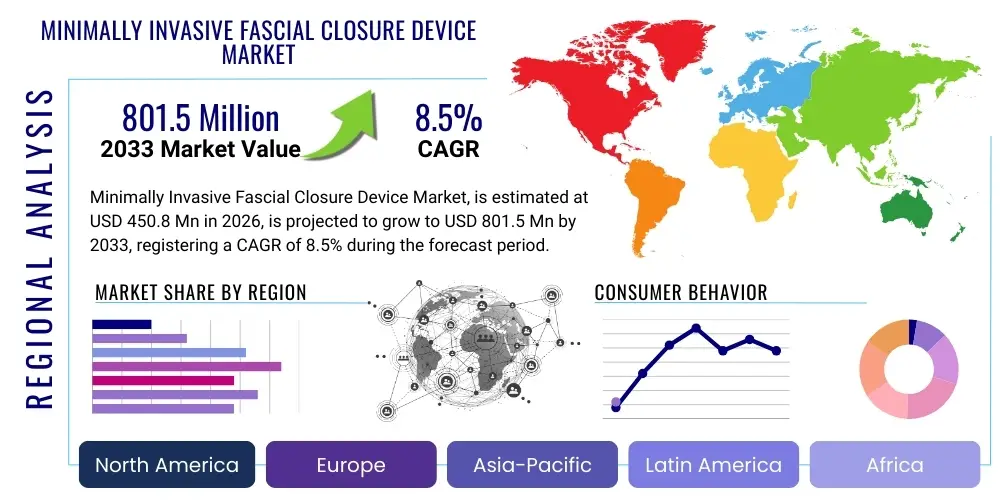

Minimally Invasive Fascial Closure Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436300 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Minimally Invasive Fascial Closure Device Market Size

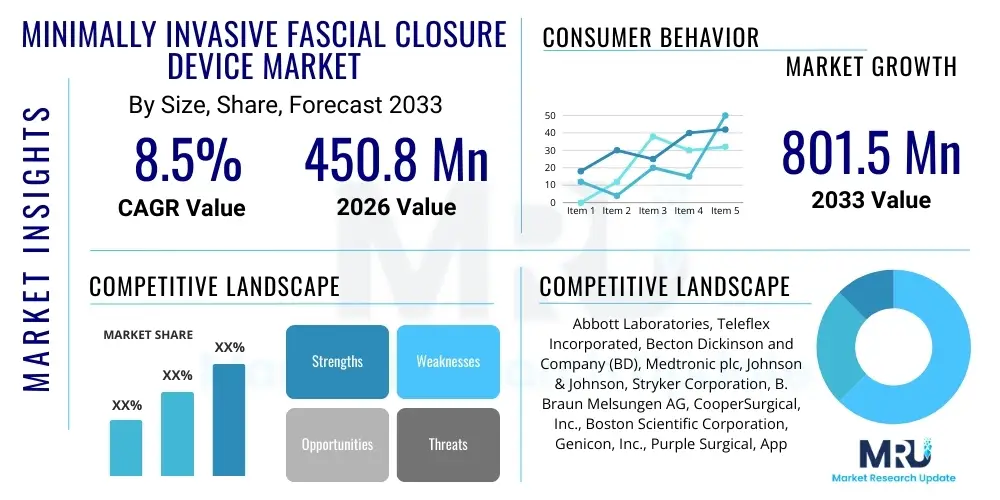

The Minimally Invasive Fascial Closure Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450.8 Million in 2026 and is projected to reach USD 801.5 Million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the increasing global preference for minimally invasive surgical procedures, which inherently demand sophisticated closure solutions to reduce post-operative complications such as herniation and wound site pain. Technological advancements focusing on enhanced safety features and ease of use for surgeons are critical factors contributing to this robust market expansion, particularly in developed healthcare economies where infrastructure supports advanced surgical practices.

Minimally Invasive Fascial Closure Device Market introduction

The Minimally Invasive Fascial Closure Device Market encompasses specialized surgical instruments used to securely close fascial layers following laparoscopic or robotic procedures, mitigating risks associated with trocar site defects, including incisional hernia formation. These devices are essential components in modern surgical suites, offering distinct advantages over traditional manual suturing techniques by providing controlled, standardized, and rapid closure, thereby improving operational efficiency and patient outcomes. Product descriptions generally involve automated or semi-automated systems that facilitate the passage of sutures through the abdominal wall under visualization, ensuring strong apposition of the fascia while minimizing tissue trauma. Major applications span general surgery, gynecological procedures, and urological interventions where port site closure is mandatory, driven fundamentally by the rising volume of complex minimally invasive surgeries being performed worldwide.

The primary benefits delivered by these advanced devices include reduced operating room time, decreased incidence of post-operative pain, and a significant lowering of the rate of trocar site hernia, which can necessitate costly secondary repair procedures. The inherent standardization offered by automated devices removes variability often associated with manual suturing, leading to predictable and reproducible closure integrity. Driving factors for market acceleration include the global shift towards value-based healthcare models that prioritize cost-effectiveness and rapid patient recovery, coupled with continuous innovation by key market players focused on developing ergonomic and single-use disposable devices. Furthermore, extensive clinical evidence supporting the safety and efficacy of these closure techniques over conventional methods continues to propel their adoption among surgical specialists.

The market landscape is characterized by intense competition centered on device design, material science improvements, and integration with high-definition visualization systems. Regulatory approvals, particularly from bodies like the FDA and EMA, play a crucial role in market access and acceptance. Surgeons are increasingly seeking instruments that provide tactile feedback and high visibility during the closure process, reinforcing the demand for next-generation devices. Educational initiatives focused on training surgeons on the correct utilization of these specialized tools are also essential market enablers, ensuring that the clinical benefits are realized across diverse surgical environments.

Minimally Invasive Fascial Closure Device Market Executive Summary

The Minimally Invasive Fascial Closure Device Market is currently undergoing significant transformation, marked by accelerated adoption driven by technological innovation and favorable surgical paradigm shifts. Business trends indicate a strong focus on strategic acquisitions and partnerships aimed at expanding geographic reach and integrating complementary technologies, such as advanced visualization and navigation systems, into closure device platforms. Companies are investing heavily in research and development to create devices optimized for robotic surgery, addressing the unique spatial and maneuverability constraints inherent in those environments. Regional trends highlight North America and Europe as dominant revenue generators due to high healthcare expenditure and established infrastructure supporting minimally invasive procedures, while the Asia Pacific region is demonstrating the highest growth potential, fueled by increasing medical tourism, improving healthcare access, and a burgeoning elderly population necessitating surgical interventions. Segment trends underscore the disposable device category maintaining market leadership owing to stringent infection control protocols and enhanced convenience, while the end-user segment of Ambulatory Surgical Centers (ASCs) is projected to exhibit rapid growth, reflecting the shifting trend of performing routine procedures outside traditional hospital settings to optimize costs and efficiency.

AI Impact Analysis on Minimally Invasive Fascial Closure Device Market

User inquiries regarding AI's influence on the Minimally Invasive Fascial Closure Device Market frequently revolve around automation of closure procedures, enhanced training simulations, and predictive analytics for complication risk. Users are keen to understand if AI-powered robotic systems could eventually execute the fascial closure entirely autonomously, ensuring optimal suture placement and tension, thereby eliminating human error. Concerns also surface regarding the integration complexity and the regulatory pathway for AI-enabled closure devices. The overarching expectation is that AI will primarily serve as a highly accurate assistant, optimizing the procedure by processing real-time anatomical data derived from imaging modalities, recommending optimal needle entry and exit points, and potentially standardizing the closure process across varied patient anatomies, leading to further reductions in post-operative hernia rates and streamlining the surgical workflow. This integration is expected to redefine the required skill set for surgeons focusing on laparoscopic closure.

- AI integration enhances surgical visualization during closure, providing real-time depth perception and tissue tension analysis.

- Predictive algorithms utilize patient data to assess and mitigate the risk of trocar site hernia formation based on closure technique parameters.

- AI-driven simulation platforms provide high-fidelity training for surgeons, improving proficiency and reducing the learning curve for novel closure devices.

- Automation potential: AI-assisted robotic systems could guide or fully execute precise suture placement, standardizing closure outcomes.

- Optimization of device design: AI analyzes usage data (force, angle, speed) to inform iterative improvements in device ergonomics and efficacy.

DRO & Impact Forces Of Minimally Invasive Fascial Closure Device Market

The market dynamics for Minimally Invasive Fascial Closure Devices are dictated by a powerful combination of drivers, significant restraints, and emerging opportunities, all interacting to generate substantial impact forces. Key drivers include the overwhelming global preference for minimally invasive surgery (MIS) across numerous medical specialties, regulatory mandates emphasizing safe and effective port site closure, and a growing body of clinical evidence proving the superiority of dedicated closure devices in preventing incisional hernias compared to conventional techniques. Conversely, restraints primarily involve the high initial cost of advanced closure devices, particularly those integrated with robotic platforms, alongside reimbursement challenges in developing economies, which limits widespread accessibility. Opportunities arise from the rapidly expanding Ambulatory Surgical Center (ASC) segment, the development of specialized devices for unique surgical approaches (e.g., single-port access), and advancements in absorbable material technologies that enhance patient comfort and healing.

Impact forces currently shaping the market are dominated by technological innovation pressure, which necessitates continuous development of safer, faster, and more ergonomic devices. The competitive intensity among market leaders drives price competition and rapid product cycles. Furthermore, the regulatory environment acts as a strong impact force; rigorous approval processes ensure device safety but can prolong market entry, while increasing demands for documented clinical efficacy necessitate significant investment in post-market surveillance and clinical trials. Healthcare economics, focused on reducing length of stay and preventing readmissions (often caused by hernias), further compels hospitals to adopt premium closure solutions, translating clinical value into economic benefits.

The market faces the persistent restraint of educating surgeons on the proper technique and value proposition of these specialized instruments. While MIS procedures are widely adopted, awareness regarding the long-term complication rate associated with poor fascial closure remains a focus area. The high adoption rate in North America and Europe exerts a positive global impact force, setting the standard for clinical practice, which gradually filters down to emerging markets. Ultimately, the cumulative effect of increasing patient awareness regarding surgical risks and technological progression towards safer procedures ensures a positive, sustained market trajectory despite cost constraints.

Segmentation Analysis

The Minimally Invasive Fascial Closure Device market is comprehensively segmented based on product type, the procedure for which it is used, and the end-user facility. This segmentation provides a granular view of market dynamics, highlighting areas of high demand and technological focus. The product segmentation between reusable and disposable devices remains critical, with disposable units generally capturing a larger market share due to ease of use, guaranteed sterility, and simplified hospital inventory management. Procedure-based analysis clearly shows that laparoscopic surgeries dominate the application landscape, although the integration of these devices into robotic-assisted procedures represents the fastest-growing niche. End-user categorization emphasizes hospitals as the current primary revenue source, but the rapid proliferation of ambulatory surgical centers (ASCs) is fundamentally altering the distribution landscape, driven by procedural migration and cost efficiency goals.

- By Product Type

- Reusable Fascial Closure Devices

- Disposable Fascial Closure Devices

- By Procedure

- Laparoscopic Surgery

- Robotic Surgery

- Single-Port Access Surgery

- Notes/Transluminal Procedures

- By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Minimally Invasive Fascial Closure Device Market

The value chain for Minimally Invasive Fascial Closure Devices begins with complex upstream activities, primarily involving specialized raw material procurement. This includes high-grade, biocompatible polymers and medical-grade stainless steel for device bodies, along with advanced suture materials (e.g., absorbable polymers like PGLA or PDA). Research and development (R&D) constitute a critical value-adding step, focusing on designing ergonomic, user-friendly devices that minimize insertion force and optimize suture placement accuracy. Manufacturers must adhere to stringent quality control and regulatory compliance (ISO 13485 standards and FDA/CE mark requirements) during the manufacturing phase. Downstream analysis focuses heavily on the distribution channel, which is typically a hybrid model.

Distribution primarily occurs through a mix of direct sales forces, especially for large established companies targeting major hospital networks, and indirect distribution through specialized medical device distributors and wholesalers who possess deep regional knowledge and established relationships with smaller clinics and ASCs. The preference for direct sales allows manufacturers to control pricing, provide specialized training, and maintain direct feedback loops from surgeons, which is vital for product improvement. Indirect channels are crucial for market penetration in geographically dispersed or emerging markets where maintaining a dedicated sales team is cost-prohibitive. Post-sales service and clinical support are high-value elements downstream, ensuring devices are used effectively and maximizing patient outcomes, thereby sustaining long-term contracts and brand loyalty.

The value chain's efficiency is heavily influenced by the speed of technological adoption by end-users. Procurement departments in hospitals often conduct extensive cost-benefit analyses, weighing the price of disposable devices against the potential long-term savings from reduced hernia repair surgeries and shorter patient recovery times. Effective market access depends on securing favorable formulary inclusion within major healthcare systems and providing compelling economic evidence to procurement teams. Innovation in material science that reduces manufacturing costs without compromising device performance represents a key area for margin expansion across the entire value chain.

Minimally Invasive Fascial Closure Device Market Potential Customers

The primary customers and end-users of Minimally Invasive Fascial Closure Devices are healthcare institutions that perform a high volume of laparoscopic and robotic-assisted surgeries requiring robust fascial defect closure. Hospitals, particularly large university-affiliated medical centers and regional surgical hubs, represent the largest segment of potential buyers due to the complexity and high volume of procedures they undertake across general surgery, gynecology, and urology departments. These institutions prioritize devices that offer demonstrated clinical superiority, ease of integration into existing surgical trays, and favorable long-term cost outcomes regarding reduced complication rates. The procurement process often involves multidisciplinary committees, including surgeons, supply chain managers, and infection control specialists, requiring manufacturers to address both clinical efficacy and total cost of ownership.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing segment of potential customers, increasingly expanding their procedural scope to include more complex minimally invasive operations that necessitate reliable fascial closure. ASCs are highly sensitive to device cost and efficiency, favoring disposable, easy-to-use systems that contribute to rapid patient turnover and minimal capital expenditure. The move of elective surgeries from inpatient hospital settings to ASCs positions this segment as a crucial growth driver for disposable fascial closure device manufacturers over the forecast period. Furthermore, specialty clinics focused on specific surgical areas, such as cosmetic or bariatric surgery, also represent niche but high-value customer bases requiring specialized closure solutions adapted to unique incision geometries and patient body types.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 Million |

| Market Forecast in 2033 | USD 801.5 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Teleflex Incorporated, Becton Dickinson and Company (BD), Medtronic plc, Johnson & Johnson, Stryker Corporation, B. Braun Melsungen AG, CooperSurgical, Inc., Boston Scientific Corporation, Genicon, Inc., Purple Surgical, Applied Medical, Ethicon (J&J), CONMED Corporation, Insight Surgical, Inc., SuturEase, Microline Surgical, Olympus Corporation, Intuitive Surgical, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Minimally Invasive Fascial Closure Device Market Key Technology Landscape

The technology landscape within the Minimally Invasive Fascial Closure Device market is highly dynamic, focused primarily on enhancing precision, reducing surgical complexity, and improving patient safety profiles. Core technologies revolve around specialized needle guiding mechanisms and suture delivery systems that ensure accurate placement of deep fascial sutures through small port site incisions. Crucial advancements include spring-loaded designs that provide controlled needle throw and retraction, minimizing the risk of accidental internal injury to underlying viscera. Visualization technologies, often integrating high-definition optics or complementary ultrasound guidance, are increasingly being paired with closure devices, allowing surgeons to confirm precise fascial layer approximation, which is particularly challenging in obese patients or those with dense abdominal walls. Furthermore, the push towards standardized, single-use, disposable technology is prevalent, addressing sterilization concerns and maintaining consistent device performance across all procedures.

A significant technological evolution involves the development of hybrid closure systems specifically designed for robotic surgical platforms. These devices must be capable of navigating the constrained port geometry and often integrate specific features to interface seamlessly with robotic arms and instrumentation, ensuring stability and control previously achieved manually. Another area of intense innovation is material science related to suture fixation and absorption rates. Companies are exploring bioresorbable anchor technologies that dissolve after the critical healing period, potentially reducing long-term complications or foreign body sensation. Electromechanical components are also being introduced in high-end devices to provide automated tension control and standardized knot tying, reducing variability in the closure quality and relying less on the surgeon’s manual dexterity.

The intellectual property landscape is competitive, with numerous patents protecting specific needle geometries, deployment mechanisms, and ergonomic handle designs. Future technological trends are expected to include better integration of smart sensor technology within the devices to measure real-time tissue impedance and tension, providing quantitative feedback to the surgeon regarding optimal closure strength. This shift toward quantitative, data-driven fascial closure will significantly enhance predictability and patient outcomes. Compatibility with varying trocar sizes and the development of universal closure mechanisms that minimize the need for multiple device types are key technological drivers influencing product strategies and market competitiveness in the immediate future.

Regional Highlights

- North America: This region dominates the global market share, primarily driven by high healthcare expenditure, rapid adoption of cutting-edge surgical technologies, favorable reimbursement policies for minimally invasive procedures, and the presence of major industry players. The United States, in particular, exhibits high awareness among surgeons regarding the long-term risks of port site herniation, leading to high utilization of specialized closure devices.

- Europe: Europe represents the second-largest market, supported by widespread acceptance of laparoscopic surgery, established healthcare infrastructure (especially in Germany, France, and the UK), and increasing government investment in advanced medical device technologies. However, the market faces slower growth compared to APAC, primarily due to rigorous, time-consuming regulatory processes (MDR transition) which can slow product launch timelines.

- Asia Pacific (APAC): The APAC region is anticipated to be the fastest-growing market globally due to rapidly developing healthcare infrastructure in countries like China and India, increasing penetration of insurance coverage, and a growing pool of patients opting for minimally invasive surgeries. Economic growth and the expansion of medical tourism further accelerate the adoption of advanced fascial closure solutions.

- Latin America (LATAM): This region shows moderate growth, primarily driven by improving healthcare access in Brazil and Mexico. Market growth is constrained by fluctuating currency values and limited reimbursement structures, but increasing efforts to modernize surgical practices provide underlying long-term potential.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the GCC nations, supported by significant government healthcare spending and sophisticated private hospital sectors. Adoption remains slow in many African countries due to infrastructural and economic barriers, necessitating a focus on cost-effective, high-volume products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Minimally Invasive Fascial Closure Device Market.- Abbott Laboratories

- Teleflex Incorporated

- Becton Dickinson and Company (BD)

- Medtronic plc

- Johnson & Johnson

- Stryker Corporation

- B. Braun Melsungen AG

- CooperSurgical, Inc.

- Boston Scientific Corporation

- Genicon, Inc.

- Purple Surgical

- Applied Medical

- Ethicon (J&J)

- CONMED Corporation

- Insight Surgical, Inc.

- SuturEase

- Microline Surgical

- Olympus Corporation

- Intuitive Surgical, Inc.

- LSI Solutions, Inc.

Frequently Asked Questions

Analyze common user questions about the Minimally Invasive Fascial Closure Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and benefit of a minimally invasive fascial closure device?

The primary function is to securely and precisely close the fascial layer at trocar insertion sites following laparoscopic surgery, significantly reducing the risk of incisional hernia formation and enhancing long-term patient safety.

Which factors are driving the growth of the Minimally Invasive Fascial Closure Device Market?

Market growth is driven by the global increase in minimally invasive surgeries, clinical data demonstrating improved outcomes compared to manual suturing, and the expansion of efficient Ambulatory Surgical Centers (ASCs) preferring specialized disposable devices.

How does the disposable segment compare to the reusable segment in terms of market share?

The disposable segment typically holds a larger market share due to superior infection control protocols, guaranteed sterility, and the convenience offered to healthcare facilities by eliminating the need for complex reprocessing and sterilization procedures.

What role does technology, such as AI, play in the future development of these closure devices?

Future development will integrate AI for enhanced visualization, real-time tissue tension monitoring, and robotic automation to standardize suture placement, minimizing human variability and further optimizing closure integrity.

Which geographical region exhibits the highest growth rate for this market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by improving healthcare infrastructure, rising surgical volumes, and increasing penetration of modern surgical techniques.

Competitive Landscape Analysis and Strategic Recommendations

The competitive landscape of the Minimally Invasive Fascial Closure Device Market is highly consolidated, dominated by a few global medical device giants who possess extensive distribution networks and robust R&D capabilities. Key players such as Teleflex, Medtronic, and J&J (Ethicon) leverage their broad product portfolios and established clinical relationships to maintain market dominance. Competition is primarily focused on achieving superior clinical efficacy data, minimizing the risk of needle-stick injuries for surgeons, and designing devices compatible with various surgical techniques, especially robotic surgery, which demands specialized, longer instruments with precise control mechanisms. Pricing strategy also plays a significant role, particularly in segments addressing Ambulatory Surgical Centers, where cost-effectiveness dictates procurement decisions.

Strategic recommendations for market penetration and expansion revolve around targeted innovation and economic value demonstration. Companies should prioritize the development of devices that simplify the learning curve for new surgeons, incorporating intuitive design features and enhanced tactile feedback. Furthermore, focusing on data collection regarding long-term hernia recurrence rates associated with device use is crucial for justifying premium pricing and securing favorable reimbursement codes. For growth in emerging markets, strategic partnerships with local distributors and the development of cost-optimized product variants are essential to navigate varying economic conditions and regulatory requirements.

A crucial competitive advantage lies in integrating educational services and comprehensive training packages alongside the product sale. As device sophistication increases, standardized training programs—potentially utilizing AI-powered simulation—become vital for ensuring optimal utilization and maximizing patient outcomes, thereby cementing market loyalty. Smaller, innovative entrants often focus on niche applications, such as specialized closure for single-port access procedures, posing competitive pressure on larger firms to continuously update their core product lines and prevent technological stagnation. Mergers and acquisitions remain a key strategy for large players looking to quickly absorb innovative technologies and consolidate market share globally.

Market Dynamics: Detailed Drivers

The primary driver accelerating the adoption of Minimally Invasive Fascial Closure Devices is the worldwide paradigm shift in surgical preference towards minimally invasive techniques. Laparoscopic and robotic procedures inherently minimize large incisions, leading to reduced patient trauma, decreased blood loss, shorter hospital stays, and quicker recovery times compared to traditional open surgery. However, these procedures create numerous small fascial defects (port sites) that require meticulous closure. Clinical guidelines increasingly mandate the closure of defects larger than 10mm to prevent incisional hernias, making dedicated closure devices indispensable.

A secondary, yet equally powerful driver is the growing clinical evidence demonstrating the safety and efficacy of these specific closure devices. Studies consistently show that standardized, technically assisted fascial closure significantly lowers the incidence of port site hernias—a costly and painful post-operative complication that necessitates subsequent surgical intervention. Healthcare systems, particularly in developed nations, are focused on value-based care models, where preventing complications translates directly into significant cost savings related to reduced readmissions and secondary procedures. This strong economic incentive encourages hospitals and ASCs to invest in advanced closure technology despite the higher initial cost.

Furthermore, demographic shifts contribute substantially to market expansion. The global population is aging, leading to an increased prevalence of chronic diseases and conditions that require surgical management, such as colorectal procedures, gynecological operations, and bariatric surgery. Since elderly patients often benefit most from the reduced recovery time associated with minimally invasive techniques, the demand for high-quality, reliable fascial closure solutions is escalating. Continuous technological refinements, including lighter, more ergonomic designs and devices tailored for specific anatomical challenges, further drive surgical acceptance and market uptake.

Market Dynamics: Key Restraints

Despite strong drivers, the Minimally Invasive Fascial Closure Device Market faces significant restraining factors, most notably the high procurement cost associated with technologically advanced, disposable systems. Compared to conventional needle and suture techniques, specialized closure devices represent a substantial budget item for hospital supply chains. In cost-sensitive environments, particularly in emerging markets or smaller rural hospitals, budgetary constraints often lead to the continued reliance on cheaper, less precise manual closure methods, even with the known higher risk of subsequent hernia formation.

Another major restraint involves the necessary training and proficiency required for optimal use of complex closure devices. While marketed as easy-to-use, proper technique remains crucial to ensure effective fascial apposition and prevent complications. The need for comprehensive training programs, continuous professional education, and overcoming the reluctance of veteran surgeons accustomed to manual techniques presents a barrier to rapid, universal adoption. In institutions with high staff turnover, maintaining consistent proficiency in specialized device usage can be challenging, impacting the perceived value and ROI of the investment.

Finally, complex and varied reimbursement scenarios across different regions act as a limiting factor. While the surgical procedure itself is often covered, the specific billing and reimbursement for the advanced closure device may be inconsistent or bundled, making it difficult for manufacturers to justify premium pricing. Furthermore, regulatory hurdles, particularly in obtaining approvals in highly regulated markets like the EU (post-MDR implementation), can significantly delay market entry for novel devices, impeding innovation and slowing the diffusion of state-of-the-art technology globally.

Market Dynamics: Emerging Opportunities

One significant opportunity lies in the explosive growth of the Ambulatory Surgical Center (ASC) segment. As healthcare providers seek to reduce costs and improve efficiency, numerous routine and moderately complex minimally invasive procedures are migrating from traditional hospital settings to ASCs. ASCs require fast turnaround times and prefer single-use, sterile, and highly reliable instruments, creating a substantial demand surge for disposable fascial closure devices that streamline the surgical process and minimize sterilization costs.

A further crucial opportunity is the specialization of closure devices for emerging surgical platforms, particularly in robotic surgery and single-port access (SPA) procedures. Robotic surgery necessitates longer, specialized instruments capable of precise movements within constrained spaces. Developing next-generation closure devices that integrate seamlessly with robotic platforms, perhaps featuring haptic feedback or augmented reality guidance, represents a premium, high-growth niche. Similarly, SPA procedures create larger, central defects requiring specific closure solutions that address the unique anatomical mechanics of single-site access, a market segment currently underserved by generic devices.

Finally, the opportunity exists in harnessing big data and AI for clinical feedback and predictive analysis. Manufacturers can develop connectivity features within their devices to collect anonymized data on technique, tissue characteristics, and resulting outcomes. This data can be utilized to provide surgeons with performance benchmarks, predict patient risk profiles, and iteratively improve device design to achieve near-perfect fascial closure results across diverse patient populations. This transition towards 'smart' surgical devices offers a compelling value proposition that transcends simple mechanical closure.

Impact Forces Analysis

The impact forces influencing the Minimally Invasive Fascial Closure Device Market are multifaceted, starting with the dominant influence of technological advancement. The continuous pursuit of faster, safer, and more reliable closure techniques dictates research priorities and market investments. Any significant technological breakthrough, such as a fully automated closure system or a novel bio-integrated material, instantly exerts pressure on competitors to innovate or risk obsolescence. This force drives up R&D expenditure but ultimately benefits the end-user by improving surgical safety margins.

A second major impact force is the stringent regulatory environment. Regulatory bodies demand extensive clinical trial data proving both the non-inferiority and superior performance of new closure devices, especially concerning long-term hernia recurrence rates. While this ensures product quality and patient safety, it imposes high barriers to entry for new companies and slows the rate at which innovative products reach the market. Regulatory harmonization or divergence between key markets (e.g., FDA vs. MDR) profoundly influences global market strategies and product launch sequencing for multinational firms.

Lastly, cost-containment pressures exerted by global healthcare payers (governments and private insurers) represent a continuous, downward impact force on pricing. Although the clinical value of preventing hernias is high, procurement departments often focus on immediate device cost. This forces manufacturers to optimize their supply chains and explore strategic pricing models, such as volume discounts or risk-sharing agreements, where payment is tied to patient outcome metrics. The interplay between demonstrated clinical superiority and economic affordability determines market access success.

Segmentation Deep Dive: Product Type

The segmentation based on product type—Reusable and Disposable Fascial Closure Devices—is fundamental to understanding the market structure and competitive dynamics. Disposable devices currently dominate the market share, a trend driven primarily by rigorous hospital protocols mandating sterility and single-use preference to minimize the risk of cross-contamination and hospital-acquired infections (HAIs). Disposable devices offer guaranteed functionality and sharpness for every procedure, eliminating the variability associated with repeated sterilization cycles and wear-and-tear inherent in reusable instrumentation. Furthermore, the convenience factor for surgical staff—not requiring complex tracking, washing, or sterilization processes—significantly enhances operating room efficiency and reduces associated labor costs.

Reusable devices, while representing a smaller market segment, still maintain relevance, particularly in institutions focused on long-term capital efficiency and high procedural volumes where the upfront cost can be amortized effectively over numerous uses. These devices typically feature durable metallic components and often require specialized, standardized sterilization processes to maintain their integrity and effectiveness. The adoption of reusable devices is more prominent in publicly funded healthcare systems in Europe and certain developing countries where capital expenditure control is prioritized over recurring operational expenses. However, the maintenance complexity and the persistent risk of device malfunction after numerous sterilization cycles continue to limit their market growth compared to disposable counterparts.

The future trajectory strongly favors disposable technology, particularly those that incorporate advanced features like guided visualization or automated suture deployment. Manufacturers are increasingly focusing R&D efforts on disposable platforms, not only to meet strict hygiene requirements but also to integrate high-tech components (such as sensors or small microprocessors) cost-effectively, knowing they only need to function for a single procedure. Strategic focus includes developing disposable systems that manage to reduce per-unit cost through optimized manufacturing processes, thereby challenging the economic justification for reusable systems even in high-volume settings. The disposable segment is thus expected to be the main engine of growth, benefiting from both regulatory push (safety) and operational pull (efficiency).

Segmentation Deep Dive: Procedure Type

Analyzing the market by procedure type reveals the dependency of fascial closure devices on the broader adoption of minimally invasive techniques. Laparoscopic surgery constitutes the largest application segment, spanning a vast array of general, gynecological, and urological procedures. The consistent need for secure closure across various trocar sizes used in multi-port laparoscopy ensures steady, high volume demand for standard closure devices. Market growth within this segment is highly sensitive to the overall growth rate of general surgical procedures being performed minimally invasively, which continues to rise globally as surgical proficiency improves and patient outcomes are demonstrably superior.

Robotic surgery represents the most dynamic and fastest-growing procedural segment for fascial closure devices. The proliferation of robotic platforms in hospitals worldwide necessitates specialized ancillary instruments, including closure devices that can be effectively manipulated by robotic arms or are designed to facilitate closure around rigid robotic ports. These devices often command a higher price point due to the specialized engineering required for robotic compatibility. The growth in this segment is tied directly to the increasing installed base and utilization rates of robotic surgical systems, particularly in the United States and Western Europe, where capital investment capacity is highest.

The emerging segments, such as Single-Port Access (SPA) and Natural Orifice Transluminal Endoscopic Surgery (NOTES), offer unique challenges and opportunities. SPA procedures create larger single defects, heightening the urgency for dedicated closure solutions that provide enhanced strength and reliability compared to standard multi-port devices. While NOTES procedures aim to eliminate external incisions, leading to minimal port site closure needs, successful SPA adoption requires tailored fascial closure devices, which are currently driving focused innovation among several market entrants. The complexity of these procedures ensures that specialized, premium closure instruments will continue to gain traction as these surgical techniques mature and become more standardized.

Segmentation Deep Dive: End-User

The End-User analysis identifies hospitals as the current primary consumer of Minimally Invasive Fascial Closure Devices, particularly large public and private hospitals that handle complex cases, trauma, and a high throughput of both inpatient and outpatient surgeries. These facilities often require a mix of both reusable devices (for amortization of capital costs in specific high-volume, standardized procedures) and premium disposable devices for complex or contamination-sensitive cases. Hospitals are influenced by key opinion leaders (KOLs) who are early adopters of advanced surgical technology, driving the initial procurement decisions for novel closure systems based on clinical validation and perceived safety improvements.

The Ambulatory Surgical Centers (ASCs) segment is experiencing exponential growth and presents the most significant market opportunity moving forward. ASCs focus intensely on efficiency, patient throughput, and operational cost control, making them ideal adopters of high-performing, single-use disposable devices. The migration of low-to-moderate complexity surgeries, such as various general and gynecological laparoscopic procedures, to the ASC setting accelerates the demand for reliable and cost-effective closure solutions. For manufacturers, succeeding in the ASC market requires offering competitive pricing models, simplified logistics, and devices that minimize inventory complexity.

Specialty clinics, including those focused on bariatric, plastic, or highly specialized gynecological surgeries, constitute the third significant end-user category. These clinics often require closure devices tailored to specific anatomical or procedural needs, such as devices suitable for high abdominal wall thickness in bariatric patients or those designed for minimal scarring in cosmetic procedures. Although smaller in volume compared to hospitals, specialty clinics often represent early adoption sites for highly innovative, niche products, and their focus on patient aesthetics and rapid recovery aligns perfectly with the core benefits delivered by advanced fascial closure technology. Targeting these segments requires specialized sales and marketing strategies focused on procedural outcomes and patient satisfaction metrics.

Regulatory Environment and Compliance

The regulatory landscape for Minimally Invasive Fascial Closure Devices is highly structured and complex, reflecting their classification as Class II or Class III medical devices depending on the jurisdiction and specific function. In the United States, devices typically require 510(k) clearance or, for novel technologies, Premarket Approval (PMA) from the FDA. The process necessitates robust clinical data proving safety and efficacy, often requiring comparison with predicate devices and, critically, demonstrating reduced hernia incidence in long-term follow-up studies. Compliance with Good Manufacturing Practices (GMP) and detailed documentation of quality management systems are mandatory for all manufacturing operations.

In Europe, the transition to the Medical Device Regulation (MDR) has significantly heightened the requirements for clinical evidence, risk assessment, and post-market surveillance (PMS). Manufacturers must now provide more comprehensive data, impacting the cost and timeline for achieving CE Mark certification. The increased rigor of the MDR acts as a market barrier for smaller companies and increases the overall expenditure required for regulatory compliance, consequently focusing investment on established, high-volume products where the regulatory costs can be easily absorbed over projected sales volume.

For APAC and emerging markets, regulatory frameworks are evolving, often requiring approval from local bodies (e.g., China's NMPA, Japan's PMDA). Manufacturers frequently leverage approvals from the FDA or CE Mark to expedite local registrations, although local testing or adaptation to regional standards may still be required. Navigating these disparate, continually changing global regulations necessitates dedicated regulatory affairs expertise and strategic planning, making regulatory compliance a significant non-product factor determining market success and geographical reach.

Market Entry and Growth Strategies

Successful market entry for new participants in the Minimally Invasive Fascial Closure Device Market requires a differentiated product offering, often targeting an underserved procedural niche such as robotic or single-port surgery, rather than competing directly in the saturated standard laparoscopic closure segment. A crucial strategy involves securing intellectual property rights for unique mechanical advantages, such as enhanced ergonomic handles, optimized suture retrieval mechanisms, or integration with non-invasive visualization technologies. Initial market validation should focus on prestigious academic medical centers and key opinion leaders (KOLs) whose endorsement can rapidly build clinical credibility and drive adoption across wider surgical communities.

For established companies aiming for growth, the strategy centers on continuous product iteration and robust economic value messaging. Growth relies on proving that their devices, despite potentially higher unit costs, deliver superior total value by reducing long-term hospital costs associated with complications like readmissions and subsequent hernia repair procedures. Furthermore, expansion into high-growth regions like APAC requires establishing localized manufacturing or assembly processes to reduce import taxes and supply chain costs, making the premium products economically viable for regional healthcare systems and competitive against local manufacturers who may offer lower-cost alternatives.

A synergistic strategy involves strategic partnerships with major robotic platform manufacturers. As robotic surgery becomes standardized, having closure devices natively integrated or officially recommended by robotic system providers ensures preferential access to a rapidly expanding user base. Education remains a core element of any growth strategy; developing certified training curricula for surgeons and surgical technicians, focusing on reproducible technique and troubleshooting, ensures positive user experiences and consistent clinical outcomes, which are essential for driving repeat purchases and securing long-term contracts with large healthcare networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager