sectors, including power generation (nuclear, fossil fuel, renewables), chemical processing, oil and gas exploration and refining, and metals and ceramics manufacturing. Their ability to handle rapid thermal cycling and extreme temperatures, sometimes exceeding 1200°C, makes them indispensable for process control, safety monitoring, and quality assurance. Key benefits include fast response time due to the compacted insulation, resistance to vibration and radiation, and extremely long operational life, directly contributing to increased plant efficiency and reduced maintenance costs.

Market growth is significantly driven by the stringent regulatory requirements for process safety and optimization across global manufacturing hubs. Furthermore, the expansion of complex industrial infrastructure, particularly in emerging economies, alongside the global shift towards high-efficiency power plants and advanced chemical reactors, fuels the demand for these high-performance cabling solutions. The continuous technological advancements in sheath materials and insulation compaction techniques further enhance the reliability and application scope of MI thermocouple cables, reinforcing their critical role in modern industrial instrumentation.

Mineral Insulated Thermocouple Cables Market Executive Summary

The Mineral Insulated Thermocouple Cables Market is positioned for robust growth, underpinned by critical business trends focusing on industrial digitalization, safety compliance, and infrastructure modernization. Key business drivers include the necessity for precise temperature monitoring in catalytic processes, furnace control, and reactor systems, especially within the rapidly evolving chemical and petrochemical sectors. Companies are investing heavily in research and development to produce cables capable of operating reliably at increasingly higher temperatures and pressures, driving product innovation in sheath metallurgy and insulation density. Strategic collaborations between cable manufacturers and major instrument suppliers are also streamlining the supply chain and accelerating the adoption of customized MI solutions across specialized industrial applications.

Regionally, the Asia Pacific (APAC) market is projected to witness the fastest growth, largely attributable to massive investments in power generation capacity expansion, robust growth in the Chinese and Indian manufacturing sectors, and increasing deployment of petrochemical complexes. North America and Europe maintain leading market shares, primarily driven by the replacement cycle of aging infrastructure, stringent environmental regulations necessitating advanced monitoring equipment, and high adoption rates in the aerospace and defense sectors. Regulatory frameworks promoting energy efficiency and operational safety act as catalysts for market expansion globally, compelling industries to upgrade to more reliable MI technology.

In terms of segment trends, the Type K thermocouple segment, known for its wide temperature range and cost-effectiveness, dominates the market, though demand for higher temperature types (R, S, B) is accelerating, particularly in high-specification industrial heating and melting applications. Stainless steel remains the dominant sheath material due to its balance of cost and performance, but the Inconel segment is gaining momentum, especially where corrosion resistance and sustained high-temperature exposure (above 800°C) are critical. The Power Generation and Oil & Gas sectors continue to represent the largest application segments, emphasizing the critical infrastructure reliance on MI thermocouple technology for safe and efficient operations.

AI Impact Analysis on Mineral Insulated Thermocouple Cables Market

User inquiries regarding AI's impact on the MI Thermocouple Cables Market generally revolve around themes of predictive maintenance, process optimization, and sensor data integration. Users frequently ask how AI can utilize the high-fidelity data generated by MI cables to predict equipment failure before it occurs, thereby reducing unplanned downtime in critical infrastructure like nuclear reactors or refinery cracking units. Key concerns focus on the integration complexity of traditional analog sensors with modern AI-driven digital systems and the cybersecurity implications of connecting highly sensitive process control data to cloud-based analytics platforms. Expectations are high regarding AI's ability to optimize cable usage, detect subtle thermal anomalies indicative of process inefficiencies, and potentially prolong the operational lifespan of the entire sensing system through proactive diagnostic insights.

AI’s role is primarily transformational in how data derived from MI thermocouple cables is processed and utilized, rather than in the manufacturing of the cable itself. The inherent robustness and accuracy of MI cables make them ideal data sources for machine learning algorithms. AI platforms can ingest vast amounts of real-time temperature data, correlate it with other operational parameters (pressure, flow rate), and establish baseline thermal signatures. Deviations from these baselines, often too subtle for human operators to detect, trigger immediate alerts, moving maintenance strategies from time-based to condition-based monitoring, which significantly improves operational reliability and asset utilization.

Furthermore, AI-driven digital twin technology relies heavily on accurate, real-time thermal inputs provided by MI thermocouples. By simulating the performance of industrial assets under various operational stresses, AI can recommend optimal operating parameters, which in turn reduces unnecessary thermal stress on both the process equipment and the MI cables themselves. This optimization cycle not only enhances safety but also extends the operational life of the sensing infrastructure, creating a positive feedback loop for high-quality data generation and continuous process improvement in environments such as advanced materials processing and supercritical boiler operations.

- AI enables advanced predictive maintenance by analyzing high-fidelity temperature data generated by MI cables.

- Integration with AI platforms optimizes energy consumption by maintaining ideal thermal profiles in complex processes.

- Machine learning algorithms detect subtle thermal drift or anomalies, improving process control accuracy far beyond human capability.

- AI aids in material science research by monitoring extreme temperature reactions, accelerating the development of new high-performance MI sheath materials.

- Implementation of digital twins utilizes MI cable data for accurate simulation and operational forecasting of critical assets.

- Automation of temperature calibration and drift compensation using AI minimizes human error and reduces system downtime.

DRO & Impact Forces Of Mineral Insulated Thermocouple Cables Market

The trajectory of the Mineral Insulated Thermocouple Cables market is shaped by a confluence of influential factors encompassing Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces. The core driver is the increasing global emphasis on industrial process safety and operational efficiency, necessitating instrumentation that can provide reliable readings under severe operating conditions. MI cables are inherently suited for these tasks, offering high accuracy and durability essential for regulatory compliance and minimizing catastrophic failures in high-risk environments such as nuclear power plants and large-scale chemical manufacturing facilities. This critical reliance ensures continuous demand regardless of short-term economic fluctuations in core industrial sectors.

However, the market faces significant restraints, primarily revolving around the relatively high initial cost associated with manufacturing and installation of MI cables compared to conventional sensing technologies. The specialized processes required for drawing the sheath material, packing the high-purity MgO insulation, and precision welding the junction points contribute to complexity and cost. Furthermore, installation often requires highly skilled labor and specific bending radii limitations, which can hinder deployment in legacy or space-constrained systems. Technological restraints also include the practical upper temperature limits of current sheath materials and the potential for insulation resistance degradation under specific contamination conditions over extremely long periods.

Opportunities for growth are substantial, particularly driven by the transition towards cleaner energy sources and the continuous demand for advanced materials. The expansion of renewable energy infrastructure, specifically concentrated solar power (CSP) and advanced geothermal systems, requires robust, high-temperature measurement capabilities ideally suited for MI technology. Additionally, the proliferation of smart factories (Industry 4.0) necessitates sensors that can reliably integrate into digital monitoring networks, positioning MI cables favorably. Strategic geographic expansion into rapidly industrializing regions, coupled with product development focusing on miniaturization and wireless integration, represents a significant avenue for long-term market penetration and value creation.

Segmentation Analysis

The Mineral Insulated Thermocouple Cables Market is systematically segmented based on key attributes including type, sheath material, gauge size, and application, allowing for precise market analysis targeting specific industrial needs. The segmentation reflects the diverse requirements of end-users, ranging from highly sensitive laboratory environments to extremely corrosive industrial furnaces. Understanding these segments is crucial for manufacturers to tailor their production, marketing strategies, and R&D efforts to meet specialized demands across various sectors like aerospace where weight and stability are paramount, or petrochemicals where chemical resistance is critical. The market structure emphasizes the trade-offs between cost, temperature range, and mechanical robustness.

Segmentation by Type (e.g., K, J, T, N, R, S, B) is fundamental, as it dictates the maximum measurable temperature and environmental stability. Type K thermocouples, composed of Nickel-Chromium/Nickel-Alumel, dominate due to their excellent versatility and wide operational range up to 1250°C, providing a balance of performance and affordability for most industrial processes. Conversely, the high-purity noble metal types (R, S, B) command premium pricing but are essential for ultra-high temperature applications in semiconductor manufacturing and high-temperature materials processing, driving high Average Selling Prices (ASPs) within their niche.

The Application segment is the primary driver of consumption volume. The Power Generation sector, particularly the monitoring of boiler tubes, turbines, and reactor cores, demands large volumes of MI cable due to the extensive network required for reliable monitoring. Similarly, the Oil & Gas industry uses these cables extensively for downhole logging, furnace monitoring, and pipeline temperature surveillance. The continuous need for asset integrity management and regulatory compliance in these high-stakes industries ensures sustained demand for high-reliability MI thermocouple solutions across all geographic regions.

- By Type:

- Type K (Ni-Cr/Ni-Al)

- Type J (Fe/Cu-Ni)

- Type T (Cu/Cu-Ni)

- Type E (Ni-Cr/Cu-Ni)

- Type N (Ni-Cr-Si/Ni-Si)

- Noble Metal Types (R, S, B)

- By Sheath Material:

- Stainless Steel (SS 304, 310, 316, 321)

- Inconel (Inconel 600, 800)

- Hastelloy

- Nicrobraz

- Others (Tantalum, Platinum)

- By Application:

- Oil & Gas (Refining, Drilling, Pipelines)

- Power Generation (Nuclear, Fossil Fuel, Renewables)

- Chemical & Petrochemical Processing

- Metals & Ceramics Manufacturing (Furnaces, Kilns)

- Aerospace & Defense

- Pharmaceutical & Biotechnology

- Others (Research Laboratories, HVAC)

- By Gauge Size:

- Standard Diameter (>3.0 mm)

- Small Diameter (1.0 mm to 3.0 mm)

- Micro-Diameter (<1.0 mm)

Value Chain Analysis For Mineral Insulated Thermocouple Cables Market

The value chain for Mineral Insulated Thermocouple Cables is characterized by several specialized stages, starting from raw material procurement and extending through highly technical manufacturing processes, culminating in installation and end-user maintenance. The upstream segment is critical, involving the sourcing of high-purity metallic alloys (e.g., Nickel, Chromium, Iron) for conductor wires and specialized metals (e.g., Stainless Steel, Inconel) for the protective sheath, along with high-grade, densely packed magnesium oxide (MgO) powder for insulation. The purity and consistency of these raw materials directly determine the cable's performance, stability, and lifespan, creating strong dependencies on specialized suppliers for niche, high-temperature alloys and certified MgO. Manufacturing involves complex drawing, swaging, and annealing processes to achieve the required density and flexibility while maintaining stringent dimensional tolerances.

The downstream analysis focuses on the integration and deployment of the MI cables. Original Equipment Manufacturers (OEMs) often incorporate these cables directly into larger temperature monitoring systems, specialized heaters, or process equipment like reactors and heat exchangers. System integrators and specialized distributors play a crucial role in providing technical consultation, customization (e.g., specific sheath lengths, termination types), and installation services to end-users across diverse industrial sectors. The high complexity and critical nature of the applications necessitate a highly skilled distribution channel capable of offering calibration, maintenance, and technical support, often leading to long-term supplier relationships based on trust and product reliability.

Distribution channels are multifaceted, relying on both direct and indirect approaches. Direct sales are common for large-volume industrial clients (e.g., major power utilities, integrated petrochemical companies) where highly customized solutions are required, ensuring close collaboration between the manufacturer and the end-user technical teams. Indirect channels, utilizing specialized industrial distributors and technical sales representatives, cater to smaller purchasers, maintenance, repair, and operations (MRO) markets, and regions where a localized presence is essential. The indirect channel relies heavily on the distributor's inventory capacity and technical expertise to quickly supply standardized products and manage local logistics efficiently, maintaining the delicate balance between rapid delivery and maintaining product integrity.

Mineral Insulated Thermocouple Cables Market Potential Customers

Potential customers for Mineral Insulated Thermocouple Cables are organizations operating mission-critical industrial processes that require accurate, robust, and reliable temperature measurement in extreme or hazardous environments. The primary end-users are large capital-intensive industries where equipment failure due to thermal mismanagement can result in catastrophic safety incidents, massive financial losses, or lengthy unplanned downtimes. Key buyer motivations include strict compliance with safety regulations (such as those governing nuclear or chemical facilities), the optimization of energy-intensive processes (like cracking or smelting), and the need for high-frequency, high-stability data inputs for advanced process control systems.

Major purchasers include global power generation entities, both governmental and private, involved in managing large-scale infrastructure such as supercritical coal plants, gas turbines, and boiling water reactors (BWRs). Petrochemical and chemical companies, managing highly volatile and corrosive processes, constitute another essential customer base, utilizing MI cables to monitor furnace tubes, catalyst beds, and fractionation columns. These buyers often require custom lengths, high-grade sheath alloys (like Inconel 600), and meticulous quality assurance documentation, making the purchasing decision heavily reliant on supplier certification and product reliability track records over cost savings.

Furthermore, specialized sectors like aerospace and defense, which require temperature sensors for engine testing, rocket propulsion systems, and classified monitoring equipment, represent high-value, albeit lower-volume, customers. The increasing global investment in advanced manufacturing, including specialized heat treatment processes for high-strength alloys and the production of specialized glass and ceramics, also expands the potential customer pool. These end-users prioritize miniaturization, rapid thermal response, and long-term stability in highly demanding, non-standard operating environments, thus continually driving innovation in the smaller gauge and higher tolerance MI cable segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 Million |

| Market Forecast in 2033 | USD 960.0 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Watlow, Okazaki Manufacturing Company, ARi Industries, Tempco Electric Heater Corporation, Conax Technologies, Thermo Electric Company, Inc., Daily-Tech, Omega Engineering, WIKA Group, Piro-Tec GmbH, SensorTec, Cable Sense, Pyromation, T&S Controls, Sandvik, Nanmac Corporation, TE Wire & Cable LLC, Precision Temperature Sensors, Thermal Detection, Inc., Spectris plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mineral Insulated Thermocouple Cables Market Key Technology Landscape

The core technology underlying Mineral Insulated Thermocouple Cables has remained fundamentally consistent—the swaging process utilizing magnesium oxide insulation—but continuous incremental innovations in materials science and manufacturing processes are crucial competitive differentiators. Key technological advancements focus on improving the maximum operating temperature, enhancing corrosion resistance, and achieving smaller diameters (micro-diameter cables) for specialized research and development applications. High-purity MgO insulation technology is consistently refined to maximize compaction density, which is directly responsible for optimizing insulation resistance and minimizing thermal response time. This ensures faster, more accurate readings in rapidly changing thermal environments, a crucial requirement in dynamic industrial processes.

Significant development is observed in advanced sheath materials. While stainless steel remains standard, the growing demand for extremely high-temperature monitoring has pushed manufacturers toward specialized nickel-based alloys like Inconel 600 and Inconel 800, which offer superior oxidation resistance and mechanical strength at temperatures exceeding 1000°C. For applications involving particularly harsh chemical agents, sheath materials such as Hastelloy and Nicrobraz are employed, requiring complex metallurgical bonding and welding techniques. These material science advancements are critical for market expansion into emerging high-stress applications such as advanced chemical vapor deposition (CVD) equipment and molten salt reactors in next-generation nuclear facilities.

Furthermore, technology related to termination and connection is evolving. The transition from traditional terminal heads to miniature connectors and hermetically sealed transitions is improving the overall system reliability, especially in moist or highly pressurized environments. The increasing adoption of digitalization in industrial settings is also driving the necessity for technologies that allow for seamless integration with digital fieldbus protocols and smart sensor networks. Manufacturers are focusing on ensuring electromagnetic compatibility (EMC) and high signal integrity over long cable runs, reinforcing the MI cable’s position as a premium data source in the context of Industry 4.0 architecture.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand patterns and market growth rates for Mineral Insulated Thermocouple Cables. Market activity is heavily correlated with regional industrial output, particularly in the energy, petrochemical, and heavy manufacturing sectors. The diverse regulatory environments and investment cycles across geographies dictate the rate of adoption of advanced MI technology, with some regions prioritizing cost-efficiency and others focusing on maximum performance and safety compliance.

North America: This region holds a mature yet robust market share, driven by stringent safety regulations in the petrochemical and nuclear power sectors, particularly in the United States and Canada. Demand is sustained by the continuous modernization and replacement of aging industrial infrastructure, requiring high-reliability temperature monitoring solutions. Key growth factors include the expanding aerospace industry and the high penetration rate of specialized, high-performance MI cables for critical applications. The market is characterized by high ASPs due to the demand for customized, certified products meeting extremely high quality and traceability standards.

Europe: Europe is a significant market, bolstered by strong regulatory oversight from the European Union emphasizing environmental safety and energy efficiency. Countries like Germany and the UK contribute substantially due to their robust automotive manufacturing and complex chemical processing industries. The region is seeing increasing demand linked to the decommissioning of old power plants and the concurrent investment in advanced, highly monitored renewable energy projects, particularly geothermal and concentrated solar power (CSP) facilities, which rely heavily on specialized high-temperature sensing technology.

Asia Pacific (APAC): APAC represents the fastest-growing market, primarily fueled by rapid industrialization, large-scale infrastructure projects, and massive capital expenditure in countries like China, India, South Korea, and Southeast Asian nations. The region is the global hub for power generation expansion, new refinery construction, and the proliferation of metals processing plants. While cost sensitivity remains a factor, the sheer volume of new plant installations drives exponential growth. The expanding semiconductor and electronics manufacturing sectors also require specialized micro-diameter MI cables for highly precise temperature control during fabrication processes.

Latin America: This region exhibits steady growth, largely dependent on investment cycles in the domestic oil and gas sector (e.g., Brazil, Mexico) and mining operations. Market demand is often volatile, tied directly to global commodity prices, but the necessity for maintaining safe and efficient operations in high-pressure drilling and refining environments ensures a baseline demand for reliable MI thermocouples.

Middle East and Africa (MEA): The MEA market is dominated by the massive oil and gas and petrochemical industries, particularly in the Gulf Cooperation Council (GCC) countries. Substantial investments in mega refinery and integrated energy projects drive the demand for high volumes of robust MI cables designed to withstand extreme heat and corrosive desert environments. Safety standards are increasingly stringent, aligning demand with high-quality, high-reliability products essential for asset integrity management across large-scale installations.

- North America (USA, Canada): Strong adoption in nuclear and aerospace; high demand for certified, custom solutions.

- Europe (Germany, UK, France): Focus on renewable energy integration and strict chemical process monitoring compliance.

- Asia Pacific (China, India, Japan): Highest growth due to massive industrial expansion and new power generation capacity.

- Middle East & Africa (Saudi Arabia, UAE): Market driven by large-scale oil & gas and petrochemical infrastructure projects.

- Latin America (Brazil, Mexico): Demand influenced by fluctuating oil prices and mining sector requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mineral Insulated Thermocouple Cables Market.- Watlow

- Okazaki Manufacturing Company

- ARi Industries

- Tempco Electric Heater Corporation

- Conax Technologies

- Thermo Electric Company, Inc.

- Daily-Tech

- Omega Engineering

- WIKA Group

- Piro-Tec GmbH

- SensorTec

- Cable Sense

- Pyromation

- T&S Controls

- Sandvik

- Nanmac Corporation

- TE Wire & Cable LLC

- Precision Temperature Sensors

- Thermal Detection, Inc.

- Spectris plc

Frequently Asked Questions

Analyze common user questions about the Mineral Insulated Thermocouple Cables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using Mineral Insulated (MI) thermocouple cables over conventional sensors?

MI cables offer exceptional mechanical robustness, resistance to high temperatures and corrosive environments, fast thermal response time, superior electrical insulation due to compressed magnesium oxide (MgO), and extended operational lifespan essential for critical process monitoring.

Which industrial applications drive the highest demand for MI thermocouple cables?

The highest demand is generated by core capital-intensive sectors including Power Generation (monitoring boilers and turbines), Oil & Gas (refining and downhole measurements), and Chemical & Petrochemical Processing, where extreme process conditions require stable and reliable temperature data.

How do sheath materials, such as Stainless Steel versus Inconel, affect MI cable performance?

Stainless Steel (e.g., SS 316) provides a cost-effective solution with good corrosion resistance up to moderate temperatures. Inconel (e.g., Inconel 600) is used in applications requiring superior performance above 800°C, offering better mechanical strength and resistance to oxidation and chemical attack.

What factors restrain the overall market growth for MI thermocouple cables?

Key restraints include the high initial manufacturing cost associated with specialized materials and technical swaging processes, the complexity and specialized labor required for correct installation, and the competition from other advanced non-contact sensing technologies.

Which geographical region is projected to experience the fastest growth in the MI Thermocouple Cables Market?

The Asia Pacific (APAC) region is projected for the fastest growth due to extensive industrialization, significant investment in new power generation capacity, and the rapid expansion of the chemical and heavy manufacturing sectors across key economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager