Mobile Payment Technologies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438542 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Mobile Payment Technologies Market Size

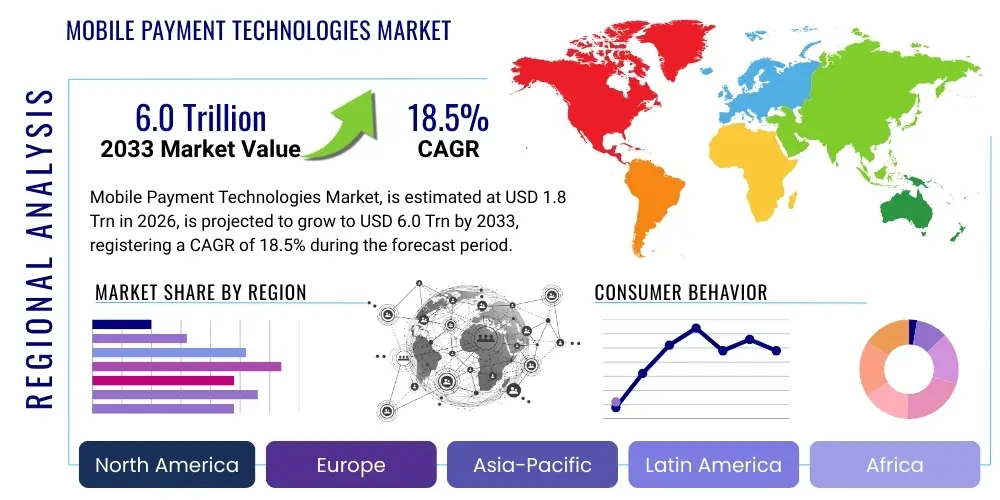

The Mobile Payment Technologies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $1.8 Trillion in 2026 and is projected to reach $6.0 Trillion by the end of the forecast period in 2033.

Mobile Payment Technologies Market introduction

The Mobile Payment Technologies Market encompasses sophisticated systems and platforms that enable monetary transactions using mobile devices, primarily smartphones and tablets. This ecosystem involves technologies such as Near Field Communication (NFC), Quick Response (QR) codes, mobile wallets, and proprietary apps, facilitating seamless financial exchanges between consumers (P2P), consumers and businesses (P2B), and businesses themselves (B2B). The core offering of these technologies is convenience, speed, and enhanced security compared to traditional payment methods, fundamentally transforming global retail, e-commerce, and banking sectors.

Products within this market range from simple SMS-based payment solutions popular in developing regions to highly complex tokenized payment systems integrated into sophisticated digital wallets provided by major tech firms and financial institutions. Major applications span retail checkout, online shopping, utility bill payments, transportation ticketing, and cross-border remittances. The evolution of mobile payments is heavily influenced by infrastructural advancements, including the rollout of 5G networks and the standardization of digital identity verification protocols, ensuring both reliability and scalability across diverse geographical landscapes.

Key driving factors accelerating market expansion include the exponential increase in global smartphone penetration, particularly in Asia Pacific and Latin America, coupled with rapid urbanization and the growing acceptance of e-commerce. Furthermore, the push towards financial inclusion, especially in underserved populations, relies heavily on mobile payment infrastructure, offering access to formal financial services without requiring physical bank branches. Regulatory support for digital finance and the implementation of secure authentication standards (like biometrics) further bolster consumer confidence, making mobile payments an indispensable part of the modern economic framework.

Mobile Payment Technologies Market Executive Summary

The global Mobile Payment Technologies Market is undergoing rapid transformation, driven primarily by evolving consumer behavior favoring digital and contactless transactions. Current business trends indicate a significant shift towards integrated payment solutions, where payment processing is embedded directly into enterprise resource planning (ERP) systems and Customer Relationship Management (CRM) platforms, streamlining operational efficiency for merchants. Furthermore, the competitive landscape is intensifying, characterized by strategic partnerships between traditional financial institutions and FinTech innovators, focusing on delivering real-time payments and cross-border solutions, often leveraging APIs for greater flexibility and faster service deployment.

Regionally, the market exhibits contrasting growth dynamics. Asia Pacific remains the dominant segment, fueled by massive user bases adopting centralized mobile wallets like Alipay and WeChat Pay, alongside robust government initiatives promoting digital economies. North America and Europe, while mature, show high adoption rates of proximity payments (NFC) and are focusing heavily on regulatory compliance, such as PSD2 in Europe, which mandates stronger security measures and encourages open banking. Latin America and the Middle East & Africa are emerging as high-growth regions, driven by young, mobile-native populations and the necessity for alternatives to conventional banking infrastructure, making them prime targets for mobile money and basic digital wallet services.

Segment-wise, the mobile wallet sub-segment continues its robust growth due to its versatility and multi-functionality, extending beyond mere payment to loyalty programs, ticketing, and digital identity management. Technology trends emphasize enhanced security through tokenization and the integration of advanced biometric authentication methods (fingerprint, facial recognition). The retail sector remains the largest application segment, though BFSI (Banking, Financial Services, and Insurance) is rapidly adopting mobile payment infrastructure for secure customer onboarding and sophisticated lending services, indicating a broadening penetration across enterprise verticals.

AI Impact Analysis on Mobile Payment Technologies Market

Common user questions regarding AI's impact on mobile payments revolve around security enhancements, personalized financial services, and the risk of automated fraud. Users frequently inquire about how AI models can detect novel forms of fraud in real-time and whether this technology accelerates transaction speeds without compromising safety. There is also significant user interest in the personalization capabilities offered by AI, such as automated budget recommendations and tailored loyalty rewards based on spending patterns. Concerns often center on data privacy implications related to continuous behavioral monitoring and the potential for algorithmic bias in credit scoring or transaction approvals within mobile payment systems.

AI algorithms are fundamentally enhancing the security posture of mobile payment platforms by providing superior fraud detection capabilities. Machine learning models analyze vast datasets of transaction histories, geo-location data, and device identifiers to establish behavioral patterns. Any deviation from these norms triggers instant alerts or transaction blocks, effectively minimizing financial losses associated with unauthorized use. This proactive approach transitions security from reactive rule-based systems to predictive, adaptive defense mechanisms, which is crucial given the high velocity and volume of mobile transactions.

Beyond security, AI is revolutionizing customer experience and operational efficiency. Chatbots and virtual assistants powered by Natural Language Processing (NLP) provide instant customer support for payment inquiries and disputes, reducing reliance on human agents. Furthermore, AI optimizes payment routing and settlement processes, minimizing latency and transaction costs for businesses. For consumers, AI drives product development by enabling hyper-personalized financial management tools, allowing mobile wallet providers to offer customized credit products, savings goals, and dynamic spending limits based on real-time financial health assessments.

- AI drives real-time, predictive fraud detection using behavioral analytics and anomaly identification.

- Enhances customer service through intelligent chatbots and virtual payment assistants (NLP integration).

- Enables hyper-personalization of financial products, loyalty programs, and spending recommendations.

- Optimizes payment processing by determining the most efficient routing and settlement pathways.

- Utilizes biometric and transactional data for dynamic risk assessment and adaptive security protocols.

DRO & Impact Forces Of Mobile Payment Technologies Market

The dynamics of the Mobile Payment Technologies Market are shaped by a strong interplay between market drivers promoting growth, intrinsic restraints challenging widespread adoption, and vast opportunities arising from technological integration and market diversification. The dominant driver is the pervasive global adoption of smartphones and the rising global consumer expectation for instant, digital services. However, this momentum is often moderated by significant restraints, primarily revolving around fragmented regulatory environments across different jurisdictions and persistent consumer anxiety regarding data security and privacy in cloud-based payment systems.

Opportunity lies heavily in penetrating emerging markets where traditional banking infrastructure is underdeveloped, making mobile money the primary gateway to financial services. Furthermore, the integration of mobile payment capabilities with nascent technologies such as the Internet of Things (IoT) and vehicular commerce (V-commerce) presents new transactional environments. The impact forces indicate a highly competitive environment where innovation in security (e.g., tokenization, zero-knowledge proofs) and interoperability (API development, open banking mandates) determines market share and consumer trust. These forces necessitate continuous R&D investment by market participants to stay relevant.

Specifically, the standardization challenge remains a critical impact force. While technologies like NFC and QR codes have gained widespread acceptance, proprietary platform restrictions and a lack of universal standards for cross-platform and cross-border mobile transactions hinder smooth global growth. Successfully navigating the balance between ensuring robust security mandated by regulators (like GDPR or PCI DSS) and maintaining the high level of convenience demanded by modern users is the central challenge that defines the market leaders in this rapidly evolving space.

Segmentation Analysis

The Mobile Payment Technologies Market is extensively segmented based on criteria such as payment mode, technology type, application, and end-user, providing a granular view of market dynamics and adoption patterns. The segmentation by Payment Mode distinguishes between proximity payments, typically using NFC or sound waves for point-of-sale (POS) transactions, and remote payments, involving online transactions through mobile apps, often secured via proprietary SDKs or gateways. This differentiation is crucial for vendors designing hardware and software tailored for specific transactional environments, whether in physical retail or e-commerce platforms.

Technology segmentation highlights the competition and co-existence of various underlying enablers. Mobile wallets, often proprietary apps like Apple Pay or PayPal, dominate the consumer space by offering comprehensive digital banking and payment management features. QR code technology, highly prevalent in APAC due to its low infrastructure cost, and tokenization, which replaces sensitive card data with a unique identifier, represent key technological pillars. The application segmentation demonstrates the widespread utility of these systems, ranging from the historically dominant retail sector to burgeoning areas such as healthcare billing and digital identity verification services.

End-user segmentation clearly defines the cash flows, focusing on Consumer-to-Consumer (P2P) transfers, essential for social remittances and split payments, and Business-to-Consumer (B2C) transactions, which cover the bulk of retail and service payments. As businesses increasingly adopt mobile-first strategies, the Business-to-Business (B2B) mobile payment segment is projected for substantial growth, driven by the need for faster, transparent, and auditable corporate payment mechanisms, particularly in supply chain financing and cross-border trade settlements.

- Payment Mode:

- Proximity Payments (NFC, QR Code, Magnetic Secure Transmission - MST)

- Remote Payments (SMS/Direct Carrier Billing, Mobile Web Payments, In-App Payments)

- Technology Type:

- Near Field Communication (NFC)

- QR Code

- Mobile Wallet/Digital Wallet

- Carrier Billing

- Tokenization

- Application:

- Retail and E-commerce

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Transportation and Logistics

- Telecommunications

- Utilities and Government Services

- End-User:

- Individual Consumers (P2P, P2B)

- Merchants and Retailers (B2C)

- Enterprises (B2B)

Value Chain Analysis For Mobile Payment Technologies Market

The value chain for mobile payment technologies is complex and highly interdependent, involving multiple layers of infrastructure and service providers, starting from the upstream providers of technology components. Upstream activities include hardware manufacturers supplying secure elements (SE), chips enabling NFC and biometric capabilities in mobile devices, and core platform developers creating operating systems (iOS, Android). Additionally, security providers specializing in encryption and tokenization services form a crucial part of the upstream segment, ensuring the foundational safety and integrity of the mobile payment ecosystem before consumer interaction even begins.

Midstream activities are dominated by payment processors, gateways, and mobile network operators (MNOs). MNOs are critical, especially for carrier billing and mobile money services in emerging markets, providing the connectivity layer. Payment processors like Visa, Mastercard, and specialized FinTech firms handle transaction authorization, clearing, and settlement. Mobile wallet providers (e.g., Apple, Google, PayPal) sit at the center of the value chain, integrating these upstream and midstream components to offer the final consumer interface and merchant services. This phase is characterized by intense competition to acquire and retain both users and merchants.

Downstream activities focus on the distribution channels and end-user interaction. Direct distribution occurs when users download proprietary mobile wallet apps (e.g., PayPal, bank apps) or utilize integrated device features (e.g., Apple Pay). Indirect channels involve partnerships with physical merchants and POS system manufacturers who integrate mobile payment acceptance capabilities. The flow of value culminates in the end-users—consumers and businesses—who adopt these technologies for transactional needs. Continuous feedback loops from these downstream users drive innovation in security and user experience within the upstream and midstream segments.

Mobile Payment Technologies Market Potential Customers

Potential customers for mobile payment technologies span a diverse range of end-users, broadly categorized into individual consumers, various merchant categories, and large enterprises. Individual consumers represent the primary market, seeking convenience, speed, and security for everyday transactions, including peer-to-peer transfers, retail purchases, and utility payments. This segment is highly fragmented globally, with differing adoption preferences—e.g., high NFC usage in mature markets versus high QR code adoption in Asia.

Merchants, from small and medium-sized enterprises (SMEs) to large retailers, constitute another crucial customer base. These customers adopt mobile payment acceptance solutions to enhance checkout efficiency, reduce cash handling costs, and integrate loyalty programs directly into the payment process. They seek robust, scalable POS systems and mobile acceptance solutions that are interoperable across various mobile wallet platforms, minimizing friction at the point of sale. The rise of m-commerce also compels online retailers to prioritize seamless in-app and mobile web checkout experiences, making them key consumers of gateway services and SDK integrations.

Furthermore, large financial institutions (BFSI), government agencies, and transportation authorities are significant institutional buyers. BFSI customers utilize mobile payment infrastructure to offer digital banking services, secure mobile card provision (tokenization), and sophisticated risk management tools. Governments and public services are increasingly implementing mobile payment platforms for tax collection, public transport fares, and disbursement of aid, valuing the enhanced transparency, auditability, and efficiency that digital transactions provide over traditional methods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Trillion |

| Market Forecast in 2033 | $6.0 Trillion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Visa Inc., Mastercard Incorporated, PayPal Holdings, Inc., Apple Inc., Google LLC, Samsung Electronics Co., Ltd., Ant Group Co., Ltd. (Alipay), Tencent Holdings Ltd. (WeChat Pay), Block, Inc. (Square), Fidelity National Information Services, Inc. (FIS), Stripe, Adyen N.V., Global Payments Inc., ACI Worldwide, Inc., FSS Technologies, Paytm. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Payment Technologies Market Key Technology Landscape

The technological landscape of the mobile payment market is characterized by convergence and continuous evolution, driven primarily by the need for enhanced security, greater speed, and seamless interoperability. Near Field Communication (NFC) remains foundational for proximity payments, enabling secure communication between a mobile device and a POS terminal via tokenization. However, the rise of QR code technology, particularly in densely populated regions like China and India, offers a cost-effective, non-hardware intensive alternative, crucial for rapidly onboarding smaller merchants and enabling dynamic payment flows without specialized terminals.

Tokenization is perhaps the most critical security innovation, replacing the user’s Primary Account Number (PAN) with a unique, cryptographically secure token during transactions. This renders stolen data useless if intercepted, significantly reducing the risk of fraud associated with mobile payments. Furthermore, biometric authentication technologies, including fingerprint scanning, facial recognition, and voice verification, are increasingly integrated into mobile payment workflows, satisfying regulatory requirements for Strong Customer Authentication (SCA) and providing a friction-reducing security layer for consumers.

Looking forward, the technology stack is being influenced by blockchain and Distributed Ledger Technology (DLT), which hold potential for optimizing cross-border remittances by offering transparency and reducing intermediary costs. Furthermore, the development of Request-to-Pay (RTP) schemes and integrated Open Banking APIs are fostering greater real-time communication between banks and payment providers, paving the way for advanced P2P and invoice payment functionalities, pushing the market beyond traditional card network limitations toward direct account-to-account mobile transfers.

Regional Highlights

The Mobile Payment Technologies Market demonstrates significant regional variation in adoption rates and preferred technologies, dictated by infrastructure maturity, regulatory frameworks, and consumer banking habits. Asia Pacific (APAC) stands as the largest and most dynamic market, characterized by immense transaction volume driven by mobile-first nations like China and India. The dominance of QR code-based ecosystems (Alipay, WeChat Pay, Paytm) reflects a leapfrogging of traditional bank card infrastructure directly into advanced mobile wallet usage, supported by aggressive governmental digitization policies and massive consumer bases who rely heavily on mobile devices for daily financial tasks.

North America (NA) and Europe represent mature markets with high penetration of sophisticated, proximity-based mobile payment systems (NFC), largely integrated with existing card network infrastructure (Visa, Mastercard). In North America, mobile payments are often linked to loyalty programs and in-store merchant apps. European growth is heavily influenced by regulatory harmonization efforts, such as the Payment Services Directive 2 (PSD2), which has accelerated the adoption of Strong Customer Authentication and fostered Open Banking, driving innovation in account-to-account mobile payments and enhanced security features for mobile wallets.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-potential growth areas. In LATAM, factors such as high mobile connectivity and a large unbanked population drive the adoption of mobile money and digital wallets as alternatives to traditional banking. The MEA region, particularly Sub-Saharan Africa, has a globally leading mobile money ecosystem, where basic phone services facilitate critical financial functions (M-Pesa being a prime example). Future growth in these regions will be fueled by expanding smartphone usage and the necessity to provide scalable, low-cost financial inclusion solutions.

- Asia Pacific (APAC): Dominant market share; high adoption of QR codes; driven by China (Alipay, WeChat Pay) and India (UPI, Paytm). Focus on super-apps and financial inclusion.

- North America (NA): High value per transaction; strong presence of proprietary wallets (Apple Pay, Google Pay); focus on security (tokenization) and seamless omnichannel retail integration.

- Europe: Growth influenced by regulatory mandates (PSD2, GDPR); shift toward Open Banking and account-to-account mobile transfers; strong NFC penetration in metropolitan areas.

- Latin America (LATAM): Rapid growth driven by high smartphone penetration and significant unbanked population; increasing adoption of local fintech solutions and digital bank offerings.

- Middle East & Africa (MEA): High growth in mobile money (especially Sub-Saharan Africa); necessity-driven adoption; strategic government investments in digital infrastructure and payment rails.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Payment Technologies Market.- Visa Inc.

- Mastercard Incorporated

- PayPal Holdings, Inc.

- Apple Inc.

- Google LLC

- Samsung Electronics Co., Ltd.

- Ant Group Co., Ltd. (Alipay)

- Tencent Holdings Ltd. (WeChat Pay)

- Block, Inc. (Square)

- Fidelity National Information Services, Inc. (FIS)

- Stripe

- Adyen N.V.

- Global Payments Inc.

- ACI Worldwide, Inc.

- FSS Technologies

- Paytm

- Wirecard (assets acquired by various entities)

- Fiserv, Inc.

- ING Group

- JPMorgan Chase & Co.

Frequently Asked Questions

Analyze common user questions about the Mobile Payment Technologies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Mobile Payment Technologies Market?

The primary factor is the accelerating global penetration of smartphones combined with the robust expansion of e-commerce, which collectively mandates convenient, secure, and instantaneous transactional capabilities outside of traditional banking hours and physical locations. Additionally, the pandemic significantly accelerated consumer acceptance of contactless and digital payment methods globally.

How does tokenization technology enhance the security of mobile payments?

Tokenization is critical for mobile payment security because it replaces sensitive payment card information (Primary Account Number - PAN) with a unique digital identifier (token) during the transaction process. Since the token is useless outside the specific transaction or device, it prevents fraud even if the data is intercepted, making mobile wallet usage safer than physical card usage.

What are the key differences between NFC payments and QR code payments?

NFC (Near Field Communication) requires specific hardware (POS terminal and chip in the mobile device) for proximity-based, instantaneous transactions, offering high security. QR code payments are software-based, requiring only a smartphone camera and a screen, making them cheaper to deploy, highly scalable for small merchants, and dominant in markets with lower traditional infrastructure investment like Asia Pacific.

Which geographical region dominates the Mobile Payment Technologies Market in terms of transaction volume?

The Asia Pacific (APAC) region currently dominates the market in terms of transaction volume and user base. This dominance is overwhelmingly driven by the massive consumer adoption of proprietary mobile wallets and QR code systems in key markets, notably China (Alipay, WeChat Pay) and India (UPI-based platforms), fueled by government efforts toward digital economies.

What is the role of AI and Machine Learning in preventing mobile payment fraud?

AI and Machine Learning analyze vast amounts of behavioral and transactional data in real-time to detect anomalous patterns and flag potentially fraudulent activity before the transaction is completed. These systems create sophisticated user profiles, enabling them to identify novel and evolving fraud schemes more effectively than traditional rule-based security systems, thus offering a crucial layer of predictive defense.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager