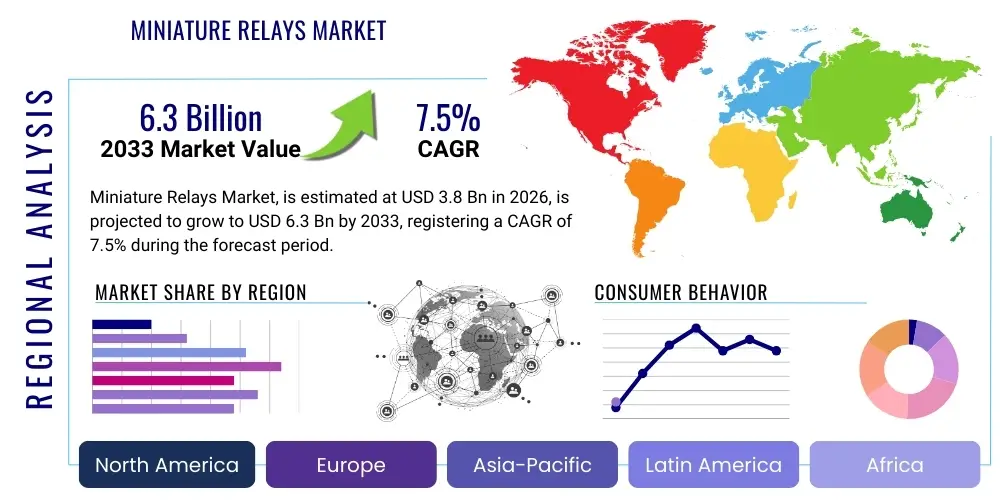

Miniature Relays Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438780 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Miniature Relays Market Size

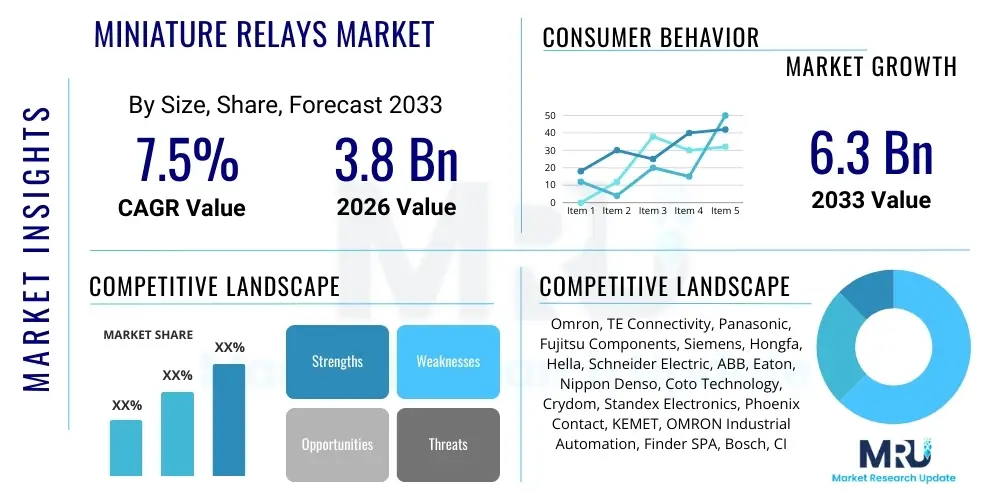

The Miniature Relays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2033.

Miniature Relays Market introduction

Miniature relays are essential electromechanical or solid-state components designed for efficient switching of high-power or signal circuits using a low-power control signal, characterized by their compact form factor and high operational reliability. These components are instrumental in maintaining electrical isolation between the control circuit and the load circuit, a crucial safety and functional requirement across numerous electronic systems. The defining characteristics of miniature relays—including low coil power consumption, high switching capacity relative to size, and excellent vibration resistance—make them indispensable across diverse industries.

The primary applications of miniature relays span critical infrastructure, including automotive electronic control units (ECUs), industrial automation systems (PLCs and motor control), telecommunications switching equipment, and sophisticated consumer appliances like smart HVAC systems. Their utility stems from the ability to reliably manage sudden current surges and ensure circuit integrity in high-density printed circuit board (PCB) layouts. Benefits derived from utilizing miniature relays include enhanced system safety through galvanic isolation, extended equipment lifespan due to reliable switching, and overall cost efficiency in system design compared to bulky alternatives.

The market is currently experiencing significant growth, primarily driven by the sustained global expansion of the Electric Vehicle (EV) sector, which requires specialized high-voltage DC miniature relays for battery management systems and charging infrastructure. Furthermore, the global proliferation of Internet of Things (IoT) devices and the integration of Industry 4.0 standards in manufacturing environments necessitate increasingly smaller, faster, and more robust switching solutions. These technological shifts are compelling manufacturers to focus on continuous miniaturization while simultaneously enhancing the component’s thermal performance and power density to meet emerging industry requirements.

Miniature Relays Market Executive Summary

The global Miniature Relays market is currently navigating a dynamic business environment marked by a strong push toward technological convergence, where traditional Electromechanical Relays (EMR) coexist with rapidly advancing Solid State Relays (SSR). Key business trends reveal intense competitive pressure among leading manufacturers, driving investment in research and development aimed at optimizing contact materials for enhanced conductivity and longevity, alongside leveraging automation to reduce manufacturing costs. Consolidation through strategic mergers and acquisitions remains a prominent strategy, particularly as companies seek to integrate specialized SSR technology or expand their geographical distribution footprint, ensuring they can serve increasingly complex supply chains globally.

From a regional perspective, the Asia Pacific (APAC) region maintains its market dominance, underpinned by its expansive manufacturing capabilities for consumer electronics, automotive components, and the swift deployment of 5G infrastructure. North America and Europe, however, represent critical growth areas, characterized by high adoption rates of premium, specialized relays driven by stringent industrial safety standards and substantial investment in smart grid and renewable energy integration projects. These mature markets demand higher performance specifications, including specialized latching relays for energy efficiency and relays certified for use in high-temperature or hazardous environments, shaping the global innovation agenda.

Segment-wise, the trend toward high-speed and high-reliability switching solutions favors the Solid State Relay (SSR) segment, especially within telecommunications and industrial automation where switching cycle counts are extremely high. Conversely, Electromechanical Relays (EMR) continue to hold significant market share in power applications, such as automotive body control and heavy machinery, due to their superior resistance to temporary overloads and excellent galvanic isolation. Future segmentation growth is anticipated in the dedicated segment for Electric Vehicle (EV) power relays, which demand exceptionally high DC voltage switching capabilities, pushing the boundaries of current miniature relay technology and material science.

AI Impact Analysis on Miniature Relays Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) techniques is poised to profoundly transform the Miniature Relays Market, moving beyond simple application to influence design, maintenance, and operational efficiency. Common user questions often revolve around how AI can guarantee zero downtime in industrial settings, prompting manufacturers to explore predictive maintenance models utilizing ML to analyze relay performance data in real-time and forecast imminent failure based on minute changes in contact resistance or coil current signatures. Users also express interest in how AI can optimize the physical dimensions and material composition of relays through sophisticated generative design, enabling bespoke components that perfectly balance thermal dissipation, switching capacity, and miniaturization requirements for specific high-density applications.

The influence of AI is also significant in the broader ecosystem where miniature relays operate; as industrial control systems become AI-driven and require instantaneous decision-making across distributed networks, the demand for ultra-low latency, highly deterministic relays increases. This necessitates rigorous quality control and higher consistency in relay manufacturing, processes often optimized and managed by AI-based vision systems. Consequently, AI acts as both a driver for component innovation—demanding faster, smarter, and more reliable switching components—and as an enabling tool for manufacturers to achieve the stringent quality and design parameters required by modern automated infrastructure. This symbiotic relationship ensures that future miniature relays are engineered not just for robust operation, but for seamless interoperability within intelligent, learning systems.

- Enhanced Predictive Maintenance: AI models analyze operational data (e.g., contact bounce, coil temperature) to accurately forecast the remaining useful life of miniature relays, drastically reducing unexpected system failures and associated downtime.

- Optimized Manufacturing Processes: Machine Learning algorithms are deployed within production facilities to monitor assembly tolerances, coil winding consistency, and welding quality, ensuring exceptionally high reliability standards for mass-produced relays.

- Generative Design for Miniaturization: AI facilitates the creation of optimized internal geometries and thermal pathways, enabling the design of relays that handle higher power densities within existing or smaller footprints.

- Quality Control Automation: AI-powered vision systems rapidly inspect and verify the placement and integrity of complex internal relay components, surpassing human accuracy and speed in quality assurance checks.

- Demand for Integrated Sensing: The move towards AI-enabled monitoring drives the need for miniature relays with embedded sensors or diagnostic capabilities that can feed real-time performance data back to centralized ML processing units.

DRO & Impact Forces Of Miniature Relays Market

The Miniature Relays market is currently experiencing significant momentum driven by fundamental shifts in global industrial and consumer electronic demands, yet it simultaneously faces structural challenges from competing technologies and material instability. Primary drivers include the accelerating adoption of factory automation, fueled by Industry 4.0 principles, which mandates high-density, reliable switching components in Programmable Logic Controllers (PLCs) and remote I/O modules. Furthermore, the sustained global transition to Electric Vehicles (EVs) creates unprecedented demand for specialized, high-performance DC power relays critical for managing high-voltage battery systems and ensuring vehicle safety, cementing the automotive sector as a cornerstone of market growth.

However, the market growth potential is constrained by several key restraints, most notably the competitive pressure exerted by advanced semiconductor switching components, such as MOSFETs and IGBTs, which are increasingly preferred in certain low-power, high-frequency applications due to their exceptional speed and non-mechanical reliability. Additionally, the Miniature Relays market is highly sensitive to the volatile pricing and supply chain instability of key raw materials, specifically precious metals like silver, palladium, and gold used for contacts, which directly impacts manufacturing costs and profit margins, forcing constant value engineering.

In terms of opportunities, significant potential lies in the development and commercialization of hybrid relay technologies that combine the high isolation characteristics of EMRs with the speed and long lifespan of SSRs, offering a best-of-both-worlds solution for demanding applications like avionics and critical medical devices. Further opportunities exist in capitalizing on global infrastructure modernization projects, particularly the implementation of smart grids and renewable energy systems (solar and wind), which require durable, specialized miniature latching relays for energy management and efficiency optimization. The impact forces acting upon the market are complex, including stringent international regulatory standards (RoHS, REACH) mandating sustainable materials, and the accelerating pace of miniaturization demanded by consumer electronics, pushing manufacturers to continuously improve power density per unit volume.

Segmentation Analysis

The Miniature Relays market segmentation provides a crucial framework for understanding diverse product needs, competitive landscapes, and targeted growth vectors across various end-use sectors. The market is primarily broken down by Type, distinguishing between the proven reliability of Electromechanical Relays (EMR) and the high-speed, long-life performance of Solid State Relays (SSR), each dominating specific operational niches based on current requirements and switching frequency. Secondary segmentation by Pole Configuration, such as Single Pole Double Throw (SPDT) and Double Pole Double Throw (DPDT), is essential for design engineers selecting components based on the complexity of the circuit control required.

Further analysis focuses on Coil Voltage specifications (e.g., 5V DC, 12V DC), which correlates directly with compatibility across modern digital control systems and microcontrollers prevalent in IoT devices and consumer electronics. The Application segment delineates products into Signal Relays, used for low-current communication signals in telecommunications equipment, and Power Relays, engineered for switching high-current loads in automotive and industrial machinery. This granular approach highlights the specialized needs of different verticals, revealing that while SSRs lead in signal applications, EMRs remain critical in the power segment due especially to their superior isolation capabilities and robustness against temporary overcurrent.

The End-Use Industry segmentation is vital for identifying major demand clusters, with Automotive, Industrial Automation, and Telecommunications being the highest consumers. The automotive sector's rapid shift towards electric vehicle technology is creating a lucrative sub-segment focused on high-voltage DC power switching solutions. Strategic planning relies heavily on these segment details to target R&D efforts—for example, focusing on high-density packaging for the Telecommunications segment and enhancing thermal management capabilities for the Industrial Automation segment, ensuring product development aligns precisely with industry-specific requirements and standards.

- By Type:

- Electromechanical Relays (EMR)

- Solid State Relays (SSR)

- Hybrid Relays

- By Pole Configuration:

- Single Pole Single Throw (SPST)

- Single Pole Double Throw (SPDT)

- Double Pole Single Throw (DPST)

- Double Pole Double Throw (DPDT)

- By Coil Voltage:

- 5V DC

- 12V DC

- 24V DC

- 48V DC

- AC Voltage Types (e.g., 120V AC, 240V AC)

- By Application:

- Signal Relays (Micro-current switching)

- Power Relays (High-current switching)

- Latching Relays (Bi-stable operation, energy efficiency)

- Time Delay Relays

- By End-Use Industry:

- Automotive (Including EV Charging Infrastructure and BMS)

- Industrial Automation and Control (PLCs, Robotics)

- Consumer Electronics and Appliances (HVAC, Smart Home)

- Telecommunications and Data Centers (Switching and Routing)

- Medical Devices (Diagnostic Equipment, Life Support Systems)

- Energy and Utilities (Smart Grid, Renewable Energy)

- Aerospace and Defense

Value Chain Analysis For Miniature Relays Market

The value chain for the Miniature Relays Market is inherently complex, starting with the upstream segment involving the highly specialized sourcing and refinement of critical raw materials, which significantly impacts the cost structure and quality of the final product. Key inputs include high-purity copper and specialized alloys for coils, advanced engineering plastics for housing, and crucial precious metals such as silver-cadmium oxide or silver-tin oxide for electrical contacts, where consistent quality control and supply stability are paramount. Upstream activities also involve the specialized fabrication of magnetic core components and armature assemblies, processes often governed by high-precision machining and stamping technologies to ensure dimensional accuracy and efficient magnetic coupling.

The midstream phase is dominated by core manufacturing, where major relay producers execute precision assembly, welding, and sealing processes. This stage demands sophisticated automation to achieve the necessary miniaturization and consistency required for high-reliability components, with continuous focus on thermal management design and verification testing to meet specific application standards like shock resistance and vibration tolerance. Manufacturers must comply with stringent international standards (e.g., ISO, UL, VDE) during this phase, creating significant barriers to entry for new competitors and reinforcing the position of established industry leaders who possess proprietary manufacturing expertise and economies of scale.

Downstream activities center on distribution and end-user integration, utilizing both direct and indirect sales channels. Direct distribution involves established, long-term relationships with large Original Equipment Manufacturers (OEMs), particularly in the automotive and aerospace sectors, where technical support and custom specifications are highly valued. Indirect channels rely on a global network of specialized electronics distributors and regional component wholesalers (e.g., Digi-Key, Arrow Electronics), serving small-to-medium enterprises and the vast Maintenance, Repair, and Overhaul (MRO) markets. Effective supply chain management in the downstream segment is crucial for minimizing lead times, managing inventory risk associated with high-mix, low-volume orders, and ensuring timely delivery across geographically dispersed customer bases in the rapidly evolving industrial and consumer electronic landscapes.

Miniature Relays Market Potential Customers

The Miniature Relays market caters to a highly diversified customer base, unified by the common need for reliable, isolated power and signal switching solutions within space-constrained or safety-critical applications. The most substantial volume buyers are centered within the automotive industry, encompassing major vehicle manufacturers and their TIER 1 suppliers who utilize relays extensively for body electronics (door locks, lighting), powertrain control systems, and increasingly sophisticated Advanced Driver-Assistance Systems (ADAS). The burgeoning electric vehicle segment specifically relies on ultra-robust miniature DC relays to manage the high currents associated with battery charging and fault interruption mechanisms, driving specialized procurement demands.

Another core demographic of potential customers resides in the industrial automation and control sector, primarily encompassing manufacturers of Programmable Logic Controllers (PLCs), industrial power supplies, and safety interlock systems. These customers require relays capable of long operational lifecycles under extreme environmental conditions, emphasizing resistance to dust, temperature fluctuation, and vibration, making component durability a top purchasing criterion. System integrators who design custom industrial machinery also form a vital customer segment, often requiring customized configurations or relays certified for hazardous location usage (Ex-rated).

Furthermore, telecommunications equipment manufacturers and data center infrastructure providers represent a critical potential customer group, specifically demanding miniature signal relays for high-density routing and switching applications where speed and thermal performance are paramount concerns in high-mix server environments. Finally, the consumer appliance sector, including manufacturers of smart home devices, refrigerators, and high-efficiency HVAC systems, consistently seeks cost-effective, high-reliability relays that ensure safe, efficient power control while adhering to stringent noise reduction standards necessary for residential use. This diverse demand structure necessitates that relay suppliers maintain broad product portfolios spanning standard power relays to specialized latching and RF switching components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Omron, TE Connectivity, Panasonic, Fujitsu Components, Siemens, Hongfa, Hella, Schneider Electric, ABB, Eaton, Nippon Denso, Coto Technology, Crydom, Standex Electronics, Phoenix Contact, KEMET, OMRON Industrial Automation, Finder SPA, Bosch, CIT Relay & Switch |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Miniature Relays Market Key Technology Landscape

The technology landscape for miniature relays is dynamically evolving, driven by the need to increase power density while reducing physical size and maintaining stringent reliability standards demanded by advanced electronic systems. A cornerstone of this evolution is the advancement in contact material science, where manufacturers are increasingly relying on sophisticated silver alloys, such as Silver Tin Oxide (AgSnO2) or alloys enhanced with metal oxides, to replace legacy materials. This shift is critical for improving arc erosion resistance, extending the operational life under high-current switching cycles, and complying with environmental directives by phasing out cadmium-containing compounds.

In the realm of electromechanical designs, technological innovation is focused on optimizing the magnetic circuit geometry and core materials to achieve higher magnetic efficiency, which in turn allows for lower coil power consumption. This reduction in control power is essential for direct interface with low-voltage logic circuits (e.g., 3.3V or 5V microcontrollers) prevalent in battery-powered and IoT applications, thereby reducing the need for intermediate drive circuitry. Further refinement includes sealed and plastic-welded casing technologies to protect the internal mechanics from harsh environmental contaminants, a requirement particularly salient in automotive under-hood applications and exposed industrial environments.

For Solid State Relays (SSRs), the technological frontier involves integrating cutting-edge power semiconductor devices. The adoption of wide-bandgap materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) is significantly altering the performance ceiling of SSRs, enabling them to operate at much higher frequencies, handle greater power loads with minimal thermal loss, and shrink the overall footprint of the switching mechanism. These advanced semiconductor materials provide ultra-low on-resistance and superior thermal characteristics, positioning high-performance SSRs as the preferred choice for mission-critical applications in aerospace, high-speed telecommunications, and high-efficiency power converters where speed and thermal stability are non-negotiable performance metrics.

Regional Highlights

- Asia Pacific (APAC): This region is the undisputed global leader in terms of market volume and revenue generation, predominantly due to the heavy concentration of Original Equipment Manufacturers (OEMs) for consumer electronics and automotive parts in nations such as China, Japan, and South Korea. APAC's robust growth trajectory is sustained by significant government-backed investment in 5G network rollouts, smart city initiatives, and the establishment of world-class EV and battery manufacturing ecosystems, creating persistent, high-volume demand for miniature relays across all categories.

- North America: Characterized by a high propensity for adopting cutting-edge technologies, North America exhibits strong demand for high-reliability, premium-priced miniature relays suitable for critical infrastructure like military, aerospace, and advanced medical devices. Growth is driven by the extensive modernization of industrial infrastructure under Industry 4.0 paradigms and substantial private sector investment in data center expansion and high-speed communications networking equipment, requiring specialized signal relays and durable SSRs.

- Europe: The European market is highly regulated and innovation-centric, with demand heavily skewed towards energy-efficient components, particularly latching miniature relays for smart meter applications and renewable energy systems (e.g., solar inverters). Strict environmental directives like RoHS and REACH compel manufacturers operating in this region to prioritize sustainable materials and advanced sealing technologies, leading to significant R&D focus on long-life, environmentally compliant components for the rigorous automotive and industrial sectors.

- Latin America (LATAM): While smaller in market size compared to APAC and North America, LATAM shows high potential, driven by infrastructure development and the gradual technological upgrade of existing industrial bases, particularly in Brazil and Mexico. The demand is currently focused on standard industrial-grade electromechanical relays for infrastructure projects, oil and gas operations, and the establishment of local electronics assembly plants, representing a high-growth emerging market for standardized components.

- Middle East and Africa (MEA): Market expansion in MEA is primarily tethered to large-scale, state-funded projects in energy, water management, and telecommunications. The construction of smart cities (such as NEOM in Saudi Arabia) and expansion of renewable energy capacity (solar farms) drive the need for robust, environmentally sealed miniature power relays capable of performing reliably under extreme temperature conditions prevalent across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Miniature Relays Market.- Omron Corporation

- TE Connectivity Ltd.

- Panasonic Corporation

- Fujitsu Components Limited

- Siemens AG

- Hongfa Technology Co., Ltd.

- Hella GmbH & Co. KGaA

- Schneider Electric SE

- ABB Ltd.

- Eaton Corporation plc

- Nippon Denso Co., Ltd.

- Coto Technology

- Crydom (Sensata Technologies)

- Standex Electronics, Inc.

- Phoenix Contact GmbH & Co. KG

- KEMET Corporation

- OMRON Industrial Automation

- Finder S.p.A.

- Bosch Group

- CIT Relay & Switch

- Zettler Group

- Goodsky Electric Co., Ltd.

- Nais Corporation (Panasonic)

- Micro-Star International Co., Ltd. (MSI)

- Fuji Electric Co., Ltd.

- Rockwell Automation, Inc.

- Hengstler GmbH (Danaher)

- Carlo Gavazzi Holding AG

- Altech Corporation

Frequently Asked Questions

What is the primary difference between EMR and SSR miniature relays?

Electromechanical Relays (EMR) utilize physical movement of contacts for switching, offering complete electrical isolation and high robustness against transient voltage spikes, making them ideal for high-current applications. Solid State Relays (SSR) use semiconductor components (like MOSFETs or SCRs) to switch current, offering faster switching speeds, silent operation, longer life cycles, and superior durability in high-frequency cycling environments.

How is the growth of Electric Vehicles (EVs) driving demand for miniature relays?

EVs significantly drive demand for power-handling miniature relays, specifically those designed for high-voltage DC switching. These components are essential for Battery Management Systems (BMS), charging circuits, and critical safety cut-off systems, where reliability and compact size are crucial for vehicle efficiency and passenger safety. These relays require enhanced arc quenching capabilities suitable for DC loads.

Which regional market holds the largest share for Miniature Relays, and why?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is attributed to the region's status as the global manufacturing hub for consumer electronics, industrial equipment, and automotive components, coupled with substantial governmental and private investment in industrial automation and 5G network infrastructure expansion.

What are the key technological trends affecting contact material in modern miniature relays?

Key technological trends involve moving away from environmentally sensitive materials toward specialized, high-performance alloys such as silver tin oxide (AgSnO2) or palladium-based materials. This shift aims to improve switching capacity, enhance arc resistance, and extend the operational lifespan of the relay while complying with international environmental directives like RoHS and REACH, focusing on durability under high temperatures.

What role does Industry 4.0 play in the adoption of advanced miniature relays?

Industry 4.0 necessitates the use of advanced, highly responsive miniature relays in sophisticated control systems and IoT gateways. These applications require relays with low latency, high current density, and integration features suitable for high-density PCBs, ensuring seamless, reliable communication and load management within automated factory settings and supporting real-time data exchange.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager