Mining metals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437383 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Mining metals Market Size

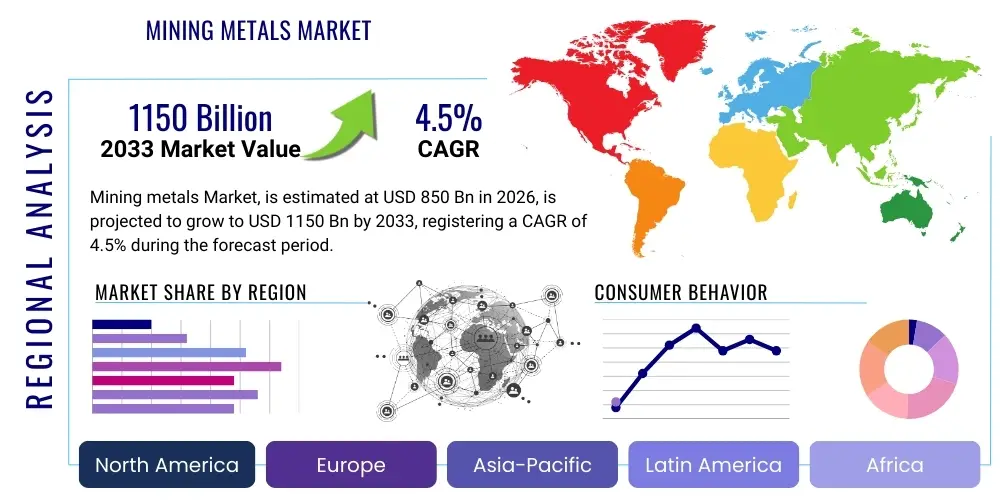

The Mining metals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $850 billion in 2026 and is projected to reach $1150 billion by the end of the forecast period in 2033.

Mining metals Market introduction

The Mining metals Market encompasses the exploration, extraction, processing, and distribution of various metallic minerals crucial for global industrial and technological development. This market forms the backbone of modern infrastructure, spanning essential materials like iron ore, copper, aluminum, and critical raw materials such as lithium, cobalt, and rare earth elements. The industry is characterized by significant capital expenditure, long lead times for project development, and high sensitivity to commodity price fluctuations and geopolitical stability. Recent trends highlight an intense focus on sustainability and Environment, Social, and Governance (ESG) criteria, driven by regulatory pressures and investor expectations, fundamentally altering traditional mining operational models.

Major applications of mined metals are deeply intertwined with the global energy transition and urbanization efforts. Copper is vital for electrical wiring and renewable energy infrastructure (wind turbines, solar panels), while lithium, nickel, and cobalt are indispensable components of electric vehicle (EV) batteries and energy storage systems (ESS). Furthermore, conventional ferrous and non-ferrous metals remain crucial for construction (steel), automotive manufacturing, and industrial machinery production. The increasing complexity of consumer electronics further necessitates a reliable supply of precious and specialty metals, making the consistent, responsible sourcing of these materials a strategic national priority for many industrialized economies.

Key benefits derived from a robust mining metals market include enabling technological innovation, supporting massive employment globally, and providing foundational raw materials necessary for infrastructural growth. Driving factors include the accelerated global push toward decarbonization, which necessitates massive investment in clean energy technologies; rapid urbanization in emerging economies, fueling demand for construction materials; and sustained technological advancement, particularly in 5G, artificial intelligence hardware, and advanced manufacturing. However, the sector faces constant challenges related to operational efficiency, environmental stewardship, and securing social license to operate in increasingly sensitive regions.

Mining metals Market Executive Summary

The Mining metals Market is experiencing a paradigm shift driven by the dual forces of energy transition demand and stringent ESG mandates. Business trends indicate a move toward portfolio diversification, emphasizing critical minerals necessary for battery technology and renewable energy, often through strategic mergers and acquisitions (M&A) focused on high-grade deposits. Operational strategies are increasingly centered on digitalization, leveraging remote monitoring, automation, and predictive maintenance to enhance safety and reduce operational costs amidst rising input expenses and declining ore grades. Geopolitical risks, particularly concerning supply chain concentration in specific regions (e.g., China's dominance in rare earth processing), continue to shape strategic decision-making and incentivize investments in secure, Western processing capacity.

Regional trends reveal Asia Pacific (APAC) as the dominant consumption hub, powered by massive manufacturing bases in China, India, and Southeast Asia, especially in electronics and automotive sectors. North America and Europe are focusing heavily on upstream security, implementing policies like the Critical Raw Materials Act (CRMA) and similar initiatives to foster domestic extraction and refining capabilities for materials deemed strategic. Latin America and Africa remain crucial supply regions for key base metals and specialty minerals, though investment in these areas is heavily scrutinized regarding labor practices and environmental impact, requiring mining companies to demonstrate exceptional social responsibility to attract capital.

Segment trends underscore the phenomenal growth of the battery metals (lithium, nickel, cobalt) segment, far outpacing traditional bulk commodities, although iron ore and copper maintain foundational market significance due to infrastructure spending. From an end-user perspective, the Electrical & Electronics and Automotive sectors (specifically EVs) are exhibiting the highest growth rates, requiring materials with specialized purity and traceability. The market structure is evolving toward integrated supply chains, where miners increasingly partner with original equipment manufacturers (OEMs) and battery manufacturers to secure long-term, direct procurement agreements, bypassing traditional commodity trading houses to a certain extent.

AI Impact Analysis on Mining metals Market

Users frequently inquire about how Artificial Intelligence (AI) can mitigate the inherent risks, high costs, and environmental impacts associated with resource extraction. Common questions revolve around AI’s efficacy in optimizing exploration and reducing drilling guesswork, improving processing plant recovery rates, and enhancing safety protocols through real-time predictive analytics. There is significant interest in AI's role in autonomous mining operations, particularly in deep underground or remote environments where human exposure is dangerous or impractical. Furthermore, users seek clarity on how AI-driven analysis of geological data, coupled with machine learning algorithms, can accelerate the identification of new, economically viable deposits, thereby addressing the long-term challenge of declining ore grades and increasing global demand for critical raw materials necessary for the energy transition.

The implementation of AI algorithms across the mining lifecycle, from geological modeling to fleet management, is critical for achieving the productivity gains necessary to justify massive capital investments. AI facilitates the integration of diverse datasets—seismic, satellite imagery, drilling logs, and production metrics—into comprehensive digital twins of the mine site, enabling optimized scheduling, dynamic adjustments to blasting patterns, and real-time ore quality control. This level of data fusion moves the industry away from historical reliance on sporadic sampling and toward continuous operational optimization, leading to substantial reductions in energy consumption, minimized waste rock generation, and a lower overall environmental footprint per unit of metal produced.

Ultimately, expectations are high that AI will transform the traditionally conservative mining industry into a high-tech, data-driven sector. The key concerns often relate to the substantial upfront investment required for integrating AI systems, the necessity of specialized digital talent, and the challenge of securing industrial-grade, reliable connectivity in remote mining locations. Successful deployment of AI is viewed not just as a cost-saving measure but as a critical enabler for ESG compliance, allowing companies to demonstrate enhanced resource efficiency and worker safety, which are vital for attracting sustainable investment capital.

- AI enhances geological modeling and predictive exploration, substantially reducing the cost and time associated with discovering new mineral deposits.

- Machine learning optimizes process control in processing plants, maximizing metal recovery rates from complex and lower-grade ores.

- AI-driven predictive maintenance monitors heavy machinery and infrastructure integrity, minimizing unplanned downtime and extending asset lifespan.

- Computer vision and robotics enable autonomous haulage and drilling, significantly improving worker safety and operational consistency in hazardous environments.

- Advanced analytics provide real-time monitoring of energy consumption and emissions, aiding regulatory compliance and sustainability reporting.

- AI facilitates dynamic mine planning, adjusting operational parameters instantly based on geological variability and commodity price shifts for maximum profitability.

DRO & Impact Forces Of Mining metals Market

The market dynamics of the Mining metals sector are currently defined by a powerful convergence of global decarbonization targets acting as the primary driver, juxtaposed against increasingly severe regulatory and financial restraints, while the technological frontier offers new avenues for opportunity. The most significant driving force is the global commitment to achieving net-zero emissions, which necessitates unprecedented volumes of copper, lithium, nickel, and cobalt for electrification, ensuring a robust, long-term demand curve that shields the sector from typical commodity volatility. Conversely, the market is heavily restrained by the rising capital intensity required to develop new, often remote, projects and the escalating complexity of obtaining regulatory permits and achieving a social license to operate, delaying supply responses to surging demand.

Opportunities are largely clustered around innovation in resource utilization and extraction. This includes the potential of deep-sea mining, although highly controversial, and the technological advances in urban mining (recycling), which could eventually diversify metal supply away from primary extraction. Furthermore, advancements in selective mining techniques, such as ore sorting and in-situ recovery, offer opportunities to exploit lower-grade deposits more economically and with reduced environmental impact. The impact forces are currently skewed toward external pressures, specifically governmental policy supporting critical mineral supply chains (a major positive impact) and heightened investor scrutiny regarding ESG performance (a major internal shaping force).

The primary impact force shaping investment decisions is the "green premium" applied by investors, favoring miners who demonstrate verifiable pathways to net-zero operations and robust community engagement. This pressure fundamentally shifts capital allocation away from polluting, high-risk assets toward operations integrating renewable energy, advanced water management, and ethical sourcing standards. While commodity prices remain a cyclical impact force, the structural demand shift toward battery metals provides a stabilizing influence, ensuring that certain segments of the mining sector maintain resilience even during broader economic slowdowns, highlighting a bifurcated market where critical mineral miners command a higher valuation multiplier.

Segmentation Analysis

The Mining metals Market is comprehensively segmented based on the type of metal extracted, which dictates its end-use application, market valuation, and extraction methodology. Key segment classifications include Ferrous Metals (dominated by iron ore and alloys), Non-Ferrous Metals (such as copper, aluminum, and zinc), Precious Metals (gold, silver, platinum group metals), and the increasingly vital segment of Critical Raw Materials (CRM), including lithium, cobalt, and rare earth elements. The dynamics within these segments are diverging significantly; while traditional segments (Ferrous) are tied closely to traditional construction and heavy industry cycles, the CRM segment is experiencing exponential growth driven almost exclusively by the electric vehicle and renewable energy storage revolutions.

Further segmentation is applied based on the end-use industry, reflecting the final consumption pattern and driving demand forecasting. The major application sectors are Construction and Infrastructure, Automotive (sub-segmented into traditional combustion engines and EVs), Electrical & Electronics (including power transmission and consumer devices), and Industrial Machinery. Understanding these end-use segments is crucial for miners to align their production capabilities with evolving industrial requirements, particularly the rigorous quality and traceability standards demanded by high-tech manufacturers. Geographic segmentation highlights the disparity between supply regions (e.g., Africa, Latin America, Australia) and primary consumption regions (e.g., Asia Pacific, North America, Europe).

The method of mining (surface mining vs. underground mining) also provides an important segmentation layer, affecting cost structures, safety profiles, and environmental considerations. Surface mining (like open-pit) is generally lower cost and higher volume but has a greater surface-level environmental impact, while underground mining is used for deeper, higher-grade deposits, incurring greater operational complexity and safety requirements. The intersection of metal type and mining method defines the specific technological needs and regulatory environment for any given mining operation globally, influencing capital expenditure cycles and operational efficiency metrics.

- By Type:

- Ferrous Metals (Iron Ore, Manganese, Chromium)

- Non-Ferrous Metals (Copper, Aluminum, Zinc, Lead, Tin)

- Precious Metals (Gold, Silver, Platinum, Palladium)

- Critical Raw Materials (Lithium, Cobalt, Nickel, Rare Earth Elements)

- By Mining Method:

- Surface Mining (Open Pit, Strip Mining)

- Underground Mining (Shaft Mining, Drift Mining)

- In-Situ Leaching

- By End-User Industry:

- Construction and Infrastructure

- Automotive (Internal Combustion Engine, Electric Vehicles)

- Electrical and Electronics (Power Grids, Consumer Devices, Batteries)

- Industrial Machinery and Equipment

- Aerospace and Defense

Value Chain Analysis For Mining metals Market

The Mining metals value chain is characterized by a high degree of integration, stretching from complex geological exploration (upstream) to final metal product manufacturing (downstream). The upstream segment begins with extensive exploration and feasibility studies, which are capital-intensive and high-risk activities, relying heavily on advanced geoscience technologies and substantial financial backing. This phase is followed by resource extraction (mining), where efficiency is paramount, determined by factors such as ore grade, strip ratio, and the adoption of mechanization and automation technologies. The subsequent step is ore processing, including crushing, grinding, flotation, and smelting/refining, where the metal is concentrated and purified to commercial-grade specifications. This processing stage often consumes vast amounts of energy and water and is the focus of intense environmental regulation.

The downstream segment primarily involves the physical distribution, trading, and primary manufacturing of the refined metals. Distribution channels are highly varied, ranging from long-term contracts directly with large industrial consumers (Direct) to sales through international commodity trading houses and exchanges like the London Metal Exchange (LME) or the Shanghai Futures Exchange (Indirect). Direct sales are increasingly favored by critical mineral producers to secure stable pricing and supply commitments from battery manufacturers. Manufacturing then converts the refined metal into semi-finished products (e.g., steel coils, copper wire rod, aluminum sheets) suitable for use in end-user industries like construction, automotive, and electronics.

A key trend in the value chain is the increasing vertical integration, particularly among companies involved in critical raw materials. Battery metal producers are moving downstream into precursor and cathode production to capture greater value and secure off-take agreements. Conversely, large end-users, especially EV manufacturers, are moving upstream through equity investments or joint ventures with mining companies to secure supply chain resilience and traceability. This shift is driven by the necessity to guarantee ESG-compliant, reliable supply, bypassing the volatility and opacity sometimes associated with traditional spot markets. The direct channel is becoming strategically vital for high-growth, technology-driven sectors.

Mining metals Market Potential Customers

The primary customers and end-users of the Mining metals Market span across fundamental global industries, categorized by their material consumption needs and the level of metal purity required. The largest volume consumers remain the Construction and Infrastructure sectors, heavily reliant on ferrous metals (steel) and base metals (aluminum, copper) for buildings, roads, and utilities. These buyers are typically sensitive to price stability and volume capacity, often securing supply through long-term contracts linked to global indices.

A rapidly growing segment of potential customers comprises the Automotive and Electronics manufacturers. The shift to electric vehicles means these customers require high-purity, battery-grade nickel, lithium, cobalt, and copper, where quality specifications are extremely rigorous and traceability (proving ethical sourcing) is mandatory. OEMs and Tier 1 suppliers in this space are moving beyond transactional relationships, seeking strategic partnerships with miners to co-invest in resource development and secure guaranteed volumes over periods exceeding five to ten years.

Other significant buyers include industrial fabricators, machinery manufacturers, and the aerospace and defense sectors, which require specialty metals and alloys with extreme performance characteristics (e.g., titanium, certain rare earth elements). Utility companies and power grid operators are also major consumers of copper and aluminum for expansion and modernization efforts related to renewable energy integration and grid stabilization. The focus for all potential customers is increasingly centered not just on the lowest price, but on supply chain resilience, verifiable low-carbon footprint, and adherence to stringent ESG standards throughout the entire mining and processing lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Billion |

| Market Forecast in 2033 | $1150 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BHP Group, Rio Tinto, Vale S.A., Glencore Plc, Freeport-McMoRan, Anglo American Plc, China Shenhua Energy Company, Southern Copper Corporation, Newmont Corporation, Barrick Gold Corporation, Teck Resources, First Quantum Minerals, Antofagasta Plc, Alcoa Corporation, Norilsk Nickel, Zijin Mining Group, Sibanye-Stillwater, Saudi Arabian Mining Company (Ma’aden), Sumitomo Metal Mining, Polymetal International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mining metals Market Key Technology Landscape

The technological landscape of the Mining metals Market is rapidly evolving, driven by the need to operate safer, more sustainably, and more efficiently amidst declining ore grades and environmental restrictions. Key technological adoption centers around achieving Level 5 automation, enabling remote and autonomous operation of haulage trucks, drill rigs, and underground loaders. This automation relies on sophisticated sensor technology, high-bandwidth industrial wireless networks (often 5G or high-capacity private LTE), and real-time integration with centralized control centers. The implementation of digital twins—virtual replicas of the entire mine site—allows operators to simulate scenarios, predict equipment failures, and optimize traffic flow and scheduling, significantly boosting productivity while reducing human presence in hazardous areas.

Furthermore, technology is revolutionizing the processing stage, moving toward less water-intensive and less energy-intensive methods. Advanced mineral processing techniques, such as coarse particle flotation, dry stack tailings, and novel separation technologies (like sensor-based ore sorting), are being deployed to reduce water usage, minimize the volume of waste generated, and improve the recovery rate of valuable minerals from increasingly complex ores. Biotechnological processes, including bioleaching, are also gaining traction for extracting metals from low-grade or refractory ores, offering a potentially more environmentally benign alternative to traditional smelting and hydrometallurgical routes, which are energy-intensive and produce significant emissions.

In the exploration phase, the integration of advanced data analytics, AI, and remote sensing (including hyperspectral imagery and drone surveys) is reducing the cost and geological uncertainty associated with new discoveries. This technological suite allows for quicker and more accurate mapping of subsurface deposits. Traceability technology, specifically the use of blockchain, is becoming crucial for establishing the provenance of critical raw materials, ensuring that metals used in high-tech supply chains are ethically sourced and meet strict regulatory standards concerning conflict minerals and environmental protection. Investment in these technologies is no longer optional but a competitive necessity for major mining organizations seeking to maintain cost advantage and secure their social license to operate.

Regional Highlights

Regional dynamics within the Mining metals Market are characterized by a clear division between primary resource suppliers and major manufacturing consumers, overlaid by strategic efforts in North America and Europe to secure independent, domestic supply chains for critical minerals.

- Asia Pacific (APAC): APAC is the epicenter of global metal consumption, driven primarily by China’s massive industrial output, infrastructure investment, and dominant position in electronics manufacturing and EV battery production. Countries like India and Southeast Asia are experiencing rapid urbanization, fueling steady demand for steel and base metals. China is also a major producer and refiner of rare earth elements and many specialty metals, holding significant influence over global processing capacity.

- North America: This region is focused heavily on securing its own supply of critical battery metals (lithium, copper, nickel). Government incentives, such as those provided in the Inflation Reduction Act (IRA) in the US, are driving massive investment in domestic exploration, mining, and, crucially, midstream processing facilities. North America is a major producer of copper, gold, and aluminum, and is characterized by high operational costs offset by stable geopolitical environments.

- Europe: Similar to North America, Europe is highly dependent on metal imports but is actively pursuing resource independence through the Critical Raw Materials Act (CRMA). The focus is on diversifying supply away from geopolitical risks, investing in advanced recycling (urban mining), and promoting sustainable, technologically advanced mining within the continent, particularly in Scandinavia and Eastern Europe, which hold significant deposits of base and battery metals.

- Latin America: Latin America remains a cornerstone of global metal supply, dominating production for copper (Chile, Peru), lithium (Chile, Argentina, Bolivia - the "Lithium Triangle"), and iron ore (Brazil). The region’s market relevance is enormous, but investments are subject to increasing resource nationalism, regulatory uncertainty, and social opposition, requiring extensive corporate responsibility efforts from miners operating there.

- Middle East and Africa (MEA): Africa is strategically crucial for cobalt (DRC), platinum group metals (South Africa), and bauxite/aluminum. The Middle East, particularly Saudi Arabia, is rapidly expanding its domestic mining sector (through entities like Ma’aden) to diversify its economy away from hydrocarbons, focusing on gold, phosphate, and bauxite, leveraging low energy costs for refining and smelting.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mining metals Market.- BHP Group

- Rio Tinto

- Vale S.A.

- Glencore Plc

- Freeport-McMoRan

- Anglo American Plc

- China Shenhua Energy Company

- Southern Copper Corporation

- Newmont Corporation

- Barrick Gold Corporation

- Teck Resources

- First Quantum Minerals

- Antofagasta Plc

- Alcoa Corporation

- Norilsk Nickel

- Zijin Mining Group

- Sibanye-Stillwater

- Saudi Arabian Mining Company (Ma’aden)

- Sumitomo Metal Mining

- Polymetal International

Frequently Asked Questions

Analyze common user questions about the Mining metals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major factors are driving the demand for critical minerals in the mining metals market?

The primary driver is the global energy transition, specifically the exponential growth in demand for electric vehicles (EVs), renewable energy infrastructure (solar and wind), and large-scale grid energy storage systems (ESS), all of which require substantial volumes of lithium, copper, nickel, and cobalt.

How is ESG compliance influencing investment decisions in the mining metals sector?

ESG compliance is now a prerequisite for accessing capital. Investors are prioritizing companies that demonstrate superior environmental performance, commitment to decarbonization, robust governance structures, and verifiable ethical sourcing practices (social license to operate), often resulting in a premium valuation for sustainable miners.

What role does technology play in mitigating the environmental impact of mining operations?

Technology, including advanced digitalization, AI-driven process optimization, and sensor-based ore sorting, helps mitigate environmental impact by increasing metal recovery rates, reducing energy and water consumption, minimizing waste rock generation, and enabling more efficient, targeted extraction processes.

Which geographic region holds the most significant influence over the critical raw materials supply chain?

Asia Pacific, particularly China, holds the most significant influence, primarily through its dominance in the refining and processing of critical raw materials (like rare earth elements and lithium), although key extraction sites remain concentrated in regions like Latin America and Africa.

What is the biggest restraint currently limiting supply growth in the mining metals market?

The most significant restraint is the combination of high capital intensity, protracted regulatory approval processes, and increasing challenges in obtaining social license to operate, which severely restricts the industry’s ability to bring new, high-volume production capacity online quickly enough to meet surging demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager