Mobile Online Music Gaming Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432106 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Mobile Online Music Gaming Market Size

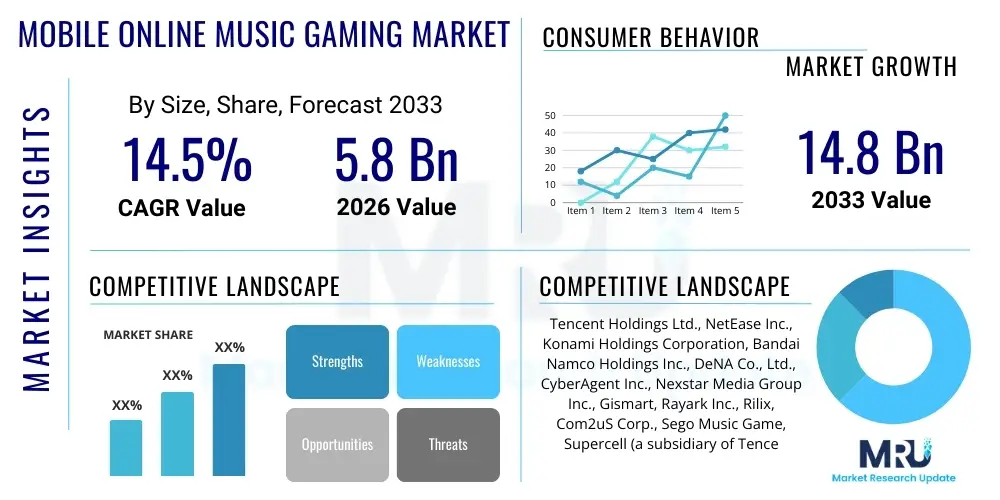

The Mobile Online Music Gaming Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $5.8 Billion USD in 2026 and is projected to reach $14.8 Billion USD by the end of the forecast period in 2033.

Mobile Online Music Gaming Market introduction

The Mobile Online Music Gaming Market encompasses digital entertainment applications focused on rhythm-based challenges, musical simulation, and interactive composition, delivered primarily via smartphone and tablet devices. This sector merges the ubiquitous penetration of mobile technology with the global consumer appetite for interactive music content. Products range from traditional rhythm-matching games (where timing visual cues to musical beats is key) to complex simulation games allowing users to manage virtual bands or create synthesized tracks. The core appeal lies in the integration of auditory and visual stimuli, offering a deeply engaging and often social gaming experience. These games leverage sophisticated audio processing and low-latency input mechanisms inherent in modern mobile operating systems to ensure precise gameplay synchronization, crucial for player satisfaction and competitive integrity.

Major applications of mobile music gaming extend beyond simple entertainment; they serve as critical platforms for music discovery, acting as promotional tools for established and emerging artists alike. The symbiotic relationship between game developers and music rights holders (labels and publishers) is a defining characteristic of this market, necessitating complex licensing agreements that dictate content refresh cycles and regional availability. Key benefits derived from these applications include enhanced cognitive functions related to timing and pattern recognition, opportunities for creative expression, and strong community building through competitive leaderboards and cooperative modes. Furthermore, the accessibility of mobile platforms removes the barrier to entry typical of dedicated console or PC gaming setups, driving mass adoption across diverse demographic segments globally.

The market growth is fundamentally driven by the escalating global mobile penetration, particularly in developing economies, coupled with the rising consumption of digital music streaming services. The continuous technological advancements in mobile hardware, including improved processing capabilities, high-fidelity audio output, and responsive touchscreens, directly enhance the immersive quality of these games. Additionally, the proliferation of free-to-play (F2P) models supported by robust in-app purchase mechanics (such as cosmetic items, energy systems, and premium track unlocks) ensures a high volume of active users and diversified revenue streams, reinforcing the market’s inherent scalability and resilience against economic fluctuations.

Mobile Online Music Gaming Market Executive Summary

The Mobile Online Music Gaming Market is currently characterized by a rapid evolution of monetization strategies and an intense focus on intellectual property (IP) integration, with business trends leaning heavily toward live service models and cross-platform synergy. Key developers are moving beyond simple F2P revenue models, incorporating Battle Pass structures, limited-time collaboration events with popular music artists, and Non-Fungible Token (NFT) integrations to enhance player investment and digital ownership. The primary strategic focus for major market participants involves securing exclusive music catalogs and developing sophisticated anti-cheat mechanisms to maintain competitive fairness. Furthermore, the expansion of cloud gaming services is anticipated to reduce hardware dependency, broadening the potential user base to devices with lower local processing power, driving overall market volume and user retention rates significantly.

Regionally, the market exhibits pronounced asymmetry, with the Asia Pacific (APAC) region, notably China, South Korea, and Japan, maintaining overwhelming dominance in both player volume and revenue generation, driven by established gaming cultures and high mobile density. North America and Europe demonstrate robust growth, characterized by higher average revenue per user (ARPU) due to greater consumer willingness to spend on cosmetic customization and premium content subscriptions. Emerging regional trends indicate accelerated adoption in Latin America and Southeast Asia, fueled by improving internet infrastructure and increasing disposable income, though content localization remains a critical success factor in these fragmented markets. Strategic investments in localized server infrastructure and culturally relevant content are paramount for companies seeking to capitalize on this regional expansion, balancing global operational efficiencies with specific local demands.

Segmentation trends reveal a strong preference for rhythm-action games that require precise timing, outpacing simpler simulation or idle music games, reflecting the competitive nature of the core demographic. In terms of technology, the integration of advanced haptic feedback systems is enhancing immersion, providing tactile synchronization to the musical beats, thus creating a more visceral gaming experience across higher-end mobile devices. Monetization segmentation continues to be dominated by the Free-to-Play model (F2P), but the rising acceptance of recurring subscription services for accessing full music catalogs or ad-free experiences signals a maturation of consumer spending habits within the mobile gaming ecosystem. The convergence of social media features, such as in-game recording and sharing of high-score performance videos, further drives organic user acquisition and segment loyalty.

AI Impact Analysis on Mobile Online Music Gaming Market

User inquiries regarding Artificial Intelligence (AI) in the Mobile Online Music Gaming Market frequently center on its capacity to revolutionize content generation, specifically asking how AI can create endless variations of gameplay challenges and personalize the soundtrack experience. Users are deeply interested in AI's role in procedural level design, adaptive difficulty scaling that smoothly adjusts to individual skill levels, and the ethical implications concerning the originality and licensing of AI-generated musical assets. Key concerns revolve around whether AI-driven personalization could inadvertently limit exposure to new music genres, and how sophisticated AI anti-cheat systems might affect legitimate competitive play. Overall expectations are high for AI to deliver dynamic, infinitely replayable content, reducing developer overhead while simultaneously enhancing user engagement through uniquely tailored musical journeys, solidifying the transition from static content libraries to fluid, ever-changing interactive entertainment.

- AI drives procedural generation of complex musical patterns and rhythm tracks, exponentially expanding content libraries without manual intervention.

- Adaptive difficulty algorithms utilize AI to analyze player performance in real-time, adjusting note speed, density, and complexity to maintain optimal challenge.

- AI-powered personalization engines curate song recommendations and tailor visual themes based on historical player behavior and stated preferences.

- Automated quality assurance and bug detection utilize machine learning to identify latency issues or desynchronization between audio and visual elements prior to release.

- Deep learning models enhance anti-cheat mechanisms, accurately detecting unauthorized inputs or rhythm bots in competitive multiplayer environments.

- AI assists in generating custom remixes or variations of licensed tracks, maximizing the utility of existing music IP within the game environment.

- Advanced vocal synthesis and text-to-speech AI are employed for dynamic tutorial narration and immersive narrative elements within music simulation games.

DRO & Impact Forces Of Mobile Online Music Gaming Market

The Mobile Online Music Gaming Market is propelled by significant Drivers (D) such as the exponential increase in global smartphone adoption and the rapid growth of the digital music streaming industry, which provides a familiar user base and established pathways for music consumption. Restraints (R) primarily include the complexity and high cost associated with securing global music licensing rights from major labels and publishers, leading to regional content fragmentation and operational bottlenecks. Opportunities (O) are emerging through the convergence with Augmented Reality (AR) and Virtual Reality (VR) technologies, promising fully immersive rhythm experiences, and the strategic integration of user-generated content (UGC) platforms that allow players to create and share custom beatmaps using licensed tools, expanding community engagement exponentially. These elements create dynamic Impact Forces, where the increasing demand for personalized and immersive mobile entertainment clashes with the persistent legal and technical challenges of content distribution and synchronization, forcing developers to adopt innovative business models and technological solutions to maintain competitiveness and scalability in a rapidly evolving digital landscape.

The primary driving force remains the ubiquity of mobile devices and improved internet infrastructure (5G deployment), enabling seamless, low-latency online gameplay critical for rhythm-based titles. This technological bedrock allows for highly competitive multiplayer modes and smooth, real-time synchronization across diverse geographical locations, a necessity for global online leaderboards. Furthermore, the gaming demographic is maturing, with increased willingness to invest in microtransactions and premium subscriptions for enhanced digital experiences, directly boosting ARPU figures. However, a significant restraint is the technical challenge of maintaining perfect audio-visual synchronization across thousands of different mobile device models, where discrepancies in processing power or operating system optimizations can lead to perceived lag, diminishing the core gameplay experience and leading to negative user reviews which severely impact new player acquisition rates. The necessity for constant, fresh content updates also places immense pressure on development studios, requiring high capital expenditure for licensing and development resources.

Major opportunities are centered around leveraging social commerce and influencer marketing within the game ecosystem. Integrating music games directly with platforms like TikTok or YouTube allows players to easily share their gameplay achievements, acting as a powerful engine for viral marketing and organic growth. The move towards cloud-based server infrastructure presents an opportunity to bypass local hardware limitations, ensuring consistent high-performance gaming regardless of the user's specific device tier. The Impact Forces are heavily skewed by competitive intensity; developers must constantly innovate in gameplay mechanics and content partnerships to differentiate their offerings. The market also faces regulatory scrutiny regarding loot box mechanics and data privacy (GDPR, CCPA), necessitating proactive compliance strategies. Successful mitigation of these restraints, particularly by streamlining the music rights acquisition process through aggregated licensing platforms, will determine which companies can scale their content offerings rapidly and capture dominant market share during the forecast period.

Segmentation Analysis

The Mobile Online Music Gaming Market is primarily segmented based on the type of game mechanics, the platform device utilized, and the dominant monetization model adopted by the developers. The segmentation provides critical insights into consumer preferences and investment viability, revealing that games focused on core rhythmic challenges maintain the highest engagement, while monetization is increasingly shifting towards hybrid models that combine free access with substantial opportunities for in-app purchases and cosmetic personalization. Geographical segmentation remains crucial, as music taste, licensing availability, and spending power differ drastically across regions, necessitating localized content strategies and pricing tiers. Understanding these segments is key for developers aiming to tailor their product features and marketing campaigns to specific high-value user cohorts.

- By Game Type:

- Rhythm Action Games (e.g., Tap/Slide mechanics)

- Music Simulation Games (e.g., Band Management, DJ Simulation)

- Creative/Composition Tools (e.g., Beatmaking applications integrated with social sharing)

- By Device Platform:

- Smartphones (iOS, Android)

- Tablets and Phablets

- Other Mobile/Handheld Devices

- By Monetization Model:

- Free-to-Play (F2P) with In-App Purchases (IAP)

- Subscription-Based Models (Premium Content Access, Ad Removal)

- Pay-to-Play (P2P) / Premium Games

- By Regional Outlook:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Mobile Online Music Gaming Market

The value chain for the Mobile Online Music Gaming Market begins with the Upstream analysis involving Content Creators, specifically music artists, record labels, and publishers who hold the necessary intellectual property (IP). This phase is critical as the quality and breadth of licensed music directly dictate the product's market appeal. Developers and game engine providers constitute the next layer, translating IP into playable software using sophisticated development kits and audio processing technologies. The negotiation of licensing fees and royalty structures at this stage often represents the highest cost component and a major bottleneck in content production and global distribution efficiency. Effective management of this upstream relationship, often through specialized digital rights management (DRM) platforms, is essential for minimizing legal risk and ensuring a continuous flow of fresh, appealing music content.

Moving into the midstream, the value chain incorporates distribution channels, primarily dominated by major mobile platform holders such as Apple’s App Store and Google’s Play Store. These platforms act as gatekeepers, handling direct consumer transactions, digital delivery, and application store optimization (ASO). Distribution is highly centralized, with platform fees representing a significant portion of the gross revenue. Simultaneously, the marketing and promotion activities (both direct via internal advertisements and indirect through social media and influencer campaigns) are crucial for driving downloads and initial player adoption. The efficacy of customer relationship management (CRM) and live operations (LiveOps) teams, which manage in-game events and community feedback, determines long-term user retention and the success of the Free-to-Play monetization strategy.

The Downstream analysis focuses on the end-users, or players, who consume the interactive content and generate revenue through microtransactions, subscriptions, and advertisement views. The direct distribution channel involves developers publishing directly through their own proprietary websites or specialized application launchers, although this method is less common in the mobile ecosystem compared to reliance on major app stores. The indirect distribution channel, which utilizes the dominant app store intermediaries, accounts for the vast majority of market transactions. The consumer feedback loop, enabled by in-game analytics and customer support, provides vital data back to developers, informing future content updates, gameplay balance adjustments, and strategic expansion into new regional markets, thereby closing the cyclical nature of the value chain and reinforcing a commitment to live service excellence.

Mobile Online Music Gaming Market Potential Customers

The primary potential customers in the Mobile Online Music Gaming Market are digitally native individuals, predominantly within the Generation Z and younger Millennial demographics, aged 15 to 35. These users possess a high level of comfort with mobile technology, actively consume digital music streaming services, and are highly susceptible to viral social media trends that often feature gameplay highlights. They are drawn to games that offer rapid, short-session entertainment suitable for commuting or brief breaks, alongside opportunities for social competition and self-expression through customizable avatars and digital merchandise. This core demographic values frequent content updates and collaborations with globally recognized musical artists, driving high engagement rates and spending on cosmetic items that signify status and achievement within the game community.

A secondary, yet rapidly expanding, segment includes casual gamers and rhythm enthusiasts across all ages who seek accessible, mentally stimulating entertainment without the commitment required by traditional console gaming. This group often prefers music simulation and lighter, less competitive rhythm titles. These customers are highly sensitive to user interface design, preferring intuitive mechanics and comprehensive tutorials that minimize the learning curve. Their monetization potential lies less in high-volume microtransactions and more in stable, recurring revenue from subscription models offering ad-free experiences or full access to exclusive, curated music libraries, viewing the game as an extension of their general music consumption habits.

Furthermore, there is a dedicated niche of competitive esports enthusiasts who focus exclusively on high-score chasing and professional-level tournament play, often associated with specific music game franchises that have an established competitive history. Although small in number, this segment drives high-volume, high-value spending on performance-enhancing items (if applicable) and dedicated accessory hardware. For developers, successfully catering to this segment requires rigorous anti-cheat measures, balanced gameplay, and investment in structured in-game and external tournament circuits. Targeting these diverse potential customers necessitates a diversified content portfolio that ranges from hyper-casual titles to intensely competitive rhythm challenges, ensuring broad market capture across varying levels of skill and dedication.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion USD |

| Market Forecast in 2033 | $14.8 Billion USD |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tencent Holdings Ltd., NetEase Inc., Konami Holdings Corporation, Bandai Namco Holdings Inc., DeNA Co., Ltd., CyberAgent Inc., Nexstar Media Group Inc., Gismart, Rayark Inc., Rilix, Com2uS Corp., Sego Music Game, Supercell (a subsidiary of Tencent), Ubisoft Entertainment SA, Square Enix Holdings Co., Ltd., Amanotes, Moonton, Voodoo SAS, and Zynga Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Online Music Gaming Market Key Technology Landscape

The technological backbone of the Mobile Online Music Gaming Market relies heavily on optimizing audio processing and minimizing input latency, which are critical for delivering a precise, enjoyable rhythm experience. Advanced Audio Processing Units (APUs) within modern smartphones allow for higher quality audio rendering and complex sound manipulation in real-time. Crucially, developers utilize specialized low-latency networking protocols, particularly in competitive multiplayer modes, to ensure that visual cues, player input, and server synchronization occur within milliseconds. This reliance on low latency extends to 5G network infrastructure adoption, which promises to stabilize connection quality and reduce inherent delays, thereby enhancing the competitive integrity and overall performance consistency across geographically distributed player bases, directly influencing high-tier gaming device specifications.

Haptic feedback technology represents another pivotal development in the market landscape. Integrating sophisticated haptic motors allows games to provide tactile responses that precisely match the musical beats or player actions, significantly boosting immersion and providing non-visual cues that aid gameplay timing. This sensory integration is moving beyond simple vibration, utilizing high-definition haptics to simulate textures and varying intensities corresponding to different musical instruments or rhythms. Furthermore, the reliance on proprietary or advanced third-party game engines (such as Unity or Unreal Engine, customized for mobile performance) ensures efficient resource management, allowing complex visual effects and large music libraries to run smoothly on diverse mobile hardware configurations without significant performance degradation or excessive battery consumption, a major concern for prolonged gaming sessions.

Data analytics and cloud services form the operational intelligence layer of the technology landscape. Cloud-based services are essential for hosting massive multiplayer online (MMO) rhythm battles, managing leaderboards, and storing extensive user-generated content libraries. Machine learning models are deeply integrated into LiveOps, analyzing player churn, purchase patterns, and difficulty curves to inform real-time adjustments and content monetization strategies. Moreover, the emergence of hybrid cloud/edge computing is being explored to reduce dependence on central servers for high-frequency operations, potentially offering even faster response times for rhythm-critical inputs by processing basic data closer to the end-user device. This comprehensive technological focus on responsiveness, immersion, and operational intelligence defines the competitive edge in the mobile music gaming domain, forcing continuous investment in hardware and software optimization.

Regional Highlights

- Asia Pacific (APAC): The APAC region stands as the undisputed market leader, driven primarily by mass market adoption in China, Japan, and South Korea. High population density, robust mobile penetration, and a deeply entrenched culture of rhythm and arcade gaming contribute to exceptional revenue figures. China, specifically, operates under unique regulatory frameworks and benefits from the dominance of local giants like Tencent and NetEase, who maintain extensive music licensing partnerships and leverage powerful social integration within their gaming platforms.

- North America (NA): Characterized by high Average Revenue Per User (ARPU) and a strong emphasis on technological innovation and premium content spending. The market is fueled by strong consumer preference for Western popular music genres and sophisticated subscription models. This region is a major hub for developer studios focused on integrating new technologies such as AR and blockchain elements into their mobile music titles, setting global trends in monetization and feature sets.

- Europe (EU): The European market displays diversity, with strong growth in Western Europe (UK, Germany, France) due to high smartphone penetration and engagement with competitive rhythm games. However, growth is tempered by stringent regulatory environments, particularly concerning data privacy (GDPR) and consumer protection related to in-game purchases. The market requires high content localization strategies to cater to varied language and specific musical tastes across different countries.

- Latin America (LATAM): This region is identified as a high-growth emerging market, supported by improving internet infrastructure and increasing access to affordable smartphones. While ARPU remains lower than in NA or EU, the sheer volume potential in countries like Brazil and Mexico makes it attractive. Key challenges include fragmented payment methods and the need for highly localized marketing campaigns utilizing regionally popular music genres and artists.

- Middle East and Africa (MEA): Growth in MEA is accelerating, concentrated in the Gulf Cooperation Council (GCC) countries due to high disposable income and advanced mobile infrastructure. The market is highly sensitive to culturally appropriate content and requires strategic partnerships for content distribution. Africa represents a vast, untapped potential, though current constraints include lower mobile data affordability and less developed payment ecosystems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Online Music Gaming Market.- Tencent Holdings Ltd.

- NetEase Inc.

- Konami Holdings Corporation

- Bandai Namco Holdings Inc.

- DeNA Co., Ltd.

- CyberAgent Inc.

- Nexstar Media Group Inc.

- Gismart

- Rayark Inc.

- Rilix

- Com2uS Corp.

- Sego Music Game

- Supercell (a subsidiary of Tencent)

- Ubisoft Entertainment SA

- Square Enix Holdings Co., Ltd.

- Amanotes

- Moonton

- Voodoo SAS

- Zynga Inc.

- Baidu, Inc. (via gaming investments)

Frequently Asked Questions

Analyze common user questions about the Mobile Online Music Gaming market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the substantial growth in the Mobile Online Music Gaming Market?

The market growth is primarily driven by three factors: the pervasive global adoption of high-performance smartphones, continuous advancements in 5G network infrastructure reducing latency for online play, and the strategic integration of major music IP through licensing deals with global artists and record labels.

How significantly does the Asia Pacific (APAC) region influence the overall market?

APAC is the most dominant region in the Mobile Online Music Gaming Market, accounting for the largest share of both user base and total revenue, fueled by established gaming traditions, high mobile density, and aggressive content investment by regional market leaders like China and South Korea.

What are the main technological challenges faced by developers in this market?

The primary technical challenges include ensuring ultra-low input latency for rhythmic precision across a multitude of diverse mobile devices, securing complex global music licensing rights, and maintaining seamless audio-visual synchronization to prevent gameplay desynchronization.

What role does Artificial Intelligence (AI) play in enhancing music games?

AI is strategically employed to drive procedural content generation, allowing games to create an infinite variety of new rhythm levels; it also powers adaptive difficulty algorithms that personalize gameplay challenges in real-time to match the individual player's skill level and progress.

Which monetization models are most effective for mobile music gaming?

The most effective strategy is the hybrid Free-to-Play (F2P) model, which relies on high user volume and revenue generated through in-app purchases (IAP) for cosmetic items and content unlocks, increasingly supplemented by recurring Battle Pass systems and premium content subscription tiers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager