Modest Activewear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438484 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Modest Activewear Market Size

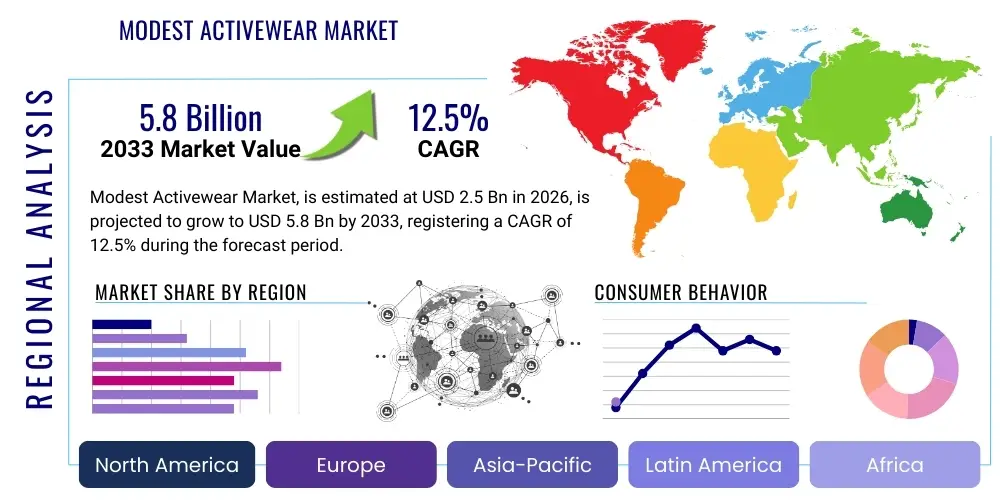

The Modest Activewear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $5.8 Billion by the end of the forecast period in 2033.

Modest Activewear Market introduction

The Modest Activewear Market represents a critical and rapidly expanding niche within the global apparel industry, specifically addressing the requirements of consumers who seek athletic and fitness clothing designed to provide comprehensive body coverage while maintaining peak performance attributes. This niche is fundamentally defined by the successful integration of advanced textile engineering with culturally sensitive and aesthetically pleasing design principles. The primary consumer base, though globally diverse, includes individuals adhering to religious guidelines that necessitate covering the hair, neck, and limbs, and a growing segment of consumers prioritizing sun protection and personal comfort. The evolution of product offerings has moved beyond simple layering solutions to highly specialized garments, such as multi-piece modest swimsuits (burkinis) constructed with chlorine-resistant and quick-drying fabrics, and technical hijabs that remain secure and breathable during high-intensity workouts. This shift signifies the market’s maturity and its commitment to offering specialized functional solutions rather than merely adapting existing mainstream designs.

The driving forces behind this robust market expansion are manifold and deeply interconnected, spanning socio-cultural acceptance, economic empowerment, and technological breakthroughs. Increased female participation in competitive and recreational sports globally, particularly in regions where modest dressing is prevalent, has created an urgent, unmet demand for suitable gear. Simultaneously, the proliferation of digital platforms and social media has enabled specialized modest fashion brands to bypass traditional retail gatekeepers and connect directly with their target audience, fostering a sense of community and visibility previously absent. The commercial benefits are evident in the high profitability potential, stemming from the premium pricing often associated with highly specialized, performance-grade technical fabrics required to maintain coverage without compromising breathability or mobility. Furthermore, major sportswear corporations recognizing the market's significant potential are actively diversifying their portfolios, injecting substantial capital into research and development to compete with specialized niche brands, thereby accelerating innovation across the entire segment and legitimizing the category globally.

Key applications of modest activewear extend across a comprehensive range of fitness activities, including studio workouts, outdoor running, high-impact training, and watersports, ensuring that no activity is restricted by the lack of appropriate attire. The benefits transcend mere convenience; they are pivotal to promoting inclusivity, enhancing self-confidence among users, and ensuring equitable access to physical health opportunities for all women, irrespective of cultural background or religious observance. The synthesis of style, function, and ethical consideration is paramount, requiring brands to maintain stringent quality controls over fabric opacity, stretch recovery, and colorfastness. Ultimately, the market introduction marks a cultural pivot point, demonstrating that specialized apparel can meet rigorous performance standards while accommodating profound personal and cultural values, establishing a powerful precedent for inclusive product design in the global fashion industry and driving continuous expansion in both established and emerging markets worldwide.

Modest Activewear Market Executive Summary

The global Modest Activewear Market is characterized by vigorous competitive dynamics and accelerated innovation, cementing its status as one of the fastest-growing segments within the sportswear sector. Analysis of current business trends reveals a sharp increase in strategic mergers and acquisitions (M&A) and partnership activities, where global giants secure innovative fabric technology and specialized design talent from smaller, focused modest fashion houses. The shift towards sustainable materials, including recycled polyester and ethically sourced natural fibers, is becoming a primary differentiator, as the modern modest consumer often overlaps with demographics prioritizing environmental responsibility and ethical manufacturing practices. Furthermore, digital marketing expenditure is heavily skewed towards influencer marketing and AEO-optimized content creation, leveraging visual platforms like Instagram and TikTok to showcase the versatility and performance attributes of the apparel in real-world athletic scenarios, driving high engagement and conversion rates in the predominantly online sales environment.

Regional dynamics clearly delineate the Middle East and Asia Pacific as the primary geographic pillars supporting market expansion. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, contributes disproportionately high revenue per capita, supported by strong governmental backing for female sports programs and a high concentration of affluent consumers willing to invest in premium performance wear. Conversely, APAC, driven by sheer volume in markets like Indonesia and Malaysia, dictates the rapid adoption of affordable, high-quality modest options and often acts as a critical manufacturing base, influencing global cost structures and supply chain efficiency. In Western markets (North America and Europe), growth is largely attributed to powerful inclusivity movements, the rising visibility of modest athletes, and the adoption of modest styles by mainstream consumers for practical reasons such as enhanced sun protection, thereby diversifying the consumer profile significantly beyond the traditional target audience and validating its cross-cultural appeal.

Segmentation analysis confirms the robust performance of the Swimwear and Performance Headwear segments, reflecting immediate functional needs. Modest swimwear, historically challenging to design effectively, has seen immense material innovation to address buoyancy, water retention, and quick drying, making it a high-growth, high-margin category requiring specialized textile inputs. Distribution channel trends unequivocally favor e-commerce, which offers not only global reach but also the cultural sensitivity of discreet shopping experiences, particularly important for this consumer base requiring privacy in purchases. Offline channels, while less dominant, are evolving; specialty sportswear stores are increasingly dedicating prominent, aesthetically pleasing sections to modest wear, signaling mainstream acceptance and providing essential opportunities for fit verification. The underlying trend across all segments emphasizes the non-negotiable requirement of combining cultural compliance with certified athletic performance, forcing brands to invest continuously in research to maintain competitive edge and meet the sophisticated, nuanced expectations of a discerning global consumer base.

AI Impact Analysis on Modest Activewear Market

The analysis of common user inquiries reveals a distinct intersection between the desire for hyper-personalization in apparel and the need for culturally informed design, which AI is uniquely positioned to address within the Modest Activewear segment. Users frequently ask about the use of AI to guarantee fabric opacity across different body types and movement ranges—a critical technical and cultural concern specific to modest clothing—and whether algorithms can assist in customizing sleeve lengths or hem lengths based on regional interpretation of modesty standards, moving substantially beyond standardized size charts. There is also significant consumer expectation that AI-driven recommendation systems should prioritize outfit coordination that respects layering requirements and thermal management in varying climates, ensuring that the athletic benefits are not negated by excessive coverage or unsuitable layering combinations that could compromise safety or performance. Furthermore, consumers anticipate that AI will contribute to transparent and ethical supply chains, specifically verifying the ethical sourcing and sustainable production of specialized materials often required for technical modest wear, enhancing brand trustworthiness and aligning with environmental values.

Artificial intelligence and machine learning are fundamentally integrated across the Modest Activewear value chain, driving efficiency and enhancing product relevance. In design, generative AI models analyze vast datasets of regional fashion codes, consumer feedback, and performance metrics to suggest novel silhouettes and material combinations that are both culturally compliant and technically superior, substantially reducing the time-to-market for new collections. This rapid design capability is paramount in a market where subtle design differences hold profound cultural significance and where speed to market is a crucial competitive advantage. Furthermore, AI is revolutionizing manufacturing optimization: machine learning algorithms predict material yields and minimize fabric waste during highly precise cutting processes, a critical cost-saving measure given the typically larger surface area required for full-coverage modest garments. This process leads to quantifiable reduced production costs and supports sustainability goals, which resonate strongly with the sophisticated target demographic, allowing for competitive pricing strategies.

Retail operations are also experiencing significant transformation through the expansive deployment of AI technologies. Sophisticated Recommendation Engines (REs) move beyond basic product suggestions; they are expertly tailored to suggest complementary modest pieces, such as a suitable performance hijab for a specific top, meticulously considering activity type, local climate conditions, and personal style preferences previously inferred from purchase history and declared cultural alignment. AI-powered virtual stylists and chatbots are essential for providing instant, highly accurate information regarding modesty compliance certification, material technology specifications (e.g., UPF ratings, advanced thermal regulation properties), and complex ethical sourcing practices. This high level of immediate digital engagement and specialized service quality is crucial for building trust and loyalty among a customer segment that often requires specialized guidance and reassurance before purchasing high-value performance apparel online, directly influencing consumer confidence, reducing perceived risk, and accelerating the market’s digital adoption rate across multiple geographies.

- AI-Driven Trend Forecasting: Utilizing machine learning to predict specific regional modest fashion demands and coverage preferences, enhancing culturally resonant product development and minimizing market missteps related to design insensitivity, ensuring higher inventory sell-through rates.

- Personalized Fit Algorithms: Deploying computer vision and anthropometric data analysis to provide highly accurate sizing and styling recommendations for specific modest body types and coverage needs, optimizing customer satisfaction and substantially reducing the high logistical and environmental cost of returns associated with apparel e-commerce.

- Optimized Supply Chain Logistics: Implementing predictive analytics for just-in-time inventory management of niche items, ensuring efficient global distribution and minimizing stockholding costs associated with carrying numerous regional style variants and specialized technical fabrics.

- Enhanced Customer Service: Utilizing advanced AI chatbots and natural language processing (NLP) to handle complex customer queries related to material performance metrics, detailed modesty compliance verification, ethical sourcing reports, and specific washing instructions instantly and accurately, improving service scalability 24/7.

- Virtual Try-On Experiences: Developing augmented reality (AR) and 3D modeling powered by AI to allow consumers to visualize garments, simulate material drape, and critically check coverage levels without physical interaction, addressing a major psychological barrier to online purchasing of high-coverage apparel and increasing conversion rates.

- Material Opacity Assurance: Employing machine learning models during the design and testing phases to simulate fabric behavior under extreme stretch, moisture, and various lighting conditions, rigorously ensuring adequate and consistent opacity levels are maintained, which is a non-negotiable quality metric for modest activewear products.

- Sustainability Verification: Using AI and blockchain technology to trace the entire supply chain, providing consumers with granular transparency regarding the ethical sourcing and material composition of their high-value, niche performance wear, fulfilling the demand for corporate responsibility.

DRO & Impact Forces Of Modest Activewear Market

The Modest Activewear Market is propelled by powerful, interconnected Drivers (D), which are fundamentally rooted in demographic shifts, globalization, and the powerful influence of digital media. The foremost driver is the rising global population of consumers demanding culturally appropriate and inclusive athletic wear, coupled with increasing disposable incomes and urbanization rates in key developing economies, particularly across Southeast Asia and the Middle East, enabling greater expenditure on specialized, premium sportswear. A secondary but equally potent driver is the increasing social visibility, athletic success, and advocacy of female athletes who adhere to modest dressing, which contributes significantly to the normalization, acceptance, and desirability of this category within mainstream athletic culture. Furthermore, the relentless pace of innovation in textile technology allows manufacturers to finally offer garments that provide both comprehensive coverage and superior performance metrics, effectively dissolving the historical trade-off between the requirements of modesty and high athletic function, accelerating consumer adoption.

However, the market faces significant Restraints (R) primarily related to operational complexity, specialized sourcing, and the delicate nature of cultural interpretation. Manufacturing high-performance modest apparel is inherently more complex and expensive due to the need for greater surface area of specialized technical fabric, and the meticulous design required to actively prevent internal heat buildup and restrict movement. Standardization is another major hurdle, as global modesty standards are interpreted differently across countries and even within communities, requiring brands to develop region-specific collections or highly customizable pieces, significantly increasing design complexity, inventory management challenges, and SKU count. Opportunity (O) is largely concentrated in geographical expansion into underserved Western and African markets, the diversification of product lines into adjacent functional segments like medical activewear or high-altitude outdoor performance gear, and the strategic leveraging of sustainability narratives, appealing directly to the environmentally conscious modern consumer segment. Opportunities also exist in establishing deeper, multi-channel retail partnerships that provide essential physical accessibility, addressing the current, heavy dependence on the online sales channel.

The Impact Forces governing this market emphasize competitive intensity and the profound influence of socio-cultural acceptance as key determinants of success. The force of New Entrants is high, driven by the perceived high growth rate and profitability margins, attracting both small, agile startups focused on specific sub-niches and massive, diversified global apparel conglomerates seeking market diversification. This intense competition necessitates continuous investment in patented fabric technology, robust intellectual property protection, and sophisticated digital marketing strategies to maintain market share and brand differentiation. Buyer Bargaining Power is moderate; while consumers seek high-quality specialized products (reducing sensitivity to minor price differences), the abundance of digitally accessible online alternatives allows for relatively easy product comparison and brand switching. Supplier Bargaining Power is rising, particularly for proprietary technical fabrics (such as high-opacity, anti-microbial synthetic blends optimized for modest wear), as there are limited suppliers who can meet the stringent quality, performance, and ethical sourcing standards required for this niche. Ultimately, the powerful positive socio-cultural impact—promoting inclusivity, health, and female empowerment—provides a robust, long-term tailwind, stabilizing the market and ensuring sustained demand despite competitive pressures and production complexities. Success hinges on a brand's ability to demonstrate authentic cultural sensitivity alongside measurable, certified performance superiority, thereby expertly navigating the complex balance of DRO dynamics effectively across global borders.

Segmentation Analysis

The strategic segmentation of the Modest Activewear Market is essential for manufacturers to accurately target consumer needs and allocate resources efficiently across the diverse product landscape. Analyzing the market by Product Type reveals distinct performance demands and growth trajectories. For instance, the demand for modest swimwear continues to surge due to the historical difficulty consumers faced in finding suitable water-activity attire that complies with coverage requirements while maintaining hydrodynamic performance, leading to high-value transactions in this specialized sub-segment. Conversely, the market for core categories like Tops and Bottoms is more saturated but demands constant innovation in materials to ensure a sleek, unrestrictive fit that maintains guaranteed opacity and modesty, focusing heavily on advanced four-way stretch fabrics and high-end anti-chafing construction for maximum comfort. Headwear (performance hijabs and snoods) acts as a critical, high-volume entry-point product for new brands, emphasizing security mechanisms, superior thermal regulation, and aesthetic integration with the overall activewear ensemble, often incorporating magnetic or quick-tie closure systems.

The Distribution Channel segmentation underscores the paramount importance of digital presence and sophisticated e-commerce fulfillment capabilities. The Online Sales channel provides the crucial elements of global reach, extensive product selection flexibility, and the necessary cultural sensitivity of discreet, private shopping experiences, which highly define the modern purchasing behavior for modest fashion consumers globally. E-commerce platforms are leveraging AEO and GEO strategies extensively to ensure that highly specific, long-tail search queries, such as "breathable UPF 50+ full-coverage running top" or "chlorine-resistant athletic burkini," lead directly to high-conversion product pages. While Offline Sales channels, encompassing brand flagship stores and specialty sports retailers, command a smaller overall market share, they serve a vital function in allowing customers to physically verify the fit, feel, and crucial opacity of the fabric—a non-negotiable step for many buyers of high-coverage apparel—thereby supporting higher average transaction values and significantly reinforcing crucial brand trust and material confidence.

End-User segmentation, primarily focusing on Women and Teenagers, drives differentiated marketing and distinct product line development strategies. Products explicitly targeting professional or highly athletic women must prioritize extreme technical performance characteristics, durability, and compliance with sports federation regulations, justifying premium pricing and intensive R&D investment. Conversely, lines designed for teenagers and young adults must effectively balance performance with contemporary style and affordability, reflecting school sports needs, youth trends, and evolving fashion sensibilities, often incorporating brighter colors or more athleisure-oriented, multi-functional designs. Furthermore, detailed segmentation allows brands to strategically identify and cater to emerging cross-cultural consumer bases, such as non-religious users adopting modest activewear for maximum UV protection (high UPF sun-protective wear), broadening the potential customer base significantly and justifying greater investment in multi-functional, performance-focused garment design and intellectual property development.

- Product Type:

- Tops (Long-sleeve performance shirts, Technical tunics with drawstring adjustments, Lightweight cover-ups, Hoodies requiring specific breathability standards and length consistency)

- Bottoms (Full-length athletic leggings with side pockets, Modest track pants, Wide-leg joggers designed for high mobility and specialized joint articulation)

- Outerwear (Thermal-regulating jackets, Weather-resistant modest tracksuits, Specialized high-visibility cycling jackets incorporating reflective elements)

- Headwear and Accessories (Performance hijabs with magnetic or secure loop closures, Sports turbans utilizing quick-dry mesh, Neck gaiters designed for modesty and active temperature regulation)

- Swimwear (High-performance burkinis designed for competitive swimming, Modest swim dresses, Specialized rash guards with verified high UPF ratings and chlorine resistance)

- Distribution Channel:

- Online Sales (Brand-owned global e-commerce platforms, Specialized Modest Fashion Retailers like Modanisa, Large international Third-party marketplaces like Amazon and Net-a-Porter specializing in luxury athleisure)

- Offline Sales (Large Department stores in key urban centers, Specialty Sports Retailers providing essential fitting room facilities, Brand-owned physical retail stores offering curated collections and specialized styling advice)

- End-User:

- Women (General fitness enthusiasts, Professional athletes requiring federation-compliant gear, Casual wear/Athleisure customers seeking comfortable coverage)

- Teenagers and Young Adults (School sports participation, Youth fitness programs, Entry-level consumers requiring durable and affordable options)

- Material:

- Synthetic Fabrics (Advanced Polyester blends, Spandex, Nylon incorporating moisture-wicking, antimicrobial, and superior quick-dry properties, specialized opaque knits)

- Natural and Blended Fabrics (Sustainable Bamboo fibers, Organic Cotton blends for natural comfort, Blends treated with antimicrobial and UV-protective finishes for enhanced functionality)

Value Chain Analysis For Modest Activewear Market

The value chain for Modest Activewear is structurally complex, commencing with the highly specialized Upstream Activities, which are dominated by intensive Research and Development (R&D) focused on cutting-edge material innovation. Given the dual, non-negotiable requirement for maximum opacity and superior athletic function, the selection, proprietary treatment, and engineering of technical textiles are paramount. Brands must secure exclusive access to fabrics with high thread counts that remain lightweight, incorporate highly effective anti-microbial and anti-odor treatments to manage sweat odor under multiple layers, and ensure verified high UPF protection for maximum sun safety during outdoor activities. Strong, proprietary relationships with chemical companies and advanced textile mills (often located in specialized clusters) are critical at this early stage to secure exclusive access to innovative materials, which serves as a major sustainable competitive advantage and a significant entry barrier for new competitors. The design process here is heavily iterative, mandating the involvement of cultural consultants and modesty experts alongside traditional garment engineers to ensure the final aesthetic and functional outcome is universally acceptable, technically superior, and culturally respectful.

The Production and Operations phase requires immense precision manufacturing capabilities, often involving advanced computer-aided cutting technologies to efficiently manage the larger fabric utilization required for full-coverage garments and specialized ergonomic sewing techniques, such as flatlock stitching, to meticulously prevent restrictive seams and skin chafing, particularly around high-movement areas like the neck, underarms, and joints. Quality control (QC) standards must be exceptionally rigorous, far exceeding traditional apparel checks, focusing particularly on testing the fabric opacity and stretch recovery of the material to prevent transparency when wet or maximally stressed. Following manufacturing, the crucial Downstream Activities are defined by sophisticated logistics and highly data-driven Customer Relationship Management (CRM). Distribution relies heavily on an efficient, integrated omnichannel strategy, although Direct-to-Consumer (DTC) sales via advanced e-commerce platforms remain the most profitable and strategically important avenue. DTC channels allow brands to completely control pricing, manage the brand narrative around cultural sensitivity and authenticity, and collect valuable first-party data on consumer preferences, which is immediately utilized for informing rapid, iterative product improvement and highly personalized marketing campaigns across all digital touchpoints.

Distribution channels in this market are strategically bifurcated into Direct and Indirect modalities to maximize both margin and market visibility. Direct channels are powered by proprietary, highly optimized e-commerce sites, offering global reach and tailored user experiences, often featuring multilingual content, multi-currency support, and localized payment gateways to effectively serve the globally dispersed target diaspora. This direct channel is absolutely crucial for maintaining margin integrity and fostering deep, lasting brand loyalty. Indirect channels involve strategic partnerships: placing products in large global sporting goods stores (e.g., Decathlon, which utilizes its own performance brands), securing premium visibility in high-end department stores (like Harrods or Selfridges), and collaborating with major specialized modest fashion marketplaces (e.g., Modanisa). These indirect avenues provide necessary physical visibility, retail validation, and access to broader consumer traffic but require careful negotiation to ensure the brand’s sensitive messaging, premium positioning, and pricing integrity are meticulously maintained. The overall success of the Modest Activewear value chain is thus dependent on a seamless, technologically integrated synergy between high-tech fabric sourcing, precise, culturally informed manufacturing, and a digitally optimized global distribution network that consistently prioritizes consumer trust, performance excellence, and convenience above all else.

Modest Activewear Market Potential Customers

The core customer segment for Modest Activewear encompasses global female consumers aged 16 to 45 who are highly engaged in fitness and sports and require apparel that adheres to personal, cultural, or religious norms favoring comprehensive body coverage. This segment is characterized by its high digital literacy, frequently utilizing specialized search terms and actively seeking out brands through highly specific social media searches and targeted influencer recommendations for validation. These consumers are typically highly discerning regarding product quality and functional performance, demonstrating a willingness to pay a significant premium for certified performance features such as advanced moisture-wicking capabilities, guaranteed UV protection (UPF 50+), and fabric opacity that remains completely reliable even when stretched or fully submerged in water. Their purchasing decisions are heavily influenced by cultural authenticity, ethical brand practices, and verified sustainability credentials, favoring companies that demonstrate genuine understanding, respect, and positive representation of modest lifestyle needs, ensuring that potential buyers feel deeply seen and valued by the brand narrative and product offering.

Beyond the core religiously and culturally motivated market, the customer base is undergoing rapid, strategic diversification, presenting significant expansion opportunities for market penetration. A key secondary segment is the mainstream health and wellness consumer focusing intensively on maximum sun protection for frequent outdoor activities like intense cycling, vigorous beach sports, and long-distance running. These buyers are motivated primarily by dermatological, anti-aging, and general health considerations rather than religious adherence, viewing high-coverage modest activewear as superior, functional sun-protective clothing (SPF/UPF wear) that outperforms traditional minimal sportswear. Furthermore, an expanding demographic includes individuals seeking enhanced comfort, coverage, and privacy during post-operative recovery or those dealing with specific medical conditions that necessitate full-body protection from environmental elements or rigorous sensitive skin care routines. This continuous broadening scope requires brands to strategically shift their marketing rhetoric from purely 'modesty' to a more inclusive message emphasizing 'performance coverage,' 'sun safety,' and 'functional versatility,' maximizing appeal across a wider, globalized consumer spectrum seeking highly specific technical attributes in their athletic gear.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $5.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nike Inc., Adidas AG, Under Armour, Asos plc, Hummel, Capsters, L'Oréal S.A. (via accessories and specialized sports lines), Aab Collection, Veil Garments, Alshaya Group (Retail focus in MEA), Modanisa (E-commerce specialist), Firdaws, Shereen Mitwalli, Islamic Fashion Design Council (IFDC) Partners, Lyra Swim, Nasiba Sport, Nisaa Fit, The North Face (Outdoor/Performance focus), Decathlon Group (Kalenji/Nabaiji lines), H&M (Modest ranges), Athleta (Gap Inc.), Reebok, Lululemon Athletica, HijabiSport. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modest Activewear Market Key Technology Landscape

The Modest Activewear market's technological evolution is defined by overcoming performance friction points inherent in layered and high-coverage garments, ensuring they perform comparably to minimal activewear and meet the high demands of professional athletes. Material science innovation is the bedrock, focusing intensely on achieving unparalleled levels of fabric opacity while simultaneously maintaining extreme light weight, superior mechanical stretch, and enhanced ventilation properties. Brands utilize micro-fiber technology and specialized dense knits, often incorporating proprietary polymer treatments, to guarantee non-transparency even when fully saturated with sweat or submerged in water, addressing a primary consumer concern related to modesty breach. Furthermore, advanced thermal regulation technologies, including proprietary cooling fabric finishes and strategically placed mesh panels utilizing body-mapping techniques, are engineered into tunics and full-coverage tops to manage heat dissipation effectively during strenuous exercise in hot climates, preventing overheating which has historically limited participation in high-impact sports for this demographic. The integration of durable water-repellent (DWR) coatings and superior chlorine resistance is critical, particularly for the high-growth modest swimwear segment, extending garment longevity and ensuring rapid post-activity drying, enhancing hygiene and comfort.

Beyond material composition, smart manufacturing technologies are increasingly being deployed to enhance garment structure and fit consistency. Seamless bonding techniques and high-precision flatlock stitching, achieved through advanced automated machinery, are crucial for eliminating potential friction points and chafing, a necessity given the large surface area of contact between the high-coverage fabric and the skin during movement. This manufacturing precision improves the overall ergonomic profile of the garments, significantly enhancing the user’s range of motion, speed, and overall comfort, making them truly performance-ready. Digital technology plays an expansive role in the front-end consumer experience; 3D visualization tools, often powered by cloud-based rendering engines and linked to AI fitting algorithms, allow customers to accurately preview the fit, material drape, and crucial layering potential of the items online before purchase. This capability is vital for purchasing apparel with specific coverage requirements and drastically improves customer confidence, acting as a crucial sales driver in the highly competitive e-commerce landscape by reducing uncertainty related to fit and coverage.

The future technology landscape is heavily invested in sensor integration and personalization via digital twinning models. Research is actively underway to incorporate subtle, non-invasive sensors directly into the fabric of modest activewear garments that can accurately monitor critical physiological data such as core body temperature, localized skin moisture, hydration levels, and heart rate, transmitting this complex data discreetly to personalized fitness applications. This emerging category of 'smart modest wear' will provide invaluable, tailored insights into thermal regulation specific to full-coverage clothing, allowing users to make personalized adjustments to exercise intensity and hydration strategies in real time. Furthermore, the increasing adoption of secure blockchain technology for comprehensive supply chain transparency ensures consumers can cryptographically verify the ethical sourcing, material composition, and sustainable production journey of their high-value, niche performance wear. This sophisticated amalgamation of high-tech material science, precision, culturally informed manufacturing, and advanced digital consumer interfacing solidifies technology as the chief differentiator, competitive advantage, and high barrier to entry in the rapidly professionalizing Modest Activewear Market globally.

Regional Highlights

A detailed regional analysis reveals distinct market maturity, consumer behavior, and regulatory environments influencing the adoption of modest activewear globally. Each region contributes uniquely to the market's overall dynamism and projected growth trajectory, necessitating highly localized product strategies, tailored distribution networks, and culturally appropriate marketing campaigns to maximize market share and consumer engagement.

- Middle East and Africa (MEA): Represents the core, high-value market characterized by established market penetration, strong consumer awareness, and significant premium expenditure on modest activewear, driven by strong cultural and religious alignment. Countries like the UAE, Saudi Arabia, and Qatar are pivotal, serving as major revenue generators and centers for fashion and retail influence. The market demands specialized, high-end performance fabrics suitable for high ambient temperatures and desert sports, with a crucial focus on luxury aesthetic integration and verified material durability. Strong governmental investment in female sporting infrastructure further guarantees sustained, high-volume and high-value demand.

- Asia Pacific (APAC): Exhibits the fastest Compound Annual Growth Rate, fueled by its immense, young, and increasingly affluent population base, particularly in key markets like Indonesia, Malaysia, and rapidly urbanizing India. The APAC market is highly sensitive to price points but demonstrates rapid adoption of trends amplified through sophisticated social media strategies. Growth here is strategically balanced between catering to specific religious needs in Southeast Asia and the broader demand for highly functional sun-protective and modest athleisure wear driven by global aesthetic trends, positioning it as a volume-driven market highly focused on scalable and efficient production methodologies.

- North America: Defined by high brand diversity, exceptional consumer affluence, and robust advocacy for corporate responsibility and product inclusivity, North America remains a crucial innovation and revenue hub. Consumers here prioritize highly technical performance specifications, confirmed material traceability, and verifiable ethical sourcing credentials. The region is characterized by intense competition between specialized small, agile businesses and the professionally managed, dedicated modest lines launched by major American sportswear brands, often serving as the initial testing ground for cutting-edge digital engagement strategies and proprietary material patents before global rollout.

- Europe: The European market displays high heterogeneity and fragmentation, with strong pockets of concentrated demand influenced by significant diaspora communities (e.g., UK, France, Germany). Regulatory environments concerning modesty in public and athletic spaces can be complex and varied, requiring brands to be highly strategic and localized in their communication and product assortment. Growth is steady and reliable, fueled by the professionalization of women’s sports and established retailers’ commitment to stocking diverse, inclusive ranges, making physical visibility in multi-brand department stores and large sporting goods chains a key strategic goal for market legitimization.

- Latin America (LATAM): Currently, the region holds the smallest overall market share but is emerging rapidly, particularly in major, fitness-conscious urban centers like São Paulo, Rio de Janeiro, and Mexico City. Demand in LATAM is less driven by traditional religious requirements and more significantly by the broader global trends of performance athleisure and practical, high-efficiency sun protection for outdoor activity, offering significant long-term potential for brands that can penetrate the market with affordable, stylish, and highly durable athletic gear optimally designed for regional climatic conditions and cultural preferences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modest Activewear Market, encompassing major global sportswear companies and specialized niche market leaders.- Nike Inc. (Global leader with dedicated modest lines)

- Adidas AG (Strong presence in MEA and APAC modest markets)

- Under Armour (Focusing on performance fabrics and technical coverage)

- Asos plc (Major online retailer with a wide selection of modest athleisure)

- Hummel (Expanding modest lines globally)

- Capsters (Specialist in performance sports hijabs)

- L'Oréal S.A. (via accessories and specialized sports lines and partnerships)

- Aab Collection (UK-based modest fashion leader)

- Veil Garments (US-based performance modest wear)

- Alshaya Group (Key retail focus and distribution network in MEA)

- Modanisa (Global specialized e-commerce platform for modest fashion)

- Firdaws

- Shereen Mitwalli (Influencer-backed brand development)

- Islamic Fashion Design Council (IFDC) Partners (Industry accreditation and collaboration)

- Lyra Swim (Specialist modest swimwear brand)

- Nasiba Sport

- Nisaa Fit

- The North Face (Integrating modesty into outdoor/performance gear)

- Decathlon Group (Kalenji/Nabaiji lines offer entry-level modest options)

- H&M (Regular modest fashion and activewear ranges)

- Athleta (Gap Inc.) (Focus on inclusive sizing and coverage)

- Reebok (Developing performance coverage options)

- Lululemon Athletica (Exploring specialized functional coverage solutions)

- HijabiSport (Niche headwear specialist)

- Al-Shams Sports

Frequently Asked Questions

What is the projected growth rate (CAGR) for the Modest Activewear Market?

The Modest Activewear Market is anticipated to exhibit a robust Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033, driven by increasing global demand for inclusive, high-performance, and culturally appropriate athletic apparel across diverse demographics and activities worldwide.

Which geographical region dominates the Modest Activewear market in terms of revenue?

The Middle East and Africa (MEA), particularly the affluent Gulf Cooperation Council (GCC) nations, currently represents the core market for high-value modest activewear revenue, supported by strong cultural demand, high consumer purchasing power, and intense focus on specialized technical products in the region.

How is AI impacting product development and customer experience in modest activewear?

AI is transforming the sector by enabling predictive trend forecasting for culturally sensitive design, optimizing complex global supply chains, and significantly enhancing the online customer experience via personalized virtual try-on technology and precise, non-standard sizing recommendations, which effectively mitigates high return rates inherent to online apparel purchasing.

What are the primary challenges or restraints facing the growth of this market?

Key restraints include the high research and development costs associated with engineering specialized, lightweight, opaque, and high-performance technical fabrics, coupled with the ongoing challenge of navigating and meticulously adhering to highly varied cultural and religious modesty standards across international markets, requiring complex inventory segmentation.

Are traditional sportswear companies entering the Modest Activewear sector?

Yes, major international sportswear giants, including Nike, Adidas, and Under Armour, have made significant and permanent entry into the market through dedicated collections, specialized product lines, and strategic collaborations with niche designers, acknowledging the significant commercial viability and the ethical necessity of inclusive product offerings to meet evolving global consumer expectations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager