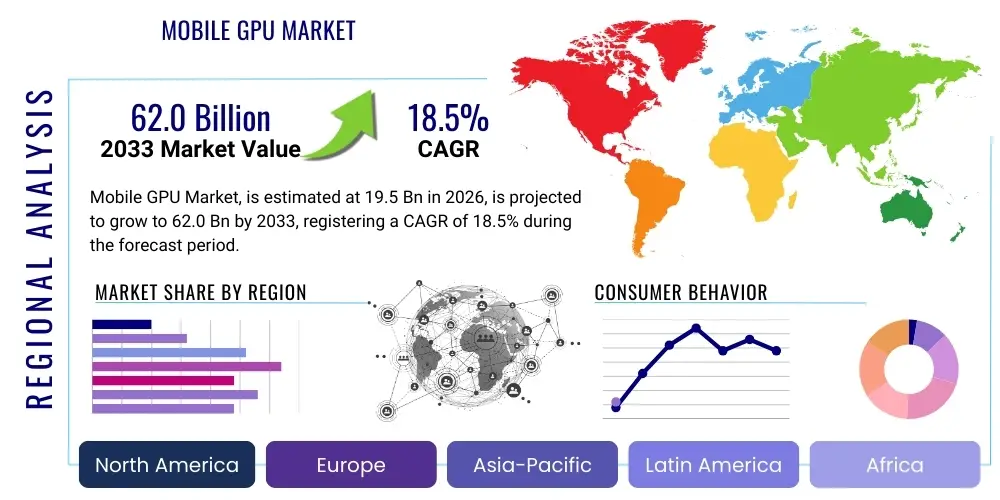

Mobile GPU Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440518 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Mobile GPU Market Size

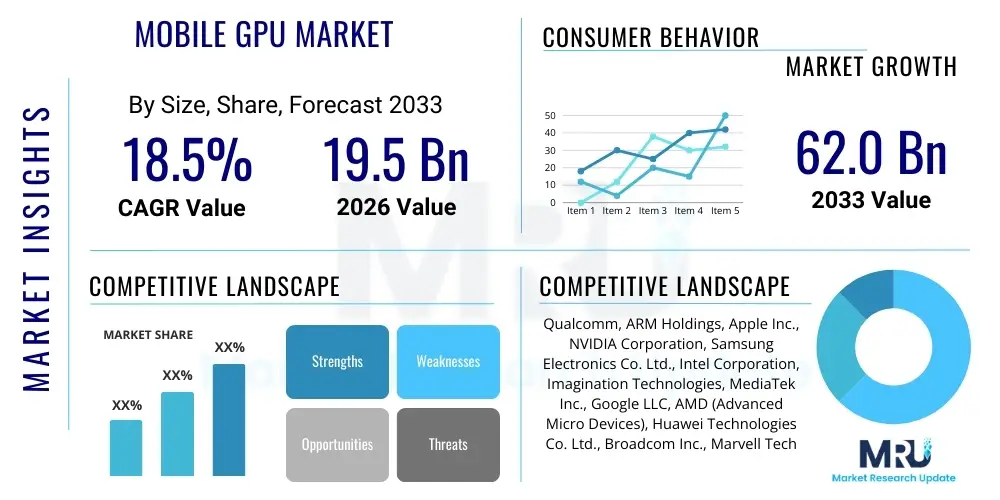

The Mobile GPU Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 62.0 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the escalating demand for advanced visual processing capabilities in mobile devices, fueled by the widespread adoption of smartphones, tablets, and a growing ecosystem of smart wearables and connected automotive systems. The continuous innovation in mobile gaming, augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) applications directly contributes to the necessity for more powerful and energy-efficient mobile GPUs.

The market's trajectory reflects a robust appetite for immersive digital experiences and on-device computational intelligence. As consumers increasingly rely on their mobile devices for entertainment, productivity, and complex computational tasks, the underlying graphics processing units become critical differentiators. Manufacturers are investing heavily in research and development to enhance GPU architectures, power efficiency, and integration capabilities, ensuring mobile platforms can support the demanding visual and processing requirements of next-generation applications. This growth is further supported by the global expansion of 5G networks, which enable faster data transfer and facilitate cloud-based gaming and computationally intensive mobile services, pushing the boundaries of what mobile devices can achieve.

Mobile GPU Market introduction

The Mobile GPU Market encompasses the design, development, manufacturing, and integration of graphics processing units specifically engineered for mobile and portable electronic devices. These specialized processors are fundamental for rendering images, videos, and complex graphical interfaces on screens, playing a pivotal role in the user experience across a vast array of devices. The core product, a mobile GPU, is often an integrated component within a System-on-Chip (SoC), designed to balance high performance with stringent power efficiency requirements crucial for battery-operated devices. It provides the computational muscle for visual data, transforming raw data into the rich, interactive graphics users expect from their modern gadgets.

Major applications for mobile GPUs span across consumer electronics, including high-end smartphones, tablets, and smartwatches, where they enhance gaming, multimedia consumption, and general UI responsiveness. Beyond personal devices, mobile GPUs are increasingly vital in emerging sectors such as automotive infotainment systems, which require sophisticated graphics for navigation, driver-assistance displays, and in-car entertainment. Furthermore, their utility extends to industrial handhelds, medical devices, and various Internet of Things (IoT) endpoints that benefit from localized graphical rendering and machine learning acceleration. The pervasive nature of visual content and interactive applications makes the mobile GPU an indispensable element in contemporary technology.

The benefits derived from advanced mobile GPUs are manifold, ranging from superior visual fidelity and smoother frame rates in gaming to efficient rendering of augmented reality environments and accelerated AI inference on the device. These advantages directly drive market growth, as consumers demand more sophisticated capabilities from their mobile platforms. Key driving factors include the relentless pursuit of enhanced mobile gaming experiences, the proliferation of AR/VR content and applications, the increasing integration of AI and machine learning features directly onto devices, and the continuous evolution of display technologies, such as higher resolutions and refresh rates, which necessitate more powerful graphics processing. Moreover, the expanding global smartphone penetration and the transition to 5G networks are creating fertile ground for the further adoption and innovation within the mobile GPU sector.

Mobile GPU Market Executive Summary

The Mobile GPU Market is experiencing dynamic growth, driven by fundamental shifts in consumer technology and industrial application demands. Business trends indicate a fierce competitive landscape dominated by a few key players that are continuously innovating their architectural designs to deliver higher performance per watt. This includes a strong focus on custom GPU designs, proprietary architectures, and advanced manufacturing processes to achieve superior power efficiency and computational throughput. Strategic partnerships between SoC manufacturers and intellectual property (IP) licensors are commonplace, aiming to integrate cutting-edge graphics capabilities into a broad range of mobile devices. Additionally, the rise of in-house chip development by major device manufacturers signifies a trend towards greater control over hardware optimization and differentiation.

Regional trends reveal significant market expansion across all major geographies. Asia Pacific, particularly China, India, and South Korea, stands out as a dominant force due to the massive volume of smartphone shipments, burgeoning mobile gaming demographics, and rapid adoption of advanced mobile technologies. North America and Europe also exhibit strong demand, driven by premium device markets and early adoption of emerging technologies like AR/VR and advanced AI applications on mobile. Latin America and the Middle East & Africa are emerging as high-growth regions, fueled by increasing smartphone penetration and improving digital infrastructure, suggesting considerable future potential for mobile GPU consumption as these markets mature and consumer spending power rises.

Segmentation trends highlight several critical areas of development. By type, integrated GPUs continue to hold the largest share due to their cost-effectiveness and sufficient performance for mainstream devices, but discrete mobile GPUs are gaining traction in high-performance computing, gaming, and professional applications on portable devices. Application-wise, smartphones remain the primary revenue generator, yet tablets, wearables, and especially the automotive sector with advanced infotainment and autonomous driving interfaces, are demonstrating impressive growth rates. From an architectural perspective, ARM Mali and Qualcomm Adreno remain dominant, but Apple's custom A-series GPUs and Samsung's collaboration with AMD for RDNA-based Xclipse GPUs are indicative of a push towards highly optimized and differentiated solutions, driving innovation and expanding the technological frontier of mobile graphics.

AI Impact Analysis on Mobile GPU Market

The emergence and rapid integration of Artificial Intelligence (AI) are profoundly reshaping the Mobile GPU Market, prompting users and industry observers alike to ponder its long-term implications. Common user questions often revolve around how AI will enhance mobile device capabilities, whether current mobile GPUs are sufficient for future AI workloads, and what new applications AI will unlock. There is a palpable expectation that AI will deliver more intuitive user interfaces, enhanced photography, real-time language translation, and sophisticated augmented reality experiences directly on handheld devices. Conversely, concerns include the potential for increased power consumption, the need for specialized AI accelerators alongside GPUs, and the challenge of balancing performance with device form factor and thermal constraints. Users are keen to understand how AI will make their devices smarter, more personalized, and more capable of handling complex tasks locally, reducing reliance on cloud computing.

- AI drives the demand for increased on-device computational power, particularly for inferencing tasks, directly benefiting mobile GPU development by necessitating greater parallel processing capabilities.

- Mobile GPUs are increasingly incorporating specialized AI acceleration units (e.g., neural processing units or NPUs) alongside traditional graphics pipelines, leading to hybrid architectures optimized for both visual rendering and machine learning workloads.

- The integration of AI enables advanced features like real-time image and video processing, computational photography, intelligent voice assistants, and sophisticated augmented reality applications, all of which heavily leverage mobile GPU resources.

- AI's role in optimizing graphics rendering through techniques such as super-resolution (e.g., NVIDIA's DLSS-like approaches for mobile) can improve visual quality while potentially reducing the raw processing load on the GPU.

- Edge AI processing, facilitated by powerful mobile GPUs, reduces latency, enhances data privacy, and decreases reliance on cloud infrastructure, making devices more autonomous and responsive for AI-driven tasks.

- The drive for greater AI capabilities fuels competition among mobile SoC vendors to differentiate their products through superior AI performance, thereby accelerating innovation in mobile GPU design and efficiency.

DRO & Impact Forces Of Mobile GPU Market

The Mobile GPU Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces shaping its evolution. Key drivers include the ever-increasing demand for high-performance mobile gaming, which consistently pushes the boundaries of graphical fidelity and processing power required from mobile GPUs. The widespread adoption of Augmented Reality (AR) and Virtual Reality (VR) applications, along with sophisticated multimedia content consumption, further necessitates more robust graphics capabilities. Moreover, the growing integration of AI and machine learning at the edge directly impacts mobile GPU development, as these units are often leveraged for parallel processing of AI workloads, providing crucial on-device intelligence. The sheer proliferation of smartphones, tablets, and other smart connected devices globally ensures a continuous and expanding customer base for mobile GPUs.

However, the market also faces significant restraints. The inherently compact nature of mobile devices imposes severe thermal management challenges, limiting the sustained performance potential of powerful GPUs and making power efficiency a paramount design consideration. High research and development (R&D) costs associated with designing and manufacturing advanced semiconductor architectures present a substantial barrier to entry for new players and demand considerable investment from incumbents. Furthermore, intense competition among leading SoC vendors often leads to price pressure, particularly in the mid-range and budget segments, which can impact profitability margins. These technical and economic constraints necessitate innovative solutions and strategic planning from market participants.

Opportunities for growth are abundant and diverse. The global rollout and increasing adoption of 5G technology promise ultra-low latency and higher bandwidth, unlocking new possibilities for cloud gaming, real-time AI applications, and richer interactive experiences that will drive demand for more powerful mobile GPUs capable of handling complex data streams. The continuous development of new AI-centric mobile applications, from advanced photography to predictive analytics, will further cement the mobile GPU's role as a critical computational engine. Moreover, the expansion into new markets, such as advanced automotive infotainment systems, industrial automation, and specialized IoT devices requiring local graphical processing, represents significant untapped potential. The synergy between hardware advancements and software innovation continues to create fertile ground for market expansion, with strategic partnerships and technological breakthroughs defining the path forward for mobile GPU development.

Segmentation Analysis

The Mobile GPU Market is meticulously segmented across various dimensions to provide a granular understanding of its structure and growth dynamics. These segments help to categorize the diverse range of mobile GPUs based on their design, performance capabilities, intended applications, and underlying architectural principles. Understanding these segments is crucial for market players to tailor their product development, marketing strategies, and investment decisions effectively, addressing the specific needs of different end-user groups and application scenarios within the rapidly evolving mobile technology landscape. The segmentation highlights the specialized requirements that drive innovation, from low-power integrated solutions for mainstream devices to high-performance discrete options for demanding mobile computing tasks, ensuring comprehensive market coverage.

- By Type: This segment differentiates mobile GPUs based on their integration within the device's main processor architecture.

- Integrated GPU: These GPUs are embedded within the System-on-Chip (SoC) alongside the CPU and other components, sharing system memory. They are prevalent in most smartphones, tablets, and mainstream mobile devices, offering a balance of performance, power efficiency, and cost-effectiveness. Sub-segments include mainstream integrated GPUs, optimized for daily tasks and casual gaming, and high-end integrated GPUs, designed for more demanding applications and premium mobile experiences.

- Discrete GPU: These are standalone graphics processors, often with their own dedicated memory, providing significantly higher performance than integrated solutions. While less common in typical mobile devices due to power and space constraints, they are finding niches in high-performance mobile workstations, advanced gaming handhelds, and some specialized tablets where raw graphical power is paramount.

- By Application: This segment categorizes mobile GPUs by the primary devices or industries they serve.

- Smartphones: The largest application segment, demanding high performance for gaming, multimedia, AR, and AI applications.

- Tablets: Requires robust GPUs for productivity, entertainment, and content creation tasks, often with larger display resolutions.

- Wearables: Includes smartwatches and smart glasses, requiring ultra-low power and compact GPUs for user interfaces and basic graphical tasks.

- Automotive Infotainment: Utilizes mobile GPUs for high-resolution displays, navigation systems, advanced driver-assistance systems (ADAS) interfaces, and in-car entertainment.

- IoT Devices: Encompasses a broad range of connected devices requiring graphical interfaces or on-device AI processing, from smart home hubs to industrial sensors.

- Other Consumer Electronics: Includes portable gaming consoles, smart TVs, and other specialized devices benefiting from integrated graphics.

- By Architecture: This segment focuses on the underlying design principles and instruction sets of the GPU, often tied to specific IP providers or manufacturers.

- ARM Mali: A widely licensed GPU IP from ARM Holdings, found in a vast array of Android devices across multiple vendors due to its scalable and power-efficient designs.

- Qualcomm Adreno: Proprietary GPUs developed by Qualcomm, highly optimized for their Snapdragon SoCs, known for strong performance in premium Android smartphones.

- Apple A-series GPUs: Custom-designed GPUs integrated into Apple's A-series SoCs for iPhones and iPads, renowned for their industry-leading performance and tight hardware-software integration.

- NVIDIA Tegra: While less dominant in the smartphone market currently, NVIDIA's Tegra GPUs are significant in specialized devices like the Nintendo Switch and automotive platforms, known for powerful graphics and AI capabilities.

- Imagination PowerVR: Another long-standing GPU IP licensor, historically found in various mobile devices, known for its tile-based deferred rendering architecture.

- Samsung Xclipse (AMD RDNA): Samsung's recent collaboration with AMD to integrate RDNA architecture into its Exynos SoCs, aiming to elevate graphics performance in premium Galaxy devices.

- By End-User: This segment identifies the primary purchasing entities or industries leveraging mobile GPU technology.

- Consumer Electronics: The dominant end-user category, driven by individual consumers purchasing smartphones, tablets, and wearables.

- Automotive: Car manufacturers and their Tier 1 suppliers integrating mobile GPUs into vehicle systems for infotainment, digital cockpits, and advanced safety features.

- Industrial: Businesses utilizing robust, durable mobile devices for field operations, inventory management, and specialized industrial applications.

- Healthcare: Incorporating mobile GPUs into portable medical imaging devices, patient monitoring systems, and health wearables.

- Telecommunications: Leveraging mobile GPU capabilities in network equipment for specialized graphical displays or edge computing applications.

Value Chain Analysis For Mobile GPU Market

The Mobile GPU Market’s value chain is a complex ecosystem stretching from fundamental intellectual property (IP) design to end-user consumption, involving numerous specialized stages and participants. Upstream analysis reveals the critical role of IP core developers and semiconductor design houses like ARM, Imagination Technologies, and Qualcomm, who design the GPU architectures and license them or integrate them into their own SoCs. These entities are responsible for the foundational research and development of microarchitectures, instruction sets, and advanced rendering techniques that define mobile GPU capabilities. Further upstream, materials suppliers provide the raw silicon wafers, chemicals, and other essential components required for semiconductor fabrication, forming the base of the manufacturing process.

Midstream activities involve sophisticated semiconductor manufacturing companies, known as foundries (e.g., TSMC, Samsung Foundry), which fabricate the actual GPU dies based on the designs provided by the IP developers or SoC designers. This stage is highly capital-intensive, requiring cutting-edge lithography and packaging technologies to produce the intricate chips. Following fabrication, there's a crucial stage of testing, assembly, and packaging of the individual GPUs or SoCs. These packaged chips are then supplied to Original Equipment Manufacturers (OEMs) such as Apple, Samsung, Xiaomi, and Huawei, who integrate these GPUs into their final mobile products like smartphones, tablets, and wearables. These OEMs are responsible for the complete device design, software optimization, and overall user experience.

Downstream analysis focuses on the distribution channels and end-user engagement. OEMs distribute their finished mobile devices through a multi-faceted network that includes direct sales channels (e.g., company stores, online portals), indirect channels through telecommunication carriers and mobile network operators, large electronics retailers, and specialized online marketplaces. Direct distribution offers greater control over branding and customer interaction, while indirect channels provide wider market reach and often bundled services. The end-users, primarily consumers, are the ultimate beneficiaries, driving demand for more powerful and efficient mobile GPUs through their purchasing decisions. The efficiency and optimization of each stage, from IP development to distribution, are critical for delivering competitive products to market and realizing profitability.

Mobile GPU Market Potential Customers

Potential customers in the Mobile GPU Market span a wide range of industries and consumer segments, each with distinct needs and performance expectations for graphical processing. Primarily, the largest segment of end-users or buyers are major smartphone and tablet manufacturers, including global giants like Apple, Samsung, Xiaomi, and Huawei, alongside a multitude of smaller regional brands. These companies purchase mobile GPUs (typically as integrated components within Systems-on-Chip) from vendors like Qualcomm, MediaTek, and Apple (for their in-house designs), to power their latest generation of mobile devices, catering to the insatiable consumer demand for enhanced gaming, multimedia, and AI-driven features. The competitive landscape in consumer electronics drives a constant pursuit of superior GPU performance and power efficiency to differentiate products and capture market share.

Beyond traditional consumer electronics, the automotive sector represents a rapidly growing and high-value potential customer segment. Car manufacturers and their Tier 1 suppliers are increasingly integrating sophisticated mobile GPUs into modern vehicles to drive advanced infotainment systems, digital cockpits with high-resolution displays, augmented reality navigation, and critical human-machine interfaces for autonomous driving systems. These applications demand robust, reliable, and often safety-certified GPUs capable of complex real-time rendering and processing. The shift towards software-defined vehicles and connected car ecosystems further amplifies the need for powerful and efficient mobile graphics processing units that can deliver rich visual experiences and support advanced driver assistance features.

Furthermore, specialized industries like industrial manufacturing, healthcare, and defense also emerge as potential customers for mobile GPUs. Industrial applications include ruggedized tablets and handhelds for field service, logistics, and inventory management, which require graphical capabilities for intuitive user interfaces and data visualization in demanding environments. In healthcare, portable diagnostic devices, patient monitoring systems, and telemedical equipment leverage mobile GPUs for rendering complex medical images and data. Emerging markets for high-performance edge computing and specific Internet of Things (IoT) devices that require local graphical processing or AI inferencing also present new avenues for mobile GPU adoption, highlighting the expanding utility and versatility of these compact yet powerful processing units across a broad spectrum of technological applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 62.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm, ARM Holdings, Apple Inc., NVIDIA Corporation, Samsung Electronics Co. Ltd., Intel Corporation, Imagination Technologies, MediaTek Inc., Google LLC, AMD (Advanced Micro Devices), Huawei Technologies Co. Ltd., Broadcom Inc., Marvell Technology Group Ltd., Synopsys Inc., Cadence Design Systems Inc., NXP Semiconductors, Renesas Electronics Corporation, STMicroelectronics, Xiaomi Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile GPU Market Key Technology Landscape

The Mobile GPU Market is characterized by a rapidly evolving technological landscape, driven by the relentless pursuit of higher performance, greater power efficiency, and enhanced functionality within the confines of compact form factors. One of the most critical technological advancements is the shift towards more sophisticated chip architectures, such as ARM's Mali (based on Bifrost and Valhall architectures), Qualcomm's Adreno (evolved from ATI/AMD Imageon), and Apple's custom-designed GPU cores. These architectures continuously introduce new shader core designs, improved memory subsystems, and optimized instruction sets to handle increasingly complex graphical workloads with fewer clock cycles and lower energy consumption. Techniques like tile-based deferred rendering (TBDR) remain fundamental for efficiency, but continuous innovation in culling algorithms, compression technologies, and cache hierarchies is paramount.

The integration of specialized hardware accelerators alongside the GPU is another significant trend. With the pervasive growth of Artificial Intelligence (AI) and machine learning (ML) applications on mobile devices, modern SoCs are now featuring dedicated Neural Processing Units (NPUs) or AI accelerators that work in conjunction with the GPU. While GPUs excel at parallel processing for certain AI tasks, NPUs are often optimized for specific inferencing operations, leading to a hybrid approach where the GPU handles general-purpose graphics and specific compute tasks, while the NPU manages dedicated AI workloads. This heterogeneous computing environment allows for superior performance and power efficiency when executing diverse and demanding applications that blend graphics and AI, such as advanced computational photography, real-time language processing, and complex augmented reality experiences.

Furthermore, advancements in manufacturing process technology, primarily moving towards smaller nodes (e.g., 5nm, 4nm, and beyond), are foundational to the progress of mobile GPUs. Finer transistor geometries allow for more transistors to be packed into the same area, leading to higher performance and reduced power leakage, directly translating to more powerful and efficient mobile GPUs. Memory technologies, such as the adoption of faster and more efficient LPDDR5/5X RAM, and improvements in on-chip caches, also play a crucial role in reducing latency and increasing bandwidth, which are critical for feeding data to powerful GPU cores. The ongoing development of advanced API support, including Vulkan and Metal, further optimizes the interaction between software and hardware, unlocking the full potential of these sophisticated mobile graphics processing units for developers and end-users alike.

Regional Highlights

- North America: This region is a significant market for mobile GPUs, characterized by high adoption rates of premium smartphones and tablets, strong consumer demand for high-end mobile gaming, and early embrace of emerging technologies like augmented reality (AR) and virtual reality (VR). The presence of major tech innovators and a robust ecosystem for content development drives continuous demand for advanced mobile GPU capabilities. Investment in 5G infrastructure further fuels growth in cloud-based gaming and computationally intensive mobile applications.

- Europe: The European market demonstrates consistent growth, driven by a mature mobile device market, high average revenue per user (ARPU), and a strong emphasis on data privacy and security, which encourages on-device AI processing. Countries like Germany, the UK, and France are key contributors, with consumers seeking high-quality multimedia experiences and efficient performance for productivity and entertainment. The region's automotive industry is also a growing segment, integrating advanced mobile GPUs into sophisticated infotainment systems.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for mobile GPUs globally. This dominance is primarily due to the immense volume of smartphone shipments in countries like China, India, and Southeast Asia. The region is also a hub for mobile gaming, with a massive user base and a culture of heavy mobile data consumption. Rapid urbanization, increasing disposable incomes, and the widespread rollout of 5G networks are accelerating the demand for more powerful and efficient mobile GPUs across all price segments. Major manufacturing hubs and a strong semiconductor ecosystem further solidify its market leadership.

- Latin America: This region is an emerging market for mobile GPUs, experiencing significant growth driven by increasing smartphone penetration and improving mobile internet infrastructure. Countries like Brazil and Mexico are leading the charge, with a growing middle class and younger demographic eager for modern mobile technologies. While the demand is currently focused on mid-range devices, the trend towards higher-performance mobile gaming and multimedia consumption indicates a rising demand for more capable mobile GPUs in the coming years.

- Middle East and Africa (MEA): The MEA region is characterized by nascent but rapidly expanding mobile markets. Increasing investment in telecommunications infrastructure, including 5G deployment, and rising smartphone adoption are the primary drivers for mobile GPU market growth. Countries in the GCC (Gulf Cooperation Council) are adopting premium devices, while broader African nations are experiencing a surge in affordable smartphone usage. The demand is multifaceted, encompassing both basic graphical capabilities for mass-market devices and advanced performance for premium segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile GPU Market.- Qualcomm

- ARM Holdings

- Apple Inc.

- NVIDIA Corporation

- Samsung Electronics Co. Ltd.

- Intel Corporation

- Imagination Technologies

- MediaTek Inc.

- Google LLC

- AMD (Advanced Micro Devices)

- Huawei Technologies Co. Ltd.

- Broadcom Inc.

- Marvell Technology Group Ltd.

- Synopsys Inc.

- Cadence Design Systems Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- STMicroelectronics

- Xiaomi Corporation

- OnePlus Technology (Shenzhen) Co. Ltd.

Frequently Asked Questions

What factors are primarily driving the growth of the Mobile GPU Market?

The Mobile GPU Market is predominantly driven by the escalating global demand for high-performance mobile gaming, the widespread adoption of augmented reality (AR) and virtual reality (VR) applications, and the increasing integration of artificial intelligence (AI) and machine learning capabilities directly onto mobile devices. Additionally, the continuous proliferation of smartphones and tablets across all regions, coupled with the rollout of 5G networks, significantly contributes to the market's robust expansion. Consumers' expectations for richer, more immersive visual experiences and efficient on-device computational tasks necessitate more powerful and energy-efficient graphics processing units.

How does AI impact the development and future of mobile GPUs?

AI significantly impacts the mobile GPU market by driving the need for enhanced on-device processing power for inferencing and parallel computations. Modern mobile GPUs are increasingly designed with specialized AI acceleration units, such as neural processing units (NPUs), or are optimized to handle AI workloads alongside traditional graphics rendering. This integration enables advanced features like real-time image processing, computational photography, and sophisticated AI-driven user interfaces. AI also influences GPU design by optimizing rendering techniques and resource allocation, pushing for hybrid architectures that efficiently balance graphics and AI performance.

Which regions are leading the Mobile GPU Market, and why?

The Asia Pacific (APAC) region, particularly countries like China, India, and South Korea, is currently leading the Mobile GPU Market due to its massive smartphone user base, burgeoning mobile gaming industry, and rapid adoption of advanced mobile technologies. North America and Europe also hold substantial market shares, driven by high consumer purchasing power, demand for premium devices, and early adoption of innovative applications like AR/VR. These regions benefit from strong technological infrastructure and a dynamic ecosystem of mobile device manufacturers and software developers, fostering continuous demand and innovation in mobile GPU technologies.

What are the main challenges facing Mobile GPU manufacturers?

Mobile GPU manufacturers face several key challenges, including stringent power consumption requirements due to battery limitations, which necessitates constant innovation in power efficiency without compromising performance. Thermal management is another significant hurdle, as powerful GPUs generate heat that must be dissipated within compact device form factors. High research and development (R&D) costs for advanced semiconductor designs and intense market competition leading to price pressures also present considerable obstacles. Balancing performance, cost, and efficiency remains a complex engineering and business challenge in this dynamic market.

What are the key technological advancements shaping the Mobile GPU landscape?

The key technological advancements shaping the Mobile GPU landscape include the continuous evolution of advanced chip architectures (e.g., ARM Mali, Qualcomm Adreno, Apple A-series GPUs) that offer superior performance per watt and introduce new rendering capabilities. The integration of specialized hardware accelerators like Neural Processing Units (NPUs) for AI workloads, often alongside the GPU, is another significant trend, fostering heterogeneous computing. Furthermore, advancements in manufacturing process technology (e.g., smaller nanometer nodes), faster memory technologies (LPDDR5/5X), and optimized API support (Vulkan, Metal) are crucial for enabling more powerful, efficient, and feature-rich mobile graphics processing units.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager