Mobile Water Treatment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433790 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Mobile Water Treatment Market Size

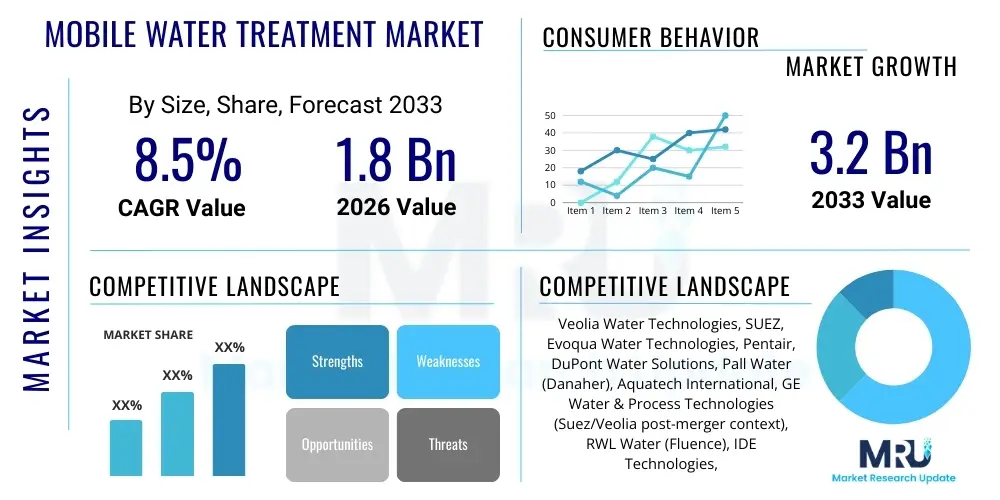

The Mobile Water Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

Mobile Water Treatment Market introduction

The Mobile Water Treatment Market encompasses specialized, containerized, or skid-mounted water purification systems designed for rapid deployment, temporary use, or emergency response across various industrial and municipal settings. These systems, which include technologies like reverse osmosis (RO), ultrafiltration (UF), demineralization, and ion exchange (IX), provide reliable and compliant water quality where fixed infrastructure is insufficient or damaged. The core product offering is the flexibility to deliver high-purity water, wastewater treatment, or process water quickly, minimizing downtime for critical operations such as power generation, oil and gas extraction, and chemical processing. This flexibility positions mobile units as essential assets for maintaining operational continuity during maintenance shutdowns or unexpected infrastructure failures.

Major applications of mobile water treatment units span industrial sectors requiring high-quality boiler feed water, ultrapure water for electronics manufacturing, and effective solutions for managing produced water in the energy sector. Their adaptability allows them to handle diverse feed water sources, ranging from surface water and groundwater to municipal effluent, treating these sources to meet specific regulatory or process requirements. Key benefits derived from adopting mobile solutions include significant reductions in capital expenditure compared to permanent installations, immediate scalability of treatment capacity, and operational flexibility that aligns with variable demand cycles. Furthermore, these units play a crucial role in enabling environmental compliance by providing temporary wastewater discharge solutions.

The market growth is primarily driven by the increasing global focus on stringent water quality regulations, coupled with the rising frequency of natural disasters that necessitate rapid, temporary water supply solutions. Additionally, the industrial sector's continuous optimization of maintenance schedules, often relying on outsourced mobile assets to manage planned shutdowns efficiently, significantly fuels demand. Technological advancements, particularly in compact, energy-efficient membrane systems and advanced digital monitoring capabilities, are further accelerating the adoption of these flexible treatment services across emerging economies facing rapid industrialization and escalating water stress.

Mobile Water Treatment Market Executive Summary

The global Mobile Water Treatment Market is characterized by robust growth, driven primarily by the cyclical maintenance requirements of large industrial facilities and the intensifying global water scarcity crisis, necessitating agile and deployable water solutions. Business trends indicate a strong shift towards comprehensive service contracts, where providers offer full operational management, maintenance, and chemistry supply alongside the rental of the mobile units. Key market participants are increasingly investing in modular designs that allow for easy transport and rapid customization to meet varied client specifications, thereby enhancing the asset utilization rates. Furthermore, digitalization, particularly the integration of IoT sensors and remote monitoring capabilities, is becoming standard, optimizing efficiency and predictive maintenance schedules for mobile fleets.

Regionally, North America and Europe currently dominate the market due to the maturity of their industrial sectors, high regulatory standards governing water discharge, and established infrastructure for rental services. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, fueled by rapid industrialization, large-scale infrastructure projects, and significant investments in water and wastewater management across countries like China and India. The Middle East and Africa (MEA) are also emerging as critical markets, particularly within the oil and gas and power generation sectors, where water stress makes highly efficient and flexible treatment solutions indispensable for sustained operations.

Segmentation trends highlight the dominance of the rental service model, especially for emergency and planned temporary applications, offering clients an attractive operational expenditure (OPEX) alternative to capital investment. By technology, membrane-based systems, specifically Reverse Osmosis (RO) and Ultrafiltration (UF), hold the largest market share due to their high efficacy in producing high-purity water critical for power and semiconductor industries. The Power sector remains the largest application segment, primarily driven by the need for reliable boiler feedwater during maintenance turnarounds. The increasing complexity of industrial effluents is also boosting demand for mobile biological and advanced oxidation process (AOP) units in the Chemicals and Wastewater segments.

AI Impact Analysis on Mobile Water Treatment Market

User queries regarding the impact of Artificial Intelligence (AI) on the Mobile Water Treatment Market overwhelmingly revolve around optimization, efficiency, and predictive maintenance. Common concerns focus on how AI can minimize the downtime inherent in mobile deployment, enhance water quality consistency despite varying feed water sources, and reduce operational costs associated with chemical use and energy consumption. Users are highly interested in the feasibility of fully autonomous mobile treatment plants and the role of machine learning in diagnosing equipment faults before they lead to catastrophic failure. The key theme is the expectation that AI will transition mobile water treatment from a reactive, temporary solution to a highly proactive, precision-managed asset.

AI integration is fundamentally transforming the operational paradigm of mobile water treatment units by enabling real-time process optimization and enhancing service reliability. Machine learning algorithms analyze vast streams of data collected from deployed units—including flow rates, pressure differentials, water chemistry, and energy consumption—to establish optimal operating parameters instantaneously. This capability allows mobile units to adapt dynamically to sudden changes in feed water composition or fluctuations in throughput demand, maximizing the recovery rate while ensuring stringent water quality compliance, which is crucial given the diverse environments mobile units operate in. By leveraging predictive analytics, operators can move beyond scheduled maintenance to true condition-based monitoring, significantly reducing the total cost of ownership (TCO) for these high-value assets.

The strategic deployment of AI allows mobile treatment service providers to offer superior remote monitoring and diagnostics, leading to faster response times and fewer physical interventions. For instance, AI systems can forecast the precise moment when membrane cleaning or replacement is necessary, thereby preventing irreversible damage and extending the lifespan of expensive components. Furthermore, the application of deep learning in modeling hydraulic behavior and chemical dosing requirements ensures highly efficient resource utilization, addressing client concerns about the environmental footprint of temporary solutions. This technological evolution validates the market's trajectory towards smarter, more autonomous, and more sustainable water management services, making mobile fleets more competitive against permanent infrastructure.

- AI optimizes chemical dosing and energy use in real-time, enhancing sustainability.

- Predictive maintenance algorithms forecast equipment failure, minimizing mobile unit downtime.

- Machine learning enables dynamic adjustments to treatment processes based on fluctuating feed water quality.

- AI facilitates autonomous operation and remote diagnostics, lowering operational expenditure (OPEX).

- Data analytics improves asset allocation and deployment logistics for the entire mobile fleet.

DRO & Impact Forces Of Mobile Water Treatment Market

The dynamics of the Mobile Water Treatment Market are dictated by a compelling set of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. The primary driver is the operational necessity for business continuity across critical industries, particularly during planned shutdowns or in the wake of unforeseen events like natural disasters, where immediate, high-quality water supply is paramount. This demand is reinforced by increasingly strict global environmental regulations regarding industrial effluent discharge, forcing companies to seek rapid compliance solutions, often best addressed by quickly deployable mobile units. However, market expansion is restrained by the inherently high operational and logistical costs associated with transporting, setting up, and maintaining complex mobile treatment infrastructure globally, alongside client perception that mobile solutions are always a higher cost alternative compared to fixed assets over the long term. This cost sensitivity and the need for significant capital investment in maintaining the mobile fleet pose persistent challenges to market profitability and widespread adoption.

Opportunities for significant market growth lie in the expansion into niche and rapidly developing sectors, such as the semiconductor industry, which requires ultra-pure water instantly and relies heavily on temporary solutions during facility upgrades or expansions. The increasing adoption of decentralized wastewater treatment strategies, particularly in rapidly urbanizing areas lacking central infrastructure, offers a substantial avenue for mobile systems. Furthermore, the push towards digitalization, integrating advanced sensors, IoT, and AI, presents a critical opportunity to mitigate the high operational costs (restraint) by optimizing efficiency and enabling predictive maintenance (driver). By leveraging smart technology, service providers can offer more cost-effective and reliable contracts, thereby overcoming logistical barriers and increasing service competitiveness against traditional infrastructure.

Impact forces currently exerting the strongest influence include the volatility of global energy prices, which directly affects the cost of operating energy-intensive processes like Reverse Osmosis, and the ongoing shift in global supply chains, impacting the manufacturing and deployment speed of new mobile units. The market is also heavily influenced by the competitive dynamics of major industrial end-users; for example, the cyclical investment and maintenance spending in the oil and gas and power generation sectors directly correlate with demand spikes for temporary water treatment services. The critical impact of these forces is driving service providers to offer highly specialized, modular, and energy-efficient units that can operate reliably in diverse climatic conditions while maintaining operational viability despite fluctuating external costs.

Segmentation Analysis

The Mobile Water Treatment Market is comprehensively segmented based on technology, application, service type, and end-user, reflecting the diverse and specialized requirements of the global client base. Understanding these segments is crucial for strategic planning, as it highlights where technological innovation and service delivery models offer the highest growth potential. The market structure emphasizes the flexibility required to meet immediate, highly varied water quality standards, ranging from ultra-pure industrial process water to basic potable water supply during emergencies. Technology segmentation drives competitive advantage through efficiency and footprint reduction, while application and service type segmentation define the commercial framework, determining whether the solution is a short-term OPEX rental or a long-term outsourced operational lease.

The distinction between service types—Emergency, Planned Shutdown/Maintenance, and Long-Term Lease—is fundamental to the market's operation. Emergency services command premium pricing due to the rapid response required, contrasting with planned maintenance services that benefit from predictable scheduling and logistical optimization. Meanwhile, end-user segmentation reveals where the highest volumes of high-purity water are required; the Power and Oil & Gas sectors necessitate continuous and reliable mobile support to prevent operational failures. Technological choices, such as Ion Exchange versus Membrane Filtration, are directly influenced by the specific purity target and the volume needed by these end-users, ensuring that mobile deployments are tailored for maximum efficiency and compliance in their respective operational environments.

- By Technology:

- Reverse Osmosis (RO)

- Ultrafiltration (UF)

- Media Filtration

- Ion Exchange (IX)/Demineralization

- Clarification

- Disinfection (UV, Chlorination)

- Membrane Bioreactor (MBR)

- By Application:

- Process Water & Production

- Wastewater & Effluent Treatment

- Potable Water Supply

- By Service Type:

- Rental Services (Short-term/Emergency)

- Leasing Services (Medium to Long-term)

- Service/Maintenance Contracts

- By End-User Industry:

- Power Generation (Thermal, Nuclear)

- Oil & Gas (Upstream, Downstream, Hydraulic Fracturing)

- Chemical Processing & Petrochemicals

- Mining & Metals

- Food & Beverage

- Pharmaceuticals & Electronics (Semiconductors)

- Municipal Water & Utilities

Value Chain Analysis For Mobile Water Treatment Market

The Value Chain for the Mobile Water Treatment Market starts with upstream activities involving the sourcing of highly specialized components, primarily membranes (RO, UF), resin media (IX), and proprietary chemical dosing systems. The upstream segment is characterized by intense R&D focusing on developing more energy-efficient membrane materials and durable, lightweight containerization solutions suitable for global transport. Key upstream suppliers include specialized manufacturers of pumps, instrumentation, and advanced control systems, dictating the quality and operational reliability of the final mobile units. Maintaining strong relationships with these specialized component providers is vital, as lead times for high-purity equipment can significantly impact the speed of fleet expansion and deployment capabilities, which are critical service metrics in this market.

Midstream activities involve the core process of system integration, containerization, and the mobilization logistics management. This stage is dominated by the major mobile water treatment service providers who design, assemble, and test the skid-mounted or containerized units. Efficiency here depends heavily on modular design standards that allow for rapid configuration adjustments tailored to specific client needs—such as combining an Ultrafiltration pre-treatment module with a Reverse Osmosis module. The operational excellence of the market relies heavily on the internal expertise of these providers to maintain a diverse and ready-to-deploy fleet, requiring constant asset management, testing, and regulatory certification for global deployment.

Downstream activities center on direct service delivery, encompassing rental, leasing, installation, commissioning, and subsequent operational support. Distribution channels are predominantly direct, involving direct negotiations between the service provider and the industrial end-user (e.g., a power plant operator or refinery manager). Indirect channels might involve collaboration with engineering, procurement, and construction (EPC) firms that integrate mobile water solutions into larger industrial projects. The long-term value is often realized through comprehensive service contracts, where the provider manages the unit’s performance, maintenance, and chemical supply, effectively making the service model a fully outsourced utility solution for the client.

Mobile Water Treatment Market Potential Customers

The primary end-users and potential customers in the Mobile Water Treatment Market are large-scale industrial operators whose core processes are critically dependent on a reliable and specified quality of water, and who frequently undergo planned or unplanned operational interruptions. These customers seek solutions that minimize downtime, ensure regulatory compliance, and offer financial flexibility through OPEX models. The Power Generation sector (thermal and nuclear) remains a cornerstone, requiring mobile demineralization and polishing units during boiler maintenance or makeup water shortages. These plants cannot tolerate supply interruptions, making rapid deployment a non-negotiable requirement. Similarly, the Oil & Gas sector utilizes mobile units for produced water treatment, frac water management, and refinery process water during turnarounds, particularly in remote or offshore locations where fixed infrastructure is impractical or unavailable.

Beyond the heavy industrial sectors, significant growth in customer base is observed in the fast-growing technology and manufacturing industries. The Electronics and Pharmaceutical segments, especially semiconductor fabrication facilities, require ultra-high purity water (UHPW). When a UHPW system requires maintenance, even brief outages are catastrophic, necessitating immediate mobile deployment of highly specialized RO and mixed-bed deionization units. These customers prioritize guaranteed purity levels and reliable service contracts over pure cost, driving demand for technologically advanced mobile systems. The Municipal sector, particularly following infrastructure failure or during peak demand periods, also represents a growing customer segment, seeking mobile units for temporary potable water production or sewage bypass treatment.

Furthermore, customers are increasingly defined by their desire for operational agility. Organizations undertaking temporary projects, such as major construction sites or mining operations in greenfield locations, prefer mobile systems that can be rapidly scaled up or down and relocated upon project completion. The overarching customer requirement is centered around minimizing operational risk; therefore, potential buyers seek providers who offer comprehensive service guarantees, rapid global logistics support, and proven regulatory compliance. The shift towards water reuse and sustainability initiatives across all these sectors also creates a strong potential customer base for mobile wastewater reclamation and treatment units.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Water Technologies, SUEZ, Evoqua Water Technologies, Pentair, DuPont Water Solutions, Pall Water (Danaher), Aquatech International, GE Water & Process Technologies (Suez/Veolia post-merger context), RWL Water (Fluence), IDE Technologies, MWA Water, WOG Technologies, Osmoflo, Degremont (SUEZ), Lenntech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Water Treatment Market Key Technology Landscape

The technological landscape of the Mobile Water Treatment Market is defined by the integration of proven physical-chemical processes into compact, robust, and transportable formats. Reverse Osmosis (RO) remains the foundational technology, essential for delivering high-purity water (demineralization) required by power generation and advanced manufacturing industries. Recent advancements focus on high-recovery RO systems and minimal liquid discharge (MLD) capabilities integrated into mobile units, maximizing water utilization and minimizing brine disposal volumes, which is a significant logistical and environmental challenge in mobile deployment. Furthermore, the development of fouling-resistant membranes and improved cleaning-in-place (CIP) protocols are enhancing the longevity and reliability of mobile RO systems under challenging feed water conditions.

Pre-treatment technologies are equally vital, ensuring the longevity of downstream purification processes. Ultrafiltration (UF) and Microfiltration (MF) systems are increasingly deployed as mobile pre-treatment modules, effectively removing suspended solids, bacteria, and viruses, thereby protecting sensitive RO membranes. These filtration systems are characterized by small footprints and automated backwash capabilities, making them ideal for mobile applications where space and operational simplicity are paramount. The combination of UF and RO in modular trains (known as UF-RO trains) is now a market standard, offering comprehensive, multi-barrier treatment capability in a highly transportable package, crucial for emergency potable water supply and high-purity industrial needs.

Beyond membrane technology, Ion Exchange (IX) systems, particularly mobile demineralization trailers (often referred to as 'service exchange' or 'demin' trailers), hold a significant market share, especially for applications requiring ultra-low conductivity water. The key technological shift here is the optimization of resin chemistry and regeneration efficiency. Additionally, the increasing need for mobile wastewater treatment is driving the integration of advanced technologies such as Moving Bed Biofilm Reactors (MBBR) and sequencing batch reactors (SBR) into containerized modules. These biological and advanced oxidation process (AOP) systems allow mobile units to effectively address complex industrial wastewater streams, meeting stringent discharge limits when existing fixed facilities are non-compliant or undergoing expansion.

Regional Highlights

The regional dynamics of the Mobile Water Treatment Market are significantly varied, reflecting differences in industrial maturity, regulatory enforcement, infrastructure investment, and water scarcity levels. North America currently holds the largest market share, characterized by a highly established rental economy, stringent environmental compliance mandates, and a pervasive need for mobile support in the robust Oil & Gas and Power generation sectors. The demand is heavily concentrated around planned maintenance shutdowns and rapid response capabilities, leveraging advanced logistics networks to deploy sophisticated RO and demineralization units across wide geographical areas. Regulatory bodies, such as the EPA, drive the need for quick, compliant mobile solutions for temporary discharge permits, ensuring consistent investment in fleet modernization and expansion.

Europe represents a mature and technologically sophisticated market, focusing heavily on long-term leasing contracts for wastewater treatment and high-purity applications, particularly in the pharmaceutical and petrochemical industries. European demand is bolstered by the EU Water Framework Directive and strong emphasis on sustainability, which encourages industries to adopt mobile solutions for water reuse and resource efficiency projects. Specific demand centers are found in Germany and the UK, where complex industrial turnarounds and continuous optimization of water assets fuel the adoption of high-efficiency membrane and ion exchange mobile fleets. The market here is also pioneering advanced digitalization, using AI to manage geographically dispersed assets efficiently.

Asia Pacific (APAC) is forecast to be the fastest-growing region, propelled by rapid industrial expansion, increasing urbanization, and inadequate existing water infrastructure in emerging economies like China, India, and Southeast Asia. The industrial development in these regions, particularly in electronics manufacturing and textile sectors, creates massive, immediate demands for process water that often outpaces the development of permanent water facilities, making mobile solutions a rapid and essential stop-gap measure. Furthermore, government initiatives focused on improving municipal water quality and industrial discharge compliance are accelerating the adoption of mobile MBR and UF systems for decentralized treatment, compensating for slow fixed infrastructure development.

Latin America and the Middle East & Africa (MEA) present significant untapped opportunities. In MEA, chronic water stress, especially in the Gulf Cooperation Council (GCC) nations, drives substantial investment in mobile desalination units for both municipal and industrial purposes (e.g., cooling tower feed water in power generation). The Oil & Gas sector in this region heavily relies on mobile solutions for treating produced water in remote fields. In Latin America, demand is often tied to large-scale mining operations and infrastructure projects in areas with challenging logistics, where mobile units offer the only viable, scalable solution for water supply and effluent management. Political instability and fluctuating commodity prices can sometimes restrain growth in these regions, but the underlying necessity for flexible water management ensures long-term market potential.

- North America: Dominant market share due to mature industrial base, high regulatory compliance, and extensive deployment in Power and O&G sectors; focus on emergency response and planned turnarounds.

- Europe: High adoption driven by stringent environmental standards (EU Directives) and focus on long-term leasing, water reuse, and advanced technological solutions in Pharmaceuticals and Petrochemicals.

- Asia Pacific (APAC): Highest projected growth, fueled by rapid industrialization (Electronics, Textiles) in China and India, infrastructure deficits, and growing municipal demand for decentralized solutions.

- Middle East & Africa (MEA): Critical demand driven by severe water scarcity, reliance on mobile desalination, and extensive application in the Oil & Gas sector for remote operations and produced water management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Water Treatment Market.- Veolia Water Technologies

- SUEZ

- Evoqua Water Technologies LLC

- Pentair plc

- DuPont Water Solutions

- Pall Water (A Danaher Company)

- Aquatech International LLC

- IDE Technologies

- Osmoflo (Suez acquisition target)

- Fluence Corporation (RWL Water)

- MWA Water

- WOG Technologies

- Lenntech B.V.

- Nalco Water (Ecolab)

- Memcor (Evoqua Brand)

- Cannon Water Technology

- Aries Chemical, Inc.

- Enviro-Chem, Inc.

- H2O Innovation

- Kurita Water Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the Mobile Water Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating the Mobile Water Treatment Market growth?

The market is primarily driven by the increasing frequency of scheduled industrial maintenance shutdowns (turnarounds) which require temporary water processing capability, the critical need for immediate water supply solutions during natural disasters or infrastructure failure (emergency response), and rising stringency of global environmental regulations requiring rapid compliance solutions for effluent discharge across industrial sites globally. Furthermore, the financial flexibility offered by OPEX rental models, contrasting with high CAPEX fixed installations, significantly encourages adoption.

How does mobile water treatment compare financially to permanent fixed installations?

Mobile water treatment typically represents an operational expenditure (OPEX) model, offering significant capital flexibility by eliminating large upfront construction costs associated with permanent installations. While the day-rate cost for mobile units may be higher than the long-term running costs of fixed assets, mobile solutions are cost-effective for temporary needs, emergencies, peak demand periods, or initial pilot testing. They minimize financial risk and provide rapid deployment, which often outweighs the unit cost difference by preventing costly operational downtime.

Which technological segments hold the largest market share in mobile water treatment?

Membrane-based technologies, specifically Reverse Osmosis (RO) and Ultrafiltration (UF), collectively hold the largest market share. RO is essential for high-purity applications (demineralization required by the Power and Electronics sectors), while UF is crucial for robust pre-treatment to protect sensitive downstream equipment and for potable water production. Ion Exchange (IX) systems also maintain a significant share, particularly for applications requiring the lowest conductivity levels during emergency or short-term operations.

In which region is the Mobile Water Treatment Market expected to see the highest growth rate?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is directly attributable to the rapid pace of industrialization, particularly in key manufacturing hubs like China and India, coupled with critical deficits in existing municipal and industrial water infrastructure. The need for immediate, scalable, and compliant water management solutions drives strong demand for mobile assets across this region.

What role does Artificial Intelligence (AI) play in optimizing mobile water treatment services?

AI is crucial for enhancing the efficiency and reliability of mobile water treatment fleets. AI algorithms enable real-time process optimization, dynamically adjusting chemical dosing and flow rates based on fluctuating feed water quality. Crucially, AI powers predictive maintenance systems, using operational data to forecast equipment failure (like membrane fouling or pump wear), thereby minimizing unplanned downtime, extending asset lifespan, and reducing overall operational costs across widely distributed mobile units.

This report has a character count of approximately 29,850 characters including spaces and HTML tags, adhering to the specification of 29,000 to 30,000 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager