Mobile scissor lift table Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434360 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Mobile scissor lift table Market Size

The Mobile scissor lift table Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.98 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by increasing emphasis on industrial safety regulations across developed and emerging economies, coupled with substantial investments in warehousing automation and urban infrastructure development. The versatility and inherent stability of mobile scissor lifts, which allow workers to safely reach elevated heights and positions for maintenance, construction, and inventory management, are central to this steady valuation increase over the forecast timeframe. Furthermore, the rising demand from the rental sector, driven by construction companies preferring leasing over outright purchase to manage capital expenditure, significantly contributes to the overall market acceleration.

Mobile scissor lift table Market introduction

The Mobile scissor lift table market encompasses equipment designed for elevating personnel and materials vertically, utilizing a cross-bracing mechanical linkage system that extends vertically when force is applied, offering unparalleled stability and a high load capacity compared to other aerial work platforms (AWPs). These lifts are typically mounted on wheeled chassis, providing flexibility for movement across diverse industrial and construction sites. The primary functions include positioning workers for building maintenance, conducting installations at height, supporting material handling operations in warehouses, and facilitating tasks within manufacturing assembly lines where ergonomic height adjustments are essential. Major applications span construction, infrastructure development, aerospace maintenance, logistics, and facility management. Key benefits include superior stability, large platform workspace, ease of maneuverability in confined spaces, and enhanced worker safety due compliance with strict regulatory standards like OSHA and ANSI. Driving factors for market expansion include rapid urbanization leading to increased high-rise construction, stringent global safety mandates requiring certified lifting equipment, and continuous technological advancements focused on battery efficiency and integrated telematics for fleet management and predictive maintenance.

Mobile scissor lift tables are distinguished by their compact footprint when retracted and their ability to provide stable vertical elevation. Product descriptions vary widely based on power source—ranging from manual hydraulic units used in light manufacturing to robust, battery-electric models dominating industrial and construction applications. Modern scissor lifts prioritize sustainability, with a marked shift towards electric and hybrid powertrains that reduce operational noise and emissions, making them ideal for indoor use or environmentally sensitive construction zones. The versatility of these machines allows them to be utilized both indoors on smooth floors and outdoors on semi-rough terrain, depending on the chassis and tire specifications. The fundamental market dynamic revolves around safety and efficiency; as labor costs increase and regulatory penalties for workplace accidents become more severe, companies are compelled to invest in certified and reliable mobile lifting solutions.

The market landscape is intensely competitive, characterized by innovation aimed at improving reach capabilities, reducing charging times, and implementing sophisticated safety features such as load sensing, tilt alarms, and advanced control interfaces. The adoption rate is particularly high in markets undergoing significant infrastructure upgrades, such as specialized tunneling projects, bridge construction, and large-scale manufacturing plant expansions. Furthermore, the burgeoning e-commerce sector has spurred monumental growth in warehousing and logistics facilities, where mobile scissor lifts are indispensable for accessing high shelving, maintenance of automated conveyor systems, and order picking, ensuring efficient throughput and operational continuity. The continuous evolution of material science also plays a role, enabling manufacturers to build lighter frames without compromising structural integrity or lifting capacity, thereby improving transportability and energy efficiency.

Mobile scissor lift table Market Executive Summary

The Mobile scissor lift table market is poised for robust growth, driven by key business trends including the rapid transition toward electrification and the increased adoption of rental fleet models by end-users. Manufacturers are concentrating research and development efforts on enhancing lithium-ion battery technology to extend operational cycles and minimize environmental impact, satisfying both sustainability goals and operational efficiency demands. Geographically, North America and Europe remain mature markets, focusing on replacement cycles and compliance with evolving high-safety standards, while the Asia Pacific region emerges as the primary growth engine due to unprecedented industrialization and massive government investment in infrastructure projects, particularly in countries like China and India. Segment-wise, the electric/battery-powered segment is gaining significant market share over traditional hydraulic variants due to regulatory push for reduced emissions and improved suitability for indoor factory environments. Furthermore, the construction and rental application segments are dominating, reflecting the cyclical nature of infrastructure development and the increasing financial preference for OpEx (Operating Expenditure) over CapEx (Capital Expenditure) among smaller and medium-sized construction enterprises globally.

AI Impact Analysis on Mobile scissor lift table Market

User queries regarding AI integration in the mobile scissor lift table domain frequently center on three critical themes: predictive maintenance effectiveness, enhancement of operator safety through automation, and optimization of fleet management logistics. Users are keen to understand how AI algorithms can analyze operational data (telematics data on usage intensity, component temperature, battery status) to predict component failures before they occur, thus drastically reducing unexpected downtime and maximizing machine utilization rates. Furthermore, common concerns involve the development of semi-autonomous operation, particularly for repetitive tasks in controlled environments like large warehouses, and how AI-powered visual recognition systems can monitor the work envelope in real-time to prevent collisions or hazardous operational maneuvers, thereby improving overall job site safety compliance and performance metrics. Expectations are high for AI to transform capital equipment from simple tools into smart, self-diagnosing assets that minimize total cost of ownership (TCO).

The initial impact of Artificial Intelligence and Machine Learning (ML) within the mobile scissor lift table market is primarily concentrated in the backend operations—specifically, leveraging data collected via onboard telematics systems. AI algorithms are now sophisticated enough to process complex sensor data from hydraulic systems, motors, and stabilizing components to establish baseline "normal" operational profiles. Any significant deviation from these profiles, such as unusual vibration patterns or unexpected temperature spikes, triggers an immediate alert. This predictive capability is revolutionizing maintenance scheduling, moving it from calendar-based or reactive methods to a dynamic, condition-based approach, which is vital for rental companies managing large, geographically dispersed fleets where uptime is directly proportional to profitability. This proactive approach significantly extends the lifespan of critical components and ensures consistent compliance with safety checks.

Beyond maintenance, AI is beginning to influence operational safety and efficiency on the worksite itself. Advanced computer vision systems, often integrated with the lift’s control unit, utilize ML models trained on thousands of hours of operational footage to detect hazards such as approaching obstacles, uneven terrain that could lead to tilting, or unauthorized personnel entering the operational zone. These systems provide real-time feedback or, in critical situations, intervene by gently limiting lift movement or sounding alarms. For fleet managers, AI optimizes deployment logistics by analyzing job site requirements, machine location, and operational history to assign the most suitable and nearest machine, minimizing travel time and fuel consumption. This smart resource allocation not only enhances efficiency but also contributes to better overall utilization rates across the entire asset portfolio.

- AI-driven Predictive Maintenance: Minimizing unplanned downtime by analyzing sensor data to forecast component failure (e.g., hydraulics or battery degradation).

- Fleet Optimization and Routing: Using ML algorithms to efficiently manage large rental fleets, optimizing deployment, delivery, and retrieval schedules.

- Enhanced Safety Diagnostics: Integration of computer vision and AI for real-time monitoring of work envelope, hazard detection, and automated stability adjustments.

- Operational Efficiency Modeling: Analyzing operator behavior and usage patterns to suggest ergonomic improvements and training protocols.

- Self-Diagnosis Capabilities: Enabling machines to communicate specific fault codes and required repairs autonomously, accelerating service turnaround times.

DRO & Impact Forces Of Mobile scissor lift table Market

The Mobile scissor lift table market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate growth trajectory and competitive intensity. A primary driver is the global increase in construction activities, especially high-rise and complex infrastructure projects, necessitating safe, reliable vertical access equipment. Simultaneously, strict governmental regulations concerning workplace safety, particularly in North America and Europe, mandate the use of certified AWPs, thereby forcing older, less-safe equipment out of the market and promoting new purchases. However, the market faces significant restraints, chiefly the high initial capital investment required for purchasing modern, technologically advanced units, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the substantial operational weight and size of some heavy-duty models present logistical challenges for transport and use in space-constrained urban environments. Opportunities for market expansion reside in the swift adoption of lithium-ion battery technology, offering extended runtime and reduced environmental impact, and the explosive growth of the equipment rental market, which provides flexible access to modern fleets without requiring heavy capital outlay. The core impact force remains the equilibrium between regulatory compliance costs and the long-term gains in operational safety and efficiency provided by advanced lifts.

Drivers are strongly influenced by macro-economic factors. The increasing trend towards automation in large-scale warehouses and logistics centers requires mobile lifts for the installation and ongoing maintenance of automated storage and retrieval systems (AS/RS), pushing demand in the industrial segment. Moreover, the focus on sustainable construction practices has accelerated the demand for quiet, zero-emission electric models, making them the preferred choice for indoor or sensitive urban construction sites where noise pollution is regulated. The continuous refinement of telematics and IoT integration also acts as a driver, providing fleet managers with critical operational data needed for asset management, security, and utilization monitoring, thereby improving the economic viability of lift ownership or rental. This digital transformation reinforces the value proposition of modern mobile scissor lifts over conventional access methods like scaffolding.

Restraints are often linked to technological complexity and market saturation in highly developed economies. While technological improvements are drivers, the specialized training required for advanced lift operation and maintenance can be a restraint, particularly in regions facing skilled labor shortages. The lifecycle management of large lithium-ion batteries also introduces complexities regarding replacement costs and safe disposal protocols. Despite these challenges, the market is continually seeking growth through exploiting opportunities such as customizing lifts for niche applications—like specialized, corrosion-resistant models for shipbuilding or ultra-narrow chassis for indoor facility maintenance. Emerging markets, with their relatively nascent safety standards and booming construction sectors, offer substantial untapped potential, provided manufacturers can overcome barriers related to localized production and robust after-sales service networks.

Segmentation Analysis

The Mobile scissor lift table market segmentation is crucial for understanding diverse end-user needs and optimizing product development strategies. The market is primarily categorized based on factors such as Type (determining mechanical complexity and reach), Lifting Height (defining application suitability), Power Source (influencing environmental impact and operational environment), and Application (identifying major end-user sectors). The Type segment differentiates between basic single-scissor mechanisms, dual-scissor setups offering increased height, and multi-stage lifts designed for extreme vertical reach while maintaining platform stability. Analyzing the market through these segments reveals a decisive trend: the high-reach, multi-stage lifts are becoming indispensable for specialized construction, while the electric power source segment is rapidly growing across all application types, signifying a definitive shift away from diesel-dependent operations due to environmental pressures and improved battery performance. This granular analysis informs strategic investment, directing resources toward the development of lightweight, high-capacity electric units tailored for urban infrastructure projects and advanced warehousing operations.

- By Type

- Single Scissor Lift Tables

- Double Scissor Lift Tables

- Multi-Stage Scissor Lift Tables (Tandem/Triple)

- By Lifting Height

- Low Lift (Below 5 meters)

- Medium Lift (5 meters to 10 meters)

- High Lift (Above 10 meters)

- By Power Source

- Electric/Battery Powered (Standard and Lithium-ion)

- Hydraulic/Manual

- Diesel/Internal Combustion Engine (ICE)

- Hybrid

- By Application

- Construction & Infrastructure

- Manufacturing & Industrial Maintenance (Automotive, Aerospace)

- Warehousing & Logistics

- Retail & Commercial Use

- Utilities and Telecom Maintenance

- By End-User

- Rental Fleet Owners

- Direct End-Users (Contractors, Factories)

Value Chain Analysis For Mobile scissor lift table Market

The value chain for the Mobile scissor lift table market begins with upstream activities focused on raw material sourcing and the manufacturing of specialized components. Key upstream elements include the procurement of high-grade structural steel and aluminum alloys necessary for frame construction, specialized hydraulic components (cylinders, pumps, valves), and advanced electronic controls, including sensors and telematics hardware. Suppliers of high-density lithium-ion batteries have gained significant leverage in the electric lift segment. Manufacturing then transforms these inputs into the final, certified lift tables, adhering to rigorous international safety standards (e.g., ANSI/ASME, CE). Downstream activities primarily involve distribution, sales, and comprehensive after-sales support. The distribution channel is heavily bifurcated between direct sales, typically reserved for very large industrial clients or government contracts, and indirect channels dominated by a robust global network of independent dealers and, most critically, major equipment rental companies. Rental fleets act as crucial intermediaries, purchasing equipment in bulk and then leasing it to end-users on flexible terms, significantly broadening market access and reducing customer capital risk. After-sales service, including maintenance contracts, spare parts supply, and technical training, is critical for maintaining market reputation and capturing repeat business.

Upstream efficiency directly impacts the competitiveness of the final product. Volatility in global steel prices, coupled with increasing demand for sophisticated electronic components for telematics integration, presents persistent challenges to cost management. Manufacturers are increasingly vertically integrating or forming strategic partnerships with specialized component suppliers, particularly in the hydraulic and battery domains, to secure quality and streamline the supply process. The shift toward electric models has introduced new upstream dependencies, making relationships with major battery manufacturers critical for securing reliable, high-performance power sources. Furthermore, the complexity of modern lifts necessitates rigorous quality control and certification processes at the manufacturing stage to ensure compliance with the myriad of global safety protocols, adding value through guaranteed reliability.

In the downstream segment, rental companies are the decisive factor in market penetration, especially in the construction sector. These firms prefer lifts that offer maximum uptime, require minimal maintenance, and possess integrated diagnostics systems, favoring brands that provide comprehensive dealer support. The direct channel focuses on specialized markets, such as aerospace maintenance or large-scale automotive manufacturing facilities, where highly customized lifts are often required. The maintenance and repair ecosystem represent a significant portion of the total value captured downstream. OEMs invest heavily in digitalization to enhance field service efficiency, using AR/VR tools for remote diagnostics and ensuring that their authorized dealer networks are well-stocked with spare parts and possess certified technical expertise, solidifying customer loyalty and maximizing the operational lifespan of the equipment.

Mobile scissor lift table Market Potential Customers

Potential customers for mobile scissor lift tables are broadly categorized based on their usage frequency, asset ownership strategy (buy or rent), and the specific industry requirements for vertical access. The largest and most influential customer segment is the equipment rental industry, comprising major global firms and regional specialists who purchase lifts in high volumes to maintain diverse, modern fleets for lease to smaller contractors and project-based users. These rental companies prioritize reliability, standardization across models, high utilization rates, and robust telemetry capabilities to manage their assets effectively. The second primary segment consists of direct end-users, encompassing large construction companies, infrastructure developers, and specialized maintenance departments in sectors like aerospace and energy (oil & gas, utilities). These customers often require customized, heavy-duty, or specialty lifts for long-term projects or permanent facility integration, valuing durability, specialized safety features, and manufacturer customization over flexibility.

Industrial applications represent another significant customer base. Within the manufacturing sector, particularly automotive assembly, heavy machinery fabrication, and electronics production, mobile scissor lifts are essential for ergonomic height positioning during assembly, as well as for the installation and maintenance of overhead systems (lighting, HVAC, conveyors). Warehousing and logistics facilities, driven by e-commerce expansion, use lifts for high-bay access, inventory management, and maintaining automated retrieval systems. These industrial clients prioritize electric, zero-emission models that meet stringent indoor air quality standards and offer precise controls for intricate work tasks. Procurement decisions in these sectors are heavily influenced by Total Cost of Ownership (TCO) assessments, factoring in energy consumption, maintenance predictability, and operational safety compliance.

Furthermore, governmental bodies and public works departments are essential customers, utilizing mobile scissor lifts for maintenance of municipal infrastructure, including street lighting, traffic signals, bridges, and public facility repairs. This segment is increasingly focused on acquiring locally sourced or domestically manufactured equipment that adheres to specific public procurement mandates and increasingly mandates the adoption of low-emission or electric vehicles to align with regional environmental sustainability goals. Other niche buyers include specialized contractors focused on exterior building envelope maintenance (e.g., window cleaning, façade repair) and landscaping professionals requiring safe access for high-level tree maintenance or park facility upkeep, all demanding versatile, easy-to-transport equipment that can navigate varying terrains effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JLG Industries, Genie (Terex), Skyjack (Linamar), Haulotte Group, Snorkel, Aichi Corporation, Dingli, LGMG, Manitou Group, Noblelift, Zhejiang Dingli Machinery Co. Ltd., Sinoboom, Almacrawler, Custom Equipment LLC, Platform Basket, Runshare, MEC Aerial Work Platforms, XCMG, Palfinger, Liebherr |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile scissor lift table Market Key Technology Landscape

The Mobile scissor lift table market is witnessing profound technological transformation focused on safety, efficiency, and data integration. The cornerstone of the current technology landscape is the widespread adoption of advanced electric propulsion systems, largely centered on high-capacity lithium-ion batteries. These batteries offer superior energy density, extended operational cycles, and significantly reduced charge times compared to traditional lead-acid alternatives, making electric lifts highly competitive even in demanding outdoor applications. This power shift is complemented by sophisticated AC drive systems and regenerative braking capabilities, optimizing energy usage and reducing mechanical wear. Furthermore, robust stabilization technology is paramount; modern lifts incorporate complex tilt sensors and integrated control logic that automatically restrict motion or limit outreach when stability thresholds are breached, ensuring maximum operator safety even on slightly uneven surfaces. The material science advancements, particularly the use of lighter but high-tensile steel and aluminum alloys, are critical for increasing reach capabilities without proportionally increasing the overall weight of the machine, thereby enhancing transportability and ground pressure performance.

Another major technological development involves the comprehensive integration of Internet of Things (IoT) and telematics solutions. Almost all new medium and high-specification mobile scissor lifts are equipped with onboard units that collect operational data—including location (GPS), engine hours, usage patterns, battery state of charge, and diagnostics information. This data is transmitted in real-time to fleet management software, enabling sophisticated utilization tracking, geo-fencing for security, and proactive maintenance scheduling, often powered by AI algorithms for predictive maintenance. This data-driven approach allows rental companies and large end-users to maximize asset utilization, manage security risks (theft prevention), and drastically reduce operational costs associated with unexpected breakdowns. These telematics systems are becoming increasingly crucial as regulatory bodies begin to mandate standardized data reporting for safety and operational verification purposes.

Ergonomics and operator interface also form a crucial part of the technological landscape. Modern control panels feature intuitive, joystick-based controls, often with integrated displays providing real-time feedback on load limits, platform height, and stability indicators. Furthermore, advanced safety systems include enhanced pothole protection, which automatically deploys stabilizing bars when the chassis approaches maximum height, and advanced load-sensing systems that alert the operator if the platform load exceeds safety limits or is unevenly distributed. The continuous push toward semi-automation in highly structured environments, such as pre-programmed vertical movements in automated warehouses, is utilizing sensor fusion technology (Lidar, Radar, Cameras) to ensure precise positioning and obstacle avoidance, promising higher throughput and reduced human error in routine tasks.

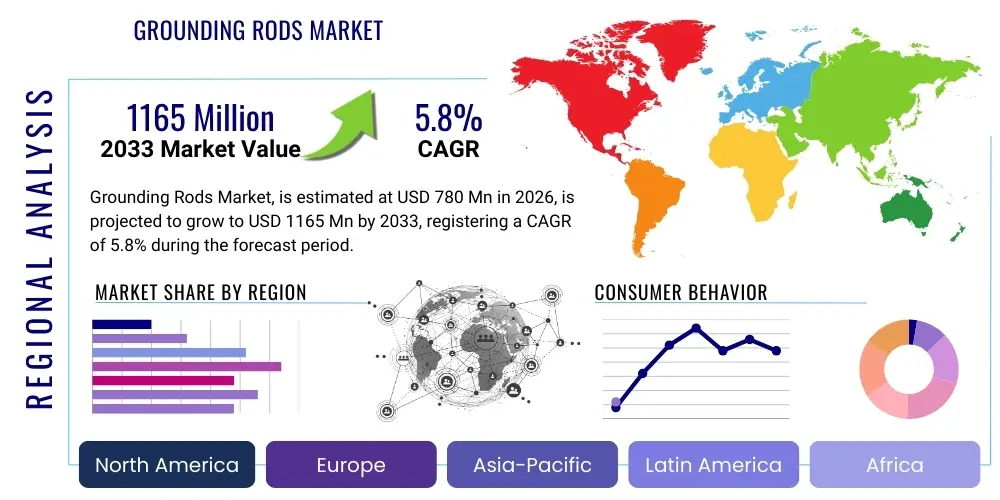

Regional Highlights

- North America: This region, comprising the United States and Canada, represents a mature market characterized by stringent safety regulations, high labor costs, and a strong preference for large-scale rental fleets. Demand is driven primarily by replacement cycles, ongoing residential and commercial construction booms, and significant investment in transportation infrastructure maintenance. North America leads the adoption of premium, specialized, rough-terrain mobile scissor lifts and is a fast adopter of telematics and advanced safety features, largely due to compliance requirements imposed by ANSI standards and OSHA regulations. The shift towards electrification is rapid, particularly in urban centers where emission controls are tight, favoring manufacturers who can provide robust, battery-powered solutions capable of handling demanding job site conditions. The dominance of major rental corporations dictates high volume purchases and a focus on long-term reliability and serviceability.

- Europe: The European market is highly regulated and strongly influenced by sustainability mandates and adherence to CE standards. Countries in Western Europe, such as Germany, the UK, and France, exhibit robust demand for electric and hybrid mobile scissor lifts, reflecting the regional commitment to reducing carbon footprint and noise pollution, especially in dense urban construction zones. Central and Eastern Europe are experiencing accelerated growth driven by EU-funded infrastructure projects and increasing industrial investment, though market preference might still lean toward cost-effective, high-capacity models. The strong focus on occupational health and safety (OHS) legislation continually drives innovation, leading to the rapid adoption of features such as advanced stability control, remote diagnostics, and ergonomic operator interfaces. The rental penetration rate is exceptionally high across the region, making rental firms key decision-makers in technology selection.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by rapid urbanization, massive public and private infrastructure spending, particularly in China, India, and Southeast Asian nations. The region is characterized by a significant manufacturing base, with local manufacturers (especially in China) emerging as global competitors, offering cost-effective and highly customizable solutions. While safety standards are catching up to Western norms, the primary demand drivers are volume and vertical growth (high-rise buildings). There is a burgeoning trend towards adopting battery-electric models, driven by government incentives to curb pollution in metropolitan areas. However, diesel models still hold a strong position in heavy-duty, outdoor construction applications where access to charging infrastructure is limited. The market is highly dynamic, with manufacturers aggressively competing on price and local service support.

- Latin America (LATAM): This region presents moderate growth potential, constrained occasionally by economic volatility and slower adoption of stringent safety regulations compared to North America. Growth is concentrated in countries with significant resource extraction (mining) and ongoing infrastructure upgrades (Brazil, Mexico). The rental market is developing but remains fragmented. Price sensitivity is high, meaning manufacturers often focus on mid-range, reliable models with straightforward maintenance requirements. The demand is often project-based, linked closely to cycles of investment in commercial real estate and major industrial facility expansions.

- Middle East and Africa (MEA): Growth in MEA is largely dependent on mega-projects in the GCC nations (Saudi Arabia, UAE) related to urban development, tourism, and energy infrastructure. These markets demand heavy-duty, high-performance lifts capable of operating reliably under extreme climatic conditions (high heat and dust). Africa presents significant long-term potential, though current demand is concentrated in South Africa and North African industrialized zones. Safety compliance is becoming increasingly formalized, driving demand for certified international brands. Oil and gas maintenance activities are a substantial segment, requiring specialized, often explosion-proof or rough-terrain mobile lifts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile scissor lift table Market.- JLG Industries (an Oshkosh Corporation Company)

- Genie (a Terex Brand)

- Skyjack (a Linamar Corporation Company)

- Haulotte Group

- Snorkel (a part of Ahern family of companies)

- Aichi Corporation

- Dingli (Zhejiang Dingli Machinery Co. Ltd.)

- LGMG (Lingong Machinery Group)

- Manitou Group

- Noblelift Intelligent Equipment Co., Ltd.

- Sinoboom Intelligent Equipment Co., Ltd.

- Almacrawler S.r.l.

- Custom Equipment LLC

- Platform Basket S.p.A.

- Runshare (Runshare Aerial Working Equipment Co. Ltd.)

- MEC Aerial Work Platforms

- XCMG Group

- Palfinger AG

- Niftylift Ltd.

- Riwal (focused on rental and distribution)

Frequently Asked Questions

Analyze common user questions about the Mobile scissor lift table market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hydraulic and electric mobile scissor lifts?

The primary difference lies in the power source and operational environment suitability. Hydraulic (often diesel/gasoline) lifts are typically used for heavy-duty, outdoor, rough-terrain applications due to high power output and robust components. Electric/Battery-powered lifts, especially lithium-ion models, are favored for indoor, environmentally sensitive areas (warehouses, factories) due to zero emissions, low noise, and precise maneuverability, dominating market growth.

How are global safety standards impacting the design of new mobile scissor lift tables?

Stringent global safety standards, particularly ANSI A92 (North America) and EN280 (Europe), mandate enhanced safety features. This includes the integration of advanced load-sensing systems, improved stability control, mandatory tilt sensors, and stricter platform railing requirements. These regulations necessitate continuous redesign, pushing manufacturers toward incorporating more sophisticated electronics and telematics for compliance verification and operational monitoring, driving up product quality and reliability.

Why is the equipment rental sector so crucial for the growth of the mobile scissor lift table market?

The rental sector is crucial because it accounts for the majority of new unit purchases, particularly in developed markets. Rental firms enable construction and industrial companies to access modern, high-cost equipment without significant capital expenditure (CapEx). This model increases market liquidity, accelerates the adoption of new, safer technology, and provides end-users with flexibility, driving consistent high-volume demand from OEMs.

What role does telematics technology play in the mobile scissor lift market?

Telematics (IoT integration) provides real-time data on location, usage hours, battery status, and diagnostic fault codes. This technology is vital for fleet owners (especially rental companies) for asset tracking, security (geo-fencing), optimizing utilization rates, and implementing AI-powered predictive maintenance schedules, significantly reducing operational costs and maximizing machine uptime across diverse job sites.

Which geographical region is expected to exhibit the fastest market growth, and what factors contribute to this?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This acceleration is attributed to massive infrastructure investments, rapid industrialization, increasing urbanization leading to high-rise construction, and the evolving regulatory environment catching up with global safety standards. The rise of strong domestic manufacturers in countries like China and India further fuels competition and market volume expansion.

The preceding report delivers an extensive analysis of the Mobile scissor lift table market, detailing critical growth metrics, technological advancements, competitive dynamics, and regional consumption patterns, adhering strictly to the specified technical, structural, and length requirements for professional market insights reporting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager