Mini Excavator Attachment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436236 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Mini Excavator Attachment Market Size

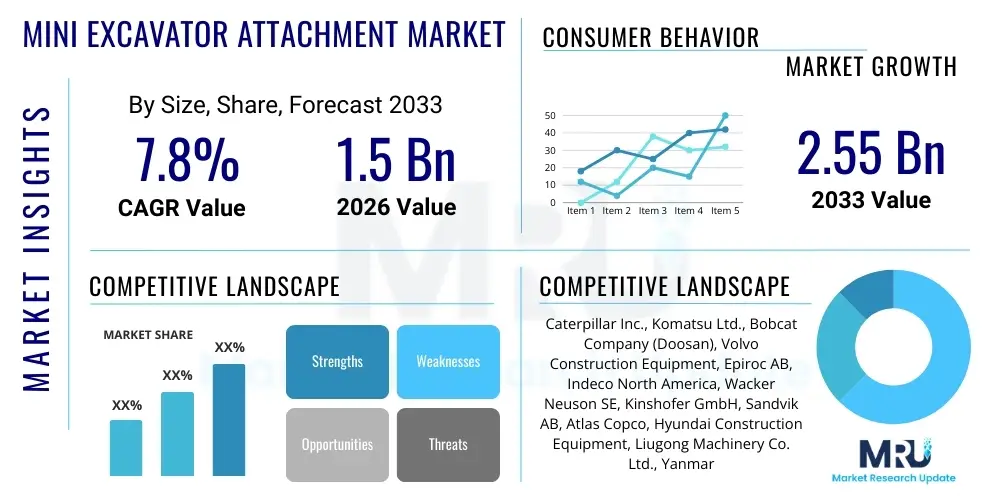

The Mini Excavator Attachment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Mini Excavator Attachment Market introduction

The Mini Excavator Attachment Market encompasses a wide range of ancillary equipment designed to enhance the versatility and productivity of compact excavators (typically machines weighing under 7 metric tons). These attachments transform the base machine from a simple digging tool into a multi-functional powerhouse capable of executing complex tasks across various industries. Key products include hydraulic breakers, augers, various types of specialized buckets (trenching, grading), grapples, and sophisticated tiltrotators. The inherent benefit of mini excavators lies in their small footprint, enabling access to confined urban and residential construction sites where larger machinery is impractical. Attachments capitalize on this advantage by providing specialized functionality such as demolition in tight spaces, intricate landscaping work, and precision utility installation.

The market is defined by the ongoing need for increased operational efficiency and flexibility in construction and infrastructure projects globally. As urbanization accelerates, the demand for compact equipment capable of maneuverability without compromising power output drives the adoption of advanced attachments. Mini excavators are particularly critical in utility trenching, residential development, and interior demolition tasks. The attachments are crucial components in maximizing return on investment for equipment owners, allowing a single machine to perform tasks that previously required multiple dedicated units. This versatility is highly appealing to rental companies and small-to-medium contractors seeking cost-effective equipment solutions.

Major applications span infrastructure development, residential and commercial construction, agriculture, and specialized landscaping. Driving factors include stringent environmental regulations promoting smaller, fuel-efficient machinery, rapid technological advancements in quick coupler systems enhancing attachment changeovers, and robust government spending on public works and utility upgrades. Furthermore, the rising awareness regarding worker safety and ergonomic designs integrated into modern attachments contributes significantly to market expansion, positioning attachments as indispensable tools for modernizing construction workflows.

Mini Excavator Attachment Market Executive Summary

The Mini Excavator Attachment Market is exhibiting robust growth, propelled primarily by global infrastructure expansion and the increasing mechanization of construction tasks in developing economies. Business trends indicate a strong shift towards hydraulic-powered, intelligent attachments equipped with sensor technology, optimizing performance and reducing operational downtime. Original Equipment Manufacturers (OEMs) are increasingly integrating proprietary quick-hitch systems and advanced telemetry into their attachment offerings to ensure seamless compatibility and data collection, positioning them strongly against pure aftermarket suppliers. Furthermore, sustainability is becoming a key metric, with demand rising for attachments engineered using lighter, high-strength materials that reduce the overall fuel consumption of the excavator.

Regionally, Asia Pacific is anticipated to remain the dominant and fastest-growing market, driven by massive investments in residential housing, road networks, and municipal water and sanitation projects, particularly in China and India. North America and Europe, characterized by highly mature construction industries, are focused on adopting high-end, specialized attachments such as tiltrotators, which offer unparalleled precision and efficiency for complex jobs, thereby commanding premium pricing. Regulatory frameworks in these developed regions often mandate the use of specialized tools for safety and environmental compliance, further stimulating high-value attachment sales. The trend towards equipment rental also significantly influences regional dynamics, requiring rental fleets to stock a diverse portfolio of durable, easily interchangeable attachments.

Segment trends highlight the dominance of Buckets (Trenching, Grading) due to their foundational necessity across almost all excavation jobs, though the highest growth trajectory is observed in high-tech specialized segments like Tiltrotators and Hydraulic Breakers, driven by urban demolition and specialized civil engineering requirements. The Aftermarket sales channel maintains a significant share, largely owing to the need for replacement parts and cost-effective alternatives by smaller contractors, yet the OEM segment is growing rapidly as end-users prioritize integrated warranty packages and guaranteed machine compatibility. Operating weight segmentation indicates that attachments suitable for the 3 to 5-ton mini excavators represent the sweet spot for maximum flexibility and volume sales.

AI Impact Analysis on Mini Excavator Attachment Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Mini Excavator Attachment market frequently revolve around themes of automation, predictive maintenance, and operational safety enhancements. Key concerns often focus on how AI-driven analytics can optimize attachment utilization across diverse job sites, determine optimal maintenance schedules for hydraulic components, and potentially enable partial or full autonomous operation of attachment functions (e.g., automated digging depth or grading angles). Users are keenly interested in the integration of vision systems and machine learning to improve the precision of tasks like sorting (using grapples) or high-tolerance grading, thereby reducing reliance on manual measurements and improving project timelines. The prevailing expectation is that AI will transform attachments from passive tools into intelligent, data-generating operational assets.

The implementation of AI algorithms, particularly through telematics systems integrated into the excavator and communicated directly with the attachment's control unit, allows for real-time performance monitoring. This monitoring includes assessing the force and stress exerted on the attachment during operation. For instance, in hydraulic breakers, AI can analyze vibration patterns to prevent premature failure, or in tiltrotators, it can utilize GPS and 3D modeling data to maintain exact grading specifications autonomously. This transition toward predictive diagnostics minimizes unexpected failures on critical job sites, significantly boosting fleet management efficiency and overall equipment uptime—a crucial metric for rental houses and large fleet owners.

Furthermore, AI plays a pivotal role in training and simulation. Advanced simulators, leveraging AI to model realistic attachment interactions with varying soil and material conditions, allow operators to rapidly gain proficiency with complex tools like specialized shears or multi-processor attachments without risking damage to the actual equipment. This capability addresses the persistent shortage of skilled operators in the construction industry. Ultimately, the adoption of AI is expected to lead to attachments that are not only stronger and more versatile but also fundamentally smarter, offering closed-loop control over operational parameters based on instantaneous environmental feedback.

- Enhanced predictive maintenance and fault detection through real-time operational data analysis.

- Integration of machine vision and learning for autonomous or semi-autonomous tasks like precision grading and object sorting.

- Optimization of hydraulic flow and power delivery based on material density and attachment load using smart control systems.

- Improved safety protocols via AI monitoring of attachment trajectory and proximity to surrounding objects or personnel.

- Development of advanced operator training simulators utilizing AI to replicate complex attachment maneuvers and conditions.

- Optimization of fleet utilization and resource allocation based on historical performance data analyzed by machine learning models.

DRO & Impact Forces Of Mini Excavator Attachment Market

The Mini Excavator Attachment Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the global surge in infrastructure development, particularly road construction and utility installation, where the compact size and maneuverability of mini excavators are essential. The increasing focus on specialization in construction tasks necessitates a broader range of high-performance, task-specific attachments, fueling demand. Conversely, the market faces restraints such as the high initial investment cost associated with premium, specialized hydraulic attachments like tiltrotators, which can be prohibitive for small contractors. Furthermore, the lack of standardization across quick-coupler systems among different OEM brands creates compatibility challenges in multi-brand fleets, hindering seamless adoption.

Opportunities for growth are primarily concentrated in the developing sophisticated digital integration between the host machine and the attachment. The development of lighter, yet stronger, material composites (such as high-tensile steel alloys) presents an opportunity to increase attachment durability while reducing the operational weight, leading to better fuel economy. Furthermore, the rapid expansion of the equipment rental market presents a sustained opportunity for attachment manufacturers, as rental companies continuously update their inventory to offer the latest, most versatile tools to a wider customer base without the need for outright purchase. The refurbishment and sale of used attachments, particularly in price-sensitive emerging markets, also present a secondary revenue stream.

The impact forces driving market evolution are predominantly technological and economic. Economic forces, such as fluctuating commodity prices (steel and raw materials), directly influence manufacturing costs, affecting final market pricing. However, the greater impact force is the relentless pursuit of operational productivity. Contractors are constantly seeking attachments that reduce cycle times and the total number of machines required on a site, thereby maximizing profitability. This technological push results in the rapid obsolescence of older, less efficient attachment models. Regulatory impact forces, particularly those relating to noise pollution and vibration limits in urban settings, necessitate the development of specialized, quieter hydraulic hammers and precision tools, mandating innovation across the product portfolio.

Segmentation Analysis

The Mini Excavator Attachment Market is systematically segmented based on the type of attachment, the specific application or end-use industry, the channel through which the product is sold (OEM or Aftermarket), and the operating weight capacity of the mini excavator for which the attachment is designed. This comprehensive segmentation allows market participants to precisely target their product development and distribution strategies toward the highest-growth areas. The functional diversity of mini excavator attachments—ranging from simple earthmoving tools to complex demolition and handling apparatuses—underscores the need for detailed segment analysis to understand where value is concentrated and how technological innovation is reshaping demand patterns across different sectors.

- By Attachment Type:

- Hydraulic Breakers

- Augers

- Buckets (Ditching, Grading, Trenching, General Purpose)

- Grapples (Demolition, Sorting, Utility)

- Rippers

- Tiltrotators

- Trenchers

- Specialized Tools (Shears, Plate Compactors)

- By Application:

- Construction (Residential, Commercial, Infrastructure)

- Agriculture and Forestry

- Landscaping and Ground Care

- Utility and Municipal Services

- Mining and Quarrying (Small Scale)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Operating Weight:

- Less than 3 Ton

- 3 to 5 Ton

- More than 5 Ton (Up to 7 Ton)

Value Chain Analysis For Mini Excavator Attachment Market

The value chain for the Mini Excavator Attachment Market begins with the upstream segment, primarily involving raw material suppliers, including high-grade steel alloy manufacturers and advanced hydraulics component producers (pumps, valves, hoses). The quality and availability of these specialized materials, particularly wear-resistant steel necessary for buckets and high-impact tools, directly influence the final product's performance and lifespan. Manufacturers rely heavily on securing stable, cost-effective supplies, often necessitating long-term contracts with key material processors. Innovation at this stage focuses on developing lighter composites and more durable components to enhance the attachment’s power-to-weight ratio and reduce maintenance cycles.

The core manufacturing and assembly stage involves design, fabrication, welding, surface treatment, and integration of hydraulic and electronic systems. Manufacturers must navigate complexities related to standardizing connection interfaces (couplers) while ensuring compatibility with a wide array of mini excavator models produced by different OEMs. The distribution channel is bifurcated into direct sales via OEM dealerships and indirect sales through independent aftermarket distributors and specialized attachment resellers. OEM channels typically target new equipment buyers, offering bundled deals and guaranteed compatibility, while the aftermarket focuses on servicing the vast existing fleet, providing more competitive pricing and diverse brand options for replacement and specialized tools.

The downstream segment encompasses the end-users (contractors, rental companies, municipalities) and the crucial element of after-sales service, including parts supply, repair, and warranty fulfillment. Rental companies act as a critical intermediary, purchasing attachments in bulk and making them accessible to a broad user base, thereby influencing market demand significantly. Effective after-sales support is a key differentiator, particularly for complex and high-wear attachments like hydraulic breakers and tiltrotators. The efficiency of the distribution network, particularly the availability of high-wear parts locally, is essential for minimizing equipment downtime for the end-user.

Mini Excavator Attachment Market Potential Customers

The primary potential customers and end-users of the Mini Excavator Attachment Market are professional contractors spanning diverse construction and maintenance sectors. General construction firms, specializing in residential and light commercial building, form a significant consumer base, relying on versatile attachments like grading buckets and augers for foundation work and site preparation. Furthermore, specialized utility contractors, responsible for installing water lines, fiber optic cables, and gas pipelines in congested urban areas, are major consumers of trenching buckets, hydraulic hammers for rock breaking, and narrow-profile specialized tools, valuing precision and minimal ground disturbance.

The equipment rental sector represents an increasingly vital customer segment. Rental houses strategically invest in a wide variety of high-demand attachments to maximize the appeal and utilization rate of their mini excavator fleet. These customers prioritize durability, ease of connection (via universal or proprietary quick couplers), and robust designs that can withstand continuous use by multiple operators. They demand attachments that offer high utilization potential across various job types, ensuring rapid return on investment and minimal servicing needs, hence their preference for high-quality, standardized products.

In addition to traditional construction, governmental agencies and municipalities constitute a substantial buyer base, utilizing mini excavators and their attachments for public works, road maintenance, park landscaping, and disaster recovery operations. These entities often procure specialized equipment through formalized tenders, focusing heavily on environmental compliance, noise reduction, and long-term service agreements. Agricultural operations, particularly specialized farming that requires earth moving, post-hole digging, or land clearing on smaller plots, also represent a growing niche for specific attachments like augers and specialty grapples.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Bobcat Company (Doosan), Volvo Construction Equipment, Epiroc AB, Indeco North America, Wacker Neuson SE, Kinshofer GmbH, Sandvik AB, Atlas Copco, Hyundai Construction Equipment, Liugong Machinery Co. Ltd., Yanmar Holdings Co. Ltd., Geith International, Paladin Attachments (Stanley Black & Decker), Miller UK, Amulet Manufacturing, VTN Europe S.p.A., Denis Cimaf Inc., NPK Construction Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mini Excavator Attachment Market Key Technology Landscape

The technology landscape of the Mini Excavator Attachment Market is rapidly evolving, driven primarily by hydraulic efficiency and digital integration. A fundamental technological advancement is the proliferation of advanced hydraulic systems that allow for precise control over the attachment’s functions, maximizing force delivery while minimizing energy loss. Modern hydraulic breakers, for example, now feature energy recovery systems that capture rebound energy, making them more powerful and quieter. Furthermore, the development of high-flow auxiliary hydraulics on mini excavators facilitates the use of powerful attachments like specialized stump grinders or mulchers, previously restricted to larger machines, significantly expanding the mini excavator’s utility scope.

Another crucial technological development is the widespread adoption of smart quick-coupler systems and tiltrotators. Quick couplers, particularly hydraulic automatic models, allow operators to switch between attachments in seconds from the cab, dramatically reducing non-productive time on the job site. Tiltrotators, often called the "Swiss Army Knife" of excavation, integrate a 360-degree rotation and up to 45-degree tilt function, enabled by sophisticated sensors and hydraulic manifolds. This technology is revolutionizing precise excavation and grading, making complex tasks far simpler and faster, particularly in space-constrained environments prevalent in Europe and increasingly adopted in North America.

Digital technology integration, encompassing telematics and proprietary machine control systems, is also paramount. Many high-value attachments are now equipped with sensors that communicate operational data—such as hours of use, stress levels, and temperature—back to the machine's telematics unit. This data is critical for accurate invoicing, utilization tracking, and predictive maintenance scheduling. Future technological advances are anticipated to focus heavily on utilizing 3D GPS guidance systems directly integrated into attachments like grading buckets and tiltrotators, offering millimeter-level accuracy for excavation and final grading without the need for constant human surveying and checks, thereby enhancing overall site productivity and quality assurance.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and most dynamic regional market, fueled by unprecedented urbanization and massive governmental investments in infrastructure projects, particularly rail networks, smart city development, and extensive residential construction across countries like China, India, and Southeast Asian nations. The region shows high demand for basic, high-volume attachments (buckets and augers) but is also rapidly increasing its uptake of specialized tools as construction standards rise. Competitive pricing and local manufacturing strength are key market characteristics in this area.

- North America: Characterized by a mature construction industry and a high rate of technological adoption, North America demonstrates strong demand for high-end, efficient attachments, focusing heavily on productivity. The expansion of utility infrastructure (gas, electricity, broadband) drives sales of trenchers and specialty grapples. Rental fleets are particularly influential here, maintaining high inventory levels of diverse attachments to serve a fragmented contractor base. Strict safety regulations also favor advanced, compliant attachment designs.

- Europe: Europe is recognized as the leading adopter of high-precision attachments, particularly tiltrotators, which originated and saw mass adoption in the Nordic countries before spreading across the continent. High labor costs and stringent environmental rules (especially regarding noise and vibration in urban centers) necessitate the use of premium, low-impact attachments like specialized hydraulic breakers and silent pile drivers. The German and UK markets are critical demand centers due to their extensive civil engineering projects and advanced construction technology ecosystem.

- Latin America (LATAM): The LATAM market, while generally smaller than APAC or North America, shows significant potential tied to mining expansion and public works in countries like Brazil and Mexico. Demand is price-sensitive, often favoring reliable aftermarket components, although large-scale infrastructure projects are beginning to drive investment in durable OEM attachments and hydraulic tools capable of handling challenging geological conditions.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around major urban development and oil and gas infrastructure projects. The Middle East, driven by mega-projects in Saudi Arabia and the UAE, demands heavy-duty attachments suitable for high temperatures and challenging soil conditions, with emphasis on large-capacity buckets and robust breakers. African markets exhibit fragmented demand, with pockets of strong growth tied to agricultural development and essential utility construction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mini Excavator Attachment Market.- Caterpillar Inc.

- Komatsu Ltd.

- Bobcat Company (Doosan)

- Volvo Construction Equipment

- Epiroc AB

- Indeco North America

- Wacker Neuson SE

- Kinshofer GmbH

- Sandvik AB

- Atlas Copco

- Hyundai Construction Equipment

- Liugong Machinery Co. Ltd.

- Yanmar Holdings Co. Ltd.

- Geith International

- Paladin Attachments (Stanley Black & Decker)

- Miller UK

- Amulet Manufacturing

- VTN Europe S.p.A.

- Denis Cimaf Inc.

- NPK Construction Equipment

Frequently Asked Questions

Analyze common user questions about the Mini Excavator Attachment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Mini Excavator Attachment Market?

The primary driver is the accelerating global focus on infrastructure development and urbanization, which increases the need for compact, versatile, and high-efficiency machinery capable of operating in confined or densely populated urban environments. The rising demand for specialized attachments that enhance machine flexibility is also a major catalyst.

How do tiltrotators impact the operational efficiency of mini excavators?

Tiltrotators significantly boost operational efficiency by enabling the attachment to rotate 360 degrees and tilt up to 45 degrees, drastically reducing the need to reposition the excavator itself. This saves significant time and fuel, making complex tasks like intricate grading, pipe laying, and sorting much faster and more accurate.

Which sales channel (OEM vs. Aftermarket) is expected to dominate the market by 2033?

While the Aftermarket currently holds a large share due to replacement needs and cost sensitivity, the OEM channel is expected to gain momentum, especially in developed markets. This growth is driven by increasing contractor preference for proprietary, integrated systems that guarantee seamless compatibility, full warranty coverage, and access to advanced telematics features.

What role does Artificial Intelligence (AI) play in modern mini excavator attachments?

AI is increasingly used to integrate predictive maintenance features and operational optimization. Sensors on attachments feed data to AI algorithms, enabling real-time diagnostics, optimizing hydraulic power delivery based on load, and facilitating the development of semi-autonomous functions like precision depth control during excavation.

Which regional market offers the highest growth potential for high-value attachments?

Although Asia Pacific offers the largest volume growth, Europe and North America offer the highest growth potential for high-value, specialized attachments such as tiltrotators and advanced hydraulic breakers. This demand is underpinned by higher labor costs, stringent safety regulations, and a focus on maximizing productivity through sophisticated tooling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager