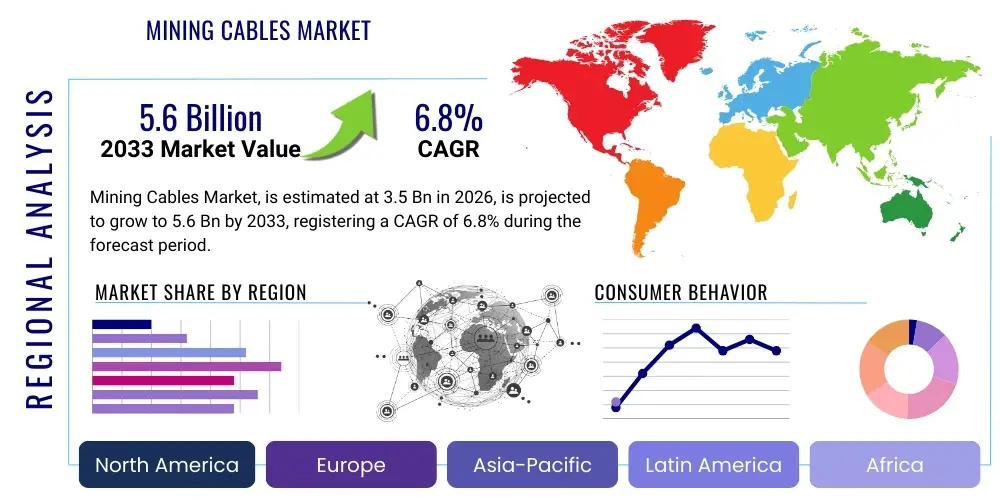

Mining Cables Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439924 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Mining Cables Market Size

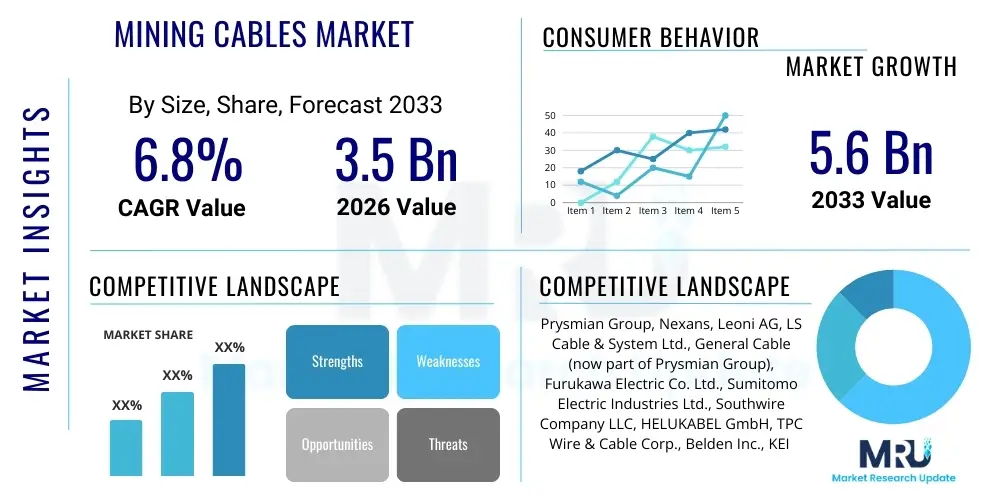

The Mining Cables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Mining Cables Market introduction

The global mining cables market plays an indispensable role in powering and enabling the operations of the vast and critical mining industry. These specialized cables are meticulously engineered to withstand the most arduous and aggressive environmental conditions encountered in both underground and surface mining operations, including extreme temperatures, corrosive chemicals, abrasive materials, high mechanical stress, and constant moisture exposure. Their primary function is to ensure the safe and reliable transmission of power, control signals, and data across various mining equipment and infrastructure, thereby supporting a wide array of activities from extraction and processing to material handling and safety systems. The market encompasses a diverse range of cable types, each designed for specific applications, such as heavy-duty power cables for large machinery, flexible trailing cables for mobile equipment, and fiber optic cables for high-speed data communication, forming the backbone of modern mining infrastructure.

Mining cables are distinctly characterized by their robust construction, often incorporating features like heavy-duty jacketing, reinforced insulation, and sometimes armored layers to provide superior resistance against cuts, abrasions, impact, and crushing. These design considerations are paramount to maintaining operational continuity and ensuring worker safety in hazardous mining environments where conventional cables would fail rapidly. The key applications span across a broad spectrum of mining activities, including powering draglines, shovels, excavators, continuous miners, longwall shearers, conveyors, pumps, and ventilation systems. Furthermore, they are crucial for instrumentation, communication networks, and lighting systems, which are vital for efficient command and control within mining sites. The structural integrity and functional reliability of these cables are critical to minimizing downtime, preventing accidents, and optimizing the overall productivity of mining operations, making them a significant capital expenditure for mining companies globally.

The inherent benefits of utilizing high-quality mining cables are multi-faceted, ranging from enhanced operational efficiency and extended equipment lifespan to, most critically, improved safety standards within mines. By providing stable and consistent power supply, these cables enable machinery to operate at peak performance, contributing to higher extraction rates and reduced operational costs. The robust design translates into fewer cable failures, which directly reduces maintenance requirements and costly production interruptions. Moreover, compliance with stringent international safety regulations is a major driving factor, compelling mining operators to invest in cables that offer superior flame retardancy, low smoke emission, and resistance to environmental degradation, thereby mitigating risks such as electrical fires and toxic gas exposure. The global demand for minerals and metals, coupled with increasing investments in new mining projects and the modernization of existing ones, further propels the growth of this specialized market, making mining cables an essential component for the sustainable future of the mining sector.

Mining Cables Market Executive Summary

The Mining Cables Market is currently experiencing dynamic shifts driven by several overarching business trends that are reshaping the global mining landscape. Foremost among these is the escalating demand for critical minerals and metals, fueled by the accelerating global energy transition and the widespread adoption of electric vehicles, which necessitates intensified mining activities and, consequently, greater investment in robust electrical infrastructure. This robust demand is fostering new mine developments and the expansion of existing operations across various geographies. Additionally, there is a pronounced trend towards digital transformation and automation within the mining sector, characterized by the deployment of autonomous vehicles, remote-controlled equipment, and advanced monitoring systems. This shift is significantly increasing the demand for specialized data and communication cables alongside traditional power cables, integrating smart capabilities and enhancing operational efficiency and safety. Sustainability and environmental concerns are also influencing business strategies, prompting mining companies to seek energy-efficient and eco-friendly cable solutions, thereby driving innovation in materials and manufacturing processes within the cable industry.

Regional trends are diverse yet converge on themes of resource extraction intensity and technological adoption. The Asia Pacific region stands out as a dominant force, primarily driven by massive mining operations in countries like China, Australia, and India, which are major producers of coal, iron ore, and other critical minerals. Rapid industrialization and urbanization in these economies continually bolster the demand for raw materials, directly translating into robust growth for the mining cables market. North America and Europe, while having mature mining industries, are increasingly focusing on technological upgrades, automation, and stringent safety standards, which necessitate the adoption of high-performance, intelligent, and compliant cable systems. Latin America, rich in copper, iron ore, and gold, continues to be a vital market, with significant investments in new projects, particularly in Chile, Peru, and Brazil. Meanwhile, the Middle East and Africa (MEA) region, with its vast untapped mineral reserves and emerging mining projects, presents considerable growth opportunities, albeit often coupled with infrastructure development challenges.

Segmentation trends within the mining cables market reflect the nuanced requirements of different mining applications and environments. By voltage type, there is a sustained demand for Low Voltage (LV) cables for auxiliary equipment and lighting, while Medium Voltage (MV) and High Voltage (HV) cables are seeing substantial growth due to the increasing depth of mines and the power requirements of larger, more sophisticated machinery. The move towards electrification of mining vehicles, replacing diesel-powered fleets, further amplifies the need for high-capacity power transmission solutions. In terms of application, both underground and surface mining segments are evolving. Underground mining requires cables with superior flexibility, flame retardancy, and crush resistance, often incorporating fiber optics for critical communication. Surface mining, particularly open-pit operations, demands extremely durable and weather-resistant cables for heavy mobile equipment like draglines and shovels. Furthermore, the increasing specialization of cables for specific mineral types, such as those resistant to unique chemical exposures in rare earth mineral extraction, underscores the market's trajectory towards highly customized and application-specific solutions, optimizing performance and safety across the mining value chain.

AI Impact Analysis on Mining Cables Market

The advent and accelerating integration of Artificial Intelligence (AI) across the mining sector are poised to significantly reshape various facets of the mining cables market. User questions frequently revolve around how AI will influence the demand for different cable types, particularly data and communication cables, and what role AI plays in enhancing the longevity and safety of existing cable infrastructure. There is considerable interest in whether AI-driven predictive maintenance systems will reduce cable consumption by extending their operational lifespan, or if the proliferation of smart mining equipment will drive an overall increase in specialized cable requirements. The core themes that emerge include the anticipation of increased demand for high-bandwidth data transmission capabilities, the potential for AI to optimize cable design and routing, and its profound impact on monitoring, safety, and efficiency protocols, ultimately affecting both the volume and sophistication of cables deployed within mining operations.

The primary concern for many stakeholders is understanding the net effect of AI: will it lead to a decrease in the overall volume of cables due to more efficient management and longer lifecycles, or will the extensive sensorization and data requirements of AI-powered systems necessitate an even greater deployment of complex cable networks? The consensus suggests that AI will undeniably drive a shift towards more intelligent cable systems. For instance, the demand for traditional power cables may see optimization through AI-powered grid management, reducing waste and overcapacity. However, this is largely counterbalanced by the exponential increase in demand for data and communication cables, including fiber optics and Ethernet cables, essential for transmitting vast amounts of real-time data from countless sensors, autonomous vehicles, and remote monitoring stations. Users also inquire about the development of "smart cables" embedded with sensors, which AI can then analyze for predictive failure detection, enhancing safety and operational uptime.

Expectations for AI's influence are generally positive, focusing on improved operational efficiency, enhanced safety, and greater sustainability. AI algorithms can analyze complex environmental data to optimize cable placement, reduce wear and tear, and predict potential failures before they occur, thereby extending cable lifespans and minimizing costly downtime. This analytical capability also contributes to better resource allocation and safer operational procedures. Moreover, AI-driven automation in mining requires reliable and high-speed communication networks, which are intrinsically reliant on advanced cabling infrastructure. The impact on the mining cables market is therefore seen as a dual transformation: a move towards more data-intensive and intelligent cable solutions that are inherently smarter, more durable, and better integrated into sophisticated, AI-managed mining ecosystems, ultimately demanding higher quality and more specialized cables rather than simply a greater volume of conventional ones. This evolution underscores a strategic shift towards value-added, technologically advanced cabling solutions.

- Increased demand for high-bandwidth data and fiber optic cables for sensor networks and autonomous operations.

- Integration of smart cable technologies with embedded sensors for AI-driven predictive maintenance and condition monitoring.

- Optimization of cable routing and design through AI analytics, reducing material usage and improving network resilience.

- Enhanced safety protocols by AI-powered real-time monitoring of cable integrity and environmental conditions, preventing failures.

- Development of specialized cables for AI-enabled robotics and autonomous mining equipment requiring robust and flexible connectivity.

- Shift towards more energy-efficient cable solutions, as AI optimizes power distribution and reduces overall energy consumption in mines.

- Facilitation of remote and automated mining operations, driving demand for reliable, long-distance communication cables.

DRO & Impact Forces Of Mining Cables Market

The Mining Cables Market is propelled by a robust confluence of drivers, yet simultaneously faces significant restraints and presents compelling opportunities, all operating under various impact forces that shape its trajectory. A primary driver is the burgeoning global demand for minerals and metals, indispensable for industrial growth, infrastructure development, and the rapidly expanding green energy sector, including electric vehicles and renewable energy technologies. This insatiable demand necessitates increased mining activities, both in developing new mines and expanding existing ones, directly translating into higher requirements for robust and reliable power and communication infrastructure, including specialized mining cables. Moreover, the increasing adoption of automation, digitalization, and smart mining technologies, aimed at enhancing efficiency and safety, is significantly boosting the demand for advanced data and communication cables alongside traditional power cables. Stringent safety regulations and environmental compliance standards across various mining jurisdictions further compel operators to invest in high-quality, flame-retardant, low-smoke, and eco-friendly cable solutions, driving product innovation and market growth.

Despite these strong tailwinds, the market is not without its challenges and restraints. The inherent volatility of commodity prices, particularly for key minerals, often leads to fluctuating investment cycles within the mining sector. Downturns in commodity prices can cause delays or cancellations of new mining projects, thereby dampening demand for mining cables. High initial capital investment required for advanced cabling systems, coupled with the complexity of installation and maintenance in harsh mining environments, can also act as a deterrent for smaller mining operators. Furthermore, environmental concerns related to mining activities, including land degradation and water pollution, sometimes lead to regulatory hurdles and public opposition, impacting project approvals and expansion plans. Competition from alternative power solutions or more efficient power distribution technologies, though nascent, could also present long-term competitive pressures. The lifecycle costs associated with mining cables, including procurement, installation, and eventual replacement, represent a substantial expenditure for mining companies, making cost-effectiveness a critical factor in purchasing decisions.

Opportunities within the Mining Cables Market are predominantly centered around technological advancements and the strategic shift towards sustainable and intelligent mining practices. The development of "smart mines" fully integrated with IoT devices, AI, and remote operations creates a significant opportunity for manufacturers to innovate and offer advanced cable solutions that are not only robust but also capable of high-speed data transmission and embedded with monitoring capabilities. The growing emphasis on electrification of mining fleets, replacing fossil fuel-dependent machinery, presents a substantial opportunity for high-capacity, durable power cables and associated charging infrastructure. Expansion into emerging economies with rich, underexplored mineral reserves, particularly in Africa and parts of Asia, represents new geographic market opportunities. Moreover, the focus on sustainable mining practices, including efforts to reduce energy consumption and environmental footprint, opens avenues for the development of greener cable materials and more energy-efficient designs. The impact forces in play include the bargaining power of buyers, driven by the need for cost-effective and reliable solutions, and the bargaining power of suppliers, influenced by the specialized nature of these products. The threat of new entrants is mitigated by the high capital and technological barriers, while the threat of substitutes is relatively low due to the indispensable nature of cables in power and data transmission. Competitive rivalry remains high among established players, driving continuous innovation and market differentiation.

Segmentation Analysis

The Mining Cables Market is meticulously segmented to reflect the diverse operational needs and technical specifications required across the global mining industry. This granular analysis allows for a clearer understanding of market dynamics, specific demand patterns, and the strategic positioning of manufacturers and suppliers. Key segmentation criteria typically include voltage type, which determines the power transmission capacity; application, distinguishing between underground and surface mining environments; and end-user, differentiating between the types of minerals or metals being extracted. Each segment possesses unique requirements regarding cable construction, material composition, flexibility, and resistance to environmental factors, driving specialized product development and market competition. Understanding these segments is crucial for identifying growth opportunities and tailoring solutions to meet precise industry demands, ranging from heavy-duty power supply for massive excavators to delicate data transmission for autonomous vehicles and monitoring systems.

- By Type:

- Low Voltage (LV) Cables: Typically rated up to 1 kV, used for lighting, auxiliary power, control systems, and smaller equipment.

- Medium Voltage (MV) Cables: Rated from 1 kV to 35 kV, essential for distributing power to large machinery and substations within mines.

- High Voltage (HV) Cables: Rated above 35 kV, used for primary power distribution from the main grid to the mine site, especially in large-scale and deep mining operations.

- By Application:

- Underground Mining Cables: Designed for extreme flexibility, flame retardancy, low smoke emission, and resistance to crushing and abrasion in confined spaces. Includes trailing cables, feeder cables, and communication cables.

- Surface Mining Cables: Built for heavy-duty applications in open-pit mines, with high resistance to weather, UV radiation, mechanical damage, and temperature variations. Powers draglines, shovels, excavators, and other mobile equipment.

- By End-User:

- Coal Mining: Cables for continuous miners, longwall shearers, conveyors, and ventilation in coal mines, often with specific flame-retardant requirements.

- Metal Mining: Cables for excavators, drills, and processing plants in operations extracting iron ore, copper, gold, silver, and other precious or base metals.

- Mineral Mining: Cables for equipment used in extracting non-metallic minerals such as limestone, potash, phosphates, and industrial sands.

- By Insulation Material:

- Ethylene Propylene Rubber (EPR): Known for excellent flexibility, heat resistance, and moisture resistance.

- Cross-Linked Polyethylene (XLPE): Offers superior electrical properties, high temperature rating, and mechanical strength.

- PVC/Nitrile Blends: Good for general-purpose, cost-effective applications with moderate resistance requirements.

- By Construction:

- Armored Cables: Provide enhanced mechanical protection against crushing and impact, often used in underground and high-risk areas.

- Unarmored Cables: Lighter and more flexible, suitable for less mechanically strenuous applications.

- Fiber Optic Cables: Integrated into power cables or standalone for high-speed data communication and monitoring.

Value Chain Analysis For Mining Cables Market

A comprehensive value chain analysis for the Mining Cables Market reveals a multi-stage process, beginning with the acquisition and processing of raw materials and extending through manufacturing, distribution, and end-user application, each stage adding distinct value and incurring costs. The upstream segment of the value chain is dominated by raw material suppliers who provide critical components such as copper and aluminum for conductors, various polymers like Ethylene Propylene Rubber (EPR), Cross-Linked Polyethylene (XLPE), and PVC for insulation and sheathing, and steel or synthetic fibers for armoring and reinforcement. The quality, availability, and cost fluctuations of these raw materials significantly impact the final product's performance and pricing. Key suppliers in this phase often specialize in high-grade, durable materials that can withstand the harsh conditions characteristic of mining environments, forming essential partnerships with cable manufacturers to ensure material compliance with stringent industry standards.

Moving downstream, the value chain encompasses the sophisticated manufacturing process where these raw materials are transformed into finished mining cables. This stage involves complex engineering, extrusion, stranding, cabling, and testing processes that adhere to specific electrical, mechanical, and safety specifications. Cable manufacturers invest heavily in R&D to innovate new materials, designs, and manufacturing techniques to improve cable flexibility, durability, flame retardancy, and data transmission capabilities. Following manufacturing, the cables enter the distribution channel, which is a critical link between producers and end-users. Distribution can occur through several avenues: direct sales, where large cable manufacturers sell directly to major mining companies or large-scale EPC (Engineering, Procurement, and Construction) contractors involved in mine development; and indirect sales, which leverage a network of specialized distributors, agents, and regional resellers. These intermediaries play a vital role in providing local stock, technical support, and logistical services, particularly to smaller mining operations and maintenance teams, ensuring timely availability of products across diverse geographic locations.

The final stage of the value chain involves the end-users—mining companies themselves, across various types of mining operations (e.g., coal, metal, mineral). These end-users, along with EPC contractors and equipment manufacturers who integrate cables into their machinery, represent the ultimate demand for mining cables. Post-purchase, the value chain extends to installation, maintenance, and eventually, replacement and recycling of the cables. Direct channels are preferred for high-value, customized, or large-volume orders where direct technical consultation and project management are essential. Indirect channels are crucial for market penetration, serving fragmented markets, and providing accessible supply for routine maintenance and smaller projects. The efficiency and reliability of both direct and indirect distribution networks are paramount to ensure that mining operations have continuous access to the critical cabling infrastructure necessary for uninterrupted and safe functioning, ultimately influencing operational uptime and profitability for the mining sector.

Mining Cables Market Potential Customers

The potential customer base for the Mining Cables Market is fundamentally rooted in the global mining and related heavy industries, comprising a diverse array of entities whose operations critically depend on robust and reliable electrical and data transmission infrastructure. Primarily, this includes large-scale, multinational mining corporations involved in the extraction of a wide range of minerals and metals, such as iron ore, copper, gold, coal, platinum, and rare earth elements. These major players operate extensive networks of surface and underground mines, requiring vast quantities of specialized cables for power distribution to heavy machinery, communication systems, lighting, and safety equipment. Their significant capital expenditures on new projects, expansions, and modernization initiatives make them cornerstone clients for cable manufacturers, often demanding customized solutions that meet stringent performance and safety standards specific to their operational environments and regulatory compliance requirements. The longevity and continuous operation of these mines necessitate ongoing investment in high-quality, durable cabling solutions.

Beyond the major mining houses, a substantial portion of the market caters to smaller and mid-sized mining companies that focus on regional extraction projects or specific niche minerals. While their individual procurement volumes might be lower, their collective demand is significant, often serviced through local distributors and supply channels that provide readily available, standardized mining cable products. Furthermore, Engineering, Procurement, and Construction (EPC) contractors specializing in mine development and infrastructure projects represent another crucial customer segment. These contractors are responsible for designing, building, and commissioning entire mining facilities, and as such, they procure vast quantities of cables as part of their project scope, often working closely with cable manufacturers to specify and integrate suitable cabling solutions into complex mine designs. Their purchasing decisions are driven by project timelines, budget constraints, and technical specifications, making strong relationships with EPC firms vital for market access.

Original Equipment Manufacturers (OEMs) of mining machinery and heavy-duty equipment also form a significant customer group. Companies that produce excavators, draglines, continuous miners, conveyors, drills, and other mining-specific vehicles and processing units require integrated cabling systems as part of their products. These OEMs often work with cable manufacturers to develop custom cable assemblies that are pre-fitted into their machinery, ensuring optimal performance and compatibility. Additionally, companies involved in mine maintenance, repair, and overhaul (MRO) services, as well as those providing specialized mining services like drilling, blasting, and material handling, regularly procure mining cables for their equipment and operational needs. The overarching need for operational continuity, safety, and efficiency across all these segments solidifies their position as essential buyers, driving sustained demand for advanced and reliable mining cable solutions, making the market highly diverse yet strategically focused on industrial heavy-duty applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans, Leoni AG, LS Cable & System Ltd., General Cable (now part of Prysmian Group), Furukawa Electric Co. Ltd., Sumitomo Electric Industries Ltd., Southwire Company LLC, HELUKABEL GmbH, TPC Wire & Cable Corp., Belden Inc., KEI Industries Ltd., Elsewedy Electric Co., NKT A/S, Brugg Cables, Tele-Fonika Kable S.A., CMI Limited, Riyadh Cables Group, Eland Cables, Anixter International (now part of Wesco International) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mining Cables Market Key Technology Landscape

The Mining Cables Market is continuously evolving, driven by advancements in materials science, manufacturing processes, and the increasing integration of smart technologies, all aimed at enhancing safety, efficiency, and durability in the challenging mining environment. A significant technological focus is on developing advanced insulation and jacketing materials that can offer superior resistance to a wider array of hazards prevalent in mines, including extreme temperatures, abrasive forces, crushing, impact, chemical exposure, and moisture ingress. Materials like highly engineered Ethylene Propylene Rubber (EPR) and Cross-Linked Polyethylene (XLPE) are being refined for improved flexibility, dielectric strength, and thermal stability, crucial for both power and control cables. Furthermore, robust outer sheaths made from specialized polyurethane, neoprene, or heavy-duty rubber compounds are designed to withstand severe mechanical stress, providing enhanced protection against cuts, tears, and crushing, thereby extending the operational lifespan of cables and reducing downtime.

Another pivotal area of technological innovation lies in the integration of fiber optics and other data transmission capabilities within mining cables. With the proliferation of smart mining operations, autonomous vehicles, remote monitoring systems, and extensive sensor networks, there is an escalating demand for high-speed, reliable data communication. Hybrid cables, which combine power conductors with fiber optic strands or twisted pair data cables, are becoming increasingly common. These hybrid solutions simplify cable management, reduce installation costs, and provide a comprehensive infrastructure for both power supply and real-time data exchange, enabling advanced analytics and decision-making for improved mine safety and productivity. The development of flame-retardant, low-smoke, zero-halogen (FR-LSZH) materials is also a critical technology, mandated by stringent safety regulations to minimize the spread of fire and the emission of toxic fumes in underground mining environments, directly impacting worker safety during emergencies.

Beyond material and structural enhancements, the "smart cable" concept is gaining traction, representing a significant technological leap in the mining cables market. This involves embedding sensors within the cable structure or integrating external monitoring devices that can detect critical parameters such as temperature fluctuations, partial discharges, mechanical stress, and insulation degradation in real-time. These smart capabilities, often leveraging IoT (Internet of Things) principles, allow for proactive maintenance, fault localization, and predictive failure analysis, significantly reducing the risk of unexpected breakdowns and improving operational reliability. Additionally, advancements in cable design focus on optimizing flexibility for mobile equipment, particularly trailing cables, through innovative stranding and lay-up techniques that allow for repeated flexing and reeling without compromising conductor integrity. The ongoing convergence of power, data, and intelligent monitoring within a single robust cable system signifies the future trajectory of technology in the mining cables market, addressing the complex demands of modern, highly automated, and safety-conscious mining operations.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market due to extensive mining activities in China, Australia, and India. China's industrial growth and massive coal/metal production, coupled with Australia's leadership in iron ore and other mineral exports, drive substantial demand for mining cables. India's growing infrastructure and energy needs also fuel significant market expansion. The region is characterized by both large-scale, technologically advanced mines and numerous smaller operations.

- North America: A mature market characterized by stringent safety regulations and a high adoption rate of advanced mining technologies, including automation and digitalization. The United States and Canada are key players, with significant mining of coal, copper, gold, and industrial minerals. Demand is driven by modernization of existing mines, investment in new projects, and a strong emphasis on high-performance, durable, and smart cable solutions.

- Europe: Despite a declining coal mining sector in some areas, the European market for mining cables remains robust due to significant metal and mineral extraction (e.g., iron ore, potash) in countries like Russia, Poland, and Scandinavia. The region emphasizes safety, environmental compliance, and technological innovation, leading to demand for specialized, high-quality, and environmentally friendly cables. Research and development in advanced cable materials are strong here.

- Latin America: A critical region for copper, iron ore, and gold mining, particularly in countries like Chile, Brazil, Peru, and Mexico. The market is driven by vast mineral reserves and ongoing investments in large-scale mining projects. While price volatility of commodities can impact growth, the long-term outlook remains positive due to the indispensable nature of these resources for global industries. Demand here often focuses on robust, high-capacity power cables for heavy machinery.

- Middle East and Africa (MEA): Emerging as a significant growth region due propelled by vast untapped mineral reserves, particularly in South Africa (platinum, chromium, gold), Democratic Republic of Congo (copper, cobalt), and other African nations. Investments in new mining projects and infrastructure development are key drivers. The demand here is for rugged and reliable cables that can withstand challenging environmental conditions and support the foundational growth of new mining ventures, often with an increasing focus on international safety standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mining Cables Market.- Prysmian Group

- Nexans

- Leoni AG

- LS Cable & System Ltd.

- Furukawa Electric Co. Ltd.

- Sumitomo Electric Industries Ltd.

- Southwire Company LLC

- HELUKABEL GmbH

- TPC Wire & Cable Corp.

- Belden Inc.

- KEI Industries Ltd.

- Elsewedy Electric Co.

- NKT A/S

- Brugg Cables

- Tele-Fonika Kable S.A.

- CMI Limited

- Riyadh Cables Group

- Eland Cables

- Anixter International (now part of Wesco International)

Frequently Asked Questions

What are the primary factors driving the growth of the Mining Cables Market?

The primary drivers for the Mining Cables Market include the escalating global demand for critical minerals and metals, which necessitates increased mining operations and infrastructure investment. Additionally, the widespread adoption of automation, digitalization, and smart mining technologies is boosting demand for advanced data and communication cables. Stringent safety regulations and environmental compliance also compel mines to invest in high-quality, specialized, and compliant cable solutions to ensure operational safety and efficiency.

What types of cables are predominantly used in mining operations, and what are their key characteristics?

Mining operations primarily utilize Low Voltage (LV) cables for auxiliary power and control, Medium Voltage (MV) cables for power distribution to heavy machinery, and High Voltage (HV) cables for main power supply. Key characteristics include extreme durability, resistance to abrasion, impact, moisture, chemicals, and temperature variations. Specialized features like high flexibility for mobile equipment (trailing cables), flame retardancy, low smoke emission, and sometimes integrated fiber optics for data transmission are crucial for safety and operational continuity in harsh mining environments.

How do safety regulations and environmental concerns impact the Mining Cables Market?

Safety regulations significantly impact the market by mandating the use of cables with superior flame retardancy, low smoke emission, and robust mechanical protection, especially in underground mines, to prevent fires and ensure worker safety. Environmental concerns drive demand for cables made with eco-friendly materials, reducing hazardous substance content and promoting energy efficiency. These regulations compel manufacturers to innovate in material science and cable design, ensuring compliance and enhancing the overall safety and sustainability profile of mining operations.

What role does technology, particularly AI and automation, play in the future of mining cables?

AI and automation are transformative forces in the mining cables market. Automation necessitates an exponential increase in high-speed data and communication cables to support autonomous vehicles, remote monitoring, and IoT sensor networks. AI-driven systems leverage this data for predictive maintenance, optimizing cable routing, and enhancing safety protocols, thereby extending cable lifespans and improving operational efficiency. This shift leads to a demand for 'smart cables' with embedded sensors and robust data transmission capabilities, integrating seamlessly into intelligent mine ecosystems and driving demand for advanced, highly specialized cabling solutions.

Which geographical regions are the most significant contributors to the Mining Cables Market, and why?

The Asia Pacific (APAC) region is the largest contributor, driven by extensive mining activities in China, Australia, and India, fueled by industrialization and raw material demand. North America and Europe are significant due to technological advancements, stringent safety standards, and modernization efforts in existing mines. Latin America is a key region for copper and iron ore extraction, with substantial new project investments. The Middle East and Africa (MEA) present emerging growth opportunities due to vast untapped mineral reserves and increasing investment in mine development, making all these regions critical for global market dynamics and specialized cable demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager