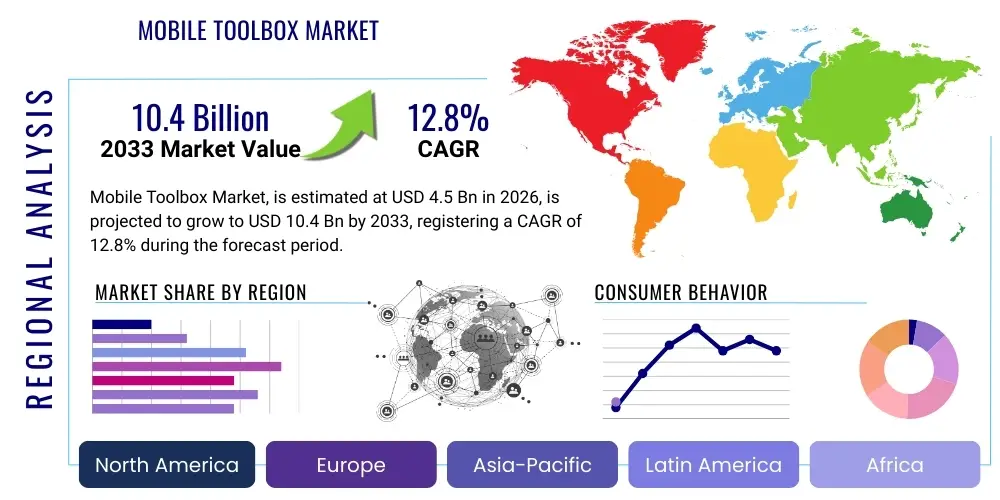

Mobile Toolbox Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436293 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Mobile Toolbox Market Size

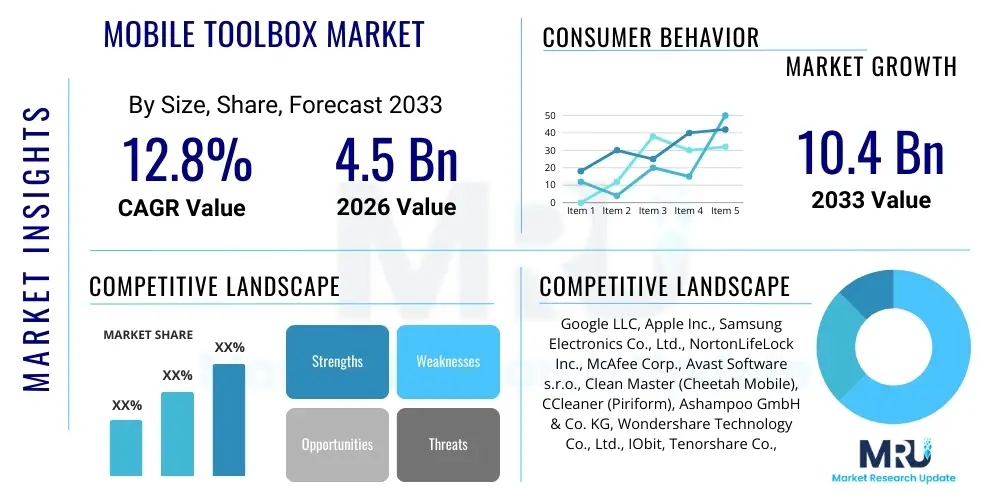

The Mobile Toolbox Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 10.4 billion by the end of the forecast period in 2033.

Mobile Toolbox Market introduction

The Mobile Toolbox Market encompasses a vast array of software applications and utility tools designed to enhance the functionality, optimize the performance, and secure the data integrity of mobile computing devices, predominantly smartphones and tablets operating on major platforms like Android and iOS. These tools serve critical functions ranging from system diagnostics, memory optimization, battery management, file transfer, data recovery, and advanced security protocols. The continuous evolution of mobile hardware and operating systems necessitates sophisticated third-party tools to help users and professionals manage device lifecycles effectively. As mobile devices transition from communication tools to primary computing platforms for professional and personal use, the demand for robust, specialized utilities continues to rise, driving market expansion globally.

Product descriptions within this sector typically involve applications categorized into performance enhancers, which focus on cleaning junk files, optimizing RAM usage, and cooling down processing units; security suites, which offer antivirus, anti-malware, and VPN services; and data management tools, crucial for backups, migration, and complex data recovery operations. Major applications span individual consumer use, particularly for users seeking to prolong device performance and battery life, and professional segments such as mobile repair shops, IT departments managing corporate fleets (MDM support), and digital forensic analysts. The primary benefits derived from using mobile toolboxes include improved device longevity, enhanced data security against increasingly sophisticated cyber threats, and maximized operational efficiency, especially important for older devices or those handling heavy multitasking loads. The utility provided by these toolsets often bypasses limitations imposed by native operating system features, offering deep-level system access necessary for advanced troubleshooting and optimization.

Driving factors for the substantial growth observed in this market are intrinsically linked to the global proliferation of smartphones, the increasing sophistication and fragmentation of the Android ecosystem, and the growing user awareness regarding data privacy and security vulnerabilities. Furthermore, the rapid release cycles of new mobile hardware generate continuous demand for tools that facilitate smooth data migration and integration with legacy systems. The complexity introduced by advanced features like 5G connectivity, expanded storage options, and intensive application demands (e.g., mobile gaming and high-resolution media consumption) necessitates dedicated toolbox solutions to maintain peak performance. These factors, combined with the rising frequency of accidental data loss and malware attacks, cement the Mobile Toolbox Market as an essential, high-growth segment within the broader software utility industry, supporting billions of devices worldwide.

Mobile Toolbox Market Executive Summary

The Mobile Toolbox Market is experiencing robust growth driven by accelerating digitalization, the proliferation of complex mobile operating systems, and heightened global concerns over mobile security and performance degradation. Current business trends indicate a strong shift toward subscription-based revenue models, offering users continuous updates and integrated security services rather than one-time purchases. This transition allows vendors to provide more dynamic protection against evolving threats and ensures sustained engagement with their user base. Furthermore, consolidation is evident, with major cybersecurity firms acquiring specialized utility developers to integrate optimization features directly into their comprehensive security suites. Key investment areas focus on developing cross-platform compatibility and leveraging cloud infrastructure to enhance data backup and recovery features, addressing the growing consumer need for seamless device transition and secure data storage across diverse ecosystems.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by the sheer volume of mobile device users, particularly in emerging economies where mid-range and budget smartphones dominate, thus increasing the need for optimization tools to maintain device performance. North America and Europe, characterized by higher average revenue per user (ARPU), lead in the adoption of premium security and data management toolboxes, emphasizing advanced features like digital forensics and enterprise-grade mobile device management (MDM) integration. Latin America and the Middle East and Africa (MEA) are witnessing rapid expansion as smartphone penetration increases, driving demand initially for basic diagnostic and cleanup applications, slowly progressing toward full security suites as digital literacy and financial capacity improve across these territories. Navigating regulatory differences, especially regarding data residency and privacy mandates like GDPR and CCPA, remains a critical regional challenge for market participants.

Segment trends highlight the dominance of Optimization Software in terms of sheer download volume, catering to the average user's desire for quick performance fixes. However, the Security Suites segment is commanding the highest revenue share due to premium pricing, recurring subscription models, and integration with broader digital security ecosystems. The Platform segmentation continues to show that Android toolboxes constitute the largest segment due to the platform's open-source nature, fragmentation, and consequent variability in performance optimization needs. Conversely, iOS toolboxes, while fewer in number due to Apple’s stringent ecosystem control, specialize in high-value services like complex data recovery, professional diagnostics, and secure file transfer mechanisms that appeal to high-end users and professional service providers. Future segment growth is heavily focused on specialized tools for niche markets, such as mobile gaming optimization and tools explicitly designed for IoT device management via a primary mobile hub, indicating diversification beyond traditional performance enhancement.

AI Impact Analysis on Mobile Toolbox Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Mobile Toolbox Market frequently revolve around three core themes: proactive problem solving, enhanced security efficacy, and personalized device optimization. Users are keen to understand if AI can move beyond simple cleanup tasks to predict hardware failures or software conflicts before they manifest, thereby offering a truly proactive maintenance paradigm. Concerns often center on the computational overhead required by AI-driven tools, questioning whether the benefit outweighs the potential battery drain or resource consumption, especially on lower-end devices. Expectations are high for AI to revolutionize mobile security by identifying zero-day vulnerabilities and crafting highly personalized optimization routines that learn individual usage patterns, leading to significant improvements in battery life and app responsiveness tailored specifically to the user rather than relying on generalized algorithms. The integration of generative AI features for troubleshooting and dynamic user support is also a major point of interest, aiming to replace complex manual setting adjustments with simple conversational commands, making advanced tools accessible to novice users.

- AI enables predictive maintenance by analyzing system logs and telemetry data to anticipate hardware component failure or performance bottlenecks, notifying users before critical issues arise.

- Machine Learning (ML) algorithms drastically enhance mobile security suites by providing real-time, behavioral anomaly detection, moving beyond static signature recognition to combat novel malware and phishing attempts.

- Generative AI facilitates sophisticated, context-aware troubleshooting interfaces, allowing users to describe their performance issues naturally and receive actionable, step-by-step resolution plans.

- AI-driven optimization software personalizes resource allocation, prioritizing specific applications based on user habits and temporal usage patterns, leading to maximum efficiency in battery consumption and CPU utilization.

- Edge AI deployment allows advanced diagnostic computations to be performed directly on the mobile device, minimizing latency and reducing dependence on continuous cloud connectivity for core toolbox functions.

- Automated threat response systems utilize AI to isolate and neutralize discovered malware or harmful processes instantly without requiring manual user input, ensuring superior background protection.

DRO & Impact Forces Of Mobile Toolbox Market

The trajectory of the Mobile Toolbox Market is governed by a dynamic interplay of propelling drivers, restrictive restraints, emerging opportunities, and significant impact forces shaping vendor strategies and consumer adoption patterns. Key drivers primarily include the relentless increase in mobile device complexity and functionality, which concurrently increases the propensity for performance degradation and the necessity for optimization. The global rise in sophisticated mobile cyber threats, including ransomware and spyware, mandates the adoption of advanced security toolboxes. Conversely, the market faces significant restraints, most notably the increasingly restrictive operating system limitations, particularly from platform owners like Apple and Google, which prioritize user privacy and system integrity, thus limiting the depth of access third-party tools can achieve. Furthermore, intense competition from native OS features that incorporate basic utility functions (e.g., built-in storage cleaners) constantly pressures third-party vendors to innovate and differentiate their offerings to justify external software investment. These countervailing forces establish a high bar for market entry and necessitate continuous technological advancement.

Opportunities for exponential market growth reside primarily in the integration of specialized technologies such as augmented reality (AR) for interactive diagnostics and advanced integration with emerging technologies like the Internet of Things (IoT), where mobile toolboxes act as centralized diagnostic and management hubs for interconnected smart devices. Furthermore, significant revenue opportunities exist in penetrating the enterprise segment with tailored mobile device management (MDM) toolboxes that adhere to strict corporate compliance and security standards, moving beyond consumer-grade utilities. The transition toward global 5G networks presents an opportunity for tools specialized in optimizing network performance and managing the increased data flow capacity. Vendors focusing on niche recovery services, such as specialized forensic data extraction from damaged devices, also capitalize on high-value, low-volume services that require highly proprietary algorithms and sophisticated technical expertise, ensuring sustainable profit margins in specialized fields.

The impact forces influencing this market are predominantly technological and regulatory. Technological impact forces include the rapid advancements in solid-state drive (SSD) technology and processing power, which shift the focus of optimization from hardware acceleration to efficient software resource management. Regulatory impact forces, particularly global data privacy laws, directly influence which data points toolboxes can access and how they are handled, often requiring significant redesigns of diagnostic processes to maintain compliance, particularly in Europe and California. Additionally, the constant platform policy updates (iOS and Android) act as a continuous and pervasive impact force, compelling vendors to dedicate substantial R&D resources solely to maintaining compatibility and functionality in the face of restricted API access. The combined pressure of proprietary platform evolution and global security requirements dictates that market success hinges on agility, compliance, and superior integration capabilities.

Segmentation Analysis

The Mobile Toolbox Market is systematically segmented based on the core functionality provided, the platform utilized, and the primary end-user application, enabling a granular understanding of market dynamics and targeted strategic development. Functional segmentation distinguishes between applications focused purely on performance enhancement (optimization), those dedicated to protecting the device and user data (security), and complex operations concerning data accessibility (recovery/management). Platform segmentation clearly divides the market based on the underlying operating system, primarily Android and iOS, reflecting the disparate technical requirements and API restrictions of each environment. Finally, end-user application segmentation separates individual consumer users from small to medium enterprises (SMEs) and large corporate entities, which demand different levels of scalability, centralized management, and security compliance. This structural division helps identify high-growth areas, segment-specific competitive pressures, and unmet specialized needs across the global user base.

The market analysis reveals that the Android platform segment dominates in volume due to its vast installed base and the intrinsic performance variability among device manufacturers, making third-party optimization tools highly necessary. However, the Security Suites segment, regardless of the platform, commands a substantial revenue share owing to the high perceived value of continuous protection and the successful adoption of subscription models. The rise of sophisticated mobile banking and e-commerce has solidified the user willingness to invest in premium security products. Furthermore, the Enterprise application segment is projected to exhibit the highest CAGR during the forecast period, driven by mandatory compliance requirements and the increasing implementation of bring-your-own-device (BYOD) policies, necessitating powerful, centrally managed mobile toolboxes for comprehensive fleet security and configuration management that native solutions often cannot adequately provide. Strategic market penetration must, therefore, be platform-aware and functionality-specific to maximize returns.

- By Type:

- Diagnostic Tools (Hardware and Software Analysis)

- Optimization Software (Junk Cleaner, RAM Booster, Battery Saver)

- Data Management & Recovery Tools (Backup, Migration, File Retrieval)

- Mobile Security Suites (Antivirus, VPN, Anti-theft)

- System Tweaking and Customization Utilities

- By Platform:

- Android OS Toolboxes

- iOS Toolboxes

- Cross-Platform Utilities

- By Application/End-User:

- Individual Consumers

- Small and Medium Enterprises (SMEs)

- Large Enterprises (Corporate MDM Support)

- Professional Repair and Service Centers (Forensics and Repair)

- By Deployment Model:

- On-Premise (Standalone Applications)

- Cloud-Based (Subscription Services with Cloud Storage)

Value Chain Analysis For Mobile Toolbox Market

The value chain for the Mobile Toolbox Market begins with the upstream activities of software development and intellectual property creation, where vendors invest heavily in researching proprietary algorithms for deep system access, data recovery, and malware detection. This initial stage is critical, requiring specialized expertise in mobile operating system internals (kernel level access, API management) and advanced cybersecurity techniques. Key upstream suppliers include technology providers offering SDKs, cloud computing services (for backup infrastructure), and AI/ML model developers. The competitive advantage at this stage often rests on patenting unique diagnostic methodologies or securing early access to new operating system features prior to public release. Strategic partnerships with silicon manufacturers (e.g., Qualcomm, MediaTek) are also crucial for optimizing performance tools specific to underlying hardware architectures, ensuring that the software can deliver optimal results across varied device specifications, which is particularly challenging in the fragmented Android environment.

The downstream segment of the value chain is focused on marketing, distribution, and post-sale customer support. Distribution channels are predominantly digital, relying heavily on official platform marketplaces (Google Play Store and Apple App Store) and, to a lesser extent, direct company websites and third-party software repositories. Success in digital distribution is inextricably linked to effective Answer Engine Optimization (AEO) and strong marketing efforts to achieve high visibility in app store search results, particularly for generic queries like "best phone cleaner" or "mobile antivirus." Direct channels are more often used for high-value enterprise licenses or specialized professional tools requiring complex setup and dedicated technical integration support. Indirect distribution involves partnerships with mobile network operators (MNOs) or device manufacturers who may bundle security or optimization software with their services or hardware sales, expanding reach but often requiring tailored, branded versions of the core product.

The most important linkage in this value chain is the feedback loop between the end-user experience and the continuous development cycle. Given the dynamic nature of mobile operating systems and the constant emergence of new threats, effective customer support, and rapid software updating capabilities are essential for retaining subscription revenue. Poor integration or infrequent updates can lead to customer churn, especially when OS updates break core application functionality. The efficiency of direct channels, such as dedicated online support portals and in-app feedback mechanisms, directly influences the speed at which developers can address critical bugs or introduce features demanded by the market. Therefore, the ability to maintain strong relationships with both platform owners (Google/Apple) and end-users dictates long-term viability, making post-deployment maintenance as crucial as the initial proprietary technology development. The market heavily rewards vendors capable of delivering rapid patches and ensuring seamless compatibility across new device launches.

Mobile Toolbox Market Potential Customers

The Mobile Toolbox Market serves a broad and highly differentiated customer base, categorized primarily into individual consumers, professional repair/service technicians, and large corporate entities. Individual consumers represent the largest volume segment, seeking fundamental utility features such as performance optimization, extended battery life, and basic security protections. These users are typically price-sensitive but increasingly willing to pay for reputable, subscription-based solutions that offer guaranteed protection against malware and ransomware, driven by reliance on mobile devices for sensitive tasks like banking and personal communication. Consumer adoption is heavily influenced by ease of use, intuitive interface design, and positive app store ratings. The marketing strategy for this segment relies heavily on digital advertising and freemium models designed to convert a large user base to premium paid subscriptions through the demonstration of superior utility compared to native, built-in system tools.

A second major customer segment includes professional users, specifically independent mobile device repair shops, authorized service centers, and specialized digital forensic analysts. These entities require highly technical, deep-level diagnostic tools capable of accessing and manipulating the device's firmware and memory, often necessary for advanced data recovery from physically damaged devices or for regulatory compliance and investigative purposes. For these users, the value proposition lies in the tool's proprietary technical capability, precision, and reliability, rather than cost. They often require specialized licenses for desktop-based software interfaces that connect to the mobile device, demanding robust technical support and certified training on complex procedures. This B2B segment, while smaller in volume, accounts for significant revenue due to high-value perpetual licenses or specialized annual maintenance fees for exclusive features.

The third critical segment comprises Small and Medium Enterprises (SMEs) and large corporations utilizing Mobile Device Management (MDM) solutions. These organizations require mobile toolboxes integrated within their broader IT security framework to enforce consistent security policies, manage software deployment across employee devices, and facilitate remote diagnostics and troubleshooting. For enterprises, the purchasing decision is driven by security certifications, compliance features (e.g., GDPR audit logging), scalability, and centralized control capabilities. The shift towards remote work and BYOD environments has accelerated the demand for enterprise-grade mobile utility software that can securely separate corporate data from personal data, ensuring compliance and mitigating data leakage risks. Therefore, vendors targeting this segment must focus on seamless integration with existing enterprise software ecosystems and offer certified technical support tailored to corporate IT standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 10.4 billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google LLC, Apple Inc., Samsung Electronics Co., Ltd., NortonLifeLock Inc., McAfee Corp., Avast Software s.r.o., Clean Master (Cheetah Mobile), CCleaner (Piriform), Ashampoo GmbH & Co. KG, Wondershare Technology Co., Ltd., IObit, Tenorshare Co., Ltd., Dr. Fone (Wondershare), SysTools Software Pvt. Ltd., EaseUS, MobiKin, AOMEI Technology, Remo Software Private Limited, Gihosoft, iMobie Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Toolbox Market Key Technology Landscape

The Mobile Toolbox Market is defined by intense technological innovation, primarily centered on securing deep-level system access while adhering to strict platform security guidelines. A foundational technology utilized is advanced Application Programming Interface (API) management and system profiling techniques. Since direct access to kernel-level operations is increasingly restricted by major OS developers, vendors rely on sophisticated monitoring tools that utilize limited public APIs in clever ways to deduce performance metrics and identify system bottlenecks without violating platform terms of service. This includes the development of proprietary algorithms for identifying and safely terminating rogue background processes and optimizing memory usage (RAM boosting) without triggering system stability warnings. Furthermore, specialized data recovery tools leverage low-level file system analysis (e.g., SQLite database recovery and sector-level reading) to retrieve deleted or lost data, often utilizing technologies originally developed for desktop forensics but adapted for mobile flash storage limitations.

The adoption of cloud computing technologies is crucial, particularly for high-value services like secure backup, cross-device data synchronization, and large-scale data migration. Modern mobile toolboxes often incorporate encryption standards (like AES-256) for data in transit and at rest within cloud storage, assuring customers of data privacy. Furthermore, the development landscape is increasingly dominated by integration with Artificial Intelligence and Machine Learning (AI/ML). AI models are leveraged not just for sophisticated malware detection—analyzing behavioral patterns rather than just signatures—but also for dynamic optimization. ML algorithms learn the individual user's typical usage patterns (e.g., peak usage times, frequently used applications) to dynamically adjust system resources, ensuring that performance optimization is both effective and non-disruptive, moving beyond simple, static "clean-up" schedules toward context-aware system maintenance.

Looking forward, the technology landscape is being shaped by advancements in mobile security frameworks and edge computing. Zero Trust Architecture (ZTA) principles are being applied to mobile security suites, ensuring that no device or user is inherently trusted, regardless of location, requiring every transaction and access attempt to be verified. This shift requires sophisticated monitoring components within the toolbox software. Additionally, the need for enhanced diagnostics for new hardware like 5G modems and complex multi-lens camera arrays drives the requirement for new diagnostic protocols and calibration tools. Vendors are also heavily investing in technology that facilitates secure communication between the mobile device and peripheral repair equipment, often through secure USB or wireless protocols, providing professional technicians with non-invasive methods to perform deep diagnostics and firmware reinstalls without compromising data integrity or system warranty status, maintaining a competitive edge through specialized proprietary connection technologies.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, driven primarily by high smartphone penetration rates in countries like India, China, and Southeast Asian nations. The region's market is characterized by a high volume of low-to-mid-range Android devices, making performance optimization and system cleaning toolboxes essential for users struggling with resource constraints. Localized competition is intense, and vendors often adapt pricing strategies to cater to diverse economic segments. Furthermore, the burgeoning mobile gaming culture demands highly effective optimization tools that reduce lag and ensure smooth performance during intensive sessions. This region is a major consumer of freemium models, demanding high quality even in the free versions.

- North America: North America holds a leading position in terms of revenue generation, primarily due to high consumer willingness to pay for premium, subscription-based security suites and advanced data management tools. The market here is highly mature, characterized by strong brand loyalty towards established cybersecurity firms. Key drivers include rigorous enforcement of corporate MDM policies and a high frequency of mobile transactions, necessitating best-in-class security. Innovation in this region often centers around integrating mobile toolboxes with broader enterprise security ecosystems and leveraging cutting-edge AI for predictive maintenance and complex data recovery services.

- Europe: The European market is highly influenced by strict regulatory frameworks, notably the General Data Protection Regulation (GDPR). This legislation places a heavy emphasis on data transparency and security, making compliance a major selling point for European consumers and businesses. Consequently, toolboxes offering advanced privacy controls, secure data handling, and robust encryption are highly favored. Western European countries contribute significantly to the premium segment, while Eastern Europe shows faster growth in the adoption of basic security and optimization utilities. Cross-platform compatibility is particularly valued given the mixed device ecosystems present in many businesses.

- Latin America (LATAM): LATAM is a rapidly evolving market with increasing smartphone adoption and digitalization across banking and retail sectors. The demand for security solutions is surging due to increasing regional cybercrime rates targeting mobile users. Market growth is stimulated by the necessity for tools that function efficiently on devices with limited mobile data plans, emphasizing offline functionality and minimal bandwidth usage. Vendors often enter this market via partnerships with local telecommunication providers to offer bundled service packages, accelerating user trust and adoption.

- Middle East and Africa (MEA): This region exhibits significant growth potential, driven by rapid urbanization and investments in digital infrastructure, particularly in the UAE, Saudi Arabia, and South Africa. The demand spectrum ranges from basic performance optimization in African markets to high-end, specialized security and enterprise MDM toolboxes utilized by multinational corporations operating in the Middle East. Geopolitical factors necessitate strong data sovereignty features in enterprise toolboxes, while consumer markets seek robust, reliable security solutions against prevalent mobile phishing scams.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Toolbox Market.- Google LLC (Android System Tools and Services)

- Apple Inc. (iOS Native Utility Infrastructure)

- Samsung Electronics Co., Ltd. (Device-Specific Optimization)

- NortonLifeLock Inc. (Security and Optimization Suites)

- McAfee Corp. (Mobile Security and Data Protection)

- Avast Software s.r.o. (Utility and Antivirus Portfolio)

- Clean Master (Cheetah Mobile)

- CCleaner (Piriform)

- Ashampoo GmbH & Co. KG

- Wondershare Technology Co., Ltd. (Data Recovery Specialists)

- IObit (Performance Optimization Software)

- Tenorshare Co., Ltd. (iOS/Android Repair and Recovery)

- Dr. Fone (Wondershare Subsidiary)

- SysTools Software Pvt. Ltd. (Forensic and Data Migration Tools)

- EaseUS (Data Recovery and Backup Solutions)

- MobiKin (Mobile Management and Transfer Software)

- AOMEI Technology (Data Backup and System Management)

- Remo Software Private Limited (Data Recovery Services)

- Gihosoft (Data Transfer and Recovery)

- iMobie Inc. (iOS Data Management Solutions)

Frequently Asked Questions

Analyze common user questions about the Mobile Toolbox market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Mobile Toolbox and why are third-party apps needed when mobile operating systems have built-in utilities?

A Mobile Toolbox refers to a collection of software utilities designed for in-depth diagnostics, performance optimization, security, and data management on mobile devices. Third-party apps are needed because they offer advanced, proprietary features such as deep-level data recovery, sophisticated AI-driven malware detection, and custom optimization algorithms that often exceed the functionality and depth of access provided by standard, restrictive native operating system utilities.

Are mobile optimization tools safe to use, and do they violate my device's warranty or platform terms of service?

Reputable mobile toolbox applications are generally safe and adhere to platform terms of service, operating within approved API parameters without voiding standard warranties. However, users must verify the vendor's credibility, as some tools, particularly those requiring "rooting" or "jailbreaking," involve modifying core OS files, which can indeed compromise security and invalidate the manufacturer's warranty. Always download from official, verified app stores.

How will 5G technology impact the future development and feature sets of mobile toolbox applications?

5G technology, with its ultra-low latency and high data throughput, necessitates specialized toolbox features focused on optimizing network performance, managing increased data consumption efficiently, and ensuring seamless device connectivity management. Future toolboxes will include advanced diagnostic modules specifically designed to troubleshoot 5G connection stability and prioritize high-bandwidth applications dynamically for optimal user experience.

Which segment—Android or iOS—drives higher revenue in the Mobile Toolbox Market?

While the Android segment commands the highest volume of downloads and installed bases due to its market size and fragmentation, the iOS segment often drives proportionally higher revenue per user. This is attributed to Apple users' higher willingness to invest in specialized, often expensive, data recovery and professional-grade diagnostic tools, often utilizing high-priced subscription models for advanced features.

What is the primary role of AI and Machine Learning in modern mobile security toolboxes?

The primary role of AI and ML is to evolve security from reactive detection (signature matching) to proactive behavioral analysis. AI enables the toolbox to learn normal user and system behavior, allowing it to instantly identify and neutralize zero-day threats or sophisticated malware by flagging anomalous activity patterns, significantly enhancing protection beyond traditional antivirus capabilities.

What are the main challenges faced by developers in maintaining compatibility across the fragmented Android ecosystem?

Developers face significant challenges due to the high degree of fragmentation stemming from numerous device manufacturers (OEMs), varying hardware specifications, and customized Android skins. This requires continuous testing and adaptation to ensure toolbox functionality remains effective across different Android versions and proprietary system modifications, leading to high R&D costs dedicated solely to compatibility maintenance.

Is the subscription model replacing the one-time purchase model for mobile utility software?

Yes, the subscription model is increasingly dominating the Mobile Toolbox Market, particularly for security suites and premium optimization tools. Subscriptions offer continuous revenue streams for vendors, enabling them to fund perpetual updates necessary to counter evolving security threats and maintain compatibility with rapidly changing mobile operating systems, providing greater long-term value to the consumer.

How do data privacy regulations like GDPR affect the design and functionality of diagnostic tools?

GDPR and similar regulations mandate that diagnostic tools must be transparent about the data they access, process, and transmit. Developers must implement strict data minimization principles, ensuring only necessary system data is analyzed, and often require explicit, verifiable user consent for data collection, particularly impacting cloud-based backup and crash reporting features to ensure compliance and avoid severe penalties.

Beyond cleaning and performance, what emerging specialized functions are gaining traction in mobile toolboxes?

Emerging specialized functions gaining traction include mobile gaming performance boosters that optimize network latency and resource allocation specifically for gaming sessions, secure IoT device management where the mobile toolbox acts as a centralized security hub for smart home devices, and advanced digital health monitoring tools integrated with OS APIs to track battery health degradation over the device's lifespan.

How critical is user interface design for the adoption success of a new mobile toolbox product?

User interface (UI) design is critically important for widespread consumer adoption. A successful mobile toolbox must simplify complex tasks, providing clear, intuitive dashboards and one-tap solutions for optimization. Poor UI can lead to user confusion, mistrust, and ultimately low adoption rates, especially for non-technical users who prioritize ease of use over technical depth.

What differentiates enterprise-grade mobile toolboxes from consumer-focused applications?

Enterprise-grade toolboxes focus on scalability, centralized management (MDM integration), robust compliance reporting, and corporate-level security features like secure containerization of business data. Consumer applications prioritize simplicity, immediate performance improvement, and basic security for individual device use, lacking the necessary infrastructure for fleet management and corporate auditing required by large organizations.

Do hardware manufacturers influence the development of third-party mobile toolboxes?

Yes, hardware manufacturers (OEMs) significantly influence development. They often work closely with specialized toolbox vendors to ensure compatibility with proprietary hardware features, such as custom cooling systems or specialized charging protocols. In some cases, OEMs may pre-install branded versions of third-party toolboxes to enhance the perceived value and performance of their devices right out of the box.

What is predictive maintenance in the context of mobile toolboxes, and how does AI enable it?

Predictive maintenance involves using the mobile toolbox to forecast potential device failures or severe performance drops before they occur. AI achieves this by continuously analyzing large volumes of real-time system data (temperature, I/O performance, battery cycle count, and crash logs) using machine learning models to identify patterns that statistically precede a component failure, allowing the user to take preventative action.

How are mobile forensic toolboxes distinct from standard data recovery applications?

Mobile forensic toolboxes are highly specialized B2B solutions used by law enforcement or service centers for legal or investigative purposes. They differ from standard data recovery apps by offering chain-of-custody documentation, deep-level unencrypted data extraction, and the ability to bypass security locks under strict legal protocols, functions standard consumer tools cannot, or legally should not, perform.

Why is the fragmentation of the Android operating system a driver for the Mobile Toolbox Market?

Android fragmentation means devices run varied OS versions and custom manufacturer skins, leading to inconsistent performance and optimization levels. This inherent variability creates a strong market demand for third-party optimization tools that can standardize and stabilize performance across diverse hardware and software configurations, addressing performance issues that the native OS may overlook.

What challenges does the increasing reliance on native cloud backup solutions (like iCloud and Google Drive) pose to third-party data management tool vendors?

The reliance on native cloud solutions reduces the demand for basic third-party backup tools. To compete, third-party data management vendors must offer superior, specialized services, such as granular, selective file restoration, cross-platform data migration between Android and iOS ecosystems, and enhanced encryption that goes beyond native platform offerings, focusing on niche, complex data challenges.

What is the role of continuous integration and continuous delivery (CI/CD) in the Mobile Toolbox development cycle?

CI/CD is essential for rapid response to mobile OS updates and new threat vectors. It allows developers to quickly test, patch, and deploy updates immediately following platform changes (e.g., a new iOS release), ensuring that the toolbox remains fully functional and compliant, minimizing periods of vulnerability or incompatibility for the user base and maintaining high subscriber retention.

How do anti-theft and anti-loss features integrate within comprehensive mobile security toolboxes?

Anti-theft features integrate mechanisms like remote data wipe, GPS tracking, remote siren activation, and camera trap capabilities. These tools utilize core system location services and administrative privileges to protect sensitive data and aid in device recovery, requiring robust security protocols to prevent unauthorized remote access or manipulation by malicious third parties.

What is the impact of edge computing on the performance of optimization software?

Edge computing enables resource-intensive optimization algorithms to execute directly on the mobile device (at the edge), rather than relying on constant server communication. This reduces latency, speeds up diagnostic processes, minimizes bandwidth usage, and improves user privacy by processing sensitive system data locally, leading to faster and more efficient performance enhancement.

In the Value Chain, why is intellectual property creation critical for upstream vendors in this market?

Intellectual property (IP) creation is critical because functionality often depends on proprietary algorithms that achieve deep system access or superior data recovery rates without violating platform rules. Patenting these specialized techniques provides a strong competitive moat against generic copycats and native OS features, justifying premium pricing and establishing market leadership in niche, high-value operations.

What are the key differences in marketing strategies when targeting individual consumers versus enterprises?

Consumer marketing relies heavily on high visibility in app stores, simple messaging focused on speed and battery life, and often uses freemium models. Enterprise marketing focuses on compliance, security certifications, scalability, integration with IT infrastructure, and requires direct B2B sales teams and detailed technical documentation to appeal to IT decision-makers.

How does the increasing trend of BYOD (Bring Your Own Device) affect demand for enterprise mobile toolboxes?

The BYOD trend significantly increases demand for enterprise toolboxes capable of creating secure, segregated corporate environments on personal devices. These tools must ensure strict separation between personal and corporate data, enforce security policies centrally, and allow remote wiping of only corporate data, protecting company assets while respecting employee privacy.

Are there specialized toolboxes for specific niche applications, such as professional photographers or mobile developers?

Yes, niche toolboxes exist, primarily targeting mobile developers who need advanced debugging, code profiling, and sandbox testing utilities, or professional content creators who require specialized data transfer, color calibration, and storage management tools optimized for large media files and specific external hardware integrations, addressing specific professional workflows not covered by general utilities.

What impact does the obsolescence cycle of mobile hardware have on the Mobile Toolbox Market?

The relatively short hardware obsolescence cycle (typically 2-4 years) is a key driver, as consumers seek toolboxes to extend the functional lifespan of older devices by optimizing diminishing resources. Furthermore, new hardware cycles create constant demand for data migration tools to facilitate seamless, secure transfers between old and new devices, maintaining high market velocity.

Why is localized content and language support essential for success in the APAC Mobile Toolbox Market?

Localized content is essential in APAC due to its linguistic diversity and varied digital literacy levels. Providing toolboxes in local languages (e.g., Mandarin, Hindi, Bahasa) and customizing marketing materials to address regionally specific performance issues enhances user trust, improves accessibility, and drives significantly higher adoption rates compared to offering only standard English interfaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager