Mobile Endoscopic Workstations Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432286 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Mobile Endoscopic Workstations Market Size

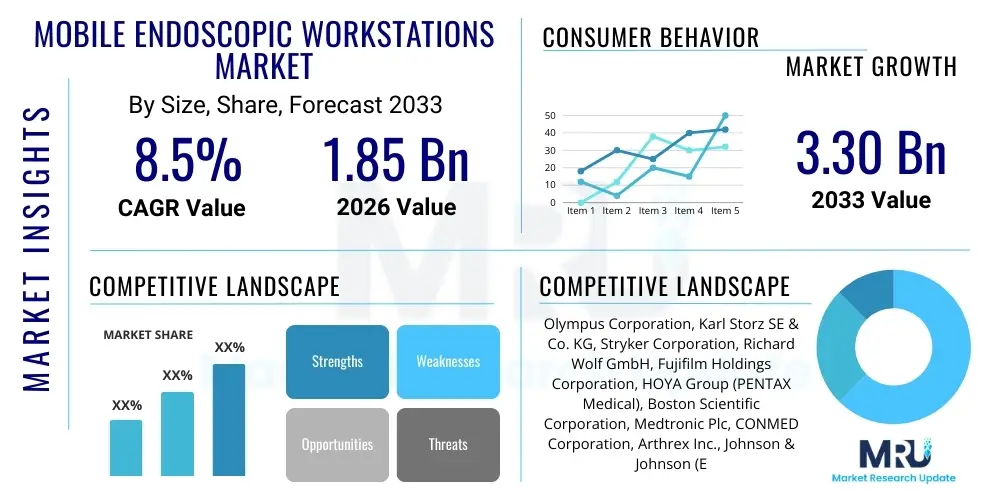

The Mobile Endoscopic Workstations Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.30 Billion by the end of the forecast period in 2033.

Mobile Endoscopic Workstations Market introduction

Mobile Endoscopic Workstations represent integrated, cart-based systems designed to facilitate minimally invasive surgical and diagnostic procedures across various medical specialties, including gastroenterology, pulmonology, and urology. These workstations combine essential components such as high-definition monitors, light sources, video processors, documentation systems, and sterile fluid management, all within a compact, easily maneuverable structure. The primary product description centers on their mobility, ergonomic design, and ability to support advanced imaging technologies, which significantly enhances procedural efficiency and patient throughput in operating rooms (ORs) and ambulatory surgical centers (ASCs). The integration capability with Electronic Health Records (EHRs) and Picture Archiving and Communication Systems (PACS) positions these workstations as critical infrastructure in modern digitized healthcare environments.

Major applications of mobile endoscopic workstations span therapeutic and diagnostic procedures where visualization and precise instrumentation are paramount. In gastroenterology, they are crucial for colonoscopies and endoscopies, while in pulmonology, they support bronchoscopies and thoracoscopies. The inherent benefit of mobility allows the same high-specification equipment to be utilized across multiple procedure rooms without the need for fixed installations, optimizing capital expenditure and ensuring consistent quality of care. Furthermore, their modular design permits easy upgrades and customization based on specific departmental needs, making them highly versatile assets within hospitals.

The market is primarily driven by the escalating demand for minimally invasive surgery (MIS), which offers advantages such as smaller incisions, reduced recovery times, and lower infection rates compared to traditional open surgery. Technological advancements, particularly in high-resolution 4K and 3D imaging capabilities integrated into these workstations, further propel adoption. Additionally, the increasing global prevalence of chronic diseases requiring regular endoscopic screening and treatment, coupled with rising healthcare infrastructure development, especially in emerging economies, solidifies the foundational driving factors for sustained market expansion throughout the forecast period.

Mobile Endoscopic Workstations Market Executive Summary

The global Mobile Endoscopic Workstations Market is experiencing robust growth fueled by increasing procedural volumes and the strategic shift towards ambulatory care settings. Business trends indicate a strong focus on system integration, ergonomic design, and the implementation of advanced visualization technologies like Narrow Band Imaging (NBI) and confocal endomicroscopy capabilities within mobile platforms. Leading manufacturers are emphasizing seamless connectivity, allowing for real-time consultation and remote maintenance, thereby reducing procedural downtime. Key business strategies involve strategic mergers, acquisitions, and partnerships to expand geographical reach and consolidate technological leadership, particularly in components related to video processing and data management. Furthermore, there is a distinct trend towards subscription-based service models for maintenance and software upgrades, appealing to institutions seeking predictable operational expenditures.

Regional trends highlight North America and Europe as dominant markets, primarily due to established healthcare infrastructure, high adoption rates of advanced surgical technologies, and favorable reimbursement policies supporting endoscopic procedures. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by massive government investments in healthcare modernization, the expanding medical tourism sector, and the rising awareness and incidence of lifestyle-related diseases requiring endoscopy. Within the APAC region, countries like China and India are emerging as critical demand centers due to their large patient populations and increasing disposable incomes allocated toward sophisticated medical treatment. Latin America and the Middle East and Africa (MEA) are also showing promising potential, albeit from a lower base, largely due to infrastructure improvements and the proliferation of private hospitals and specialized clinics.

Segment trends underscore the dominance of the Component segment, specifically high-definition (HD and 4K) monitor and camera systems, which account for the largest revenue share, reflecting the continuous need for superior image quality to improve diagnostic accuracy. The Application segment is led by Gastroenterology, given the high volume of routine procedures like gastroscopies and colonoscopies. However, Pulmonology and Urology segments are projected to experience accelerated growth due to the increased application of flexible endoscopy in minimally invasive cancer detection and treatment. The End-User segment sees Hospitals retaining the majority share, but Ambulatory Surgical Centers (ASCs) are rapidly gaining momentum, favored for their cost-effectiveness and efficiency in high-volume, outpatient procedures. This shift necessitates mobile, modular workstations that can efficiently transition between procedure rooms and handle high throughput demands.

AI Impact Analysis on Mobile Endoscopic Workstations Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Mobile Endoscopic Workstations predominantly center on four themes: enhancement of diagnostic accuracy, workflow automation, data security, and the integration costs associated with AI-powered modules. Users are keen to understand how AI-driven image analysis algorithms, such as those used for polyp detection or tissue differentiation (virtual biopsies), can be seamlessly integrated into existing mobile platforms without sacrificing mobility or increasing latency. Concerns often revolve around regulatory approval timelines for AI-assisted endoscopy devices and the necessary computational power required within the mobile cart. Expectations are high regarding AI’s ability to standardize procedural documentation and optimize equipment management, reducing the cognitive load on endoscopists and improving overall patient outcomes through automated quality control checks during the procedure.

- AI algorithms facilitate real-time identification and characterization of lesions (e.g., polyps in colonoscopy) with high sensitivity and specificity.

- Integration of Computer-Aided Diagnosis (CAD) tools directly into the workstation’s video processor accelerates diagnostic throughput during procedures.

- AI-driven automation optimizes procedural workflow, including automatic image capture of key anatomical landmarks and standardized reporting generation.

- Predictive maintenance analytics, powered by AI, monitor workstation component performance (light source, cooling systems), minimizing unexpected equipment failure.

- Enhanced training simulations utilizing AI feedback systems allow junior endoscopists to practice complex procedures on virtual workstations with objective performance metrics.

- AI models support dose reduction strategies for fluoroscopy integration in certain endoscopic applications by optimizing imaging parameters automatically.

DRO & Impact Forces Of Mobile Endoscopic Workstations Market

The market dynamics for Mobile Endoscopic Workstations are shaped by a complex interplay of Drivers, Restraints, and Opportunities, resulting in significant impact forces. Key drivers include the global expansion of minimally invasive procedures, advancements in high-definition imaging systems (4K and 3D), and the rising geriatric population requiring frequent endoscopic screening and intervention. Restraints primarily involve the high initial capital investment required for these sophisticated integrated systems and stringent regulatory frameworks mandating lengthy approval processes, especially for new AI-enabled features. Opportunities reside in the emerging markets of Asia Pacific and Latin America, the increasing demand for highly specialized workstations (e.g., for robotic-assisted endoscopy integration), and the shift towards disposable or single-use endoscopes and their compatible mobile processing units.

The cumulative impact forces dictate a moderate to high growth trajectory. The proliferation of Ambulatory Surgical Centers (ASCs) worldwide acts as a persistent positive force, as these centers require flexible, high-performance equipment that can be easily moved and adapted. Furthermore, the push for improved ergonomic solutions in the OR drives innovation, compelling manufacturers to design lighter, quieter, and more user-friendly mobile carts. However, pricing pressure from healthcare providers focused on cost containment remains a significant restraining force, influencing manufacturers to develop mid-range systems that balance advanced features with affordability, especially for competitive tenders in public healthcare systems.

Ultimately, technological innovation and strategic regional expansion are the most critical impact forces currently shaping the competitive landscape. Companies that successfully integrate AI diagnostics and maintain strong post-sales support networks, particularly in newly developing regions, are best positioned for long-term growth. The market is increasingly demanding interoperability standards; therefore, systems designed to seamlessly communicate with diverse hospital IT infrastructure (HIS, RIS, PACS) will gain a substantial competitive edge over proprietary or closed systems. The continuous drive toward faster data transfer and enhanced cybersecurity measures within mobile healthcare devices also represents a powerful, non-negotiable requirement for future product development.

Segmentation Analysis

The Mobile Endoscopic Workstations Market segmentation provides a granular view of market structure based on Component, Application, and End-User, allowing stakeholders to identify high-growth areas and specific product demands. The analysis reveals that technological components, particularly those governing visualization quality and data processing, command premium pricing and drive segment revenue. Application-wise, routine screening procedures dominate volume, while therapeutic interventions drive average revenue per procedure. The shift in healthcare delivery models is heavily reflected in the End-User segmentation, highlighting the growing significance of specialized outpatient facilities seeking flexible, highly optimized mobile solutions.

- By Component:

- Video Processors and Light Sources

- High-Definition Monitors (HD, 4K, 3D)

- Data Management and Documentation Systems

- Mobile Endoscopic Carts/Trolleys

- Pumps and Insufflators

- By Application:

- Gastroenterology

- Pulmonology and Bronchoscopy

- Urology (Cystoscopy and Ureteroscopy)

- Orthopedics (Arthroscopy)

- General Surgery and Laparoscopy

- Others (ENT, Gynecology)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics and Diagnostic Centers

- By Modality:

- Flexible Endoscopy Workstations

- Rigid Endoscopy Workstations

- By Technology:

- Standard Definition (SD) Systems

- High Definition (HD) Systems

- Ultra-High Definition (UHD/4K) Systems

Value Chain Analysis For Mobile Endoscopic Workstations Market

The value chain for Mobile Endoscopic Workstations commences with upstream activities focused on the sourcing of highly specialized raw materials and components, including optical lenses, high-resolution display panels, advanced semiconductor chips for video processing, and robust, lightweight materials for cart construction. Key suppliers are often specialized OEMs in medical imaging electronics and precision mechanics. Manufacturing involves complex assembly, integration of proprietary software, rigorous quality assurance, and sterilization protocols. Upstream efficiency and quality control are paramount, as the performance of the final workstation heavily relies on the input components. Strong relationships with core technology providers (e.g., camera sensor manufacturers) are crucial for maintaining a competitive edge in imaging fidelity.

The distribution channel represents a critical mid-stream phase, encompassing both direct sales and indirect distribution through specialized medical device distributors and regional representatives. For major multinational players, a direct sales force is often employed for key institutional clients (large hospital networks) to manage complex procurement contracts, installation, and initial training. Indirect channels are frequently used in geographically fragmented or emerging markets, leveraging local expertise and established relationships. The effectiveness of the distribution network determines market penetration speed and post-sales service responsiveness, which is essential given the high complexity and maintenance needs of these systems. Strategic partnerships with regional distributors that possess deep knowledge of local regulatory requirements significantly accelerate market access.

Downstream analysis focuses on the end-users—hospitals, ASCs, and diagnostic centers—and the crucial aspect of post-sales support, maintenance, and ongoing software updates. Direct engagement is necessary for custom installations, clinical training, and ensuring seamless integration with existing hospital IT systems (EHRs/PACS). The long operational lifespan of these workstations means that service contracts and the availability of spare parts are critical determinants of customer loyalty. The entire value chain is currently emphasizing sustainability and modularity, allowing users to upgrade specific components (like the video processor) without replacing the entire cart, thereby extending product life and reducing waste. Furthermore, indirect channels also play a major role in refurbishing and reselling older models, supporting market saturation.

Mobile Endoscopic Workstations Market Potential Customers

The primary end-users and buyers of Mobile Endoscopic Workstations are institutional healthcare providers that perform high volumes of diagnostic and therapeutic endoscopic procedures. Hospitals, particularly large tertiary and quaternary care centers, represent the largest customer base due to their comprehensive service offerings, high patient throughput, and ability to afford high-end integrated systems. Within hospitals, key purchasing departments include Gastroenterology, Pulmonology, Urology, and Operating Room management, often requiring standardized equipment across multiple specialized labs. Purchasing decisions are typically driven by procedural volume, requirements for advanced imaging (e.g., 4K visualization), and the need for system interoperability with existing IT infrastructure.

Ambulatory Surgical Centers (ASCs) constitute the fastest-growing customer segment. ASCs focus predominantly on outpatient procedures, demanding highly efficient, space-saving, and mobile workstations that facilitate rapid turnover between cases. Cost-effectiveness is a major consideration for ASCs, leading them to favor modular systems that can be customized and easily maintained. Diagnostic Centers, which focus primarily on screening and non-invasive diagnostics, represent another key customer group, valuing ease of use, superior image quality for accurate diagnoses, and robust data documentation features. The expansion of private diagnostic chains, especially in populous urban areas, directly correlates with increased demand for these mobile systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.30 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, Karl Storz SE & Co. KG, Stryker Corporation, Richard Wolf GmbH, Fujifilm Holdings Corporation, HOYA Group (PENTAX Medical), Boston Scientific Corporation, Medtronic Plc, CONMED Corporation, Arthrex Inc., Johnson & Johnson (Ethicon), Intuitive Surgical, Inc., PENTAX Medical (Hoya Group), Vention Medical, Integrated Medical Systems International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Endoscopic Workstations Market Key Technology Landscape

The technology landscape of the Mobile Endoscopic Workstations market is dominated by advancements in visualization and computational power, transitioning rapidly from traditional High Definition (HD) systems to Ultra-High Definition (4K) and sophisticated 3D imaging capabilities. Key technology elements include advanced Complementary Metal-Oxide-Semiconductor (CMOS) sensor technology within the endoscopes, paired with high-throughput video processing units integrated into the mobile cart, capable of handling massive data streams for real-time rendering. Furthermore, specialized optical enhancement technologies, such as Narrow Band Imaging (NBI) pioneered by Olympus, and Intelligent Color Enhancement (ICE) from other key players, are becoming standard features, significantly improving mucosal surface visualization and aiding in early cancer detection by highlighting vascular patterns and subtle mucosal irregularities. This continuous pursuit of superior image quality is the fundamental technology driver.

Beyond core imaging, connectivity and integration technologies are crucial differentiators. Modern workstations feature comprehensive digital documentation systems that allow for instant capture, annotation, and secure transmission of images and video directly to hospital Picture Archiving and Communication Systems (PACS) and Electronic Health Records (EHRs). This requires robust, secured networking interfaces (often utilizing encrypted high-speed Ethernet or secure wireless protocols) to maintain patient data integrity and compliance with regulations like HIPAA or GDPR. The workstation cart itself incorporates ergonomic design elements, featuring powered height adjustment, integrated cable management solutions to enhance sterility and safety, and modular configurations that allow quick swapping of peripheral devices like suction pumps or irrigation systems, optimizing surgical setup time.

The emerging technological frontier is the adoption of Artificial Intelligence (AI) and Machine Learning (ML). AI is being embedded in video processors to perform real-time image analysis, offering computer-aided detection (CADe) and computer-aided diagnosis (CADx) functionalities. For instance, AI algorithms can automatically detect polyps, measure their size, or assess the probability of malignancy during a live procedure, providing immediate feedback to the clinician. Additionally, advancements in miniaturization are driving the development of extremely compact mobile workstations compatible with single-use endoscopes, addressing cross-contamination risks and offering high flexibility for lower acuity settings. The integration of augmented reality (AR) technology for overlaying pre-operative imaging data onto the live video feed is also gaining traction, particularly in complex therapeutic procedures, representing the future direction of visualization technology.

Regional Highlights

- North America (United States, Canada): North America maintains market dominance, driven by high healthcare spending, rapid adoption of advanced surgical technologies, and the strong presence of major market players. The market is characterized by a mature infrastructure supporting high-definition and 4K integration, extensive utilization of ASCs for routine endoscopy, and favorable reimbursement structures. The U.S. remains the largest regional consumer, investing heavily in IT integration within mobile workstations to comply with stringent electronic health record mandates.

- Europe (Germany, UK, France, Italy, Spain): Europe is the second-largest market, exhibiting steady growth primarily fueled by the increasing focus on cancer screening programs (like national colonoscopy screening initiatives) and the demand for efficient, mobile equipment in large public healthcare systems (NHS, etc.). Germany and France are key innovators and early adopters of specialized systems, particularly for robotic endoscopy assistance. Economic constraints in Southern and Eastern Europe drive demand for cost-effective, modular HD systems.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is the fastest-growing region, propelled by massive population size, rising prevalence of gastrointestinal disorders, and accelerating healthcare infrastructure development, particularly in Tier 1 and Tier 2 cities in China and India. Government initiatives to improve access to diagnostic services and increasing medical tourism necessitate highly mobile and reliable endoscopic platforms. Japan and South Korea, with established medical technology sectors, lead in the adoption of AI-enabled workstations and 4K technology.

- Latin America (Brazil, Mexico, Argentina): The market in Latin America is characterized by increasing foreign investment in private hospital networks and a gradual modernization of public health facilities. Growth is moderate but accelerating, driven by the need to manage rising chronic disease burdens. Price sensitivity is high, often favoring reliable, mid-range mobile systems that offer strong value propositions over ultra-premium features. Brazil represents the largest market share within the region.

- Middle East and Africa (MEA) (GCC Countries, South Africa): The MEA region is witnessing high-value demand, primarily concentrated in the Gulf Cooperation Council (GCC) countries, supported by high disposable income and ambitious state-funded healthcare projects focused on establishing world-class medical facilities. These countries often skip traditional technology phases and directly adopt the latest 4K and AI-integrated mobile workstations. South Africa acts as a regional hub for medical device distribution across the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Endoscopic Workstations Market.- Olympus Corporation

- Karl Storz SE & Co. KG

- Stryker Corporation

- Richard Wolf GmbH

- Fujifilm Holdings Corporation

- HOYA Group (PENTAX Medical)

- Boston Scientific Corporation

- Medtronic Plc

- CONMED Corporation

- Arthrex Inc.

- Johnson & Johnson (Ethicon)

- Intuitive Surgical, Inc.

- Medar (Medovations)

- Vention Medical

- Integrated Medical Systems International

- GIMMI GmbH

- B. Braun Melsungen AG

- Cook Medical

- Smith & Nephew plc

- Welch Allyn (Hill-Rom)

Frequently Asked Questions

Analyze common user questions about the Mobile Endoscopic Workstations market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Mobile Endoscopic Workstations?

The increasing global demand for minimally invasive surgery (MIS) and the need for flexible, high-resolution imaging systems in high-throughput settings like Ambulatory Surgical Centers (ASCs) are the primary market drivers.

How does 4K technology impact the Mobile Endoscopic Workstations Market?

4K technology significantly enhances visualization quality, improving diagnostic accuracy and supporting complex therapeutic interventions. This drives demand for high-end workstations, pushing manufacturers to integrate advanced video processing units for latency-free imaging.

What role does AI play in next-generation mobile endoscopy systems?

AI is increasingly used for computer-aided detection (CADe) of polyps and lesions in real-time, improving procedural efficiency, standardizing reporting, and offering predictive maintenance capabilities for the workstation components.

Which geographical region exhibits the highest growth potential for this market?

The Asia Pacific (APAC) region, particularly driven by modernization in China and India and expanding healthcare access, is projected to record the highest Compound Annual Growth Rate (CAGR) through 2033.

What are the main segments covered in the Mobile Endoscopic Workstations Market report?

The key segments analyzed include Components (e.g., Video Processors, Monitors, Carts), Applications (Gastroenterology, Pulmonology, Urology), and End-Users (Hospitals and ASCs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager