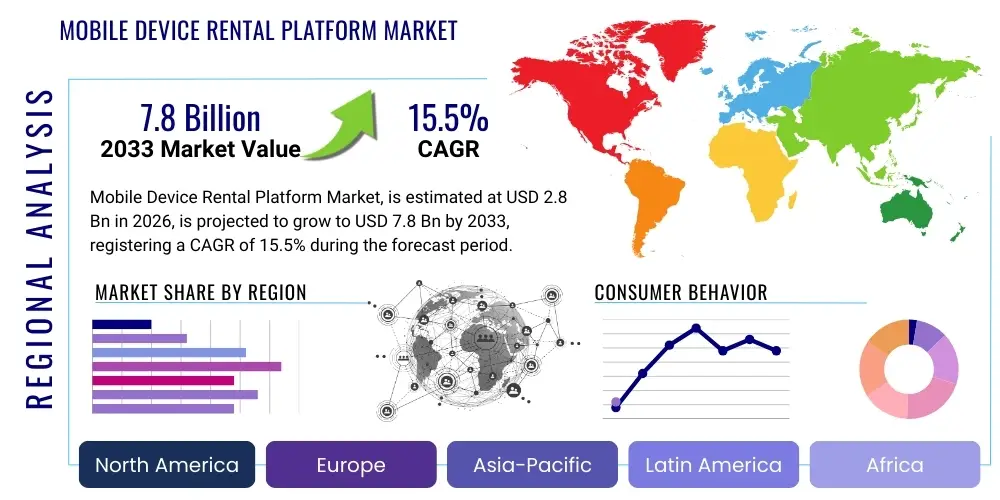

Mobile Device Rental Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438851 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Mobile Device Rental Platform Market Size

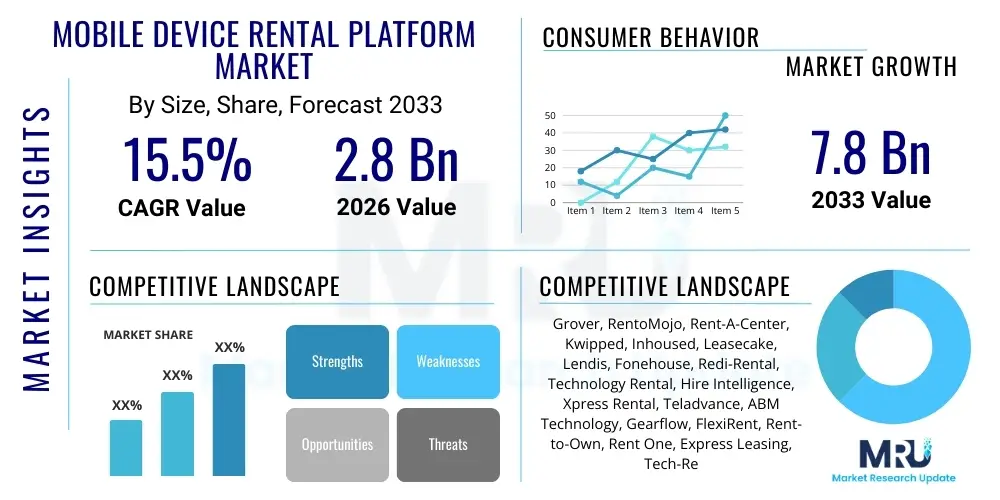

The Mobile Device Rental Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $2.8 Billion in 2026 and is projected to reach $7.8 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the rising need for flexible technology procurement models among businesses and individuals, coupled with the rapid evolution of mobile technology, which necessitates frequent device upgrades without significant capital expenditure.

The valuation reflects the increasing acceptance of rental and subscription models as viable alternatives to outright device ownership, particularly within the corporate sector seeking streamlined asset management and cost optimization. Furthermore, the global proliferation of events, temporary projects, and educational programs demanding short-term access to high-end mobile devices significantly contributes to the market expansion. Emerging economies, characterized by price sensitivity and high mobile penetration rates, are increasingly adopting rental platforms to bridge the digital divide and access premium technology affordably.

Market expansion will be further bolstered by platform advancements that integrate AI-driven inventory management, sophisticated device tracking, and enhanced cybersecurity features, addressing key enterprise concerns regarding data security and compliance. The shift towards circular economy models also positions rental platforms favorably, emphasizing sustainability and reducing electronic waste, thereby attracting environmentally conscious consumers and corporations committed to ESG principles. The overall trajectory indicates robust demand across B2B and B2C segments.

Mobile Device Rental Platform Market introduction

The Mobile Device Rental Platform Market encompasses digital ecosystems and services facilitating the temporary leasing of various mobile devices, including smartphones, tablets, laptops, and specialized IoT devices, to businesses and consumers globally. These platforms offer flexible rental durations, ranging from short-term daily rentals for events or travel to long-term monthly subscriptions for corporate employees or individual use. The primary product offering is not the device itself, but the integrated service package that includes maintenance, insurance, technical support, and seamless logistics (delivery and pickup).

Major applications of these platforms span across diverse industry verticals. In the enterprise sector, they are crucial for equipping temporary staff, managing device lifecycles, and facilitating large-scale testing or training programs. For the events industry, platforms provide high-volume device provisioning for conferences, trade shows, and interactive exhibits. Individually, consumers utilize these services for travel, short-term professional needs, or accessing flagship devices affordably without the long-term commitment of purchase. The core benefit lies in cost efficiency, flexibility, and immediate access to the latest technology without capital blockage.

The market is primarily driven by the corporate trend of shifting from Capital Expenditure (CapEx) to Operational Expenditure (OpEx) for technology assets, driven by the desire for scalability and predictable monthly costs. Other critical driving factors include the acceleration of remote work models requiring standardized device provision across dispersed teams, the high rate of technological obsolescence necessitating frequent upgrades, and the increasing focus on sustainable consumption models, which rental platforms intrinsically support by extending device utility and lifespan.

Mobile Device Rental Platform Market Executive Summary

The Mobile Device Rental Platform Market is characterized by vigorous growth, largely propelled by shifting enterprise procurement strategies and the democratization of high-end technology access. Business trends highlight a strong B2B focus, with platforms increasingly integrating asset management software and cybersecurity measures to serve corporate clients requiring standardized global deployment. Subscription models are gaining prominence over traditional short-term rentals, offering better revenue predictability for service providers. Geographically, North America and Europe dominate due to established corporate infrastructure and high digital literacy, while the Asia Pacific (APAC) region is demonstrating the fastest growth owing to massive mobile penetration and a burgeoning startup ecosystem.

Segment trends reveal that the Smartphone and Tablet segments hold the largest market share, driven by their universal utility in both consumer and enterprise settings. However, the Laptop segment is experiencing accelerated growth following the global sustained adoption of hybrid and remote work environments. By End-User, the Enterprise/B2B segment remains the primary revenue source, demanding tailored services such as bulk provisioning, customized software installation, and rapid technical support. The market landscape is competitive, with established rental companies diversifying their technology portfolios and specialized tech-leasing startups leveraging advanced platform technology to optimize user experience and logistics.

The future market trajectory is heavily influenced by technological integration, particularly the adoption of AI for dynamic pricing and predictive maintenance, enhancing platform efficiency. Regulatory factors concerning data privacy and cross-border device logistics present manageable restraints. Overall, the market remains highly attractive, focusing on providing 'Technology-as-a-Service' rather than merely device hardware, positioning rental platforms as essential partners in modern corporate operations and individual technological accessibility.

AI Impact Analysis on Mobile Device Rental Platform Market

Common user questions regarding AI's influence in the Mobile Device Rental Platform Market center around operational efficiency, customer experience personalization, and risk management. Users frequently inquire about how AI can enhance the accuracy of device valuation and dynamic pricing models, especially considering rapid depreciation rates. A significant concern revolves around using AI for fraud detection during the rental process and ensuring seamless, automated customer support without sacrificing service quality. Furthermore, users are keen to understand how AI-driven predictive analytics can optimize inventory allocation, maintenance schedules, and global logistics, minimizing turnaround times and improving overall supply chain resilience. The consensus indicates high expectations for AI to automate complex processes, reduce operational costs, and deliver a hyper-personalized rental journey.

AI technologies, including machine learning algorithms and natural language processing (NLP), are fundamentally transforming how mobile device rental platforms operate. AI is leveraged extensively in demand forecasting, enabling platforms to accurately predict regional and seasonal requirements for specific device models, minimizing inventory surplus or shortages. This predictive capability directly impacts profitability and operational flexibility, allowing companies to scale rapidly in response to market shifts. Moreover, AI-powered chatbots and virtual assistants are being integrated into customer service interfaces, providing instant, 24/7 support for routine inquiries, technical troubleshooting, and rental process guidance, thus enhancing customer satisfaction and reducing dependence on human resources.

In the crucial area of device lifecycle management, AI algorithms analyze historical data related to device usage, damage patterns, and technical failures to predict when a device is likely to require maintenance or replacement. This predictive maintenance approach drastically reduces unexpected downtime and associated costs, improving the device utilization rate. Furthermore, sophisticated machine learning models are applied to the complex task of calculating optimal rental pricing, dynamically adjusting rates based on real-time market supply, competitor pricing, device condition, and rental duration, ensuring maximum revenue generation while remaining competitive in a highly sensitive market environment.

- AI-Driven Dynamic Pricing: Optimizes rental rates based on real-time demand, device availability, and competitive analysis.

- Predictive Inventory Management: Forecasts regional demand for specific devices, minimizing stockouts and optimizing logistics costs.

- Enhanced Fraud Detection: Machine learning models analyze user behavior and transactional data to mitigate risk and detect fraudulent applications.

- Automated Customer Support: Implementation of NLP-enabled chatbots for instant resolution of technical and logistical queries.

- Optimized Maintenance Scheduling: Predicting device failure points to schedule proactive maintenance, extending asset lifespan and reducing repair costs.

- Personalized Rental Recommendations: AI analyzes past rental history and user profiles to suggest suitable device packages and subscription models.

DRO & Impact Forces Of Mobile Device Rental Platform Market

The market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key impact forces. The dominant Driver is the paradigm shift in corporate asset financing, moving away from large capital investments towards flexible operational leasing models that provide budgetary stability and easier scalability, especially for multinational enterprises managing diverse device portfolios across various geographical locations. Concurrently, the increasing frequency of device release cycles and the high cost of flagship models necessitate more accessible, temporary solutions for both professional and consumer use, accelerating rental adoption. These factors combine to create a strong pull impact, ensuring sustained demand growth across the forecast period.

However, significant Restraints challenge rapid market expansion. Primary among these is the inherent risk of device damage, loss, or theft, which necessitates expensive insurance and rigorous recovery protocols, sometimes increasing the overall cost for the end-user. Data security and privacy concerns are also paramount, particularly for enterprise clients handling sensitive information, requiring platforms to invest heavily in certified data wiping and compliance infrastructure, which adds operational complexity. Furthermore, competition from established manufacturers offering their own trade-in and subscription programs, coupled with the deeply ingrained consumer preference for outright ownership in some mature markets, acts as a decelerating force.

Despite these challenges, substantial Opportunities abound. The untapped potential in emerging markets, characterized by high growth and low purchasing power, offers a vast customer base receptive to rental models. Moreover, the integration of 5G technology and the proliferation of specialized IoT devices create new rental avenues beyond traditional smartphones and tablets, particularly in industrial and medical applications. The circular economy mandate further serves as a long-term opportunity, allowing rental companies to market their services as sustainable alternatives, gaining favor among ESG-focused institutional clients. Successfully navigating the regulatory landscape while leveraging technological advancements in asset tracking and security will determine market leadership and growth trajectory.

The collective impact forces suggest a market segment currently experiencing high growth momentum, driven by favorable economic and technological shifts, yet requiring continuous investment in robust logistical infrastructure and data security measures to mitigate inherent operational risks associated with managing high-value, portable assets across multiple jurisdictions. Strategic differentiation through superior service quality and specialized B2B offerings remains critical.

Segmentation Analysis

The Mobile Device Rental Platform Market is extensively segmented based on device type, rental model, end-user industry, and operating system, reflecting the diverse applications and demands within this ecosystem. This segmentation provides a granular view of market dynamics, revealing varying growth rates and adoption patterns across different verticals. The differentiation in device complexity and required service level profoundly influences pricing and platform specialization. For instance, renting high-end specialized devices requires more stringent insurance and technical support compared to standard consumer smartphones, leading to distinct service packages tailored for specific segments.

The segmentation by rental model—short-term, long-term, and subscription—is crucial, as it dictates revenue stability and customer relationship duration. While short-term rentals are volatile but high-margin (catering primarily to events and travel), long-term and subscription models offer predictable recurring revenue and higher customer lifetime value (CLV), preferred by corporate clients for stable asset management. Geographically, segmentation helps identify areas ripe for expansion, with mature markets showing high penetration in the B2B segment, while developing regions demonstrate faster uptake in B2C subscriptions.

Understanding these segments is vital for service providers to tailor their offerings effectively, optimize inventory management, and align marketing strategies with target customer needs. The fastest-growing segments are generally those tied to sustained technological megatrends, such as enterprise mobility and flexible workforce arrangements, propelling the long-term rental of laptops and specialized devices. Continuous innovation in platform features and customized logistics solutions will be key determinants of success within these specific market niches.

- By Device Type:

- Smartphones

- Tablets

- Laptops

- Wearables (Smartwatches, AR/VR Headsets)

- Specialized Devices (POS Systems, Industrial Scanners)

- By Rental Model:

- Short-Term Rentals (Daily/Weekly)

- Long-Term Rentals (Monthly/Annual)

- Subscription Services (Technology-as-a-Service)

- By End-User:

- Enterprise/B2B (SMEs, Large Enterprises)

- Individual/B2C

- Education Institutions

- Events and Hospitality

- Government and Public Sector

- By Operating System:

- iOS

- Android

- Windows

- Others (Linux, Custom OS)

Value Chain Analysis For Mobile Device Rental Platform Market

The Value Chain for the Mobile Device Rental Platform Market begins with Upstream activities centered on device procurement, financing, and initial asset preparation. Platforms typically engage directly with manufacturers, distributors, or secondary market suppliers to acquire devices in bulk, often securing favorable financing terms. This stage includes initial quality checks, device configuration (including software loading for B2B clients), and secure data wiping procedures for previously used inventory. Efficient upstream management is critical for controlling capital costs and ensuring a diverse, high-quality inventory pool ready for deployment. Strategic partnerships with financing institutions often underpin the scalability of procurement operations.

The Midstream phase involves the core platform operations, encompassing demand generation through digital marketing, customer onboarding, contract management, and sophisticated inventory tracking systems. Key activities here include ensuring regulatory compliance, securing insurance coverage against damage or loss, and maintaining the technological infrastructure of the rental platform itself (website, apps, CRM integration). The efficiency of the platform's user experience (UX) and the automation of the leasing process are critical midstream differentiators that directly impact conversion rates and customer satisfaction.

Downstream activities focus heavily on logistics and post-rental management. This includes direct and indirect distribution channels such as last-mile delivery services, authorized pickup locations, and return processing centers. Crucially, the downstream also involves rigorous reverse logistics: device collection, comprehensive technical inspection, certified data sanitation (critical for data privacy compliance), repair, refurbishment, and redeployment into the rental pool. Direct distribution provides greater control over the customer experience and device handling, while indirect channels (partnerships with local logistics firms) are used for reaching geographically dispersed or international customers. The profitability of the rental model hinges significantly on the efficient and timely execution of these downstream processes, maximizing the lifespan and utilization rate of each asset.

Mobile Device Rental Platform Market Potential Customers

The primary end-users and buyers of mobile device rental platform services are broadly categorized into large enterprises seeking flexible workforce technology, small and medium enterprises (SMEs) managing tight CapEx budgets, and individual consumers requiring temporary or cost-effective access to premium technology. Large enterprises utilize these services for rapid staff scaling, standardized global device deployment, and managing cyclic needs such as seasonal staff or project-based teams. Their buying decisions are driven by total cost of ownership (TCO) reduction, reliable customer support, and robust compliance guarantees regarding data security and asset tracking. They demand long-term contractual solutions.

SMEs represent a rapidly growing customer base, often lacking the internal IT resources or capital reserves to purchase and manage extensive device inventories. Rental platforms allow them to equip employees with professional-grade tools immediately, paying through predictable monthly operational expenses. This segment values simplicity, bundled services (like insurance and support), and transparent pricing. Furthermore, the education sector and specialized industries like healthcare and construction frequently require temporary device deployment for training, surveys, or site inspections, forming a significant cohort of short-term rental customers.

The B2C segment, while smaller in revenue than B2B, is highly active, driven primarily by individuals seeking to experience the latest smartphone models without the long-term debt, digital nomads requiring international connectivity, and travelers needing local access solutions. For B2C customers, the deciding factors are device availability, ease of process (online application and rapid delivery), and competitive monthly subscription rates. The platform must cater to this segment through seamless digital interfaces and flexible cancellation policies to maximize conversion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.8 Billion |

| Market Forecast in 2033 | $7.8 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grover, RentoMojo, Rent-A-Center, Kwipped, Inhoused, Leasecake, Lendis, Fonehouse, Redi-Rental, Technology Rental, Hire Intelligence, Xpress Rental, Teladvance, ABM Technology, Gearflow, FlexiRent, Rent-to-Own, Rent One, Express Leasing, Tech-Rentals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Device Rental Platform Market Key Technology Landscape

The technological landscape underpinning the Mobile Device Rental Platform Market is characterized by sophisticated software integration designed to manage complex logistics, secure asset tracking, and ensure data integrity across the rental lifecycle. Central to this landscape is advanced Enterprise Resource Planning (ERP) and Asset Management Software (AMS) systems, which handle the entire inventory flow—from initial procurement and configuration to tracking utilization, maintenance history, and eventual end-of-life disposal or refurbishment. These systems must seamlessly integrate with e-commerce platforms and payment gateways to facilitate smooth customer transactions and subscription management.

Crucially, robust security technologies are non-negotiable, particularly in the B2B segment. This includes mandatory, certified data wiping solutions (meeting standards like NIST 800-88 or equivalent) executed upon device return to ensure client data is irrecoverably removed, mitigating significant liability risks. Furthermore, remote monitoring and Mobile Device Management (MDM) solutions are vital. MDM allows platforms to remotely enforce security policies, update software, track the geographical location of devices (geo-fencing), and even remotely wipe a device in case of theft or non-return, securing the asset and the data it may contain.

Finally, the growing reliance on cloud computing infrastructure enables platforms to achieve scalability, handle high transaction volumes, and provide real-time reporting to corporate clients regarding asset utilization and performance. Integration of machine learning and AI, as previously discussed, is rapidly becoming a core technology for optimizing pricing and predicting maintenance needs. Blockchain technology is also emerging as a potential solution for transparent, immutable tracking of high-value assets throughout their complex rental life cycle across global supply chains, enhancing trust and compliance in device provenance and data handling.

Regional Highlights

Regional dynamics significantly influence the Mobile Device Rental Platform Market, driven by varying economic conditions, technological maturity, and corporate adoption rates across continents. North America currently holds the largest market share, characterized by high corporate IT spending, a mature digital infrastructure, and a strong propensity among large enterprises to adopt OpEx models for IT assets. The demand is robust across sectors like technology, finance, and media, all requiring frequent updates and large volumes of high-end mobile devices. The presence of major rental corporations and a highly competitive service environment necessitate continuous technological innovation and advanced customer support offerings.

Europe, particularly Western Europe (Germany, UK, France), represents the second-largest market. Growth here is fueled by stringent environmental regulations encouraging circular economy models and a strong SME sector keen on cost-effective technology access. European platforms often focus heavily on sustainability credentials and localized compliance, especially regarding GDPR and other data protection mandates. The Nordic countries are pioneering in subscription models, reflecting a broader consumer trend toward service-based consumption over ownership. The fragmentation of regulations across different EU member states, however, presents logistical and legal complexities for cross-border operations.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is underpinned by explosive mobile penetration, a booming startup ecosystem, and rapidly expanding manufacturing and service industries in countries like India, China, and Southeast Asia. While price sensitivity is higher, the sheer volume of potential users and the increasing need for temporary device provisioning for large-scale BPO operations and training facilities drive massive demand. Platforms operating in APAC must address complex logistics and diverse consumer preferences across highly varied cultural and regulatory environments. Latin America and the Middle East & Africa (MEA) represent emerging markets, with growth concentrated in urban centers and oil-rich nations, focused predominantly on enterprise mobility solutions.

- North America: Market leader, driven by enterprise OpEx shift, advanced MDM adoption, and high disposable income supporting premium device rental.

- Europe: Strong market base, emphasizing sustainability (circular economy models) and high compliance standards (GDPR-compliant data wiping services).

- Asia Pacific (APAC): Fastest-growing region, fueled by massive mobile market size, high population density, and rapid industrial digitization requiring flexible device scaling.

- Latin America (LATAM): Emerging market focusing on affordable access and corporate expansion, though logistical challenges persist.

- Middle East & Africa (MEA): Growth concentrated in GCC nations due to large infrastructure projects and high-value expatriate workforce needing temporary connectivity solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Device Rental Platform Market.- Grover

- RentoMojo

- Rent-A-Center

- Kwipped

- Inhoused

- Leasecake

- Lendis

- Fonehouse

- Redi-Rental

- Technology Rental

- Hire Intelligence

- Xpress Rental

- Teladvance

- ABM Technology

- Gearflow

- FlexiRent

- Rent-to-Own

- Rent One

- Express Leasing

- Tech-Rentals

Frequently Asked Questions

Analyze common user questions about the Mobile Device Rental Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Mobile Device Rental Platform Market?

The market growth is primarily driven by the increasing corporate shift from capital expenditure (CapEx) to operational expenditure (OpEx) for technology assets, the high rate of technological obsolescence necessitating frequent device upgrades, and the rising global demand for flexible, short-term technology access solutions for events and remote workforces.

How does the Mobile Device Rental Platform Market ensure data security for rented devices?

Platforms ensure data security by mandating certified, military-grade data wiping procedures (such as compliance with NIST 800-88 standards) on all devices immediately upon return. Additionally, they utilize Mobile Device Management (MDM) software for remote monitoring, security policy enforcement, and remote data erasure in case of theft or loss, providing enhanced security assurance to enterprise clients.

Which segments are expected to show the fastest growth rate?

The Asia Pacific (APAC) region, driven by massive mobile penetration and industrial expansion, and the Laptop rental segment, fueled by the sustained global adoption of hybrid and remote work models, are projected to exhibit the highest Compound Annual Growth Rates (CAGR) through 2033.

What role does AI play in optimizing rental platform operations?

AI is crucial for operational optimization through dynamic pricing models, allowing platforms to adjust rates based on real-time demand and competitive data. It also enhances efficiency by powering predictive inventory management, forecasting regional needs, and scheduling predictive maintenance to maximize asset utilization and minimize downtime.

Are rental platforms catering more towards B2B or B2C end-users?

While B2C services are expanding, the market structure is heavily skewed towards the Enterprise/B2B segment. Enterprises, including large corporations and SMEs, represent the largest revenue share, demanding specialized services like bulk provisioning, MDM integration, and comprehensive, long-term leasing and subscription agreements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager