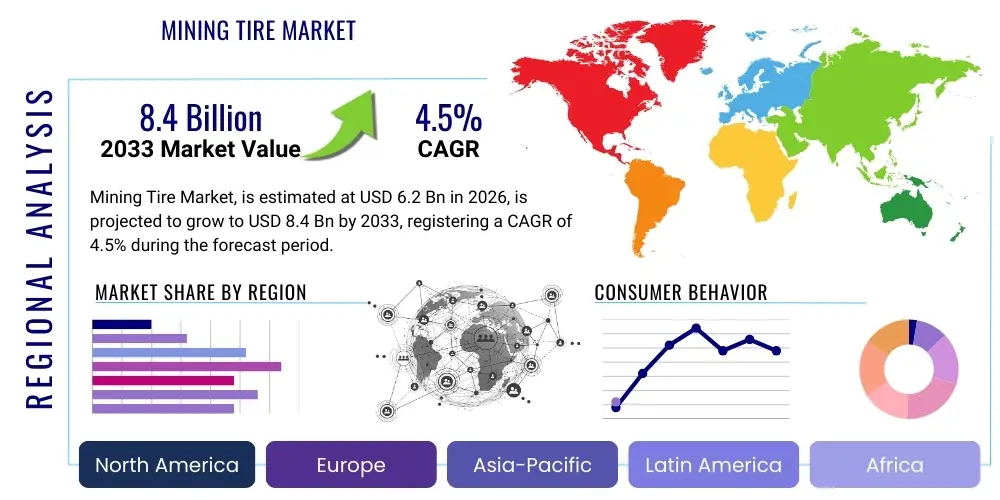

Mining Tire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436486 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Mining Tire Market Size

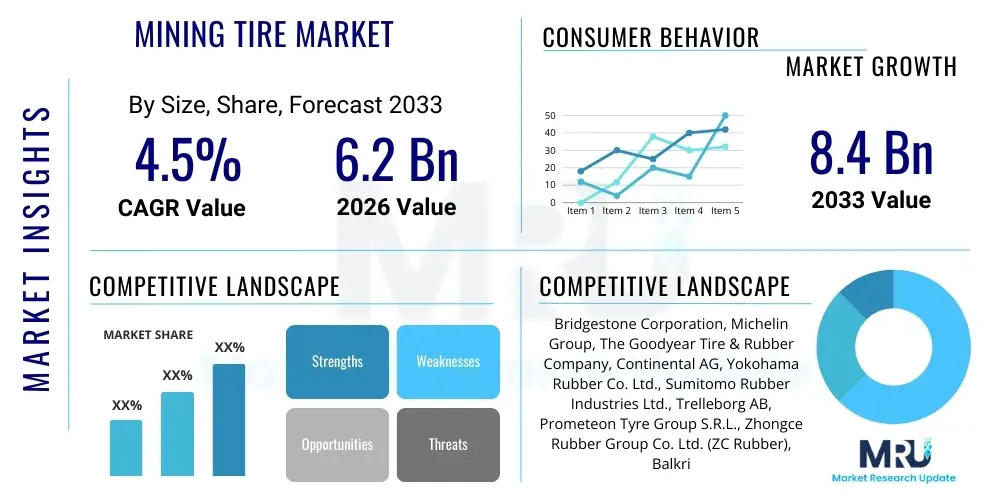

The Mining Tire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 8.4 Billion by the end of the forecast period in 2033.

The steady expansion of the mining sector globally, driven by the increasing demand for critical minerals such as copper, lithium, and rare earth elements necessary for the energy transition and technological advancements, is the primary accelerator for the robust growth projected in the mining tire segment. Furthermore, stringent safety regulations and the operational necessity for durable, high-performance tires that minimize downtime in harsh operating environments contribute significantly to market valuation. Investment cycles in new mining equipment fleets and the subsequent replacement cycles for Off-the-Road (OTR) tires are core economic factors underpinning this forecasted market size increase.

Market valuation growth is also heavily influenced by technological advancements in tire manufacturing, focusing on enhanced tread compounds, greater heat dissipation capabilities, and smart tire integration. These innovations translate into higher initial investment but deliver superior longevity and operational efficiency, thereby securing premium pricing and expanding the overall market size. Geographical concentration of large-scale mining operations, particularly in APAC and Latin America, dictates regional market dynamics, with procurement volumes directly correlating to commodity prices and infrastructure development pace.

Mining Tire Market introduction

The Mining Tire Market encompasses specialized, heavy-duty tires designed explicitly for vehicles utilized in surface and underground mining operations, including haul trucks, loaders, bulldozers, and graders. These tires are engineered to withstand extreme loads, severe abrasive conditions, high impact resistance, and fluctuating temperatures characteristic of mine sites. The product range spans various sizes, primarily categorized as giant radial or bias-ply Off-The-Road (OTR) tires, critical for maintaining operational continuity and safety in high-stress environments. Major applications involve transporting excavated raw materials and overburden, site preparation, and material handling within quarries and pits. The primary benefit derived from these specialized tires is the reduction in equipment downtime, improved fuel efficiency, and enhanced safety profile for personnel and assets. Key driving factors include escalating global mineral demand, increasing fleet utilization rates across major mining regions, and technological mandates for enhanced tire durability and lifecycle management.

The structural integrity and performance requirements for mining tires far exceed those of standard commercial tires, necessitating complex manufacturing processes and specialized materials, often featuring reinforced sidewalls and deep treads for traction on unstable terrain. The industry is witnessing a shift towards radial construction due to its superior heat resistance and fuel economy compared to traditional bias-ply tires, particularly for operations requiring long haul distances and high speeds. The introduction of advanced rubber compounds, frequently incorporating synthetic elastomers and sophisticated additives, is aimed at optimizing resistance to cuts, chips, and abrasive wear, which are perpetual challenges in aggressive mining settings. Market maturity varies regionally, with established markets focusing on replacement sales and emerging economies seeing growth driven by greenfield project development and modernization of existing fleets.

Moreover, the mining sector's persistent focus on lowering the Total Cost of Ownership (TCO) for equipment strongly influences tire procurement decisions. Tire performance, longevity, and reliable retreading potential are crucial metrics evaluated by mine operators. Regulatory pressures related to environmental sustainability and worker safety also play a foundational role, pushing manufacturers toward producing tires that offer better thermal management and are compatible with tire monitoring systems (TMS). This comprehensive focus on safety, efficiency, and sustainability defines the current state and future trajectory of the Mining Tire Market.

Mining Tire Market Executive Summary

The Mining Tire Market is characterized by robust business trends driven by high commodity prices and global infrastructural investment, particularly in Asia Pacific and Latin America. Key business dynamics include consolidation among major tire manufacturers seeking economies of scale and the rapid adoption of specialized tire management solutions (TMS) to optimize asset performance and reduce operational expenses. Regional trends show Asia Pacific dominating the market due to massive coal, iron ore, and base metal extraction activities in countries like China, India, and Australia. Latin America is also a significant growth hub, fueled by extensive copper and lithium mining necessary for electric vehicle battery supply chains. Conversely, mature markets like North America and Europe emphasize premium, technologically advanced tires focused heavily on maximizing retreadability and incorporating sophisticated sensor technology for predictive maintenance.

Segment trends highlight the dominance of the OEM segment in terms of technological specification, although the aftermarket (replacement) segment captures the majority of the market value and volume due to the necessity of continuous tire replacement cycles inherent to high-abrasion mining operations. By vehicle type, haul trucks require the largest volume of large OTR tires, representing the most significant value contribution to the market. Technological segmentation reveals a rapid transition toward radial tires over bias tires, especially for large-scale open-pit operations, reflecting the industry's continuous drive toward energy efficiency and reduced heat generation. The segmentation by tire size further reveals the high-value concentration in the 40-inch to 63-inch rim diameter categories, corresponding to the ultra-class and mega-class haul trucks.

Overall, the market landscape is intensely competitive, requiring players to invest heavily in R&D to deliver tires capable of higher load capacities and extended service life. Strategic emphasis is placed on developing comprehensive service packages that integrate tire supply with predictive maintenance, site surveys, and specialized tire handler training, creating sticky customer relationships. Economic uncertainty linked to fluctuating commodity markets remains a constant factor, necessitating agile supply chain management and pricing strategies to mitigate risks, while the long-term outlook remains positive due to the indispensable role of raw materials in the global energy transition narrative.

AI Impact Analysis on Mining Tire Market

User queries regarding the impact of Artificial Intelligence (AI) on the Mining Tire Market frequently revolve around optimizing tire lifespan, enabling predictive maintenance, and enhancing operational safety in autonomous mining environments. Users are particularly keen on understanding how AI-driven analytics, coupled with integrated tire sensors (Tire Pressure Monitoring Systems - TPMS), can transition maintenance strategies from reactive or scheduled events to genuine predictive interventions, minimizing unexpected tire failures which are costly downtime events. Key concerns include the accuracy and reliability of AI models in variable terrain and climate conditions, data security surrounding fleet performance metrics, and the practical implementation cost-benefit ratio for smaller mining operations. Expectations center on AI significantly extending tire usage life, potentially reducing annual replacement expenditure, and facilitating the optimal pairing of tire type to specific mine routes and payload requirements.

AI is increasingly being utilized to process massive datasets generated by OTR tire sensors, operational telematics, and environmental factors. By applying machine learning algorithms, tire wear patterns, heat buildup anomalies, and internal pressure fluctuations can be correlated with operational parameters (speed, load, distance, grade) to create high-fidelity wear models. These models inform dynamic operational adjustments and provide precise predictions of the Remaining Useful Life (RUL) of individual tires. This shift from aggregated data analysis to per-tire, real-time diagnostics fundamentally changes how maintenance departments manage their most expensive consumable asset. Consequently, the relationship between tire suppliers and mining companies evolves into a data-driven service partnership, ensuring maximum asset utilization and optimal safety standards.

Furthermore, in mines transitioning to autonomous operations, AI plays a critical role in integrating tire health information directly into the autonomous navigation system. For example, if an AI detects excessive tire stress or suboptimal pressure on a specific wheel, it can autonomously adjust vehicle speed, trajectory, or payload limits to prevent immediate failure and schedule a maintenance intervention during the next planned idle time. This level of real-time optimization not only maximizes tire investment but also significantly contributes to the broader objective of achieving fully optimized, 24/7 continuous operation in modern mining environments, ultimately driving demand for AI-compatible smart tires.

- AI enables real-time, predictive modeling of tire failure, significantly reducing unscheduled downtime.

- Integration of machine learning algorithms optimizes tire selection and configuration based on specific mine terrain and duty cycle.

- AI processes sensor data (TPMS, temperature) to recommend dynamic operational adjustments (speed, load) to maximize tire longevity.

- Enhances safety by integrating tire health into autonomous vehicle control systems, preventing high-speed blowouts.

- Facilitates optimized retreading strategies by accurately tracking casing health and cumulative stress history.

DRO & Impact Forces Of Mining Tire Market

The dynamics of the Mining Tire Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the impact forces determining market direction and growth velocity. Key drivers include the sustained global demand for critical minerals required for renewable energy technologies and electronics, which necessitates increased extraction activity and subsequent demand for OTR tires for haulage fleets. The mandatory replacement cycle—as tires have a limited operational lifespan in harsh environments—ensures continuous demand for replacement units, forming the backbone of market stability. Furthermore, technological advances, such as the preference for radial tires offering better fuel economy and enhanced durability, also drive market adoption and value. These drivers exert a strong positive impact, pushing the market toward higher valuation and volume.

Conversely, the market faces significant restraints. The highly volatile nature of global commodity prices directly affects miners' capital expenditure (CapEx) budgets; sudden price drops can halt or delay new fleet purchases and major replacement programs. The considerable cost of large OTR tires, which represents a substantial operational expense for mining companies, also acts as a restraint, prompting operators to seek extended life solutions and retreading services rather than immediate replacement. Environmental and labor regulations, particularly concerning mining permits and waste disposal of non-retreadable tires, impose restrictions and compliance costs. These restraining forces introduce periods of cyclical slowdown and pricing pressure on manufacturers, necessitating continuous cost management and efficiency gains.

Opportunities within the market lie primarily in the expansion of high-growth mining regions (e.g., Africa and Latin America), the shift toward sustainable and smart mining practices, and the development of specialized tire solutions for deep underground or extreme-weather environments. The increased focus on digitalization and the adoption of advanced Tire Management Systems (TMS) and AI-driven predictive maintenance offer substantial opportunities for service providers and smart tire manufacturers to capture premium value. The impact forces are generally positive over the long term, driven by indispensable mineral needs, but are subject to short-term cyclical volatility linked to macroeconomic factors and commodity market sentiment, demanding robust strategic planning from key market participants.

Segmentation Analysis

The Mining Tire Market is structurally segmented based on crucial dimensions including construction type, vehicle type, tire size, sales channel, and application (surface vs. underground). This multi-faceted segmentation allows for precise market sizing and strategic targeting, reflecting the varied operational requirements across the global mining industry. The segmentation by construction type—Bias vs. Radial—is the most fundamental, with Radial tires increasingly dominating higher-capacity segments due to their superior heat resistance and load-carrying capability, particularly favored in large open-pit operations. Analyzing these segments reveals shifting demand patterns driven by technological modernization and the necessity for improved Total Cost of Ownership (TCO) efficiency.

Segmentation by vehicle type, specifically the dominance of haul trucks and loaders, defines the highest value portions of the market, as these vehicles use the largest and most expensive OTR tires. The sales channel segmentation, comprising Original Equipment Manufacturers (OEMs) and the Aftermarket, highlights the critical difference between initial fleet outfitting and recurring maintenance expenditure. While OEM sales are linked to new capital investment cycles, the Aftermarket segment, driven by tire wear and replacement frequency, provides a steady, high-volume revenue stream crucial for long-term market stability. Geographic segmentation further differentiates needs, with high-abrasion resistance crucial in arid regions and extreme cold weather compounds necessary in Arctic mining operations.

Understanding these segments is essential for manufacturers tailoring their product portfolios and distribution strategies. For instance, focusing on the replacement market requires a robust service network and inventory management, whereas targeting OEM contracts demands competitive pricing and compliance with strict engineering specifications. The convergence of segment trends, such as the adoption of larger radial tires (57 inches and above) coupled with advanced sensor technology (a technology segment), underscores the industry’s push towards highly efficient, data-integrated heavy hauling solutions.

- By Construction Type: Radial, Bias

- By Vehicle Type: Dump Trucks (Haul Trucks), Loaders, Dozers and Graders, Others (Utility Vehicles, Service Trucks)

- By Tire Size (Rim Diameter): Less than 35 Inches, 35 to 49 Inches, 51 to 63 Inches, Above 63 Inches

- By Sales Channel: OEM (Original Equipment Manufacturer), Aftermarket (Replacement)

- By Application: Surface Mining (Open Pit), Underground Mining

Value Chain Analysis For Mining Tire Market

The value chain for the Mining Tire Market is complex and capital-intensive, starting with the upstream sourcing of raw materials, primarily natural rubber, synthetic rubber (elastomers), carbon black, steel cord, and specialized chemicals. The upstream segment is critical, as volatility in commodity prices (especially natural rubber and oil-derived synthetics) directly impacts manufacturing costs. Manufacturers often engage in vertical integration or long-term contracts to stabilize supply and quality. The subsequent manufacturing phase involves heavy investment in specialized molding and curing technologies necessary to produce the massive OTR tires, requiring high energy consumption and stringent quality control. This phase adds the most significant value through complex engineering and proprietary compound formulations that dictate tire performance and longevity.

The midstream section involves distribution, which is bifurcated into direct and indirect channels. Direct distribution is common for large OEM contracts and major replacement accounts, often involving sophisticated logistics to deliver oversized tires to remote mine sites. Indirect channels utilize specialized tire distributors and service partners, particularly in the aftermarket segment, who offer localized inventory, fitting services, and often retreading capabilities. The selection of distribution channel significantly affects market reach, service quality, and final cost to the end-user. Effective distribution networks are essential, given the bulk and weight of the product, requiring specialized handling and transport infrastructure.

The downstream segment centers on usage, maintenance, and end-of-life management. After tires are purchased and installed, intensive tire management systems (TMS) are deployed by mining operators to maximize tire life. Retreading services form a crucial part of the value chain here, extending the life of the expensive casing and reducing waste. Finally, the disposal or recycling of worn-out tires presents an environmental and logistical challenge, driving innovation in sustainable material recovery and pyrolysis techniques. The ultimate objective across the chain is minimizing the Total Cost of Ownership for the mining operator while adhering to increasingly strict environmental and safety standards.

Mining Tire Market Potential Customers

The primary potential customers and end-users of mining tires are global mining corporations and independent contractors engaged in the extraction of raw materials. These customers are broadly segmented by the type of mineral extracted and the scale of their operation. Major buyers include integrated global resource companies involved in iron ore, copper, gold, coal, and lithium mining, requiring vast fleets of heavy equipment and consequently large volumes of specialized OTR tires. Companies like Rio Tinto, BHP, Vale, and Freeport-McMoRan represent the highest tier of potential customers, characterized by long-term contracts, centralized procurement, and rigorous performance specifications demanding premium products and integrated tire management services.

A secondary, yet significant, customer base comprises regional mining companies and quarry operators focused on industrial minerals, aggregates, and construction materials. Although these companies typically operate smaller fleets, their demand for tires optimized for specific environments, often involving extreme rock abrasion or high-cycle operations, is consistent. These customers often rely heavily on local distributors and aftermarket service providers for both supply and maintenance expertise, prioritizing durability and immediate availability over the complex technology integration favored by the global giants.

Furthermore, Original Equipment Manufacturers (OEMs) of heavy mining machinery, such as Caterpillar, Komatsu, and Hitachi Construction Machinery, constitute an essential customer group. Although technically a sales channel, they are primary buyers of tires for equipping new vehicles leaving the factory floor, defining initial tire specifications and influencing future replacement market demand based on their initial selection. Ultimately, the purchasing decision is driven by maximizing operational uptime, minimizing exposure to unscheduled maintenance, and achieving the lowest cost per operating hour.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 8.4 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, Michelin Group, The Goodyear Tire & Rubber Company, Continental AG, Yokohama Rubber Co. Ltd., Sumitomo Rubber Industries Ltd., Trelleborg AB, Prometeon Tyre Group S.R.L., Zhongce Rubber Group Co. Ltd. (ZC Rubber), Balkrishna Industries Limited (BKT), Apollo Tyres Ltd., Titan International Inc., Camso (a Michelin subsidiary), Maxam Tire International S.A., Shandong Linglong Tyre Co. Ltd., Cheng Shin Rubber Ind. Co. Ltd. (Maxxis), Sailun Group Co. Ltd., JK Tyre & Industries Ltd., MRF Limited, Specialty Tires of America Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mining Tire Market Key Technology Landscape

The technology landscape in the Mining Tire Market is rapidly evolving, driven by the need for enhanced durability, efficiency, and integration within digital mining ecosystems. A primary technological focus is the continuous refinement of rubber compounding, moving beyond traditional materials to incorporate advanced synthetic polymers, novel fillers like high-dispersion silica, and specialized additives that drastically improve resistance to heat, cuts, and chips—the leading causes of OTR tire failure. Manufacturers are leveraging nanotechnology in compound design to optimize the molecular structure, thereby extending tire life even under extreme load and speed conditions. This innovation is crucial for ultra-class haul trucks operating in demanding open-pit environments where thermal degradation is a major concern. The trend towards larger radial tires (57 inches and above) is directly supported by these compounding breakthroughs, allowing for higher load indices without sacrificing safety or operational lifespan.

Another significant technological pillar is the pervasive integration of smart tire technology, fundamentally redefining tire management. This involves embedding sophisticated sensors, generally known as Tire Pressure Monitoring Systems (TPMS) or more comprehensive Tire Monitoring Systems (TMS), directly into the tire structure or on the rim. These systems provide real-time data on internal pressure, core temperature, and sometimes tread depth, transmitting this information wirelessly to central fleet management platforms. The use of robust, battery-less sensor technology, often powered by vibration or induction, is increasingly preferred to ensure longevity in harsh conditions. This data stream allows operators to identify and mitigate issues like underinflation or excessive heat buildup immediately, preventing catastrophic failure and enabling proactive maintenance scheduling, directly impacting the Cost Per Ton (CPT) metric.

Furthermore, advancements in manufacturing processes, particularly in automated winding and curing techniques, ensure uniformity and precision across the massive tire structures, which is paramount for safety and performance consistency. Retreading technology has also seen major improvements, utilizing advanced non-destructive inspection techniques (like shearography) to assess casing integrity accurately before retreading, ensuring the maximum number of lifecycles from the expensive tire carcass. These technological shifts are not merely product enhancements but represent a transition toward a data-centric service model where tire health is intrinsically linked to overall mine productivity and predictive logistics.

Regional Highlights

Regional dynamics play a crucial role in the Mining Tire Market, reflecting the distribution of mineral resources, maturity of mining operations, and regional economic growth cycles. Asia Pacific (APAC) stands as the dominant and fastest-growing region, driven by extensive mining activities in China, Australia, and India. Australia, a major exporter of iron ore, coal, and gold, possesses highly modernized, large-scale mining operations that necessitate continuous procurement of high-value, radial OTR tires for vast fleets of mega-class haul trucks. China and India, focusing heavily on coal and base metals to support massive domestic infrastructure development, generate immense demand for both OEM and aftermarket tire sales. The growth trajectory in APAC is further cemented by investments in crucial battery metals mining across the region.

Latin America is recognized as another high-potential region, primarily due to its significant reserves of copper (Chile, Peru) and lithium (Argentina, Chile, Bolivia). The extensive open-pit operations in the Andean regions require specialized tires capable of handling steep grades, high altitudes, and abrasive rock types. Investment in new projects, spurred by the global push for electrification and energy transition, guarantees sustained demand for mining tires. Countries such as Brazil, with robust iron ore and bauxite operations, also contribute substantially to regional market volume, often requiring tires optimized for wet and humid tropical conditions.

North America and Europe represent mature markets characterized by stringent safety regulations and a high adoption rate of advanced tire technologies. While the volume growth may be slower compared to APAC, the emphasis is heavily placed on premium, technologically integrated products, including smart tires and advanced retreading services, to achieve maximum operational efficiency and minimize environmental impact. The focus here is on value enhancement, sophisticated fleet management solutions, and adherence to high labor safety standards, demanding tires with superior performance reliability and compatibility with advanced vehicle telemetry systems.

- Asia Pacific (APAC): Dominates the market value and volume due to extensive iron ore, coal, and copper mining in Australia, China, and India; high growth rate fueled by new infrastructure projects and battery metal extraction.

- Latin America: Significant growth driver, anchored by massive copper and lithium operations in Chile and Peru; characterized by demand for tires suited for high altitude and steep gradient operations.

- North America: Mature market focused on high-technology adoption, emphasizing predictive maintenance, smart tires, and premium, long-lasting products for specialized mining (e.g., oil sands, gold).

- Europe: Smaller in extraction volume but high in value; characterized by demanding environmental standards and a preference for highly specialized tires for quarrying and niche underground mining operations.

- Middle East & Africa (MEA): Emerging growth market, particularly driven by diamond, platinum, and base metal mining in South Africa and high growth in mineral extraction across West Africa; logistical challenges require robust, easily maintainable tire solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mining Tire Market.- Bridgestone Corporation

- Michelin Group

- The Goodyear Tire & Rubber Company

- Continental AG

- Yokohama Rubber Co. Ltd.

- Sumitomo Rubber Industries Ltd.

- Trelleborg AB

- Prometeon Tyre Group S.R.L.

- Zhongce Rubber Group Co. Ltd. (ZC Rubber)

- Balkrishna Industries Limited (BKT)

- Apollo Tyres Ltd.

- Titan International Inc.

- Camso (a Michelin subsidiary)

- Maxam Tire International S.A.

- Shandong Linglong Tyre Co. Ltd.

- Cheng Shin Rubber Ind. Co. Ltd. (Maxxis)

- Sailun Group Co. Ltd.

- JK Tyre & Industries Ltd.

- MRF Limited

- Specialty Tires of America Inc.

Frequently Asked Questions

Analyze common user questions about the Mining Tire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors determine the service life of OTR mining tires?

The service life of Off-The-Road (OTR) mining tires is primarily determined by four critical factors: the heat generated during operation (influenced by speed and distance), load applied (tonnage carried), site conditions (abrasiveness of terrain and haul road quality), and proper tire management (correct inflation pressure and maintenance practices). Heat buildup and impact damage are the leading causes of premature failure, making thermal management and operational discipline essential for maximizing lifespan.

Why are radial tires increasingly preferred over bias-ply tires in large-scale mining operations?

Radial tires are preferred due to their superior structural design, which minimizes rolling resistance and heat generation compared to traditional bias-ply tires. Reduced heat buildup allows radial tires to handle heavier loads and operate at higher average speeds over long distances, resulting in better fuel efficiency, longer tire lifespan, and a significantly lower cost per hour of operation, critical metrics for large haul trucks.

How does smart tire technology impact operational costs in mining?

Smart tire technology, integrating sensors like TPMS, impacts operational costs by enabling predictive maintenance. By providing real-time data on pressure and temperature, these systems prevent unscheduled downtime due to sudden failure, optimize tire inflation for maximum lifespan, reduce fuel consumption through lower rolling resistance, and thereby lower the overall Total Cost of Ownership (TCO) for the fleet.

Which geographical region represents the highest growth potential for the Mining Tire Market?

Asia Pacific (APAC) represents the highest growth potential, largely driven by consistent, high-volume demand from large-scale mineral extraction operations in countries such as Australia, China, and India. The region benefits from ongoing infrastructure development, robust resource consumption, and significant investment in key minerals necessary for global technology supply chains, leading to high fleet utilization rates.

What is the role of retreading services within the mining tire value chain?

Retreading services play a pivotal role in the mining tire value chain by extending the operational life of expensive tire casings, which can constitute up to 80% of the tire's initial cost. By safely applying new tread rubber to a verified, sound casing, retreading significantly reduces material waste, lowers replacement expenditure for mine operators, and contributes to sustainability efforts by delaying the need for new tire production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager