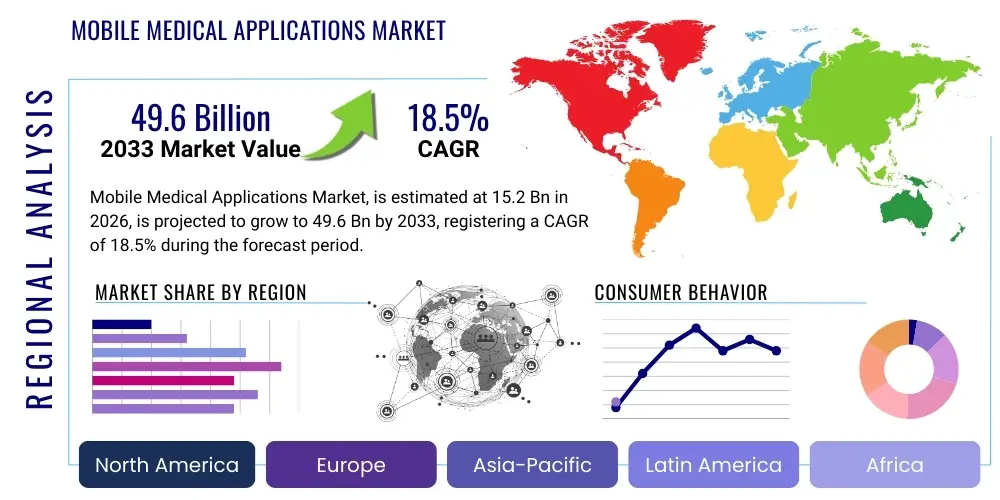

Mobile Medical Applications Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439380 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Mobile Medical Applications Market Size

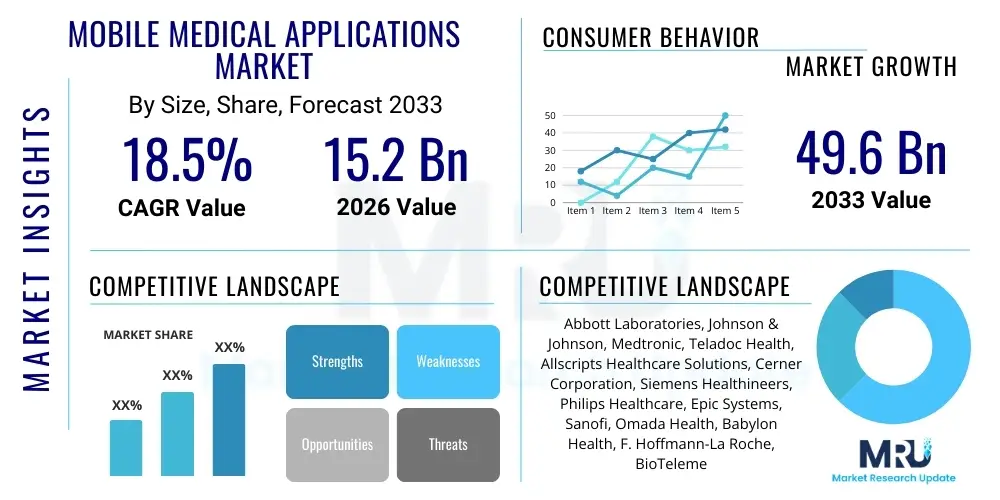

The Mobile Medical Applications Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 49.6 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the increasing penetration of smartphones and wearable devices globally, coupled with a fundamental shift towards remote patient monitoring and decentralized healthcare models.

Mobile Medical Applications Market introduction

The Mobile Medical Applications market, often categorized under the broader umbrella of mHealth, encompasses a diverse range of software applications designed to run on smartphones, tablets, and other wireless devices to address various medical and health-related issues. These applications span functionality from simple wellness tracking and medication reminders to complex diagnostic tools, clinical decision support systems, and remote physiological monitoring. Products are typically classified based on their intended use, including lifestyle and wellness management, monitoring applications, diagnostic and treatment applications, and healthcare management tools, all aiming to empower patients and streamline clinical workflows.

A central tenet of mobile medical applications is their ability to enhance accessibility and efficiency within the healthcare ecosystem. By providing immediate access to health data and professional consultations, these tools significantly reduce the need for in-person visits for routine management, thereby lowering healthcare costs and improving patient compliance, particularly for those managing chronic conditions such as diabetes, hypertension, and cardiovascular diseases. The inherent connectivity features enable seamless data exchange between patients and providers, supporting timely intervention and personalized care pathways that were previously reliant on sporadic clinical interactions. This digitalization of patient engagement is critical in overburdened healthcare systems.

The principal driving factors propelling this market forward include the ubiquitous adoption of high-speed internet connectivity, regulatory shifts supporting telehealth and digital health integration, and increasing consumer interest in self-managing health and wellness. Furthermore, the persistent rise in chronic disease prevalence globally necessitates innovative, scalable solutions for long-term management and preventative care, areas where mobile medical applications excel. The continuous advancement in sensor technology integrated into smartphones and wearables allows for highly accurate data collection, transforming these devices into legitimate medical tools capable of capturing clinical-grade data outside traditional settings.

Mobile Medical Applications Market Executive Summary

The Mobile Medical Applications Market is experiencing robust acceleration driven by powerful business trends, notably the integration of artificial intelligence (AI) and machine learning (ML) to enhance predictive diagnostics and personalization capabilities. Strategic collaborations between technology giants and established pharmaceutical companies are redefining market boundaries, focusing on developing integrated platforms that combine therapeutic interventions with digital monitoring. Key business trends include the shift towards subscription-based models for premium medical apps and the increasing emphasis on achieving regulatory clearances (such as FDA or CE Mark) to legitimize apps for clinical use, moving them beyond basic wellness tools into certified medical devices.

Regionally, North America maintains market dominance due to high healthcare expenditure, advanced technological infrastructure, and proactive regulatory frameworks that facilitate the rapid adoption of digital health solutions, particularly in remote patient monitoring (RPM) services reimbursed by government payers. Conversely, the Asia Pacific region is poised for the fastest growth, fueled by vast, underserved populations, rapidly expanding mobile connectivity, and government initiatives promoting digital health to bridge geographical gaps in healthcare access. European markets are characterized by stringent data privacy regulations (GDPR), which mandate sophisticated security architectures for mobile applications but simultaneously drive innovation in secure data handling and interoperability within centralized public healthcare systems.

From a segmentation perspective, monitoring applications, particularly those focused on chronic disease management and mental health, are witnessing the highest uptake. By product type, fitness and wellness apps still hold the largest volume share, but certified medical apps offering diagnostic or therapeutic functions are commanding higher revenue growth rates. The end-user segment is increasingly shifting towards Providers and Payers, who leverage these applications for cost reduction, improved patient outcomes, and efficient data aggregation, signaling a maturation of the market from purely direct-to-consumer (DTC) wellness tools to enterprise-level clinical solutions integrated into Electronic Health Records (EHRs).

AI Impact Analysis on Mobile Medical Applications Market

User queries regarding the impact of AI on Mobile Medical Applications overwhelmingly center on three core themes: diagnostic accuracy improvement, data privacy implications, and the future role of personalized intervention algorithms. Users frequently ask how AI can detect subtle health anomalies missed by human interpretation and whether the proprietary algorithms are transparent and regulated. Concerns also revolve around the ethical use of continuously gathered personal health data and the potential for algorithmic bias affecting treatment recommendations across different demographic groups. High expectations are placed on AI to transition apps from passive data collectors to active, predictive health coaches capable of delivering clinically validated, immediate feedback and prescriptive guidance.

The integration of artificial intelligence is fundamentally transforming mobile medical applications, transitioning them from simple data visualization tools to sophisticated diagnostic and predictive platforms. AI algorithms facilitate the real-time analysis of large datasets collected via wearables and smartphone sensors, allowing for early detection of conditions such as atrial fibrillation, sleep apnea, or impending diabetic crises. This shift towards proactive monitoring enhances the clinical utility of mobile apps, enabling physicians to intervene preemptively rather than reactively. Furthermore, AI-driven chatbots and virtual assistants are improving patient adherence by offering highly personalized medication schedules, behavioral nudges, and interactive support tailored to individual psychological profiles and recovery progress.

AI's influence is also profoundly felt in the operational aspects of healthcare delivery. Machine learning models optimize clinical workflows by automating tasks such as preliminary symptom assessment, triage, and scheduling, thereby reducing administrative burdens on healthcare providers. For complex medical specialties like radiology and dermatology, AI-powered mobile apps can analyze images with high accuracy, often comparable to human experts, particularly in remote settings where specialist access is limited. As data volumes continue to swell, AI is essential for distilling actionable clinical insights, ensuring the Mobile Medical Applications market remains a frontier for highly efficient, data-driven personalized medicine.

- Enhanced diagnostic accuracy and speed through automated image and signal analysis.

- Development of personalized treatment pathways and dosage recommendations based on individual data profiles.

- Implementation of predictive analytics for identifying patients at high risk of adverse health events.

- Deployment of AI-powered conversational agents for 24/7 patient support and mental health triage.

- Optimization of clinical workflow and resource allocation via automated patient monitoring and alerts.

- Improvement in data security and anomaly detection to safeguard sensitive patient information.

DRO & Impact Forces Of Mobile Medical Applications Market

The Mobile Medical Applications market is driven primarily by the escalating demand for accessible and affordable healthcare solutions, accelerated by the global proliferation of smartphones and high-speed internet infrastructure. Key drivers include the growing incidence of chronic diseases requiring continuous monitoring and the paradigm shift towards patient-centric care models, incentivized by value-based reimbursement systems that reward better health outcomes. However, the market faces significant restraints, chiefly related to the fragmented regulatory landscape across different geographies, concerns surrounding the security and privacy of sensitive patient data (PHI), and the challenge of achieving seamless integration of diverse app data into existing hospital EHR systems, which often leads to workflow friction.

Opportunities within this domain are vast, centered on the expansion of remote patient monitoring (RPM) services, particularly for elderly and rural populations, and the integration of mobile apps with advanced wearable technologies and Internet of Medical Things (IoMT) devices, creating comprehensive digital health ecosystems. The impact forces acting upon the market are characterized by high technological velocity and significant regulatory scrutiny. Technological advancements ensure continuous functional improvements, moving from simple trackers to regulated Software as a Medical Device (SaMD). Simultaneously, the force of regulatory compliance compels developers to invest heavily in validation, certification, and robust cybersecurity measures, influencing market entry and competitive positioning. Economic factors, such as increasing healthcare costs worldwide, strongly impact adoption, as mobile apps offer a compelling cost-effective alternative to traditional care settings, strengthening their long-term value proposition for payers and consumers alike.

The interplay of these factors suggests a highly dynamic environment where market success hinges on innovation balanced with compliance. While the massive market opportunity presented by chronic disease management fuels investment, the inherent risks associated with data breaches and the need for clinical validation act as necessary checks. The resultant impact forces are pushing the market toward greater standardization of data protocols (e.g., FHIR) and increased scrutiny from governmental health bodies, guaranteeing that the mobile medical solutions being deployed are both innovative and clinically safe and effective for widespread public use, ensuring market sustainability and user trust.

Segmentation Analysis

The Mobile Medical Applications market is comprehensively segmented based on various technical and commercial parameters, including operating system compatibility, product type, application area, and the specific end-user category. This multidimensional segmentation is crucial for understanding specific growth pockets, consumer preferences, and regulatory requirements within different market subsets. The dominant segmentation variables reflect the current shift from basic consumer wellness tools to complex, regulated clinical instruments, impacting pricing structures and adoption curves across different healthcare stakeholders.

- By Operating System:

- iOS

- Android

- Windows

- By Product Type:

- Monitoring Applications (e.g., remote vital signs, glucose tracking)

- Fitness and Wellness Applications (e.g., exercise, diet, sleep)

- Diagnosis and Treatment Applications (e.g., disease specific, clinical calculators)

- Healthcare Management Applications (e.g., EHR access, scheduling, billing)

- By Application:

- Cardiovascular

- Diabetes Management

- Neurology

- Mental Health and Behavioral Health

- Drug Interaction and Information

- Oncology

- By End User:

- Patients/Consumers

- Healthcare Providers (Hospitals, Clinics, Physicians)

- Payers (Insurance Companies)

- Pharmaceutical Companies and Biotech Firms

Value Chain Analysis For Mobile Medical Applications Market

The value chain for Mobile Medical Applications begins with the Upstream activities centered on fundamental research, data science, and software development, involving highly specialized engineers, clinical experts, and UX/UI designers who conceptualize and build the core functionality, ensuring compliance with relevant medical standards like ISO 13485 for medical device software. This stage involves significant investment in securing proprietary algorithms and clinical validation studies to demonstrate efficacy, particularly for regulated applications classified as Software as a Medical Device (SaMD). Crucial to this upstream phase is the secure development of cloud infrastructure and API integration capabilities necessary for seamless data exchange with EHR systems and IoMT devices.

The Midstream phase involves distribution and marketing, where the primary distribution channel is through Direct-to-Consumer (DTC) platforms, such as major app stores (Apple App Store and Google Play), and increasingly, Indirect channels involving partnerships with hospital systems, pharmaceutical companies, and insurance payers who bundle or mandate the use of specific applications. The direct channel focuses heavily on search engine optimization, user reviews, and digital marketing to attract individual users, while the indirect channel requires extensive B2B sales cycles, regulatory navigation, and sophisticated integration support to ensure the app functions effectively within a complex institutional environment. Pricing strategies vary significantly here, ranging from freemium models to high-value, enterprise-level licensing agreements.

The Downstream phase is characterized by maintenance, data analytics, and customer support. Continuous product refinement through iterative updates based on user feedback and technological advancements is essential for retaining market share. Data generated by the applications offers immense value, enabling developers and partners (including pharmaceutical companies and researchers) to derive real-world evidence (RWE) for improving treatment protocols and drug development. Effective and secure post-sale support is paramount, especially for clinical applications, where technical failure could impact patient health, necessitating specialized medical helpdesk services and stringent compliance monitoring to protect patient safety and ensure operational reliability.

Mobile Medical Applications Market Potential Customers

The primary customers and end-users of Mobile Medical Applications are broadly categorized into four major groups, each utilizing the technology for distinct strategic objectives. Patients and Consumers represent the largest volume segment, using apps for personal health tracking, disease management (e.g., blood glucose monitoring), fitness motivation, and accessing remote consultations. This segment demands user-friendly interfaces, robust data privacy features, and applications that provide clear, actionable health insights, focusing heavily on convenience and accessibility in managing chronic conditions outside of clinical settings.

Healthcare Providers, including hospitals, independent physician groups, and specialized clinics, constitute a crucial institutional customer base. Providers leverage these applications primarily for efficiency gains, remote patient monitoring (RPM), and enhancing diagnostic capabilities. The goal for providers is to reduce readmission rates, manage large patient cohorts more effectively, and improve the quality of care through continuous, objective data streams from the patient’s home. Apps must be fully interoperable with existing Electronic Health Records (EHRs) and comply with institutional security standards to gain widespread clinical acceptance and integration into daily medical practice.

Payers (Insurance Companies and Government Health Agencies) represent a high-value customer segment driven by the imperative to control long-term healthcare expenditure and incentivize preventative health behaviors. Payers often subsidize or mandate the use of mobile medical applications—especially those focused on chronic disease management and mental wellness—as a means of reducing costly inpatient admissions and emergency services utilization. Furthermore, Pharmaceutical and Biotech companies are increasingly becoming integral customers, utilizing mHealth applications for enhancing patient recruitment in clinical trials, monitoring adherence to new therapies, and gathering valuable real-world data on drug efficacy and side effects in diverse patient populations, thereby integrating digital therapeutics into their product portfolios.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 49.6 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Johnson & Johnson, Medtronic, Teladoc Health, Allscripts Healthcare Solutions, Cerner Corporation, Siemens Healthineers, Philips Healthcare, Epic Systems, Sanofi, Omada Health, Babylon Health, F. Hoffmann-La Roche, BioTelemetry (Philips), Ginger, GoodRx, Livongo Health, Happify Health, 2Morrow Inc., Propeller Health |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Medical Applications Market Key Technology Landscape

The technological infrastructure supporting the Mobile Medical Applications market is built upon a foundation of robust cloud computing, enabling scalable data storage, processing, and instantaneous access across global networks. Adoption of secure, compliant cloud services (such as AWS, Azure, and Google Cloud, often utilizing HIPAA and GDPR compliant architectures) is critical for handling the massive volume of Protected Health Information (PHI) generated by these applications. The use of Fast Healthcare Interoperability Resources (FHIR) standards is increasingly mandatory, facilitating the seamless and secure exchange of data between mobile apps, hospital Electronic Health Records (EHRs), and clinical data repositories, ensuring that data is both accessible and actionable by healthcare providers.

A second pivotal element is the proliferation of the Internet of Medical Things (IoMT) integration. Mobile applications frequently serve as the central hub connecting and interpreting data from various external devices, including smart watches, continuous glucose monitors (CGMs), blood pressure cuffs, and specialized patches. Advanced Application Programming Interfaces (APIs) and Bluetooth Low Energy (BLE) connectivity protocols are essential for establishing reliable, low-power connections, translating raw physiological data into meaningful health metrics displayed within the mobile interface. The market’s technological trajectory is heavily reliant on enhancing sensor accuracy and improving battery life without compromising data transmission integrity, moving towards passive data capture that minimizes user interaction requirements.

Finally, cybersecurity and advanced data analytics technologies form the backbone of trust and clinical utility. With mobile devices being vulnerable endpoints, sophisticated encryption methods (both in transit and at rest), multi-factor authentication, and continuous security auditing are necessary to meet stringent regulatory requirements globally. Machine Learning (ML) algorithms are intrinsic to the app's functionality, utilized not only for predictive modeling but also for optimizing resource utilization, detecting fraudulent access patterns, and ensuring the clinical relevance of alerts and recommendations provided to both patients and clinicians, thereby elevating the technological sophistication required for market entry and sustained growth.

Regional Highlights

- North America: North America, comprising the United States and Canada, holds the dominant revenue share in the global Mobile Medical Applications market. This leadership position is attributed to the high per capita healthcare spending, the advanced infrastructure for digital health implementation, and favorable reimbursement policies for remote patient monitoring (RPM) services established by major payers like CMS (Centers for Medicare & Medicaid Services). The presence of numerous key market players, coupled with a high rate of chronic disease incidence and an established culture of early technology adoption, drives continuous innovation, particularly in certified diagnostic and therapeutic applications (SaMD). The market growth is also sustained by ongoing regulatory clarity from the FDA regarding software classification and validation processes, fostering investor confidence and development speed.

- Europe: The European market demonstrates significant growth, albeit constrained by a highly fragmented market structure and stringent data privacy regulations, primarily the General Data Protection Regulation (GDPR). Adoption is strongest in countries with centralized public healthcare systems (like the UK, Germany, and France) that prioritize eHealth integration for efficiency and patient accessibility. A key regional trend is the rapid expansion of digital health applications focusing on mental health and chronic disease self-management, often spurred by national digital health initiatives and specific regulatory paths, such as Germany's DiGA (Digital Health Applications) fast-track process, which allows approved apps to be reimbursed by statutory health insurance.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This explosive growth is fueled by massive untapped patient populations, rapidly increasing mobile connectivity, and substantial governmental investments in digital infrastructure, particularly in populous countries like China, India, and Japan. While basic wellness apps initially dominated, the market is quickly evolving toward sophisticated clinical applications driven by the necessity to address healthcare disparities and long travel distances, particularly in rural areas. Challenges remain concerning varying regulatory maturity and low health literacy in certain sub-regions, but the sheer volume of mobile users and increasing awareness of chronic lifestyle diseases present unparalleled market opportunities.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets characterized by significant growth potential driven by low penetration rates and acute needs for accessible healthcare solutions. In LATAM, smartphone density is high, but regulatory frameworks and reimbursement structures are still maturing. In MEA, high-income Gulf Cooperation Council (GCC) countries are rapidly adopting sophisticated mobile medical applications as part of ambitious national digital transformation strategies, focusing on telemedicine and chronic disease management to elevate the standard of care and modernize health services delivery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Medical Applications Market.- Abbott Laboratories

- Johnson & Johnson

- Medtronic

- Teladoc Health

- Allscripts Healthcare Solutions

- Cerner Corporation

- Siemens Healthineers

- Philips Healthcare

- Epic Systems

- Sanofi

- Omada Health

- Babylon Health

- F. Hoffmann-La Roche

- BioTelemetry (Philips)

- Ginger

- GoodRx

- Livongo Health

- Happify Health

- 2Morrow Inc.

- Propeller Health

Frequently Asked Questions

Analyze common user questions about the Mobile Medical Applications market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Mobile Medical Applications Market?

The primary driver is the accelerating shift towards remote patient monitoring (RPM) and decentralized care models, supported by the massive global increase in smartphone penetration and regulatory acceptance of telehealth technologies, which offer cost-effective management solutions for chronic diseases.

How do stringent regulatory frameworks like GDPR affect mobile medical application development?

Regulations like GDPR enforce rigorous standards for data privacy, security, and consent management. This compels developers to invest heavily in robust encryption, secure cloud infrastructure, and clear data governance policies, thereby raising the barrier to entry but ensuring higher quality, trustworthy clinical applications.

What is the difference between a Mobile Medical Application and a Digital Therapeutic (DTx)?

While both are mobile apps, a Digital Therapeutic (DTx) is a specific class of mobile medical application that delivers evidence-based therapeutic interventions to patients, often requiring regulatory approval (e.g., FDA clearance) to prove clinical efficacy and safety comparable to traditional pharmaceutical or medical devices.

Which end-user segment is experiencing the fastest adoption rate for advanced mobile medical solutions?

Healthcare Providers and Payers are showing the fastest adoption rate for advanced, integrated mobile medical solutions (like RPM platforms) because these tools directly contribute to achieving key institutional goals: reducing operating costs, improving patient outcomes, and facilitating compliance with value-based care models.

How is Artificial Intelligence (AI) enhancing the functionality of modern mobile medical apps?

AI integration enhances apps by enabling real-time predictive diagnostics, personalizing treatment protocols through adaptive algorithms, and optimizing patient engagement via sophisticated chatbots, moving the functionality beyond simple tracking to active clinical decision support and preemptive intervention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager