Mint Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436858 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Mint Powder Market Size

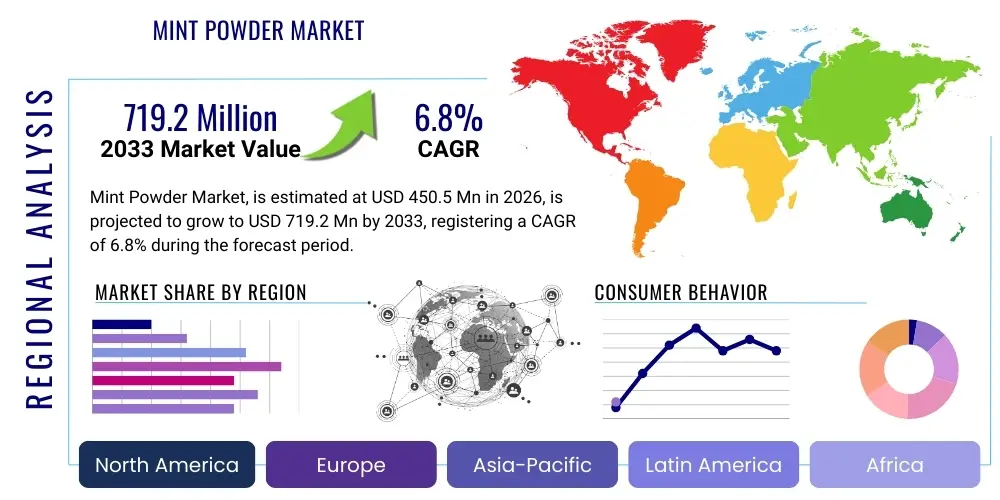

The Mint Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 719.2 Million by the end of the forecast period in 2033.

Mint Powder Market Introduction

The Mint Powder Market encompasses the global trade and consumption of dried and meticulously pulverized leaves derived predominantly from the genus Mentha, including commercially significant species such as Mentha piperita (peppermint) and Mentha spicata (spearmint). This specialized segment of the botanical ingredients market is undergoing rapid transformation, fueled by shifting global consumer preferences favoring natural, highly concentrated, and versatile flavoring agents. Mint powder differentiates itself from mint essential oils and extracts by offering fiber content and maintaining a more holistic profile of the plant's constituents, making it highly desirable for clean-label formulation strategies across industrial applications. The inherent advantages of mint powder—including its extended shelf-stability, ease of storage compared to fresh leaves, and consistent year-round availability—make it a critical input for multinational food and pharmaceutical corporations seeking reliable supply chains. The market expansion is closely tied to advancements in drying technologies that minimize the loss of volatile compounds, thereby preserving the distinct aromatic and therapeutic qualities essential for high-grade products.

The product description highlights its multifunctional utility, serving not merely as a flavorant but also as a natural colorant and a functional ingredient. In the Food & Beverages sector, mint powder is indispensable in producing high-quality chewing gums, specialty confectionery, natural herbal teas, and a burgeoning segment of savory snacks and seasonings, where it imparts characteristic refreshing and digestive attributes. The Pharmaceutical industry relies on mint powder derivatives, often standardized for menthol content, to formulate gastrointestinal relief remedies, cough suppressants, and various herbal dietary supplements targeting proactive health maintenance. The move towards preventive healthcare globally has amplified the demand for botanical ingredients with proven efficacy, positioning mint powder as a core component in the rapidly expanding nutraceutical landscape. Manufacturers are increasingly focused on achieving specific particle size distribution to optimize functionality, such as enhanced solubility in beverage applications or improved mouthfeel in food matrices, ensuring seamless integration into complex industrial formulations.

The primary driving forces accelerating market growth include the robust global consumer trend emphasizing wellness and the substitution of synthetic flavors with botanical extracts. Growing evidence supporting the digestive, antioxidant, and anti-microbial benefits of mint powder further validates its inclusion in functional products. Furthermore, strategic standardization efforts by major ingredient manufacturers, ensuring consistent active component levels, have fostered greater confidence among industrial buyers regarding product quality and regulatory compliance. The demand is also positively impacted by the expanding market for specialized, lifestyle-focused food products, such as those catering to vegan, gluten-free, or specific ethnic dietary requirements, where natural and potent flavoring is paramount. Emerging economies, particularly in Asia, are simultaneously witnessing a rise in packaged food consumption coupled with a cultural affinity for herbal remedies, establishing them as pivotal growth hubs for mint powder consumption and sustaining high demand projections throughout the forecast period due to large population bases and improving economic conditions.

Mint Powder Market Executive Summary

The global Mint Powder market demonstrates dynamic expansion, characterized by strategic business trends centered on vertical integration and technological innovation aimed at enhancing product quality and supply chain resilience. Major ingredient suppliers are increasingly investing in proprietary cultivation and processing technologies, such as advanced controlled environment agriculture (CEA) and cryogenic milling, to secure premium raw material supply and achieve superior flavor consistency, mitigating the risks associated with volatile commodity markets. A key business strategy involves developing differentiated product lines, offering specialized grades (e.g., high-menthol peppermint for pharma, low-menthol spearmint for beverages) to capture specific, high-margin end-user niches. Furthermore, rigorous traceability protocols, often leveraging digital tools, are becoming non-negotiable for large industrial buyers responding to intense pressure for transparent sourcing and sustainability certifications, profoundly influencing supplier selection processes across the globe and requiring significant capital investment in compliance infrastructure.

Regionally, the market landscape is bifurcated. Asia Pacific (APAC) dominates the production volume and is experiencing the most rapid growth in consumption, anchored by colossal markets in India and China, which possess both large agricultural capacity and deeply embedded cultural usage of mint. The growth in APAC is spurred by rapid industrialization of the food sector and the integration of herbal formulations into modern healthcare practices. Conversely, North America and Europe command the largest share of market value, driven by high per capita consumption of premium processed goods, pharmaceuticals, and sophisticated cosmetic products, demanding highly standardized, certified, and often organic mint powder. Regulatory stringency in these Western markets ensures a focus on quality control and safety, dictating high barriers to entry for uncertified or substandard ingredient suppliers. Investment flows are concentrating on developing local, sustainable supply chains in Europe to reduce import dependence and associated carbon footprints, minimizing exposure to geopolitical supply risks.

Analysis of segment trends reveals a robust performance across both Type and Application segments. Spearmint Powder is exhibiting above-average growth, largely due to its increasing adoption in the mainstream beverage and savory snack categories where a milder, less overpowering mint note is preferred, appealing to a broader demographic. Simultaneously, the application of mint powder in the Pharmaceuticals and Nutraceuticals segment is projected to show the highest Compound Annual Growth Rate (CAGR). This acceleration is directly linked to the widespread consumer movement towards preventive health management and the corresponding increase in demand for standardized botanical supplements. Ingredient innovation is also driving growth in specialized sub-segments, such such as microencapsulated mint powder, designed for targeted flavor release or enhanced bioavailability, demonstrating the market's continuous evolution towards higher value-added products that solve complex formulation challenges for industrial buyers in key end-use sectors.

AI Impact Analysis on Mint Powder Market

The inquiries surrounding AI's influence in the Mint Powder sector generally center on how advanced analytics and automation can stabilize quality and optimize the notoriously variable agricultural supply chain. Users frequently ask about AI's capability to predict crop yields under changing climatic conditions, thereby mitigating supply shocks, and how machine learning (ML) models can be trained to analyze sensor data from drying equipment to ensure optimal moisture content and maximum essential oil retention in the final powder. Concerns often surface regarding the cost implications of implementing such sophisticated technologies and the accessibility of these tools to small and medium-sized mint cultivators who form the backbone of the upstream supply. The overriding expectation is that AI integration will lead to a more consistent, traceable, and economically viable product, reducing waste, enhancing global market competitiveness, and facilitating faster R&D cycles for new mint-based products that meet evolving consumer needs.

AI is fundamentally reshaping the upstream segment through the adoption of precision agriculture. ML algorithms process vast datasets—including soil composition, hyperlocal weather forecasts, spectral imaging from drones, and historical yield data—to provide farmers with prescriptive recommendations regarding optimal planting density, targeted irrigation, and precise timing for harvesting when the plant's essential oil content peaks. This level of optimization drastically reduces input costs (water, fertilizers) while simultaneously elevating the quality of the harvested mint, directly translating into a superior, more potent powder. Furthermore, AI-powered image recognition systems are being tested in post-harvest processing facilities to rapidly sort and grade mint leaves, identifying contaminants or substandard material before processing, which is critical for maintaining pharmaceutical-grade purity standards and reducing the risk of costly product recalls due to contamination or inconsistency in key quality metrics.

In the midstream and downstream phases, AI applications enhance manufacturing efficiency and market responsiveness. For instance, predictive maintenance powered by ML monitors grinding equipment vibration and temperature, forecasting potential breakdowns and minimizing costly downtime in critical processing stages like cryogenic milling, thereby preserving capital expenditure and maximizing throughput. In the commercial realm, AI models analyze complex consumer buying patterns, social media sentiment related to flavor trends, and competitive product launches, enabling manufacturers to adjust production schedules and fine-tune inventory levels to avoid stockouts or oversupply, optimizing working capital management. This data-driven approach to market dynamics, facilitated by AI, ensures that the supply of various mint powder grades (Peppermint vs. Spearmint) aligns closely with immediate regional demand, thereby minimizing capital tied up in inventory and optimizing profitability for processors and distributors across the entire global network.

- AI-driven Predictive Farming: Utilizing satellite and sensor data with ML to forecast optimal harvest times and maximize essential oil concentration in mint leaves for higher potency.

- Automated Quality Control: Deployment of deep learning models for visual inspection during sorting, ensuring purity and consistency in color and particle size, especially critical for high-grade applications.

- Supply Chain Optimization: ML algorithms streamlining logistics, reducing transit times, and minimizing environmental degradation risk of volatile components during storage and transport.

- Demand Forecasting & Pricing Strategy: AI predicting short-term market fluctuations based on consumer behavior and climate models to stabilize procurement strategies and minimize commodity price risk exposure.

- R&D Acceleration: Use of generative AI models to simulate and test new mint powder blend formulations for flavor houses, dramatically shortening time-to-market for innovative products.

DRO & Impact Forces Of Mint Powder Market

The Mint Powder market is governed by powerful Drivers, structural Restraints, and significant strategic Opportunities that collectively determine its growth trajectory. The predominant market driver is the undeniable global shift toward clean-label ingredients. Consumers are actively seeking natural alternatives to synthetic food additives, positioning mint powder as a highly desirable ingredient due to its natural origin, recognizable flavor profile, and inherent digestive health benefits. This is further reinforced by the burgeoning nutraceutical sector, where mint’s scientifically supported anti-inflammatory and soothing properties are highly valued, leading to robust, consistent demand across diverse global markets, particularly in North America and Europe. The convenience and versatility offered by a standardized, concentrated powder form, compared to volatile fresh herbs, are strong commercial drivers for large-scale industrial users seeking ingredient stability and ease of formulation.

Conversely, significant restraints challenge market stability and growth. Firstly, the market is profoundly sensitive to agricultural risks, including erratic climate change impacts, susceptibility to pests, and the sheer unpredictability of crop yields, which cause major fluctuations in the supply and raw material pricing. Mint cultivation is often labor-intensive, and any disruption in key producing regions can send shockwaves through the value chain, compelling buyers to seek price hedging strategies. Secondly, the technological challenge of preserving volatile organic compounds (VOCs) during drying and milling without using specialized, high-cost equipment (like cryogenic grinders) limits the ability of smaller players to produce premium-grade powder, leading to quality inconsistencies across the broader market and driving up capital expenditure for advanced processors necessary to meet stringent international quality benchmarks.

Strategic opportunities, however, present compelling avenues for future expansion. The rapidly growing segment of functional foods and personalized nutrition offers a high-value niche for mint powder encapsulated products, targeting enhanced bioavailability or specific flavor release profiles in complex matrices like specialized dietary supplements or sports nutrition products. Furthermore, integrating mint powder into new, non-traditional applications—such as clean-label preservatives, natural antimicrobial agents, or as an active ingredient in specialized pet food formulations—opens entirely new revenue streams. Focusing R&D on developing mint varieties that exhibit higher resilience to climate stress or naturally possess elevated levels of desirable compounds represents a long-term opportunity to stabilize the supply chain and enhance product superiority, ensuring sustainable competitive advantage for innovative market players who invest in proprietary breeding and cultivation practices. These opportunities leverage consumer trends toward natural efficacy and sustainability.

Segmentation Analysis

The strategic segmentation of the Mint Powder Market allows for precise analysis of consumer behavior and industrial purchasing patterns across various product formats and end-use sectors. Detailed segmentation is essential for ingredient suppliers to align production capabilities with demand trends, identifying whether to prioritize high-volume food-grade powder or specialized, low-volume pharmaceutical-grade extracts. The classification by Type reflects fundamental differences in menthol/carvone chemistry and sensory attributes, influencing product placement; for instance, the intense flavor of Peppermint powder targets oral care and pharmaceutical segments, while the milder profile of Spearmint powder dominates culinary and cosmetic applications, necessitating distinct cultivation and processing requirements for each to ensure targeted compound concentrations are maintained.

Analysis of the Application segment reveals profound differences in required quality standards and scale. The Food & Beverages segment, although consuming the largest volume, typically requires bulk, competitively priced powders, whereas the Pharmaceuticals and Nutraceuticals segments mandate stringent standardization, purity validation, and complete traceability, justifying premium pricing due to regulatory requirements like GMP compliance. The Cosmetics and Personal Care segment, particularly oral hygiene products, serves as a high-growth area where mint powder is prized for its natural fragrance, cooling sensation, and purported antimicrobial effects. Understanding the specific regulatory hurdles and formulation demands of each application sector is critical for market entry and sustained growth, driving processors towards specialized certifications like Kosher and Halal alongside rigorous quality control protocols.

The segmentation by Distribution Channel highlights the increasing efficiency of B2B e-commerce platforms, which are streamlining procurement for smaller and mid-sized industrial buyers, offering competitive pricing and transparent sourcing data, especially beneficial for specialty products. However, direct sales relationships remain dominant for major industrial contracts, particularly for customized or proprietary blends, emphasizing the importance of long-term strategic partnerships between primary ingredient manufacturers and large multinational corporations. The constant drive towards product innovation, such as the introduction of organic-certified or single-origin mint powders, allows manufacturers to command higher price points and create distinct market categories within these established segments, ultimately driving overall market value expansion and fostering brand loyalty based on quality and ethical sourcing narratives.

- By Type

- Peppermint Powder: High Menthol Content; dominant in oral care, analgesic applications, and pharmaceutical preparations requiring strong flavor masking.

- Spearmint Powder: High Carvone Content; preferred for mild flavor in beverages, culinary uses, and sensitive cosmetic formulations due to its less intense profile.

- Japanese Mint (Corn Mint) Powder: Historically used for industrial menthol extraction; emerging in cheaper flavoring blends and industrial bulk applications due to cost efficiency.

- Other Mint Varieties: Includes watermint and apple mint used in niche gourmet applications and specific regional traditional medicine systems.

- By Application

- Food & Beverages: Largest volume segment, encompassing confectionery, bakery, dairy, functional beverages (teas, infusions), and complex savory seasoning mixes.

- Pharmaceuticals & Nutraceuticals: Highest value segment, focusing on digestive aids, cough preparations, and herbal dietary supplements requiring high standardization and purity verification.

- Cosmetics & Personal Care: Key areas are toothpaste, mouthwash, soaps, and specialized skincare, driven by cooling sensation, natural aroma, and purported antimicrobial effects.

- Flavoring Agents and Fragrances: Used as a core ingredient by specialized flavor houses for composite flavor development and targeted aromatic profiles in finished goods.

- Others (Incense, Home Care): Niche uses in aromatherapy, natural cleaning products, and traditional household remedies.

- By Distribution Channel

- Direct Sales (B2B Industrial): Sales straight to large food and pharma manufacturers for customized, high-volume, long-term contractual orders.

- Indirect Sales (Distributors, Wholesalers, Retailers): Leveraging third-party networks and specialty ingredient brokers to reach smaller entities and diversify geographical reach.

- E-commerce/Online Platforms: Growing importance for specialized, small-batch, and transparently sourced organic mint ingredients, catering to niche market demands.

- By Grade

- Food Grade: Standard quality, broad application, focusing primarily on flavor consistency and basic food safety standards.

- Pharmaceutical Grade: Highest purity, strict contaminant limits, mandatory active compound standardization (GMP certified) for therapeutic use.

- Cosmetic Grade: Fine particle size, focused on aroma stability, low abrasive potential, and skin/oral compatibility testing.

Value Chain Analysis For Mint Powder Market

The comprehensive value chain for the Mint Powder market initiates with critical upstream activities involving agricultural R&D and raw material cultivation. This stage is pivotal, as the quality of the harvested mint leaf—specifically its essential oil concentration and freedom from pesticides—directly determines the final product's market price and functional efficacy. Upstream analysis focuses on selecting optimal mint cultivars, implementing sustainable, climate-resilient farming practices, and utilizing advanced harvest timing techniques based on phytochemical profiling to ensure peak potency. Key stakeholders at this stage include specialized botanical farms and agricultural cooperatives. Challenges here involve land utilization efficiency, managing water stress, and ensuring that primary drying immediately post-harvest is executed carefully to minimize enzymatic degradation and flavor loss, often utilizing solar or low-temperature belt dryers before the material moves to industrial processing, requiring significant investment in on-farm infrastructure.

The midstream sector, dedicated to industrial transformation, represents the highest value-addition stage. This involves receiving semi-dried raw material, performing secondary drying to achieve precise moisture thresholds, and critical fine-milling processes, often using state-of-the-art cryogenic or hammer mills to achieve the required particle size distribution (PSD) for specific end-applications (e.g., extremely fine powder for encapsulation). Quality control is intensive, involving sophisticated analytical testing (GC-MS, HPLC) to guarantee standardization, microbial load compliance, and freedom from heavy metals, conforming to strict global import standards. Leading processors differentiate themselves by investing heavily in proprietary technologies to encapsulate or treat the powder, enhancing stability and prolonging shelf life, transforming a volatile commodity into a high-specification industrial ingredient suitable for global distribution and diverse regulatory environments like those in the EU and US.

The downstream section centers on distribution, market entry, and end-user consumption. Distribution channels are robustly segregated into direct and indirect routes. Direct distribution involves large, customized supply contracts negotiated with global food and flavor corporations, ensuring stable, long-term relationships and tailored product specifications. Indirect distribution relies on global ingredient distributors and regional wholesalers who maintain diverse portfolios and service smaller manufacturers and local markets, providing necessary warehousing, logistical support, and localized technical expertise regarding formulation. The increasing prevalence of e-commerce allows small-to-mid-sized enterprises (SMEs) to bypass traditional intermediaries, purchasing specialized organic or rare mint powders directly from niche producers. End-users in the food, pharma, and cosmetic sectors subsequently incorporate the powder, with successful integration dependent on the powder's functional performance in their final product matrices, thereby validating the quality assurance processes executed further upstream through verifiable traceability systems.

Mint Powder Market Potential Customers

The primary and largest volume purchaser segment comprises the vast Food & Beverages industry, including global confectionery giants, leading snack food manufacturers, and beverage companies. These industrial customers utilize mint powder extensively in products such as chewing gum, flavored carbonated beverages, chocolate fillings, herbal teas, and complex savory seasoning blends used in chips and processed meats. Their purchasing criteria are centered on high volume capacity, competitive unit pricing, consistent flavor profile stability over shelf life, and strict compliance with international food safety standards (e.g., ISO 22000, HACCP). The demand here is highly diversified by mint type, with Spearmint powder often preferred for mainstream beverages and Peppermint for high-impact confectionery flavorings, requiring suppliers to offer flexible product specifications and substantial production scalability.

The high-value segment is defined by the Pharmaceutical and Nutraceutical industries. These customers, including branded supplement providers and over-the-counter medicine manufacturers, require mint powder that meets the highest criteria for purity, efficacy, and regulatory documentation. They demand detailed chemical analysis verifying the precise concentration of active biomarkers (like menthol) and require GMP-certified production facilities, often necessitating detailed audit trails of the manufacturing process. Unlike food-grade buyers, these customers are less price-sensitive and prioritize standardization, documentation, and batch consistency, typically purchasing highly refined or specialized encapsulated mint extracts suitable for tablet compression or liquid suspension formulations, underpinning their high contribution to the overall market value and driving innovation in quality control technology.

A rapidly expanding segment involves the Cosmetics and Personal Care sector, particularly within oral care (toothpaste, mouthwash) and specialized skin soothing applications. These manufacturers value mint powder for its refreshing scent, cooling sensation, and natural antimicrobial properties, aligning with the clean beauty movement and demands for botanical sourcing. Purchasing decisions here often hinge on the powder's fineness (to prevent grittiness), water solubility, and sustained aromatic stability within complex chemical matrices. Furthermore, smaller, artisanal food producers and specialized gourmet seasoning companies form a growing niche, seeking organic, single-origin, or rare mint powder varieties, often procured through direct trade or high-end ingredient distributors focusing on traceability and premium quality narratives, willing to pay a premium for verified sustainable and ethical sourcing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 719.2 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Symrise AG, Givaudan SA, Archer Daniels Midland (ADM), Takasago International Corporation, Sensient Technologies Corporation, Mane SA, Doehler GmbH, Robertet Group, Synthite Industries Ltd., Vidya Herbs Pvt. Ltd., Mountain Rose Herbs, P.T. Indesso Aroma, V. Mane Fils, Flavorchem Corporation, Akay Group, Kanta Enterprises Private Limited, Natural Herbs & Spices, Frutarom (now IFF). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mint Powder Market Key Technology Landscape

The technological sophistication of the Mint Powder market is heavily concentrated in methods designed to optimize flavor and functional integrity, countering the inherent volatility of mint’s active compounds. A crucial area is advanced drying technology. Moving beyond simple air drying, manufacturers utilize technologies such as vacuum shelf drying and microwave-assisted vacuum drying, which allow for rapid moisture removal at significantly lower temperatures. This minimizes thermal degradation, resulting in a powder that retains a higher percentage of natural color and volatile essential oils, essential for meeting the sensory expectations of the premium food and flavor sectors. The selection of drying equipment is often customized based on the intended grade; pharmaceutical-grade mint powder frequently relies on costly, but highly effective, freeze-drying (lyophilization) to preserve the bioactivity of specific compounds and achieve superior dissolution properties required for medicinal applications with high regulatory scrutiny.

The second pillar of the technology landscape is particle engineering, particularly advanced milling techniques. Cryogenic grinding, involving the grinding of dried mint leaves while frozen by liquid nitrogen or similar inert cooling agents, is a revolutionary method. This process renders the leaves brittle and inert, allowing for an extremely fine particle size distribution (PSD) without generating heat that would otherwise vaporize essential oils. The resulting powder exhibits higher potency and superior flow characteristics, making it ideal for processes like pharmaceutical tablet encapsulation and high-speed food blending lines where powder consistency is critical. Furthermore, specific encapsulation technologies are gaining prominence. Techniques such as spray-drying encapsulation and coacervation protect the sensitive mint flavor profile from external factors (light, oxygen) and premature interaction with other ingredients in complex food matrices, enabling controlled or delayed flavor release in products like baked goods and instant drink mixes, significantly extending the shelf life of the flavoring components.

Finally, technology related to quality assurance and traceability is paramount, driven by increasing regulatory demands and consumer scrutiny. Modern mint powder production lines integrate sophisticated sensor technologies and non-destructive testing, such as Near-Infrared (NIR) spectroscopy, to perform rapid, real-time chemical fingerprinting of batches, ensuring standardization of menthol or carvone levels before final packaging. The rise of digital traceability systems, often utilizing blockchain integrated with IoT sensors in the supply chain, allows buyers to verify the exact farm of origin, processing history, and quality checkpoints of any given batch. This level of transparency is becoming essential for securing contracts in key Western markets and establishing brand trust, mitigating risks associated with adulteration or mislabeling which historically plagued the botanical ingredient sector, thereby ensuring compliance with stringent regulatory requirements imposed by importing nations globally.

Regional Highlights

The Mint Powder Market exhibits distinct consumption and production patterns across major geographical regions, influencing supply chain dynamics and pricing structures globally. Regional performance is driven by a confluence of agricultural capacity, regulatory environment, and evolving consumer packaged goods trends.

- Asia Pacific (APAC): APAC is the global engine for mint production, especially China and India, which lead in cultivation volume due to favorable agroclimatic conditions and lower production costs. This region is projected to register the highest CAGR in consumption, fueled by the massive pharmaceutical sector using traditional mint-based remedies, the explosive growth of the convenience food industry, and rising consumer awareness regarding natural ingredients. The focus here is increasingly shifting towards enhancing processing quality to meet international export standards, moving beyond commodity-grade powder towards standardized, high-purity extracts, positioning the region as both a key supplier and consumer hub.

- North America: Holding the largest share in market value, North America is a critical consumer market driven by the high penetration of oral hygiene products, specialty confectionery, and the high demand for nutraceuticals and dietary supplements. The market is characterized by a high preference for organic and non-GMO verified mint powder, coupled with rigorous regulatory oversight (FDA standards) that favors suppliers capable of providing comprehensive traceability documentation and consistent quality. Investment in advanced processing facilities is common to ensure local supply security and meet stringent buyer specifications, minimizing logistical complexity and foreign sourcing risks.

- Europe: Europe is a mature market focused heavily on premiumization and sustainability. Demand is strong in functional beverages, herbal teas, and the rapidly growing clean beauty sector. European buyers, particularly those in Germany, France, and the UK, demand sophisticated environmental and ethical certifications (e.g., Fair Trade, Carbon Neutral), pushing suppliers to establish highly transparent and sustainable sourcing programs. Regulatory requirements (EFSA guidelines) for food safety and flavor limits are among the strictest globally, driving technological adaptation among regional processors and ensuring market access requires consistent quality assurance.

- Latin America (LATAM): The LATAM market is in an accelerated growth phase, particularly in countries like Brazil and Mexico, correlating with increased consumer disposable income and a shift towards packaged, Western-style food products. Mint powder penetration is expanding in the regional confectionery and flavor industry, though local cultivation capacity sometimes struggles to meet industrial demand, leading to increased import reliance, creating significant opportunities for international exporters to establish strong distribution networks.

- Middle East and Africa (MEA): MEA traditionally consumes mint heavily in fresh form or as whole dried leaves (especially in tea). The industrial mint powder market is growing due to investment in local food processing capabilities and the rising popularity of global savory and seasoning blends. Demand is concentrated in urban centers and high-end markets, often supplied via specialized ingredients distributors catering to the regional flavor houses, with growth heavily influenced by tourism and international food imports setting new consumption benchmarks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mint Powder Market.- Symrise AG

- Givaudan SA

- Archer Daniels Midland (ADM)

- Takasago International Corporation

- Sensient Technologies Corporation

- Mane SA

- Doehler GmbH

- Robertet Group

- Synthite Industries Ltd.

- Vidya Herbs Pvt. Ltd.

- Mountain Rose Herbs

- P.T. Indesso Aroma

- V. Mane Fils

- Flavorchem Corporation

- Akay Group

- Kanta Enterprises Private Limited

- Natural Herbs & Spices

- Frutarom (now IFF)

Frequently Asked Questions

Analyze common user questions about the Mint Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Peppermint and Spearmint powder applications?

Peppermint powder contains higher concentrations of menthol, resulting in a stronger, pungent, and cooling flavor, making it ideal for pharmaceutical products, breath mints, and certain confectionery. Spearmint powder has higher carvone content, offering a milder, sweeter flavor profile, preferred for culinary dishes, beverages, and subtle savory applications, appealing to a broader consumer base seeking less intense botanical notes.

Which technological innovation is crucial for preserving the quality of mint powder?

Cryogenic grinding, or milling under extremely cold conditions, is crucial as it minimizes the heat generated during processing. This prevents the degradation and volatilization of delicate essential oils like menthol and carvone, ensuring the final powder retains maximum flavor potency, color integrity, and efficacy required for premium ingredients in the nutraceutical sector.

How is the demand for mint powder influenced by the clean-label trend?

The clean-label trend significantly boosts demand for mint powder, as consumers and manufacturers globally prioritize natural botanical ingredients over artificial flavors and synthetic additives. Mint powder serves as a verifiable, single-ingredient source of flavor, coloring, and functional properties, aligning perfectly with clean-label requirements for ingredient transparency and simplicity, driving robust demand in CPG sectors.

What is the Compound Annual Growth Rate (CAGR) projected for the Mint Powder Market?

The Mint Powder Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This consistent growth rate is primarily driven by the expanding functional food applications and the sustained global shift towards natural flavor ingredients in oral care and pharmaceutical formulations worldwide.

Which end-user segment is expected to drive the highest growth rate?

The Pharmaceuticals and Nutraceuticals segment is anticipated to register the highest Compound Annual Growth Rate in terms of value. This growth is spurred by the increasing adoption of standardized herbal supplements for digestive health and anti-inflammatory benefits, which require high-purity, pharmaceutical-grade mint powder derivatives, commanding a significant price premium over bulk food-grade powder.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager