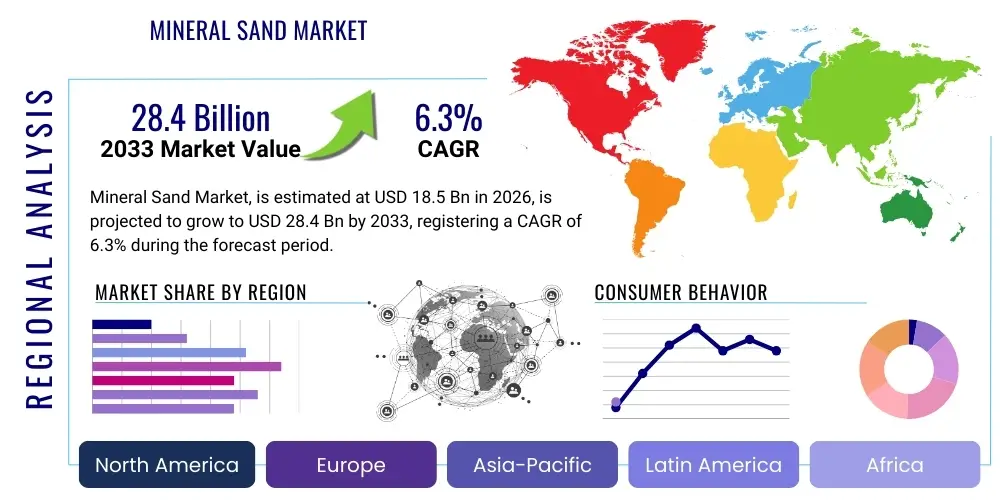

Mineral Sand Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436520 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Mineral Sand Market Size

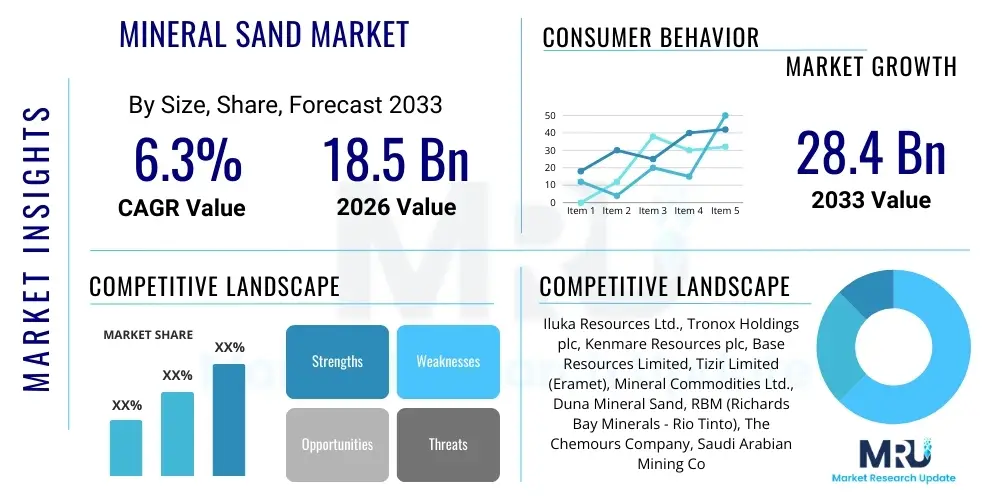

The Mineral Sand Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 28.4 Billion by the end of the forecast period in 2033.

Mineral Sand Market introduction

Mineral sands represent a crucial industrial resource, characterized by deposits containing heavy minerals such as ilmenite, rutile, zircon, and leucoxene. These minerals are primarily extracted from ancient shorelines and dunes. Ilmenite and rutile are essential sources of titanium dioxide (TiO2), which is extensively used in high-performance pigments, coatings, and specialized metal applications. Zircon is highly valued for its exceptional resistance to heat and chemical corrosion, making it indispensable in the manufacturing of ceramics, refractories, and foundry sands. The unique properties of mineral sands—including opacity, brilliance, and durability—make them irreplaceable components across multiple industrial sectors globally.

Major applications of mineral sands span across industries dependent on high-quality materials. The predominant end-use sector is the pigment industry, where titanium dioxide derived from ilmenite and rutile provides whiteness and opacity for paints, plastics, and paper. Furthermore, the burgeoning construction sector globally relies heavily on zircon for high-end ceramic tiles and specialty glass. Minor, yet critical, applications include the production of titanium metal for aerospace and defense industries, and the use of monazite (often co-mined) in rare earth element extraction. The increasing demand for infrastructure development and durable consumer goods directly correlates with the demand trajectory of mineral sands.

The market is fundamentally driven by global urbanization trends, leading to sustained demand for housing, infrastructure, and automotive components that require high-performance coatings and materials. Benefits derived from mineral sands include enhanced product lifespan, superior material strength, and environmental stability, particularly provided by TiO2 pigments that offer UV resistance. Key driving factors include the rapid industrialization across Asia Pacific economies, technological advancements in mineral separation techniques boosting yield efficiency, and sustained research into new applications for titanium and zirconium compounds, securing the market's long-term growth prospects despite volatility in commodity prices.

Mineral Sand Market Executive Summary

The Mineral Sand Market is characterized by robust growth underpinned by strong business trends focusing on vertical integration and resource efficiency. Key industry players are increasingly integrating mining operations with processing facilities, particularly for converting ilmenite into synthetic rutile or titanium slag, ensuring greater control over the supply chain and mitigating risks associated with raw material price fluctuations. Sustainability initiatives are emerging as major business drivers, pushing companies toward lower-impact mining practices and stricter tailings management. Furthermore, the shift toward specialty, high-purity TiO2 applications and the premiumization of ultra-fine zircon powders are generating higher profit margins, diversifying revenue streams away from traditional bulk commodities and bolstering overall market resilience.

Regional trends indicate a pronounced shift in consumption and production dominance. While established producers like Australia and South Africa maintain high-quality outputs, the Asia Pacific (APAC) region, spearheaded by China and India, remains the largest consumer, primarily due to explosive growth in construction and manufacturing sectors demanding ceramics and pigments. Infrastructure spending initiatives in emerging economies are particularly stimulating regional demand. Conversely, political instability and stringent environmental regulations in some traditional mining regions, particularly in Africa, pose operational challenges, leading to increased investment in stable jurisdictions offering reliable regulatory frameworks and high mineral concentrations, such as Western Australia and specific regions in North America.

Segmentation trends highlight the continued dominance of the titanium feedstock segment (ilmenite and rutile), driven by relentless global demand for paint and coatings. However, the zircon segment is exhibiting accelerated growth, primarily driven by the expanding middle class in APAC demanding high-specification ceramic tiles and sanitaryware, which utilize zircon opacity and durability properties. Within the application segments, the refractory materials sector is seeing steady, high-value growth due to the need for advanced lining materials in steel production and glass manufacturing. This indicates a strategic market movement toward specialized end-uses that can absorb higher material costs, signaling maturity and diversification beyond basic commodity reliance.

AI Impact Analysis on Mineral Sand Market

User queries regarding the impact of Artificial Intelligence (AI) on the mineral sand industry primarily revolve around enhancing operational efficiency, improving resource utilization, and mitigating environmental risks. Common themes include how AI can optimize geological modeling for new reserve identification, whether machine learning algorithms can refine mineral separation processes to increase yield purity (particularly separating zircon from titanium minerals), and the role of predictive maintenance in reducing costly downtime of heavy mining and processing equipment. Users are keenly interested in AI’s potential to address sustainability concerns by optimizing water usage, minimizing energy consumption during drying and milling, and managing complex tailings storage facilities (TSFs) through real-time monitoring and structural integrity prediction, ultimately seeking improved profitability and a reduced ecological footprint.

AI’s influence is rapidly extending across the entire mineral sand value chain, starting from upstream exploration where complex geophysical data analysis is transformed. Machine learning models can analyze seismic, magnetic, and hyperspectral imaging data far faster and more accurately than traditional methods, pinpointing high-grade mineral deposits with significantly reduced exploration time and cost. This enhanced precision minimizes the risk associated with Greenfield projects. Furthermore, in the operational phase, AI is applied to optimize blast patterns in dry mining or dredge movement in wet mining, ensuring maximum resource recovery while minimizing energy input per ton of ore processed, leading directly to lower operational expenses and improved throughput rates.

Midstream and downstream processing benefit profoundly from AI-driven process control. Mineral separation plants, which use complex sequences of gravity, magnetic, and electrostatic separation, are optimized using reinforcement learning and neural networks. These systems continuously adjust parameters—such as feed rate, magnetic field intensity, and particle size distribution—in real-time to maintain the highest purity of concentrates (e.g., maximizing rutile recovery or zircon percentage), crucial for meeting stringent customer specifications, particularly in the premium ceramics and specialty chemicals markets. This technological adoption positions companies prioritizing digitalization for a distinct competitive advantage in cost leadership and product quality consistency.

- AI-driven geological modeling enhances the accuracy of reserve estimation, reducing exploration risk.

- Predictive maintenance schedules optimize the uptime of critical processing machinery like heavy mineral separators and drying kilns.

- Machine learning algorithms optimize the complex sequences of magnetic and electrostatic separation, maximizing the yield and purity of ilmenite, rutile, and zircon concentrates.

- Real-time sensor data processed by AI ensures optimal energy consumption during processing (e.g., crushing, milling, and drying).

- Autonomous hauling and drilling systems improve safety and operational consistency in challenging mining environments.

- AI monitoring systems are deployed for continuous structural integrity assessment of tailings dams, drastically improving environmental risk management.

- Supply chain optimization using AI predicts demand fluctuations, enabling proactive inventory management of high-value products like specialized zircon flour.

DRO & Impact Forces Of Mineral Sand Market

The mineral sand market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the impact forces shaping its trajectory. A primary driver is the insatiable global demand for titanium dioxide pigment, critical for coatings and plastics across rapidly industrializing regions. Coupled with this is the continuous growth in high-value applications for zircon, particularly in the production of high-specification ceramic tiles and specialized refractories required by glass and steel industries. These demand-side forces are amplified by increasing global construction activity and automotive production, establishing a high baseline demand for mineral sand products, thereby maintaining upward pressure on commodity prices.

However, significant restraints temper this growth. Environmental regulation is becoming increasingly stringent globally, particularly concerning water usage, rehabilitation requirements for mined land, and the disposal of radioactive byproducts like monazite, adding substantial complexity and cost to mining operations. Furthermore, the decreasing availability of high-grade, easily accessible mineral sand deposits necessitates mining lower-grade reserves or using more remote resources, increasing extraction complexity, transportation costs, and capital expenditure (CAPEX). Market volatility, influenced by macroeconomic conditions and geopolitical disruptions affecting key supply regions (like Mozambique or South Africa), also presents a substantial restraint on long-term investment planning.

Opportunities within the market lie prominently in technological innovation and circular economy principles. Advancements in processing technology allow for the effective separation and utilization of previously discarded lower-grade resources, effectively extending the lifespan of existing mine sites and increasing resource recovery rates. There is a growing opportunity in the recycling and recovery of titanium and zirconium from waste streams, though currently nascent, offering a sustainable alternative to primary mining in the long term. Moreover, exploring and developing resources in politically stable regions, alongside developing new high-purity applications in areas like 3D printing and advanced battery components (utilizing titanium), provides avenues for significant future market expansion and value creation, mitigating the impact of existing restraints.

Segmentation Analysis

The Mineral Sand Market is predominantly segmented based on the type of product extracted, its primary application, and the geographic location of both production and consumption. Product segmentation is crucial as it determines the end-user market and price realization, with high-purity rutile and premium zircon commanding significantly higher prices than bulk ilmenite. Understanding these segments allows market participants to strategically position their production assets to meet specific industrial demands, ensuring supply chain resilience and optimal revenue generation. The market structure reflects the essential role mineral sands play as foundational materials for several critical downstream manufacturing industries globally.

Segmentation by application highlights the dependence of the market on major industrial sectors. The titanium dioxide pigment manufacturing segment represents the largest volume consumption, directly linking the mineral sand industry to global trends in housing, packaging, and automotive manufacturing. Conversely, specialized applications, such as refractories and foundry casting, while lower in volume, often require higher purity material, making them crucial segments for driving technological development and offering stable, high-value demand. Geographical segmentation is vital, reflecting the uneven distribution of mineral resources (e.g., high-quality zircon mostly from Australia and South Africa) versus the concentrated consumption in densely populated and rapidly industrializing regions, especially in East Asia.

The continuous refinement of segmentation is driven by technological advancements enabling the commercial separation of historically non-commercial minerals found within mineral sand deposits (e.g., garnet or rare earth elements). This capability creates new nested subsegments and offers miners additional revenue streams. Furthermore, the rising demand for sustainably sourced and processed materials is beginning to create a 'Green Mineral Sand' subsegment, commanding premium pricing among environmentally conscious buyers in Europe and North America, necessitating differentiated marketing strategies tailored to stringent environmental compliance and traceability requirements throughout the supply chain.

- Product Type:

- Ilmenite

- Rutile

- Zircon

- Synthetic Rutile/Titanium Slag

- Leucoxene

- Others (Monazite, Garnet)

- Application:

- Titanium Dioxide (TiO2) Pigments

- Ceramics & Tiles

- Foundry & Casting

- Refractories

- Welding Electrodes

- Metal & Alloys (Titanium Metal)

- Others (Abrasives, Chemicals)

- Mining Method:

- Dry Mining

- Wet Mining (Dredging)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Mineral Sand Market

The mineral sand value chain is intricate, beginning with exploration and extending through complex mineral separation processes before reaching highly diverse end-user industries. The upstream phase encompasses geological exploration, resource evaluation, and the physical mining operation, which typically involves either dry stripping and excavation or wet dredging, dependent on the deposit location and water table depth. Key upstream activities focus on efficiently extracting the heavy mineral concentrate (HMC) from the bulk sand matrix. Success at this stage relies heavily on advanced geological modeling and massive capital investment in specialized mining equipment and initial beneficiation (wet concentration) plants located near the mine site to remove lighter materials before transport.

The midstream segment is characterized by sophisticated and technologically intensive separation processes. The heavy mineral concentrate is transported to dry processing plants where magnetic, electrostatic, and gravity separation techniques are employed sequentially to separate the individual mineral commodities—ilmenite, rutile, zircon, and others—to high purity levels required by specific industries. This beneficiation process often includes secondary processing like calcining or chemical modification to upgrade ilmenite into higher-value synthetic rutile or titanium slag, thereby enhancing titanium recovery and usability. The efficiency and environmental compliance of these separation plants are crucial determinants of overall profitability, driving innovation in flotation and chemical leaching technologies.

The downstream sector involves the utilization of these refined mineral products by end-user manufacturing industries. Distribution channels are varied, involving direct sales to large, integrated customers (e.g., global TiO2 producers like Chemours or Tronox) or through specialized commodity traders and distributors, especially for smaller ceramic or foundry clients globally. Direct channels ensure long-term supply contracts and price stability, while indirect channels provide market liquidity and reach niche geographic markets. The primary downstream consumers—pigment manufacturers, ceramic producers, and specialized metal producers—dictate product specifications and demand cycles, completing the circular dependence within the mineral sand market ecosystem and highlighting the necessity for robust logistics and inventory management.

Mineral Sand Market Potential Customers

The primary customers for mineral sand products are large-scale industrial manufacturers across several key sectors, driven by the unique properties these minerals impart to their final products. For titanium feedstocks (ilmenite and rutile), the dominant customer base comprises titanium dioxide pigment producers who require these materials for the chloride or sulfate process to manufacture the world's most ubiquitous white pigment used in paints, plastics, paper, and sunscreens. These customers, including multinational chemical corporations, seek secure, high-volume, and long-term contracts to ensure stable operation of their capital-intensive pigment plants. Their purchasing decisions are primarily influenced by the purity and titanium content of the feedstock, as higher quality reduces processing complexity and waste.

For the zircon segment, the customer base is more diversified but concentrates heavily within the construction material supply chain. Major buyers include global ceramic tile manufacturers, particularly those serving the rapidly expanding architectural and infrastructure markets in Asia and the Middle East, using zircon for glaze opacity and whiteness. Furthermore, the refractory industry, crucial for lining furnaces in steel, cement, and glass production, relies on zircon's high melting point and chemical inertia. Foundries also constitute a significant customer group, utilizing zircon sands for mold casting due to their low thermal expansion and superior finish properties. These customers are highly sensitive to particle size distribution and consistency of supply.

An emerging high-value customer segment is the specialized titanium metal and alloy manufacturers, serving the aerospace, defense, and medical implant industries. These applications require ultra-high-purity rutile or titanium slag as the precursor for titanium sponge production. While volume is lower, the strict quality control and high price point of these niche customers make them strategically important for mineral sand producers. Additionally, chemical companies producing zirconium chemicals and catalysts for water treatment and nuclear applications also form a vital part of the specialized demand ecosystem, seeking consistent, traceable, and certified mineral sources.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 28.4 Billion |

| Growth Rate | CAGR 6.3% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Iluka Resources Ltd., Tronox Holdings plc, Kenmare Resources plc, Base Resources Limited, Tizir Limited (Eramet), Mineral Commodities Ltd., Duna Mineral Sand, RBM (Richards Bay Minerals - Rio Tinto), The Chemours Company, Saudi Arabian Mining Company (Ma'aden), Astron Corporation Limited, Vostoc Emerging Resources, China National Nonferrous Metals Corp., W. R. Grace & Co., Sibelco, Lomon Billions, CRISTAL (National Titanium Dioxide Company), Exxaro Resources, Image Resources NL, AEL Mining Services |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mineral Sand Market Key Technology Landscape

The technological landscape within the mineral sand market is rapidly evolving, driven primarily by the need to optimize processing yields from lower-grade or geologically complex deposits and the imperative to reduce environmental footprint. A core focus remains on separation technology refinement. Advanced magnetic and electrostatic separation techniques are being continuously improved, utilizing sophisticated sensor technology and AI-driven process control to handle complex mineralogical assemblages, particularly those containing fine-grained or altered minerals (like highly weathered ilmenite or fine zircon), which are difficult to separate efficiently using traditional mechanical methods. Innovations in high-tension electrostatic separators (HTES) and rare-earth magnetic drums are crucial for achieving the ultra-high purity required by specialized chemical and titanium metal producers, ensuring that even low-concentration streams become commercially viable.

Beyond separation, the industry is increasingly adopting comprehensive digitalization and automation technologies across the entire mining lifecycle. Integrated digital mine solutions leverage the Internet of Things (IoT) sensors installed on dredges, classifiers, and processing equipment to collect vast datasets on performance, throughput, and energy consumption in real-time. This data feeds into centralized operational technology (OT) systems, often managed by AI, which perform predictive analytics for equipment maintenance, adjust processing parameters instantaneously, and model long-term resource recovery. Automation extends to autonomous vehicle deployment for bulk material handling and the use of drones for high-resolution aerial surveying and mapping of reserves and rehabilitation areas, leading to enhanced safety records and significant reductions in labor costs and human error.

Sustainability and water management technologies represent another critical area of innovation. Given that mineral sand mining operations are highly water-intensive, particularly wet dredging, producers are investing heavily in advanced water recycling and dewatering technologies, such as high-rate thickeners and filter presses, to maximize water recovery and minimize discharge into local ecosystems. Simultaneously, new rehabilitation techniques are being researched to accelerate the recovery of mined land, focusing on soil remediation and rapid restoration of native biodiversity, often monitored using advanced geospatial technologies. These technological investments are not just regulatory compliance measures but are becoming competitive differentiators, particularly for producers selling into environmentally conscious markets in Europe and North America that require verifiable supply chain sustainability.

Regional Highlights

The Mineral Sand Market exhibits distinct regional dynamics dictated by resource endowment, industrial demand, and regulatory environments. Asia Pacific (APAC) holds the dominant position in terms of consumption, propelled by extensive urbanization, infrastructure development, and the explosive growth of the ceramics, paint, and plastics industries in countries like China, India, and Southeast Asian nations. China, as the world's largest producer and consumer of finished goods, drives unparalleled demand for both titanium dioxide pigment feedstocks and high-grade zircon, often relying heavily on imports from Australia and Africa to supplement domestic production. The sheer scale of industrial output in APAC ensures this region remains the primary engine for global market growth.

Australia continues to be the bedrock of global mineral sand supply, particularly for high-value rutile and premium zircon, owing to its vast, high-quality resources, stable political climate, and adherence to stringent environmental and labor standards. Australian producers are highly competitive, focusing on technological innovation and efficient logistical chains to maintain their position as leading exporters. Conversely, the Middle East and Africa (MEA) region, particularly South Africa, Mozambique, and Saudi Arabia (with investments in titanium slag processing), represent critical global production hubs, hosting some of the largest ilmenite and rutile deposits. While offering high-volume potential, production in parts of MEA can be subject to geopolitical risk and infrastructure constraints, which influence global supply stability and pricing.

North America and Europe, while having limited domestic mineral sand mining (especially in Europe), are major consumers of high-purity mineral sand products, driven by specialized applications like aerospace, high-performance coatings, and advanced manufacturing. These regions demand high-specification materials, such as titanium sponge for the defense sector and specialty zircon for precision casting and nuclear applications. Their influence is less about volume and more about setting quality benchmarks and driving sustainability requirements. European environmental regulations, such as REACH, significantly impact product formulation and sourcing decisions globally, compelling suppliers to ensure complete traceability and minimal impurity profiles, particularly regarding trace radioactive elements often found in mineral sands.

- Asia Pacific (APAC): Dominant consumption hub due to infrastructure boom; major growth market for ceramics (zircon) and coatings (TiO2) in China and India.

- Australia: Leading global exporter of premium rutile and zircon; characterized by high-quality resources and advanced mining technologies.

- Africa (South Africa, Mozambique, Kenya): Significant global producer of ilmenite and rutile; market stability influenced by local infrastructure and political risks.

- North America: High-value market focused on specialized applications like aerospace titanium and high-performance coatings; significant technology adopter for downstream processing.

- Europe: Key market for demanding high-purity and sustainable materials; strict environmental regulations influence sourcing decisions globally.

- Latin America: Emerging market for consumption, particularly in Brazil and Chile, driven by localized construction and industrial expansion, though regional production is minor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mineral Sand Market.- Iluka Resources Ltd.

- Tronox Holdings plc

- Kenmare Resources plc

- Base Resources Limited

- Tizir Limited (Eramet)

- Mineral Commodities Ltd.

- Duna Mineral Sand

- RBM (Richards Bay Minerals - Rio Tinto)

- The Chemours Company

- Saudi Arabian Mining Company (Ma'aden)

- Astron Corporation Limited

- Vostoc Emerging Resources

- China National Nonferrous Metals Corp. (CNMC)

- W. R. Grace & Co.

- Sibelco

- Lomon Billions

- CRISTAL (National Titanium Dioxide Company)

- Exxaro Resources

- Image Resources NL

- AEL Mining Services

Frequently Asked Questions

Analyze common user questions about the Mineral Sand market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of demand for Zircon in the Mineral Sand Market?

The primary driver for Zircon demand is the global ceramic tile industry, particularly rapid housing and commercial construction in the Asia Pacific region. Zircon's high opacity and thermal stability make it essential for manufacturing glazes and specialty refractories, driving sustained demand, especially for high-grade ceramic applications.

How does the production of Titanium Dioxide (TiO2) pigment influence Ilmenite and Rutile pricing?

TiO2 pigment production is the largest consumer of titanium mineral feedstocks (Ilmenite, Rutile, and Synthetic Rutile). Pricing for these raw materials is fundamentally linked to the capacity utilization and profitability of the global pigment industry, with high TiO2 demand translating directly into higher feedstock prices due to supply-side tightness.

What is the main environmental challenge facing the Mineral Sand mining industry?

The main environmental challenge is the effective management and safe storage of tailings, particularly those containing trace radioactive elements like monazite. Strict regulatory compliance regarding site rehabilitation, water usage efficiency, and the long-term stability of tailings storage facilities (TSFs) requires significant ongoing investment in advanced processing and monitoring technologies.

Which geographical region holds the largest reserves and production capacity for high-grade Mineral Sands?

Australia consistently holds the largest known reserves of high-quality rutile and premium zircon and is the leading global exporter. Significant volumes of ilmenite and rutile are also produced from large-scale operations across the Middle East and Africa (MEA), especially in South Africa and Mozambique, influencing global supply dynamics.

How are technological advancements impacting the economic viability of low-grade mineral sand deposits?

Technological advancements, including the adoption of sensor-based sorting, advanced magnetic and electrostatic separation circuits, and AI-driven process optimization, are significantly improving the recovery rate and purity from low-grade and complex deposits. This reduces waste and makes historically uneconomical deposits commercially viable, extending resource lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager