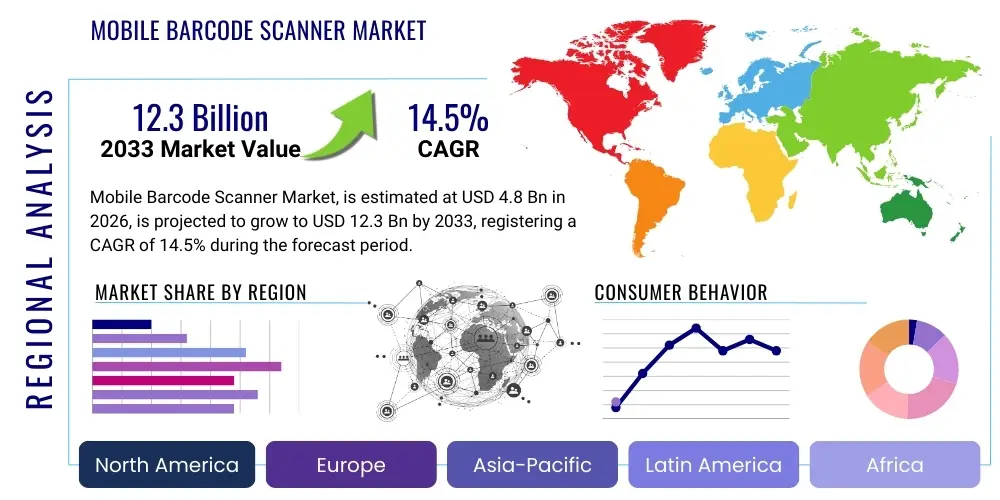

Mobile Barcode Scanner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436407 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Mobile Barcode Scanner Market Size

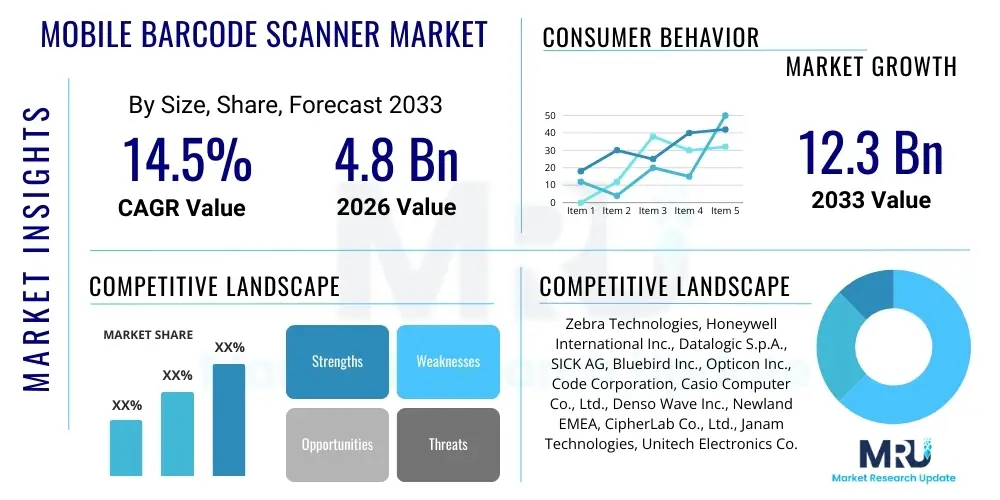

The Mobile Barcode Scanner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 12.3 Billion by the end of the forecast period in 2033.

Mobile Barcode Scanner Market introduction

The Mobile Barcode Scanner Market encompasses devices ranging from dedicated ruggedized handheld scanners to software applications transforming smartphones and tablets into scanning solutions. These technologies facilitate rapid, accurate data capture for inventory management, asset tracking, point-of-sale transactions, and logistics operations across various industries. Unlike fixed scanners, mobile barcode scanners offer flexibility and portability, allowing workers to perform scanning tasks anywhere within a facility or across complex supply chains, significantly improving operational efficiency and data fidelity. The primary goal of deploying these devices is to minimize manual entry errors, accelerate transactional speeds, and provide real-time visibility into stock levels and asset locations, which is critical for modern business intelligence and efficient resource allocation in a highly competitive global environment.

Product descriptions within this market span several technological formats, including 1D (linear) and 2D (matrix, QR code) imaging systems, utilizing laser, linear imager, or area imager technologies. Dedicated mobile computers, often running Android or Windows Mobile operating systems, integrate robust scanning capabilities with communication features (Wi-Fi, 5G, Bluetooth), making them essential tools for frontline workers in retail, warehousing, manufacturing, and healthcare sectors. The increasing demand for omnichannel fulfillment strategies and the rise of e-commerce necessitating efficient last-mile delivery and reverse logistics are major factors propelling the adoption of advanced mobile scanning solutions that can withstand harsh industrial environments while maintaining ergonomic design standards crucial for long shifts.

Major applications of mobile barcode scanners include warehouse management systems (WMS) for receiving and picking processes, tracking patient records and medication in healthcare, managing assets in field service operations, and accelerating checkout processes in retail environments through mobile point-of-sale (mPOS) integrations. Key benefits derived from their implementation include reduced operational costs associated with manual data handling, enhanced inventory accuracy leading to lower stockouts and overstock situations, and improved customer satisfaction through faster service delivery. Driving factors underpinning this robust market expansion are the continuous growth of global logistics networks, the pervasive digitalization of industrial operations (Industry 4.0), and the necessity for regulatory compliance, particularly in pharmaceuticals and food safety, requiring reliable traceability systems. The convergence of mobile scanning with augmented reality (AR) and cloud computing further enhances their utility, offering visual guidance and seamless integration with enterprise resource planning (ERP) systems.

Mobile Barcode Scanner Market Executive Summary

The Mobile Barcode Scanner Market is experiencing robust expansion driven by global advancements in e-commerce fulfillment, the maturation of Industry 4.0 paradigms, and the critical need for real-time supply chain visibility. Business trends indicate a significant shift from bulky, proprietary operating systems towards lightweight, consumer-grade form factors running Android, enabling easier integration, faster development cycles, and improved user familiarity. Key competitive differentiation is increasingly centered on software capabilities, including advanced data processing, seamless connectivity to cloud platforms, and durable, ergonomic designs suitable for intensive, all-day use in harsh conditions. Furthermore, the market is characterized by strategic partnerships between hardware manufacturers and software developers to provide end-to-end solutions that meet specific vertical needs, such as refrigerated logistics tracking or high-volume parcel sorting. Investment is pouring into improving scanner longevity, battery life, and optimizing imaging technology to accurately read damaged or poorly printed barcodes quickly, a crucial feature for efficiency gains in dynamic operational settings.

Regional trends highlight that North America and Europe remain mature markets, focusing on upgrading existing infrastructure with smart scanners that offer integration with AI-powered analytics for predictive maintenance and demand forecasting. In contrast, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive investments in warehousing and logistics infrastructure, particularly in China and India, alongside the rapid expansion of organized retail and manufacturing bases. Developing economies in Latin America and the Middle East and Africa (MEA) are showing increasing adoption, driven by the desire to formalize inventory systems and enhance trade efficiency. The regional variances also reflect differences in technology adoption speed; North America is quickly adopting sophisticated 2D imagers and camera-based solutions, while emerging markets are consolidating standard dedicated scanning devices as a foundational digital transformation step.

Segmentation trends reveal that the dedicated mobile computer segment, which combines scanning with mobile computing features, holds the largest market share due to its ruggedness and multifunctionality required in industrial settings like large distribution centers and manufacturing plants. However, the rugged smartphone/tablet add-on and sled segment is gaining significant traction, particularly in smaller retail operations and field service, offering a cost-effective route to high-performance scanning utilizing existing consumer mobile infrastructure. Based on technology, the area imager segment is dominating the growth trajectory, largely displacing traditional laser scanners, owing to its ability to read 2D barcodes, capture images, and offer better performance on screens and varied surfaces. The retail and e-commerce sector remains the primary end-user, experiencing unparalleled demand for mobile scanning tools to manage inventory, facilitate curbside pickup, and handle returns processing efficiently.

AI Impact Analysis on Mobile Barcode Scanner Market

User inquiries concerning the integration of Artificial Intelligence (AI) and Machine Learning (ML) into mobile barcode scanning primarily revolve around performance enhancement, data utilization, and the potential for these tools to evolve beyond simple data capture. Users commonly ask whether AI can improve the accuracy of reading damaged, obscured, or non-standard barcodes in dynamic environments, which represents a significant operational pain point. Another major theme is the role of AI in analyzing the massive datasets generated by scanners, specifically how ML algorithms can optimize inventory routing, predict stock replenishment needs, or identify anomalies indicative of theft or process inefficiencies. Furthermore, there is considerable interest in how AI facilitates the integration of advanced vision systems, blurring the line between traditional barcode scanning and full-fledged object recognition, which could ultimately lead to automated counting and inspection without relying solely on printed codes, transforming future inventory auditing processes.

The implementation of AI algorithms, particularly deep learning models, allows mobile scanners to perform sophisticated image processing in real-time. This capability translates directly into higher first-pass read rates, especially in challenging lighting or when dealing with low-contrast labels often found in logistics. AI models embedded at the edge (on the device) or leveraged through cloud connectivity enable the device to learn from poor scans and adapt its imaging parameters dynamically, providing robustness far superior to conventional decoding logic. This enhanced resilience to real-world operational variables is critical for industries like manufacturing and harsh outdoor logistics where pristine labels are the exception, not the rule. The integration of AI moves the scanner from a passive data capture device to an active data intelligence node, immediately flagging critical inventory discrepancies.

Beyond simple decoding, AI’s impact is profound in optimizing workforce deployment and operational workflows. By analyzing patterns in scan frequency, location, and time stamps, ML algorithms can identify bottlenecks in warehousing or retail operations, recommending optimal routes for picking tasks or alerting managers to potential equipment failure based on usage metrics. In retail, AI-driven mobile scanners can contribute to loss prevention by recognizing patterns in transactions or scanning habits associated with fraud. For end-users, this shift means less reliance on perfectly formatted data and more focus on harnessing actionable insights derived from the rapid stream of transactional data, pushing the industry towards autonomous data environments where human intervention is minimized. This strategic convergence of high-speed mobile scanning and sophisticated analytics is redefining efficiency benchmarks across all supply chain activities.

- AI enables robust decoding of damaged, partially obscured, or low-contrast barcodes through advanced image recognition models.

- Machine Learning algorithms optimize device power consumption and battery life based on predicted usage patterns, extending operational runtime.

- Predictive analytics facilitated by AI integration helps optimize picking routes and inventory slotting in warehouses, significantly reducing travel time.

- AI-driven data processing allows for real-time anomaly detection, enhancing security, and facilitating proactive loss prevention measures.

- Future integration involves merging barcode scanning with computer vision for automated, code-less item identification and verification, expanding application scope.

DRO & Impact Forces Of Mobile Barcode Scanner Market

The Mobile Barcode Scanner Market is shaped by a powerful interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory and competitive dynamics. The fundamental Driver is the unprecedented growth of the global e-commerce sector, which necessitates faster, more accurate, and flexible fulfillment processes, pushing retailers and logistics providers to invest heavily in mobile data capture tools for last-mile delivery and inventory accuracy. Compounding this, the global push towards digitalization (Industry 4.0) mandates the implementation of connected devices that provide real-time operational data, turning mobile scanners into essential nodes in the Industrial Internet of Things (IIoT). This digital transformation provides a continuous demand floor for rugged, connected, and highly efficient scanning solutions across manufacturing, healthcare, and logistics sectors, solidifying their role as mission-critical equipment.

However, the market faces significant Restraints, primarily stemming from the increasing sophistication of modern smartphones and tablets. The development of high-quality, inexpensive consumer-grade cameras coupled with sophisticated software decoding libraries presents a viable, lower-cost alternative to dedicated rugged scanners, particularly for less intensive applications or smaller businesses, potentially cannibalizing market share for entry-level professional devices. Furthermore, the high initial capital investment required for deploying dedicated, enterprise-grade mobile computers, including hardware, licensing, and integration costs, particularly in small and medium-sized enterprises (SMEs), acts as a deterrent. Data security concerns associated with mobile devices handling sensitive inventory and patient information, alongside the challenges of managing and maintaining a large fleet of mobile devices, including battery degradation and software updates, also pose significant friction points for widespread adoption.

Opportunities abound, predominantly in the expansion of high-growth segments such as healthcare, where mobile scanners are essential for patient safety, medication administration, and strict adherence to traceability regulations like serialization standards. The emergence of Augmented Reality (AR) integration with mobile scanning platforms offers new paradigms for guided workflow, where users receive visual overlays directing them during picking or assembly, promising substantial efficiency gains. Crucially, the transition to 2D barcodes (QR, Data Matrix) across industries—driven by the need to embed more data for traceability and consumer interaction—creates a continuous upgrade cycle, as older 1D laser scanners become obsolete. The impact forces show a strong trajectory towards growth, with the powerful drivers of e-commerce and digitalization generally outweighing the restraints, provided manufacturers innovate rapidly by integrating high-end computing, robust security features, and superior ergonomic design to justify the premium over consumer alternatives.

Segmentation Analysis

The Mobile Barcode Scanner Market is meticulously segmented across key dimensions including Product Type, Technology, Form Factor, and End-User, enabling detailed analysis of specific market dynamics and growth opportunities within each category. The core segmentation by Product Type distinguishes between dedicated Mobile Computers, which integrate robust scanning capabilities with full mobile computing platforms for demanding tasks; dedicated Handheld Scanners, which are ruggedized scanners reliant on tethering or Bluetooth connection to a separate host device; and Smartphone/Tablet Scanner Sleds/Add-ons, which utilize consumer devices coupled with specialized accessories for enterprise-grade scanning performance. This detailed breakdown highlights the diverse solutions available to meet varying operational requirements, budgets, and ruggedness needs across industries. Analyzing these segments is critical for understanding where capital investment is concentrated and predicting future shifts in hardware preferences based on evolving operational demands and software ecosystems, especially the move towards flexible Android platforms.

- By Product Type

- Mobile Computers (Handheld, Vehicle-Mounted)

- Handheld Scanners (Corded, Cordless/Bluetooth)

- Smartphone/Tablet Scanner Sleds and Add-ons

- By Technology

- Laser Scanning (1D)

- Linear Imagers (1D)

- Area Imagers (2D/Omni-Directional)

- By Form Factor

- Industrial/Rugged

- Consumer/Standard

- By End-User Industry

- Retail and E-commerce (Point-of-Sale, Inventory Management, Click-and-Collect)

- Logistics and Transportation (Warehouse Management, Fleet Tracking, Last-Mile Delivery)

- Manufacturing (Work-in-Process Tracking, Asset Management)

- Healthcare (Patient ID, Medication Administration, Lab Tracking)

- Government and Public Sector

- Others (Field Service, Hospitality)

Value Chain Analysis For Mobile Barcode Scanner Market

The value chain for the Mobile Barcode Scanner Market begins with upstream activities dominated by component manufacturing, including the sourcing of sophisticated imaging sensors, decoding chips, specialized lenses, durable housing materials, and advanced battery technology. Key upstream suppliers include providers of high-performance CMOS sensors and dedicated ASIC processors optimized for rapid image acquisition and decoding. Success at this stage relies heavily on securing reliable supply chains for scarce electronic components and maintaining high quality standards for ruggedized components essential for industrial-grade devices. The design and assembly phase, led by major OEMs, involves integrating these components, developing proprietary operating systems (though increasingly moving towards customized Android distributions), and ensuring ergonomic design and compliance with stringent environmental certifications (IP ratings) and drop specifications. This stage is crucial for differentiation based on ruggedness, scanning speed, and device longevity in demanding operational environments.

Midstream activities primarily involve manufacturing, quality assurance, and the crucial step of software development and integration. OEMs invest heavily in developing Software Development Kits (SDKs) and Application Programming Interfaces (APIs) that allow their devices to seamlessly integrate with major Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS) such as SAP, Oracle, and proprietary systems. The distribution channel forms the critical link to the end-users. Distribution is multifaceted, involving both direct sales channels, typically for very large enterprise deployments or specialized government contracts, and indirect channels through a complex network of Value-Added Resellers (VARs), system integrators, and specialized industrial distributors. VARs play a pivotal role, offering localized support, customized software solutions, and integration services tailored to specific vertical market needs (e.g., cold chain logistics or hospital workflow).

Downstream activities focus on deployment, maintenance, and support services. The indirect channel, dominated by VARs and distributors, often provides the frontline technical support and post-sale maintenance, including device management, repair services, and software updates, which are essential for maximizing the lifecycle of high-cost industrial mobile computers. The growing reliance on software and cloud connectivity has also increased the importance of managed services providers (MSPs) who offer Device-as-a-Service (DaaS) models, bundling hardware, software, maintenance, and fleet management into a subscription service. This shift in the downstream model offers customers predictable operational costs and reduces the complexity of managing large, diverse fleets of mobile scanners, reflecting a trend towards total solution provisioning rather than just hardware sales. This comprehensive support structure ensures high uptime, which is a non-negotiable requirement for mission-critical logistics and manufacturing operations worldwide.

Mobile Barcode Scanner Market Potential Customers

Potential customers for mobile barcode scanning solutions are distributed across virtually every sector engaged in the movement, storage, and tracking of physical goods or assets, reflecting the essential nature of accurate data capture in the modern economy. The largest and most demanding customer base resides within the retail and e-commerce sector, encompassing large global retailers, specialized boutiques, and pure-play online merchants. These entities utilize scanners for point-of-sale efficiency, complex omnichannel inventory management, facilitating click-and-collect orders, and streamlined reverse logistics (returns processing). The requirement here is often dual: ruggedness for warehouse operations combined with sleek, consumer-friendly design for in-store or curbside interactions, driving demand for versatile mobile computers and sled solutions.

The logistics, transportation, and warehousing segment represents another core demographic, including third-party logistics (3PL) providers, parcel carriers, postal services, and large private fleet operators. These customers demand extremely rugged devices with superior battery life and advanced reading capabilities to handle high volumes of scanning in outdoor environments, large-scale distribution centers, and often dimly lit or temperature-controlled settings. Their primary use cases revolve around receiving, put-away, cycle counting, order fulfillment, and critical last-mile delivery proof-of-delivery applications, requiring seamless GPS and cellular connectivity alongside robust scanning performance. Downtime for these organizations translates directly into supply chain disruption, making reliability and comprehensive support paramount purchasing factors.

In addition to these core segments, the healthcare industry constitutes a rapidly growing market, driven by regulatory mandates and the necessity for enhanced patient safety. Hospitals, clinics, pharmacies, and pharmaceutical manufacturers are vital end-users, leveraging mobile scanners for positive patient identification (PPID), accurate medication administration (point-of-care scanning), and tracking lab samples and physical assets like medical equipment. The manufacturing sector utilizes these tools for tracking work-in-process (WIP), quality control monitoring, tool crib management, and asset tracking across sprawling factory floors. Collectively, these diverse end-users prioritize different features—ruggedness for logistics, ergonomics for retail, and clinical-grade sanitization compatibility for healthcare—but all share the fundamental need for mobile efficiency, accuracy, and real-time data connectivity provided by advanced mobile scanning hardware and software ecosystems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 12.3 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, Honeywell International Inc., Datalogic S.p.A., SICK AG, Bluebird Inc., Opticon Inc., Code Corporation, Casio Computer Co., Ltd., Denso Wave Inc., Newland EMEA, CipherLab Co., Ltd., Janam Technologies, Unitech Electronics Co., Ltd., KoamTac Inc., Shenzhen Rakinda Technology Co., Ltd., Sunmi Technology, Mindeo, Seiko Epson Corporation, Trimble Inc., Panasonic Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Barcode Scanner Market Key Technology Landscape

The technological landscape of the Mobile Barcode Scanner Market is characterized by a rapid evolution away from traditional laser-based 1D scanning towards advanced area imaging (2D) technology, which utilizes CMOS sensors and sophisticated optics to capture matrix codes (QR, Data Matrix) alongside linear barcodes. Area imagers are dominant because they offer omni-directional reading, meaning the orientation of the barcode does not need to be precisely aligned, significantly accelerating throughput in high-volume environments like warehouses. Crucially, the latest generation of imagers incorporates superior optics and illumination systems designed to read barcodes displayed on electronic screens (smartphones, tablets), catering directly to the needs of mobile couponing, digital ticketing, and mobile point-of-sale applications, which are fundamental drivers in modern retail and transportation sectors. This transition is not merely an upgrade but a foundational shift enabling richer data encoding and improved security protocols inherent in 2D standards.

A second major technological advancement is the integration of powerful mobile computing platforms, predominantly based on the Android operating system, into dedicated mobile scanning devices. The shift to Android offers several advantages over legacy proprietary operating systems: easier application development, integration with common enterprise mobile management (EMM) tools, and greater user familiarity, which reduces training time and increases user acceptance. Furthermore, modern devices are increasingly equipped with advanced wireless connectivity features, including 5G capability, Wi-Fi 6, and robust Bluetooth Low Energy (BLE), ensuring seamless, high-speed data transmission back to ERP and WMS systems in real-time. This real-time data flow is essential for achieving the promised efficiency gains of Industry 4.0, where decisions must be made instantaneously based on current inventory status and location tracking data generated by the scanners.

Finally, durability and battery technology remain critical components of the technological landscape, particularly for industrial form factors. Manufacturers are continuously innovating ruggedization features, employing higher IP ratings for protection against dust and water ingress, and designing devices to withstand multiple drops onto concrete from significant heights. Parallel innovation in battery technology, including hot-swappable batteries and intelligent power management systems optimized by integrated AI, ensures that devices can operate continuously through long shifts without requiring recharging breaks. Furthermore, specialized technology such as simultaneous decoding of multiple codes and advanced reading algorithms for poorly printed or reflective surfaces exemplify the ongoing efforts to optimize scanning efficiency, providing a clear competitive edge to manufacturers who can deliver the fastest, most accurate, and most resilient data capture experience in the demanding environment of modern global logistics.

Regional Highlights

- North America: This region is characterized by high market maturity and technological leadership. Adoption is concentrated in sophisticated logistics hubs, advanced retail supply chains, and large healthcare systems adhering to stringent identification standards. The market here focuses on replacement cycles for legacy systems, demanding high-performance 2D imagers, devices integrated with robust fleet management software, and early adoption of AI/ML-enhanced scanning for complex data analysis and predictive maintenance. The proliferation of major e-commerce players drives continuous investment in automation and high-throughput mobile scanning solutions across the US and Canada.

- Europe: The European market demonstrates steady growth, driven by stringent traceability regulations, particularly within the pharmaceutical (EU Falsified Medicines Directive) and food and beverage sectors. Western European countries exhibit high adoption rates, concentrating on devices compliant with GDPR data security requirements and those that support seamless cross-border logistics operations. Central and Eastern Europe are emerging as high-growth areas due to increasing foreign direct investment in manufacturing and the modernization of distribution infrastructure, promoting the transition from manual processes to automated mobile data capture using rugged industrial computers.

- Asia Pacific (APAC): APAC represents the fastest-growing region globally, fueled by massive infrastructure development, explosive e-commerce penetration (especially in China, India, and Southeast Asia), and the rapid expansion of organized retail. This region is a major manufacturing hub, creating substantial demand for industrial mobile computers for work-in-process tracking and inventory management. The market is highly price-sensitive but exhibits strong volume growth, with significant localized competition driving innovation in cost-effective, high-performance Android-based devices tailored for dense urban logistics and varied climatic conditions.

- Latin America: This region shows accelerating adoption, primarily driven by the need to formalize retail and distribution networks and improve supply chain transparency to combat inefficiencies. Brazil and Mexico are the largest markets, where mobile scanners are crucial for improving inventory accuracy in large-scale agribusiness and retail environments. Growth is spurred by increasing digitalization initiatives and the implementation of mobile solutions to manage logistics challenges across diverse geographic terrains, with a preference for durable and adaptable scanning sleds utilizing locally sourced consumer mobile devices for cost efficiency.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated around Gulf Cooperation Council (GCC) states due to significant government investment in smart city projects, logistics hubs, and expanding retail infrastructure. Mobile scanners are essential tools for managing complex oil and gas asset tracking and optimizing cold chain logistics for perishable goods. The market here demands highly ruggedized devices capable of operating reliably under extreme heat and dusty conditions, with recent high-profile projects in transportation and warehousing driving adoption of the latest connectivity technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Barcode Scanner Market.- Zebra Technologies

- Honeywell International Inc.

- Datalogic S.p.A.

- SICK AG

- Bluebird Inc.

- Opticon Inc.

- Code Corporation

- Casio Computer Co., Ltd.

- Denso Wave Inc.

- Newland EMEA

- CipherLab Co., Ltd.

- Janam Technologies

- Unitech Electronics Co., Ltd.

- KoamTac Inc.

- Shenzhen Rakinda Technology Co., Ltd.

- Sunmi Technology

- Mindeo

- Seiko Epson Corporation

- Trimble Inc.

- Panasonic Corporation

- Handheld Group AB

- Getac Technology Corporation

- TouchStar Technologies

- M3 Mobile

- Point Mobile Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Mobile Barcode Scanner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Mobile Barcode Scanner Market?

The central driver is the explosive global growth of the e-commerce sector and the resulting critical need for high-speed, accurate, and flexible inventory management and last-mile delivery processes, which necessitates real-time mobile data capture solutions across the supply chain.

Why are Area Imagers replacing traditional Laser Scanners in new deployments?

Area Imagers (2D technology) are preferred because they offer omni-directional reading, can decode complex matrix barcodes (like QR codes), and are effective at scanning codes displayed on electronic screens, providing superior flexibility and efficiency compared to directional 1D laser scanners.

How is the adoption of Android impacting the Mobile Computer segment?

The transition to the Android OS is driving significant market expansion by reducing operational complexity, lowering development costs for enterprise applications, enhancing user familiarity, and enabling seamless integration with modern cloud-based Enterprise Mobility Management (EMM) systems.

What role does Artificial Intelligence (AI) play in modern mobile scanning solutions?

AI is integrated primarily to enhance decoding accuracy for damaged or challenging barcodes, optimize operational workflows through predictive analytics (e.g., picking route optimization), and facilitate advanced computer vision capabilities beyond simple barcode recognition.

Which geographical region is expected to exhibit the highest market growth rate through 2033?

The Asia Pacific (APAC) region is projected to experience the highest Compound Annual Growth Rate (CAGR), driven by large-scale infrastructural investments in logistics, rapid expansion of manufacturing capabilities, and accelerating e-commerce penetration across emerging economies like India and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager