Missile Seeker Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431835 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Missile Seeker Detector Market Size

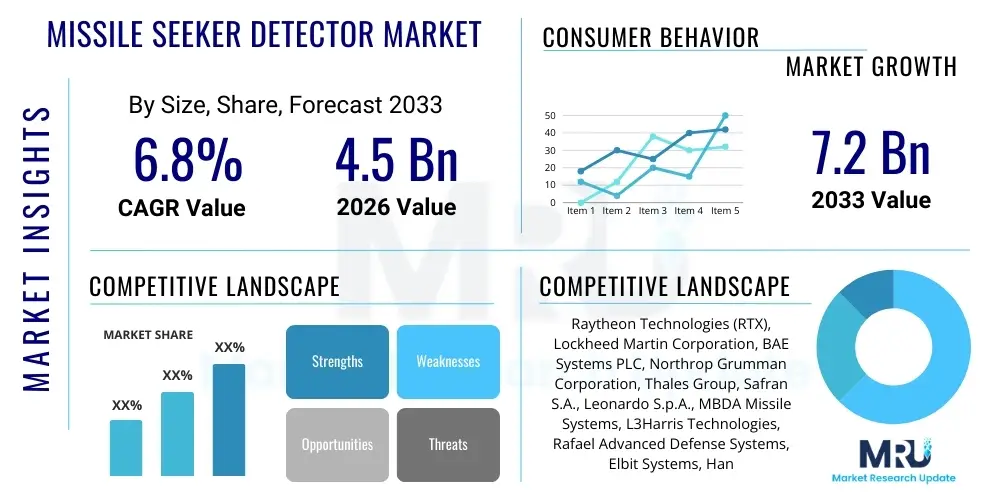

The Missile Seeker Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Missile Seeker Detector Market introduction

The Missile Seeker Detector Market encompasses the design, manufacture, and integration of highly specialized sensing devices crucial for guiding missiles to their intended targets. These detectors, often complex electro-optical or radio frequency (RF) systems, form the "eyes" and "brains" of precision-guided munitions, enabling autonomous target acquisition, tracking, and terminal guidance. Key products include Infrared (IR) seekers, radar seekers (Active, Semi-Active, Passive), and increasingly, multi-mode systems that combine different detection technologies to enhance robustness against countermeasures and improve accuracy across varying operational environments. The sophistication of these components is directly tied to the lethality and reliability of modern missile systems deployed globally by major military powers and allied forces.

The core function of a missile seeker detector is to gather electromagnetic radiation—whether thermal signatures (IR), reflected radar energy (RF), or laser illumination—from the target and convert it into tracking data for the missile’s guidance system. The demand for these advanced detectors is fundamentally driven by the global imperative for accurate, fire-and-forget capabilities in conflict zones, alongside the continuous development of sophisticated countermeasures by potential adversaries. This ongoing technological arms race necessitates lighter, faster, more sensitive, and multi-spectral detectors capable of operating under severe clutter, jamming, or decoys, pushing manufacturers toward incorporating advanced materials, focal plane arrays (FPAs), and high-speed signal processing.

Major applications of missile seeker detectors span air-to-air, surface-to-air, air-to-surface, and surface-to-surface missiles across naval, land, and aerial platforms. The primary benefits derived from these advanced seekers include dramatically increased probability of kill (Pk), reduced collateral damage due to precision targeting, and enhanced survivability of launching platforms. Key factors driving market growth include escalating geopolitical tensions necessitating modernization of legacy missile inventories, increased defense spending in emerging economies focused on technological parity, and rapid advancements in component miniaturization which allow for integration into smaller tactical munitions and unmanned aerial vehicles (UAVs).

Missile Seeker Detector Market Executive Summary

The Missile Seeker Detector Market is currently characterized by intense technological competition and strategic acquisitions among dominant global defense contractors, focusing heavily on developing countermeasures-resistant multi-mode seekers. Business trends indicate a strong shift towards open architecture designs to facilitate easier integration and faster technology upgrades, particularly in the domain of cognitive electronic warfare. Companies are investing significantly in advanced manufacturing techniques, such as microelectromechanical systems (MEMS) and 3D printing, to reduce the size, weight, and power (SWaP) consumption of detector assemblies, making them viable for integration into next-generation hypersonic weapons and smart autonomous platforms. Furthermore, supply chain resilience, especially concerning sensitive components like specialized semiconductor chips and exotic optical materials, remains a critical strategic concern influencing market structure and procurement decisions.

Regionally, North America maintains its dominance due to substantial R&D investment by the Department of Defense (DoD) into sophisticated guidance technologies, particularly in infrared and hyperspectral imaging seekers. However, the Asia Pacific region, led by China, India, and South Korea, is experiencing the fastest growth, fueled by ambitious military modernization programs and rising territorial disputes that necessitate advanced defensive and offensive missile capabilities. European nations are collaboratively pursuing joint defense projects (like the MBDA Meteor seeker upgrades) to achieve technological independence, focusing on advanced RF seekers and integrated anti-access/area denial (A2/AD) capabilities. The Middle East remains a key procurement market, often relying on foreign suppliers for high-end seeker technology essential for border security and regional stability initiatives.

Segmentation trends highlight the increasing prominence of Imaging Infrared (IIR) seekers, which offer superior spatial resolution and target discrimination compared to older generations, becoming standard for high-value interceptors. Concurrently, the RF seeker segment is undergoing transformation with the deployment of highly agile Active Electronically Scanned Array (AESA) technology, offering improved tracking precision and simultaneous multi-target engagement capability. The fastest-growing segment, however, is the Multi-Mode Seeker category, which strategically combines IR, RF, and sometimes semi-active laser technologies to ensure mission success even when one detection modality is compromised. This convergence of technologies is central to developing truly autonomous, next-generation missile systems capable of neutralizing highly maneuverable threats under severe electronic warfare conditions.

AI Impact Analysis on Missile Seeker Detector Market

User inquiries regarding AI's impact on missile seeker detectors frequently center on its role in enhanced target discrimination, autonomous decision-making in complex environments, and the ability to rapidly counter novel threat maneuvers. Users are particularly concerned about the reliability and ethical implications of "fire-and-forget" systems achieving full autonomy, especially concerning non-cooperative target recognition (NCTR) and distinguishing targets from decoys or civilian clutter. The consensus expectation is that AI algorithms, leveraging machine learning and deep neural networks, will dramatically improve seeker performance by processing vast amounts of sensor data instantly, moving beyond traditional filter-based tracking to cognitive tracking systems that adapt in real-time to unforeseen conditions, significantly enhancing the probability of mission success in cluttered, heavily defended airspace.

The integration of artificial intelligence directly within the seeker’s processing unit (often referred to as 'edge processing') is revolutionizing how missiles navigate and engage targets. Traditional seekers rely on pre-programmed logic, but AI allows the seeker to interpret complex sensor data patterns, automatically classify targets (e.g., differentiating between aircraft types or identifying specific vulnerabilities), and dynamically adjust flight paths and terminal guidance parameters mid-flight. This capability is vital for defeating sophisticated decoys and countermeasures that overwhelm conventional signal processors, ensuring that the missile retains lock even under intense electronic attack. This AI-driven processing significantly reduces the time from detection to engagement, a crucial factor when targeting high-velocity or maneuvering platforms like hypersonic glide vehicles.

Furthermore, AI-enabled seekers facilitate true multi-spectral data fusion, seamlessly integrating inputs from IR, RF, and potential ultraviolet sensors to build a comprehensive, high-confidence picture of the operational battlespace. This level of data synthesis is beyond human or standard computational capability within the constraints of a missile body. The continuous learning aspect of AI allows deployed systems to learn from past failures or observed adversary tactics, enabling faster firmware updates and performance enhancements across entire missile fleets, thereby shortening the technological feedback loop necessary in modern warfare. This operational leap drives procurement decisions towards systems offering upgradeability and adaptable software architectures capable of hosting advanced AI models.

- AI enables real-time, cognitive target recognition (NCTR) and classification.

- Deep Learning algorithms enhance multi-spectral sensor data fusion for improved tracking accuracy.

- Edge AI processing facilitates autonomous decision-making and optimal trajectory correction in terminal phase.

- Machine learning models improve seeker resistance to advanced electronic and physical countermeasures (decoys, flares).

- AI shortens development cycles by analyzing telemetry data and optimizing guidance logic post-flight.

- Predictive maintenance and fault detection within complex electro-optical systems are improved using AI monitoring.

DRO & Impact Forces Of Missile Seeker Detector Market

The Missile Seeker Detector Market is fundamentally shaped by powerful Driving factors (D), Restraints (R), Opportunities (O), and structural Impact Forces. The primary drivers include rapidly escalating global geopolitical tensions, which compel nations to significantly increase defense procurement budgets and modernize their existing missile systems with superior guidance packages. The continuous requirement for enhanced precision, coupled with the proliferation of low-observable stealth technology and high-speed platforms, pushes R&D investment towards next-generation multi-mode and hyper-spectral seekers. Furthermore, the global shift towards autonomous warfare necessitates seekers capable of complex, unsupervised target identification and terminal guidance, further fueling demand for AI-integrated solutions.

However, the market faces significant restraints, chiefly the immensely high cost associated with R&D, manufacturing, and integration of cutting-edge seeker technology, particularly components utilizing advanced Focal Plane Arrays (FPAs) and Gallium Nitride (GaN) radar components. Stringent export controls and complex regulatory frameworks, such as the Missile Technology Control Regime (MTCR), restrict the transfer of high-end seeker technology, limiting market access and scalability for certain manufacturers. Moreover, the long lifecycle and slow procurement processes typical of defense acquisition can delay the adoption of new, highly advanced detector technologies, creating friction between technological readiness and operational deployment.

Opportunities for growth are abundant, particularly in the development of modular and open-architecture seekers that facilitate rapid replacement and integration across different missile platforms, reducing overall lifecycle costs. The emerging field of quantum sensing technology presents a long-term opportunity for highly sensitive, low-noise detection capabilities far superior to current systems. Additionally, the proliferation of smaller, inexpensive missile and rocket systems requires the development of highly miniaturized, low-SWaP seeker detectors, opening up a new segment focused on tactical and drone-based munitions. Impact forces—specifically competition, supplier power, and technological threat—are extremely high, driving relentless innovation to stay ahead of rapidly evolving adversary countermeasures, making technological differentiation the most critical factor for market participants.

Segmentation Analysis

The Missile Seeker Detector Market is segmented based on the core technology employed, the type of missile platform utilizing the seeker, and the specific application or mission profile. Understanding these segments is crucial as defense modernization programs prioritize different capabilities based on strategic requirements, often dictating procurement volumes for specific seeker types. The primary segmentation revolves around the electromagnetic spectrum used for detection—ranging from infrared (heat), visible light, radio frequency (radar), to laser illumination. Market dynamics within these segments are driven by the trade-offs between cost, operational range, resistance to weather, and efficacy against various countermeasures, leading to strategic investments in multi-spectral integration.

Within the technology segmentation, Imaging Infrared (IIR) seekers hold significant value due to their passive nature and high resolution, making them ideal for high-precision, short-to-medium-range applications where stealth is paramount. Conversely, Radar Frequency (RF) seekers dominate long-range, all-weather interception scenarios, with Active Radar Seekers (ARS) representing the most complex and expensive segment, characterized by advanced phased array or AESA technology. The Multi-Mode seeker segment, representing the convergence of these technologies, is projected to exhibit the fastest growth, as defense planners seek resilience and flexibility across diverse operational theaters and threat profiles, prioritizing systems that guarantee target engagement success regardless of the adversary's electronic warfare posture or environmental conditions.

- By Technology

- Infrared (IR) Seekers (Including Imaging Infrared - IIR)

- Radio Frequency (RF) Seekers (Active Radar, Semi-Active Radar, Passive Radar)

- Laser Seekers (Semi-Active Laser - SAL)

- Multi-Mode Seekers (Combining IR, RF, or Laser)

- Visible Light/Electro-Optical Seekers

- By Platform

- Air-to-Air Missiles

- Surface-to-Air Missiles (SAMs)

- Air-to-Surface Missiles

- Surface-to-Surface Missiles

- Anti-Tank Guided Missiles (ATGMs)

- Anti-Ship Missiles

- By Application/Range

- Short Range

- Medium Range

- Long Range

- Ballistic Missile Defense Systems

Value Chain Analysis For Missile Seeker Detector Market

The value chain for the Missile Seeker Detector Market is highly specialized, beginning with the upstream supply of highly sensitive and restricted raw materials and components. This upstream segment is dominated by specialized manufacturers providing critical inputs such as high-purity semiconductor materials (e.g., Indium Antimonide, Mercury Cadmium Telluride - MCT, and GaN), specialized optical lenses (Germanium, Sapphire), and ultra-high-speed signal processing chips. Due to the military nature of the product, the supply base is highly concentrated and subject to rigorous governmental oversight and strict quality assurance standards, significantly increasing barriers to entry for new component suppliers and intensifying bargaining power among incumbent specialized material providers.

The midstream phase involves the core activities of system design, integration, and manufacturing, typically performed by Tier 1 defense prime contractors. This stage includes assembling the detector sensor head, integrating it with sophisticated cooling systems (for IR seekers), packaging the processing electronics, and conducting extensive environmental and performance testing. Vertical integration is a common strategy among large defense firms (such as Lockheed Martin or Raytheon) to secure critical intellectual property and ensure supply reliability for core components like Focal Plane Arrays (FPAs) and proprietary guidance software. Design complexity and the requirement for highly specialized cleanroom manufacturing facilities dictate that this segment operates on a very long lead-time cycle and high capitalization requirement.

The downstream distribution channel is almost exclusively direct, utilizing a highly controlled business-to-government (B2G) model. Manufacturers negotiate directly with defense ministries, prime integrators responsible for missile platforms, or authorized defense procurement agencies. Indirect channels are virtually non-existent for high-end seeker technology due to strict regulatory controls and the classified nature of the systems. The final stage involves integration into the weapon platform and deployment, followed by long-term service contracts covering maintenance, repair, and upgrades (MRO). The lifecycle support and continuous software updates for cognitive seekers are becoming increasingly important aspects of the downstream revenue stream.

Missile Seeker Detector Market Potential Customers

The primary customer base for the Missile Seeker Detector Market consists overwhelmingly of national defense organizations, encompassing the Ministries of Defense (MoD) and their affiliated procurement agencies globally. These governmental bodies drive demand through large-scale missile modernization programs, seeking to replace aging stockpiles or acquire new capabilities necessary for strategic deterrence and regional security. Specific requirements often differ based on the customer’s strategic doctrine, with major powers focusing on hypersonic defense and multi-spectral stealth targeting, while developing nations prioritize cost-effective, high-reliability systems for localized conflicts and border defense.

The second tier of significant customers includes major aerospace and defense prime contractors who act as system integrators. These companies, such as Northrop Grumman, Boeing, Airbus Defense, and MBDA, purchase seeker detectors as sub-systems to integrate into their larger missile programs (e.g., air defense systems, cruise missiles, or anti-tank weapons). The relationship between seeker detector manufacturers and these system integrators is crucial, often involving lengthy qualification and collaborative development processes to ensure seamless electrical and mechanical interface compatibility, especially when integrating proprietary or highly classified guidance algorithms.

Beyond national defense forces and prime contractors, authorized international allies and allied military coalitions constitute another vital customer segment, often facilitated through Foreign Military Sales (FMS) programs or direct commercial sales authorized by originating governments. These international sales typically involve slightly downgraded or export-controlled versions of the most advanced detector systems. Emerging demand also comes from specialized government organizations, such as space agencies (for orbital defense and tracking systems) and certain paramilitary border control forces, although these represent a smaller volume compared to conventional military procurement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Raytheon Technologies (RTX), Lockheed Martin Corporation, BAE Systems PLC, Northrop Grumman Corporation, Thales Group, Safran S.A., Leonardo S.p.A., MBDA Missile Systems, L3Harris Technologies, Rafael Advanced Defense Systems, Elbit Systems, Hanwha Systems, Mitsubishi Electric Corporation, Collins Aerospace (Raytheon), Aselsan A.Ş., Diehl Defence, General Dynamics, Hindustan Aeronautics Limited (HAL), Israel Aerospace Industries (IAI), Roketsan A.Ş. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Missile Seeker Detector Market Key Technology Landscape

The technological landscape of the Missile Seeker Detector Market is characterized by rapid evolution aimed at enhancing accuracy, survivability, and resistance to environmental noise and electronic warfare. A cornerstone of modern seeker technology is the deployment of high-resolution Focal Plane Arrays (FPAs), particularly those operating in the Mid-Wave Infrared (MWIR) and Long-Wave Infrared (LWIR) bands, often requiring sophisticated cryogenic cooling systems for optimal performance. These FPAs, built using materials like Indium Antimonide (InSb) or Mercury Cadmium Telluride (MCT), enable Imaging Infrared (IIR) seekers to generate detailed target images, allowing for precise identification and terminal guidance, significantly improving performance over older non-imaging IR systems and driving the market towards fifth-generation seeker capabilities.

Another dominant technological trend is the proliferation of Active Electronically Scanned Array (AESA) radar seekers. Unlike mechanically steered parabolic antennas, AESA seekers use thousands of tiny transmit/receive (T/R) modules, enabling instantaneous beam steering, multi-mode operation (e.g., simultaneous tracking and mapping), and ultra-low probability of intercept (LPI) characteristics due to their agile frequency hopping capabilities. The incorporation of Gallium Nitride (GaN) semiconductor technology in AESA T/R modules is a major differentiator, offering significantly higher power output and efficiency, which translates into increased detection range and robustness against jamming while adhering to stringent Size, Weight, and Power (SWaP) constraints inherent in missile design.

The most forward-looking technology is the development and maturation of true Multi-Spectral Seekers, which combine inputs from two or more distinct electromagnetic bands (e.g., combining IIR data with Passive RF data and, potentially, UV or visible light sensors). The processing required for seamless fusion of this diverse data stream demands high-performance embedded processors and the application of Artificial Intelligence (AI) and Machine Learning (ML) algorithms. Furthermore, advancements in anti-countermeasure technology include sophisticated signal processing techniques to differentiate real targets from flares and decoys, and the exploration of quantum sensors for highly sensitive, low-noise target acquisition in the future, promising a revolutionary leap in detection capability that is virtually impervious to current jamming techniques.

Regional Highlights

North America, driven overwhelmingly by the United States defense budget and the complex requirements of the Department of Defense (DoD), remains the largest and most technologically advanced market for missile seeker detectors. The region is the global hub for R&D, focusing heavily on integrating Artificial Intelligence into seekers for hypersonic missile programs and developing resilient, highly sophisticated multi-mode detection systems capable of operating in highly contested electromagnetic environments. The market here is characterized by long-term, high-value contracts awarded to established defense giants like Raytheon and Lockheed Martin for programs such as next-generation air-to-air missile upgrades and advanced Ballistic Missile Defense (BMD) interceptors, maintaining a continuous pipeline of funding for seeker innovation.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by the intense military buildup and modernization efforts, particularly in China, India, Japan, and South Korea. Geopolitical tensions, notably concerning maritime security and territorial disputes, necessitate significant investment in advanced long-range and anti-ship missile systems, which require complex RF and IIR seekers. China's rapid indigenous development of missile technologies, often incorporating advanced AESA and dual-band IR seekers, is a major factor driving competitive response spending throughout the region. India's ‘Make in India’ initiative encourages domestic production and technology transfer, impacting the regional supply chain and creating opportunities for localized manufacturing partnerships for seeker components.

Europe represents a mature market, prioritizing collaborative projects under entities like the European Defence Agency (EDA) and involving companies such as Thales and MBDA. European countries focus on advanced air defense and cruise missile capabilities, emphasizing multi-spectral seekers for enhanced survivability against sophisticated Russian missile technology. Procurement trends favor highly sophisticated, standardized components to maintain technological parity with global military leaders while maximizing interoperability among NATO allies. Meanwhile, the Middle East and Africa (MEA) remains a crucial import market, with substantial procurement of advanced guided munitions driven by regional instability, relying heavily on FMS from the US and commercial sales from European and Israeli defense contractors to acquire proven, high-performance seeker technologies.

- North America: Dominant market share; driven by high DoD R&D spending on AI integration and hypersonic missile seekers. Focus on advanced IIR and GaN-based AESA radar technology.

- Asia Pacific (APAC): Fastest growing region; high military modernization spending (China, India). Strong demand for anti-ship and air defense seekers. Increasing indigenous manufacturing capability.

- Europe: Focus on interoperability and collaborative defense projects (NATO, EDA). Demand for high-end multi-mode seekers for air defense and strategic deterrence. Key players include Thales and MBDA.

- Middle East and Africa (MEA): Major import market for US/European/Israeli systems. Procurement driven by regional security needs and counter-terrorism applications.

- Latin America: Stable but smaller market, focused primarily on maintenance, repair, and selective acquisition of medium-range missile systems and associated older generation seekers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Missile Seeker Detector Market.- Raytheon Technologies (RTX)

- Lockheed Martin Corporation

- BAE Systems PLC

- Northrop Grumman Corporation

- Thales Group

- Safran S.A.

- Leonardo S.p.A.

- MBDA Missile Systems

- L3Harris Technologies

- Rafael Advanced Defense Systems

- Elbit Systems

- Hanwha Systems

- Mitsubishi Electric Corporation

- General Dynamics Corporation

- Aselsan A.Ş.

- Diehl Defence

- Israel Aerospace Industries (IAI)

- Roketsan A.Ş.

- Hindustan Aeronautics Limited (HAL)

- Huntington Ingalls Industries (HII)

Frequently Asked Questions

Analyze common user questions about the Missile Seeker Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological challenges facing the development of next-generation missile seekers?

The primary challenges involve overcoming sophisticated adversary countermeasures, achieving seamless multi-spectral sensor fusion (IR, RF, Laser) within minimal SWaP constraints, and integrating reliable, robust Artificial Intelligence algorithms for autonomous target recognition and tracking under extreme conditions, especially against maneuvering hypersonic threats.

How does the shift towards multi-mode seekers impact missile effectiveness and cost?

Multi-mode seekers significantly increase missile effectiveness by guaranteeing engagement success across various operational environments and mitigating single-mode countermeasures. This resilience justifies the higher upfront cost, as it drastically improves the probability of kill (Pk) and mission reliability compared to traditional, single-sensor guidance systems.

Which technology segment, IR or RF, is currently experiencing faster innovation?

While both segments are innovating rapidly, the RF segment, particularly with the adoption of Gallium Nitride (GaN) components in Active Electronically Scanned Array (AESA) radar seekers, is undergoing transformative changes, offering superior range, efficiency, and multi-functionality. Simultaneously, the integration of high-resolution Imaging Infrared (IIR) FPAs remains crucial for terminal guidance precision.

What is the role of cryocoolers in advanced Infrared (IR) missile seekers?

Cryocoolers are essential in advanced IR seekers, especially those utilizing Mid-Wave or Long-Wave Infrared Focal Plane Arrays (FPAs), as they must maintain extremely low operational temperatures (typically below 80 Kelvin). This cooling reduces thermal noise generated by the sensor itself, allowing the detector to achieve the sensitivity required to accurately detect and track faint thermal signatures from distant targets.

How do geopolitical factors specifically drive the demand in the Missile Seeker Detector Market?

Escalating geopolitical tensions, particularly among major global powers (US, China, Russia) and regional conflicts (Middle East, South China Sea), directly translate into increased national defense budgets. This necessity drives immediate procurement demand for guided munitions and long-term R&D investment into superior seeker technology capable of neutralizing emerging threats like cruise missiles, advanced fighters, and hypersonic weapons.

What is the significance of Size, Weight, and Power (SWaP) optimization in missile seeker design?

SWaP optimization is critical because modern missiles, especially those launched from smaller platforms or drones, have highly restricted internal volume and power budgets. Reducing SWaP allows for increased range, higher payload capacity (e.g., larger warheads), or the integration of additional sensor suites (leading to multi-mode capabilities) without compromising the missile’s fundamental kinematic performance.

Are there commercial applications for missile seeker detector technology?

While the highly specialized and classified components of missile seekers are strictly military, derivative technologies—especially high-resolution FPAs and advanced signal processing algorithms—find applications in commercial sectors such as high-end thermography, advanced remote sensing for environmental monitoring, industrial inspection using non-destructive testing, and high-performance astronomical imaging systems.

What is the impact of open architecture design on the procurement of missile seekers?

Open architecture designs, such as the Sensor Open Systems Architecture (SOSA) standard, allow defense ministries to source seeker components and software from multiple vendors interchangeably. This approach reduces vendor lock-in, facilitates faster technological upgrades and integration of AI modules, encourages competition, and potentially lowers overall maintenance and lifecycle costs for missile systems.

How are missile seekers being adapted to counter hypersonic weapons?

Countering hypersonic weapons requires seekers with extremely high processing speeds, enhanced sensitivity, and wider fields of view to track fast, maneuvering targets. This adaptation involves developing advanced AESA seekers capable of rapid re-targeting and deploying multi-band IR seekers with complex algorithms to maintain continuous tracking lock against high-speed, high-altitude targets generating intense aerodynamic heating signatures.

Who are the key suppliers for specialized FPA materials (e.g., MCT) used in IR seekers?

The supply chain for specialized Focal Plane Array materials like Mercury Cadmium Telluride (MCT) is highly concentrated and vertically integrated within the major defense contractors (like Raytheon and Leonardo) or relies on a select few highly specialized component manufacturers in allied nations. Due to export controls and strategic importance, sourcing these materials is complex and restricted, representing a critical bottleneck in the value chain.

What is Passive Radar Seeker technology and how is it utilized?

Passive Radar Seekers (PRS) do not emit their own energy but instead detect and track the RF emissions from a target (such as a hostile aircraft's radar or communications). PRS provides a crucial advantage by being completely stealthy, offering a ‘silent’ attack capability highly valued in electronic warfare environments, often used for anti-radiation missiles designed to destroy enemy radar sites.

What role does 3D printing play in the manufacturing of missile seeker detectors?

3D printing (Additive Manufacturing) is increasingly used in the production of complex, intricate components for seekers, such as internal waveguides for RF systems, thermal management structures, and lightweight mechanical enclosures. It allows for the rapid prototyping of customized components, reduces material waste, and helps achieve stringent SWaP requirements by creating highly optimized geometric structures that traditional manufacturing cannot replicate.

What is Non-Cooperative Target Recognition (NCTR) and why is it important for missile seekers?

NCTR is the ability of the seeker system to identify the class, type, and specific characteristics of a target without receiving any identifying data from the target itself (non-cooperative). This is vital in combat scenarios to distinguish enemy platforms from allied or civilian assets, providing the necessary assurance for autonomous engagement and preventing fratricide or collateral damage, often achieved through AI-based signature analysis.

How is cybersecurity relevant to the Missile Seeker Detector Market?

Cybersecurity is increasingly critical, focusing on protecting the seeker's embedded software, guidance algorithms, and data links from unauthorized access, hacking, or remote manipulation by adversaries. Securing the supply chain against hardware Trojans and ensuring the integrity of the AI models used in cognitive seekers are paramount concerns, as compromised seekers could lead to mission failure or misdirection.

What is the difference between Imaging Infrared (IIR) and traditional IR seekers?

Traditional IR seekers typically use a single detector element or simple arrays to track a target's hot spot directionally. IIR seekers, utilizing FPAs, capture a detailed thermal image of the target and its surroundings, allowing the missile to track specific features (like the exhaust nozzle or wings) rather than just the centroid of the heat source, resulting in dramatically improved precision and target discrimination capabilities.

What are the implications of the Missile Technology Control Regime (MTCR) on the market?

The MTCR significantly restrains market growth by imposing strict controls on the export of missiles and missile technology capable of delivering weapons of mass destruction. High-performance seeker detectors, being critical components of advanced guidance systems, fall under these restrictions, limiting the number of international sales and creating substantial regulatory hurdles for manufacturers seeking non-allied foreign markets.

How are radar seekers being designed to resist electronic jamming (EW)?

Modern radar seekers incorporate advanced features like ultra-agile frequency hopping, high-power GaN components, and sophisticated digital radio frequency memory (DRFM) countermeasures processing. AESA technology enables instantaneous beam steering to evade jamming attempts, while cognitive electronic warfare algorithms allow the seeker to adapt its frequency and waveform in real-time to maintain lock amidst intense electronic attack.

What future disruptive technologies are expected to influence missile seekers after 2030?

Beyond 2030, disruptive technologies are anticipated to include quantum sensing (offering unprecedented sensitivity and noise reduction), metamaterials for creating ultra-light, highly efficient sensor apertures, and fully autonomous, cooperative multi-missile systems enabled by federated AI learning, allowing small missile swarms to share and synthesize target data instantaneously.

What impact do missile defense programs have on seeker detector demand?

Missile defense programs (like THAAD, Aegis, and Patriot) are major drivers of demand for highly sensitive, long-range seeker detectors. Interceptor missiles require exceptionally precise seekers, often multi-mode or advanced IIR, capable of tracking small, non-emitting ballistic warheads in the vacuum of space or at high altitudes, necessitating substantial investment in cryogenic and electro-optical technologies for reliable interception.

Why is supply chain management particularly challenging for seeker detector manufacturers?

Supply chain management is challenging due to the reliance on a limited number of specialized, often single-source suppliers for highly regulated, high-purity materials (like semiconductor wafers and exotic optics). Geopolitical risks, long qualification cycles, and the need for ITAR compliance (in the US) mean manufacturers must maintain robust security and strict traceability throughout the entire supply chain to ensure product integrity and availability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager