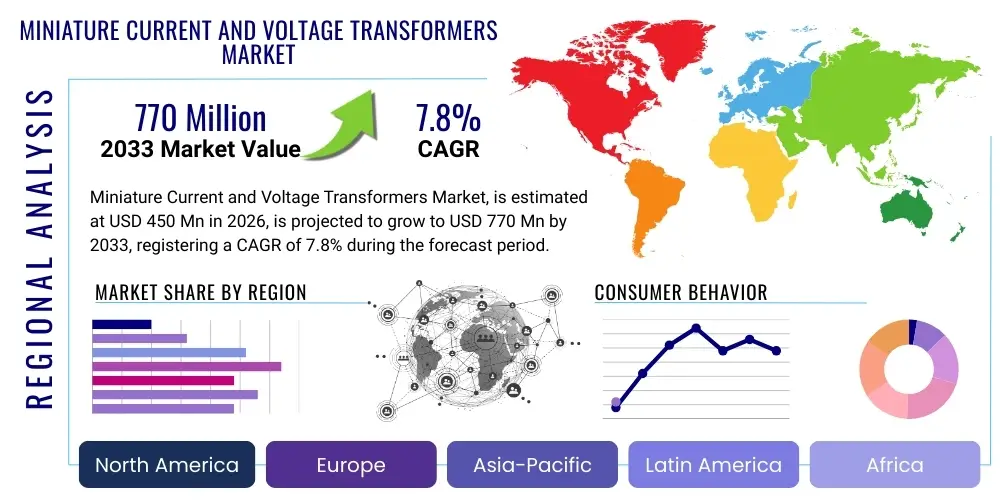

Miniature Current and Voltage Transformers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436524 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Miniature Current and Voltage Transformers Market Size

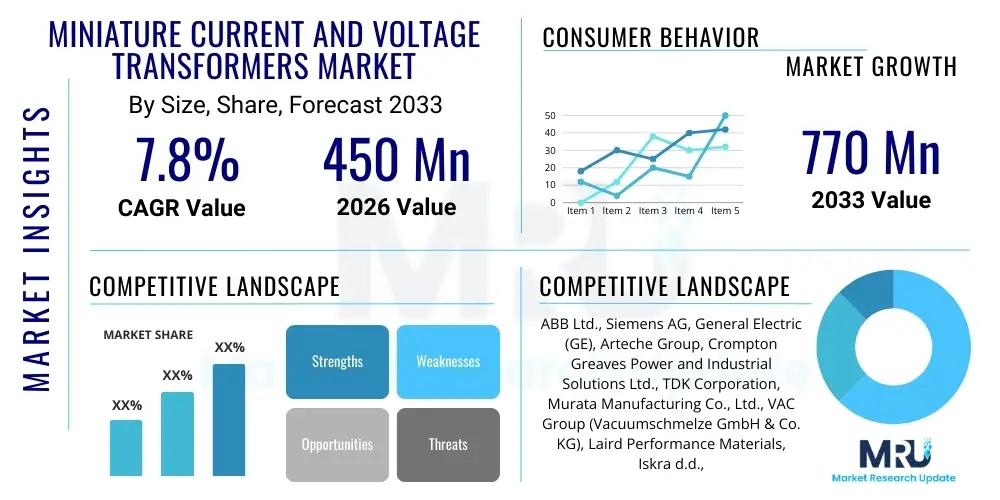

The Miniature Current and Voltage Transformers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 770 Million by the end of the forecast period in 2033.

Miniature Current and Voltage Transformers Market introduction

The Miniature Current and Voltage Transformers Market encompasses devices designed for precise and safe measurement, protection, and monitoring of electrical circuits, utilizing compact designs suitable for integration into modern, space-constrained electronic systems. These transformers are crucial components in metering systems, protective relays, and industrial control equipment, performing the essential function of scaling high primary currents or voltages down to standardized, low-level secondary signals that can be safely processed by microcontrollers or measuring instruments. Their small footprint, high accuracy, and reliability are driving their adoption across various energy management and automation sectors, distinguishing them from traditional, bulkier instrument transformers.

Product descriptions for these miniature devices emphasize characteristics such as low phase shift, wide frequency range handling capabilities, and excellent linearity across the required operating span. Miniature Current Transformers (CTs) typically operate based on the principle of electromagnetic induction or utilize Hall-effect sensors, providing galvanic isolation while accurately reflecting the primary current waveform. Miniature Voltage Transformers (VTs), sometimes referred to as Potential Transformers (PTs), are designed to step down high voltages to manageable levels for measurement purposes. The evolution of these devices is heavily focused on materials science, incorporating advanced magnetic cores like nanocrystalline or amorphous materials to achieve higher performance with minimal size and weight.

Major applications of miniature current and voltage transformers span across critical infrastructure and consumer electronics. Key applications include smart energy meters (AMI infrastructure), where accurate measurement is paramount for billing and grid management; protection relays in medium and low-voltage switchgear; power quality monitoring systems; and increasingly, in integrated circuits and control boards for electric vehicle (EV) charging stations and renewable energy inverters. The primary benefits driving market expansion include enhanced system safety due to electrical isolation, improved measurement accuracy critical for modern grid operations, significant reduction in panel space requirements, and lower overall system cost compared to larger alternatives. Driving factors center around global smart grid deployments, regulatory mandates for energy efficiency, and the rapid proliferation of IoT-enabled industrial and consumer devices requiring precise power monitoring.

Miniature Current and Voltage Transformers Market Executive Summary

The Miniature Current and Voltage Transformers market is experiencing robust expansion driven primarily by global investment in smart grid infrastructure and the mandatory integration of advanced metering infrastructure (AMI). Business trends indicate a strong shift towards surface-mount device (SMD) and PCB-mountable designs, facilitating high-density integration in compact electronic metering and control modules. Key industry players are focusing heavily on developing high-accuracy class transformers (e.g., Class 0.1 or 0.2) to meet stringent regulatory standards for utility-scale measurement, coupled with materials innovation, such as the use of advanced molded insulation materials for enhanced reliability and thermal stability. Strategic partnerships between transformer manufacturers and smart meter manufacturers are commonplace, aiming to co-develop optimized sensing solutions that reduce time-to-market for new energy management products.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing market, primarily fueled by massive infrastructure projects in China and India related to electrification and smart city development. Government initiatives focused on reducing transmission and distribution losses through improved monitoring drive substantial demand in this region. North America and Europe demonstrate mature market characteristics, emphasizing replacement cycles and integration into high-reliability industrial automation and renewable energy storage systems. European growth is notably supported by the rollout of industrial automation standards and the increasing penetration of distributed energy resources (DERs), requiring sophisticated, miniature sensing components for localized control and protection.

Segmentation trends reveal that Current Transformers (CTs) maintain the largest market share due to their essential role in energy metering and protection circuits, although the Voltage Transformer (VT) segment is exhibiting accelerated growth, particularly in applications related to power quality monitoring and high-precision battery management systems (BMS). By application, the Smart Grid and Energy Metering segment dominates, demanding high volume and cost-effective miniature solutions. Technologically, the transition from traditional wound core designs towards innovative solid-state or hybrid (Hall-effect and Rogowski coil-based) miniature sensors is defining future product development, offering advantages in terms of dynamic range, immunity to saturation, and further miniaturization, catering specifically to the needs of modern, digitally interconnected systems.

AI Impact Analysis on Miniature Current and Voltage Transformers Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Miniature Current and Voltage Transformers Market generally revolve around four core themes: how AI enhances the accuracy and lifespan of the sensors themselves, how AI-driven analysis utilizes the data provided by these miniature transformers, the role of predictive maintenance enabled by AI, and the necessity of high-frequency data sampling facilitated by miniaturization for AI processing. Users are concerned about whether existing miniature transformer infrastructure is adequate for feeding the massive data requirements of sophisticated grid-level AI algorithms, and if AI will necessitate even higher performance metrics (such as ultra-low latency and higher dynamic range) from future generation components. The consensus points toward AI not replacing the transformers, but rather maximizing the value derived from the measurements they provide.

The synergy between AI and these miniature sensors fundamentally lies in data utility. Miniature current and voltage transformers are the primary physical layer interface, converting critical grid parameters into digital signals. AI algorithms, particularly machine learning models used for anomaly detection, power quality forecasting, and optimized energy routing in smart grids, require reliable, high-resolution input from hundreds of thousands of distributed sensors. The compactness and high-density deployment capabilities of miniature transformers are thus crucial, enabling the dense sensor networks necessary for effective AI implementation. AI systems use this granular data to detect subtle changes in current signatures that indicate impending equipment failure, a task impossible without the consistent and accurate data provided by high-quality miniature transformers.

Furthermore, AI is increasingly being applied internally within the monitoring systems linked to these transformers. For instance, AI can compensate for minor manufacturing variances or environmental drift in the transformer’s output characteristics, effectively maintaining measurement accuracy over extended periods without physical recalibration. This ability to digitally refine the transformer's performance profile increases system reliability and reduces operational expenditure. The expectation is that AI will drive demand for miniature transformers capable of providing very rapid, time-synchronized data points, necessitating tighter integration between the sensor technology and digital communication interfaces to support real-time predictive analytics and fast-acting protection schemes.

- AI optimizes measurement calibration and drift compensation, enhancing the effective lifespan and sustained accuracy of miniature transformers.

- Increased demand for high-frequency sampling capabilities in miniature sensors to feed real-time AI-driven grid optimization models.

- AI utilizes miniature transformer data for predictive maintenance (PdM) of downstream equipment, reducing unplanned outages in substations and industrial facilities.

- AI-enabled power quality analysis requires miniature transformers with extremely low phase shift and extended linearity, particularly for detecting harmonic distortion.

- Miniaturization facilitates the creation of dense sensor networks, providing the necessary data granularity required for effective machine learning algorithms in grid monitoring.

DRO & Impact Forces Of Miniature Current and Voltage Transformers Market

The Miniature Current and Voltage Transformers Market is fundamentally shaped by a dynamic interplay of regulatory push, technological advancements, and economic pressures. Key drivers include mandatory global rollouts of smart metering and AMI infrastructure, driven by governmental policies aiming to curb energy losses and improve billing accuracy. These mandates necessitate high-volume production of miniature, accurate, and cost-effective measuring components. Furthermore, the rapid expansion of renewable energy sources (solar, wind) and the proliferation of electric vehicle (EV) charging infrastructure introduce highly variable loads and complex power flow dynamics, demanding sophisticated, space-saving sensing solutions for effective grid integration and monitoring. These drivers collectively amplify the need for highly reliable, miniaturized instrument transformers capable of operating under diverse environmental conditions.

However, the market faces significant restraints. One major restraint is the persistent challenge of maintaining high measurement accuracy (e.g., Class 0.1 or better) while continuously reducing the physical size of the component. Miniaturization often introduces greater sensitivity to external factors such as temperature fluctuations and electromagnetic interference, requiring costly shielding and advanced compensation techniques. Furthermore, the reliance on specialized magnetic materials (e.g., amorphous or nanocrystalline alloys) can lead to supply chain volatility and cost pressures, particularly for high-performance models. The long qualification and certification cycles required by utility companies and industrial standards bodies (such as IEC and ANSI) also represent a barrier to rapid market entry and technological adoption, slowing down innovation cycles compared to general electronics components.

Opportunities in this market are significant, particularly in developing integrated sensor solutions. The trend towards hybridization, combining CTs/VTs with integrated signal conditioning, analog-to-digital conversion, and communication interfaces into a single module (often referred to as 'smart sensors'), offers significant value proposition. The emerging markets for high-power, fast-charging EV infrastructure and large-scale battery energy storage systems (BESS) require specialized, high-bandwidth miniature transformers capable of handling transient currents and precise DC measurements, opening new avenues for product differentiation. Impact forces, such as the increasing global push for distributed power generation and stringent grid reliability standards, necessitate continuous innovation in core materials and manufacturing processes to maximize performance per unit volume, ensuring that miniature transformers remain indispensable for future intelligent electrical networks.

Segmentation Analysis

The Miniature Current and Voltage Transformers Market segmentation offers a granular view of device characteristics, application requirements, and geographical demand patterns. The market is primarily segmented based on the fundamental type of measurement (current vs. voltage), the core technology employed (wound type, molded, Hall-effect), the voltage class handled (low vs. medium), and the end-use application (energy metering, protection, industrial control). This structure helps manufacturers align their product development efforts with specific high-growth areas, such as high-precision sensing requirements within smart grids or the ruggedized design needs for industrial automation environments. The complexity of these segments reflects the diverse operational requirements across the electricity value chain, from residential metering to transmission-level protection.

The core segmentation by type—Miniature Current Transformers (CTs) and Miniature Voltage Transformers (VTs)—is crucial, as CTs often involve higher volume production for metering applications, while VTs cater to specific needs in power quality and protection. Within the current transformer segment, technologies like split-core designs, designed for retrofitting existing systems without disconnecting wires, are gaining traction. Furthermore, the method of mounting is a key differentiator, with PCB-mountable miniature transformers becoming the standard for integrated electronic devices, emphasizing compact footprints and automated assembly compatibility. Understanding these technological shifts allows stakeholders to target manufacturing investments towards advanced molding techniques and efficient coil winding processes that deliver necessary accuracy in reduced sizes.

Application-based segmentation reveals the highest growth potential in the Smart Grid and Renewable Energy sectors. These applications demand transformers that excel in harsh environments, offer enhanced thermal stability, and provide outputs compatible with digital protection relays (DPRs). The convergence of IT and operational technology (OT) in smart grids requires miniature transformers that support high data throughput and synchronization. This necessitates specific product lines tailored for substation automation versus residential metering, where cost-effectiveness often supersedes ultra-high accuracy. Analyzing these segments ensures a targeted approach to market penetration and product portfolio optimization across global regulatory landscapes.

- By Type:

- Miniature Current Transformers (CT)

- Miniature Voltage/Potential Transformers (VT/PT)

- Combined Miniature Sensors (Current and Voltage)

- By Technology:

- Wound Type (Toroidal/Rectangular Core)

- Molded Type (Epoxy/Resin Encapsulated)

- Hall-Effect Sensors (Hybrid Miniature)

- Rogowski Coil (Miniature Flexible and Rigid)

- By Voltage Level:

- Low Voltage (Below 1kV)

- Medium Voltage (1kV to 36kV, primarily for specialized integrated protection)

- By Application:

- Smart Grid and Energy Metering (AMI)

- Protection Relays and Circuit Breakers

- Industrial Automation and Control Systems

- Power Quality Monitoring (PQM)

- Electric Vehicle (EV) Charging Infrastructure

- Battery Energy Storage Systems (BESS)

- Consumer Electronics and Home Automation

Value Chain Analysis For Miniature Current and Voltage Transformers Market

The value chain for Miniature Current and Voltage Transformers begins with upstream activities focused on the procurement and processing of highly specialized raw materials, particularly magnetic core materials and insulating compounds. Upstream analysis involves suppliers of nanocrystalline and amorphous metals, high-grade copper wire, and engineered plastics or epoxy resins used for encapsulation. The performance and cost efficiency of the final transformer are heavily dependent on the quality and stable supply of these core materials. Manufacturers continuously seek vertically integrated suppliers or long-term contracts to mitigate volatility in the pricing of essential magnetic alloys, as core material characteristics directly dictate the accuracy, linearity, and physical size limits of the miniature component. Material processing innovation, such as high-precision coil winding and vacuum encapsulation techniques, is critical at this stage.

Midstream activities involve the design, manufacturing, and assembly of the miniature transformers. This includes sophisticated design simulation (FEA analysis) to optimize magnetic circuits for minimal phase angle error and saturation resistance, followed by high-volume automated production. Quality control and testing are paramount, as miniature transformers must pass stringent certification standards (e.g., IEC 61869 series) before being integrated into end products. The efficiency of the manufacturing process, particularly clean room assembly for sensitive electronic components and rapid throughput of PCB-mountable designs, significantly influences profitability. Manufacturers must also invest heavily in R&D to continually shrink form factors while maintaining or improving accuracy classes, which is a key competitive differentiator in this high-precision component market.

Downstream analysis focuses on the distribution channel and the ultimate integration into end-user systems. Distribution primarily occurs through indirect channels, utilizing specialized electronic component distributors and authorized resellers that cater to large Original Equipment Manufacturers (OEMs) such as smart meter producers, switchgear manufacturers, and power inverter companies. Direct sales are typically reserved for large, customized utility projects or strategic partnerships where manufacturers work closely with system integrators (SIs) to develop bespoke sensing solutions. The final integration involves embedding the miniature transformer into a larger measurement or protection module, making compatibility, packaging, and robust mechanical design critical. Post-sales support involves technical assistance for integration and long-term reliability guarantees, which are vital given the extended operational lifetimes expected in grid infrastructure.

Miniature Current and Voltage Transformers Market Potential Customers

The primary end-users and buyers of miniature current and voltage transformers are companies engaged in the manufacture and deployment of electrical infrastructure and energy management systems. These include global utility companies, through their procurement of smart meters and substation components, and major Original Equipment Manufacturers (OEMs) specializing in metering devices, protection relays, and industrial motor control centers (MCCs). These customers require high-volume supply of standardized components that adhere strictly to international measurement and safety standards. Their purchasing decisions are driven by accuracy class (e.g., 0.1, 0.2), long-term stability, physical footprint, and competitive unit cost, as these components are critical, non-negotiable elements in their final assemblies.

A rapidly expanding segment of potential customers includes manufacturers of renewable energy equipment, specifically solar inverters, wind turbine control systems, and large-scale Battery Energy Storage Systems (BESS). These applications demand miniature transformers capable of handling complex power quality issues, bidirectional current flow, and transient events with high fidelity. The emergence of high-speed DC charging infrastructure for Electric Vehicles (EVs) also represents a significant customer base, requiring specialized miniature sensors for high-current DC measurement and isolation within charging piles and onboard charging units. For these technology-driven customers, innovation in materials and integration (e.g., surface-mount technology) often outweighs marginal cost differences.

Additionally, the burgeoning industrial Internet of Things (IIoT) and industrial automation sector constitutes a substantial segment of potential buyers. Companies manufacturing condition monitoring systems, process controllers, and high-precision monitoring sensors for robotics and machine tools require miniature transformers to ensure safe operation and accurate energy consumption profiling at the equipment level. These industrial buyers prioritize robust construction, immunity to noise (EMI/RFI), and guaranteed long operational life in challenging factory environments. The strategic market approach for miniature transformer vendors involves customizing packaging and insulation to meet the specific environmental and regulatory demands of these diverse high-growth sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 770 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, General Electric (GE), Arteche Group, Crompton Greaves Power and Industrial Solutions Ltd., TDK Corporation, Murata Manufacturing Co., Ltd., VAC Group (Vacuumschmelze GmbH & Co. KG), Laird Performance Materials, Iskra d.d., Huatech Power, Accuenergy Ltd., Eaglerise Electric & Electronic Co., Ltd., Power Measurement Ltd., Littelfuse, Inc., Shenzhen Chint Power Systems Co., Ltd., Huayi Electric Appliance Group Co., Ltd., R. Bourgeois, RE Energy Group, and Magnelab. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Miniature Current and Voltage Transformers Market Key Technology Landscape

The technological landscape of the Miniature Current and Voltage Transformers Market is defined by continuous efforts to optimize core material properties and enhance measurement stability within shrinking dimensions. Traditional technologies heavily rely on wound toroidal cores, utilizing materials like grain-oriented silicon steel, which offer established performance but present limitations in size reduction. The leading edge of innovation now focuses significantly on high-permeability, low-loss magnetic materials such as nanocrystalline and amorphous metals. These advanced core materials allow manufacturers to achieve the required induction levels and maintain high linearity (low phase error) with far fewer turns and smaller physical cores, directly enabling the ultra-compact form factors necessary for PCB mounting and integration into dense electronic assemblies. Miniaturization also demands improved encapsulation technologies, primarily high-dielectric epoxy or resin molding, to ensure robust insulation and stability against environmental factors like moisture and vibration.

A parallel significant technological advancement is the integration of alternative sensing principles, particularly Hall-Effect sensors and Rogowski coils, which are increasingly miniaturized for specialized applications. Miniature Hall-Effect sensors offer the advantage of measuring DC currents and provide intrinsic isolation, making them ideal for applications such as battery management systems (BMS) in EVs and solar power electronics where mixed AC/DC circuits are common. While generally less precise than high-grade wound CTs for standard AC metering, their versatility and ability to handle high transient currents make them vital in power electronics. Rogowski coils, known for their wide bandwidth and resistance to saturation, are being adopted in miniature flexible and rigid formats, particularly for power quality analysis and protection systems requiring rapid response to transient faults.

The future technology landscape is moving towards "Smart Sensors" which integrate the core sensing element with advanced signal conditioning and digital communication interfaces (e.g., Modbus, optical fiber output). This transition addresses the need for seamless integration into digital substations and IoT networks. Key technological challenges remain in overcoming thermal management issues—dissipating heat efficiently in very small volumes without compromising accuracy—and achieving higher levels of immunity to electromagnetic interference (EMI), which is pervasive in densely packed industrial control environments. Manufacturers are exploring micro-electro-mechanical systems (MEMS) technology for ultra-miniature, high-bandwidth voltage sensors, promising further disruption in the low-voltage monitoring space by enabling unprecedented integration capabilities directly onto control boards.

Regional Highlights

The regional analysis of the Miniature Current and Voltage Transformers Market reveals distinct growth trajectories and demand characteristics influenced by local regulatory frameworks, infrastructure maturity, and investment priorities in renewable energy and smart grids. Asia Pacific (APAC) dominates the market due to massive investments in electrification, large-scale smart metering deployments (especially in China, India, and Southeast Asia), and rapid urbanization. North America and Europe, while mature, are driven by high-reliability standards and the need for component replacement and upgrades within established industrial and utility infrastructure, with a strong focus on advanced power quality monitoring components.

- Asia Pacific (APAC): APAC is the largest market share holder, propelled by the largest energy consumption base and substantial government support for smart grid projects. Countries like China and India are undertaking massive deployments of smart meters, requiring millions of miniature, cost-effective, yet highly accurate current transformers. This region also serves as a major global manufacturing hub for electronic components, leading to localized innovation in cost-effective miniaturization techniques. Growth is also significantly influenced by the rapid adoption of solar photovoltaic (PV) systems, necessitating specialized transformers for inverter systems.

- North America: This region is characterized by high technical sophistication and strict reliability requirements (e.g., NERC standards). The demand is driven by modernizing aging infrastructure, adopting high-performance protection relays, and the rapid expansion of EV charging infrastructure. Customers prioritize high accuracy (Class 0.1) and long-term stability, favoring premium, specialized miniature transformers often integrated with digital output capabilities. Investment in utility-scale BESS is a major catalyst for specialized high-current DC miniature sensing solutions.

- Europe: Europe exhibits strong demand fueled by decarbonization goals, the integration of distributed energy resources (DERs), and stringent regulations regarding energy efficiency (e.g., Measuring Instruments Directive - MID). The focus is heavily on industrial automation, where miniature transformers are essential for monitoring motor loads and optimizing energy consumption in factory settings. Germany, France, and the UK are key markets, emphasizing innovation in low-power, high-precision sensors suitable for complex power monitoring and industrial IoT applications.

- Latin America (LATAM): The LATAM market is poised for growth, driven by efforts to reduce non-technical losses (electricity theft) and improve grid stability through smart metering infrastructure, particularly in countries like Brazil and Mexico. Demand is sensitive to cost, favoring high-volume, standard miniature CTs for residential metering, though infrastructure modernization projects are gradually introducing higher-accuracy requirements.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC nations (UAE, Saudi Arabia) due to large-scale construction projects and ambitious smart city initiatives. The demand here is for robust, highly temperature-stable miniature transformers capable of operating reliably in harsh climatic conditions, primarily used in new substation construction and industrial power distribution systems. Electrification projects in parts of Africa also contribute to the low-voltage metering segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Miniature Current and Voltage Transformers Market.- ABB Ltd.

- Siemens AG

- General Electric (GE)

- Arteche Group

- Crompton Greaves Power and Industrial Solutions Ltd.

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- VAC Group (Vacuumschmelze GmbH & Co. KG)

- Laird Performance Materials

- Iskra d.d.

- Huatech Power

- Accuenergy Ltd.

- Eaglerise Electric & Electronic Co., Ltd.

- Power Measurement Ltd.

- Littelfuse, Inc.

- Shenzhen Chint Power Systems Co., Ltd.

- Huayi Electric Appliance Group Co., Ltd.

- R. Bourgeois

- RE Energy Group

- Magnelab

Frequently Asked Questions

Analyze common user questions about the Miniature Current and Voltage Transformers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for miniature current transformers (CTs)?

The primary driver is the global mandate for smart grid implementation and Advanced Metering Infrastructure (AMI), which necessitates the integration of high-accuracy, compact current sensors into residential and commercial smart meters for precise energy billing and loss reduction.

How does AI technology affect the lifespan and accuracy of these miniature transformers?

AI does not physically alter the transformer but enhances its operational utility. AI algorithms perform digital compensation for temperature drift and non-linearity, effectively maintaining high measurement accuracy over longer periods and optimizing the effective operational lifespan without the need for physical recalibration.

What are the key technical differences between traditional wound CTs and miniature Hall-Effect sensors?

Traditional wound CTs are generally preferred for high-accuracy AC metering, relying on electromagnetic induction. Miniature Hall-Effect sensors are fundamentally capable of measuring both AC and DC currents, offer intrinsic isolation, and are essential for DC applications like EV battery management systems and solar power inverters.

Which application segment offers the highest growth potential for miniature voltage transformers (VTs)?

The highest growth potential lies within the Electric Vehicle (EV) charging infrastructure and Battery Energy Storage Systems (BESS) segments, where compact, highly accurate VTs are required for insulation monitoring, voltage regulation, and complex power quality analysis in high-power DC/AC conversion systems.

What is the main challenge related to achieving ultra-miniaturization while maintaining performance standards?

The main challenge is overcoming the physical limitations of magnetic physics; reducing the transformer size often compromises accuracy (linearity and phase angle error) and saturation resistance. Manufacturers must utilize extremely advanced, high-permeability magnetic core materials (like nanocrystalline alloys) and sophisticated shielding techniques to mitigate these performance trade-offs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager