Mobile Pallet Racking System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433003 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Mobile Pallet Racking System Market Size

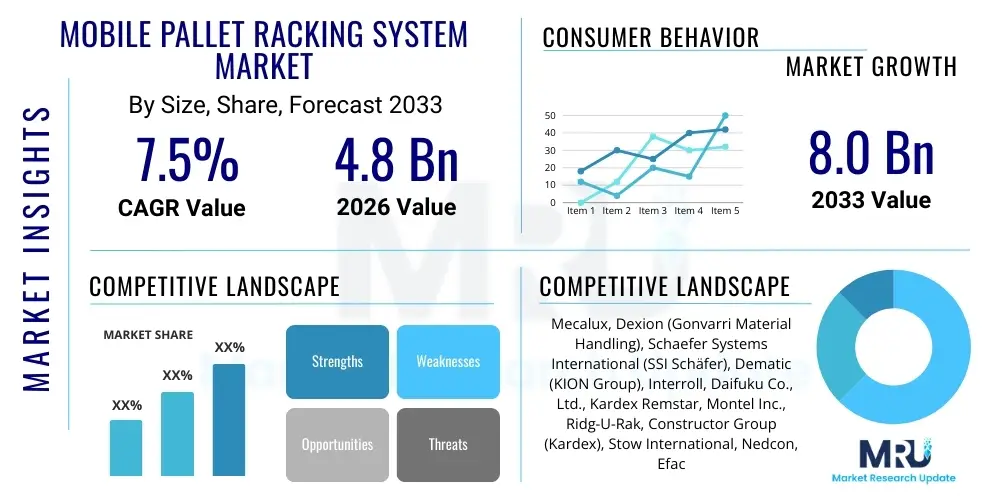

The Mobile Pallet Racking System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Mobile Pallet Racking System Market introduction

The Mobile Pallet Racking System Market encompasses dynamic storage solutions designed to fundamentally optimize warehouse space utilization and operational efficiency across various logistics and manufacturing environments. These sophisticated material handling systems, often interchangeably termed compact pallet racking or powered mobile shelving, operate by mounting conventional static pallet racks onto heavy-duty mobile bases. These bases run along specialized floor rails, a mechanism that critically eliminates the requirement for multiple fixed access aisles. This innovative design allows facilities to achieve the highest possible storage density while crucially maintaining 100% selectivity of every stored pallet, a feature that distinguishes it from other high-density options like drive-in or push-back racking. The primary application sectors are inherently those characterized by high-volume inventory, seasonal peaks, and stringent requirements for both immediate access and maximized cubic utilization, such as specialized cold storage facilities, burgeoning Third-Party Logistics (3PL) warehouses, and extensive distribution centers serving the demanding retail and pharmaceutical sectors. The technology is an essential strategic investment for enterprises grappling with escalating urban real estate costs and the pressing mandate for streamlined, efficient inventory management practices globally.

The core product architecture within this specialized market segment spans a spectrum of capabilities, ranging significantly from standard-duty systems engineered for lighter loads and ambient warehousing conditions, to robust, heavy-duty mobile solutions meticulously engineered to withstand extremely high load capacities, resist corrosion, and operate reliably in deep-freeze environments or regions prone to high seismic activity. Key system components are highly technical and integrated, including advanced electric motors and drive units, sophisticated control panels featuring modern Human-Machine Interfaces (HMI), complex safety mechanisms such such as photo eye sensors and pressure-sensitive floor strips, and high-precision rail guidance systems that must be seamlessly integrated into the warehouse floor infrastructure. Major applications for these dynamic systems are broad and critical, spanning the secure storage of automotive parts, the compliant warehousing of sensitive pharmaceutical products, large-scale document and archival management, and general merchandise logistics for massive retail chains. These systems are inherently scalable, highly customizable, and designed to adapt dynamically to diverse warehouse dimensions, ceiling heights, and fluctuating load requirements, positioning them as the preferred solution over traditional static racking in any operational scenario where physical floor space and maximum volumetric efficiency are the paramount financial considerations.

The substantial growth trajectory of the Mobile Pallet Racking System Market is fundamentally driven by two interconnected macro trends: the accelerating global demand for optimized, streamlined supply chains and the exponential expansion of the e-commerce sector, which collectively necessitates exceptionally high-speed order fulfillment processes and maximized achievable storage capacity within fixed or expanding distribution centers. Furthermore, the persistent evolution of technological integration, specifically the seamless interfacing with modern automation technologies including Automated Guided Vehicles (AGVs), Shuttle Systems, and centralized Warehouse Management Systems (WMS), is significantly enhancing the overall safety, speed, precision, and operational transparency of mobile pallet racking operations. The intrinsic, compelling benefits derived from adopting these systems—including a drastically reduced storage footprint (often achieving a 40% to 60% saving compared to traditional fixed-aisle systems), substantial long-term operational cost reductions due to reduced labor and energy usage, and superior inventory organization and accessibility—collectively reinforce and solidify the sustained, robust growth trajectory anticipated for this essential and highly specialized segment of the material handling industry worldwide. The focus on integrating intelligent controls for predictive movement and energy optimization further catalyzes adoption.

Mobile Pallet Racking System Market Executive Summary

The global Mobile Pallet Racking System Market is currently undergoing a period of intense innovation and robust expansion, largely catalyzed by transformative business imperatives focused relentlessly on maximizing logistics infrastructure efficiency and mitigating the widespread challenge of chronic warehouse labor shortages. A paramount emerging business trend involves the rapid integration of highly advanced sensor technology, sophisticated software controls, and IoT connectivity, effectively transitioning these systems from mere mechanical moving structures into intelligent, data-generating, and predictive storage assets. This enhanced technological integration is vital for supporting the exceptionally high throughput environments that are now mandated by modern omnichannel retailing and just-in-time manufacturing models. Moreover, the increasing corporate focus on environmental, social, and governance (ESG) factors is shaping the product development lifecycle; sustainability has become a critical purchasing criterion, spurring manufacturers to engineer systems that exhibit significantly lower power consumption and utilize more environmentally friendly manufacturing processes and recycled raw materials, thereby aligning with global corporate responsibility mandates. The industry landscape is also witnessing strategic market consolidation, where leading players are aggressively investing in Research and Development to pioneer modular, quick-to-assemble, and easy-to-install systems, significantly reducing the complexity and duration of implementation, which is accelerating adoption among mid-market logistics operators and small-to-medium enterprises (SMEs).

Analysis of regional dynamics clearly indicates a powerful acceleration in system adoption across the entire Asia Pacific (APAC) region. This growth is substantially powered by colossal infrastructure investments and the establishment of modern, efficient logistics parks in rapidly developing economies such as India, Vietnam, and Indonesia. These nations are prioritizing streamlined domestic and international trade capabilities, requiring state-of-the-art storage solutions. In sharp contrast, North America and Western Europe represent highly mature markets characterized primarily by intensive system replacement cycles and the pervasive retrofitting of existing, older warehouses. These markets are driven by the urgent necessity to reclaim and maximize cubic space, particularly in economically prohibitive, high-cost urban centers where physical expansion is practically impossible. European regional growth is also fundamentally influenced by its extensive regulatory framework, specifically stringent mandates regarding industrial health and safety, compelling continuous investment in highly certified, reliable, and technologically compliant mobile systems that meet the latest operational standards. Concurrently, the Middle East and Africa (MEA) region is emerging as a critical growth node, driven by massive public and private sector investments in building modern, resilient cold chain infrastructure, often linked to national food security strategies, where the inherent high-density storage capability of mobile racks within energy-intensive refrigerated environments offers unmatched efficiency returns.

A granular examination of segment trends confirms that the Fully Automatic/Automated Operational Type segment is unequivocally forecasted for the most rapid expansion throughout the forecast period. This rapid growth is directly attributable to the industry-wide impetus to drastically minimize reliance on manual labor, effectively eliminate human error, significantly boost operational speed, and ensure absolutely reliable functionality in extremely demanding environments, such as deep-freeze storage or hazardous goods handling. The Heavy Duty segment, designed explicitly for managing high-capacity loads, continues to sustain its dominance, particularly within the specialized automotive manufacturing and general heavy manufacturing sectors where the storage of components is characterized by high volume and substantial unit weights, demanding exceptional structural rigidity. Furthermore, the Third-Party Logistics (3PL) segment remains firmly established as the overwhelmingly dominant end-user category. 3PL providers strategically utilize mobile racking systems to deliver highly flexible, maximum-density storage services to their diverse clientele, thereby maximizing the utilization and maximizing the tangible return on investment (ROI) derived from their premium storage assets. The overarching market trajectory decisively confirms a widespread and sustained migration away from outdated, static warehousing models toward sophisticated, dynamic, automated, and supremely space-efficient storage systems across virtually all critical industrial verticals globally.

AI Impact Analysis on Mobile Pallet Racking System Market

User inquiries regarding the application of Artificial Intelligence (AI) frequently delve into how the technology can elevate mobile racking systems beyond their core function of movement and spatial optimization. The most common analytical themes raised by potential buyers and industry stakeholders include utilizing AI for creating highly granular, predictive maintenance schedules based on real-time acoustic and vibrational signatures of motors, dynamically optimizing the specific slotting and physical layout of stored SKUs (Stock Keeping Units) informed by sophisticated real-time demand forecasting and seasonal volatility analysis, and implementing intelligent motion planning algorithms to effectively prevent potential collisions while simultaneously minimizing the overall travel distances and access times for integrated robotic retrieval systems like AGVs or stacker cranes. Users express substantial concerns regarding the total implementation costs necessary to integrate robust AI platforms with legacy mobile racking systems versus the measurable, quantifiable return on investment realized through AI-driven enhancements in system efficiency, throughput, and energy consumption. Furthermore, securing these interconnected industrial assets is a major concern, necessitating robust cybersecurity measures to protect the proprietary operational data and sensitive movement controls of interconnected mobile systems from external threats.

The overarching expectation is that AI will rapidly catalyze the transformation of these systems into truly autonomous components of a comprehensive smart warehouse infrastructure. AI is anticipated to dynamically manage inventory location strategies to consistently ensure the fastest possible retrieval access for high-velocity items, continuously optimize the highly variable energy consumption profiles of the drive motors based on predicted workload peaks, and dramatically minimize critical system downtime through the proactive identification and prediction of component failures before they occur. AI integration facilitates a paradigm shift from reactive maintenance to preventative, prescriptive maintenance strategies. For instance, by leveraging computer vision and deep learning, AI can verify pallet conditions and placement compliance automatically during movement, significantly reducing the risk of structural damage or retrieval errors. This level of intelligent oversight ensures operational continuity and optimizes the entire flow of goods within the high-density storage matrix, maximizing the efficacy of the warehouse's logistical output while minimizing operational risk exposure.

- AI algorithms enable highly accurate predictive maintenance by analyzing thousands of data points regarding motor stress, temperature, and vibration patterns, leading to a reduction in unplanned system downtime often exceeding 30%.

- Machine learning models optimize the dynamic placement and organization of pallets (smart slotting) based on real-time order fulfillment data, historical demand patterns, and seasonality, thereby maximizing the overall efficiency of retrieval operations.

- Advanced image recognition and computer vision integrated via AI systems enhance inventory accuracy, verify regulatory compliance of load stacking, and confirm precise pallet positioning on the mobile bases during transit.

- AI-driven energy management platforms continuously modulate motor speed, acceleration, and deceleration profiles based on load, movement frequency, and current aisle access demand, resulting in measurable and substantial reductions in power consumption, especially crucial in refrigerated environments.

- Seamless integration with advanced AI-powered Warehouse Management Systems (WMS) facilitates dynamic, on-demand aisle creation and optimized sequencing, significantly improving overall traffic flow and coordinating the movement of auxiliary material handling equipment (e.g., robotic forklifts and stacker cranes) to eliminate bottlenecks.

DRO & Impact Forces Of Mobile Pallet Racking System Market

The fundamental growth trajectory of the Mobile Pallet Racking System Market is intrinsically defined and shaped by a powerful confluence of compelling drivers rooted in logistical efficiency and critical space utilization metrics, which are constantly balanced against inherent installation complexities and the substantial upfront capital expenditure required. The paramount driver remains the critical and intensifying need to maximize achievable storage capacity, particularly within logistics hubs located in high-cost urban areas where land acquisition or expansion is prohibitively expensive or geographically impossible. This need is amplified by the unrelenting pressures of e-commerce, which necessitates extremely high throughput from localized distribution centers positioned close to consumer populations. Parallel to this spatial optimization drive is the accelerating macro trend toward full automation across manufacturing and logistics sectors, where mobile systems provide the essential, dense physical structure required to support advanced high-density automated storage and retrieval processes. However, these powerful market tailwinds are significantly restrained by the substantial initial capital investment required for the specialized precision-engineered mobile bases, custom floor rails, sophisticated electronic controls, and high-capacity electrical systems. Furthermore, the intensive engineering planning and physical disruption required to seamlessly integrate the specialized floor-mounted rails into existing warehouse infrastructure often present a major cost and timeline friction point, delaying adoption, particularly for smaller facilities.

Substantial opportunities for sustained market expansion are predominantly identified within the rapidly proliferating global cold chain logistics sector. In this domain, the innate ability of mobile racking to operate reliably and efficiently in freezing and sub-freezing temperatures offers unparalleled density advantages, dramatically reducing the critical volume of air that must be continuously and expensively refrigerated. Further significant opportunities stem from the accelerating trend of automation adoption within large, developing emerging markets, which are consciously and strategically moving away from outdated, inefficient static warehousing models. These markets are increasingly prioritizing robust, scalable logistics infrastructure. These opportunities, while vast, remain highly susceptible to several overarching impact forces. Key among these are global economic volatility and cycles of recession, which can abruptly pause or delay multi-million dollar capital expenditure projects required for large-scale mobile racking installations. Additionally, evolving global and regional regulatory changes pertaining to industrial workplace safety, seismic resilience, and environmental impact necessitate continuous, expensive updating of system safety features, structural certifications, and electrical compliance, thereby impacting manufacturer R&D costs and end-user adoption cycles.

Ultimately, the long-term viability and growth of the market are defined by the critical tension between realizing substantial, long-term operational savings—driven by reduced real estate needs, lower energy consumption, and diminished labor costs—versus overcoming the immediate, high hurdle of short-term capital outlay. The perceived complexity of the bespoke installation process, the necessary disruption to existing operations, and the requirement for specialized, high-skill maintenance expertise represent continuous friction points that suppliers must address through simpler, more modular designs. Nevertheless, the irresistible operational pressure on major industrial verticals, including pharmaceuticals, high-volume food processing, and large-scale retail distribution, to compress their supply chains, minimize logistical risk, and maintain inventory closer to the ultimate customer base, strongly ensures that the fundamental driving forces centered on maximizing spatial optimization and enhancing throughput efficiency will consistently outweigh the major restraints and challenges. This sustained advantage fundamentally underpins and ensures the continued robust market momentum throughout the entirety of the forecast period, emphasizing mobile racking's role as a core efficiency enabler in modern warehousing.

Segmentation Analysis

The comprehensive segmentation analysis of the Mobile Pallet Racking System Market provides a critical, detailed structural breakdown based on key differentiating factors: operational type, duty level specification, rail system methodology, and the primary end-use application industry, effectively reflecting the highly diverse and specialized demands across the global logistics and storage ecosystem. The core operational categories—Manual (typically push-pull handles, usually for very light loads or infrequent access), Semi-Automatic (electric movement but requiring a forklift operator to manually control the aisle opening), and Fully Automatic (integrated movement controlled entirely by WMS or remote control)—dictate the requisite investment in both mechanical complexity and sophisticated control software. The clear industry preference is increasingly shifting towards Semi-Automatic and Fully Automatic systems due to their superior efficiency, labor savings, and capacity for integration with other automation technologies, moving capital expenditure towards operational intelligence. Duty classification (Standard Duty vs. Heavy Duty) is vital, as it directly addresses the load-bearing requirements specific to different industrial cargo, ensuring structural integrity and system stability for everything from light consumer packaged goods to extraordinarily dense automotive engine blocks or heavy manufacturing components. This structural granularity allows system providers to design and tailor material handling solutions precisely to the client's specific inventory characteristics and required throughput velocity.

The end-user segmentation is highly influential in driving specialized system demand, underscoring the critical vertical markets powering market growth. Third-Party Logistics (3PL) providers remain the most critical and flexible consumers of mobile racking. These firms strategically employ these systems to offer highly agile, dense storage-as-a-service to a wide spectrum of clients, ensuring they maximize the billable revenue derived from every square meter of their expensive warehouse footprint. Simultaneously, the Food & Beverage sector, especially within the rapidly expanding frozen and chilled food segments, relies on mobile systems as a foundational technology for achieving maximum efficiency in cold storage operations. By eliminating unnecessary heated/cooled aisle volume, these systems substantially cut the massive operational expenses associated with continuous refrigeration. Furthermore, the specialized Retail & E-commerce sectors and the Automotive manufacturing industries constitute major consumers, driven by their combined needs to manage vast quantities of disparate Stock Keeping Units (SKUs) while strictly maintaining high and immediate inventory accessibility for rapid order fulfillment or assembly line feeding. The distinct and varied storage challenges faced by these key segments necessitate the development of highly scalable, adaptable, and purpose-built mobile racking solutions capable of addressing specific industrial requirements, such as stringent hygiene standards, precise humidity control, or extreme seismic resistance.

The complexity embedded within the market segmentation is further refined by notable geographic variations in system adoption rates and technical preferences. For instance, mature markets in North America and Europe often concentrate their investments on upgrading to the most technologically advanced Fully Automated and Heavy Duty systems for highly specialized, high-value applications, focusing on retrofitting for enhanced compliance and performance. Conversely, emerging markets in APAC and Latin America typically demonstrate a higher initial demand for more cost-effective Manual or Semi-Automatic systems, allowing for significant initial space optimization gains while managing capital expenditure within tighter budgetary constraints. Understanding these nuanced regional and vertical segment preferences is essential for formulating effective, targeted market penetration and product development strategies. The continuing evolution toward fully integrated "smart" warehousing further propels convergence; increasingly, Semi-Automatic systems are being equipped with advanced sensor packages, IoT telemetry, and sophisticated WMS communication capabilities. This pervasive trend is steadily driving the entire mobile racking market toward inherently higher levels of operational intelligence, predictive functionality, and seamless integration into the digital supply chain ecosystem, offering improved data visibility regarding inventory location and real-time movement status.

- By Operational Type: Manual, Semi-Automatic, Fully Automatic/Automated

- By Duty Level: Standard Duty, Heavy Duty

- By Rail System: Surface-Mounted Rail, Embedded Rail

- By End-Use Industry: Third-Party Logistics (3PL), Retail & E-commerce, Food & Beverage (F&B) and Cold Storage, Automotive, Pharmaceutical & Healthcare, Manufacturing, Others

Value Chain Analysis For Mobile Pallet Racking System Market

The value chain for the Mobile Pallet Racking System Market commences with a critical Upstream Analysis, which focuses intently on the strategic sourcing and specialized processing of foundational raw materials. The dominant material requirement is high-grade structural steel, complemented by specialized precision electrical components (including high-efficiency motors, advanced sensors, Programmable Logic Controllers (PLCs), and frequency drives), and custom-engineered rail materials. The quality, certification, and consistent cost of steel are of paramount importance, as the structural integrity, load-bearing capability, and longevity of the heavy-duty racking frames and the mobile bases are entirely dependent upon robust material specifications. Suppliers at this initial stage are predominantly large, international steel mills and highly specialized industrial electronics manufacturers. Procurement strategies employed by major racking OEMs often necessitate establishing long-term, stable contractual relationships to effectively mitigate volatile commodity price fluctuations and ensure stringent compliance with global quality standards, particularly concerning tensile strength, welding standards, and the specialized corrosion resistance treatments mandatory for cold storage environments. The efficient, strategic management of this upstream segment is foundational, as the cost of raw materials and complex components typically constitutes the largest single share of the final deployed system cost.

Transitioning through the mid-stream activities, the core value chain encompasses crucial phases of product design, precision engineering, and highly technical manufacturing and assembly. Mobile racking systems demand extensive, highly customized Computer-Aided Design (CAD) modeling to optimally integrate the structure within the client's existing warehouse geometry, floor load capacity constraints, and operational flow requirements. The manufacturing process involves sophisticated, high-precision automated welding, specialized surface treatments (such as premium powder coating, hot-dip galvanization, or specialized corrosion inhibitors), and the complex electromechanical assembly of the motorized mobile bases and their advanced electronic control systems. Distribution channels for the finished products are typically structured as a strategic blend of Direct and Indirect methods. Extremely large, highly complex, or bespoke automation projects predominantly utilize a Direct channel strategy, wherein the racking manufacturer provides a fully integrated, end-to-end service scope encompassing initial consultation, detailed engineering design, manufacturing, meticulous installation, seamless software integration, and comprehensive ongoing maintenance contracts. This direct approach ensures superior control over quality, guarantees optimal system performance, and is particularly vital for integrating sophisticated fully automated mobile systems with facility-wide WMS infrastructure.

The Downstream Analysis segment encompasses the critical stages of physical installation, software integration, commissioning, and robust post-sale service support. Given the precise technical requirements involved in setting and aligning the floor rails (which must be accurate to within millimeters over long runs) and establishing the connection to the central control panels and electrical supply, professional, highly trained installation teams are absolutely mandatory. Indirect channels, which facilitate broader market reach, involve utilizing authorized regional dealers, certified distributors, or independent system integrators. These partners procure the engineered components and systems from the OEM, then manage localized sales, perform the complex installation, and execute regional maintenance contracts. Potential major customers, ranging from major 3PL powerhouses to specialized deep-freeze operators, place an exceedingly high value on suppliers capable of offering comprehensive, proactive post-installation support, ensuring ready availability of critical spare parts, and providing detailed, long-term service level agreements (SLAs). The ultimate success of the downstream operation, and by extension, customer satisfaction, is intensely reliant on the quality and robustness of the system's integration with the client's legacy or new WMS and associated MHE (Material Handling Equipment), cementing the indispensable role of highly skilled, technically proficient system integrators in the overall market value delivery proposition.

Mobile Pallet Racking System Market Potential Customers

The highly specialized Mobile Pallet Racking System Market targets an expansive and financially significant customer base, primarily consisting of organizations whose operational success hinges on achieving maximal storage density and streamlining logistical flow, particularly those managing high-volume, dynamic inventory or operating within strictly temperature-controlled environments. Chief among these demand generators are Third-Party Logistics (3PL) and Fourth-Party Logistics (4PL) providers. These logistics giants operate on narrow margins and continuously seek strategic ways to drastically increase the revenue-generating potential of their strategically located, expensive warehouse space. Mobile racking provides the essential physical infrastructure, allowing 3PLs to offer diverse, flexible, and high-density storage configurations to their wide-ranging client base, efficiently accommodating severe seasonal inventory fluctuations and greatly varying client-specific storage needs. Their purchasing decisions are rigorously driven by detailed Return on Investment (ROI) models based squarely on metrics related to maximized cubic meter utilization and reduced cost per pallet stored, giving them a significant competitive edge through superior spatial efficiency.

Another critically important customer cohort includes vast, centralized Retail distribution centers and rapidly expanding E-commerce fulfillment hubs. As consumer expectations for instantaneous order processing and expedited delivery continue to escalate, these operations must guarantee immediate, error-free access to an enormous, diverse range of Stock Keeping Units (SKUs) housed within often physically constrained urban footprints. Mobile systems are uniquely suited to support these high-throughput demands by providing an organized, accessible, high-density matrix for both manual and sophisticated robotic retrieval operations. Furthermore, the Food & Beverage processing and distribution sector, particularly within the burgeoning frozen and chilled goods market segments, constitutes an exceptionally high-value customer group. The inherent, immense operational cost associated with perpetually refrigerating the large volume of non-productive aisle air makes mobile systems functionally indispensable, as their ability to eliminate redundant aisles drastically reduces the energy load required for cooling, directly leading to substantial and immediate operational cost savings that elevate their adoption from an option to a necessity in modern cold chain infrastructure design.

The global Manufacturing and specialized Automotive industries also represent a substantial and consistent segment of potential customers, predominantly for the deployment of rugged, specialized Heavy Duty mobile systems utilized for the voluminous storage of massive components, specialized tooling, heavy molds, or finished product assemblies. Companies within these complex sectors highly value the structural rigidity, robust load capacity, and systematic organization provided by high-density mobile racking, ensuring instantaneous, precise tracking and rapid accessibility of critical production parts necessary to maintain continuous, expensive assembly line operations. The Pharmaceutical and regulated Healthcare organizations form an additional, rapidly growing high-value segment. These firms operate under stringent regulatory mandates requiring precise environmental condition control (temperature and humidity) and meticulous inventory traceability for compliance adherence. Their purchasing criteria are heavily focused on suppliers that can guarantee validated cleanroom compatibility, provide detailed temperature mapping, and ensure the seamless integration of precise environmental monitoring and management capabilities directly into the core mobile storage architecture, certifying compliance with Good Manufacturing Practice (GMP) requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mecalux, Dexion (Gonvarri Material Handling), Schaefer Systems International (SSI Schäfer), Dematic (KION Group), Interroll, Daifuku Co., Ltd., Kardex Remstar, Montel Inc., Ridg-U-Rak, Constructor Group (Kardex), Stow International, Nedcon, Efacec, Pentalift Equipment Corporation, Hannibal Industries, AK Material Handling Systems, Speedrack Products Group, Advance Storage Products, Krost Shelving & Racking, Fami Storage Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Pallet Racking System Market Key Technology Landscape

The technological landscape characterizing the Mobile Pallet Racking System Market is marked by relentless advancements focused on high-precision control, superior safety integration, and profound connectivity capabilities, collectively positioning these systems as increasingly intelligent components of the modern supply chain. The operational core of modern systems relies heavily on the utilization of advanced, high-performance Programmable Logic Controllers (PLCs) and robust Variable Frequency Drives (VFDs) which meticulously manage the precise, fully synchronized movement of the exceptionally heavy mobile bases. This sophisticated electromechanical orchestration is fundamental to ensuring strict adherence to complex safety protocols, including multi-tier anti-tilt, anti-seismic bracing, and redundant anti-collision mechanisms. Recent and ongoing technological innovations are strongly focused on implementing ubiquitous wireless communication protocols, leveraging Industrial IoT standards, to facilitate seamless, real-time bidirectional data exchange. This communication connects the racking system directly with the facility’s central Warehouse Management System (WMS) and coordinates the movements of surrounding Material Handling Equipment (MHE) such as sophisticated Automated Guided Vehicles (AGVs) or specialized high-reach stacker cranes. Furthermore, the mandatory adoption of integrated laser scanners, volumetric sensors, and light curtain arrays has become standard practice, significantly boosting operational safety compliance and dramatically mitigating the risk of accidents in dynamically operating, high-traffic warehouse environments, ensuring compliance with global machine safety directives.

Technological differentiation among market participants is highly visible in the engineering and deployment of specialized floor rail systems. Historically, installations mandated embedded rails, requiring extensive and costly floor preparation and curing time. However, newer technological offerings provide highly robust, highly precise surface-mounted rail systems. These advanced surface-mounted systems drastically simplify the installation process, substantially reduce the critical construction downtime, and consequently make high-density mobile racking solutions far more economically viable and logistically accessible for the extensive retrofitting of existing, older warehouse facilities. Moreover, the imperative for enhanced energy efficiency has emerged as a central technological focus area, directly influencing component selection and motor design. Contemporary mobile systems incorporate regenerative braking technology and highly efficient permanent magnet motors, which minimize peak current draws and significantly reduce total power consumption during the frequent and demanding start-stop cycles characteristic of high-throughput operations. This decisive drive for superior energy efficiency is a key strategic imperative that strongly aligns with widespread corporate environmental sustainability goals (ESG) and delivers measurable, substantial reductions in long-term operational costs for all end-users, particularly critical in the high energy consumption context of refrigerated storage facilities.

The most crucial and forward-looking aspect of the current technological landscape is the pervasive push toward developing truly "smart" mobile racking solutions, leveraging sophisticated sensor fusion, edge computing, and integration with predictive analytics platforms. Embedded sensors meticulously monitor a continuous stream of data related to track alignment, motor health, precise load distribution across the rails, and vibrational patterns, feeding this diagnostic information back to a centralized cloud-based or on-premises predictive maintenance platform. This data-driven approach allows facility operators to transition from reactive failure response to proactive, prescriptive scheduling of maintenance interventions, thereby maximizing system uptime and throughput availability. The ultimate goal is to seamlessly evolve mobile racking into a fully integrated, intelligent storage matrix that can dynamically communicate load statuses, optimize movement pathways, and coordinate seamlessly with autonomous fulfillment robots and order picking systems, forming a resilient, highly efficient part of the overarching fully automated warehouse ecosystem. To enhance user interaction and reduce training overhead, major companies are significantly investing in developing highly intuitive, graphically rich HMI (Human-Machine Interface) touchscreens that offer comprehensive system control, real-time diagnostic feedback, and integrated troubleshooting guides directly accessible at the aisle level, further simplifying complex operations for frontline warehouse personnel.

Regional Highlights

- North America: This market is defined by its maturity, exceptionally high labor costs, and the rigorous demands for infrastructure efficiency imposed by leading global e-commerce and retail powerhouses. Market growth is fundamentally driven by massive, multi-million dollar automation and modernization projects and a high technical requirement for systems capable of achieving seismic resistance, particularly in high-risk zones. The primary growth engine involves the strategic retrofitting of existing, high-value warehouse space located within expensive major metropolitan logistics hubs (e.g., the Northeast corridor, Southern California). This focus necessitates the deployment of highly sophisticated, fully automated mobile racking solutions that feature deep, intelligent integration capabilities with advanced Warehouse Management System (WMS) platforms.

- Europe: Europe represents another highly mature market characterized by extremely stringent occupational health and safety regulations, exceptionally high standards for energy efficiency, and the presence of a vast, complex, and highly specialized cold chain logistics network. Western European countries (notably Germany, the United Kingdom, and France) exhibit the highest adoption rates, driven by the specialized needs of the high-value pharmaceutical, advanced manufacturing, and processed food industries. Growth is predictable and steady, primarily focusing on replacing older, less-efficient static installations with modern mobile systems to meet superior density metrics, achieve critical energy savings, and ensure full compliance with the latest European safety directives and environmental standards.

- Asia Pacific (APAC): This region is universally recognized as the fastest-growing market globally for mobile racking systems, propelled by explosive urbanization, unprecedented investment in modern logistics infrastructure across key economies (China, India, Indonesia), and the rapid acceleration of e-commerce penetration. The market dynamic involves a significant, strategic shift away from outdated traditional storage methodologies towards the construction of large, modern, and efficient logistics parks. Demand is highly diversified, ranging from initial investment in cost-effective manual or semi-automatic systems to the swift development of colossal, automated, new-build facilities, primarily serving the high-volume requirements of the fast-moving consumer goods (FMCG), electronics, and automotive components sectors.

- Latin America: Market development remains dynamic yet emerging, with adoption highly concentrated within the major economic and logistics centers, predominantly in Brazil, Mexico, Chile, and Colombia. The market expansion is primarily driven by expanding organized retail supply chains, increasing import/export activity, and the immediate need for fundamental space optimization solutions. Investment patterns tend to favor Semi-Automatic and Standard Duty systems, reflecting a strategic balance between immediate storage maximization needs and constraints related to upfront capital expenditure availability. Project timelines and investment cycles can be periodically impacted by regional political instability and macroeconomic fluctuations.

- Middle East and Africa (MEA): This is an emerging but strategically significant market heavily focused on developing resilient and technologically advanced cold chain capabilities, particularly within the Gulf Cooperation Council (GCC) nations, driven by critical national food security and large-scale pharmaceutical distribution initiatives. Major demand drivers are large-scale government-backed infrastructure and logistics projects, often necessitating highly customized, extremely heavy-duty mobile cold storage solutions engineered to operate reliably in harsh ambient conditions. The regional focus is squarely on achieving superior system reliability, structural integrity, and maximum energy efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Pallet Racking System Market.- Mecalux

- Dexion (Gonvarri Material Handling)

- Schaefer Systems International (SSI Schäfer)

- Dematic (KION Group)

- Interroll

- Daifuku Co., Ltd.

- Kardex Remstar

- Montel Inc.

- Ridg-U-Rak

- Constructor Group (Kardex)

- Stow International

- Nedcon

- Efacec

- Pentalift Equipment Corporation

- Hannibal Industries

- AK Material Handling Systems

- Speedrack Products Group

- Advance Storage Products

- Krost Shelving & Racking

- Fami Storage Systems

Frequently Asked Questions

Analyze common user questions about the Mobile Pallet Racking System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary financial advantage of installing a Mobile Pallet Racking System?

The primary financial advantage is the significant reduction in required physical warehouse footprint and building volume, often achieving up to 60% more storage capacity than conventional static racking systems. This dramatic saving translates directly into lower long-term real estate costs, reduced initial construction expenses for new facilities, and substantially lower ongoing operational costs, particularly regarding energy expenditure for heating, lighting, or cooling the minimized aisle space.

Are Mobile Pallet Racking Systems suitable for cold storage or freezer environments?

Yes, mobile pallet racking systems are universally recognized as the most efficient solution for cold storage. They are custom-engineered with specialized corrosion-resistant materials, high-efficiency motors, and insulated components to function reliably in extreme sub-zero temperatures. Their ability to eliminate redundant refrigerated aisle volume makes them the most energy-efficient high-density storage solution for freezer applications, providing rapid ROI through massive energy cost savings.

How does automation impact the safety features and compliance of mobile racking systems?

Automation critically enhances safety and compliance through sophisticated, integrated technologies such as multi-zone laser scanners, safety mats, emergency pull cords, and redundant anti-collision photo eye sensors. These systems immediately and safely halt all movement if an obstacle or human presence is detected in the aisle. Fully automatic systems operate under strict PLC and WMS control, minimizing human risk exposure and adhering rigorously to complex international machine safety and seismic standards.

What specialized preparation is needed for the warehouse floor before mobile racking installation?

The warehouse floor requires specialized preparation involving high-precision laser leveling and achieving specific flatness and load-bearing tolerances far exceeding those for static racking. This preparation is essential to guarantee the synchronized, smooth, and safe movement of extremely heavy mobile bases under full load. This critical phase involves either embedding or securely surface-mounting high-tolerance precision rails, which must be perfectly aligned across the entire length of the warehouse bay.

Which end-use industry is the fastest growing segment for mobile racking adoption?

The Third-Party Logistics (3PL) sector is experiencing the fastest growth, closely followed by the high-demand Food & Beverage and Cold Storage segment. 3PLs are aggressively adopting these systems to maximize their space utilization and flexibility for multi-client operations, offering premium, high-density storage services, while the cold storage sector views mobile racking as a non-negotiable solution for minimizing expensive air refrigeration requirements and achieving operational sustainability goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager