Mini Motherboard Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432331 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Mini Motherboard Market Size

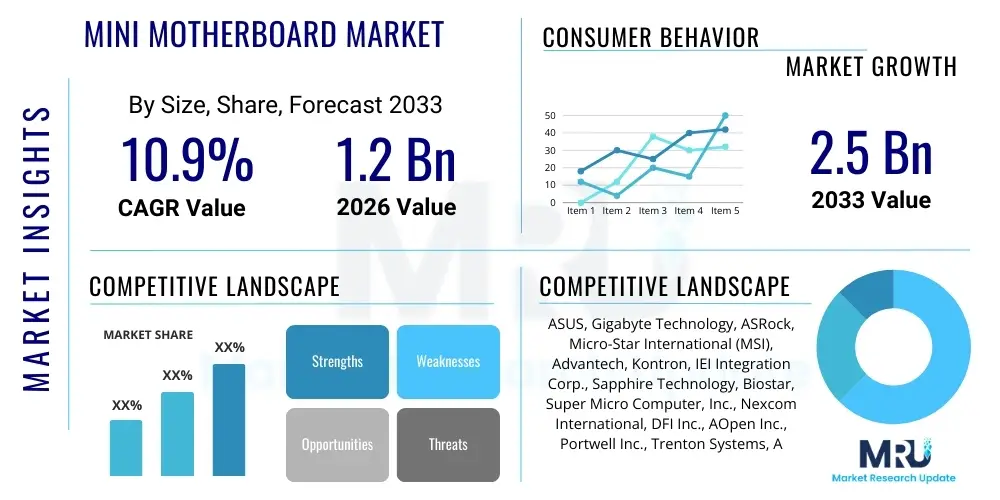

The Mini Motherboard Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.9% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.5 Billion by the end of the forecast period in 2033.

Mini Motherboard Market introduction

The Mini Motherboard Market encompasses specialized computing platforms designed to fit into small form factor (SFF) enclosures, primarily utilizing standards such as Mini-ITX (170mm x 170mm) and sometimes Micro-ATX, though the focus is generally on ultra-compact designs. These motherboards integrate core processing logic, memory controllers, and peripheral connections into minimal footprints, allowing for highly efficient space utilization. Key features often include integrated graphics, low power consumption chipsets, and robust connectivity options tailored for specific use cases where size and thermal management are critical constraints. The increasing demand for compact, yet powerful, computing solutions across consumer and industrial sectors is the core catalyst for this market's expansion.

Mini motherboards serve a vast range of major applications, extending beyond traditional desktop computing into specialized fields. These applications include Home Theater Personal Computers (HTPCs), network-attached storage (NAS) devices, point-of-sale (POS) systems, digital signage, embedded systems, and sophisticated industrial control panels. Furthermore, the burgeoning Internet of Things (IoT) ecosystem heavily relies on the physical constraints and high reliability offered by these compact boards, making them foundational components for edge computing devices and smart infrastructure projects. The ability to deploy high-performance computing power in harsh or space-constrained environments provides a significant competitive advantage.

The primary benefits driving market adoption stem from their inherent space savings, reduced power consumption, and portability. These features translate directly into lower operational costs and greater flexibility in system design. Driving factors include the persistent global trend toward device miniaturization, the rapid expansion of edge computing necessitating distributed processing power, and the increasing sophistication of gaming and professional content creation requiring compact workstations that do not compromise on performance. Manufacturers are continually innovating in chipset integration and thermal management to address the performance demands within restricted dimensions, further propelling market growth.

Mini Motherboard Market Executive Summary

The Mini Motherboard Market is currently characterized by robust growth fueled by several converging business trends, most notably the transition towards distributed computing models and the rising penetration of smart technologies across industries. Key business dynamics include increasing collaboration between chipset designers (e.g., Intel, AMD) and specialized motherboard manufacturers (e.g., ASRock, Gigabyte) to optimize integration for low-power architectures. There is also a significant trend toward custom-designed mini motherboards for specific industrial automation and medical imaging equipment, shifting the focus from purely consumer DIY segments to specialized B2B applications. Investment in robust I/O solutions suitable for industrial temperature ranges and continuous operation is dominating the innovation landscape.

Regionally, the Asia Pacific (APAC) market, particularly China, South Korea, and Japan, demonstrates the fastest growth and holds the largest market share due to its established manufacturing base, high rate of IoT deployment, and massive adoption of embedded systems in consumer electronics and automotive sectors. North America and Europe remain key markets characterized by high adoption of high-performance SFF systems used in gaming and professional workstations, coupled with significant early adoption of edge AI infrastructure. The regional trends highlight a performance-driven demand in Western markets balanced by a volume and cost-efficiency focus in APAC, driving differentiated product strategies globally.

Segment trends reveal that the Mini-ITX form factor segment continues to dominate due to its optimal balance between size and functionality, while the adoption of ARM-based mini motherboards is accelerating, especially for low-power and specialized computing tasks relevant to telecommunications and dedicated server applications. In terms of application, the industrial PC and embedded systems segment exhibits the highest forecasted growth rate, surpassing traditional desktop computing applications. This shift reflects the broader macroeconomic trend of digital transformation and the necessity of deploying robust, small-scale computing nodes closer to data sources, confirming the vital role of mini motherboards in modern distributed architectures.

AI Impact Analysis on Mini Motherboard Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Mini Motherboard Market frequently revolve around performance limitations, thermal dissipation challenges, and the necessity of integrating specialized AI acceleration hardware within limited physical space. Common questions include whether SFF systems can adequately support deep learning inference models, how to manage the significant heat generated by high-TDP CPUs and GPUs in compact enclosures, and the availability of chipsets optimized for AI workloads (like those supporting M.2 slots for dedicated AI accelerators or specialized NPUs). The consensus expectation among users is that mini motherboards must evolve to offer superior power delivery and cooling capabilities, along with enhanced connectivity for high-speed AI data transfer, without increasing the board dimensions. The primary concern remains the trade-off between miniaturization and the raw computational power required for modern AI applications.

The influence of AI is fundamentally reshaping the design requirements for mini motherboards, shifting the focus from general-purpose computing to optimized parallel processing and enhanced I/O throughput. AI inference at the edge, crucial for autonomous vehicles, smart manufacturing, and retail analytics, mandates highly reliable SFF platforms. This demand forces manufacturers to integrate cutting-edge cooling technologies, such as advanced heat pipe designs and liquid cooling compatibility, into previously constrained chassis designs. Furthermore, the integration of dedicated Neural Processing Units (NPUs) directly into the System on Chip (SoC) utilized by mini motherboards is becoming a standard expectation to handle low-latency AI tasks efficiently without relying solely on the main CPU or a discrete GPU.

The market is responding to these demands by developing specialized mini-ITX boards with features like multiple high-speed storage interfaces (NVMe PCIe 4.0/5.0) and high-density RAM support, specifically catering to data-intensive AI models. AI development kits, often based on mini motherboards, are increasingly prevalent, bundling optimized software stacks with hardware tailored for rapid deployment. This necessitates closer collaboration between hardware providers and AI software developers to ensure seamless optimization. Ultimately, AI adoption drives the premium segment of the mini motherboard market, demanding higher complexity and tighter integration of specialized processing units within the confined space.

- Increased demand for robust voltage regulators and superior power delivery systems to support high-TDP AI-optimized CPUs/GPUs.

- Acceleration of NPU integration and specialized AI accelerator slots (e.g., M.2 E-key for specialized AI modules).

- Development of advanced passive and active cooling solutions specifically for SFF chassis to manage heat generated by AI processing.

- Requirement for higher bandwidth connectivity (PCIe 5.0, 10GbE LAN) to facilitate rapid data ingress and egress essential for real-time edge AI inference.

- Focus on energy efficiency for long-duration, battery-powered edge AI devices utilizing ARM-based mini motherboards.

DRO & Impact Forces Of Mini Motherboard Market

The market dynamics are significantly shaped by a confluence of powerful drivers (D), persistent restraints (R), and compelling opportunities (O), which collectively dictate the direction and pace of growth. The primary drivers include the exponential rise of the Internet of Things (IoT) ecosystem, which necessitates billions of small, reliable computing nodes, and the consumer trend toward minimalist, yet high-performance, gaming and productivity setups (SFF PCs). These factors push motherboard vendors to constantly enhance component density and performance per square inch. Opportunities are concentrated in emerging technologies such as 5G network infrastructure deployment, which requires dense, reliable computing at base stations and localized data centers, and the expanding field of edge computing, particularly within industrial automation and robotics, which demands ruggedized and highly integrated solutions.

However, the market faces inherent limitations acting as restraints. The most critical restraint is thermal management; accommodating high-performance components (like flagship processors) within the confined dimensions of mini motherboards leads to significant heat dissipation challenges, often necessitating expensive, proprietary cooling solutions that increase the total system cost. Furthermore, restricted physical space limits component connectivity, such as the number of expansion slots (PCIe, RAM slots) and port count, inherently limiting scalability compared to standard ATX formats. The complexity of manufacturing and the precision required for high-density soldering also contribute to higher production costs and complexity, impacting mass market pricing in certain segments.

These drivers and restraints create specific impact forces on the industry. The force of performance convergence dictates that mini motherboards must bridge the gap between small size and high power, requiring innovation in layered PCB design and power regulation. The market is also heavily influenced by competitive pricing pressures, particularly in the entry-level embedded segment where system-on-module (SoM) solutions pose a viable alternative. Moreover, regulatory compliance and standardization, especially concerning electromagnetic compatibility (EMC) in densely packed systems, exert a strong impact, forcing meticulous design validation and quality control processes across the value chain. Balancing performance, cost, thermal management, and physical constraints remains the core challenge defining market success.

Segmentation Analysis

The Mini Motherboard Market is comprehensively segmented based on various technical specifications, primary application areas, and end-user adoption patterns, enabling detailed analysis of specific growth pockets and market maturity levels. Key segmentation categories include the form factor (which dictates size and I/O limits), the chipset and processor type (influencing performance and power profile), the target application (defining reliability and feature sets), and the end-user industry (reflecting vertical adoption rates). This granular view allows manufacturers to tailor product development for specific requirements, such as ruggedization for industrial use or advanced multimedia capabilities for consumer entertainment systems. Understanding these distinct segments is crucial for strategic planning and resource allocation within the competitive landscape.

- By Form Factor:

- Mini-ITX (Dominant Segment)

- Micro-ATX (Often included in broader SFF discussions but larger than core mini boards)

- Nano-ITX

- Pico-ITX

- Custom/Proprietary Form Factors

- By Component:

- Processor Type (Intel, AMD, ARM, Others)

- Chipset Type (Integrated vs. Discrete)

- Memory Slots (DDR4, DDR5, LPDDR)

- Integrated Graphics/GPU Solutions

- By Application:

- Consumer Electronics (HTPC, Gaming SFF PCs)

- Industrial PC (IPC) and Automation

- Embedded Systems (Digital Signage, Kiosks, Robotics)

- Networking and Communication Infrastructure (Routers, Firewalls)

- Automotive Infotainment and Control Systems

- Medical Devices and Imaging Equipment

- By End User:

- System Integrators and OEMs

- Gaming Enthusiasts and Hobbyists

- Industrial Manufacturers

- Telecommunications Providers

- Government and Defense

Value Chain Analysis For Mini Motherboard Market

The value chain for the Mini Motherboard Market begins with upstream activities centered on raw material procurement and core component design. Upstream stakeholders include silicon vendors (Intel, AMD, NVIDIA, ARM designers), passive component suppliers (capacitors, resistors), and PCB manufacturers. The complexity in this stage is high, as the dense component layout requires specialized, high-layer count PCBs and advanced soldering techniques (SMT). Strategic relationships with silicon designers are paramount, as the form factor heavily dictates the choice of embedded processors and chipsets. Innovation in upstream packaging technology, particularly in System-on-Module (SoM) and Ball Grid Array (BGA) solutions, directly impacts the feasibility of extreme miniaturization required for pico-ITX and nano-ITX boards.

The manufacturing and assembly phase constitutes the core middle segment of the value chain. This involves Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs) who handle board design, component placement, and rigorous testing. Given the stringent thermal and reliability requirements for mini motherboards, especially those destined for industrial or automotive applications, quality control and validation processes are intense. Direct distribution often occurs through B2B channels, where manufacturers supply bulk quantities directly to large System Integrators (SIs) and OEM clients (e.g., manufacturers of specialized kiosks or medical devices) who integrate the boards into their final products. The rise of customization necessitates highly flexible manufacturing lines capable of handling low-volume, high-mix orders.

Downstream activities involve the distribution channel, which spans both direct sales and indirect routes. Indirect channels primarily include global IT distributors, specialized electronics retailers, and e-commerce platforms catering to DIY enthusiasts and small SIs. Direct sales, typically involving dedicated sales teams, are reserved for large-scale industrial customers requiring specific technical support and long-term product availability contracts. The increasing prominence of Answer Engine Optimization (AEO) demands that downstream marketing content provides highly detailed technical specifications and application suitability guides to reach niche customers researching specialized SFF solutions online. Post-sales support, particularly long-term warranty and availability guarantees for embedded systems, is a critical differentiating factor in the highly competitive industrial segment.

Mini Motherboard Market Potential Customers

The primary customers for the Mini Motherboard Market are diverse, ranging from large industrial conglomerates requiring embedded computing solutions to individual consumers building high-end, compact gaming systems. System Integrators (SIs) and Original Equipment Manufacturers (OEMs) represent the largest volume segment. SIs utilize mini motherboards as the core component in building specialized systems for clients in sectors such as digital signage, automated retail, and sophisticated surveillance infrastructure. OEMs, particularly those manufacturing specialized machinery like medical scanners, industrial robots, or telecom network appliances, purchase these boards for integration into their proprietary products, often demanding highly customized configurations, guaranteed long product lifecycles, and stringent environmental specifications.

Another significant customer base resides within the technology and telecommunications sector, specifically companies developing edge computing infrastructure and 5G network components. These entities require ultra-reliable, high-performance computing nodes that can operate efficiently in non-traditional data center environments, often necessitating passive cooling designs and ruggedized motherboards capable of withstanding extreme temperatures and vibrations. The focus here is on maximizing density and minimizing energy consumption while ensuring high data throughput, pushing demand for mini motherboards optimized for networking chipsets and multiple high-speed I/O ports for data aggregation.

The consumer market, comprising gaming enthusiasts, professional content creators, and Home Theater PC (HTPC) builders, constitutes the third major customer segment. Gaming enthusiasts drive demand for premium Mini-ITX boards that support the latest high-end CPUs and GPUs, prioritizing aesthetics, overclocking features, and superior thermal performance within compact cases. HTPC users, conversely, prioritize silent operation, integrated multimedia capabilities, and extremely small form factors (like Nano-ITX). These retail buyers leverage extensive online reviews and community recommendations, making digital marketing and transparent technical specifications essential for market penetration and customer acquisition in this segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.5 Billion |

| Growth Rate | 10.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASUS, Gigabyte Technology, ASRock, Micro-Star International (MSI), Advantech, Kontron, IEI Integration Corp., Sapphire Technology, Biostar, Super Micro Computer, Inc., Nexcom International, DFI Inc., AOpen Inc., Portwell Inc., Trenton Systems, Abaco Systems, Axiomtek, Elitegroup Computer Systems (ECS), Silicon Integrated Systems (SIS), VIA Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mini Motherboard Market Key Technology Landscape

The Mini Motherboard Market is characterized by rapid technological evolution, primarily driven by the need to maximize computational power and connectivity within diminishing physical constraints. A core technological focus involves advanced PCB stacking and layering techniques to accommodate high-density component placement without compromising signal integrity or power delivery. The transition to advanced silicon processes, notably 7nm and 5nm architectures from key vendors, allows for lower power consumption and heat generation per transistor, which is critical for SFF thermal management. Furthermore, the adoption of BGA (Ball Grid Array) packaging, where the CPU and sometimes the RAM are soldered directly onto the board, is common in industrial and embedded mini motherboards, enhancing ruggedness, reliability, and reducing overall vertical profile compared to socketed solutions.

Thermal management innovation represents a second crucial area of technological advancement. Manufacturers are increasingly utilizing sophisticated heat pipe arrays, vapor chambers, and low-profile active cooling solutions designed specifically for cramped enclosures. This includes leveraging unconventional cooling materials and phase change cooling systems in high-end SFF gaming boards. Concurrently, power delivery systems are becoming more efficient, integrating higher quality MOSFETs and digital VRMs (Voltage Regulator Modules) that can handle rapid current spikes required by modern multicore CPUs while operating efficiently in high ambient temperatures. The pursuit of fanless (passive) designs for industrial reliability relies heavily on optimizing heat transfer from the board components directly to the chassis.

Connectivity standards are also rapidly advancing within the mini motherboard space. The adoption of PCIe 5.0 and soon PCIe 6.0 is essential for integrating next-generation AI accelerators, high-speed storage (NVMe SSDs), and 10 Gigabit Ethernet (10GbE) networking capabilities, which are non-negotiable for edge computing and professional workstations. Wireless connectivity, including Wi-Fi 6/6E and integrated 5G modules, is another vital technological enabler, transforming mini motherboards into highly flexible and mobile network endpoints. Lastly, integrated security features, such as Trusted Platform Modules (TPMs) and secure boot functionalities, are standard requirements for embedded systems deployed in critical infrastructure, driving specialized chipset development tailored for enhanced platform security.

Regional Highlights

- Asia Pacific (APAC): APAC holds the dominant market share and exhibits the highest growth potential, primarily driven by massive manufacturing capabilities, expansive consumer electronics production, and high-volume deployment of IoT devices and digital signage in rapidly urbanizing areas like China and India. Government initiatives promoting smart city development and industrial automation (e.g., Industry 4.0 adoption in Japan and South Korea) accelerate the demand for high-reliability embedded mini motherboards. The regional ecosystem benefits from short supply chains and intense competition among local manufacturers, leading to rapid product cycles and competitive pricing.

- North America (NA): Characterized by strong demand for high-performance Mini-ITX systems catering to premium gaming, professional workstation, and specialized military/aerospace applications. North America is a key region for early adoption of advanced technologies like edge AI and 5G network components, necessitating mini motherboards with cutting-edge PCIe and high-speed networking standards. The presence of major semiconductor designers and leading cloud service providers further drives technological innovation and market maturity in SFF solutions.

- Europe: Europe represents a mature market focusing heavily on industrial automation (Germany, Nordic countries), medical technology, and stringent energy efficiency requirements. Demand is high for ruggedized, fanless mini motherboards designed for long-term embedded use and compliance with strict environmental regulations (e.g., RoHS, REACH). The regional market shows strong growth in the specialized vertical markets, emphasizing quality, stability, and guaranteed long product lifecycles rather than mass consumer volume.

- Latin America (LATAM): This region is an emerging market with growing adoption fueled by rising internet penetration and increased investment in IT infrastructure and telecommunications modernization projects. While cost sensitivity is higher, the demand for digital signage, basic embedded systems for retail (POS), and entry-level HTPCs drives steady, moderate growth. Market expansion is closely tied to external foreign investment in manufacturing and localized tech assembly plants.

- Middle East and Africa (MEA): Growth in MEA is highly localized and driven by large-scale government infrastructure projects, particularly in smart cities (Saudi Arabia, UAE) and oil and gas exploration, requiring highly specialized, rugged mini motherboards for monitoring and control systems in harsh environments. The telecom sector's transition to 5G also generates significant demand for local network appliance mini motherboards, although the market remains relatively fragmented compared to APAC or NA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mini Motherboard Market.- ASUS

- Gigabyte Technology

- ASRock

- Micro-Star International (MSI)

- Advantech

- Kontron

- IEI Integration Corp.

- Sapphire Technology

- Biostar

- Super Micro Computer, Inc.

- Nexcom International

- DFI Inc.

- AOpen Inc.

- Portwell Inc.

- Trenton Systems

- Abaco Systems

- Axiomtek

- Elitegroup Computer Systems (ECS)

- Silicon Integrated Systems (SIS)

- VIA Technologies

Frequently Asked Questions

Analyze common user questions about the Mini Motherboard market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high demand for Mini-ITX motherboards?

The primary driver is the widespread industry trend toward miniaturization and the surging demand for small form factor (SFF) computing solutions required for edge computing, IoT devices, and high-performance compact gaming rigs where space efficiency is paramount without significant performance trade-offs.

Are Mini Motherboards suitable for high-end professional gaming and content creation?

Yes, modern high-end Mini-ITX motherboards are specifically designed to support flagship CPUs, high-speed RAM, and full-length discrete GPUs (via the single PCIe slot), making them fully capable of handling professional gaming and content creation tasks, provided adequate attention is paid to advanced cooling solutions.

What technological innovations are addressing thermal constraints in small form factor boards?

Technological innovations addressing thermal constraints include the integration of sophisticated heat pipe technology, vapor chambers, multi-layered PCBs for better heat dissipation pathways, and the widespread adoption of highly efficient, low-TDP chipsets and processors designed specifically for passive or constrained active cooling environments.

Which application segment is expected to show the fastest growth in the Mini Motherboard Market?

The Industrial PC (IPC) and Embedded Systems segment is projected to exhibit the fastest growth, fueled by the global adoption of Industry 4.0, smart factory automation, and the need for durable, reliable, and compact computing nodes deployed in non-traditional and often harsh operating environments.

How does the integration of AI impact the required specifications for mini motherboards?

AI integration demands significantly higher specifications, particularly concerning power delivery, connectivity, and dedicated acceleration hardware. This includes robust VRMs, support for PCIe 5.0 for high-speed AI accelerators, and increased focus on integrating specialized NPUs directly onto the system architecture to handle localized inference tasks efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager