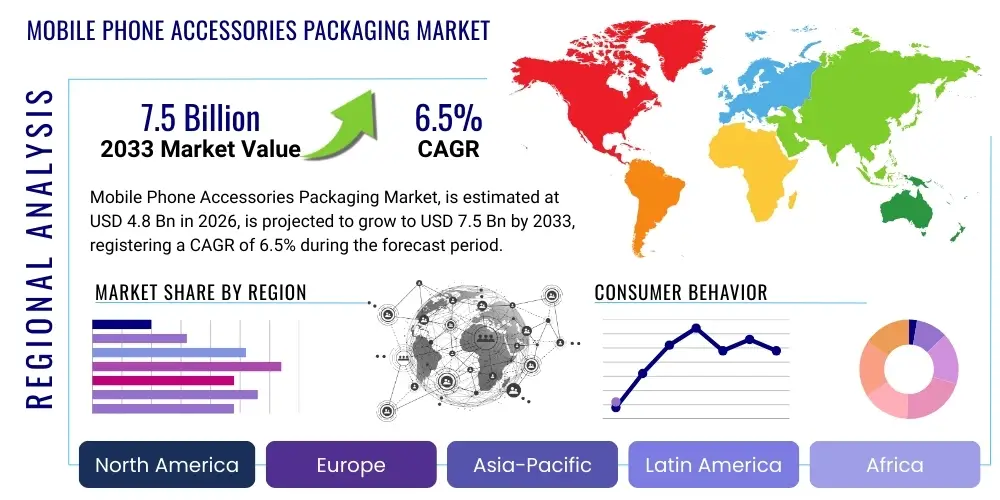

Mobile Phone Accessories Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436290 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Mobile Phone Accessories Packaging Market Size

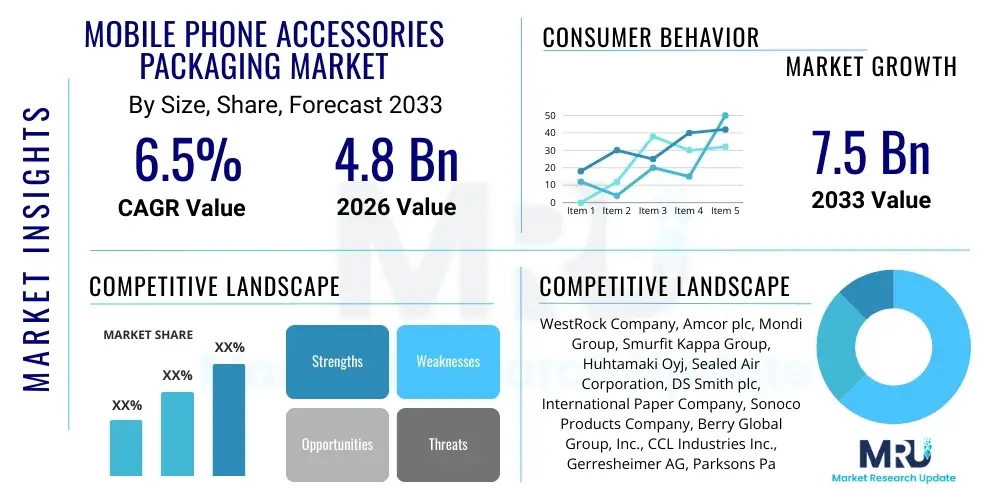

The Mobile Phone Accessories Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the relentless expansion of the global smartphone market, coupled with the rising consumer demand for premium, protective, and personalized accessories. As mobile devices become increasingly integral to daily life, the ancillary products like chargers, cases, and audio equipment necessitate specialized packaging that ensures product integrity, enhances brand perception, and adheres to stringent sustainability standards.

Mobile Phone Accessories Packaging Market introduction

The Mobile Phone Accessories Packaging Market encompasses the design, manufacturing, and distribution of specialized containers used for securing, presenting, and branding mobile phone complementary products, including but not limited to charging devices, protective cases, screen protectors, cables, power banks, and audio peripherals. The primary function of this packaging is multifaceted: protection during transit, attractive retail display, provision of necessary product information, and mitigation of theft and counterfeiting. Packaging solutions range from minimalist, eco-friendly paperboard boxes to high-security blister packs and sophisticated smart packaging featuring NFC tags for authenticity verification. The industry is rapidly transitioning towards sustainable material usage, responding directly to heightened consumer and regulatory pressure regarding environmental impact.

Major applications for mobile accessory packaging span across all segments of the mobile device lifecycle, from initial purchase protection to premium aftermarket retailing. The packaging must be highly adaptive, catering to diverse product dimensions and materials, such as robust clamshells for fragile screen protectors or compact boxes for charging adaptors. The benefits derived from effective packaging are crucial for brand equity; it serves as a silent salesperson in the retail environment, communicating quality, durability, and technological alignment. Furthermore, well-designed packaging reduces logistical costs by optimizing space and weight, thereby improving overall supply chain efficiency. Key driving factors include the rapid upgrade cycle of smartphones, the burgeoning market for wireless accessories (like TWS earbuds), and aggressive technological advancements in protective and aesthetically pleasing packaging materials.

The continuous innovation in mobile phone technology necessitates corresponding innovation in packaging. As accessories become smaller, smarter, and often more valuable (e.g., high-capacity power banks or premium wireless headphones), the requirement for secure, tamper-evident packaging increases significantly. Furthermore, the proliferation of e-commerce channels demands packaging that is optimized for mail-order fulfillment, focusing on lightweight design, durability against rough handling, and the inclusion of elements that enhance the unboxing experience. The interplay between aesthetic appeal, environmental responsibility, and logistic efficiency defines the competitive landscape of this specialized packaging sector, pushing manufacturers towards advanced material science and digital printing technologies.

Mobile Phone Accessories Packaging Market Executive Summary

The Mobile Phone Accessories Packaging Market is characterized by robust growth, primarily fueled by global digitalization trends and the saturation of smartphone usage across emerging and developed economies. Business trends highlight a pronounced shift towards Sustainable Packaging Solutions, including the adoption of recycled content, bioplastics, and fiber-based materials, driven by corporate social responsibility mandates and consumer preferences. Market players are heavily investing in anti-counterfeiting measures, integrating QR codes and holographic security features to protect intellectual property and brand integrity in highly fragmented distribution channels. The competitive environment is intensifying, leading to higher investments in automated packaging machinery to achieve cost efficiencies and faster time-to-market, particularly for rapidly evolving accessory lines.

Regionally, the Asia Pacific (APAC) region dominates the market, largely due to its status as the global hub for mobile device and accessory manufacturing, particularly in China, South Korea, and Vietnam. However, North America and Europe exhibit the highest adoption rates for premium and environmentally certified packaging, reflecting mature consumer markets willing to pay a premium for eco-friendly and high-quality presentation. Regional regulatory divergence regarding packaging waste disposal and material restrictions also significantly influences market strategies, requiring localized adaptation of packaging formats and compositions. Emerging markets in Latin America and MEA show accelerating growth, driven by increasing smartphone penetration rates and the formalization of retail distribution networks.

Segment trends reveal that the Product Type segment focusing on Protective Cases and Covers remains the largest consumer of packaging, requiring solutions that offer excellent visibility and robust protection. In terms of material, Paperboard and molded pulp are experiencing the fastest growth rate, displacing traditional plastics due to environmental mandates. Blister packs, while still prevalent for certain high-volume items due to cost-efficiency, are being increasingly replaced by sustainable retail boxes that offer a superior unboxing experience and better surface area for complex graphics and brand storytelling. The shift towards online distribution necessitates packaging optimized for shipping rather than purely retail shelf appeal, prioritizing dimensional stability and minimum material usage to reduce freight costs.

AI Impact Analysis on Mobile Phone Accessories Packaging Market

Common user questions regarding AI's impact on accessory packaging revolve around how automation can reduce labor costs, how predictive analytics influence inventory and material sourcing, and whether AI can personalize packaging design at scale. Users frequently inquire about the integration of AI-powered quality control systems to detect printing defects or structural flaws instantaneously. A core theme is the expectation that AI should streamline the entire packaging lifecycle, from demand forecasting for specific accessories in different regions to optimizing the structural design to minimize material usage while maintaining maximum protective capability, directly impacting sustainability goals and operational efficiency.

AI is beginning to revolutionize the market by optimizing packaging workflows and enhancing supply chain predictability. Through machine learning algorithms, manufacturers can analyze vast datasets concerning accessory sales, seasonal trends, and regional purchasing behaviors to accurately forecast demand for specific accessory types (e.g., fast chargers vs. wireless charging pads). This proactive forecasting minimizes overproduction of packaging materials, reducing waste and associated inventory costs. Furthermore, generative AI tools are assisting designers in rapidly prototyping sustainable packaging structures that meet rigorous protection criteria while adhering to dimensional constraints for efficient shipping, thus accelerating the product development cycle significantly.

The integration of AI also plays a pivotal role in the manufacturing and quality assurance phases. AI-powered vision systems are deployed on production lines to inspect thousands of packaging units per hour, detecting subtle imperfections in print quality, structural alignment, and sealing integrity far more reliably than human inspection. This enhancement in quality control ensures brand consistency and reduces product damage during transit, which is particularly critical for high-value accessories. In the realm of customer experience, AI-driven analytics help tailor packaging experiences, potentially allowing for customized inserts or localized language messaging on standardized global packaging formats, improving perceived value and brand loyalty.

- AI-driven Demand Forecasting: Enhances accuracy in predicting accessory packaging needs, minimizing material waste and inventory holding costs.

- Generative Design Optimization: Utilizes algorithms to create structurally sound, lightweight, and sustainable packaging geometries.

- Automated Quality Control: Deploys machine vision systems for precise, high-speed inspection of packaging defects and printing accuracy.

- Supply Chain Efficiency: Optimizes palletization and logistics planning based on real-time data, reducing shipping damage and costs.

- Personalized Packaging Experience: Facilitates micro-segmentation for regional or demographic-specific packaging messaging and inserts.

DRO & Impact Forces Of Mobile Phone Accessories Packaging Market

The Mobile Phone Accessories Packaging Market is heavily influenced by a dynamic interplay of factors. Key drivers include the exponential increase in smartphone penetration globally and the necessity for protective and high-quality packaging to reflect the premium nature of modern accessories, such as TWS devices and high-speed charging solutions. Simultaneously, the global mandate towards sustainability acts as both a driving force—pushing innovation in eco-friendly materials—and a restraint, as the cost of sustainable substitutes (like biodegradable polymers or recycled fiber) often exceeds traditional plastic options, impacting profitability margins. Opportunities lie significantly in developing smart packaging solutions that offer anti-theft and anti-counterfeiting protection, catering directly to brand security concerns in emerging markets. These factors collectively exert significant impact forces on material selection, manufacturing processes, and final retail presentation across all accessory categories.

Major restraints faced by the market include the volatility of raw material prices, particularly petrochemical derivatives used in plastic-based packaging, and increasingly stringent global regulations regarding single-use plastics and packaging waste. These regulations force costly retooling and reformulations, especially in markets like the European Union. Furthermore, the rapid obsolescence cycle inherent to mobile technology creates challenges in inventory management for packaging materials; accessory designs frequently change, rendering existing packaging stocks redundant. The market also faces substantial pressure from consumers and retailers demanding "minimum packaging," which complicates the task of ensuring adequate product protection and brand visibility simultaneously.

Opportunities for market growth are abundant within niche segments. The rise of refurbished mobile devices and accessories requires specialized, high-security packaging for certified pre-owned products. Moreover, advancements in Active and Intelligent Packaging, incorporating features like temperature indicators for battery safety or NFC chips for user engagement, represent high-value growth areas. Strategic focus on lightweighting and modular design allows packaging suppliers to offer versatile solutions that cater to multiple accessory types while reducing material consumption, directly appealing to cost-conscious brands seeking environmentally responsible options. Successfully navigating the high compliance costs associated with sustainability mandates while leveraging technological innovation will determine long-term success in this competitive arena.

Segmentation Analysis

The Mobile Phone Accessories Packaging Market is segmented based on Material Type, Product Type, Packaging Type, and Distribution Channel. This segmentation allows for granular analysis of demand patterns, material preferences, and regional consumption behavior. The material segmentation is critical, reflecting the industry's transition from petrochemical-based plastics towards more environmentally benign alternatives like paperboard and molded pulp. The Product Type segmentation highlights the packaging requirements unique to different accessory categories, recognizing that a complex earbud kit requires different protection and presentation compared to a simple charging cable.

The segmentation by Packaging Type distinguishes between shelf-friendly retail boxes and high-visibility blister or clamshell packs, with significant observable migration from plastic thermoforms to fiber-based designs. Lastly, the Distribution Channel segmentation, spanning online retail and offline brick-and-mortar stores, dictates key packaging attributes; e-commerce channels prioritize lightweight, durable, and minimal packaging for efficient shipping, whereas physical retail focuses on robust anti-theft features and eye-catching aesthetics. Understanding these segments is paramount for manufacturers to tailor their production capabilities and material sourcing to meet diverse global market needs effectively.

- Material Type:

- Paperboard/Fiberboard (Corrugated, Boxboard, Molded Pulp)

- Plastics (PET, PVC, PP, HDPE)

- Bio-plastics and Sustainable Alternatives

- Others (Metal, Glass)

- Product Type:

- Cases and Covers Packaging

- Chargers and Adapters Packaging

- Cables and Connectors Packaging

- Power Banks Packaging

- Screen Protectors Packaging

- Audio Accessories (Earphones, Headphones) Packaging

- Other Accessories (Gimbals, Stylus) Packaging

- Packaging Type:

- Retail Boxes (Folding Cartons, Set-up Boxes)

- Blister Packs and Clamshells

- Pouches and Bags

- Inserts and Sleeves

- Distribution Channel:

- Online Retail (E-commerce)

- Offline Retail (Supermarkets, Specialty Stores, Electronic Stores)

Value Chain Analysis For Mobile Phone Accessories Packaging Market

The value chain for mobile phone accessories packaging begins with upstream activities focused on raw material procurement, which includes sourcing specialized paper pulp, recyclable polymers (PET, PP), and printing chemicals. Key participants at this stage are forestry companies, chemical processors, and recycled material suppliers. Efficiency and sustainability commitments at the upstream level significantly influence the final cost and environmental profile of the packaging product. Maintaining a secure and consistent supply of high-grade recycled materials is becoming increasingly critical, requiring close collaboration and traceability among suppliers.

The midstream phase involves the core manufacturing processes: printing, cutting, forming (for plastics or molded pulp), and assembly. Packaging converters and specialized printing firms utilize sophisticated equipment for high-resolution graphics, variable data printing for security features, and automated assembly lines to produce complex structures like folding cartons or multi-component blister packs. Operational excellence and technological investment in rapid prototyping and high-speed production lines are vital here to meet the fast turnover demands of the mobile accessories industry. Quality control, particularly for color consistency and structural integrity, is a paramount concern during this stage.

The downstream sector focuses on distribution and integration. Packaging is supplied either directly to major Original Equipment Manufacturers (OEMs) of mobile phones and their accessory divisions (direct distribution) or through specialized packaging distributors who serve smaller accessory brands (indirect distribution). The final stage involves the packaging of the actual mobile accessories by the brand owners and their contract manufacturers, followed by distribution through various channels—B2B, e-commerce fulfillment centers, or traditional retail logistics networks. The rise of e-commerce has heavily optimized the downstream flow, demanding packaging that minimizes shipping dimensions and weight while maximizing protection, often leading to the bypassing of traditional retail display requirements.

Mobile Phone Accessories Packaging Market Potential Customers

Potential customers for mobile phone accessories packaging are diverse but primarily concentrated within the technology manufacturing ecosystem. The largest segment comprises Tier 1 Mobile Phone Original Equipment Manufacturers (OEMs) such as Apple, Samsung, Xiaomi, and Huawei. These major players require vast volumes of standardized, high-quality, and highly branded packaging for their own accessory lines (e.g., chargers, official cases, earbuds). Their demand often dictates global trends in sustainability and security features, as they require packaging solutions that uphold their premium brand image and meet strict global environmental compliance standards, often influencing the entire supply chain.

The second major group consists of Aftermarket Accessory Brands, including specialized manufacturers of protective cases (e.g., OtterBox, Spigen), audio equipment (e.g., Sony, JBL), and charging technology (e.g., Anker, Belkin). These companies often prioritize innovative and visually appealing packaging that distinguishes their product on crowded retail shelves. Their procurement focuses heavily on speed-to-market and flexible order quantities, favoring packaging suppliers capable of rapid graphic changes and diverse structural formats. This segment drives innovation in unique materials and unboxing experiences designed to elevate consumer perception against white-label competition.

A growing customer segment includes Telecom Carriers and Retail Chains that often offer their own private-label accessory lines. These entities require cost-effective packaging that maintains acceptable quality standards while minimizing logistical footprints. Furthermore, the burgeoning market of Certified Pre-Owned (CPO) device and accessory resellers also represents a significant, though niche, customer base demanding secure, tamper-evident, and clearly identifiable secondary packaging. Meeting the diverse functional and aesthetic demands of these varied buyer groups requires packaging providers to offer scalable, customizable, and globally compliant solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WestRock Company, Amcor plc, Mondi Group, Smurfit Kappa Group, Huhtamaki Oyj, Sealed Air Corporation, DS Smith plc, International Paper Company, Sonoco Products Company, Berry Global Group, Inc., CCL Industries Inc., Gerresheimer AG, Parksons Packaging Ltd., Hip Lik Packaging, Shenzhen Yuto Packaging Technology Co., Ltd., Greatview Aseptic Packaging Company, Hangzhou Xinren Packing Co., Ltd., Rengo Co., Ltd., Coveris Holdings S.A., Graphic Packaging Holding Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Phone Accessories Packaging Market Key Technology Landscape

The technological evolution in mobile phone accessories packaging centers on achieving sustainability, enhanced security, and superior visual appeal efficiently. A primary technological focus is on High-Definition Digital Printing, which allows for smaller production runs, rapid design changes, and personalized graphic elements, crucial for addressing the fast-moving consumer electronics market. Digital printing minimizes plate setup costs and significantly reduces waste compared to traditional lithography or flexography, enabling brands to maintain a fresh aesthetic and adapt quickly to market feedback without large inventory commitments. Furthermore, advancements in specialized coatings and varnishes, including those providing soft-touch finishes or enhanced UV protection, are used to elevate the perceived quality of fiber-based packaging.

Another critical area of technological advancement is the development and adoption of Sustainable Material Processing Technologies. This includes advanced pulping and molding techniques for creating high-strength, dimensionally stable molded pulp inserts that replace plastic thermoforms, offering equivalent shock absorption capabilities. Innovations in bio-based and compostable polymer films are also enabling the replacement of traditional plastic windows or protective seals. These processes require specialized machinery capable of handling biodegradable materials which often have different thermal and tensile properties than conventional plastics, driving investment in advanced extrusion and forming equipment to maintain high production speeds and structural consistency.

Security and interactivity are defined by the integration of Smart Packaging Technologies. This involves embedding or integrating tamper-evident features, micro-text printing, holographic security seals, and increasingly, near-field communication (NFC) or radio-frequency identification (RFID) tags directly into the packaging structure. These technologies serve dual purposes: preventing counterfeiting and facilitating direct consumer engagement via smartphones (e.g., accessing product manuals, registering warranties, or verifying authenticity). The technological infrastructure required includes high-precision insertion mechanisms on packaging lines and specialized software platforms for tag management and data analytics, ensuring that the packaging itself becomes a key security and marketing tool within the digital ecosystem.

Regional Highlights

The market dynamics of mobile phone accessories packaging show significant regional variation, influenced by manufacturing concentration, consumer wealth, regulatory frameworks, and sustainability priorities. Asia Pacific (APAC) holds the largest market share, predominantly driven by the concentration of global electronic contract manufacturers and original equipment manufacturers (OEMs) in countries such as China, Taiwan, South Korea, and Vietnam. The sheer volume of accessory production, coupled with expanding domestic markets for mobile devices, generates massive demand for packaging materials. While cost-efficiency remains a primary concern in APAC manufacturing, there is an accelerating trend, led by major international brands operating in the region, towards adopting sustainable and premium packaging to meet export market requirements and elevate domestic brand positioning.

North America and Europe are characterized by their maturity and strong regulatory environments, making them the leading regions for the adoption of premium, eco-friendly, and intelligent packaging solutions. In these regions, consumer sentiment heavily favors sustainable choices, often leading to market mandates for fiber-based or certified compostable materials, particularly displacing PVC and conventional blister packs. European regulations, such as those related to Extended Producer Responsibility (EPR) and forthcoming circular economy policies, impose significant costs and requirements on packaging materials, forcing brands to invest heavily in lightweighting, recycling-friendly designs, and clear labeling. North America, driven by major e-commerce platforms, emphasizes highly durable, frustration-free packaging optimized for direct-to-consumer shipping, prioritizing protection over traditional retail aesthetics.

Latin America (LATAM) and the Middle East & Africa (MEA) represent fast-growing markets, albeit with differing market drivers. LATAM's growth is spurred by rapid smartphone adoption and the increasing formalization of retail, demanding more sophisticated and secure packaging to combat prevalent counterfeiting issues. The MEA region, particularly the GCC countries, shows high consumption of premium accessories, necessitating luxury packaging solutions that reflect the high-end nature of the product. However, both regions face challenges related to recycling infrastructure, often slowing the widespread adoption of advanced sustainable packaging compared to developed markets. Growth in these regions is largely contingent on improving logistical infrastructure and brand security measures.

- Asia Pacific (APAC): Dominant region due to large-scale manufacturing and high volume production of mobile accessories; focused on cost-efficiency alongside increasing requirements for sustainable export packaging.

- North America: High demand for protective, aesthetically pleasing, and e-commerce optimized (lightweight and durable) packaging; strong emphasis on sustainable and frustration-free designs.

- Europe: Leader in adopting fiber-based and bio-plastic solutions, driven by strict environmental regulations (EPR) and high consumer willingness to pay for eco-certified products.

- Latin America (LATAM): Characterized by accelerated growth in smartphone adoption; high demand for anti-counterfeiting and tamper-evident packaging to secure supply chains.

- Middle East and Africa (MEA): Rapidly developing consumer market with growing demand for premium, luxury packaging that matches high-end accessory purchases, particularly in GCC nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Phone Accessories Packaging Market.- WestRock Company

- Amcor plc

- Mondi Group

- Smurfit Kappa Group

- Huhtamaki Oyj

- Sealed Air Corporation

- DS Smith plc

- International Paper Company

- Sonoco Products Company

- Berry Global Group, Inc.

- CCL Industries Inc.

- Gerresheimer AG

- Parksons Packaging Ltd.

- Hip Lik Packaging

- Shenzhen Yuto Packaging Technology Co., Ltd.

- Graphic Packaging Holding Company

- Rengo Co., Ltd.

- Coveris Holdings S.A.

- Tekni-Plex, Inc.

- Evergreen Packaging Inc.

Frequently Asked Questions

Analyze common user questions about the Mobile Phone Accessories Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of sustainable packaging in the mobile accessory market?

The primary driver for sustainable packaging adoption is the confluence of stringent governmental regulations, particularly in Europe and North America, targeting single-use plastics, and overwhelming consumer preference for environmentally responsible brands. This market pressure necessitates a rapid transition to materials like recycled paperboard, molded pulp, and certified compostable bioplastics, directly impacting material procurement and design innovation across the value chain, ensuring that brands maintain their corporate social responsibility profile.

How is e-commerce changing the design requirements for mobile accessories packaging?

E-commerce fundamentally shifts packaging focus from retail shelf appeal to logistical efficiency and product protection during shipping. Requirements prioritize lightweight materials to minimize freight costs, robust structural integrity to withstand multiple handling points, and minimal, frustration-free designs that reduce material waste and simplify the unboxing process for the end consumer, often reducing the need for traditional high-visibility blister or clamshell packaging designs prevalent in physical retail.

What role does anti-counterfeiting technology play in accessory packaging?

Anti-counterfeiting technology is essential for protecting brand equity and ensuring consumer safety, particularly for high-value accessories like premium headphones or fast chargers. Packaging is increasingly integrated with security features such as unique serialization (QR codes or barcodes), holographic labels, tamper-evident seals, and embedded NFC/RFID tags. These technologies allow brands and consumers to verify product authenticity, mitigating revenue losses from unauthorized imitations prevalent in global distribution networks.

Which material segment is experiencing the fastest growth and why?

The Paperboard and Molded Pulp segment is experiencing the fastest growth rate, primarily driven by the global imperative to reduce plastic waste and enhance recyclability. Paper-based solutions offer excellent customization capabilities, superior surface area for branding, and high consumer acceptance regarding end-of-life disposal. Continuous technological improvements are enhancing the moisture resistance and structural strength of fiber packaging, allowing it to effectively replace plastic trays and inserts in many accessory applications.

What are the challenges associated with implementing smart packaging solutions?

The implementation of smart packaging (e.g., NFC, RFID integration) faces challenges primarily related to cost and complexity. Integrating electronic components increases the unit price of the packaging, which can be prohibitive for high-volume, low-margin accessories. Furthermore, challenges exist in ensuring seamless integration of these technologies into high-speed packaging lines, managing the associated data and security protocols, and ensuring global standardization and compliance for the embedded electronic elements, demanding significant capital investment in automation and IT infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager