Mobile Air Trailer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432410 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Mobile Air Trailer Market Size

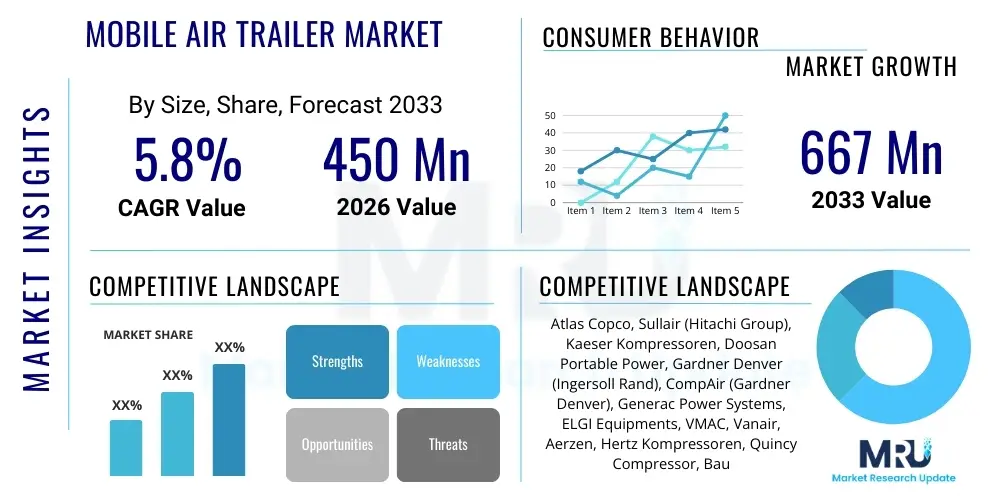

The Mobile Air Trailer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 667 Million by the end of the forecast period in 2033.

Mobile Air Trailer Market introduction

The Mobile Air Trailer Market encompasses robust, portable compressed air solutions mounted on trailers for easy transportation across various job sites. These trailers integrate high-capacity air compressors, receivers, aftercoolers, and necessary plumbing systems, providing continuous and reliable pneumatic power in environments where stationary infrastructure is impractical or unavailable. Product descriptions often highlight durability, fuel efficiency, and compliance with stringent environmental regulations, particularly concerning noise and emissions. These systems are indispensable for operations requiring temporary or flexible compressed air supply, ranging from sandblasting and pile driving to powering pneumatic tools for maintenance operations.

Major applications of mobile air trailers span critical sectors such as infrastructure development, oil and gas exploration, mining operations, aerospace maintenance, and specialized industrial cleaning. In construction, they support large-scale demolition and foundation work, while in the energy sector, they are crucial for pipeline testing and drilling activities. The primary benefits driving adoption include exceptional mobility, rapid deployment capabilities, scalability, and enhanced operational flexibility. Furthermore, modern trailers are increasingly equipped with telemetry systems, allowing for remote monitoring and predictive maintenance, thereby reducing downtime and improving overall equipment effectiveness (OEE).

Key driving factors fueling market expansion include sustained growth in global infrastructure investments, particularly in emerging economies, the rising trend of equipment rental over capital purchase among contractors, and the increasing demand for high-pressure air for specialized applications like drilling and large-scale industrial painting. Regulatory emphasis on minimizing operational noise and emissions has pushed manufacturers towards developing quieter, more energy-efficient diesel and electric-powered models, further stimulating market growth by replacing older, less compliant fleets.

Mobile Air Trailer Market Executive Summary

The Mobile Air Trailer Market is currently characterized by strong business trends focusing on digitalization and sustainability. Manufacturers are actively integrating IoT solutions to enable real-time performance tracking, optimize fuel consumption, and facilitate preventive maintenance schedules, leading to significant improvements in operational efficiency for end-users, especially large rental fleets. Furthermore, there is a pronounced shift towards electric or hybrid mobile air trailers, driven by stringent environmental standards in North America and Europe, positioning energy efficiency as a core competitive differentiator. Consolidation through strategic mergers and acquisitions remains a persistent trend, allowing key players to expand their technological portfolios and geographic reach, particularly into high-growth regions like Asia Pacific.

From a regional perspective, North America and Europe represent mature markets defined by high adoption rates of advanced, regulatory-compliant equipment and a strong preference for rental services. These regions prioritize sophisticated features such as variable speed drive (VSD) technology and advanced filtration systems for oil-free air delivery. Conversely, the Asia Pacific region, led by robust infrastructure and manufacturing investments in China and India, exhibits the highest growth potential. Regional trends here emphasize cost-effectiveness, rugged design suitable for harsh environments, and increasing demand for medium to high-pressure units necessary for large mining and construction projects. Latin America and MEA are focused on expanding their resource extraction capabilities, driving stable demand for heavy-duty, reliable trailer-mounted compressors.

Segment trends indicate that the high-pressure capacity segment is experiencing rapid acceleration due to specialized applications in deep drilling and offshore energy maintenance. The end-user segment is dominated by the construction and mining industries, which require powerful, continuously running units. However, the rental sector is emerging as the fastest-growing component, as businesses seek to minimize capital expenditure and manage equipment upgrades more flexibly. Technological innovation within segments is concentrated on enhancing the receiver tank materials for reduced weight and improved safety compliance, alongside the integration of advanced air treatment systems to meet the stringent quality requirements of pharmaceutical and food processing facilities that occasionally utilize mobile units for emergency support.

AI Impact Analysis on Mobile Air Trailer Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Mobile Air Trailer Market primarily revolve around predictive maintenance capabilities, optimization of fleet logistics, and enhancing operational energy efficiency. Users are concerned about whether AI integration will significantly increase the cost and complexity of standard mobile units, questioning the return on investment for small to medium-sized rental companies. Expectations center on AI-driven algorithms capable of analyzing vibration, temperature, and pressure data in real-time to forecast component failures, thereby drastically reducing unplanned downtime—a critical factor in high-stakes construction and mining environments. Users also anticipate AI being utilized to optimize routing and deployment schedules for rental fleets, ensuring the right capacity unit is delivered to the site efficiently, minimizing transport costs and idle time. The consensus among prospective buyers is that AI must deliver tangible benefits related to uptime, fuel savings, and asset longevity to justify the investment in smart air trailers.

- AI-driven Predictive Maintenance: Analyzing compressor data (vibration, heat) to anticipate equipment failure before it occurs, maximizing uptime.

- Optimized Fuel Consumption: Machine learning algorithms adjusting engine speed and load based on real-time pneumatic demand, enhancing fuel efficiency.

- Automated Fleet Management: Using AI for optimal routing, scheduling, and geographic deployment of rental trailers based on predicted demand patterns.

- Remote Diagnostics and Troubleshooting: AI assisting technicians by interpreting fault codes and suggesting repair procedures remotely.

- Enhanced Safety Monitoring: AI systems continuously monitoring operating parameters to ensure compliance with safety limits and flag potential hazards.

DRO & Impact Forces Of Mobile Air Trailer Market

The market dynamics of mobile air trailers are fundamentally shaped by a confluence of powerful drivers (D), significant restraints (R), evolving opportunities (O), and external impact forces. Primary drivers include rapid urbanization and large-scale infrastructure projects requiring mobile, heavy-duty pneumatic power, alongside the steady expansion of the equipment rental industry, which lowers the barrier to entry for users. However, significant restraints challenge market growth, notably the high initial capital investment required for advanced, emission-compliant compressors and the volatility in raw material costs, particularly steel and diesel fuel, which directly impact manufacturing and operational expenses. Opportunities arise from the increasing adoption of electric and hybrid air trailers, driven by stringent emission standards, and the potential for expansion into niche applications such as emergency services and specialized clean air delivery for pharmaceutical manufacturing, requiring ultra-clean, oil-free mobile units.

Impact forces stemming from technological innovation, regulatory mandates, and macroeconomic shifts exert significant influence. The shift toward Stage V and Tier 4 Final emission standards acts as a powerful external force, compelling manufacturers to redesign engines and integrate complex after-treatment systems, favoring companies with robust R&D capabilities. Furthermore, the competitive rivalry within the industry, characterized by several established global giants, forces constant innovation in terms of efficiency, portability, and connectivity (telematics). Substitute threat remains moderate, primarily from stationary compressors when permanent air supply is feasible, but for mobile and temporary needs, dedicated trailers hold a distinct advantage.

The combination of these elements dictates market direction. Drivers ensure sustained demand from core industrial sectors, while restraints necessitate careful cost management and technological leapfrogging. Opportunities guide future product development towards sustainable and connected solutions, ensuring the long-term viability and growth of specialized mobile air trailer manufacturers. The cumulative effect of these forces suggests a market leaning towards high-efficiency, digitally managed, and environmentally conscious solutions over the forecast period, positioning those manufacturers who invest in electrification and IoT integration for substantial competitive advantage.

Segmentation Analysis

The Mobile Air Trailer Market is segmented based on Capacity (Low, Medium, High Pressure), End-User (Construction, Mining, Oil & Gas, Manufacturing, Rental/Equipment Hire), and Component (Compressors, Air Receivers/Tanks, Hoses and Reels, Filtration Systems). Analyzing these segments provides a clear understanding of market dynamics, revealing that the High-Pressure segment is set for robust growth due to increasing requirements in deep drilling and specialized industrial cleaning applications. The dominance of the Construction and Rental sectors underscores the market's reliance on temporary, high-throughput air supply solutions for fluctuating project demands. Furthermore, technological advancements within the Component segment, particularly improved filtration and lighter air receiver materials, are contributing to enhanced portability and safety across all application types.

- By Capacity:

- Low Pressure (Up to 150 psi)

- Medium Pressure (151 psi to 350 psi)

- High Pressure (Above 350 psi)

- By End-User:

- Construction and Infrastructure

- Mining and Quarrying

- Oil and Gas (Upstream, Midstream, Downstream)

- Manufacturing and Industrial

- Rental and Equipment Hire Services

- Aerospace and Defense

- By Component:

- Air Compressors (Screw, Reciprocating)

- Air Receivers/Tanks

- Air Treatment and Filtration Systems

- Hoses, Reels, and Couplings

- Trailer Chassis and Running Gear

Value Chain Analysis For Mobile Air Trailer Market

The value chain for the Mobile Air Trailer Market starts with upstream activities centered on raw material procurement and specialized component manufacturing. Upstream suppliers are crucial, providing high-grade steel for trailer chassis and air receivers, as well as specialized inputs like diesel engines (compliant with Tier 4/Stage V regulations), electric motors, and advanced compressor components (rotors, valves). Efficiency and compliance are paramount at this stage; fluctuations in steel and engine costs directly influence the final product price. Key strategic relationships are maintained with core component suppliers (e.g., engine manufacturers like Cummins or Caterpillar) to ensure supply stability and technological integration for advanced, energy-efficient compressors.

The middle segment involves the core manufacturing process, where major players design, assemble, and rigorously test the complete mobile air trailer unit. This stage includes sophisticated engineering for noise reduction, vibration damping, and integrating telematics systems. Post-manufacturing, the product moves through complex distribution channels. Distribution is split between direct sales to large industrial customers (e.g., major construction firms or mining corporations) and indirect channels, predominantly involving specialized rental companies and third-party distributors who provide local sales, maintenance, and rental fleet management. The relationship with rental companies is symbiotic, as they often drive the bulk volume purchase of standardized units.

Downstream activities focus on the delivery, installation, maintenance, and eventual retirement or recycling of the equipment. Direct distribution often involves tailored service contracts, while indirect distribution through rental houses places the burden of immediate servicing on the fleet owner, supported by manufacturer training and spare parts supply. The end-users, such as construction site managers or oil rig operators, prioritize rapid repair and high reliability, making aftermarket service and spare parts availability a crucial profit center and competitive differentiator within the downstream segment. Effective reverse logistics for fleet refurbishment and decommissioning also plays an increasing role in the overall value proposition.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 667 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Sullair (Hitachi Group), Kaeser Kompressoren, Doosan Portable Power, Gardner Denver (Ingersoll Rand), CompAir (Gardner Denver), Generac Power Systems, ELGI Equipments, VMAC, Vanair, Aerzen, Hertz Kompressoren, Quincy Compressor, Bauer Compressors, Parker Hannifin, P.W. Air Compressors, Chicago Pneumatic, Rotorcomp Verdichter GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Air Trailer Market Potential Customers

The primary potential customers for mobile air trailers are businesses and organizations requiring robust, temporary, or semi-permanent compressed air capacity away from established utility infrastructure. These customers are categorized by their need for high uptime and operational flexibility, often prioritizing total cost of ownership (TCO) over initial price. Large-scale construction contractors represent a major customer base, needing mobile air for jackhammers, drilling rigs, and heavy-duty concrete spraying, often demanding units with high CFM and portability to move across vast construction sites rapidly. Their buying decisions are heavily influenced by equipment reliability, fuel efficiency, and compliance with local noise ordinances.

Another significant segment comprises rental and equipment hire companies, which serve as intermediaries for smaller contractors and provide specialized equipment for short-term projects. Rental houses are focused on optimizing their fleet utilization, durability, ease of maintenance, and the integration of advanced telematics to manage asset location and health remotely. They seek models that offer versatility and high residual value. The oil and gas sector, particularly for upstream exploration and pipeline maintenance (like pigging operations and hydro-testing), constitutes a high-value customer group demanding specialized, often high-pressure, oil-free mobile units certified for use in potentially hazardous environments, emphasizing safety and performance certifications.

Furthermore, government entities and defense organizations purchase or rent mobile air trailers for emergency preparedness, disaster relief, and military field operations, requiring rugged, reliable equipment capable of operating in extreme conditions. Customers in the manufacturing and utility sectors utilize these trailers as crucial backup systems to maintain operational continuity during scheduled maintenance or unexpected failures of stationary compressors, focusing primarily on immediate availability and specified air quality requirements (e.g., clean, dry air). These diverse potential customers ensure sustained demand across varying specifications and contractual terms, driving innovation towards modularity and customization.

Mobile Air Trailer Market Key Technology Landscape

The technology landscape of the Mobile Air Trailer Market is rapidly evolving, driven primarily by twin demands for enhanced efficiency and reduced environmental impact. The centerpiece of this evolution is the widespread adoption of Variable Speed Drive (VSD) technology in compressors. VSD systems match the compressor’s output directly to the required air demand, preventing the wasteful idling common in traditional fixed-speed units. This drastically improves energy efficiency, particularly in applications with fluctuating air needs, offering substantial fuel savings. Furthermore, advanced filtration and air treatment systems, including multi-stage filters and desiccant dryers, are becoming standard, enabling mobile units to deliver highly purified, oil-free air critical for sensitive sectors like food and beverage processing, pharmaceuticals, and specialized painting operations, extending the market's applicability beyond heavy industry.

A second major technological trend is the proliferation of IoT (Internet of Things) and sophisticated telematics integration. Modern mobile air trailers are equipped with embedded sensors that collect voluminous data on operational metrics, including engine temperature, fuel level, pressure stability, and GPS location. This data is transmitted via cloud platforms to fleet managers, enabling predictive maintenance schedules based on actual usage patterns rather than fixed intervals. This connectivity minimizes unplanned downtime, optimizes service routes, and enhances asset security. This digitalization is paramount for large rental companies seeking to maximize utilization rates and enhance customer service through transparent performance reporting.

Finally, the movement towards alternative power sources is reshaping the market. While diesel remains the dominant power source due to its high energy density and ubiquity, manufacturers are heavily investing in battery-electric and hybrid air trailer solutions. Battery-electric trailers offer zero emissions at the point of use and extremely quiet operation, making them ideal for urban construction sites and indoor industrial applications where noise and air quality regulations are strict. Although currently facing challenges related to battery weight and charging infrastructure, the demand for sustainable options ensures that electric drivetrain technology and high-efficiency permanent magnet motors will define the next generation of mobile air trailers, necessitating significant redesign of the trailer chassis to accommodate battery packs without sacrificing portability or durability.

Regional Highlights

Regional dynamics heavily influence the mobile air trailer market, reflecting varying levels of industrialization, regulatory pressures, and infrastructure investment cycles across the globe.

- North America (NA): Represents a mature market characterized by high demand for Tier 4 Final compliant, technologically advanced units, favoring rental solutions. Key drivers include sustained construction activity and the revitalization of the oil and gas sector, particularly shale extraction. The market emphasizes telematics integration for efficient fleet management and a growing shift towards electric/hybrid units in urban centers to meet stringent emission standards.

- Europe: Highly sensitive to environmental regulations (Stage V compliance). Europe leads in the adoption of electric and hybrid mobile compressors due to strict noise pollution controls and urban clean air zones. Western Europe demonstrates strong demand in specialized applications requiring high-quality, oil-free air, while Eastern Europe benefits from ongoing infrastructure development and manufacturing expansion.

- Asia Pacific (APAC): The fastest-growing regional market, driven by massive public and private infrastructure investments in China, India, and Southeast Asian nations. Demand is characterized by a need for rugged, cost-effective, and high-capacity units suitable for large-scale mining, road construction, and industrial expansion. While regulatory pressure is increasing, cost remains a more significant purchasing factor compared to Europe or NA.

- Latin America (LATAM): Growth is intrinsically tied to commodity prices, particularly mining and resource extraction projects in countries like Chile, Brazil, and Peru. The market requires heavy-duty, reliable, diesel-powered units capable of operating in remote and challenging terrains. Rental penetration is increasing, but direct sales to large mining operators remain strong.

- Middle East and Africa (MEA): Driven by large-scale energy projects, petrochemical expansions, and infrastructure megaprojects (e.g., Saudi Vision 2030). Demand is focused on high-pressure units for pipeline testing, specialized desert-proofed equipment, and continuous air supply for remote construction camps. Climate resilience and robust cooling systems are critical regional requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Air Trailer Market.- Atlas Copco

- Sullair (Hitachi Group)

- Kaeser Kompressoren

- Doosan Portable Power

- Gardner Denver (Ingersoll Rand)

- CompAir (Gardner Denver)

- Generac Power Systems

- ELGI Equipments Ltd.

- VMAC – Vehicle Mounted Air Compressors

- Vanair Manufacturing

- Aerzen

- Hertz Kompressoren

- Quincy Compressor (Atlas Copco)

- Bauer Compressors

- Parker Hannifin Corporation

- P.W. Air Compressors

- Chicago Pneumatic (Atlas Copco)

- Rotorcomp Verdichter GmbH

Frequently Asked Questions

Analyze common user questions about the Mobile Air Trailer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards electric mobile air trailers?

The primary driver is the implementation of stringent environmental regulations, particularly in urban areas of North America and Europe, mandating lower noise levels and zero or near-zero exhaust emissions, making battery-powered units essential for compliance and quiet operation.

How does telematics technology improve fleet management for rental companies?

Telematics enables real-time tracking of asset location, operational hours, fuel consumption, and performance data. This allows rental companies to optimize scheduling, minimize asset theft, implement predictive maintenance, and significantly increase overall equipment utilization rates (OER).

Which end-user segment dominates the demand for high-pressure mobile air trailers?

The Oil and Gas and specialized Mining segments dominate the demand for high-pressure units (above 350 psi), as these sectors require powerful pneumatic energy for deep drilling, pipeline hydro-testing, and rigorous abrasive blasting applications.

What are the key technical specifications required for oil-free mobile air applications?

Oil-free applications, common in pharmaceutical and food industries, require mobile air trailers utilizing oil-free scroll or centrifugal compressor technologies, paired with multi-stage filtration (coalescing and carbon filters) and air drying systems to meet ISO 8573-1 standards for air purity.

What is the projected CAGR for the Mobile Air Trailer Market between 2026 and 2033?

The Mobile Air Trailer Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 5.8% over the forecast period, fueled by global infrastructure development and the increasing adoption of mobile rental solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager