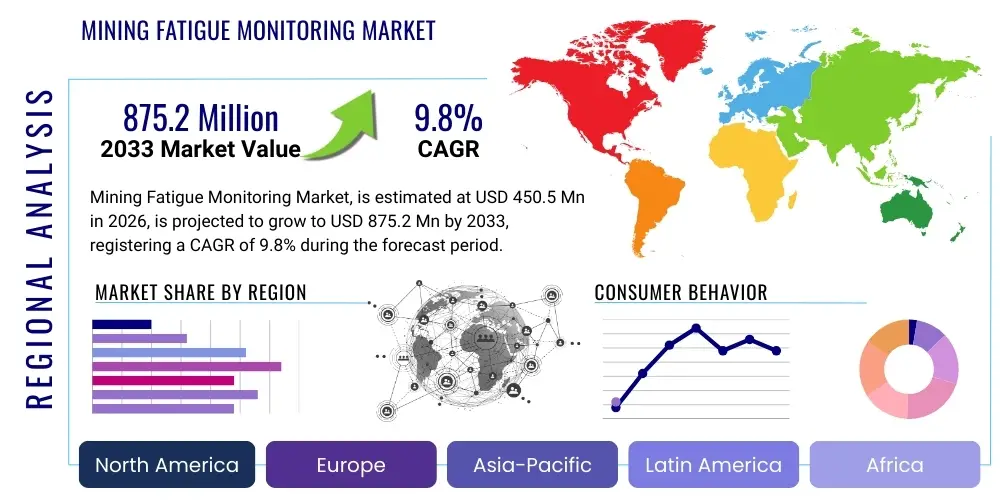

Mining Fatigue Monitoring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437716 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Mining Fatigue Monitoring Market Size

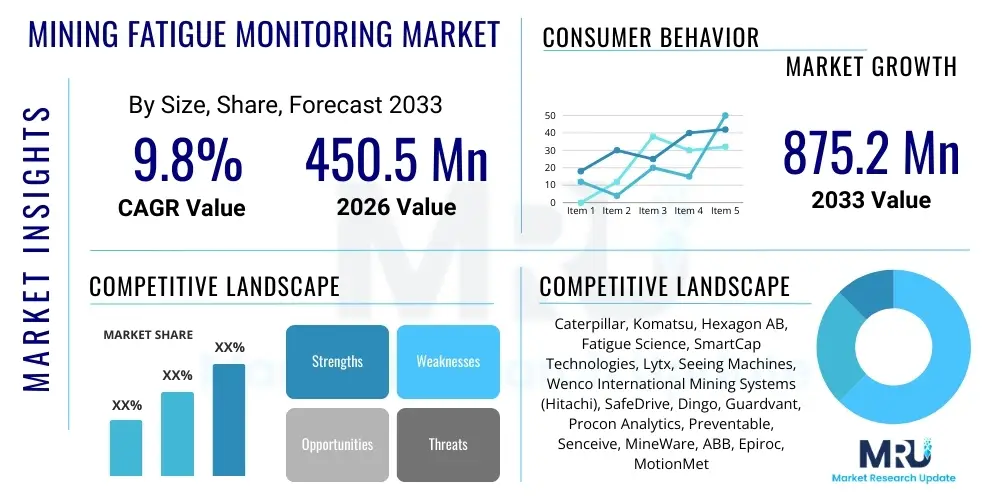

The Mining Fatigue Monitoring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 875.2 Million by the end of the forecast period in 2033. This substantial expansion is primarily fueled by increasing global regulatory pressure aimed at enhancing worker safety in high-risk mining environments, coupled with the economic imperative to reduce costly accidents and operational downtime resulting from operator drowsiness and fatigue. The adoption of advanced sensor technologies and integrated analytical platforms is key to driving this growth trajectory, enabling mining companies to shift from reactive incident management to proactive fatigue prevention strategies.

Mining Fatigue Monitoring Market introduction

The Mining Fatigue Monitoring Market encompasses specialized systems and technologies designed to continuously measure, assess, and manage operator alertness levels in demanding mining operations. These solutions utilize a combination of wearable devices, in-cabin cameras, biometric sensors, and advanced analytical software to detect signs of impending fatigue or microsleep events before they lead to catastrophic failures or safety incidents. The primary product offering includes sophisticated hardware components that capture physiological and behavioral data, supported by robust software platforms that apply machine learning algorithms to process this data into actionable real-time alerts and long-term risk management insights.

Major applications of fatigue monitoring systems span across crucial operational areas within both surface and underground mining, including heavy machinery operation (haul trucks, excavators, dozers), drilling, blasting coordination, and control room supervision. The undeniable benefits derived from the deployment of these systems include significant reductions in accident rates, improved compliance with occupational health and safety standards, optimized shift scheduling based on personalized alertness patterns, and overall enhancement of operational efficiency. By minimizing fatigue-related errors, mining organizations protect their most valuable assets—their personnel and their expensive equipment—while simultaneously stabilizing production output.

The primary driving factors propelling the growth of this market include increasingly stringent governmental regulations, particularly across developed mining regions like North America and Australia, mandating active fatigue management programs. Furthermore, the economic drivers are compelling; the high direct and indirect costs associated with a single major mining accident—encompassing investigations, insurance hikes, downtime, and reputational damage—far outweigh the initial investment in monitoring technology. Finally, continuous technological advancements, especially the integration of edge computing and predictive AI, are making these systems more accurate, less intrusive, and seamlessly integrated into existing fleet management infrastructure, further stimulating market adoption globally.

Mining Fatigue Monitoring Market Executive Summary

The Mining Fatigue Monitoring Market is experiencing rapid evolution, driven by core business trends centered on digitization and risk mitigation. There is a notable industry shift towards predictive and preventative models, moving beyond simple reactive alerting systems to comprehensive workforce management platforms that integrate fatigue data with other operational parameters like environmental conditions and maintenance schedules. Business models are increasingly favoring Software-as-a-Service (SaaS) subscriptions for data analytics and continuous updates, lowering the barrier to entry for smaller mining companies. Furthermore, strategic alliances between technology providers and major Original Equipment Manufacturers (OEMs) are embedding fatigue monitoring solutions directly into new heavy machinery during the manufacturing phase, accelerating adoption rates and ensuring compatibility across large-scale fleets.

Regionally, the market dynamics are dominated by established mining economies, particularly North America and Asia Pacific (APAC). North America, driven by strong occupational safety standards and union pressures, exhibits a high adoption rate of sophisticated, non-wearable, in-cabin camera systems. Conversely, the APAC region, particularly Australia and emerging economies like India and Indonesia, demonstrates robust growth due to massive mining volumes and newly implemented, often strict, national safety regulations; these regions frequently leverage wearable technologies for their flexibility and cost-effectiveness across diverse operational setups. Europe maintains steady growth, focusing heavily on integrating fatigue management into holistic occupational health and wellness programs, often mandated by EU-wide directives.

Segmentation trends highlight the increasing importance of the Software and Services component within the market value chain. While hardware provides the foundational data capture, the true value lies in the advanced analytical software capable of providing deep, personalized insights into risk profiles. The technology segment shows a strong move towards integrated systems that combine multiple data sources (biometrics, visual confirmation, vehicle telemetry) to enhance accuracy and reduce false alarms, ensuring operator acceptance. Surface mining, due to the high visibility and long, monotonous shifts associated with haul truck operations, remains the largest application segment, though underground mining is rapidly adopting compact, ruggedized solutions optimized for low-light, confined environments, often focusing on intrinsic safety ratings.

AI Impact Analysis on Mining Fatigue Monitoring Market

Common user questions regarding AI's impact on the Mining Fatigue Monitoring Market frequently revolve around the accuracy of prediction, the privacy implications of biometric data analysis, the reduction of false positives, and the potential for AI to personalize intervention strategies. Users are keen to understand how AI, specifically Machine Learning (ML) and Computer Vision (CV), can move beyond merely detecting drowsiness signs (like eyelid closure or yawning) and accurately predict fatigue onset based on complex variables such as circadian rhythms, historical performance data, and shift patterns. There is significant concern about data sovereignty and how collected personal health data is managed and secured, alongside the expectation that AI should facilitate seamless integration into existing operational systems without requiring massive infrastructure overhauls. Overall, users anticipate that AI will fundamentally transform fatigue monitoring from a reactive alerting mechanism into a genuinely proactive, predictive safety management tool.

The application of Artificial Intelligence is the single most critical technological determinant shaping the future of the market. AI algorithms are essential for processing the massive, continuous streams of data generated by monitoring systems—ranging from heart rate variability and electrodermal activity to micro-facial expressions and steering wheel inputs. Traditional threshold-based systems are prone to false alerts, which erode operator trust and operational efficiency. AI solves this by establishing complex, personalized baselines for each operator, learning their unique physiological and behavioral norms, and only flagging deviations that statistically correlate with high fatigue risk, thereby dramatically improving system reliability and acceptance.

Furthermore, predictive analytics powered by AI allows mining companies to implement preventative measures far in advance of a shift. By analyzing shift histories, rest periods, travel times, and even external factors like recent sleep quality reported through integrated APIs, ML models can calculate a fatigue risk score for upcoming shifts. This allows management to proactively adjust roster schedules, assign mandatory micro-breaks, or reassign operators identified as high risk, moving the industry towards true preventative safety culture rather than simply reacting to an active incident. This capability offers massive economic returns by minimizing high-risk shifts and maximizing operator alertness when it is most critical, ensuring optimal productivity.

- AI algorithms enable personalized fatigue risk profiles based on historical biometric and behavioral data, significantly enhancing prediction accuracy.

- Machine Learning models facilitate advanced predictive scheduling, allowing management to preemptively adjust rosters for high-risk operators.

- Computer Vision (CV) utilizes deep learning to analyze nuanced facial features, head movements, and eye tracking with high precision, minimizing false positive alerts.

- AI integration allows for seamless fusion of physiological data with operational telemetry (speed, braking, throttle input), creating a holistic safety risk assessment.

- The adoption of Generative AI tools assists in simplifying complex data visualization and reporting, making fatigue insights more accessible to non-technical safety managers.

DRO & Impact Forces Of Mining Fatigue Monitoring Market

The Mining Fatigue Monitoring Market is subject to significant dynamics defined by powerful Drivers, inherent Restraints, substantial Opportunities, and fluctuating Impact Forces that determine market direction and adoption rates. Key drivers include stringent regulatory compliance requirements, particularly in jurisdictions like Western Australia and North America, which mandate systematic risk management for human factors like fatigue. This regulatory push is compounded by the undeniable economic benefit of fatigue management; safety incidents cost millions in immediate damage and long-term litigation, making monitoring systems a necessary investment in operational continuity and risk mitigation. Additionally, continuous innovations in sensor miniaturization and edge computing are making devices more reliable and easier to deploy, further stimulating market demand.

However, the market faces several inherent restraints. The most significant is the high initial capital investment required for deploying large-scale integrated systems across extensive mining fleets, particularly for software licensing and infrastructure customization. Furthermore, resistance from the workforce, driven by concerns over privacy relating to continuous biometric and behavioral surveillance, poses a deployment challenge; successful implementation requires comprehensive change management and demonstrated operator benefit. Technical restraints also exist, including the challenge of maintaining data accuracy in harsh, dusty, vibration-heavy underground environments, and managing the sheer volume of data generated by hundreds of sensors across multiple shifts.

Despite these hurdles, significant opportunities abound. The integration of fatigue monitoring with emerging technologies such as autonomous and semi-autonomous vehicles presents a key growth avenue, where human operators still interact with automated systems and require heightened alertness during takeover periods. Expanding the scope of monitoring to include cognitive fatigue, beyond physical drowsiness, opens new product lines focused on mental workload assessment. Furthermore, there is vast potential in penetrating developing mining economies in Africa and South America, where safety standards are rapidly improving and where foundational infrastructure for digital safety management is being established for the first time. The overarching impact forces—regulatory demands, economic pressure to increase productivity, and rapid technological convergence—collectively mandate the adoption of advanced fatigue monitoring solutions as standard operational procedure.

These forces drive investment decisions and technological focus. The direct impact of regulatory changes often creates immediate demand spikes, forcing companies to adopt compliant technologies quickly. Economic impact forces compel large corporations to prioritize solutions that offer clear Return on Investment (ROI) through measurable reductions in insurance premiums and accident-related losses. Meanwhile, competitive impact forces necessitate that leading mining organizations demonstrate superior safety records to maintain their reputation and secure social licenses to operate, making fatigue monitoring not just a compliance measure but a competitive differentiator.

Segmentation Analysis

The Mining Fatigue Monitoring Market is highly segmented based on Technology, Component, and Application, reflecting the diverse operational needs and technological maturity levels across the global mining industry. The primary segments differentiate between the type of sensor used (wearable vs. non-wearable), the essential parts of the system (hardware vs. software), and the environment in which the system is deployed (surface vs. underground). Understanding these segments is crucial for technology providers to tailor solutions that meet specific requirements, such as ruggedization for underground operations or high throughput data processing for large surface fleets operating in continuous 24/7 cycles.

The fastest-growing segment is often the Software and Services component, which includes proprietary analytical platforms, cloud infrastructure, predictive algorithms, and ongoing support. While hardware sales provide an initial revenue boost, the subscription model for advanced software generates recurring and high-margin revenue, driving long-term market valuation. Simultaneously, non-wearable technology, predominantly based on Computer Vision (in-cabin cameras) and physiological sensors embedded in seats or steering wheels, is gaining significant traction due to higher operator acceptance, as it eliminates the need for operators to remember or maintain personal devices and provides robust, non-intrusive data collection crucial for reliable safety assessments.

Furthermore, segmentation by application highlights the intense focus on large-scale surface mining operations, primarily involving haul trucks, where the consequences of fatigue-related accidents are economically devastating due to the size and cost of the equipment involved. However, the unique challenges of underground mining—low light, restricted space, higher immediate risk—are fueling specialized demand for intrinsically safe, compact, and highly accurate monitoring systems that can operate reliably in these challenging environments. Strategic investments are increasingly targeting solutions that offer modularity and scalability across both surface and underground divisions within integrated mining companies.

- By Technology:

- Wearable Sensors (Wristbands, Caps, Smart Helmets)

- Non-wearable Sensors (In-cabin Cameras, Steering Wheel Sensors, Seat Sensors)

- Integrated Systems (Combining multiple data streams)

- By Component:

- Hardware (Sensors, Data Acquisition Units, Display Screens)

- Software (Data Analytics Platforms, Cloud Services, Reporting Tools)

- Services (Implementation, Training, Consulting, Maintenance)

- By Application:

- Surface Mining (Haul Trucks, Excavators, Loaders, Dozers)

- Underground Mining (Drills, LHDs, Continuous Miners)

- By Geography:

- North America (US, Canada, Mexico)

- Europe (UK, Germany, France, Russia)

- Asia Pacific (China, Australia, India, Indonesia)

- Latin America (Brazil, Chile, Peru)

- Middle East and Africa (South Africa, Saudi Arabia)

Value Chain Analysis For Mining Fatigue Monitoring Market

The Mining Fatigue Monitoring Market value chain begins with upstream component suppliers, which include specialized sensor manufacturers (biometric, optical), semiconductor producers, and ruggedized hardware enclosure providers. This upstream segment is characterized by high research and development intensity, focusing on miniaturization, power efficiency, and data accuracy, often requiring deep collaboration with specialized software developers to ensure seamless data integration. The efficiency and reliability of upstream suppliers directly impact the final product quality and the speed of technological innovation within the broader market, particularly concerning the next generation of highly accurate, non-intrusive sensors.

The midstream involves system integrators and solution providers (e.g., key market players like Hexagon, Caterpillar, and SmartCap). These entities assemble the hardware and develop proprietary software algorithms for fatigue detection and predictive analytics, adding the critical intelligence layer. Distribution channels are typically bifurcated: direct sales channels involve technology vendors working directly with Tier 1 and Tier 2 mining companies, providing customized implementations, training, and long-term support services, which is essential given the complexity of integration into existing Fleet Management Systems (FMS). Indirect channels utilize partnerships with heavy machinery OEMs (Original Equipment Manufacturers) who pre-install or recommend monitoring systems as optional add-ons, increasing market reach and simplifying procurement for end-users.

The downstream segment centers on the deployment, operation, and consumption of the data by end-users—the mining companies. Key downstream activities include system calibration, continuous data monitoring by safety and operations teams, and the utilization of analytical reports for strategic shift scheduling and policy refinement. The success of the system relies heavily on the quality of the post-implementation services, including reliable maintenance, software updates, and advanced data consulting to ensure that the generated fatigue data translates into genuine safety improvements and operational efficiency gains. The value chain is highly integrated, demanding close communication between software developers and the mining sites to continually refine algorithms based on real-world operational feedback and specific environmental conditions.

Mining Fatigue Monitoring Market Potential Customers

The primary end-users and buyers in the Mining Fatigue Monitoring Market are mining operators across various scales and commodity types, ranging from multinational corporations to smaller, single-site operations. Tier 1 global miners, such as Rio Tinto, BHP, Glencore, and Vale, represent the largest customer segment, characterized by their high safety standards, massive fleet sizes, extensive capital budgets, and readiness to adopt sophisticated, integrated solutions that offer enterprise-wide visibility and predictive capabilities. These large buyers typically prioritize non-wearable, AI-driven systems that integrate seamlessly with their existing heavy equipment and operational technology (OT) infrastructure, often purchasing through multi-year service contracts.

Tier 2 and Tier 3 mining companies, often operating regionally or focusing on niche commodities like gold or specialized metals, constitute another significant customer base. Although budget constraints might lead them to initially favor more cost-effective solutions, such as simple wearable devices or entry-level camera systems, increasing regulatory pressures are compelling even smaller players to invest in robust fatigue management programs. Equipment rental and leasing companies also represent a growing segment, as they increasingly equip their rental fleet with monitoring technology as a value-added safety feature, appealing to contractors and short-term project operators who require high safety compliance without major long-term capital outlay.

Furthermore, specialized segments such as mining contractors and associated service providers (e.g., overburden removal firms, drilling contractors) are increasingly becoming mandatory users of these technologies, often driven by contractual requirements imposed by the Tier 1 asset owners. The key buying criteria across all these customer segments remain a combination of demonstrated accuracy in fatigue detection, resilience and durability in extreme environments, compliance with regional safety standards, and the provision of actionable data insights that directly contribute to reducing operational risk and optimizing shift performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 875.2 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar, Komatsu, Hexagon AB, Fatigue Science, SmartCap Technologies, Lytx, Seeing Machines, Wenco International Mining Systems (Hitachi), SafeDrive, Dingo, Guardvant, Procon Analytics, Preventable, Senceive, MineWare, ABB, Epiroc, MotionMetrics, SRK Consulting, SmartWitness. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mining Fatigue Monitoring Market Key Technology Landscape

The technological landscape of the Mining Fatigue Monitoring Market is characterized by a rapid convergence of data capture mechanisms and sophisticated analytical processing capabilities. Core technologies center around Computer Vision (CV) utilizing near-infrared cameras for in-cabin monitoring, which accurately track behavioral indicators like PERCLOS (Percentage of Eyelid Closure) and head position, even in low-light conditions. These CV systems are increasingly powered by Edge Computing, allowing for real-time processing of video data directly on the device within the vehicle. This approach minimizes data latency, crucial for immediate alert generation, and reduces the strain on network bandwidth, which is often limited in remote mining environments.

Alongside behavioral monitoring, physiological measurement technologies, including high-accuracy heart rate variability (HRV) sensors and electrodermal activity (EDA) monitoring, are integral. When packaged into wearable devices like smart caps or wristbands, these technologies offer deeper insights into the operator's autonomic nervous system state, providing robust data for calculating objective physiological fatigue levels. The challenge lies in ensuring these wearables are comfortable, durable, and intrinsically safe (IS certified) for hazardous environments, leading to continuous innovation in materials science and battery life management. Advanced vendors are focusing on multi-modal sensing—combining both behavioral (CV) and physiological (biometric) data streams to achieve unprecedented accuracy in fatigue identification.

Furthermore, the future of the technology landscape is heavily invested in predictive analytics platforms powered by complex AI algorithms. These platforms move beyond simple alerting to forecast fatigue risk hours or even days in advance by correlating personal data (sleep patterns, shift history) with environmental data (vibration, noise, temperature) and operational parameters (task complexity, drive duration). Successful systems offer robust application programming interfaces (APIs) to seamlessly integrate the fatigue data into existing enterprise resource planning (ERP) systems, workforce management software, and overall safety data lakes, ensuring fatigue risk management is a holistic, integrated component of the mining operation's digital twin strategy.

Regional Highlights

The global Mining Fatigue Monitoring Market exhibits distinct regional maturity and growth patterns, largely dictated by regulatory frameworks, existing infrastructure, and the scale of mining activity.

- North America: This region, encompassing the United States and Canada, represents a highly mature market segment driven primarily by stringent regulatory bodies such as the Mine Safety and Health Administration (MSHA). Adoption rates are high, particularly for advanced, non-wearable, in-cabin camera and AI systems. Key market relevance stems from the large-scale, technologically sophisticated mining operations focusing on commodities like coal, copper, and gold. Companies prioritize systems that offer detailed forensic reporting and compliance assurance, viewing fatigue monitoring as a strategic liability reducer.

- Asia Pacific (APAC): The APAC region, spearheaded by Australia, holds immense importance due to its vast resource base and recent, proactive safety legislative reforms (e.g., in Queensland and Western Australia). Australia is a global leader in adopting innovative fatigue solutions, often serving as a testbed for new technologies. Emerging economies like India and Indonesia are rapidly increasing their adoption, driven by massive domestic commodity demand and a concerted push to improve historically poor safety records, leading to high growth potential for cost-effective wearable and entry-level non-wearable solutions.

- Europe: The European market demonstrates steady, controlled growth, focusing heavily on integrating fatigue monitoring into broader occupational health and wellness programs mandated by the European Union. Countries like Germany and the UK emphasize ergonomic design and data privacy in solution deployment. While the overall volume of mining operations is lower compared to APAC or North America, the market prioritizes sophisticated, intrinsically safe systems, particularly for underground coal and metal mining operations common across Eastern Europe.

- Latin America: This region, particularly Chile, Brazil, and Peru (major copper and iron ore producers), is characterized by significant capital investment in safety technologies aimed at protecting vast, geographically remote operations. Growth is accelerating as large multinational companies operating here enforce global safety standards. The market relevance is defined by the need for rugged, reliable systems that can operate effectively across high altitudes and varied climatic conditions, often requiring localized language support and remote connectivity solutions.

- Middle East and Africa (MEA): South Africa remains the largest market within MEA, historically leading in deep-level, hard rock mining safety innovations. The region is seeing increasing adoption driven by the need to manage severe environmental risks and extremely long commute/shift cycles common in remote African sites. Adoption is crucial for maintaining profitability and securing social license to operate, with a particular focus on minimizing fatalities related to operator error.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mining Fatigue Monitoring Market.- Caterpillar

- Komatsu

- Hexagon AB

- Fatigue Science

- SmartCap Technologies

- Lytx

- Seeing Machines

- Wenco International Mining Systems (Hitachi)

- SafeDrive

- Dingo

- Guardvant

- Procon Analytics

- Preventable

- Senceive

- MineWare

- ABB

- Epiroc

- MotionMetrics

- SRK Consulting

- SmartWitness

Frequently Asked Questions

Analyze common user questions about the Mining Fatigue Monitoring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of deploying fatigue monitoring systems in mining?

The primary benefit is the significant reduction of high-consequence safety incidents and accidents caused by operator drowsiness or fatigue. This directly translates to minimized operational downtime, reduced costs associated with accidents, and enhanced regulatory compliance, protecting both personnel and valuable heavy machinery assets.

Are wearable or non-wearable technologies dominating the market?

Non-wearable technologies, specifically AI-driven in-cabin camera systems (Computer Vision), are increasingly dominating the market for heavy machinery due to higher operator acceptance, non-intrusiveness, and better reliability in continuously capturing behavioral data without requiring active participation from the user.

How does AI contribute to improving fatigue management accuracy?

AI utilizes machine learning to process complex, multi-modal data streams (biometrics, visual cues, vehicle telemetry) to establish personalized fatigue baselines for each operator. This predictive approach significantly reduces the rate of false alerts compared to traditional systems, ensuring timely and accurate interventions before safety thresholds are breached.

Which regions are leading in the adoption of advanced fatigue monitoring solutions?

North America and the Asia Pacific region (particularly Australia) are the leading markets. North America is driven by strict MSHA regulations and technological maturity, while Australia exhibits rapid adoption fueled by state-level safety legislation and a commitment to innovation in large-scale resource operations.

What are the main restraints impacting the growth of the market?

The main restraints include the high initial capital expenditure required for integrated systems, inherent concerns among the workforce regarding data privacy and continuous surveillance, and the ongoing challenge of achieving reliable data transmission and processing in remote and harsh underground mining environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager