Mobile Tool Cabinets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431753 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Mobile Tool Cabinets Market Size

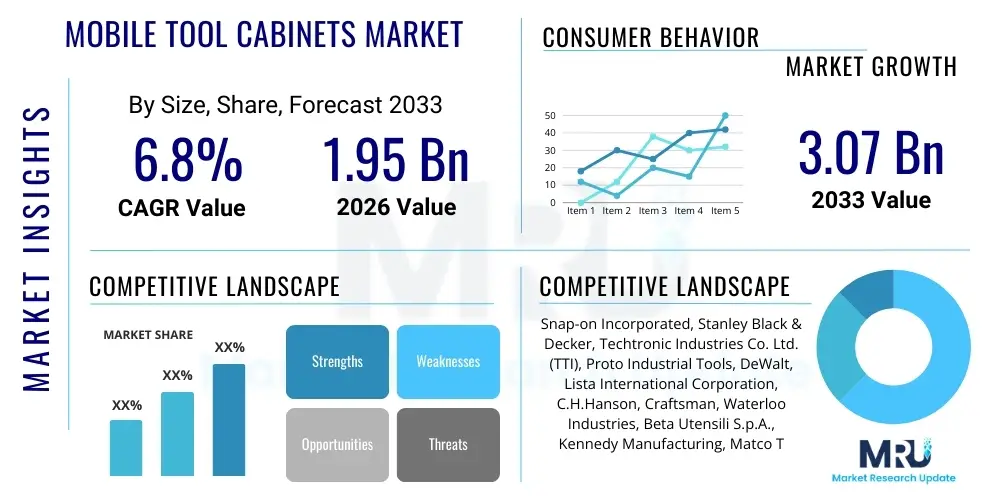

The Mobile Tool Cabinets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This robust expansion is driven by the consistent growth in the automotive aftermarket industry, increasing standardization of professional workshops, and rising demand for efficient inventory management solutions across various industrial sectors. The enhanced utility and ergonomic design of modern tool storage systems contribute significantly to market buoyancy, facilitating faster retrieval and improved security for valuable professional instruments.

The market is estimated at $1.95 Billion in 2026 and is projected to reach $3.07 Billion by the end of the forecast period in 2033. This significant upward trajectory reflects the global investment in maintenance, repair, and operations (MRO) activities, coupled with the necessity for highly durable and specialized storage solutions capable of handling heavy industrial environments. Furthermore, technological advancements leading to 'smart' tool cabinets equipped with tracking and organizational features are expected to command premium pricing, boosting overall market valuation.

Mobile Tool Cabinets Market introduction

The Mobile Tool Cabinets Market encompasses the production and distribution of portable storage units designed primarily for organizing, securing, and transporting tools and equipment within professional environments such as automotive repair shops, manufacturing facilities, aerospace maintenance hubs, and sophisticated DIY settings. These cabinets, typically constructed from high-grade steel, aluminum, or durable plastics, feature multiple drawers, heavy-duty caster wheels, and advanced locking mechanisms to ensure stability and security during movement and use. The essential utility of these products lies in minimizing downtime, improving workplace safety by reducing clutter, and ensuring the immediate availability of specialized tools required for specific tasks.

Major applications of mobile tool cabinets span across heavy machinery maintenance, automotive service centers, military installations, and industrial assembly lines. The inherent benefits include superior organization, protection against tool loss or damage, and crucial mobility that allows technicians to bring their complete array of necessary equipment directly to the workstation or vehicle requiring service. This efficiency gain is particularly vital in large factory floor environments or expansive maintenance yards where fixed tool storage is impractical. The evolution of cabinet design focuses increasingly on ergonomic features, weight capacity, and integrated features like power strips and digital interfaces.

Key driving factors accelerating market expansion include rapid industrialization and urbanization in emerging economies, resulting in a surge in manufacturing and construction activities that necessitate professional-grade tooling infrastructure. The increasing average age of vehicles globally fuels the automotive aftermarket sector, a primary end-user of mobile storage solutions. Moreover, stringent workplace safety regulations globally mandate better organization and storage practices, indirectly fostering demand for professional, high-quality mobile tool cabinets that comply with industrial standards.

Mobile Tool Cabinets Market Executive Summary

The Mobile Tool Cabinets Market is undergoing notable shifts characterized by a preference for heavy-duty, high-drawer count models offering enhanced security features. Business trends indicate a strong move towards customization and modularity, allowing professional end-users to configure storage solutions precisely according to their specific tool inventory and workflow requirements. Key manufacturers are focusing on integrating advanced materials, such as lightweight composite alloys, to improve mobility without sacrificing load-bearing capacity. Furthermore, the convergence of storage solutions with digital technology, including IoT-enabled tracking and inventory management systems, represents a significant growth vector transforming traditional business models toward value-added service provision.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive governmental investments in infrastructure, rapid expansion of the automotive and electronics manufacturing sectors in nations like China, India, and Southeast Asian countries. North America and Europe, while representing mature markets, maintain high revenue shares, driven primarily by continuous replacement cycles, strict occupational health and safety (OHS) standards, and the adoption of premium, specialized tool storage for high-tech maintenance activities (e.g., aerospace and medical device manufacturing). The demand profile in developed economies favors cabinets with advanced security and integration capabilities.

Segment trends reveal that the steel-based cabinets segment dominates due to their durability and cost-effectiveness, although the plastic/composite segment is gaining traction, particularly in applications requiring resistance to corrosive chemicals or reduced weight. Application-wise, the Automotive segment, encompassing professional repair shops and fleet maintenance, remains the largest consumer. The distribution landscape is experiencing a noticeable transition, with e-commerce platforms increasingly offering a convenient and competitive channel for procuring standardized and mid-range mobile tool storage units, while high-end, customized solutions still rely heavily on direct manufacturer sales or specialized industrial distributors.

AI Impact Analysis on Mobile Tool Cabinets Market

User queries regarding the impact of Artificial Intelligence on mobile tool cabinets predominantly revolve around automated inventory management, predictive maintenance of the cabinets themselves (e.g., wheel lubrication warnings, drawer mechanism health), and the integration of smart retrieval systems. Users are concerned about how AI can eliminate tool shrinkage, improve audit processes, and provide real-time location tracking of high-value tools stored within the mobile unit, particularly across large operational sites. The consensus among professional users is an expectation for AI-driven insights that optimize workflow by suggesting the most efficient tool layouts based on usage frequency and project requirements, moving the tool cabinet from a static storage unit to an active, intelligent asset management hub.

- AI-enabled predictive inventory analysis minimizing tool stock-outs and excess holdings.

- Integration of machine vision and sensors for automated tool check-in/check-out verification, drastically reducing shrinkage.

- Optimized route planning algorithms for mobile cabinets across large industrial floors, improving technician efficiency.

- Voice-activated or gesture-controlled locking and unlocking mechanisms powered by deep learning authentication protocols.

- Real-time usage analytics derived from AI processing of embedded sensor data to inform cabinet design improvements and ergonomic layout.

- Automated internal environment monitoring (temperature/humidity control) for sensitive tools, managed by AI regulators.

DRO & Impact Forces Of Mobile Tool Cabinets Market

The market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the core Impact Forces. Key drivers include the robust expansion of the global automotive repair and MRO sectors, coupled with increasing investments in manufacturing infrastructure, necessitating organized and secure tool storage. The growing adoption of the '5S Methodology' (Sort, Set in order, Shine, Standardize, Sustain) in industrial settings is also a powerful driver, pushing companies towards purchasing specialized, high-quality mobile storage solutions. Conversely, the market faces restraints such as the volatility in the prices of primary raw materials like steel and aluminum, which directly impacts manufacturing costs and, consequently, the final price point for consumers. Moreover, the long lifespan of professional-grade cabinets often results in extended replacement cycles, periodically dampening demand in mature markets.

Significant opportunities exist in the integration of IoT and smart technologies into tool cabinets, transforming them into intelligent assets capable of communicating location, content, and maintenance status, providing manufacturers a pathway to higher-margin products. The proliferation of specialized trade sectors, such as electric vehicle maintenance and renewable energy installation, creates niche demands for specialized, mobile, and insulated storage units. Furthermore, expansion into untapped markets in emerging economies, where professional tooling standards are rapidly developing, offers considerable long-term growth potential. The market’s Impact Forces ensure a perpetual cycle of innovation focused on enhancing durability, security, and connectivity to justify premium pricing and sustain growth trajectory.

Ultimately, the market trajectory is heavily influenced by global economic health; positive industrial output strongly correlates with higher demand for MRO tools and storage. The pressure to improve labor efficiency across manufacturing and service sectors forces companies to invest in ergonomic and mobile storage solutions. While economic downturns can temporarily slow capital expenditure on new equipment, the regulatory push for workplace safety and organization provides a continuous baseline demand, ensuring steady, albeit fluctuating, growth driven by the need for operational excellence and loss prevention.

Segmentation Analysis

The Mobile Tool Cabinets Market is extensively segmented based on material, drawer count, application, and distribution channel, reflecting the diverse requirements of professional and DIY users across various industries. Analysis of these segments is crucial for understanding specific market penetration strategies and identifying high-growth niches. For instance, segmentation by material helps differentiate between the cost-effectiveness and robustness of steel cabinets versus the specialized corrosion resistance offered by plastic or aluminum units. The application segmentation clearly delineates the massive volume required by the automotive sector versus the highly specialized, high-security demands emanating from the aerospace or industrial MRO sectors, dictating distinct product designs and features tailored to each user group’s specific operational needs and regulatory compliance requirements.

The segmentation based on drawer count (e.g., 3-5 drawers, 6-9 drawers, 10+ drawers) provides insights into user maturity and application scale. Smaller units often cater to specialty technicians or smaller workshops, while cabinets with ten or more drawers are preferred in large industrial maintenance facilities requiring the storage of extensive and varied tool sets. Furthermore, the segmentation by distribution channel highlights the shift toward digital procurement. While direct sales and specialized retail remain critical for premium products, the growing trend for standardized products to be purchased via e-commerce platforms reflects evolving consumer behavior and the global reach of online marketplaces, influencing manufacturer pricing and logistics strategies across the entire value chain.

- By Material:

- Steel Tool Cabinets (Dominant due to durability and cost)

- Aluminum Tool Cabinets (Preferred for lighter weight and corrosion resistance)

- Plastic/Composite Tool Cabinets (Used in specialized environments, e.g., chemical resistance)

- By Drawer Count:

- 3 to 5 Drawers (Utility/Specialty use)

- 6 to 9 Drawers (Standard Professional use)

- 10+ Drawers (Heavy-Duty Industrial/Comprehensive Tool Kits)

- By Application:

- Automotive Maintenance and Repair (Largest Segment)

- Industrial Maintenance, Repair, and Operations (MRO)

- Aerospace and Defense

- Construction and Infrastructure

- Residential/DIY

- By Distribution Channel:

- Offline (Specialty Retailers, Industrial Supply Stores, Direct Sales)

- Online (E-commerce Platforms, Manufacturer Websites)

Value Chain Analysis For Mobile Tool Cabinets Market

The Value Chain for the Mobile Tool Cabinets Market begins with upstream activities centered on the procurement and processing of raw materials, primarily high-grade steel sheets, aluminum, heavy-duty caster components, and locking mechanisms. Efficiency in this phase is critical, as fluctuations in metal commodity prices directly impact manufacturing profitability. Key focus areas include securing stable supply contracts and implementing advanced manufacturing techniques such as CNC bending and robotic welding to ensure high precision and structural integrity. Strategic partnerships with specialized component manufacturers for high-end features like soft-close drawers and biometric locks are essential for market differentiation.

The downstream flow involves extensive distribution channels designed to reach a heterogeneous customer base. Direct distribution is common for large industrial orders or highly customized units, allowing manufacturers to maintain tight control over quality and pricing. Conversely, indirect distribution through specialized industrial distributors, hardware wholesalers, and big-box retailers facilitates widespread market penetration, especially for mid-range and standardized products. The increasing prominence of e-commerce platforms has necessitated robust logistics and warehousing solutions to handle bulky items, requiring optimized packaging and last-mile delivery capabilities to maintain competitive shipping costs.

The value addition at the distribution stage lies in inventory management, technical support, and the ability to bundle cabinets with accompanying tool sets. Final end-users, encompassing automotive workshops, MRO facilities, and individual professionals, prioritize post-sale services, including warranty fulfillment and spare part availability, particularly for caster wheels and drawer slides which endure the highest wear. The efficiency of the entire chain, from raw material conversion to customer delivery and support, dictates the final competitive positioning and perceived value of the mobile tool cabinet brand in the marketplace.

Mobile Tool Cabinets Market Potential Customers

Potential customers for mobile tool cabinets are predominantly entities or individuals involved in professional technical and maintenance work that necessitates frequent movement of a consolidated tool kit. The largest consumer base resides in the institutional Maintenance, Repair, and Operations (MRO) segment, specifically targeting large manufacturing plants, utility service providers, and energy production facilities where complex machinery requires continuous servicing. These corporate end-users prioritize high capacity, superior durability, and secure locking systems to protect corporate assets and ensure compliance with auditing standards. The purchasing decisions in this segment are typically centralized and volume-driven, focusing on long-term cost of ownership.

The Automotive sector constitutes another critical group of buyers, encompassing independent garages, national service chains, dealership service bays, and specialty modification shops. Within this segment, the demand centers around medium to high-drawer count cabinets that offer specialized features such as deep storage for power tools and specific compartments for diagnostic equipment. Mobility is paramount, allowing technicians to navigate busy service bays efficiently. Furthermore, the burgeoning electric vehicle (EV) service market presents new customer needs for electrically insulated and chemically resistant mobile storage solutions, creating specialized product development avenues for manufacturers.

Beyond these primary segments, substantial demand originates from the aerospace and defense industries, where requirements are stringent regarding material specifications, foreign object debris (FOD) control, and tool tracking (often requiring RFID integration). Other important buyers include vocational training institutions, specialized construction contractors, and highly skilled DIY enthusiasts who seek professional-grade organizational tools for home workshops. Successful market penetration necessitates tailored product offerings that meet the distinct professional requirements and budget constraints of these diverse end-user groups, from the high-volume industrial buyer to the discerning individual tradesperson.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $3.07 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Snap-on Incorporated, Stanley Black & Decker, Techtronic Industries Co. Ltd. (TTI), Proto Industrial Tools, DeWalt, Lista International Corporation, C.H.Hanson, Craftsman, Waterloo Industries, Beta Utensili S.p.A., Kennedy Manufacturing, Matco Tools, MAC Tools, Hazet, Knipex, Stahlwille, Treston, Teng Tools, Homak Manufacturing, Milwaukee Tool |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Tool Cabinets Market Key Technology Landscape

The technological landscape of the Mobile Tool Cabinets Market is evolving rapidly, moving beyond basic metallic boxes toward sophisticated, integrated systems designed for modern industrial environments. A primary technological focus is the adoption of Internet of Things (IoT) capabilities. This involves embedding sensors, microprocessors, and connectivity modules (Wi-Fi or Bluetooth) within the cabinets. IoT integration enables features such as real-time tool inventory tracking, cabinet location monitoring across sprawling facilities, and automated alerts regarding missing or misplaced high-value instruments. This technological advancement significantly enhances operational security and provides valuable data for optimizing workshop layout and workflow, positioning the cabinet as a connected component of the larger MRO ecosystem.

Another crucial technological development involves advanced security and access control systems. Traditional physical keys are increasingly being replaced by digital and biometric authentication methods. Modern cabinets incorporate RFID technology for automatic tool identification upon placement or removal, facial or fingerprint recognition for access authorization, and sophisticated electronic locking mechanisms that can be centrally managed via software. This layer of security is vital in industries handling sensitive or expensive equipment, like aerospace or regulated manufacturing, ensuring only authorized personnel access specific tools and providing an unalterable audit trail of usage, directly supporting compliance requirements and loss prevention strategies.

Furthermore, innovations in material science and mechanical design are perpetually enhancing the product's core functionality. Manufacturers are leveraging high-strength, lightweight composite materials alongside optimized steel alloys to improve durability and corrosion resistance while reducing the overall weight for easier mobility. Design improvements include heavy-duty, shock-absorbing caster systems capable of traversing uneven industrial floors, soft-close drawer slides that handle extreme load capacities smoothly and quietly, and integrated power management solutions (e.g., built-in charging stations and power strips) that transform the mobile cabinet into a fully functional, mobile workstation. The competitive edge is increasingly determined by the seamless integration of rugged physical design with intelligent digital features.

Regional Highlights

The global Mobile Tool Cabinets Market exhibits distinct consumption patterns and growth drivers across major geographic regions. North America maintains its position as a dominant market, characterized by high adoption rates of premium, heavy-duty storage solutions driven by a mature automotive aftermarket and highly regulated aerospace and industrial sectors. The focus in this region is on tool control (FOD prevention), technological integration (RFID tracking), and long-term durability, leading to strong sales for brands known for quality and extensive warranties. Replacement demand and upgrades to smart storage systems are the primary growth mechanisms here.

Asia Pacific (APAC) is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fundamentally fueled by ongoing industrialization, significant infrastructure development, and the establishment of new manufacturing hubs, particularly in countries such as China, India, and Vietnam. The growing middle class and subsequent rise in vehicle ownership are spurring unprecedented demand for new professional service facilities, creating a vast market for both mid-range and high-volume mobile tool cabinets. Government initiatives promoting domestic manufacturing and skill development further accelerate the need for professional tooling and storage solutions across the region.

Europe represents another key region, characterized by strong demand driven by sophisticated manufacturing (especially in Germany and Italy) and stringent safety standards. European users often prioritize ergonomic design, environmental compliance, and high-quality construction materials, favoring specialized manufacturers who adhere to specific EU industrial norms. Meanwhile, Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets, showing steady growth linked to investments in oil & gas infrastructure, mining operations, and burgeoning regional automotive industries. Growth in these regions is often sensitive to capital expenditure cycles but offers long-term potential as industrial maturity increases and localized distribution networks become more efficient.

- North America (USA, Canada, Mexico): Dominant revenue share, characterized by high investment in high-end, connected tool storage solutions, replacement cycles, and robust demand from aerospace MRO.

- Europe (Germany, UK, France, Italy): Mature market focused on quality, ergonomic design, and regulatory compliance; strong demand from specialized automotive and high-tech manufacturing sectors.

- Asia Pacific (China, India, Japan, South Korea): Fastest-growing region driven by rapid industrialization, expansion of the automotive and electronics manufacturing bases, and increasing professionalization of workshops.

- Latin America (Brazil, Argentina): Steady growth driven by mining, infrastructure projects, and developing industrial base, albeit prone to economic volatility.

- Middle East and Africa (MEA): Growth tied to oil & gas industry investments, infrastructure development, and military/defense maintenance requirements, with growing localized demand for durable solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Tool Cabinets Market. These companies are pivotal in driving innovation, setting industry standards for durability and security, and influencing global distribution strategies through vast retail and professional networks.- Snap-on Incorporated

- Stanley Black & Decker

- Techtronic Industries Co. Ltd. (TTI)

- Proto Industrial Tools

- DeWalt

- Lista International Corporation

- C.H.Hanson

- Craftsman

- Waterloo Industries

- Beta Utensili S.p.A.

- Kennedy Manufacturing

- Matco Tools

- MAC Tools

- Hazet

- Knipex

- Stahlwille

- Treston

- Teng Tools

- Homak Manufacturing

- Milwaukee Tool

Frequently Asked Questions

Analyze common user questions about the Mobile Tool Cabinets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for professional mobile tool cabinets over fixed storage systems?

The primary driver is the need for increased operational efficiency and workflow optimization. Mobile tool cabinets allow technicians to transport their entire specialized inventory directly to the point of service, drastically reducing transit time, improving ergonomics, and ensuring that all necessary tools are available immediately, a critical factor in complex MRO environments.

How are 'smart' mobile tool cabinets utilizing technology like RFID and IoT?

Smart cabinets integrate RFID for automatic, real-time tool tracking and inventory auditing, which is crucial for Foreign Object Debris (FOD) control in sensitive sectors like aerospace. IoT connectivity allows for centralized management, location tracking, and predictive maintenance alerts regarding the cabinet's condition, optimizing asset utilization and minimizing loss.

Which material segment holds the largest market share and why is it preferred by industrial users?

The steel segment holds the largest market share due to its superior strength, exceptional durability, and competitive cost profile. High-gauge industrial steel construction offers robust protection against heavy loads and physical impact commonly encountered in demanding industrial and automotive repair environments, ensuring a long operational lifespan.

What are the key considerations when choosing a mobile tool cabinet for an automotive workshop?

Key considerations include high weight capacity for handling heavy components and power tools, the quality and load rating of caster wheels for smooth movement, drawer slide mechanism durability (e.g., ball-bearing slides), and advanced locking mechanisms to prevent theft in high-traffic areas. Ergonomic design and modularity are also highly valued for workflow adaptation.

How do fluctuations in raw material prices impact the profitability of mobile tool cabinet manufacturers?

Since high-grade steel and aluminum constitute a significant portion of manufacturing costs, volatility in global commodity prices directly pressures manufacturers' profit margins. Companies often mitigate this risk through long-term hedging contracts or by passing costs to end-users, leading to periodic price adjustments for high-capacity, heavy-duty mobile cabinets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager