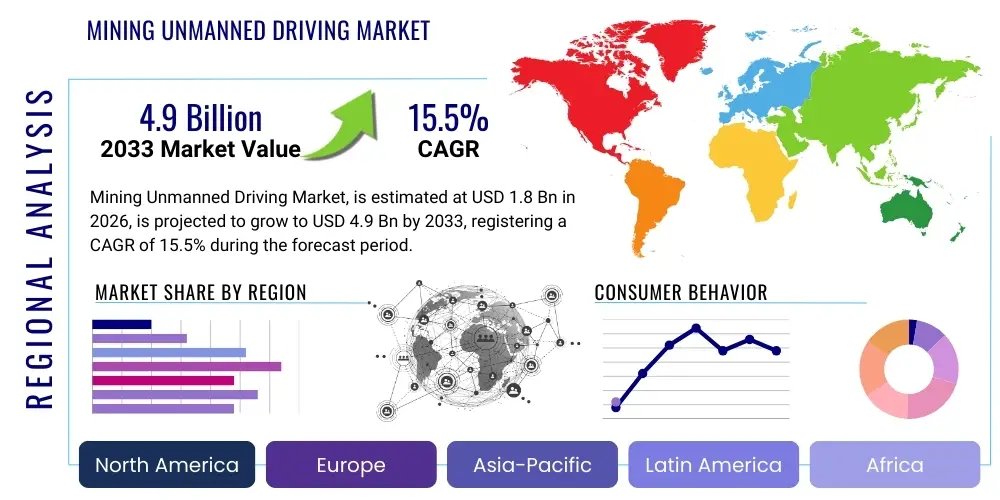

Mining Unmanned Driving Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435039 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Mining Unmanned Driving Market Size

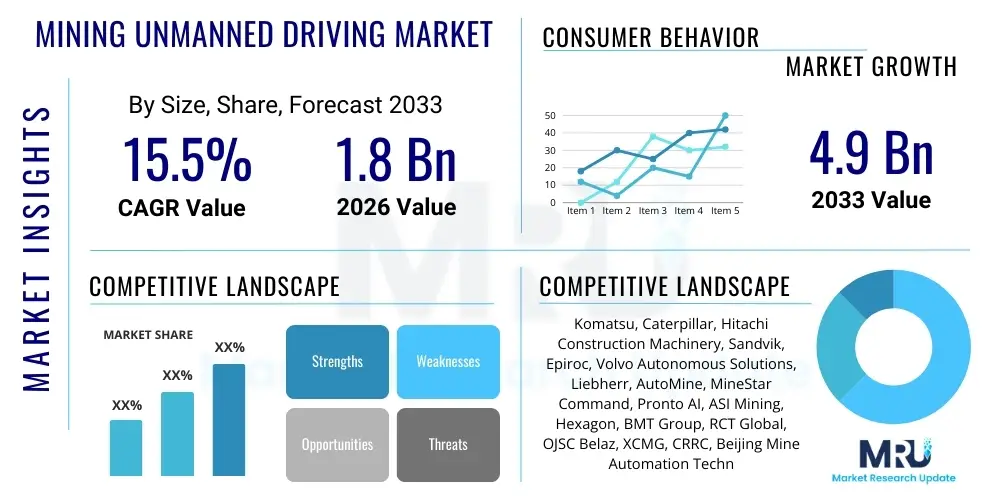

The Mining Unmanned Driving Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Mining Unmanned Driving Market introduction

The Mining Unmanned Driving Market defines the ecosystem of technologies, hardware, software, and services dedicated to eliminating the need for human operators inside heavy mining machinery. This technological paradigm shift is not merely an automation effort but a comprehensive restructuring of operational logistics, risk management, and throughput capacity in resource extraction industries globally. These systems utilize a complex layered architecture comprising robust sensing technologies (LiDAR, Radar, high-definition cameras), high-precision localization systems (RTK-GPS, inertial navigation), powerful onboard computing units capable of executing real-time AI algorithms, and secure, low-latency communication networks (private LTE/5G). The primary goal is to enable equipment—ranging from massive haul trucks capable of carrying hundreds of tons of material to precision drilling rigs—to navigate, execute tasks, and interact safely within dynamic environments autonomously, ensuring continuous, optimized performance regardless of weather or shift cycle limitations.

The product offerings within this dynamic market are increasingly sophisticated, moving beyond simple programmed routes to cognitive automation where vehicles can make complex, adaptive decisions. Key technologies include Autonomous Haulage Systems (AHS), which manage traffic flow and material transport logistics; Autonomous Drilling Systems (ADS), which ensure hole placement accuracy and optimize blasting patterns; and Automated Loading systems, which synchronize dig cycles with truck arrivals to minimize queuing and idle time. The applications are vital across both open-pit environments, where vehicle scale and fleet management are critical, and underground mines, where localization, ventilation, and proximity detection are paramount safety concerns. The integration of these systems necessitates significant investment in digital infrastructure, including dedicated control centers and robust data analytics platforms capable of processing petabytes of operational data generated by autonomous fleets daily.

The fundamental benefits driving accelerated market penetration are multifaceted. Foremost is the undeniable improvement in safety; by removing humans from the direct line of fire—eliminating risks associated with fatigue, remote terrain travel, and exposure to hazardous air quality or unstable rock formations—mining companies meet stringent compliance standards and protect human capital. Economically, autonomous operations deliver enhanced utilization rates (often exceeding 95%), predictable and reduced wear-and-tear leading to extended equipment lifespan, and optimized fuel efficiency achieved through consistent, algorithm-driven driving patterns. The continuous pressure from investors and regulators regarding ESG (Environmental, Social, and Governance) performance further incentivizes adoption, as autonomous electric vehicles and optimized logistics contribute significantly to lowering the carbon footprint and improving resource stewardship, solidifying the market's long-term sustainability and growth trajectory.

Mining Unmanned Driving Market Executive Summary

The global Mining Unmanned Driving Market is experiencing a pivotal transition from initial pilot projects and limited fleet deployment to large-scale commercialization across core mining regions. Current business trends highlight strong collaboration and strategic consolidation between traditional Original Equipment Manufacturers (OEMs) like Komatsu and Caterpillar and specialized software/AI firms like Hexagon and ASI Mining. This convergence aims to deliver fully integrated, end-to-end autonomous ecosystems rather than disparate components. Financing models are shifting favorably, with R-as-a-Service (RaaS) models gaining traction, effectively converting high upfront capital expenditures into predictable operational expenses, making advanced autonomy accessible to a wider pool of mid-tier mining clients and accelerating deployment cycles globally. Furthermore, the focus on interoperability—ensuring different vendors’ equipment can communicate and operate seamlessly on a single platform—is becoming a competitive necessity.

Regional dynamics illustrate divergent but equally important growth pathways. Asia Pacific maintains its volume leadership, fueled by large-scale, high-tonnage open-pit operations in iron ore (Australia) where autonomous fleets are mature and highly utilized. However, North America and Europe are setting the pace for advanced technological integration, particularly in underground mining where sophisticated SLAM and inertial navigation systems are deployed. This regional focus on complexity addresses unique geological challenges and stringent environmental regulations common in Canadian and Northern European markets. Latin America is characterized by robust investment in copper and lithium extraction, representing a crucial frontier for greenfield autonomous mine deployment, often directly leveraging mature Australian and North American operational blueprints to leapfrog development stages.

Segmentation analysis underscores the evolving technological hierarchy. While the Hardware segment (sensors, compute units) holds the largest immediate revenue base, the fastest growth is observed in the Software and Services segment. This includes AI-driven optimization algorithms, predictive maintenance platforms, and specialized systems integration services. By application, Autonomous Haulage (AHS) remains foundational, driving overall market volume, yet Autonomous Drilling and Loading are the emerging segments, crucial for realizing the vision of a fully autonomous mine site, thereby ensuring higher value capture per ton extracted. The overall trend indicates that market competition is moving away from the vehicle itself and shifting towards superior software intelligence, system resilience, and data utilization capabilities.

AI Impact Analysis on Mining Unmanned Driving Market

The penetration of Artificial Intelligence is transforming autonomous mining from simple programmed automation into cognitive operation systems. User inquiries frequently probe the extent to which AI can guarantee safety and reliability in highly variable conditions. Key questions include: "How effective is deep learning in distinguishing subtle geological shifts from operational hazards?", "Can AI models learn optimal driving behaviors faster than human training?", and "What infrastructure is required to support real-time data flow for AI decision-making?". The user community expects AI to solve the 'edge case' problem—the unpredictable, non-standard event that traditional automation struggles with—thereby unlocking full operational autonomy (Level 5) and achieving unprecedented levels of efficiency, particularly concerning fleet resource allocation and predictive asset health monitoring.

In practice, AI algorithms are fundamental to the perception stack. Machine learning (ML) models are trained on vast datasets of real-world mining conditions to perform highly accurate object detection and environmental classification under challenging circumstances such as extreme dust, blinding sunlight, or heavy rain. This sophistication allows autonomous vehicles to safely interact with dynamic elements, including manually operated light vehicles or personnel, distinguishing them rapidly and reliably. Beyond perception, Reinforcement Learning (RL) is being applied to operational strategy. RL agents learn through trial-and-error in simulation to optimize complex tasks, such as minimizing fuel consumption across variable haul gradients or efficiently managing traffic flow bottlenecks at loading and dumping sites, achieving efficiencies that surpass heuristic human planning or fixed programming schedules.

The strategic deployment of AI also heavily influences maintenance practices. Predictive analytics, utilizing ML models, ingest data points from thousands of sensors embedded in engines, transmissions, and tires to forecast component failure probabilities with high accuracy. This capability transitions maintenance from reactive or scheduled interventions to condition-based and proactive services, minimizing costly unscheduled downtime, which is magnified in a 24/7 autonomous operation. Furthermore, AI is crucial for cyber resilience, monitoring network traffic and behavioral patterns to detect and mitigate unauthorized access or malicious activities, securing the proprietary operational data and critical control systems against increasingly sophisticated digital threats, thus ensuring system integrity and continuity of production.

- AI-enhanced Sensor Fusion: Improves object detection and classification accuracy in harsh operating conditions (dust, vibration). Enhances the system's ability to interpret conflicting sensor inputs for higher navigational confidence.

- Predictive Maintenance: Machine learning models analyze operational data (vibration, temperature, fluid quality) to forecast component failures, drastically reducing unplanned downtime and optimizing maintenance scheduling intervals.

- Dynamic Route Optimization: Uses real-time traffic, terrain, and weather data in conjunction with deep learning models to calculate the most efficient, safest, and lowest-wear haul routes and cycle times on a continuous basis.

- Cognitive Decision Making: Allows vehicles to autonomously react to complex, non-standard events (e.g., unexpected rock fall, debris on road) based on learned patterns and simulated responses, moving beyond simple programmed logic.

- Data Security: Employs AI for anomaly detection to protect proprietary operational data and critical infrastructure from cyber threats, ensuring system integrity and regulatory compliance.

- Simulation and Training: Generative AI creates high-fidelity virtual environments for rapid model testing, validation, and training of autonomous algorithms against millions of potential edge cases prior to field deployment.

- Grade and Material Recognition: Uses advanced computer vision to instantaneously classify material being loaded or hauled, ensuring optimal processing and reducing errors in material blending.

DRO & Impact Forces Of Mining Unmanned Driving Market

The trajectory of the Mining Unmanned Driving Market is defined by a dynamic interplay between compelling economic incentives and significant technical hurdles. The dominant forces accelerating adoption are global stringent safety regulations and the undeniable economic efficiency derived from continuous, optimized operations. These drivers strongly outweigh the fundamental restraints, which primarily revolve around the colossal initial financial investment necessary for full fleet conversion and the inherent difficulties in integrating cutting-edge digital systems with vast, often decades-old brownfield mining infrastructure. The market's forward momentum is secured by emerging opportunities in deep underground applications and the ongoing maturation of low-cost, high-reliability sensor technology, promising substantial market democratization over the forecast period.

Drivers are centrally focused on productivity and personnel protection. The economic model favoring automation demonstrates clear gains: a 24/7 operational capability, reduction in vehicle damage due to standardized, optimized driving profiles, and lowered energy consumption. The diminishing availability of skilled labor willing to work in remote or high-risk environments further pushes organizations toward reliable robotic solutions. Furthermore, global commodity market volatility necessitates that mining organizations maintain the lowest possible cost per ton extracted to remain profitable, a goal directly facilitated by autonomous operational efficiency. The success stories from flagship autonomous mines, which showcase substantial operational cost reductions (often 15-20% lower than traditional methods), serve as powerful blueprints for industry-wide adoption, creating a competitive pressure to automate.

Restraints are complex and deeply rooted in the industry structure. The single largest impediment is the sheer financial barrier to entry, encompassing not just equipment purchases or retrofits but also the necessary high-speed network infrastructure and the dedicated control center facilities. Technical restraints include the pervasive challenge of ensuring functional safety in mixed-mode operations (where manned and unmanned vehicles co-exist) and managing system resilience against environmental extremes and cyberattacks. Regulatory ambiguity across different jurisdictions regarding the liability and operational standards for autonomous heavy equipment also creates a cautious environment for full-scale global deployment, requiring customized compliance strategies for each country of operation.

Opportunities are concentrated on geographical expansion and technological standardization. Greenfield mine developments offer ideal conditions for designing fully autonomous infrastructure from the outset, eliminating legacy integration problems. The development of vendor-agnostic, open-standard platforms (such as ISO 21815) promises to dramatically reduce complexity and CapEx by allowing interoperability among different equipment providers, thus fostering greater competition and customization. The rapid advancement and cost reduction of enabling technologies—particularly high-resolution solid-state LiDAR and enhanced edge computing capacity—are broadening the application scope to smaller operators and more complex environments, notably deep underground and complex mineral extraction where specialized automation provides the only viable path to resource recovery. These positive technological impacts significantly amplify the overall market size potential.

Segmentation Analysis

A granular understanding of the Mining Unmanned Driving Market requires careful analysis across its defining segments, illustrating where value is currently realized and where future investment is accelerating. The segmentation by component reveals the ongoing pivot in the competitive landscape: while the physical hardware elements (vehicles and sensors) represent the bulk of the initial investment and market revenue, the critical differentiator and highest growth rate reside within the Software and Services segments. This shift reflects the commoditization of physical components versus the increasing specialization and recurring value derived from proprietary fleet optimization algorithms, predictive maintenance subscriptions, and sophisticated systems integration consulting services necessary for successful deployment.

In terms of application, the market is structurally dependent on the Autonomous Haulage Systems (AHS) segment, which commands the largest volume due to its successful implementation in large open-pit iron ore and copper mines over the last decade. However, the future growth narrative is driven by the Autonomous Drilling Systems (ADS) and Loading/Excavation segments. Optimization in these upstream activities provides crucial data and precision necessary for seamless downstream AHS operation, ensuring maximum value across the entire mining cycle. The move towards fully integrated, pit-to-port autonomous solutions is the defining trend for major players aiming to lock in client ecosystems through comprehensive application offerings.

The segmentation by mine type confirms that Open Pit mining remains the most accessible and largest revenue segment due to simpler topography and established technological frameworks (primarily GPS reliance). Conversely, the Underground Mine segment, while smaller in absolute value, is the high-growth area, driven by continuous innovation in GNSS-denied localization technologies (SLAM, inertia-based navigation). The inherent risks and operational complexities of underground environments make automation an essential requirement, not just an economic optimization, pushing technology developers to focus on ruggedized, highly precise solutions adapted for confined spaces and high-vibration conditions, signifying premium market potential in this niche.

- By Component: Hardware (Sensors, GPS, Computing Units, Retrofit Kits), Software (Fleet Management Systems, Optimization Algorithms, Simulation Tools, Remote Control Interfaces), Services (Maintenance, Technical Support, Training, System Integration and Consulting, Robotics-as-a-Service).

- By Application: Autonomous Haulage Systems (AHS) (Material Transport), Autonomous Drilling Systems (ADS) (Precision Blasting Hole Creation), Autonomous Excavation and Loading (Shovel Automation, Synchronization with AHS), Support Vehicle Automation (Light Vehicle Control, Personnel Transport).

- By Mine Type: Open Pit Mines (High volume, simpler environment), Underground Mines (High complexity, GNSS-denied environments, high safety criticality).

- By Technology: GPS/GNSS (RTK and Differential GPS), LiDAR (3D mapping, obstacle avoidance), Radar (Weather resilience, range finding), Sensor Fusion (Integrating multiple sensor inputs for reliability), Communication Systems (Private 4G/LTE, 5G, Wi-Fi mesh networks).

- By Autonomy Level: Semi-Autonomous (Operator supervision required, assistance systems), Fully Autonomous (Level 4/5, unsupervised operation within defined boundaries).

Value Chain Analysis For Mining Unmanned Driving Market

The complexity of the Mining Unmanned Driving value chain necessitates deep, specialized collaborations starting at the upstream component level. Upstream suppliers are heavily focused on producing rugged, high-reliability components essential for system survival in harsh operational environments. This includes specialized semiconductor manufacturers for high-performance computing units capable of executing complex AI models at the edge, and suppliers of industrial-grade sensing technologies such as specialized LiDAR units built to withstand extreme temperatures and vibration. The R&D efforts at this stage are crucial, concentrating on miniaturization, power efficiency, and increasing the Mean Time Between Failures (MTBF) for safety-critical hardware, laying the foundation for system resilience and accuracy.

The midstream section is the integration and manufacturing hub, dominated by two primary groups: established mining Original Equipment Manufacturers (OEMs) like Caterpillar and Komatsu, and dedicated autonomy specialists (e.g., ASI Mining, Epiroc). OEMs integrate autonomous capabilities directly into new vehicles (often termed "Autonomy Ready"), while specialists often provide highly sophisticated retrofit kits that enable brownfield sites to upgrade existing fleets. This stage involves sophisticated software development, including the proprietary operating system and safety stack that manages sensor data fusion and vehicle control. The trend here is moving toward open architecture integration platforms that allow mining companies to leverage best-in-class components, reducing dependence on a single vendor ecosystem for the entire fleet.

Downstream activities are highly service-intensive. Given the custom nature of mine sites, success hinges on system integration, commissioning, and continuous operational support. Distribution is predominantly direct, allowing OEMs and autonomy providers to manage complex contracting, tailored deployment, and ongoing technical support, often facilitated through dedicated, on-site control room personnel or remote operational centers. Post-implementation services, including software updates, calibration, performance optimization consulting, and comprehensive training for mine supervisors and maintenance staff, constitute a recurring, high-margin revenue stream. The transition to RaaS models further cements the long-term relationship between provider and customer, ensuring continuous platform improvement and maximum asset utilization through specialized service agreements.

Mining Unmanned Driving Market Potential Customers

The core customer base for sophisticated unmanned driving solutions consists of major global mining houses, classified as Tier 1 organizations, which manage massive, multi-billion dollar operations globally. These companies (e.g., Rio Tinto, Vale, FMG) primarily operate in high-tonnage commodities such as iron ore and copper, where the sheer volume of material moved provides an immediate and verifiable return on investment for large-scale autonomous fleets. These customers possess the necessary financial capability and organizational maturity to absorb the change management and technological complexity associated with implementing full-scale autonomy, focusing intensely on reducing OpEx per unit of production and achieving world-class safety records to satisfy institutional investors and regulatory bodies.

The accelerating market maturation is broadening the customer horizon to include Tier 2 and mid-sized mining operators, who increasingly face competitive pressures similar to the majors but lack the deep capital pools for upfront investment. These customers are highly sensitive to flexible financing options, driving the demand for leasing, RaaS, and phased implementation strategies, often starting with a smaller fleet or targeting a single, high-risk application like autonomous drilling. These operators frequently seek simplified, scalable solutions that promise rapid integration with existing infrastructure and require minimal bespoke development, preferring off-the-shelf and standardized technological packages that ensure a faster path to operational gains.

Furthermore, specialized segments represent crucial, high-growth customer clusters. This includes companies focused on underground metallic and non-metallic mineral extraction (e.g., gold, platinum, potash), where automation is essential due to extreme depth, limited ventilation, and high rock fall risks. For these customers, particularly in jurisdictions like South Africa and Northern Europe, autonomy guarantees access to reserves that would otherwise be economically or safely inaccessible. Additionally, government entities and state-owned enterprises involved in strategic resource exploitation, particularly in developing economies, represent a significant customer group driven by national modernization goals and the mandate to improve the safety profile of their workforce, often initiating large, state-backed pilot programs to test and deploy the technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Komatsu, Caterpillar, Hitachi Construction Machinery, Sandvik, Epiroc, Volvo Autonomous Solutions, Liebherr, AutoMine, MineStar Command, Pronto AI, ASI Mining, Hexagon, BMT Group, RCT Global, OJSC Belaz, XCMG, CRRC, Beijing Mine Automation Technology, Huawei, Rockwell Automation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mining Unmanned Driving Market Key Technology Landscape

The underlying technological infrastructure of autonomous mining is defined by extreme precision, redundancy, and resilience against environmental degradation. The critical foundation is the highly accurate localization system, typically achieved through Real-Time Kinematic (RTK) Global Navigation Satellite Systems (GNSS) providing sub-centimeter accuracy, essential for tight path planning and avoidance maneuvers. This is always fused with Inertial Measurement Units (IMUs) and odometry data, ensuring the vehicle maintains precise positioning even when satellite signals are momentarily lost, such as in tunnel entrances or under heavy cloud cover. The robustness of this fusion is the primary determinant of system safety and functional reliability in dynamic, operational environments.

Perception technology relies on a multi-modal approach to overcome the limitations of any single sensor type in harsh mining conditions. LiDAR sensors are paramount for generating high-resolution 3D point clouds for accurate mapping and sophisticated obstacle avoidance. Radar provides complementary strength, offering reliable range and velocity measurements that penetrate dust, fog, and rain, which often degrade LiDAR and camera performance. High-definition camera systems, powered by deep learning computer vision algorithms, provide contextual awareness and critical object classification (e.g., distinguishing a rock pile from a human). The complex task of combining this voluminous, disparate data into a single, cohesive, and real-time operational picture requires immense computational power provided by ruggedized, edge-computing platforms integrated directly onto the heavy machinery.

Connectivity is the central nervous system of the autonomous fleet. The shift towards standardized, high-throughput communication technologies, specifically private 4G/LTE and 5G networks, is a crucial enabler. These networks offer the low latency and massive capacity required for real-time sensor data transmission, remote monitoring, immediate execution of emergency commands, and over-the-air software updates across large operational areas. Furthermore, the technological landscape is increasingly governed by functional safety standards (derived from ISO 26262 and adapted for off-road machinery), dictating stringent requirements for system architecture, hardware redundancy, and software verification, ensuring that failures are immediately detected and mitigated without compromising safety. Continuous technological innovation focuses on developing more affordable solid-state sensor solutions and enhancing AI models for robust performance in previously challenging mixed-mode traffic scenarios.

Regional Highlights

Global market dominance in deployment volume resides with Asia Pacific (APAC), primarily driven by Australia’s advanced iron ore sector, which boasts some of the world's most mature and largest autonomous haulage fleets managed by industry giants like Rio Tinto and BHP. Australian success is attributed to its vast open-pit operations and the high cost of skilled labor, which provided an early and powerful economic incentive for automation. Simultaneously, China is rapidly emerging as a technological powerhouse, spurred by governmental "smart mining" initiatives and significant domestic investment, primarily focusing on automating its vast coal and metal mining operations to meet escalating safety and environmental standards, often leveraging homegrown technology solutions.

North America and Europe, while possessing smaller material volumes than APAC, are critical drivers of technological complexity and high-value solutions. North America (Canada and the US) is distinguished by intense focus on specialized underground mining automation in challenging deposits, utilizing highly advanced navigation technology that does not rely on GPS. This market segment demands sophisticated automation systems tailored for complex geological structures and stringent regulatory environments. European markets, led by nations like Sweden and Finland (homes to Sandvik and Epiroc), serve as innovation hubs, focusing on the development of highly customized, safety-certified automation for deep mining and niche applications, often setting global functional safety benchmarks.

Latin America (LATAM) represents the most significant region for future market acceleration. Countries like Chile and Peru, major global suppliers of copper, are undergoing rapid digital transformation. The operational characteristics of these mines—high altitude, remote locations, and massive scale—are highly conducive to autonomous operations, promising high throughput gains. Initial multi-billion dollar deployments of autonomous fleets are accelerating across the region, transitioning LATAM from an early adopter to a key center for autonomous mining deployment, often utilizing technology and operational blueprints perfected in Australia. The Middle East and Africa (MEA) are emerging, with initial project focus primarily in key resource-rich nations (South Africa, Saudi Arabia) aiming to modernize state-controlled operations for enhanced efficiency and resource security, leveraging automation to overcome remote operational challenges.

- Asia Pacific (APAC): Largest market share; pioneering autonomous deployment in open-pit iron ore (Australia) and rapid governmental-backed automation in coal and non-ferrous metals (China). Key strategic focus on high-volume material movement.

- North America: Leader in technological complexity; specialized focus on autonomous drilling and loading in high-cost, underground metallic mining environments (US, Canada). High regulatory safety standards drive demand for advanced systems.

- Latin America (LATAM): Fastest projected growth; major transition to autonomous fleets in Chilean and Peruvian copper mines, leveraging autonomy to overcome operational challenges associated with high altitude and scale.

- Europe: Innovation epicenter for deep mining and functional safety; development of specialized underground navigation systems and vendor-agnostic interoperability standards (Nordic countries).

- Middle East and Africa (MEA): Emerging market; initial adoption focused on state-backed, large-scale resource projects seeking modernization, improved safety profiles, and long-term operational sustainability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mining Unmanned Driving Market.- Komatsu

- Caterpillar

- Hitachi Construction Machinery

- Sandvik

- Epiroc

- Volvo Autonomous Solutions

- Liebherr

- AutoMine (Sandvik)

- MineStar Command (Caterpillar)

- Pronto AI

- ASI Mining

- Hexagon

- BMT Group

- RCT Global

- OJSC Belaz

- XCMG

- CRRC

- Beijing Mine Automation Technology

- Huawei

- Rockwell Automation

- Siemens (Specific Mining Solutions)

- Trimble (Integrated Systems)

- P&H Mining (Komatsu)

- Wabtec Corporation (Rail Haulage Automation)

Frequently Asked Questions

Analyze common user questions about the Mining Unmanned Driving market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of unmanned driving systems in mining?

The primary factor driving adoption is the critical need to enhance worker safety by removing personnel from hazardous operational areas, followed closely by the ability of autonomous systems to achieve 24/7 consistent operation, significantly boosting productivity and lowering long-term operating costs (OpEx). Safety compliance is the non-negotiable strategic imperative.

How does connectivity impact the performance of autonomous mining fleets?

Reliable, low-latency connectivity, typically provided by dedicated private LTE or 5G networks, is essential for real-time fleet management, control, and communication between autonomous vehicles and the central control center. Poor connectivity can lead to operational stoppages, data loss, and safety risks, making robust network infrastructure a prerequisite for functional safety and continuous deployment.

Which mining application segment currently holds the largest market share?

Autonomous Haulage Systems (AHS) currently dominate the market share. AHS technology is the most mature and offers the clearest return on investment in large-scale open-pit operations due to the high volume of material movement involved and the consistency autonomous systems bring to the hauling cycle, maximizing utilization rates.

What are the main technical challenges for autonomous operations in underground mines?

The main technical challenges in underground mining are the lack of consistent Global Positioning System (GPS) signals and the confined, dynamic nature of tunnel environments. This requires specialized localization technologies such as SLAM (Simultaneous Localization and Mapping), inertial navigation, and advanced LiDAR systems for accurate navigation and dynamic obstacle detection.

Is the Mining Unmanned Driving Market suitable for small and mid-sized mining operations?

Historically, the high CapEx limited adoption to large enterprises. However, the introduction of modular retrofit kits, coupled with flexible pay-per-use models like Robotics-as-a-Service (RaaS), is making unmanned driving solutions increasingly accessible and financially viable for small and mid-sized mining operations, enabling phased implementation and reducing the barrier to entry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager